El herramental compuesto FDM de gran tamaño se refiere al herramental fabricado mediante la tecnología de Modelado por Deposición Fundida (FDM) con materiales compuestos para la producción de piezas a gran escala. El FDM es un proceso de fabricación aditiva en el que el material se extruye capa a capa para construir una pieza. Al combinarse con materiales compuestos, como la fibra de carbono o los polímeros reforzados con fibra de vidrio, mejora la resistencia y la durabilidad del herramental. Este enfoque permite la creación de geometrías y estructuras complejas que, a menudo, son ligeras pero robustas. El herramental compuesto FDM de gran tamaño se utiliza comúnmente en industrias como la aeroespacial, la automotriz y la manufactura, donde el alto rendimiento y la precisión son esenciales.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-fdm-composite-large-size-tooling-market

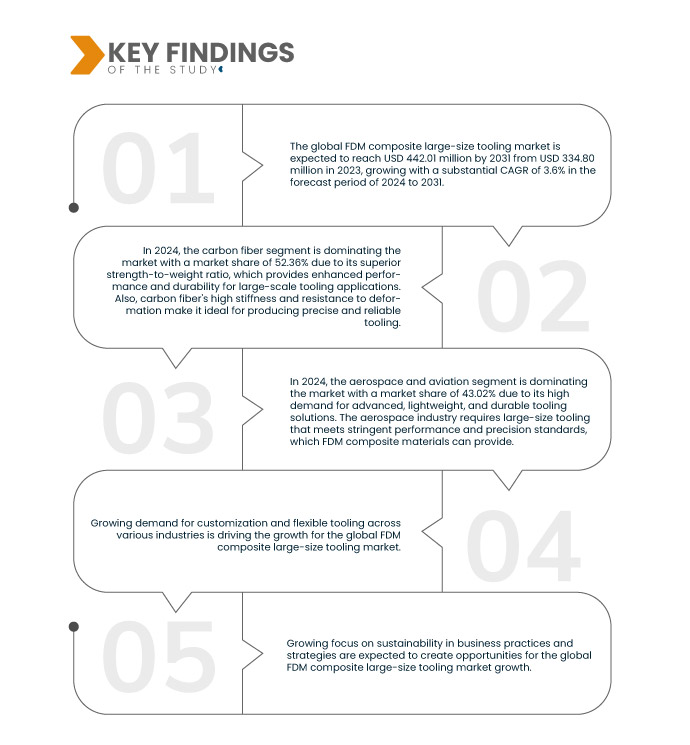

Se espera que el mercado global de herramientas de gran tamaño compuestas FDM alcance los USD 442,01 millones para 2031 desde USD 334,80 millones en 2023, creciendo con una CAGR sustancial del 3,6% en el período de pronóstico de 2024 a 2031.

Principales hallazgos del estudio

Opciones de materiales diversos asociados

La tecnología de Modelado por Deposición Fundida (FDM) impulsa el mercado global de herramientas compuestas FDM de gran tamaño al ofrecer diversas opciones de materiales, incluyendo termoplásticos como PLA, ABS, policarbonato y nailon, así como filamentos compuestos reforzados con fibras como el carbono o el vidrio. Esta versatilidad permite a los fabricantes seleccionar materiales que cumplen con los requisitos específicos de rendimiento, durabilidad y coste en sectores como el aeroespacial, el automotriz y el sanitario. La capacidad de prototipar e iterar diseños rápidamente utilizando diversos materiales mejora la innovación y la eficiencia, lo que hace que la tecnología FDM sea esencial para la producción de herramientas avanzadas a gran escala.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2021-2016)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Material ( fibra de carbono , fibra de vidrio, aleaciones metálicas, caucho de silicona y otros), usuario final (industria aeroespacial y de aviación, industria automotriz, energías renovables, electricidad y electrónica, construcción y edificación, medicina y otros)

|

Países cubiertos

|

EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Singapur, Indonesia, Tailandia, Filipinas, Australia y Nueva Zelanda, Malasia, resto de Asia-Pacífico, Alemania, Italia, Reino Unido, Francia, España, Turquía, Rusia, Suiza, Bélgica, Países Bajos, resto de Europa, Brasil, Argentina, resto de Sudamérica, Emiratos Árabes Unidos, Arabia Saudita, Sudáfrica, Kuwait y resto de Medio Oriente y África.

|

Actores del mercado cubiertos

|

Stratasys (EE. UU.), Proto3000 (Canadá) y Airtech Advanced Materials (EE. UU.)

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos:

El mercado global de herramientas de gran tamaño compuestas FDM está segmentado en dos segmentos notables según el material y el usuario final.

- Sobre la base del material, el mercado global de herramientas de gran tamaño compuestas FDM se segmenta en fibra de carbono, fibra de vidrio, aleaciones metálicas, caucho de silicona y otros.

En 2024, el segmento de fibra de carbono dominará el mercado mundial de herramientas de gran tamaño compuestas FDM.

En 2024, el segmento de fibra de carbono dominará el mercado con una cuota de mercado del 52,36% gracias a su excelente relación resistencia-peso, que proporciona un mayor rendimiento y durabilidad para aplicaciones de herramientas a gran escala. Además, su alta rigidez y resistencia a la deformación la hacen ideal para la producción de herramientas precisas y fiables.

- Sobre la base del usuario final, el mercado global de herramientas de gran tamaño compuestas FDM está segmentado en aeroespacial y aviación, industria automotriz, energía renovable, electricidad y electrónica, construcción y edificación, medicina y otros.

En 2024, el segmento aeroespacial y de aviación dominará el mercado global de herramientas de gran tamaño compuestas FDM.

