New Zealand Clinical Oncology Next Generation Sequencing Market

Market Size in USD Million

CAGR :

%

USD

4.12 Million

USD

14.83 Million

2024

2032

USD

4.12 Million

USD

14.83 Million

2024

2032

| 2025 –2032 | |

| USD 4.12 Million | |

| USD 14.83 Million | |

|

|

|

Clinical Oncology Next Generation Sequencing Market Analysis

The clinical oncology NGS market in New Zealand is part of the rapidly evolving precision medicine field. NGS is transforming oncology by enabling comprehensive genomic profiling of tumors, identification of actionable mutations, and aiding personalized cancer treatments. The market is influenced by technological advancements, growing cancer prevalence, and government healthcare initiatives.

Clinical Oncology Next Generation Sequencing Market Size

New Zealand clinical oncology next generation sequencing market size was valued at USD 4.12 million in 2024 and is projected to reach USD 14.83 million by 2032, with a CAGR of 17.4% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Clinical Oncology Next Generation Sequencing Market Trends

“Technological Advancement in Genomic Sequencing”

The rapid pace of technological advancements in genomic sequencing has significantly contributed to the transformation of oncology diagnostics and treatment in New Zealand. In particular, the evolution of Next-Generation Sequencing (NGS) technology has provided more accurate, efficient, and scalable solutions for cancer detection and treatment planning. The ability of NGS to analyze large volumes of genetic data quickly and with high precision enables clinicians to uncover critical genetic mutations that may influence the course of cancer. This technology is particularly valuable in the context of personalized medicine, as it helps tailor treatments to the specific genetic makeup of a patient’s tumor, ensuring more effective and targeted therapies. As New Zealand faces a rising incidence of cancer, with over 27,000 new cases reported in 2020 and an expected increase to 52,000 by 2040, the demand for advanced diagnostic tools like NGS is expected to grow. Furthermore, the rising trend and increasing accessibility of NGS technologies, combined with the rapid adoption of digital health solutions, is making it easier for healthcare professionals to integrate genetic insights into routine clinical practice. With the support of governmental initiatives and collaborations with global biotechnological firms, New Zealand is poised to see even greater integration of NGS technologies in its healthcare systems, ultimately enhancing early detection, monitoring, and treatment of various types of cancer.

Report Scope and Clinical Oncology Next Generation Sequencing Market

|

Attributes |

Clinical Oncology Next Generation Sequencing Market Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

New Zealand |

|

Key Market Players |

Illumina Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN (Netherlands), PacBio (U.S.), Agilent Technologies, Inc. (U.S.), Zymo Research Corporation (U.S.), SOPHiA GENETICS (Switzerland), Takara Bio Inc., (Japan), Myriad Genetics, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Devyser (Sweden), Macrogen Oceania (Australia), Mérieux NutriSciences Corporation (France), and Creative Biolabs (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Clinical Oncology Next Generation Sequencing Market Definition

Clinical oncology Next-Generation Sequencing (NGS) refers to the use of advanced sequencing technologies to analyze the genetic makeup of cancer cells. It helps identify genetic mutations, variations, and biomarkers that can guide personalized treatment plans, improve diagnosis, and monitor treatment responses in cancer patients. NGS enables more precise, targeted therapies by providing in-depth insights into the molecular characteristics of tumors.

Clinical Oncology Next Generation Sequencing Market Dynamics

Drivers

- Advancements in Liquid Biopsy Technology

The rapid advancements in liquid biopsy technology and evolution of clinical NGS sequencing in oncology, particularly in New Zealand, allow for the non-invasive detection and monitoring of cancer through the analysis of circulating tumor DNA (ctDNA), Circulating Tumor Cells (CTCs) and other biomarkers found in bodily fluids such as blood. This method has revolutionized cancer diagnostics by offering an alternative to traditional tissue biopsies, which can be invasive and challenging in some cases. As the incidence of cancer continues to rise in New Zealand, suggesting that new cases will almost double, the demand for innovative diagnostic technologies like liquid biopsy grows. These technologies enable earlier detection, better monitoring of treatment responses, and more personalized treatment plans, thus improving patient outcomes.

