A indústria automóvel enfrenta uma necessidade crescente de otimizar as operações da cadeia de abastecimento. A implementação de soluções EDI robustas é crucial para melhorar a comunicação e a visibilidade em toda a cadeia de abastecimento. Os sistemas EDI eficientes otimizam os processos, reduzem os erros e melhoram a eficiência operacional global. Ao aproveitar a tecnologia EDI, as empresas automóveis podem manter-se competitivas num cenário de mercado em rápida evolução. Adotar operações simplificadas da cadeia de abastecimento através de EDI é essencial para satisfazer as exigências dos clientes e alcançar um crescimento sustentável.

A crescente necessidade de otimizar as operações da cadeia de abastecimento na indústria automóvel sublinha a importância da adoção do Intercâmbio Eletrónico de Dados (EDI). O EDI automatiza a troca de documentos cruciais, como ordens de compra, faturas e notificações de expedição, reduzindo os erros de introdução manual de dados e acelerando o tempo de processamento de transações. Esta automatização garante um fluxo contínuo de informação entre fabricantes, fornecedores e retalhistas, facilitando uma tomada de decisão mais rápida.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/global-edi-market

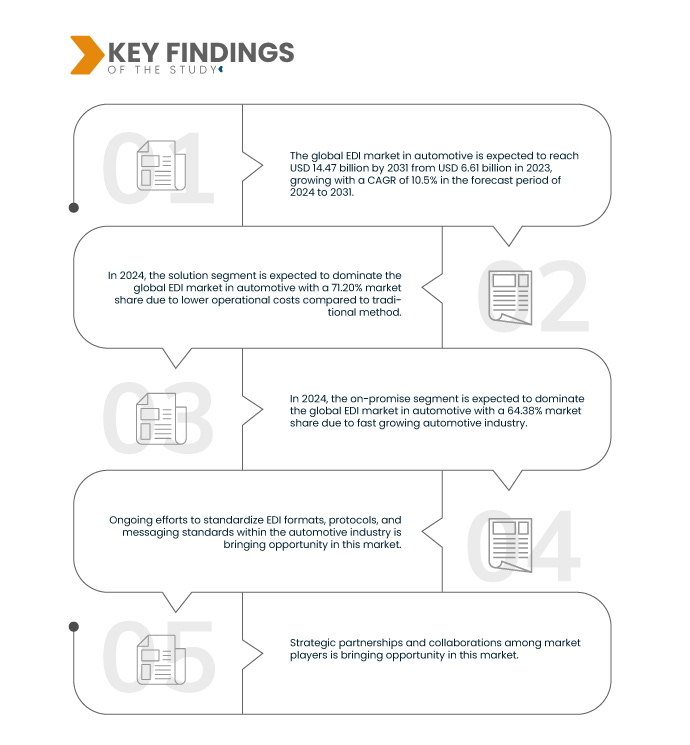

A Data Bridge Market Research analisa que o mercado global de EDI no setor automóvel deverá atingir um valor de 14,47 mil milhões de dólares até 2031, face aos 6,61 mil milhões de dólares em 2023, com um CAGR de 10,5% durante o período previsto de 2024-2031.

Principais conclusões do estudo

Indústria automóvel em rápido crescimento

Na indústria automóvel de rápido crescimento, a adoção do Intercâmbio Eletrónico de Dados (EDI) é crucial para otimizar as operações da cadeia de abastecimento. O EDI facilita a comunicação e a troca de dados entre fabricantes, fornecedores e distribuidores, permitindo uma aquisição eficiente, gestão de stocks e processamento de encomendas. Ao automatizar processos e proporcionar visibilidade em tempo real, o EDI aumenta a eficiência, reduz custos e garante uma resposta rápida às exigências do mercado.

A indústria automóvel de rápido crescimento depende muito do Intercâmbio Eletrónico de Dados (EDI) para otimizar as operações e aumentar a eficiência. O EDI automatiza a troca de documentos importantes, reduzindo erros e custos administrativos e acelerando as transações. Esta tecnologia é crucial para gerir cadeias de abastecimento complexas e suportar sistemas de produção just-in-time. Ao uniformizar os protocolos de comunicação, o EDI permite operações internacionais mais tranquilas, facilitando a globalização do setor. No geral, o EDI é vital para sustentar o crescimento e a vantagem competitiva do setor automóvel.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Oferta (solução e serviços), modo de implementação (local e na cloud), tipo (EDI direto, EDI habilitado para rede de valor acrescentado (VAN), EDI habilitado para declaração de aplicabilidade 2 (AS2), EDI na Web, EDI móvel, EDI terceirizado e EDI indireto), standard (ANSI X12, EDIFACT, ODETTEE, VDA, XML e outros), aplicação (programações de produção, gestão de stocks, ordens de compra, notificações de expedição e outros), utilizador final (fabricantes, fornecedores de logística, fornecedores, distribuidores e concessionários)

