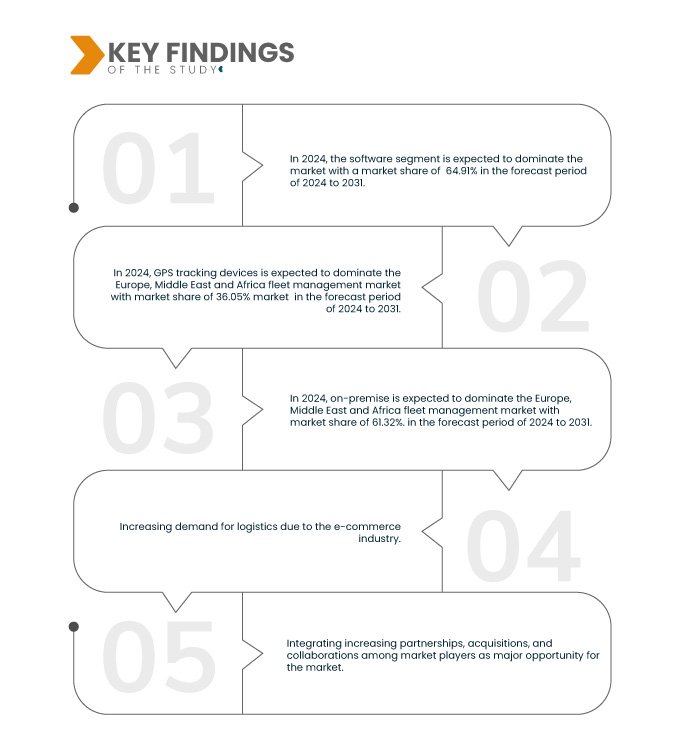

Aumento da procura de logística devido ao setor do comércio eletrónico. A gestão de frotas é uma prática que permite às organizações gerir e coordenar os veículos de entrega para alcançar a eficiência ideal e reduzir os custos. Esta prática é utilizada para monitorizar e registar os estafetas e o pessoal de entrega. É necessário um sistema de tecnologias que facilite ao gestor de frotas a coordenação das atividades, desde a gestão de combustível ao planeamento de rotas, e que possa ser facilmente gerido através de um software de gestão de frotas.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/europe-middle-east-and-africa-fleet-management-market

A Data Bridge Market Research analisa que o mercado de gestão de frotas da Europa, Médio Oriente e África deverá atingir os 19.529,06 milhões de dólares até 2031, face aos 9.185,79 milhões de dólares em 2023, crescendo a um CAGR de 10,0% no período previsto de 2024 a 2031. A expansão do setor do comércio eletrónico impactou significativamente o setor da logística. A logística é considerada a espinha dorsal do setor do comércio eletrónico, uma vez que afeta imediatamente as operações planeadas, os stocks e as organizações das redes de produção. Dependerão progressivamente de reavaliações para lidar com as crescentes solicitações relacionadas com o desenvolvimento da quota de negócios na internet. Adotar este curso, seja para entrega de última milha ou para satisfação de pedidos, irá capacitá-los para garantir uma entrega previsível, fiável, produtiva e sem falhas. Portanto, este pode ser um ótimo fator para gerir e expandir a pressão devido ao crescimento esperado do setor empresarial do comércio eletrónico.

Principais conclusões do estudo

Adoção rápida de sistemas de gestão de combustível em frotas

O sistema de gestão de combustível é utilizado para monitorizar e controlar a utilização de combustível nos veículos. Estes sistemas podem ser integrados no software de gestão de frotas para ajudar as empresas a otimizar a utilização de combustível, reduzir custos e melhorar a eficiência global. Além disso, a crescente utilização de combustíveis alternativos, como veículos eléctricos e híbridos, está também a impulsionar a adopção de sistemas de gestão de combustível. Prevê-se que a rápida adoção de sistemas de gestão de combustível na gestão de frotas impulsione o mercado de gestão de frotas na Europa, Médio Oriente e África.

A adoção de sistemas de gestão de combustível também está a ser impulsionada pelos avanços na tecnologia. O desenvolvimento de sensores avançados e tecnologia telemática tornou mais fácil monitorizar a utilização de combustível em tempo real e fornecer dados para ajudar a otimizar o desempenho. Além disso, o desenvolvimento de software de análise preditiva permitiu prever a utilização de combustível e identificar possíveis problemas antes que estes ocorram.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em milhões de dólares americanos

