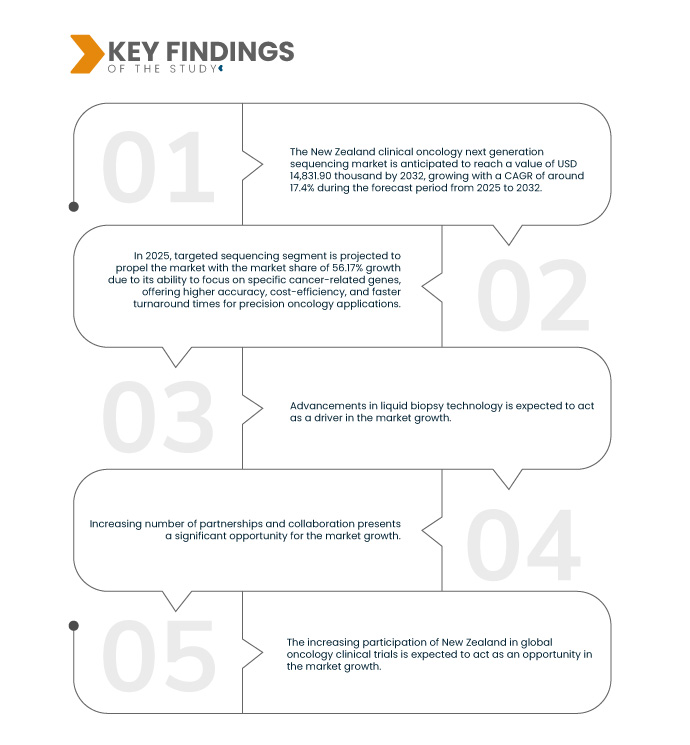

إن التطورات السريعة في تقنية الخزعة السائلة وتطور تسلسل الجيل التالي من الجينوم السريري في علم الأورام، وخاصة في نيوزيلندا، تتيح الكشف عن السرطان ومراقبته بطريقة غير جراحية من خلال تحليل الحمض النووي للورم الدائر (ctDNA) وخلايا الورم الدائر (CTCs) وغيرها من المؤشرات الحيوية الموجودة في سوائل الجسم مثل الدم. وقد أحدثت هذه الطريقة ثورة في تشخيص السرطان من خلال تقديم بديل لخزعات الأنسجة التقليدية، والتي قد تكون جراحية وصعبة في بعض الحالات. ومع استمرار ارتفاع معدل الإصابة بالسرطان في نيوزيلندا، مما يشير إلى أن الحالات الجديدة ستتضاعف تقريبًا، يزداد الطلب على تقنيات التشخيص المبتكرة مثل الخزعة السائلة. تتيح هذه التقنيات الكشف المبكر، ومراقبة أفضل لاستجابات العلاج، ووضع خطط علاج أكثر تخصيصًا، مما يحسن نتائج المرضى. ومع التحول المتزايد نحو علم الأورام الدقيق، حيث تُصمم العلاجات بناءً على التركيب الجيني لكل أورام على حدة، يصبح دور الخزعة السائلة أكثر أهمية. يُعزز دمج تقنية تسلسل الجيل التالي (NGS) قدرات الخزعة السائلة، مما يسمح بتحليل جينومي أكثر شمولاً ودقة. ومع استمرار تطور تقنيات الخزعة السائلة، فإنها تُقدم رؤىً أعمق في بيولوجيا السرطان، مما يُتيح إمكانية التدخلات المبكرة، وخفض تكاليف العلاج، وتحسين معدلات نجاة المرضى في نيوزيلندا.

يمكنك الوصول إلى التقرير الكامل على الرابط التالي: https://www.databridgemarketresearch.com/reports/new-zealand-clinical-oncology-next-generation-sequencing-market

تحلل شركة Data Bridge Market Research أن حجم سوق تسلسل الجيل التالي لعلم الأورام السريري في نيوزيلندا قُدِّر بـ 4.12 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 14.83 مليون دولار أمريكي بحلول عام 2032، بمعدل نمو سنوي مركب قدره 17.4٪ خلال الفترة المتوقعة من 2025 إلى 2032.

