O seguro saúde é um tipo de seguro que oferece cobertura para todos os tipos de despesas cirúrgicas, bem como tratamentos médicos decorrentes de uma doença ou lesão. Aplica-se a uma gama abrangente ou limitada de serviços médicos que cobrem os custos totais ou parciais de serviços específicos. Oferece apoio financeiro ao segurado, pois cobre todas as despesas médicas quando o segurado é hospitalizado para tratamento. Também cobre despesas pré e pós-hospitalização.

Acesse o relatório completo @ https://www.databridgemarketresearch.com/reports/indonesia-private-health-insurance-market

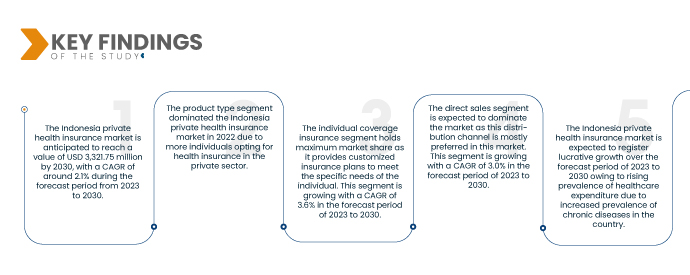

A Data Bridge Market Research analisa que o Mercado de seguros de saúde privados da Indonésia deverá crescer a um CAGR de 2,1% no período de previsão de 2023 a 2030 e deverá atingir US$ 3.321,75 milhões até 2030. Em 2023, espera-se que o segmento de tipo de produto domine o mercado devido a um aumento na conscientização sobre o benefícios do seguro saúde.

Principais conclusões do estudo

Crescente turismo médico na Indonésia

Crescente turismo médico na Indonésia

O turismo médico é uma tendência cada vez mais popular em que as pessoas viajam para diferentes países para tratamentos, procedimentos ou cirurgias médicas. A Indonésia tem visto um crescimento constante no turismo médico nos últimos anos, graças à melhoria da infra-estrutura de saúde do país, aos custos acessíveis e aos profissionais médicos bem treinados. A indústria de turismo médico da Indonésia oferece uma ampla gama de serviços, incluindo tratamentos odontológicos, cirurgia estética, cirurgias cardíacas e cirurgias ortopédicas. O país também oferece práticas de medicina tradicional, como jamu e acupuntura, populares entre os turistas que buscam métodos alternativos de cura.

Concluindo, a crescente indústria do turismo médico na Indonésia é resultado da melhoria da infraestrutura de saúde do país, dos custos acessíveis e das ofertas culturais únicas. Com o investimento contínuo do governo na saúde e no turismo, a Indonésia está preparada para se tornar um destino líder para o turismo médico no Sudeste Asiático. Assim, por sua vez, espera-se que o aumento da procura de seguros de saúde privados na Indonésia funcione como uma grande oportunidade para o crescimento do mercado.

Escopo do relatório e segmentação de mercado

|

Métrica de relatório

|

Detalhes

|

|

Período de previsão

|

2023 a 2030

|

|

Ano base

|

2022

|

|

Ano histórico

|

2021 (personalizável para 2015 - 2020)

