The Australia private health insurance market refers to the sector within the country's healthcare system that provides coverage for medical expenses beyond what is covered by the public healthcare system. A range of providers offers private health insurance in Australia which is commonly used to cover services such as hospital stays, specialist consultations, and elective surgeries. It allows individuals to access private healthcare facilities and services, offering them more choice and potentially shorter wait times. Australians often opt for private health insurance to supplement the government-funded healthcare provided by Medicare, ensuring comprehensive healthcare coverage tailored to their needs.

Access Full Report @ https://www.databridgemarketresearch.com/reports/australia-private-health-insurance-market

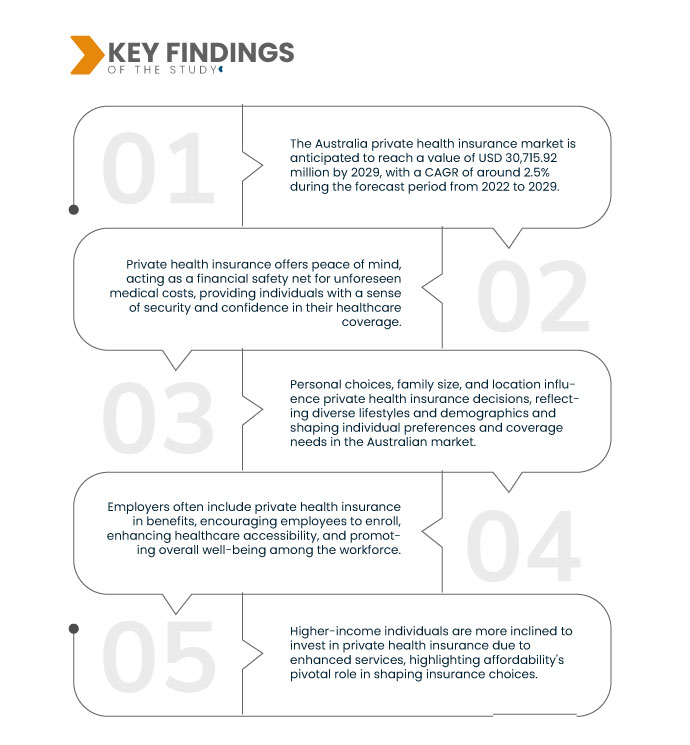

Data Bridge Market Research analyses that the Australia Private Health Insurance Market is expected to grow at a CAGR of 2.5% in the forecast period of 2022 to 2029 and is expected to reach USD 30,715.92 million by 2029 from USD 25,209.98 million in 2021. Australia's aging demographic fuels higher demand for healthcare services. This trend amplifies interest in private health insurance, mainly to cater to age-related health concerns. As the population ages, the need for comprehensive health coverage intensifies, driving individuals to seek private insurance solutions that specifically address the challenges associated with aging.

Key Findings of the Study

Rising healthcare costs are expected to drive the market's growth rate

The relentless increase in healthcare costs, including hospitalizations and medical treatments, motivates people to turn to private insurance. This choice offers a means of alleviating the financial burden associated with medical expenses and affording them access to superior healthcare services. As healthcare expenditure rises, private insurance becomes an increasingly appealing option for individuals seeking financial security and enhanced medical care.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020(Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Critical Illness Insurance, Individual Health Insurance, Family Health Insurance, Disease-Specific Insurance, and Others), Health Plan Category/Metal Levels (Bronze, Silver, Gold Platinum, and Others), Provider Type (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS) Plans, High-Deductible Health Plans (HDHPS) and Others), Age Group (Young Adulthood (19-44 Years), Middle Adulthood (45-64 Years) and Older Adulthood (65 Years And Above)), Distribution Channel (Direct Insurance Companies, Insurance Aggregators and Others)

|

|

Countries Covered

|

Australia

|

|

Market Players Covered

|

AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), Suncorp Group (Australia), Medibank Private Limited (Australia), HSBC Group (Hong Kong), Tokio Marine (Japan), Great Eastern Holdings Limited (Malaysia), The Royal Automobile Club of WA (Inc.). (Australia), AXA (France), Income (Australia), Aetna Inc. (A subsidiary of CVS Health), Cigna

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Australia private health insurance market is segmented on the basis of type, health plan category/metal levels, provider type, age group, and distribution channel.

