A power alloy is created when different components found in stainless steel are combined. In some circumstances, stainless steel, an alloy of iron, chromium, and nickel, give resistance to corrosion of iron. This resistant quality of the alloy is due to chromium. The passive layer is a thin oxide film secreted by chromium. In addition to chromium, this alloy also includes nitrogen and molybdenum. It is an environmentally neutral and inert alloy, making it indefinitely recyclable. Stainless steel is strong and long-lasting, making it ideal for usage in many end-user verticals.

Access Full Report at https://www.databridgemarketresearch.com/reports/mexico-stainless-steel-market

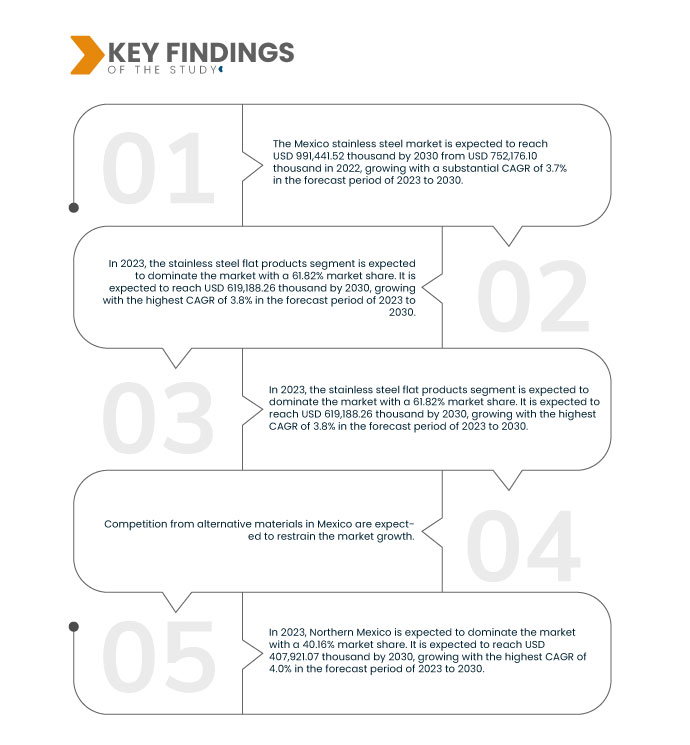

Data Bridge Market Research analyzes that Mexico Stainless Steel Market is expected to reach USD 991,441.52 thousand by 2030 from USD 752,176.10 thousand in 2022, growing with a substantial CAGR of 3.7% in the forecast period of 2023 to 2030. increasing industrial activities in Mexico will drive market growth.

Key Findings of the Study

Increasing Industrial Activities in Mexico

Increasing industrial activity is driving stainless steel demand in Mexico. There has been a notable increase in industrialization across various industries, including automotive, construction, manufacturing, and energy. Stainless steel has become the preferred material for various industrial applications due to its exceptional properties, such as corrosion resistance, strength, and aesthetic appeal. A growing need for durable and reliable materials has accompanied the expansion of industrial activities in Mexico. Stainless steel's unique characteristics make it an ideal choice for diverse applications within the industrial landscape. Stainless steel's versatility and resilience position it as a key player in Mexico's economic development as industries continue to evolve and strive for efficiency and sustainability.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Thousand and Volume in Tons

|

|

Segments Covered

|

Product (Stainless Steel Flat Products, Stainless Steel Long Products, and Others), Forming Process (Hot Rolled and Cold Rolled), Type (Austenitic Stainless Steel, Ferritic Stainless Steel, Martensitic Stainless Steel, Duplex Stainless Steel, and Precipitation-Hard Enable Stainless Steel), Grade (300 Series, 400 Series, 200 Series, 500 Series, and 600 Series), Application (Automotive and Transportation, Mechanical Engineering and Heavy Industries, Metal Products, Consumer Goods, Medical and Healthcare, Building and Construction, Marine, and Others)

|

|

Regions Covered

|

Northern Mexico, Central Mexico, Eastern Mexico, Western Mexico, and Southern Mexico

|

|

Market Players Covered

|

Acerinox (Spain), Aperam (Luxembourg), NIPPON STEEL CORPORATION (Japan), Alleima (Sweden), MITSUI & CO., LTD. (Japan), Olympic Steel (U.S.), Outokumpu (Finland), Ulbrich Stainless Steels and Special Metals Inc. (U.S.), Swiss Steel Holding AG (Switzerland), Gibbs Wire & Steel Company LLC (U.S.), TIMEX METALS (India), Shrikant Steel Centre (India), Nitech Stainless Inc (India), Industeel (France), and R H Alloys (India), among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The market is segmented into five notable segments on the basis of product, forming process, type, grade, and application.

- On the basis of product, the market is segmented into stainless steel flat products, stainless steel long products, and others.

In 2023, the stainless steel flat products segment is expected to dominate the market

In 2023, the stainless steel flat products segment is expected to dominate the market with a 61.82% market share due to its use in the production of sheets, plates, structural beams, and strips. These products are extensively served in building & infrastructure, transportation, and electrical appliance industries owing to their unique properties.

- On the basis of forming process, the market is segmented into hot rolled and cold rolled.

In 2023, the hot rolled segment is expected to dominate the market

In 2023, the hot rolled segment is expected to dominate the market with a 54.68% market share as hot rolling provides improved properties to the steel like toughness, flexibility, and resistance to shock, which helps the stainless steel to be durable in the long run.

- On the basis of type, the market is segmented into austenitic stainless steel, ferritic stainless steel, martensitic stainless steel, duplex stainless steel, and precipitation-hard enable stainless steel. In 2023, the austenitic stainless steel segment is expected to dominate the market with a 46.59% market share growing.