النتائج الرئيسية للدراسة

ارتفاع معدل الإصابة بالسرطان

يُعدّ ارتفاع معدل الإصابة بالسرطان في نيوزيلندا دافعًا قويًا لتوسيع نطاق تطبيقات تسلسل الجيل التالي (NGS) السريرية في علم الأورام. ويُعزى هذا الارتفاع بشكل كبير إلى شيخوخة السكان، وتغيرات نمط الحياة، وزيادة عوامل الخطر البيئية، والتي تُسهم مجتمعةً في تزايد عبء السرطان. ومع تزايد الحاجة إلى أساليب كشف أكثر دقةً في مراحله المبكرة، تبرز تقنية تسلسل الجيل التالي كأداة حاسمة في مكافحة السرطان. فهي تتيح تحديد الملامح الجينومية التفصيلية للأورام، مما يُمكّن الأطباء من فهم الطفرات الجينية المُسببة للسرطان وتحديد العلاجات المُستهدفة الأكثر فعالية لكل مريض على حدة. علاوةً على ذلك، يُمكن استخدام هذه التقنية في الخزعات السائلة قليلة التوغل، مما يُقلل الحاجة إلى خزعات الأنسجة التقليدية الأكثر توغلًا، ويُوفر وسيلة أسرع وأكثر شمولًا لتتبع المرض. ومع توقع ارتفاع كبير في معدل الإصابة بالسرطان، من المُتوقع أن يزداد الطلب على هذه التقنيات التشخيصية والعلاجية المُتقدمة، نظرًا لقدرتها على تحسين نتائج علاج السرطان بشكل كبير، وتحسين خطط العلاج، وخفض تكاليف الرعاية الصحية. مع مواجهة نظام الرعاية الصحية لضغوط متزايدة بسبب العبء المتزايد للسرطان، فإن اعتماد نظام NGS في علم الأورام يمثل تحولاً محورياً نحو رعاية أكثر تخصيصًا ودقة وفعالية للسرطان في نيوزيلندا.

لذلك، يزداد الطلب على أدوات تشخيصية أكثر تطورًا استجابةً لارتفاع عبء السرطان، ويزداد دور الجيل التالي من التسلسل (NGS) في تطوير رعاية مرضى السرطان أهميةً. فمع الجيل التالي من التسلسل، يمكن لأطباء الأورام اتخاذ قرارات أكثر استنارة، مما يؤدي إلى تحسين خطط العلاج ومراقبة تطور المرض. ويؤكد الاعتراف المتزايد بفعالية هذه التقنيات، إلى جانب ارتفاع معدل الإصابة بالسرطان، على الحاجة إلى مواصلة تطوير الجيل التالي من التسلسل ودمجه في الممارسة السريرية، مما يُهيئ بيئةً تُصبح فيها رعاية مرضى السرطان الشخصية أكثر سهولةً وفعاليةً في جميع أنحاء نيوزيلندا.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2025 إلى 2032

|

سنة الأساس

|

2024

|

السنوات التاريخية

|

من 2018 إلى 2023 (قابلة للتخصيص من 2013 إلى 2017)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية

|

القطاعات المغطاة

|

التكنولوجيا (التسلسل المستهدف، وتسلسل الإكسوم الكامل ، وتسلسل الجينوم الكامل)، والمنتجات والخدمات (المواد الاستهلاكية والأجهزة والخدمات)، ونوع التسلسل (التسلسل النهائي المزدوج، وتسلسل القراءة الفردية)، ونوع السرطان (سرطان الرئة، وسرطان الثدي، وسرطان القولون والمستقيم، وسرطان البروستاتا، والورم الميلانيني، والورم اللمفاوي، وغيرها)، والمستخدم النهائي (المستشفيات، والمختبرات السريرية، والمعاهد الأكاديمية والبحثية، وشركات الأدوية والتكنولوجيا الحيوية، ومنظمات أبحاث العقود (CROS)، وغيرها)، وقناة التوزيع (العطاء المباشر، ومبيعات التجزئة، وغيرها)

|

الدول المغطاة

|

نيوزيلندا

|

الجهات الفاعلة في السوق المغطاة

|

Illumina Inc. (الولايات المتحدة)، Thermo Fisher Scientific Inc. (الولايات المتحدة)، F. Hoffmann-La Roche Ltd (سويسرا)، QIAGEN (هولندا)، PacBio (الولايات المتحدة)، Agilent Technologies, Inc. (الولايات المتحدة)، Zymo Research Corporation (الولايات المتحدة)، SOPHiA GENETICS (سويسرا)، Takara Bio Inc. (اليابان)، Myriad Genetics, Inc. (الولايات المتحدة)، Bio-Rad Laboratories, Inc. (الولايات المتحدة)، Devyser (السويد)، Macrogen Oceania (أستراليا)، Mérieux NutriSciences Corporation (فرنسا)، وCreative Biolabs (الولايات المتحدة) وغيرها.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات

