Middle East And Africa Aluminum Foil Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.89 Billion

USD

2.76 Billion

2024

2032

USD

1.89 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.76 Billion | |

|

|

|

중동 및 아프리카 알루미늄 호일 시장 세분화, 제품별(호일 포장지, 파우치, 블리스터 포장, 접이식 튜브, 트레이/용기, 캡슐, 라미네이트 뚜껑, 호일 라이닝 백, 초콜릿 호일, 호일 원형 밀봉, 기타), 유형별(인쇄, 비인쇄), 두께(0.07mm, 0.09mm, 0.2mm, 0.4mm), 최종 사용자별(식품, 제약, 화장품, 단열재, 전자, 지구화학 샘플링, 자동차 부품, 기타) – 산업 동향 및 2032년까지의 전망

알루미늄 호일 시장 분석

알루미늄 호일은 플라스틱으로 인한 환경 오염에 대한 인식이 높아짐에 따라 전 세계적으로 다양한 제품에 사용되고 있습니다. 고객은 일반 오븐과 팬 보조 오븐 모두에서 알루미늄 호일을 사용할 수 있어 두 가지 모두에 사용할 수 있습니다. 또한, 알루미늄 호일은 밀봉을 형성하여 암석 샘플을 유기 용매로부터 보호합니다.

알루미늄 호일 시장 규모

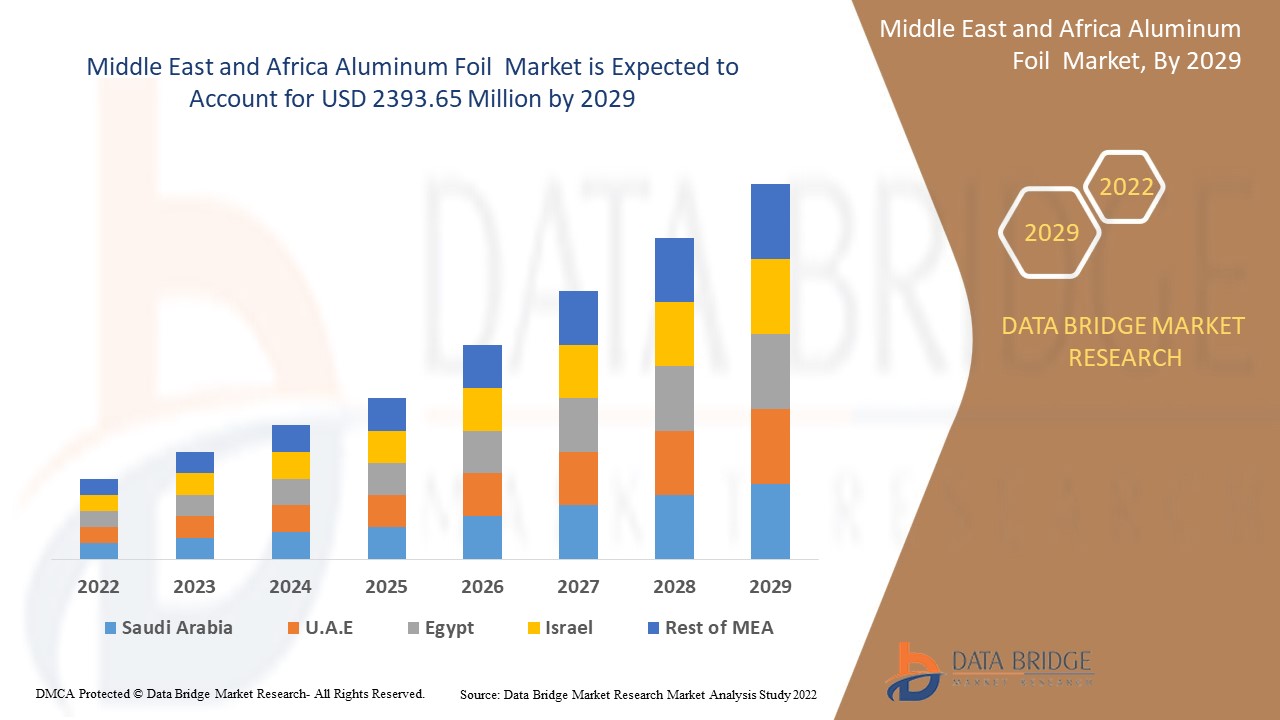

중동 및 아프리카 알루미늄 호일 시장 규모는 2024년에 18억 9천만 달러로 평가되었으며, 2032년까지 27억 6천만 달러에 이를 것으로 예상되며, 2025년부터 2032년까지의 예측 기간 동안 연평균 성장률은 4.84%입니다.

보고서 범위 및 시장 세분화

|

속성 |

알루미늄 호일 주요 시장 통찰력 |

|

분할 |

|

|

포함 국가 |

아랍에미리트, 사우디아라비아, 이집트, 이스라엘, 남아프리카공화국, 기타 중동 및 아프리카 국가. |

|

주요 시장 참여자 |

Amcor PLC(스위스), Constantia Flexibles(오스트리아), Novelis Aluminum(미국), Raviraj Foils Ltd(인도), Novelis Aluminum(미국), Ampco metal(스위스), All hilal group(사우디 아라비아), Caterpack(남아프리카 공화국), Alcon(스위스), Huyi Aluminum Co, Ltd(UAE), Cosmoplast(UAE), Symetal(미국), Aluminum Foil Converters(남아프리카 공화국), UNIPACK(미국), Express Group(UAE), ERAMCO(사우디 아라비아) |

|

시장 기회 |

|

알루미늄 호일 시장 정의

알루미늄 호일은 라미네이트의 핵심 구성 요소이며 식품 포장재에 흔히 사용됩니다. 플라스틱 라미네이트 소재보다 습기, 산소 및 기타 기체뿐 아니라 휘발성 냄새와 빛에 대한 차단 기능이 뛰어납니다. 알루미늄 호일은 살균 포장재에도 사용됩니다. 알루미늄 호일은 포장재, 식품 산업, 그리고 소비자에게 소비자 친화성 및 재활용성 등 다양한 이점을 제공합니다.