. - On the basis of grade, the market is segmented into 300 series, 400 series, 200 series, 500 series, and 600 series. In 2023, the 300 series segment is expected to dominate the market with a 52.71% market share growing.

. - On the basis of application, the market is segmented into automotive and transportation, mechanical engineering and heavy industries, metal products, consumer goods, medical and healthcare, building and construction, marine, and others. In 2023, the automotive and transportation segment is expected to dominate the market with a 24.87% market share.

Major Players

Data Bridge Market Research recognizes the following companies as the major players in the Mexico stainless steel market that include are Acerinox (Spain), Aperam (Luxembourg), NIPPON STEEL CORPORATION (Japan), Alleima (Sweden), MITSUI & CO., LTD. (Japan), Olympic Steel (U.S.), Outokumpu (Finland), Ulbrich Stainless Steels and Special Metals Inc. (U.S.), Swiss Steel Holding AG (Switzerland), Gibbs Wire & Steel Company LLC (U.S.), TIMEX METALS (India), Shrikant Steel Centre (India), Nitech Stainless Inc (India), Industeel (France), and R H Alloys (India), among others.

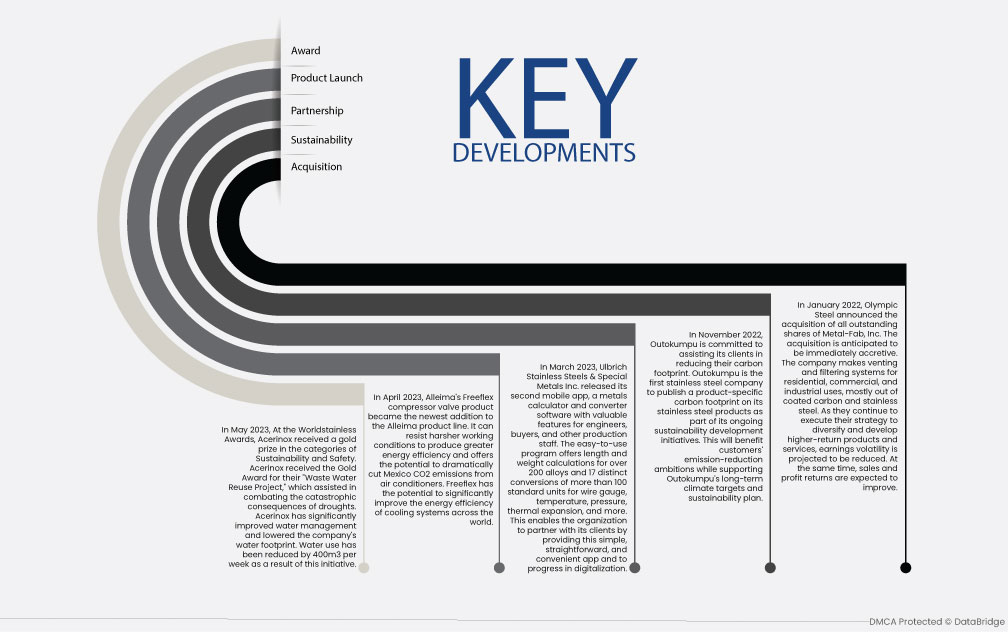

Market Development

- In May 2023, At the Worldstainless Awards, Acerinox received a gold prize in the categories of Sustainability and Safety. Acerinox received the Gold Award for their "Waste Water Reuse Project," which assisted in combating the catastrophic consequences of droughts. Acerinox has significantly improved water management and lowered the company's water footprint. Water use has been reduced by 400m3 per week as a result of this initiative.

- In April 2023, Alleima's Freeflex compressor valve product became the newest addition to the Alleima product line. It can resist harsher working conditions to produce greater energy efficiency and offers the potential to dramatically cut Mexico’s CO2 emissions from air conditioners. Freeflex has the potential to significantly improve the energy efficiency of cooling system across the world.

- In March 2023, Ulbrich Stainless Steels & Special Metals Inc. released its second mobile app, a metals calculator and converter software with valuable features for engineers, buyers, and other production staff. The easy-to-use program offers length and weight calculations for over 200 alloys and 17 distinct conversions of more than 100 standard units for wire gauge, temperature, pressure, thermal expansion, and more. This enables the organization to partner with its clients by providing this simple, straightforward, and convenient app and to progress in digitalization.

- In November 2022, Outokumpu is committed to assisting its clients in reducing their carbon footprint. Outokumpu is the first stainless steel company to publish a product-specific carbon footprint on its stainless steel products as part of its ongoing sustainability development initiatives. This will benefit customers' emission-reduction ambitions while supporting Outokumpu's long-term climate targets and sustainability plan.

- In January 2022, Olympic Steel announced the acquisition of all outstanding shares of Metal-Fab, Inc. The acquisition is anticipated to be immediately accretive. The company makes venting and filtering systems for residential, commercial, and industrial uses, mostly out of coated carbon and stainless steel. As they continue to execute their strategy to diversify and develop higher-return products and services, earnings volatility is projected to be reduced. At the same time, sales and profit returns are expected to improve.

Regional Analysis

Geographically, the regions covered in the Mexico stainless steel market are Northern Mexico, Eastern Mexico, Central Mexico, Western Mexico, and Southern Mexico.

As per Data Bridge Market Research analysis:

Northern Mexico is expected to dominate and be a fastest growing region in the Mexico stainless steel market during the forecast period 2023-2030

Northern Mexico is expected to dominate the market due to rising urbanization and infrastructure development. Also, Northern Mexico estimated to be fastest growing region in the Mexico stainless steel market as there is an increasing industrial activity.

For more detailed information about the Mexico stainless steel market report, click here – https://www.databridgemarketresearch.com/reports/mexico-stainless-steel-market