يتم تقسيم سوق التسلسل الجيني للجيل القادم لعلم الأورام السريري في نيوزيلندا إلى ستة قطاعات بارزة تعتمد على التكنولوجيا والمنتجات والخدمات ونوع التسلسل ونوع السرطان والمستخدم النهائي وقناة التوزيع.

- على أساس التكنولوجيا، يتم تقسيم السوق إلى تسلسل مستهدف، وتسلسل الإكسوم الكامل، وتسلسل الجينوم الكامل

في عام 2025، من المتوقع أن يهيمن قطاع التسلسل المستهدف على سوق تسلسل الجيل التالي لعلم الأورام السريري

ومن المتوقع أن تهيمن شريحة التسلسل المستهدف على السوق في عام 2025 بحصة سوقية تبلغ 56.17% بسبب قدرتها على التركيز على جينات محددة مرتبطة بالسرطان، مما يوفر دقة أعلى وكفاءة من حيث التكلفة وأوقات استجابة أسرع لتطبيقات علم الأورام الدقيق.

- على أساس المنتجات والخدمات، يتم تقسيم السوق إلى المواد الاستهلاكية، والأجهزة، والخدمات.

في عام 2025، من المتوقع أن يهيمن قطاع المواد الاستهلاكية على سوق تسلسل الجيل القادم لعلم الأورام السريري

ومن المتوقع أن تهيمن شريحة المواد الاستهلاكية على السوق في عام 2025 بحصة سوقية تبلغ 55.25% بسبب الحاجة المستمرة إلى الكواشف والمجموعات والمواد الأساسية الأخرى المطلوبة لاختبارات الجيل التالي من التسلسل والبحث المستمر في تشخيص وعلاج السرطان.

- بناءً على نوع التسلسل، يُقسّم السوق إلى تسلسل طرفي مزدوج وتسلسل قراءة واحدة. في عام ٢٠٢٥، من المتوقع أن يهيمن قطاع التسلسل الطرفي المزدوج على السوق بحصة سوقية تبلغ ٦٦.٩١٪.

- بناءً على نوع السرطان، يُقسّم السوق إلى سرطان الرئة، وسرطان الثدي، وسرطان القولون والمستقيم، وسرطان البروستاتا، والورم الميلانيني ، والورم اللمفاوي، وغيرها. ومن المتوقع أن يهيمن قطاع سرطان الرئة على السوق بحصة سوقية تبلغ 24.08% في عام 2025.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مستشفيات، ومختبرات سريرية، ومعاهد أكاديمية وبحثية، وشركات أدوية وتكنولوجيا حيوية، ومنظمات أبحاث تعاقدية (CROS)، وغيرها. في عام 2025، من المتوقع أن يهيمن قطاع المستشفيات على السوق بحصة سوقية تبلغ 49.15%.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى مناقصة مباشرة، ومبيعات التجزئة، وغيرها. في عام ٢٠٢٥، من المتوقع أن يهيمن قطاع المناقصة المباشرة على السوق بحصة سوقية تبلغ ٦٠.٤١٪.

اللاعبون الرئيسيون

تحلل شركة Data Bridge Market Research الشركات التالية: Illumina Inc. (الولايات المتحدة)، وThermo Fisher Scientific Inc. (الولايات المتحدة)، وF. Hoffmann-La Roche Ltd (سويسرا)، وQIAGEN (هولندا)، وPacBio (الولايات المتحدة) هم اللاعبون الرئيسيون العاملون في السوق.