En 2024, el sector aeroespacial y de aviación dominará el mercado con una cuota de mercado del 43,02% debido a la alta demanda de soluciones de herramientas avanzadas, ligeras y duraderas. La industria aeroespacial requiere herramientas de gran tamaño que cumplan con estrictos estándares de rendimiento y precisión, que los materiales compuestos FDM pueden proporcionar.

Jugador principal

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores en el mercado global de herramientas de gran tamaño compuestas FDM, entre las que se incluyen Stratasys (EE. UU.).

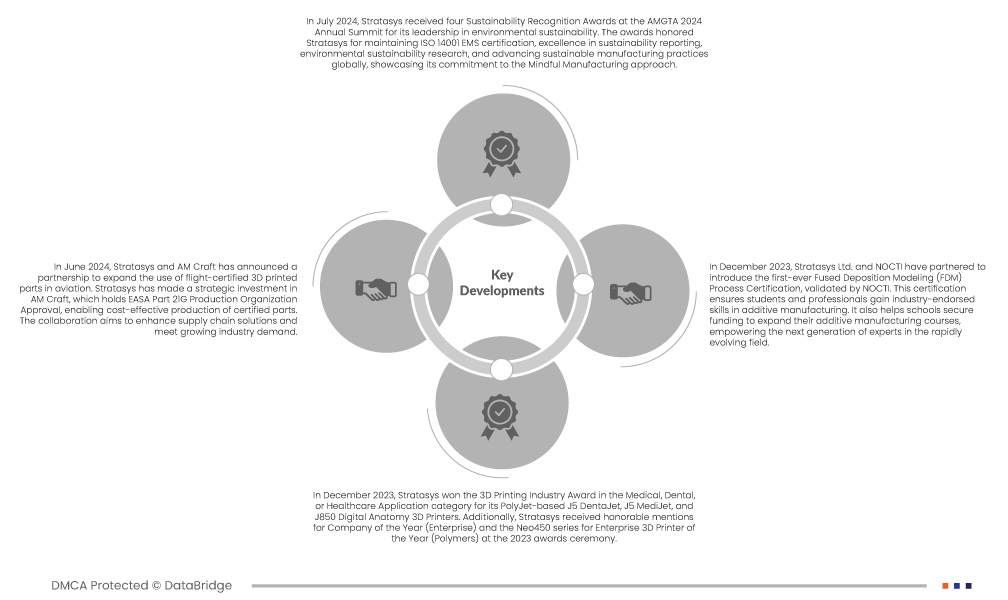

Desarrollo del mercado

- En julio de 2024, Stratasys recibió cuatro Premios de Reconocimiento a la Sostenibilidad en la Cumbre Anual AMGTA 2024 por su liderazgo en sostenibilidad ambiental. Los premios reconocieron a Stratasys por mantener la certificación ISO 14001 EMS, su excelencia en informes de sostenibilidad, su investigación sobre sostenibilidad ambiental y el avance de las prácticas de fabricación sostenible a nivel mundial, demostrando así su compromiso con el enfoque de Fabricación Consciente.

- En junio de 2024, Stratasys y AM Craft anunciaron una colaboración para expandir el uso de piezas impresas en 3D con certificación de vuelo en la aviación. Stratasys realizó una inversión estratégica en AM Craft, que cuenta con la Aprobación de Organización de Producción EASA Parte 21G, lo que permite una producción rentable de piezas certificadas. La colaboración busca optimizar las soluciones para la cadena de suministro y satisfacer la creciente demanda del sector.

- En diciembre de 2023, Stratasys ganó el Premio de la Industria de la Impresión 3D en la categoría de Aplicaciones Médicas, Dentales o Sanitarias por sus impresoras 3D J5 DentaJet, J5 MediJet y J850 Digital Anatomy, basadas en PolyJet. Además, Stratasys recibió menciones honoríficas como Empresa del Año (Empresa) y la serie Neo450 como Impresora 3D Empresarial del Año (Polímeros) en la ceremonia de premios de 2023.

- En diciembre de 2023, Stratasys Ltd. y NOCTI se asociaron para presentar la primera Certificación del Proceso de Modelado por Deposición Fundida (FDM), validada por NOCTI. Esta certificación garantiza que estudiantes y profesionales adquieran habilidades con el respaldo de la industria en fabricación aditiva. Además, ayuda a las instituciones educativas a obtener financiación para ampliar sus cursos de fabricación aditiva, impulsando así a la próxima generación de expertos en este campo en constante evolución.

Análisis regional

Geográficamente, los países cubiertos en el informe global del mercado de herramientas de gran tamaño compuestas FDM son EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Singapur, Indonesia, Tailandia, Filipinas, Australia y Nueva Zelanda, Malasia, resto de Asia-Pacífico, Alemania, Italia, Reino Unido, Francia, España, Turquía, Rusia, Suiza, Bélgica, Países Bajos, resto de Europa, Brasil, Argentina, resto de América del Sur, Emiratos Árabes Unidos, Arabia Saudita, Sudáfrica, Kuwait y resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge :

Asia-Pacífico es la región dominante y de más rápido crecimiento en el mercado global de herramientas de gran tamaño compuestas FDM durante el período de pronóstico de 2024 a 2031.

La región Asia-Pacífico domina el mercado global de herramientas de gran tamaño para compuestos FDM gracias al rápido crecimiento del sector manufacturero. Los países de Asia-Pacífico están invirtiendo fuertemente en tecnologías de fabricación avanzadas para mejorar la eficiencia y reducir costos, lo que genera una demanda significativa de herramientas para compuestos FDM.

Para obtener información más detallada sobre el informe del mercado global de herramientas de gran tamaño compuestas FDM, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-fdm-composite-large-size-tooling-market