Menstrual disorders encompass a range of conditions affecting the normal menstrual cycle in women. These disorders can manifest as irregular, heavy, painful, or absent menstrual periods and often result from hormonal imbalances, structural abnormalities in the reproductive organs, medical conditions such as polycystic ovary syndrome (PCOS), or certain medications. Common menstrual disorders include menorrhagia (excessive menstrual bleeding), oligomenorrhea (infrequent periods), dysmenorrhea (painful menstruation), and amenorrhea (absence of menstruation). Menstrual disorders can significantly impact a woman physical and emotional well-being, fertility, and overall quality of life, often requiring medical evaluation and management to alleviate symptoms and address underlying causes.

Access Full Report @ https://www.databridgemarketresearch.com/reports/north-america-and-europe-endometrial-ablation-devices-market

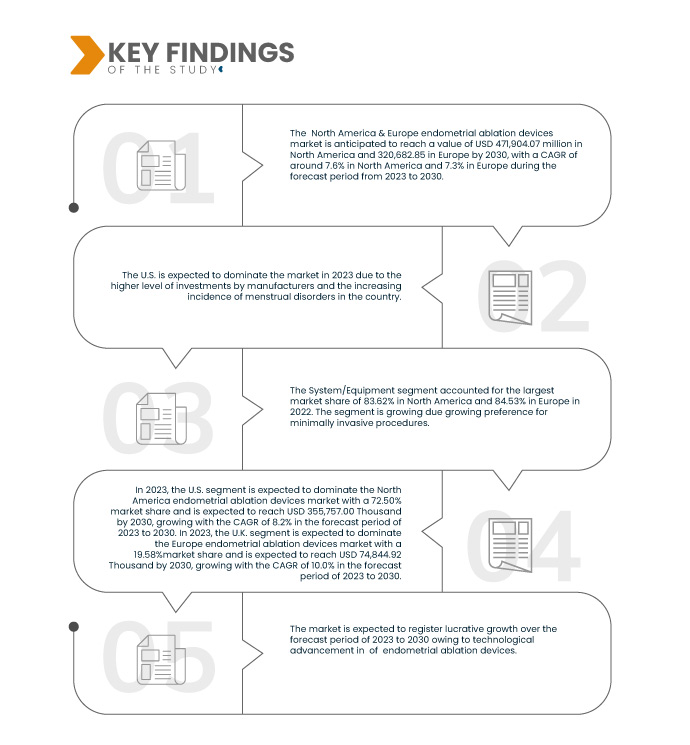

Data Bridge Market Research analyzes that the North America & Europe Endometrial Ablation Devices Market is expected to grow with a CAGR of 7.6% in North America and 7.3% in Europe in the forecast period of 2023 to 2030 and is expected to reach USD 471,904.07 thousand in North America and 320,682.85 in Europe by 2030. The system/equipment segment is projected to propel the market growth due to the growing preference for minimally invasive procedures.

Key Findings of the Study

Growing Preference for Minimally Invasive Procedures

The growing preference for minimally invasive procedures represents a significant trend in healthcare, driven by several factors that prioritize patient comfort, faster recovery, and reduced complications.

The growing preference for minimally invasive procedures in healthcare represents a significant opportunity for the endometrial ablation device market. As patients increasingly seek treatments that offer reduced pain, quicker recovery times, and lower risks, endometrial ablation procedures, known for their minimally invasive nature, become more appealing. This trend expands the potential patient base and improves the overall patient experience. In addition, the capacity to offer these procedures in outpatient settings aligns with healthcare cost-efficiency goals. Manufacturers in the endometrial ablation device market can leverage these factors to meet the rising demand for minimally invasive solutions in addressing endometrial disorders and enhancing their market presence.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Product Type (System/Equipment, Consumables, and Others), Portability (Portable, Standalone, and Benchtop), Site (Facility Based Procedure Site and In Office Procedure Site), Technology (Radiofrequency Ablation, Hydrothermal Ablation, Thermal Balloon Ablation, Cryoablation, Microwave Ablation, Laser Ablation and Others), Technique (Non-Resectoscopic and Resectoscopic), Application (Abnormal Uterine Bleeding (AUB), Menorrhagia (Heavy Menstrual Bleeding), Dysmenorrhea (Painful Menstruation), Polyps, Fibroids, Adenomyosis, and Others), Age-Group (Peri-Menopausal, Pre-Menopausal, and Post-Menopausal), End User (Hospitals, Ambulatory Surgical Centers, Independent Treatment Centers, Diagnostic Imaging Centers, Clinical Laboratories, Catherization Laboratories and Others), Distribution Channel (Direct Tender, Retail Sales, and Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, Denmark, Norway, Sweden, Finland, Poland and Rest of Europe

|

|

Market Players Covered

|

Hologic, Inc., (U.S.), CooperSurgical Inc. (U.S.), Minerva Surgical, Inc. (U.S.), Medtronic (Ireland), IDOMAN-MED (Canada), Veldana Medical (Switzerland), Channel Medsystems Inc. (U.S.), Olympus (Japan), Gynesonics (U.S.), RF Medical Co., Ltd. (South Korea), LiNA Medical ApS. (Denmark), and OCON Medical Ltd. (Israel) and among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis and regulatory framework.

|

Segment Analysis:

North America & Europe endometrial ablation devices market is categorized into nine notable segments based on product type, portability, site, technology, technique, application, age group, end-user and distribution channel.