For instance,

- In February 2024, according to the article published by Twist Bioscience Corporation, the company introduced the cfDNA Library Preparation Kit to advance liquid biopsy research. This innovative kit is designed to enhance the capture of unique cfDNA molecules during library preparation, ensuring greater efficiency and accuracy. This enables more comprehensive analysis it supports researchers in gaining deeper insights into liquid biopsy applications. This launch reflects Twist Bioscience’s commitment to driving progress in oncology research and diagnostics

Hence, the growing adoption of liquid biopsy technology, combined with the increasing incidence of cancer, is positioning advanced diagnostic tools, like NGS sequencing, as essential components in New Zealand's fight against cancer. The ability to non-invasively track tumor progression and genetic alterations holds significant promise in improving cancer treatment outcomes and ensuring that patients receive the most appropriate and effective therapies based on their unique genetic profiles. As such, these technological advancements are helping to shape a more precise and efficient approach to cancer care in the country.

- Increasing Incidence Rate of Cancer

The increasing incidence rate of cancer in New Zealand is a powerful driver for the expansion of clinical Next-Generation Sequencing (NGS) applications in oncology. This surge is largely attributed to the aging population, lifestyle changes, and increased environmental risk factors, which collectively contribute to the growing cancer burden. As the need for more precise, early-stage detection methods becomes ever more pressing, NGS technology stands out as a critical tool in the fight against cancer. NGS allows for the detailed genomic profiling of tumors, enabling clinicians to understand the genetic mutations driving cancer and identify targeted therapies that are most likely to be effective for individual patients. Moreover, this technology can be used for minimal-invasive liquid biopsies, reducing the need for traditional, more invasive tissue biopsies and providing a faster, more comprehensive means of tracking the disease. With the incidence of cancer expected to rise substantially, the demand for these advanced diagnostic and therapeutic technologies is set to grow, as they offer the potential to significantly improve cancer outcomes, optimize treatment plans, and reduce healthcare costs. As the healthcare system faces mounting pressure from the increasing cancer burden, the adoption of NGS in oncology represents a pivotal shift toward more personalized, precise, and effective cancer care in New Zealand.

For instance

- In September 2024, according to the article published by Cancer Society New Zealand, the country reported over 27,000 new cancer cases, highlighting the growing burden of the disease in the region. This figure is projected to nearly double by 2040, reaching approximately 52,000 new cases annually, driven by factors such as an aging population, lifestyle changes, and increased exposure to environmental risk factors. The rising incidence emphasizes the urgent need for advancements in cancer diagnostics and treatment solutions to manage this surge effectively

Therefore, the demand for more sophisticated diagnostic tools intensifies in response to the higher cancer burden, and the role of NGS in transforming cancer care becomes increasingly pivotal. With NGS, oncologists can make more informed decisions, leading to better treatment plans and monitoring of disease progression. The growing recognition of the effectiveness of these technologies, paired with the rising cancer incidence, underscores the need for continued advancements and integration of NGS in clinical practice, ultimately fostering an environment where personalized cancer care becomes more accessible and impactful across New Zealand.

Opportunities

- Increasing Number of Partnerships and Collaboration

The New Zealand clinical oncology Next-Generation Sequencing (NGS) market offers significant potential for advancing precision oncology through collaborations between local institutions, biotech firms, and global NGS providers. These partnerships can drive innovation by introducing advanced sequencing technologies, developing region-specific assays, and conducting clinical trials to validate NGS utility in cancer care. They also enhance knowledge sharing and workforce training, equipping healthcare professionals to manage NGS workflows and improving patient outcomes.

For instance,

- In July 2023, Illumina, Inc. and Pillar Biosciences have announced a strategic partnership to integrate Pillar's oncology assays into Illumina's global portfolio, offering advanced next-generation sequencing solutions to improve the efficiency, accuracy, and cost-effectiveness of cancer testing

This collaboration strengthens Illumina’s oncology product offerings, enhancing its ability to provide comprehensive, personalized cancer treatment options, expanding market reach, and improving patient access to precision medicine. For global NGS providers, collaborations in New Zealand offer opportunities to expand market presence while meeting the rising demand for personalized medicine. These synergies position New Zealand as a regional leader in precision oncology, enhancing cancer care and advancing clinical genomics.