|

Países abrangidos

|

China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Malásia, Tailândia, Indonésia, Filipinas, Taiwan, Vietname, Resto da Ásia-Pacífico, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Turquia, Polónia, Bélgica, Holanda, Suécia, Finlândia, Suíça, Noruega, Dinamarca, Resto da Europa, EUA, Canadá, México, Brasil, Argentina, Resto da América do Sul, Arábia Saudita, África do Sul, Israel, Emirados Árabes Unidos, Egito, Kuwait, Omã, Bahrein, Qatar e Resto do Médio Oriente e África

|

Participantes do mercado abrangidos

|

Open Text Corporation (Canadá), Cegedim e-business (Reino Unido), Rocket Software, Inc (EUA), True Commerce, Inc (EUA), THE DESCARTES SYSTEMS GROUP INC (Canadá), SPS Commerce (EUA), In, Comarch SA (Polónia), SAP SE (Alemanha) e Epicor Software Corporation (EUA), entre outros

|

Pontos de dados abordados no relatório

|

Para além das perspetivas de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

|

Análise de Segmentos

O mercado global de EDI no setor automóvel está categorizado em seis segmentos notáveis com base na oferta, tipo, utilizador final, aplicação, padrão e modo de implementação.

- Com base na oferta, o mercado global de EDI na indústria automóvel está segmentado em soluções e serviços

Em 2024, prevê-se que o segmento de soluções domine o mercado global de EDI no setor automóvel

Em 2024, prevê-se que o segmento de soluções domine o mercado global de EDI no setor automóvel, com uma quota de mercado de 71,20%, devido aos menores custos operacionais em comparação com o método tradicional.

- Com base no modo de implementação, o mercado global de EDI no setor automóvel está segmentado em promessa e cloud

Em 2024, prevê-se que o segmento on-promise domine o mercado global de EDI no setor automóvel

Em 2024, prevê-se que o segmento on-promise domine o mercado global de EDI no setor automóvel, com uma quota de mercado de 64,38%, devido à crescente adoção da automatização do fluxo de trabalho no setor automóvel.

- Com base no tipo, o mercado global de EDI no setor automóvel está segmentado em EDI direto, EDI habilitado para Rede de Valor Acrescentado (VAN), EDI habilitado para declaração de aplicabilidade 2 (AS2), EDI web, EDI móvel, EDI terceirizado e EDI indireto. Em 2024, prevê-se que o segmento de EDI direto domine o mercado global de EDI no setor automóvel, com uma quota de mercado de 30,95%.

- Com base na norma, o mercado global de EDI automóvel está segmentado em ANSI X12, EDIFACT, ODETTEE, VDA, XML e outros. Em 2024, prevê-se que o segmento ANSI X12 domine o mercado global de EDI no setor automóvel, com uma quota de mercado de 39,84%.

- Com base na aplicação, o mercado global de EDI no setor automóvel está segmentado em planos de produção, gestão de stocks, ordens de compra, notificações de expedição e outros. Em 2024, prevê-se que o segmento dos planos de produção domine o mercado global de EDI no setor automóvel, com uma quota de mercado de 38,08%.

- Com base no utilizador final, o mercado global de EDI no setor automóvel está segmentado em fabricantes, fornecedores de logística, fornecedores, distribuidores e concessionários. Em 2024, prevê-se que os fabricantes dominem o mercado global de EDI no setor automóvel com uma quota de mercado de 54,63%.

Principais jogadores

A Data Bridge Market Research analisa a Open Text Corporation (Canadá), a Cegedim e-business (Reino Unido), a Rocket Software, Inc. (EUA), a True Commerce, Inc (EUA) e a THE DESCARTES SYSTEMS GROUP INC (Canadá) como principais participantes neste mercado.