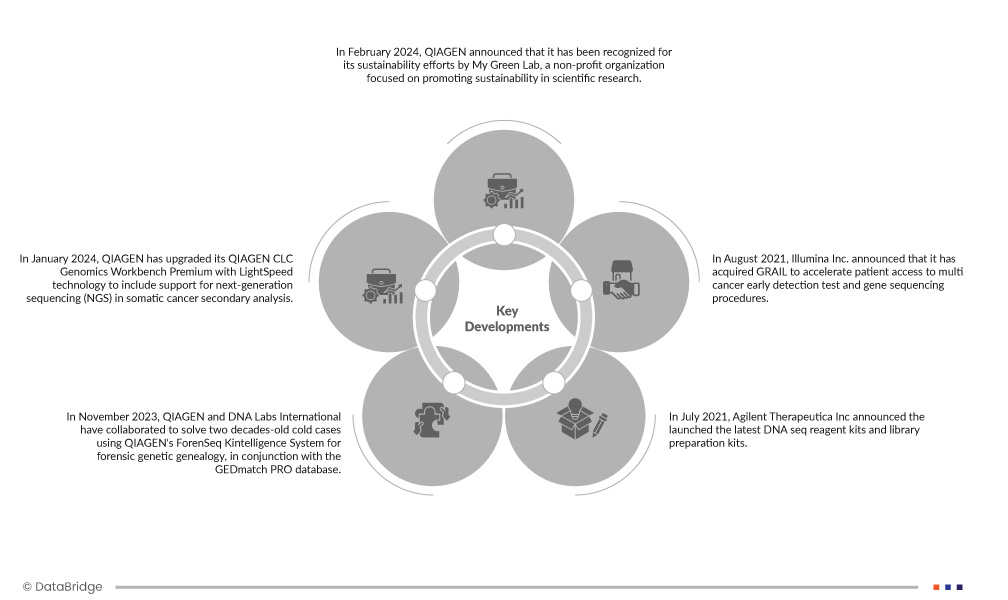

تطورات السوق

- في ديسمبر 2021، أطلقت شركة روش نظام AVENIO Edge لتبسيط وأتمتة تحضير عينات التسلسل الجيني NGS، مما يقلل من الأخطاء البشرية ويعزز الطب الدقيق. سيعزز هذا الحل الآلي المتكامل تقنيات روش للتسلسل، ويحسن الكفاءة ويدعم نموها في سوق الطب الدقيق.

- في نوفمبر 2021، أعلنت شركة Illumina Inc. عن شراكة مع Sequoia Capital China لتأسيس أولى الشركات الناشئة للانضمام إلى حاضنة الجينوميات في الصين. سيعزز هذا خطط الشركة للبحث والتطوير في مجال الجينوميات، وقد ساهم في إنشاء مكتبة جينوميات في الصين.

- في أكتوبر 2021، أعلنت شركة ThermoFisher Scientific Inc. عن إطلاق نظام تفاعل البوليميراز المتسلسل الرقمي Applied Biosystem QuantSudio Absolute Q-Digital، المصمم لتوفير نتائج دقيقة للغاية في التحليل الجيني. يُستخدم هذا النظام بالفعل لمراقبة الطفرات السرطانية في الخزعات السائلة. وقد ساعد هذا الشركة على زيادة محفظة منتجاتها.

- في سبتمبر 2021، أعلنت شركة ThermoFisher Scientific Inc. عن شراكتها مع شركة AstraZeneca لتطوير تشخيصات مصاحبة قائمة على تقنية NGS. تتضمن آلية عمل NGS حلولاً متعددة لاختبار الخزعة السائلة والعلامات الحيوية للأورام الصلبة. من المتوقع أن يُوسّع هذا محفظة منتجات الشركة.

- في أغسطس 2021، أعلنت شركة Illumina Inc. عن استحواذها على شركة GRAIL لتسريع وصول المرضى إلى اختبارات الكشف المبكر عن السرطان المتعدد وإجراءات تسلسل الجينات. وقد ساعد ذلك الشركة على زيادة محفظة منتجاتها.

للحصول على معلومات أكثر تفصيلاً حول تقرير سوق تسلسل الجيل التالي لعلم الأورام السريري في نيوزيلندا، انقر هنا - https://www.databridgemarketresearch.com/reports/new-zealand-clinical-oncology-next-generation-sequencing-market