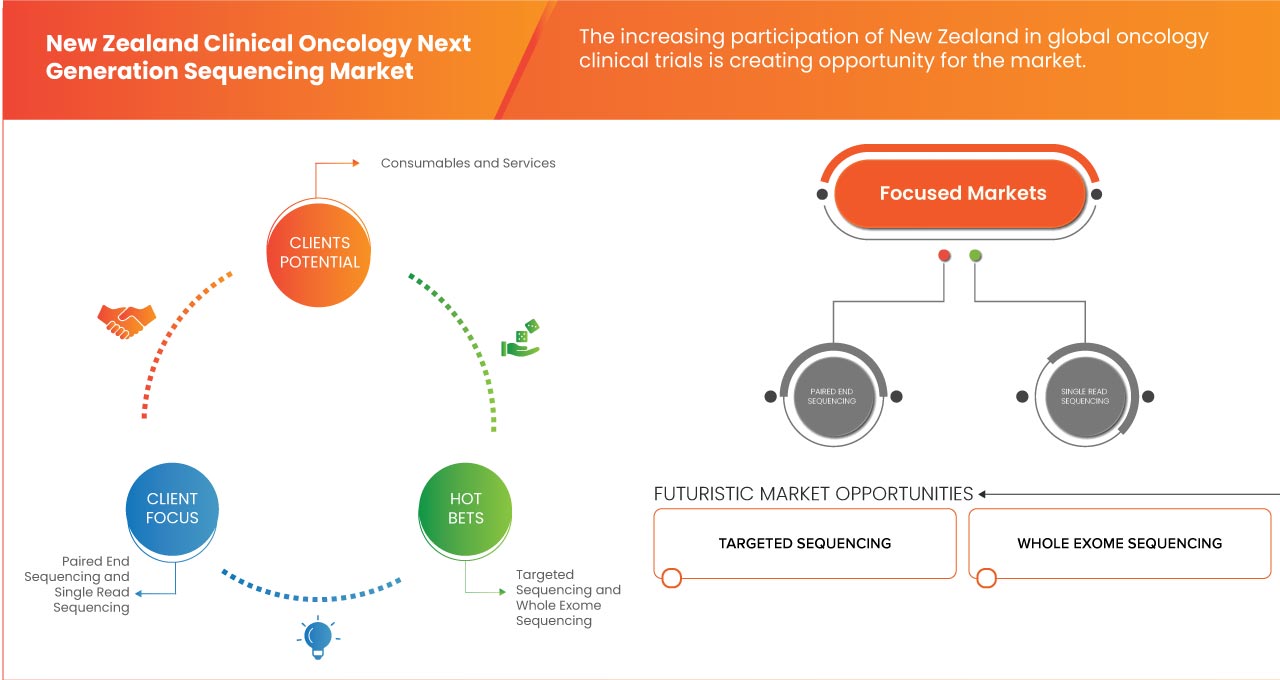

- The Increasing Participation of New Zealand in Global Oncology Clinical Trials

NGS is essential for patient stratification in clinical trials, identifying genetic markers to tailor therapies and improve trial success. It also monitors treatment efficacy and resistance, refining therapeutic approaches. With its diverse patient population, New Zealand's increasing role in global oncology trials makes it an attractive hub for advanced cancer research.

For instance,

- In June 2024, according to an article published by Health Research Council of New Zealand (HRC), a new study funded by the Health Research Council of New Zealand will test a model to improve cancer patient access to clinical trials across the country. This initiative, part of the 2024 funding rounds, supports increased participation in global oncology trials. This expanded access may drive demand for advanced oncology technologies, like NGS, strengthening the company's market presence. By improving trial access, this model is likely to boost New Zealand’s involvement in both local and global oncology research

Growing participation in global oncology trials drives NGS adoption in New Zealand, boosting precision medicine, enhancing research capabilities, and positioning the country as a key player in clinical oncology.

Restraint/Challenge

- Lack of Skilled Professionals to Perform NGS

Effective utilization of NGS technologies in oncology demands specialized expertise to accurately interpret complex genomic data. A lack of bioinformatics proficiency among healthcare providers can impede the full potential of NGS in delivering precise cancer diagnoses and personalized treatments, delaying the adoption of precision medicine. This skills gap also poses challenges for advancing research initiatives and clinical trials, limiting the country’s ability to fully benefit from advancements in genomics.

