A inclusão de serviços de manutenção e suporte nos contratos de renting melhora significativamente a eficiência operacional das empresas. Ao externalizar a manutenção e o suporte, as empresas evitam as complexidades e os custos associados à gestão destas funções internamente. Este acordo permite que as empresas se concentrem nas suas operações principais, garantindo ao mesmo tempo que o equipamento alugado é mantido e calibrado de forma consistente. Esta eficiência é particularmente valiosa em ambientes de elevada exigência, onde o tempo de atividade e a fiabilidade do equipamento são cruciais para cumprir os prazos do projeto e manter a produtividade. Incorporar a manutenção e o apoio aos contratos de renting ajuda as empresas a gerir os custos de forma mais eficaz. Em vez de suportar todo o encargo financeiro da manutenção do equipamento, que inclui a manutenção regular, reparações e resolução de problemas, as empresas beneficiam de um custo de aluguer previsível e geralmente mais baixo, que inclui estes serviços.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/global-renting-and-leasing-test-and-measurement-equipment-market

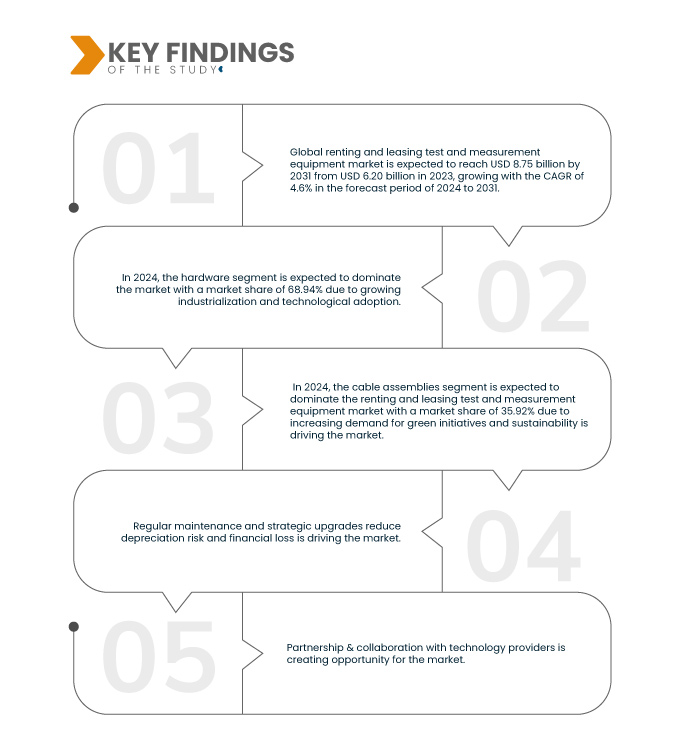

A Data Bridge Market Research analisa que o mercado de aluguer e leasing de equipamentos de teste e medição deverá atingir os 8,75 mil milhões de dólares até 2031, face aos 6,20 mil milhões de dólares em 2023, crescendo com um CAGR de 4,6% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento da procura por equipamentos baseados em projetos

A crescente procura de equipamentos baseados em projetos é um importante impulsionador do mercado de aluguer e leasing de equipamentos de teste e medição. Os projetos requerem frequentemente equipamentos de teste e medição especializados por períodos limitados, e o aluguer oferece uma solução flexível para satisfazer estas necessidades de curto prazo. As empresas podem aceder às ferramentas específicas de que necessitam sem se comprometerem com a propriedade a longo prazo, o que é ideal para setores com requisitos de projeto flutuantes ou para aqueles que embarcam em iniciativas temporárias. O aluguer de equipamentos de teste e medição para trabalho baseado em projetos oferece eficiência de custos, uma vez que as empresas evitam os elevados custos iniciais e a depreciação associados à compra no setor de aluguer e leasing de equipamentos de teste e medição.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (Personalizável de 2016 a 2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Oferta (Hardware e Serviços), Componente (Conjuntos de Cabos, Conectores, Acessórios de Valor Acrescentado e Outros), Tipo de Sistema (Sistema de Deteção, Sistema de Conectividade, Sistema de Segurança, Interface Homem-Máquina (HMI), Sistema de Gestão de Energia e Energia, Sistema de Controlo de Motores e Sistema de Iluminação), Tipo (Aluguer e Leasing), Características (Equipamento de Diagnóstico, Deteção Elétrica, ICS de Medição e Outros), Utilizador Final (TI e Telecomunicações, Automóvel, Aeroespacial e Defesa, Industrial, Eletrónica de Consumo , Energia e Serviços Públicos, Equipamentos Médicos e Outros)