|

Segmentos abrangidos

|

Oferta (soluções, serviço), tipo de leasing (on-lease, sem leasing), hardware (dispositivos de localização GPS, câmaras DASH, etiquetas de localização Bluetooth, registadores de dados), dimensão da frota (pequenas frotas (1 a 5 veículos), frotas médias (5 a 20 veículos), frotas grandes e empresariais (20 a 50+ veículos)), alcance de comunicação (comunicação de curto alcance, comunicação de longo alcance), modo de implantação (on-site, cloud, híbrido), tecnologia (GNSS, sistemas celulares, intercâmbio eletrónico de dados (EDI), deteção remota, método computacional e tomada de decisão, geografia RFID), funções (gestão de ativos, gestão de rotas, consumo de combustível, localização do veículo em tempo real, calendário de entrega, prevenção de acidentes, aplicações móveis , monitorização do comportamento do condutor, atualizações de manutenção do veículo, conformidade com ELD), operação (comercial, privada), tipo de negócio (grande empresa, pequena empresa), tipo de veículo ( motor de combustão interna , veículo elétrico ), modo de transporte (automóveis de passageiros, veículos comerciais ligeiros, veículos comerciais pesados), Utilizador final (automóvel, transportes e logística, retalho, manufatura, alimentos e bebidas, energia e serviços públicos, mineração, governo, saúde, agricultura, construção e outros)

|

Países abrangidos

|

Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Polónia, Países Baixos, Bélgica, Turquia, Suíça, Noruega, Dinamarca, Finlândia, Suécia, resto da Europa, Arábia Saudita, Emirados Árabes Unidos, Israel, África do Sul, Egito, Qatar, Kuwait, Omã, Bahrein e resto da Europa

|

Participantes do mercado abrangidos

|

Ayvens Group (França), Arval (EUA), Alphabet (Alemanha), TÜV SÜD (Alemanha), HERE (Holanda), TATA Consultancy Services Limited (Índia), SAP SE (Alemanha), Zain (Riad), Webfleet Solutions Sales BV (Holanda), STILL GmbH (Alemanha), Free2move (França), FATEC (França), Athlon (Holanda), FleetAfrica (África do Sul), Roambee Corporation (EUA), LocoNav (EUA), Frotcom International (Portugal), Easyfleet (Reino Unido), Fleetroot (Emirados Árabes Unidos), Falcon Trackers, GoFleet Tracking (EUA), V Zone International LLC (Emirados Árabes Unidos), Ecofleet (Estanio), Ramco Systems (Índia), Arabitra, Aeromark Communications LTD (Reino Unido), Digital Myth Solutions (Arábia Saudita), TENDERD, ODOOTEC KSA (Arábia Saudita) e DETASAD Cloud (Arábia Saudita), entre outros

|

Pontos de dados abordados no relatório

|

Para além dos insights de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

|

Análise de Segmentos

O mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em treze segmentos notáveis, que se baseiam na oferta, tipo de aluguer, hardware, tamanho da frota, alcance de comunicação, modo de implantação, tecnologia, funções, operações, tipo de negócio, tipo de veículo, modo de transporte e utilizador final

- Com base na oferta, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em soluções e serviços

Em 2024, prevê-se que a solução domine o mercado de gestão de frotas da Europa, Médio Oriente e África

Em 2024, prevê-se que o segmento de soluções domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 64,91%, devido à crescente procura de telemática integrada, análises avançadas e tecnologias IoT que oferecem uma otimização de frotas abrangente e eficiente.

- Com base no tipo de leasing, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em leasing e sem leasing.

Em 2024, prevê-se que o on-lease domine o mercado de gestão de frotas na Europa, Médio Oriente e África

- Em 2024, prevê-se que o on-lease domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 69,48% devido à crescente procura de leasing de serviço completo.

- Com base no hardware, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em dispositivos de localização GPS, câmaras de painel, etiquetas de localização Bluetooth, registadores de dados e outros. Em 2024, prevê-se que os dispositivos de localização GPS dominem o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 36,05%.

- Com base no alcance da comunicação, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em comunicação de curto alcance e comunicação de longo alcance. Em 2024, prevê-se que as pequenas frotas (1 a 5 veículos) dominem o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 47,24%.

- Com base no modo de implementação, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em local, cloud e híbrido. Em 2024, prevê-se que o On-premise domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 61,32%.

- Com base na tecnologia, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em GNSS, sistemas celulares, Intercâmbio Eletrónico de Dados (EDI), deteção remota, método computacional e tomada de decisão, RFID e outros. Em 2024, prevê-se que o GNSS domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 42,10%.

- Com base na função, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em gestão de ativos, gestão de rotas, consumo de combustível, localização de veículos em tempo real, calendário de entregas, prevenção de acidentes, aplicações móveis, monitorização do comportamento do condutor, atualizações de manutenção de veículos, conformidade com ELD e outros. Em 2024, prevê-se que a gestão de ativos domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 20,54%.

- Com base na operação, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em comercial e privado. Em 2024, prevê-se que o mercado comercial domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 67,78%.

- Com base no tipo de negócio, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em grandes empresas e pequenas empresas. Em 2024, prevê-se que as grandes empresas dominem o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 64,55%.

- Com base no tipo de veículo, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em motores de combustão interna e veículos elétricos. Em 2024, prevê-se que os motores de combustão interna dominem o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 78,05%.

- Com base no modo de transporte, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em automóveis de passageiros, veículos comerciais ligeiros e veículos comerciais pesados. Os automóveis de passageiros são subsegmentados com base no tipo em camiões, reboques, empilhadores e veículos especializados. Em 2024, prevê-se que os automóveis de passageiros dominem o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 67,84%.