For instance,

- In November 2024, according to an article published by Springer Nature Limited, the deployment of a system like this in New Zealand could place significant strain on the workforce, requiring highly skilled workers who are already in short supply. This highlights the challenge of having a sufficient number of trained professionals to manage and perform NGS, especially when considering the need for advanced skills in areas like genomic analysis and the rapid processing of samples

The shortage of trained professionals in bioinformatics and NGS interpretation presents a significant challenge to the New Zealand clinical oncology NGS market. This skills gap hampers the effective utilization of NGS technologies, limiting the country’s ability to advance in precision oncology and impacting patient outcomes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Clinical Oncology Next Generation Sequencing Market Scope

The market is segmented on the basis of technology, products & services, sequencing type, cancer type, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Targeted Sequencing

- Whole Exome Sequencing

- Whole Genome Sequencing

Products & Services

- Consumables

- Products Type

- Kits

- Reagents

- Others

- Type

- Library Preparation and Target Enrichment Consumables

- Sample Preparation Consumables

- Products Type

- Instruments

- Operating Mechanism

- Automated

- Semi-Automated

- Modality

- Benchtop

- Standalone

- Operating Mechanism

- Services

- Sequencing Services

- DNA Sequencing

- RNA Sequencing

- Data Management Services

- Ngs Data Analysis Software and Workbenches

- Ngs Data Analysis Services

- Sequencing Services

Sequencing Type

- Paired End Sequencing

- Single Read Sequencing

Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Melanoma

- Lymphoma

- Others

End User

- Hospitals

- Public

- Private

- Clinical Laboratories

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROS)

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Offline

- Online

- Others

Clinical Oncology Next Generation Sequencing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Clinical Oncology Next Generation Sequencing Market Leaders Operating in the Market Are:

- Illumina Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QIAGEN (Netherlands)

- PacBio (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Zymo Research Corporation (U.S.)

- SOPHiA GENETICS (Switzerland)

- Takara Bio Inc., (Japan)

- Myriad Genetics, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Devyser (Sweden),

- Macrogen Oceania (Australia)

- Mérieux NutriSciences Corporation (France)

- Creative Biolabs (U.S.)

Latest Developments in New Zealand Clinical Oncology Next Generation Sequencing Market

- In December 2021, Roche has launched the AVENIO Edge System to simplify and automate NGS sample preparation, reducing human error and enhancing precision medicine. This fully-integrated, automated solution will strengthen Roche's sequencing technologies, improving efficiency and supporting their growth in the precision medicine market

- In November 2021, Illumina Inc., announced a partnership with Sequoia Capital China to establish first start-ups to join Genomics Incubator in China. This will increase the company’s research and development plans towards Genomics and has supported the company to establish genomics library in China

- In October 2021, ThermoFisher Scientific Inc. announced that it has launched Applied Biosystem QuantSudio Absolute Q-Digital PCR System, which is a designed to provide highly accurate results in genetic analysis. The digital PCR is already in use for monitoring cancer driven mutations in liquid biopsy. This has helped he company to increase its product portfolio

- In September 2021, ThermoFisher Scientific Inc. announced that it has entered into partnership with AstraZeneca to develop NGS-based companion diagnostics. The NGS workflow includes multiple solutions for liquid biopsy testing and solid tumor biomarkers. This is expected to expand the company’s product portfolio

- In August 2021, Illumina Inc. announced that it has acquired GRAIL to accelerate patient access to multi cancer early detection test and gene sequencing procedures. This has helped the company to increase its product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PRODUCT & SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.2 PORTER FIVE FORCES

5 REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 ADVANCEMENTS IN LIQUID BIOPSY TECHNOLOGY

6.1.2 INCREASING INCIDENCE RATE OF CANCER

6.1.3 TECHNOLOGICAL ADVANCEMENT IN GENOMIC SEQUENCING

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE OF EQUIPMENT IN THE LABORATORY

6.2.2 IMPLEMENTATION OF NGS IN THE CLINICAL LAB

6.3 OPPORTUNITIES

6.3.1 INCREASING NUMBER OF PARTNERSHIPS AND COLLABORATION

6.3.2 THE INCREASING PARTICIPATION OF NEW ZEALAND IN GLOBAL ONCOLOGY CLINICAL TRIALS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM NGS