|

Países abrangidos

|

EUA, Canadá e México, Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Turquia, Bélgica, Países Baixos, Suíça, Noruega, Finlândia, Dinamarca, Suécia, Polónia e restante Europa, Japão, China, Coreia do Sul, Índia, Austrália, Nova Zelândia, Singapura, Tailândia, Malásia, Indonésia, Filipinas, Taiwan, Vietname e resto da Ásia-Pacífico, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel, Bahrein, Omã, Qatar, Kuwait e resto do Médio Oriente e África, Brasil, Argentina e resto da América do Sul

|

Participantes do mercado abrangidos

|

Siemens (Alemanha), Keysight Technologies (EUA), Rohde & Schwarz (Alemanha), Fortive (EUA), Emerson Electric Co. (EUA), Texas Instruments Incorporated (EUA), ADVANTEST CORPORATION (Japão), Viavi Solutions (EUA), Yokogawa Electric Corporation (Japão), STMicroelectronics (Suíça), Learnado DRS (EUA), General Electric Company (EUA), Anritsu (Japão), EXFO Inc. (Canadá), Megger (Reino Unido), ADLINK Technology Inc. (Taiwan), Transcat, Inc (EUA), electrorent com.Inc (EUA), Good Will Instrument Co, Ltd (China), Leader Electronics of Europe Lim (Taiwan), Doble Engineering Company (EUA), Bird (Holanda), Boontoon Electronics (EUA), Saluki Technology (Taiwan), Fluke Networks (EUA) e DS Instruments (EUA), entre outras.

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos

O mercado global de equipamentos de teste e medição para locação e leasing está dividido em seis segmentos notáveis, que se baseiam na oferta, componente, tipo de sistema, tipo, características e utilizador final.

- Com base na oferta, o mercado de aluguer e leasing de equipamentos de teste e medição está segmentado em hardware e serviços

Em 2024, prevê-se que o segmento de hardware domine o mercado global de aluguer e leasing de equipamentos de teste e medição

Em 2024, prevê-se que o segmento de hardware domine o mercado com uma quota de mercado de 68,94% devido à elevada procura de instrumentos especializados e dispendiosos que as empresas preferem alugar em vez de comprar, reduzindo os gastos de capital iniciais.

- Com base no componente, o mercado de equipamentos de teste e medição para aluguer e leasing está segmentado em conjuntos de cabos, conectores, acessórios de valor acrescentado e outros

Em 2024, prevê-se que o segmento dos conjuntos de cabos domine o mercado global de aluguer e leasing de equipamentos de teste e medição

Em 2024, prevê-se que o segmento dos conjuntos de cabos domine o mercado com uma quota de mercado de 35,92% devido ao rápido avanço na inovação tecnológica.

- Com base no tipo de sistema, o mercado de equipamentos de teste e medição para aluguer e leasing está segmentado em sistema de iluminação, sistema de conectividade, interface homem-máquina (IHM), sistema de deteção, sistema de segurança, sistema de controlo do motor e sistema de gestão de energia. Em 2024, prevê-se que o sistema de deteção domine o mercado de aluguer e leasing de equipamentos de teste e medição com uma quota de mercado de 30,31%.