|

|

Unidades Quantitativas

|

Receita em milhões e preços em dólares

|

|

Segmentos cobertos

|

Por tipo de produto (em seguro Mediclaim, seguro de cobertura de hospitalização, seguro de doenças graves, seguro de cobertura individual, seguro de cobertura flutuante familiar, seguro de cobertura para idosos, planos de saúde unit linked, seguro de saúde privado permanente e outros), solução de negócios (soluções de geração de leads , automação robótica de processos, soluções de inteligência artificial e blockchain, soluções de gerenciamento de receita e faturamento, soluções em nuvem para administração de sinistros, soluções de pagamentos com base em valor, soluções inteligentes de gerenciamento de casos, soluções em nuvem para seguros e outros), tipo de assistência/serviço (internação/creche, Alojamento Hospitalar, Benefício por Morte Acidental, Cuidados Paliativos, Maternidade, Evacuação Médica, Plano de Repatriação, Ambulatorial, Odontológico, Oncológico, Tratamento Oftalmológico a Laser, Psiquiatria e Psicoterapia, Transplante de Órgãos, Tratamento de Reabilitação e Outros), Nível de Cobertura (Bronze, Silver, Gold e Platinum), Tipo de Planos de Seguro (Organizações de Manutenção de Saúde (HMOs), Organizações de Provedores Preferenciais (PPOs), Organizações de Provedores Exclusivos (EPOs), Planos de Ponto de Serviço (POS), Seguro de Saúde Privado de Indenização, Saúde Conta Poupança (HSA), Acordos de Reembolso de Saúde para Pequenos Empregadores Qualificados (QSEHRAs) e Outros), Dados Demográficos (Adultos, Idosos e Menores), Tipo de Cobertura (Cobertura Vitalícia e Cobertura Prazo), Usuário Final (Indivíduo, Casal, Família e Corporativo), Canal de Distribuição (Vendas Diretas, Instituições Financeiras, Hospitais, Clínicas, E-Commerce e Outros)

|

|

País coberto

|

Indonésia

|

|

Participantes do mercado cobertos

|

Pacific Cross (Filipinas), Allianz Indonesia (Alemanha), Etiqa (Malásia), PT FWD Insurance Indonesia (China), Aetna Inc. (Subsidiária da CVS health) (EUA), BUPA Global (Reino Unido), Manulife (Canadá), PT BANK MANDIRI (PERSERO) TBK (Indonésia), AXA (França), AIA Group Limited (China), PRUDENCIAL INDONESIA (Indonésia), Medibank Private Limited. (Austrália), BNI Life (subsidiária do Bank Negara Indonesia) (Indonésia), Sun Life Financial (Canadá), PT AVRIST ASSURANCE (Indonésia), Great Eastern Holdings Limited (Singapura), Now Health International (China), PT Tokio Marine Life Insurance Indonesia (subsidiária da Tokoi Marine Holdings) (Indonésia), Cigna (EUA) e ALLIANZ WORLDWIDE CARE LIMITED (Irlanda), entre outros.

|

|

Pontos de dados abordados no relatório

|

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research também incluem análise especializada aprofundada, epidemiologia de pacientes, análise de pipeline, análise de preços, e quadro regulamentar.

|

Análise de Segmento

O mercado de seguros de saúde privados da Indonésia é categorizado em nove segmentos notáveis com base no tipo de produto, solução de negócios, tipo de assistência/serviço, nível de cobertura, tipo de planos de seguro, demografia, tipo de cobertura, usuário final e canal de distribuição.

- Com base no tipo de produto, o mercado é segmentado em seguro de cobertura de hospitalização, seguro mediclaim, seguro de doença crítica, seguro de cobertura individual, seguro de cobertura flutuante familiar, planos de saúde vinculados à unidade de seguro de cobertura para idosos, seguro de saúde privado permanente, entre outros. Em 2023, o segmento de seguros de cobertura individual deverá dominar o mercado com uma participação de mercado de 21,68% e deverá atingir US$ 798,67 milhões até 2030, crescendo com um CAGR de 3,6% no período previsto de 2023 a 2030.

- Com base em soluções de negócios, o mercado é segmentado em soluções de geração de leads, automação de processos robóticos, soluções de inteligência artificial e blockchain, soluções de gerenciamento de receitas e faturamento, soluções de nuvem de administração de sinistros, soluções de pagamentos baseadas em valor, soluções inteligentes de gerenciamento de casos, soluções de nuvem de seguros, e outros. Em 2023, o segmento de soluções de geração de leads deverá dominar o mercado com uma participação de mercado de 30,94% e deverá atingir US$ 1.125,29 milhões até 2030, crescendo com um CAGR de 3,4% no período previsto de 2023 a 2030.