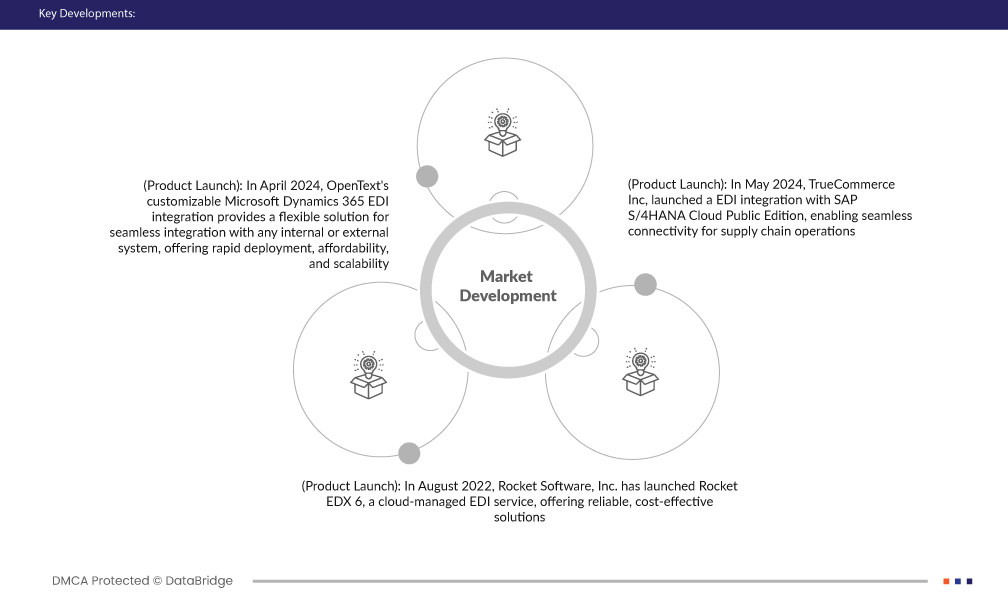

Desenvolvimento de Mercado

- Em abril de 2024, a integração personalizável do Microsoft Dynamics 365 EDI da OpenText fornece uma solução flexível para uma integração perfeita com qualquer sistema interno ou externo, oferecendo uma rápida implementação, acessibilidade e escalabilidade. Este desenvolvimento beneficia a OpenText ao abordar os desafios das soluções de integração B2B rígida, posicionando-a como um parceiro de confiança com uma vasta experiência em integração de ERP.

- Em agosto de 2022, a Rocket Software, Inc. lançou o Rocket EDX 6, um serviço de EDI gerido na cloud, que oferece soluções fiáveis e económicas. Este desenvolvimento permite uma integração simplificada, custos de propriedade reduzidos e uma rápida integração de parceiros. A Rocket Software beneficia ao fornecer uma solução segura e on-demand, integrando-se com os ERPs existentes e suportando padrões comuns de EDI, melhorando a sua posição no mercado

- Em maio de 2024, a TrueCommerce Inc lançou uma integração EDI com o SAP S/4HANA Cloud Public Edition, permitindo uma conectividade perfeita para as operações da cadeia de abastecimento. Esta integração direta simplifica a troca de dados, melhora a visibilidade e melhora a tomada de decisões. A integração sublinha o compromisso da TrueCommerce Inc. em fornecer soluções escaláveis e posiciona-a como um fornecedor fiável em conectividade de parceiros comerciais e soluções omnicanal.

- Em setembro de 2022, a TrueCommerce Inc adquiriu a Decentral, expandindo a sua base de clientes, a sua rede global e a sua experiência em cadeias de abastecimento automóvel. Esta aquisição reforça a posição da True Commerce nos mercados internacionais e a sua capacidade de oferecer soluções de integração perfeitas, melhorando a visibilidade da cadeia de abastecimento e impulsionando o crescimento das empresas em todo o mundo.

Em outubro de 2023, a TrueCommerce Inc ganhou oito selos G2 e manteve uma classificação de fornecedor de EDI de 4,5 em cinco estrelas, confirmando a sua excelência em soluções de cadeia de abastecimento e parceiros comerciais. Com elogios pela configuração mais fácil, maior adoção por parte do utilizador e muito mais. Estas conquistas refletem o compromisso da empresa com a satisfação do cliente e a inovação contínua, aumentando a eficiência da cadeia de abastecimento e impulsionando o crescimento do negócio dos seus clientes.

Análise Regional

Geograficamente, os países abrangidos pelo relatório global do mercado de EDI no setor automóvel são a China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Malásia, Tailândia, Indonésia, Filipinas, Taiwan, Vietname, restante Ásia-Pacífico, Alemanha, Reino Unido, França, Itália, Espanha, Rússia, Turquia, Polónia, Bélgica, Holanda, Suécia, Finlândia, Suíça, Noruega, Dinamarca, restante Europa, EUA, Canadá, México, Brasil, Argentina, restante América do Sul, Arábia Saudita, África do Sul, Israel, Emirados Árabes Unidos, Egito, Kuwait, Omã, Bahrein, Qatar e restante Médio Oriente e África.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Espera-se que a região da Ásia-Pacífico domine e cresça mais rapidamente no mercado global de EDI no setor automóvel

Espera-se que a Ásia-Pacífico domine e seja a região com o crescimento mais rápido no mercado devido à sua crescente indústria automóvel, produção em grande escala e rápida adoção tecnológica.

Para obter informações mais detalhadas sobre o mercado global de EDI no relatório automóvel, clique aqui – https://www.databridgemarketresearch.com/reports/global-edi-market