- Com base no utilizador final, o mercado de gestão de frotas da Europa, Médio Oriente e África está segmentado em automóvel, transporte e logística, retalho, fabrico, alimentos e bebidas, energia e serviços públicos, mineração, governo, saúde, agricultura, construção e outros. Em 2024, prevê-se que o segmento automóvel domine o mercado de gestão de frotas da Europa, Médio Oriente e África, com uma quota de mercado de 22,92%.

Principais jogadores

A Data Bridge Market Research analisa a Ayvens Group (França), a Arval (EUA), a Alphabet (Alemanha), a TÜV SÜD (Alemanha), a HERE (Holanda), a TATA Consultancy Services Limited (Índia), a SAP SE (Alemanha) e a Zain (Riad) como as principais empresas que operam no mercado global de automação industrial.

Desenvolvimento de Mercado

- Em julho de 2024, a nova parceria da Ayvens com a BYD irá promover a adoção de frotas de veículos elétricos na Europa. Esta colaboração impulsionou a distribuição de veículos elétricos de passageiros e comerciais ligeiros. Para a Ayvens, este desenvolvimento aumentou a sua presença no mercado europeu de veículos elétricos, alargou as suas soluções de mobilidade sustentável e reforçou a sua capacidade de oferecer opções de frotas ecológicas para ambos; clientes empresariais e de retalho

- Em março de 2022, a LocoNav concentrou-se em democratizar a tecnologia de frotas nos países em desenvolvimento, oferecendo soluções de gestão de frotas acessíveis e orientadas por IA. Estas soluções visavam melhorar a segurança dos veículos, otimizar as operações e reduzir custos utilizando tecnologias avançadas de IoT, IA e telemática de vídeo. Esta estratégia posicionou a LocoNav como líder nos mercados emergentes, abordando as necessidades sensíveis ao preço e aumentando a sua vantagem competitiva com dados em tempo real e uma gestão eficiente da frota.

- Em março de 2022, a V Zone International LLC lançou a sua inovadora tecnologia GPS Autopilot FO-ERP nos Emirados Árabes Unidos, combinando telemática 4G LTE com IA e IoT para uma gestão avançada de frotas e combustíveis. Este desenvolvimento impulsionou as capacidades de gestão de frotas da V Zone International, forneceu soluções de rastreamento e redução de custos de ponta e reforçou a sua liderança no rastreamento GPS global.

- Em junho de 2024, a ALD Automotive e a Northe anunciaram uma parceria estratégica com o objetivo de promover a adoção de veículos elétricos. Esta colaboração permitiu à ALD Automotive aproveitar a plataforma da Northe para soluções abrangentes de leasing e carregamento de automóveis elétricos, integrando o carregamento residencial, comercial e público num serviço unificado. A parceria proporcionou aos clientes da ALD experiências de faturação contínua e faturação consolidada. Esta parceria veio melhorar o mercado de gestão de frotas na Europa, Médio Oriente e África ao otimizar as soluções de leasing e carregamento de veículos elétricos. A integração de uma infraestrutura de carregamento abrangente e de sistemas de faturação facilitou a transição para frotas elétricas, impulsionando o crescimento do mercado e apoiando a adoção mais ampla de soluções de transporte sustentáveis nessas regiões.

- Em novembro de 2024, a Ayvens beneficiou do acordo multibilionário de euros com a Stellantis, que fornecerá 500.000 veículos — incluindo carros citadinos, SUV, carrinhas multifuncionais e veículos elétricos — à sua frota europeia até 2026. Esta parceria expandiu significativamente o stock de veículos da Ayvens, melhorando a sua capacidade de oferecer uma gama diversificada de modelos e está alinhada com a sua estratégia PowerUP 2026, reforçando a sua posição no mercado europeu de gestão de frotas.

Análise Regional

Geograficamente, os países abrangidos pelo relatório de mercado de gestão de frotas da Europa, Médio Oriente e África são a Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Polónia, Países Baixos, Bélgica, Turquia, Suíça, Noruega, Dinamarca, Finlândia, Suécia, resto da Europa, Arábia Saudita, Emirados Árabes Unidos, Israel, África do Sul, Egito, Qatar, Kuwait, Omã, Bahrein e resto da Europa.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Prevê-se que a Europa domine e seja a região com o crescimento mais rápido no mercado de gestão de frotas da Europa, Médio Oriente e África

Em 2024, prevê-se que a Europa domine a gestão de frotas na Europa, Médio Oriente e África devido à sua infraestrutura tecnológica avançada, ao investimento significativo na gestão de frotas e à ampla adoção de práticas de transporte sustentáveis. Além disso, o forte apoio governamental e um ecossistema bem estabelecido de empresas de transporte e de negócios contribuem para a liderança da região.

Para obter informações mais detalhadas sobre o mercado de gestão de frotas na Europa, clique aqui – https://www.databridgemarketresearch.com/reports/europe-middle-east-and-africa-fleet-management-market