- Com base no tipo de assistência/serviço, o mercado é segmentado em internação/creche, hospedagem hospitalar, benefício por morte acidental, cuidados paliativos, maternidade, evacuação médica, plano de repatriação, ambulatorial, odontológico, oncológico, tratamento ocular a laser, psiquiatria e psicoterapia, transplante de órgãos, tratamento de reabilitação e outros. Em 2023, o segmento de internação/creche deverá dominar o mercado com uma participação de mercado de 25,07% e deverá atingir US$ 877,65 milhões até 2030, crescendo com um CAGR de 2,9% no período previsto de 2023 a 2030.

- Com base no nível de cobertura, o mercado é segmentado em bronze, prata, ouro e platina. Em 2023, o segmento bronze deverá dominar o mercado com uma participação de mercado de 42,91% e deverá atingir US$ 1.499,81 milhões até 2030, crescendo com um CAGR de 2,8% no período previsto de 2023 a 2030.

- Com base no tipo de planos de seguro, o mercado é segmentado em organizações de manutenção de saúde (HMOs), organizações de provedores preferenciais (PPOs), organizações de provedores exclusivos (EPOs), planos de ponto de serviço (POS), seguro de saúde privado de indenização, poupança de saúde conta (HSA), pequeno empregador qualificado, acordos de reembolso de saúde (QSEHRAs) e outros. Em 2023, espera-se que o segmento de organizações de manutenção da saúde (HMOs) domine o mercado com uma participação de mercado de 37,94% e deverá atingir US$ 1.309,79 milhões até 2030, crescendo com um CAGR de 2,7% no período de previsão de 2023 a 2030. .

- Com base na demografia, o mercado é segmentado em adultos, idosos e menores. Em 2023, o segmento adulto deverá dominar o mercado com uma participação de mercado de 53,44% e deverá atingir US$ 1.853,97 milhões até 2030, crescendo com um CAGR de 2,7% no período previsto de 2023 a 2030.

- Com base no tipo de cobertura, o mercado é segmentado em cobertura vitalícia e cobertura a prazo. Em 2023, o segmento de cobertura vitalícia deverá dominar o mercado com uma participação de mercado de 62,58% e deverá atingir US$ 2.138,51 milhões até 2030, crescendo com um CAGR de 2,5% no período previsto de 2023 a 2030.

- Com base no usuário final, o mercado é segmentado em individual, casal, família e corporativo. Em 2023, o segmento individual deverá dominar o mercado com uma participação de mercado de 52,39% e deverá atingir US$ 1.812,94 milhões até 2030, crescendo com um CAGR de 2,7% no período previsto de 2023 a 2030.

- Com base no canal de distribuição, o mercado é segmentado em vendas diretas, instituições financeiras, hospitais, clínicas, e-commerce, entre outros. Em 2023, o segmento de vendas diretas deverá dominar o mercado com uma participação de mercado de 36,48% e deverá atingir US$ 1.292,78 milhões até 2030, crescendo com um CAGR de 3,0% no período previsto de 2023 a 2030.

Jogadores principais

A Data Bridge Market Research reconhece as seguintes empresas como os principais players do mercado de seguros de saúde privados no mercado de seguros de saúde privados da Indonésia, que incluem Pacific Cross (Filipinas), Allianz Indonesia (Alemanha), Etiqa (Malásia), PT FWD Insurance Indonesia (China), Aetna (Subsidiária da CVS health) (EUA), BUPA Global (Reino Unido), Manulife (Canadá), PT BANK MANDIRI (PERSERO) TBK (Indonésia), AXA (França), AIA Group Limited (China), PRUDENCIAL INDONÉSIA (Indonésia) ), Medibank Private Limited. (Austrália), BNI Life (subsidiária do Bank Negara Indonesia) (Indonésia), Sun Life Financial (Canadá), PT AVRIST ASSURANCE (Indonésia), Great Eastern Holdings Limited (Singapura), Now Health International (China), PT Tokio Marine Life Insurance Indonesia (subsidiária da Tokoi Marine Holdings) (Indonésia), Cigna (EUA) e ALLIANZ WORLDWIDE CARE LIMITED (Irlanda), entre outros.