- Com base no tipo, o mercado de aluguer e leasing de equipamentos de teste e medição está segmentado em leasing e leasing. Em 2024, prevê-se que o segmento de aluguer domine o mercado de aluguer e leasing de equipamentos de teste e medição, com uma quota de mercado de 59,38%.

- Com base nas características, o mercado de aluguer e leasing de equipamentos de teste e medição está segmentado em ICS de medição, equipamentos de diagnóstico , deteção elétrica e outros. Em 2024, prevê-se que o segmento de equipamentos de diagnóstico domine o mercado de aluguer e leasing de testes e medições, com uma quota de mercado de 40,63%.

- Com base no utilizador final, o mercado de aluguer e leasing de equipamentos de teste e medição está segmentado em TI e telecomunicações, automóvel, aeroespacial e defesa, eletrónica de consumo , industrial, energia e serviços públicos, equipamentos médicos e outros. Em 2024, prevê-se que o segmento de TI e telecomunicações domine o mercado de aluguer e leasing de equipamentos de teste e medição, com uma quota de mercado de 29,64%.

Principais jogadores

A Data Bridge Market Research analisa a Siemens (Alemanha), a Keysight Technologies (EUA), a Rohde & Schwarz (Alemanha), a Fortive (EUA), a Emerson Electric Co. (EUA) como as principais empresas que operam no mercado.

Desenvolvimento de Mercado

- Em abril de 2024, a Rohde & Schwarz e a IPG Automotive lançaram uma solução de teste de radar automóvel Hardware-in-the-Loop (HIL) que integra software de simulação com equipamento de radar, movendo os testes de condução autónoma do campo de provas para o laboratório, de forma a reduzir custos e melhorar a eficiência. Esta solução reforçou a posição da Rohde & Schwarz no mercado de aluguer de testes e medições, oferecendo ferramentas avançadas que atraem OEMs automóveis e fornecedores de radares, e aumentam as oportunidades de leasing

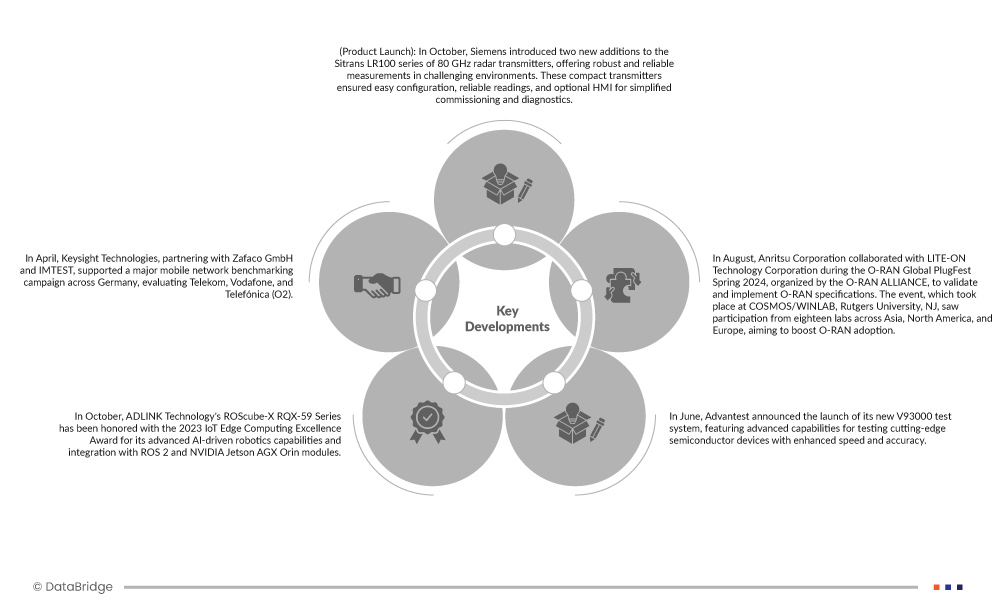

- Em abril de 2024, a Keysight Technologies, em parceria com a Zafaco GmbH e a IMTEST, apoiou uma grande campanha de benchmarking de redes móveis na Alemanha, avaliando a Telekom, a Vodafone e a Telefónica (O2). Isto destacou as soluções de teste avançadas da Keysight, aumentando a sua presença no mercado e o seu potencial para o aluguer e leasing de equipamentos de teste e medição.