- On the basis of product type, the North America & Europe endometrial ablation devices market is segmented into system/equipment, consumables, and others.

In 2023, the system/equipment segment is expected to dominate the North America & Europe endometrial ablation devices market

In 2023, the system/equipment segment is expected to dominate the North America endometrial ablation devices market as system/equipment due to growing preference for minimally invasive procedures, with a market share of 83.70%.

In 2023, the system/equipment segment is expected to dominate the Europe endometrial ablation devices market due to rising prevalence of endometrial cancer, with a market share of 84.70%.

- On the basis of portability, the North America & Europe endometrial ablation devices market is segmented into portable, standalone, and benchtop.

In 2023, the portable segment is expected to dominate the North America & Europe endometrial ablation devices market

In 2023, the portable segment is expected to dominate the North America endometrial ablation devices market due to technological advancement, growing with the market share of 71.76%.

In 2023, the portable segment is expected to dominate the Europe endometrial ablation devices market growing with the market share of 73.32%.

- On the basis of site, the North America & Europe endometrial ablation devices market is segmented into facility-based procedure site and in office procedure site. In 2023, the facility-based procedure site segment is expected to dominate the North America endometrial ablation devices market with a market share of 60.52%.

In 2023, the facility-based procedure segment is expected to dominate the Europe endometrial ablation devices market with a market share of 62.70%.

- On the basis of technology, the North America & Europe endometrial ablation devices market is segmented into radiofrequency ablation, hydrothermal ablation, thermal balloon ablation, cryoablation, microwave ablation, laser ablation, and others. In 2023, the radiofrequency ablation segment is expected to dominate the North America endometrial ablation devices market with a market share of 39.04%.

In 2023, the radiofrequency ablation segment is expected to dominate the Europe endometrial ablation devices market with a market share of 42.36%.

- On the basis of technique, the North America & Europe endometrial ablation devices market is segmented into non-resectoscopic and resectoscopic. In 2023, the non-resectoscopic segment is expected to dominate the North America endometrial ablation devices market with a market share of 88.55%.

In 2023, the non-resectoscopic segment is expected to dominate the Europe endometrial ablation devices market growing with the market share of 89.18%.

- On the basis of application, the North America & Europe endometrial ablation devices market is segmented into abnormal uterine bleeding (AUB), menorrhagia (heavy menstrual bleeding), dysmenorrhea (painful menstruation), polyps, fibroids, adenomyosis and others. In 2023, the abnormal uterine bleeding (AUB) segment is expected to dominate the North America endometrial ablation devices market with a market share of 33.84%.

In 2023, the abnormal uterine bleeding (AUB) segment is expected to dominate the Europe endometrial ablation devices market with a market share of 37.44%.

- On the basis of age-group, the North America & Europe endometrial ablation devices market is segmented into peri-menopausal, pre-menopausal, and post-menopausal. In 2023, the peri-menopausal segment is expected to dominate the North America endometrial ablation devices market with a market share of 72.87%.

In 2023, the peri-menopausal segment is expected to dominate the Europe endometrial ablation devices market with a market share of 74.37%.

- On the basis of end user, the North America & Europe endometrial ablation devices market is segmented into hospitals, ambulatory surgical centers, independent treatment centers, diagnostic imaging centers, clinical laboratories, catherization laboratories and others. In 2023, the hospitals segment is expected to dominate the North America endometrial ablation devices market with a market share of 56.69%.

In 2023, the hospitals segment is expected to dominate the Europe endometrial ablation devices market with a market share of 59.04%.

- On the basis of distribution channel, the North America & Europe endometrial ablation devices market is segmented into direct tender, retail sales, and others. In 2023, the direct tender segment is expected to dominate the North America endometrial ablation devices market with a market share of 76.38%.

In 2023, the direct tender segment is expected to dominate the Europe endometrial ablation devices market growing with a market share of 77.68%.

Major Players

Data Bridge Market Research analysis Hologic, Inc., (U.S.), CooperSurgical Inc. (U.S.), LiNA Medical ApS. (Denmark), Olympus (Japan), Gynesonics (U.S.) as the major market players in the North America & Europe endometrial ablation devices market.