- On the basis of product type, the Australia private health insurance market is segmented into critical illness insurance, individual health insurance, family health insurance, disease-specific insurance, and others.

- On the basis of health plan category/metal levels, the Australia private health insurance market is segmented into bronze, silver, gold platinum, and others.

- On the basis of provider type, the Australia private health insurance market is segmented into health maintenance organizations (HMOS), preferred provider organizations (PPOS), exclusive provider organizations (EPOS), point-of-service (POS) plans, high-deductible health plans (HDHPS) and others.

- On the basis of age group, the Australia private health insurance market is segmented into young adulthood (19-44 Years), middle adulthood (45-64 Years), and older adulthood (65 years and above).

- On the basis of distribution channel, the Australia private health insurance market is segmented into direct insurance companies, insurance aggregators, and others.

Major Players

Data Bridge Market Research recognizes the following companies as the major Australia private health insurance market players in Australia private health insurance market are AIA Group Limited (Hong Kong), HCF (Australia), Allianz (Germany), Suncorp Group (Australia), Medibank Private Limited (Australia), HSBC Group (Hong Kong), Tokio Marine (Japan), Great Eastern Holdings Limited (Malaysia).

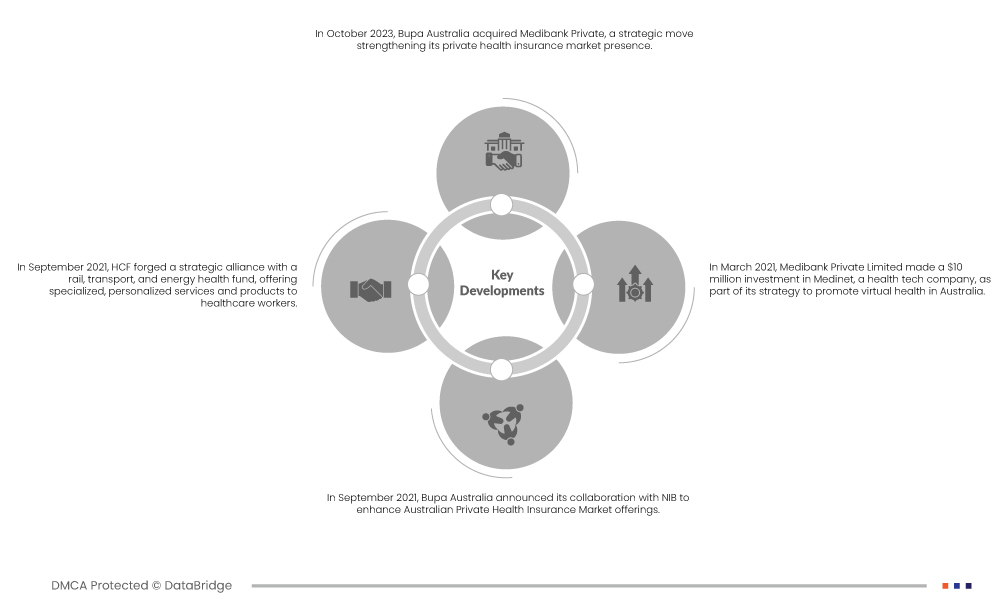

Market Developments

- In October 2023, Bupa Australia acquired Medibank Private, a strategic move strengthening its private health insurance market presence. This collaboration expanded Bupa's portfolio, enhancing its ability to offer the Australian population a more comprehensive range of healthcare services.

- In September 2021, HCF forged a strategic alliance with a rail, transport, and energy health fund, offering specialized, personalized services and products to healthcare workers. This initiative bolstered HCF's business, fostering growth and improving its presence in the market.

- In September 2021, Bupa Australia announced its collaboration with NIB to enhance Australian Private Health Insurance Market offerings. This strategic partnership aims to provide tailored support and services to its members, fostering growth and innovation in the sector.

- In March 2021, Medibank Private Limited made a $10 million investment in Medinet, a health tech company, as part of its strategy to promote virtual health in Australia. This move aligns with their goal of advancing preventive and integrated care, enhancing the company's reputation, and fostering business growth in the evolving healthcare landscape.

For more detailed information about the Australia private health insurance market report, click here – https://www.databridgemarketresearch.com/reports/australia-private-health-insurance-market