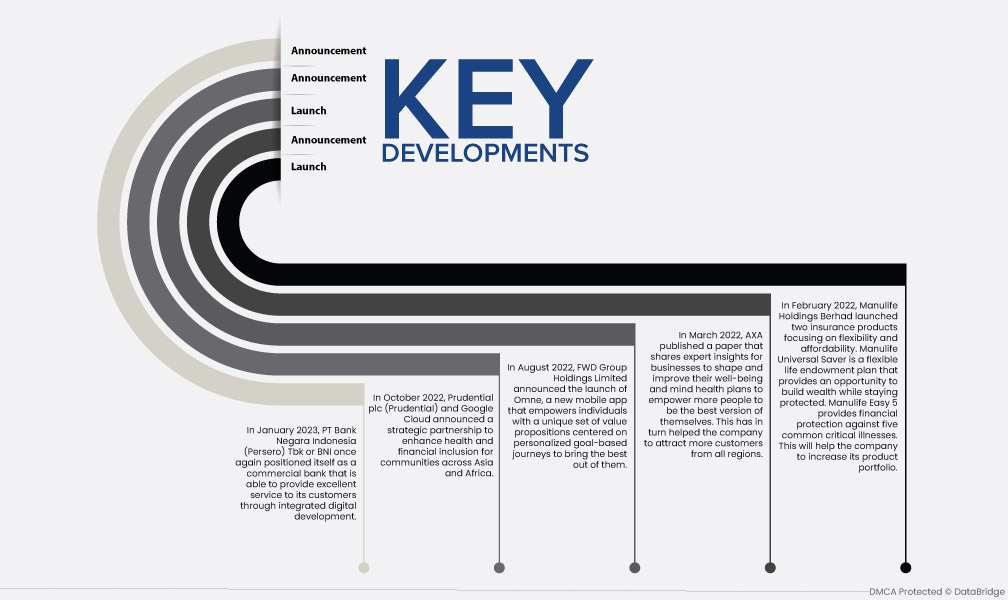

Desenvolvimento de mercado

- Em Janeiro de 2023, o PT Bank Negara Indonesia (Persero) Tbk ou BNI voltou a posicionar-se como um banco comercial capaz de prestar um serviço de excelência aos seus clientes através do desenvolvimento digital integrado.

- Em outubro de 2022, a Prudential plc (Prudential) e o Google Cloud anunciaram uma parceria estratégica para melhorar a saúde e a inclusão financeira para comunidades em toda a Ásia e África.

- Em agosto de 2022, o FWD Group Holdings Limited anunciou o lançamento do Omne, um novo aplicativo móvel que capacita os indivíduos com um conjunto exclusivo de propostas de valor centradas em jornadas personalizadas baseadas em objetivos para extrair o melhor deles.

- Em março de 2022, a AXA publicou um artigo que partilha conhecimentos de especialistas para que as empresas possam moldar e melhorar os seus planos de bem-estar e saúde mental para capacitar mais pessoas a serem a melhor versão de si mesmas. Isso, por sua vez, ajudou a empresa a atrair mais clientes de todas as regiões.

- Em fevereiro de 2022, a Manulife Holdings Berhad lançou dois produtos de seguros com foco na flexibilidade e acessibilidade. Manulife Universal Saver é um plano de doação vitalício flexível que oferece uma oportunidade de acumular riqueza enquanto permanece protegido. Manulife Easy 5 oferece proteção financeira contra cinco doenças críticas comuns. Isso ajudará a empresa a aumentar seu portfólio de produtos.

Análise Regional

Geograficamente, o país coberto pelo relatório do mercado de seguros de saúde privados da Indonésia é a Indonésia.

Para obter informações mais detalhadas sobre o relatório do mercado de seguro saúde privado da Indonésia, clique aqui -https://www.databridgemarketresearch.com/reports/indonesia-private-health-insurance-market