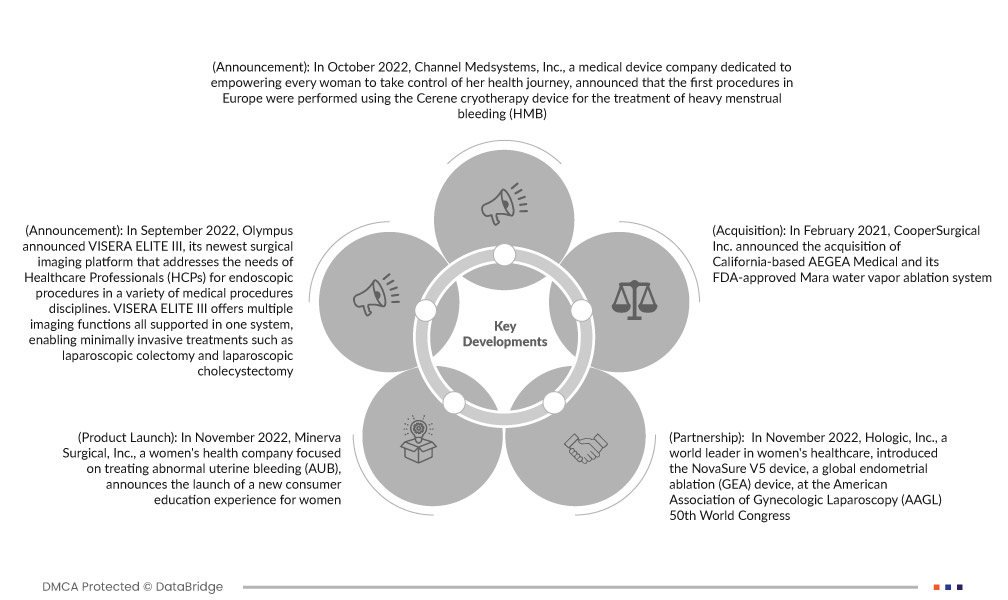

Market Development

- In October 2022, Channel Medsystems, Inc., a medical device company dedicated to empowering every woman to take control of her health journey, announced that the first procedures in Europe were performed using the Cerene cryotherapy device for the treatment of heavy menstrual bleeding (HMB). The procedures were performed by Fleur Bergwerff, M.D. at Bergman Clinics in Amsterdam, the largest network of clinics in the Netherlands offering outpatient care and procedures to dedicated medical professionals and their patients. This important innovation offers patients and doctors much more accessible minimally invasive in-office anesthesia care, helping more women find relief from bothersome menstrual cycle symptoms.

- In September 2022, Olympus announced VISERA ELITE III, its newest surgical imaging platform that addresses the needs of Healthcare Professionals (HCPs) for endoscopic procedures in a variety of medical procedures disciplines. VISERA ELITE III offers multiple imaging functions all supported in one system, enabling minimally invasive treatments such as laparoscopic colectomy and laparoscopic cholecystectomy. Future software updates will advance surgical imaging technology and enable custom configurations to seamlessly support a variety of surgical applications, reducing investment costs. VISERA ELITE III will be available in Europe, the Middle East and Africa (EMEA), parts of Asia, Oceania, and Japan in September 2022 or later. This launch has helped the company to expand its product portfolio for medical systems.

- In November 2022, Minerva Surgical, Inc., a women's health company focused on treating abnormal uterine bleeding (AUB), announced the launch of a new consumer education experience for women: www.aubandme.com. The company will present the site at the 50th World Congress of the American Association of Gynecologic Laparoscopes (AAGL) in Austin, Texas. This innovation has helped to create awareness among women about uterine abnormal bleeding.

- In November 2022, Hologic, Inc., a world leader in women's healthcare, introduced the NovaSure V5 device, a global endometrial ablation (GEA) device, at the American Association of Gynecologic Laparoscopy (AAGL) 50th World Congress. The most researched and trusted endometrial ablation method in the United States, the innovative new NovaSure V5 device represents Hologic's continued commitment to improving the physician experience.

- In February 2021, CooperSurgical Inc. announced the acquisition of California-based AEGEA Medical and its FDA-approved Mara water vapor ablation system. The acquisition builds on more than 30 years of experience in women's health care and complements CooperSurgical's growing portfolio of medical products focused on clinical and practical women's health.

Regional Analysis

Geographically, the countries covered in the North America & Europe endometrial ablation devices market report are U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, Denmark, Norway, Sweden, Finland, Poland and Rest of Europe.

As per Data Bridge Market Research analysis:

U.S. is expected to dominate and fastest the North America endometrial ablation devices market during forecast period 2023-2030

U.S. is expected to dominate and fastest the North America endometrial ablation devices market due to changing lifestyles and delayed childbearing.

U.K. is expected to dominate and fastest the Europe endometrial ablation devices market during forecast period 2023-2030

U.K. is expected to dominate and fastest the Europe endometrial ablation devices market due to increasing incidence of menstrual disorders.

For more detailed information about the North America & Europe endometrial ablation devices market report, click here – https://www.databridgemarketresearch.com/reports/north-america-and-europe-endometrial-ablation-devices-market