A crescente procura de automóveis na Arábia Saudita é um fator-chave que impulsiona o crescimento do mercado de peças de substituição. Com a população do país a crescer constantemente e a urbanização a aumentar, há um aumento correspondente na necessidade de transporte pessoal. Esta procura crescente é evidente no aumento das vendas de veículos em vários segmentos, incluindo automóveis de passageiros, veículos comerciais e veículos todo-o-terreno, expandindo assim o tamanho geral da frota automóvel no país. À medida que mais carros são comprados e utilizados na Arábia Saudita, há uma necessidade crescente de peças de substituição e serviços de substituição. Esta procura é motivada por vários fatores, incluindo o envelhecimento dos veículos ao longo do tempo, o que exige uma manutenção regular e a substituição periódica dos componentes desgastados para garantir um desempenho e segurança ideais. Além disso, as diversas condições meteorológicas na Arábia Saudita, caracterizadas por temperaturas extremas e terrenos acidentados, aceleram o desgaste dos veículos, aumentando ainda mais a procura de peças de substituição, como filtros, componentes do sistema de refrigeração e peças de suspensão.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/ksa-aftermarket-spare-parts-market

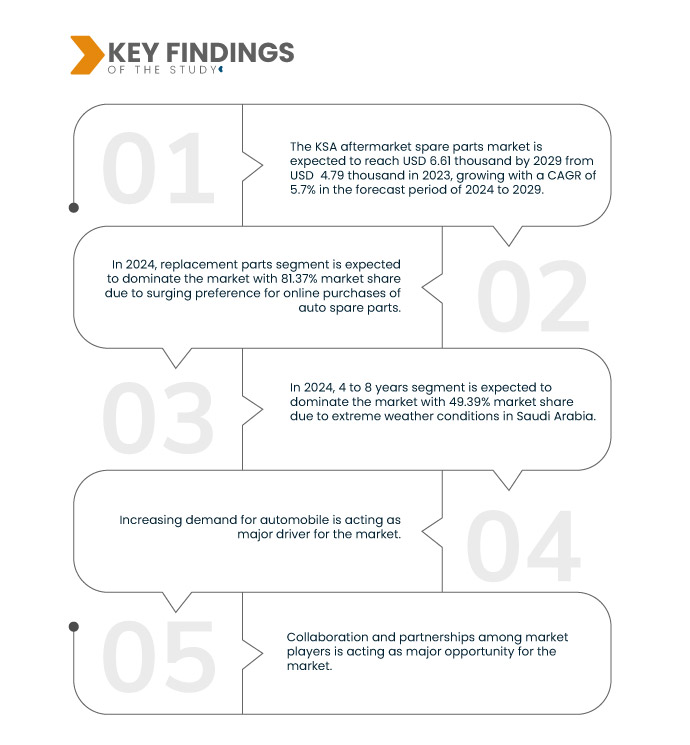

A Data Bridge Market Research analisa que o mercado de peças de substituição de substituição da Arábia Saudita deverá atingir um valor de 6,61 mil dólares até 2029, face aos 4,79 mil de 2023, crescendo a um CAGR de 5,7% durante o período previsto de 2024 a 2029.

Principais conclusões do estudo

Aumento da preferência por compras online de peças de substituição para automóveis

A tendência crescente de compras online de peças de substituição para automóveis é um importante impulsionador do mercado de peças de substituição da Arábia Saudita. À medida que a digitalização e o comércio eletrónico ganham força, os consumidores valorizam a conveniência, a acessibilidade e a vasta seleção de produtos das plataformas online. Com a proliferação de canais de comércio eletrónico e sites dedicados a peças automóveis, os proprietários de veículos podem facilmente navegar, comparar preços e comprar peças de substituição em casa ou no trabalho. Esta mudança para as compras online elimina a necessidade de visitas físicas às lojas, poupando tempo e esforço aos consumidores e permitindo aos fornecedores de peças de substituição alcançar uma base de clientes mais ampla em diferentes regiões da Arábia Saudita.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2029

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em USD Mil

|

Segmentos abrangidos

|

Tipo (peças de substituição e acessórios), canal de distribuição (grossistas, distribuidores e retalhistas), perspetiva de certificação (peças originais, peças certificadas e peças não certificadas), canal de serviço (DIFM (faça por mim), DIY (faça você mesmo) e OE (delegando para OEMs)), idade do veículo (4 a 8 anos, 0 a 4 anos e acima de 8 anos), tipo de veículo (automóveis de passageiros, veículos comerciais, veículos utilitários (UTV), veículos de recreio), canal de vendas (off-line e on-line), tipo de propulsão (gasóleo/gasolina, GNC e elétrico)

|

Países abrangidos

|

Arábia Saudita

|

Participantes do mercado abrangidos

|

Continental AG (Alemanha), The Goodyear Tire & Rubber Company (EUA), DENSO CORPORATION. (Japão), Tenneco Inc. (EUA), Robert Bosch GmbH (Alemanha), Aptiv (Irlanda), Michelin (França), ZF Friedrichshafen AG (Alemanha), Yokohama Tire Corporation (Japão) e Knorr-Bremse AG (Alemanha), entre outras

|

Pontos de dados abordados no relatório

|

Para além dos insights de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

|

Análise de Segmentos

O mercado de peças de substituição da Arábia Saudita está segmentado em oito segmentos notáveis com base no tipo, canal de distribuição, perspetiva de certificação, tipo de propulsão, canal de serviço, idade do veículo, tipo de veículo e canal de vendas.