- Em outubro, a Siemens apresentou duas novas adições à série Sitrans LR100 de transmissores de radar de 80 GHz, oferecendo medições robustas e fiáveis em ambientes desafiantes. Estes transmissores compactos garantiram uma configuração fácil, leituras fiáveis e HMI opcional para comissionamento e diagnóstico simplificados. Foram concebidos para uma vasta gama de aplicações nos setores da energia, mineração, agregados e água. Esta notícia reforçou a posição da Siemens como líder em soluções de medição inovadoras, reforçando a sua reputação e alargando o seu portefólio de produtos.

- Em maio, o Teste de Interatividade da Rohde & Schwarz foi reconhecido pela UIT como um novo padrão para a avaliação do desempenho da rede, fornecendo medições mais precisas para aplicações interativas e em tempo real do que os métodos tradicionais. Este avanço reforça a posição da Rohde & Schwarz no mercado de aluguer e leasing, destacando as suas soluções de teste de ponta aprovadas pela UIT, atraindo operadores de redes móveis e aumentando as oportunidades de leasing dos seus equipamentos avançados.

- Em outubro, a Siemens apresentou duas novas adições à série Sitrans LR100 de transmissores de radar de 80 GHz, oferecendo medições robustas e fiáveis em ambientes desafiantes. Estes transmissores compactos garantiram uma configuração fácil, leituras fiáveis e HMI opcional para comissionamento e diagnóstico simplificados. Foram concebidos para uma vasta gama de aplicações nos setores da energia, mineração, agregados e água. Esta notícia reforçou a posição da Siemens como líder em soluções de medição inovadoras, reforçando a sua reputação e alargando o seu portefólio de produtos.

Análise Regional

Geograficamente, os países abrangidos pelo relatório do mercado global de equipamentos de teste e medição para aluguer e leasing são os EUA, Canadá e México, Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Turquia, Bélgica, Países Baixos, Suíça, Noruega, Finlândia, Dinamarca, Suécia, Polónia e restante Europa, Japão, China, Coreia do Sul, Índia, Austrália, Nova Zelândia, Singapura, Tailândia, Malásia, Indonésia, Filipinas, Taiwan, Vietname e resto da Ásia-Pacífico, Emirados Árabes Unidos, Arábia Saudita, África do Sul, Egito, Israel, Bahrein, Omã, Qatar, Kuwait e resto do Médio Oriente e África, Brasil, Argentina e resto da América do Sul.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Espera-se que a América do Norte domine o mercado global de aluguer e leasing de equipamentos de teste e medição

Prevê-se que a América do Norte domine o mercado de aluguer e leasing de equipamentos de teste e medição devido à sua infraestrutura tecnológica avançada, maior investimento em I&D e forte presença de indústrias importantes, levando a uma maior procura de aluguer e leasing de equipamentos de teste e medição em comparação com outras regiões.

Espera-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado global de aluguer e leasing de equipamentos de teste e medição

Prevê-se que a Ásia-Pacífico seja a região de crescimento mais rápido no mercado global de aluguer e leasing de equipamentos de teste e medição devido à manutenção regular e atualizações estratégicas que reduzem o risco de depreciação e perdas financeiras.

Para obter informações mais detalhadas sobre o relatório do mercado global de equipamentos de teste e medição para aluguer e leasing, clique aqui – https://www.databridgemarketresearch.com/reports/global-renting-and-leasing-test-and-measurement-equipment-market