6.4.2 DATA MANAGEMENT ISSUES

7 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY PRODUCTS & SERVICES

7.1 OVERVIEW

7.2 CONSUMABLES

7.2.1 KITS

7.2.2 REAGENTS

7.2.3 OTHERS

7.2.4 LIBRARY PREPARATION AND TARGET ENRICHMENT CONSUMABLES

7.2.5 SAMPLE PREPARATION CONSUMABLES

7.3 INSTRUMENTS

7.3.1 AUTOMATED

7.3.2 SEMI-AUTOMATED

7.3.3 BENCHTOP

7.3.4 STANDALONE

7.4 SERVICES

7.4.1 SEQUENCING SERVICES

7.4.2 DNA SEQUENCING

7.4.3 RNA SEQUENCING

7.4.4 DATA MANAGEMENT SERVICES

8 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY SEQUENCING TYPE

8.1 OVERVIEW

8.2 PAIRED END SEQUENCING

8.3 SINGLE READ SEQUENCING

9 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 TARGETED SEQUENCING

9.3 WHOLE EXOME SEQUENCING

9.4 WHOLE GENOME SEQUENCING

10 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 LUNG CANCER

10.3 BREAST CANCER

10.4 COLORECTAL CANCER

10.5 PROSTATE CANCER

10.6 MELANOMA

10.7 LYMPHOMA

10.8 OTHERS

11 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 PUBLIC

11.2.2 PRIVATE

11.3 CLINICAL LABORATORIES

11.4 ACADEMIC & RESEARCH INSTITUTES

11.5 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

11.6 CONTRACT RESEARCH ORGANIZATIONS (CROS)

11.7 OTHERS

12 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.3.1 OFFLINE

12.3.2 ONLINE

12.4 OTHERS

13 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 ILLUMINA, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 THERMO FISHER SCIENTIFIC INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 F. HOFFMANN-LA ROCHE LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 QIAGEN

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 PACBIO

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AGILENT TECHNOLOGIES, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIO-RAD LABORATORIES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CREATIVE BIOLABS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DEVYSER

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 MÉRIEUX NUTRISCIENCES CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 MACROGEN OCEANIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MYRIAD GENETICS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 SOPHIA GENETICS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 TAKARA BIO INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 ZYMO RESEARCH CORPORATION

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PRICES OF THE ALL NGS INSTRUMENTS IN 2022

TABLE 2 PRICES OF PLATFORM/COMPANY WISE FOR NGS INSTRUMENTS IN 2022

TABLE 3 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY PRODUCTS & SERVICES, 2018-2032 (USD THOUSAND)

TABLE 4 NEW ZEALAND CONSUMABLES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NEW ZEALAND CONSUMABLES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NEW ZEALAND INSTRUMENTS IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY OPERATING MECHANISM, 2018-2032 (USD THOUSAND)

TABLE 7 NEW ZEALAND INSTRUMENTS IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY MODALITY, 2018-2032 (USD THOUSAND)

TABLE 8 NEW ZEALAND SERVICES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NEW ZEALAND SEQUENCING SERVICES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NEW ZEALAND DATA MANAGEMENT SERVICES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY SEQUENCING TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 13 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY CANCER TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 15 NEW ZEALAND HOSPITALS IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 17 NEW ZEALAND RETAIL SALES IN CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: SEGMENTATION

FIGURE 2 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: DATA TRIANGULATION

FIGURE 3 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: DROC ANALYSIS

FIGURE 4 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: SEGMENTATION

FIGURE 10 ADVANCEMENTS IN LIQUID BIOPSY TECHNOLOGY ARE DRIVING THE GROWTH OF THE NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET FROM 2025 TO 2032

FIGURE 11 THE TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET IN 2025 AND 2032

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL NEXT GENERATION SEQUENCING (NGS) MARKET

FIGURE 13 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY PRODUCTS & SERVICES, 2024

FIGURE 14 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY PRODUCTS & SERVICES, 2025-2032 (USD THOUSAND)

FIGURE 15 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY PRODUCTS & SERVICES, CAGR (2025-2032)

FIGURE 16 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY PRODUCTS & SERVICES, LIFELINE CURVE

FIGURE 17 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY SEQUENCING TYPE, 2024

FIGURE 18 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY SEQUENCING TYPE, 2025-2032 (USD THOUSAND)

FIGURE 19 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY SEQUENCING TYPE, CAGR (2025-2032)

FIGURE 20 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY SEQUENCING TYPE, LIFELINE CURVE

FIGURE 21 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY TECHNOLOGY, 2024

FIGURE 22 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 23 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 24 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 25 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY CANCER TYPE, 2024

FIGURE 26 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY CANCER TYPE, 2025-2032 (USD THOUSAND)

FIGURE 27 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY CANCER TYPE, CAGR (2025-2032)

FIGURE 28 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 31 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 32 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 34 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 35 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 36 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NEW ZEALAND CLINICAL ONCOLOGY NEXT GENERATION SEQUENCING MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.