- Com base no tipo, o mercado está segmentado em peças de substituição e acessórios

Em 2024, prevê-se que o segmento de peças de substituição domine o mercado de peças de substituição do mercado de pós-venda da Arábia Saudita

Em 2024, prevê-se que o segmento das peças de substituição domine o mercado com uma quota de mercado de 81,37%, uma vez que, com o envelhecimento dos veículos e das máquinas, existe uma procura crescente de peças de substituição para manter e reparar os equipamentos existentes.

- Com base no canal de distribuição, o mercado está segmentado em grossistas e distribuidores e retalhistas

Em 2024, prevê-se que o segmento dos grossistas e distribuidores domine o mercado de peças de substituição de substituição da Arábia Saudita

Em 2024, prevê-se que o segmento dos grossistas e distribuidores domine o mercado com 62,32% de quota de mercado devido às crescentes iniciativas governamentais para o fabrico localizado de peças de substituição automóveis.

- Com base na perspetiva da certificação, o mercado está segmentado em peças genuínas, peças certificadas e peças não certificadas. Em 2024, prevê-se que o segmento das peças genuínas domine o mercado com 52,66% de quota de mercado

- Com base no canal de serviço, o mercado está segmentado em DIFM (Faça por mim), DIY (Faça você mesmo) e OE (Delegação para OEMs). Em 2024, o segmento DIFM (Do It for ME) será segmentado por tipo, com base nos grossistas e distribuidores e retalhistas. Em 2024, prevê-se que o segmento DIFM (Do It for Me) domine o mercado com 70,99% de quota de mercado

- Com base na idade do veículo, o mercado está segmentado em 4 a 8 anos, 0 a 4 anos e acima dos 8 anos. Em 2024, prevê-se que o segmento dos 4 aos 8 anos domine o mercado com 49,39% de quota de mercado

- Com base no tipo de veículo, o mercado está segmentado em automóveis de passageiros, veículos comerciais, veículos utilitários (UTV) e veículos de recreio. Em 2024, prevê-se que o segmento dos automóveis de passageiros domine o mercado com 65,39% de quota de mercado

- Com base no canal de vendas, o mercado está segmentado em offline e online. Em 2024, prevê-se que o segmento offline domine o mercado com 84,32% de quota de mercado

- Com base no tipo de propulsão, o mercado está segmentado em diesel/gasolina, GNC e elétrico. Em 2024, prevê-se que o segmento gasóleo/gasolina domine o mercado com 94,83% de quota de mercado

Principais jogadores

A Data Bridge Market Research analisa a Michelin (França), a The Goodyear Tire & Rubber Company (EUA), a Continental AG (Alemanha), a Aptiv (Irlanda) e a ZF Friedrichshafen AG (Alemanha) como principais participantes deste mercado.

Desenvolvimento de Mercado

- Em abril de 2024, a Continental AG adquiriu a especialista em fabrico de moldes EMT Púchov sro, com sede na Eslováquia. O fabricante de pneus e os acionistas da EMT, a maior parte dos quais são a Dynamic Design (Roménia), têm um acordo correspondente. A Continental contratou todos os 107 trabalhadores, todos com competências especializadas no fabrico de moldes. Com a aquisição da EMT, a empresa completa o seu portfólio interno de tecnologias de fabrico de moldes. A partir de agora, o fabricante de pneus pode produzir de forma independente moldes de pneus para todas as aplicações, se necessário

- Em março de 2024, a Aptiv foi nomeada uma das principais empresas éticas pelo 12º ano consecutivo pela Ethisphere. A empresa é reconhecida pelo seu compromisso com a integridade empresarial através de programas sólidos de ética, conformidade e governação. Este reconhecimento reafirma o compromisso da empresa em promover uma cultura de ética, conformidade e excelência na governação em todas as suas operações.

- Em março de 2024, os pneus Continental AG ficaram no topo nos testes realizados por associações e revistas automóveis. As associações de veículos alemãs, ADAC e ACE, bem como publicações automóveis, AutoBild, AutoBild Reisemobil, Autozeitung, auto motor und sport e sportauto, estavam todas na mesma página, onde o PremiumContact 7 da Continental é um claro vencedor, liderando os seus testes e classificações. O sucesso do PremiumContact 7 contribui para o reforço da posição da Continental como fabricante líder de pneus premium a nível mundial

- Em março de 2024, a Goodyear lança os pneus RangeMax RSA ULT e RangeMax RTD ULT para veículos de trabalho regionais, oferecendo tração, autonomia e quilometragem equilibradas. Os pneus servem veículos elétricos e movidos a gás/gasóleo, com características como baixa resistência ao rolamento e construção sustentável com óleo de soja. Esta expansão da sua gama de pneus “Electric Drive Ready” ajuda as frotas a reduzir os custos operacionais e o impacto ambiental

- Em outubro de 2023, a Goodyear Tire & Rubber Company lança os novos pneus KMAX S EXTREME GEN2 para climas quentes no Médio Oriente e em África, proporcionando uma melhor quilometragem e desempenho em eixos direcionais. Os pneus reformáveis e reesculpáveis reduzem os custos operacionais e o impacto ambiental, alargando a gama de produtos da Goodyear e aumentando a competitividade no segmento das peças de substituição. Também apoiam a sustentabilidade ao permitir que as frotas otimizem os ativos de pneus e reduzam a pegada ambiental

Análise Regional

Geograficamente, os países abrangidos pelo relatório do mercado global de gestores de infraestruturas virtuais são a Arábia Saudita.

Para obter informações mais detalhadas sobre o relatório do mercado de peças de substituição da KSA , clique aqui – https://www.databridgemarketresearch.com/reports/ksa-aftermarket-spare-parts-market