알루미늄 호일 시장 동향

운전자

- 소비자 인식 확산을 위한 정부 이니셔티브 증가

정부가 식품 안전에 대한 인식을 높이기 위한 조치를 강화함에 따라 식품, 의약품, 화장품 등 최종 사용자의 알루미늄 호일 수요가 증가하면서 시장이 성장하고 있습니다.

- 식품 안전에 대한 엄격한 규칙과 규정

식품 안전 및 품질 기준을 강화하는 정부 규정은 국내 알루미늄 호일 사업의 성장을 촉진했으며, 생산자들은 식품 오염을 방지하는 효과적인 포장 솔루션을 개발하도록 장려되었습니다.

- 전자상거래 수요 증가

변화하는 소매업계의 상황은 다양한 소매 제품에 대한 수요를 증가시켜, 즉시 사용 가능한 포장재의 성장을 긍정적으로 촉진할 것으로 예상됩니다. 또한, 온라인 소매 부문의 발전은 소비자들이 소매점에서 온라인 매장으로 이동하도록 유도했습니다. 온라인 식품 산업은 앞으로도 알루미늄 호일 제품의 주요 소비 시장으로 남을 것으로 예상됩니다.

- 생물학제제 수요 증가

생명공학의 발전과 생물학 제제에 대한 수요 증가로 인해 분말, 액체, 정제와 같은 제품에서 알루미늄 호일 수요가 증가할 것으로 예상됩니다.

기회

- 제품 혁신의 증가

제품 개발 증가는 새로운 시장 기회를 창출하여 산업 성장률을 향상시킬 것입니다. 알루미늄은 재활용 가능한 소재로, 제조업체에게 수익성 있는 기회를 제공합니다. 제품의 수거 및 회수율 증가는 생산 단가 하락과 수익성 향상을 의미하기 때문입니다.

- 경량 패키지 생산에 대한 수요

알루미늄 호일과 유연 필름을 함께 사용하여 경량 포장재를 생산하는 방식이 적절한 속도로 증가하고 있습니다. 이는 단기적으로 시장 판매자들에게 새로운 기회를 제공할 것으로 예상됩니다. 이러한 포장재는 식품, 커피, 생선 포장에 사용될 수 있습니다.

제약/도전

세계 시장은 엄청나게 성장하고 있습니다. 하지만 성장 경로에는 몇 가지 어려움이 있습니다. 적절한 포장 기술의 부족이 이러한 장애물 중 하나입니다. 일부 국가는 여전히 전통적인 방식을 고수하고 있습니다. 사람들의 생활 방식이 변화함에 따라 여전히 포장 식품을 구매할 돈이 부족한 사람들이 세계 곳곳에 있습니다. 이러한 요소들이 시장 성장을 저해하는 주요 시장 제약입니다.

이 알루미늄 호일 시장 보고서는 최근 동향, 무역 규제, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 현지 시장 참여자의 영향, 신규 매출 창출 기회 분석, 시장 규제 변화, 전략적 시장 성장 분석, 시장 규모, 카테고리별 시장 성장, 적용 분야별 틈새 시장 및 시장 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장 기술 혁신 등에 대한 자세한 정보를 제공합니다. 알루미늄 호일 시장에 대한 자세한 정보는 Data Bridge Market Research에 문의하여 분석 브리핑을 요청하십시오. 저희 팀은 시장 성장을 위한 정보에 기반한 시장 결정을 내릴 수 있도록 도와드리겠습니다.

알루미늄 호일 시장 범위

알루미늄 호일 시장은 제품, 종류, 두께 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트의 성장은 산업 내 저조한 성장 세그먼트를 분석하고, 사용자에게 핵심 시장 응용 분야를 파악하기 위한 전략적 의사 결정에 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 될 것입니다.

제품

- 호일 포장지

- 파우치

- 블리스터 팩

- 접이식 튜브

- 트레이/용기

- 캡슐

- 라미네이트 뚜껑

- 호일 라이닝 백

- 초콜릿 호일

- 호일 원형 씰

- 기타

유형

- 인쇄됨

- 인쇄되지 않음

두께

- 0.07mm

- 0.09mm

- 0.2mm

- 0.4mm

최종 사용자

알루미늄 호일 시장 지역 분석

알루미늄 호일 시장을 분석하고, 위에 언급된 대로 국가, 제품, 유형, 두께 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

알루미늄 호일 시장 보고서에서 다루는 국가는 아랍에미리트, 사우디아라비아, 이집트, 이스라엘, 남아프리카공화국, 기타 중동 및 아프리카입니다.

보고서의 국가별 섹션은 현재 및 미래 시장 동향에 영향을 미치는 개별 시장 영향 요인과 시장 규제 변화도 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 동향, 포터의 5대 경쟁 요인 분석, 사례 연구 등의 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 활용됩니다. 또한, 글로벌 브랜드의 존재 및 가용성, 그리고 국내 및 국내 브랜드와의 경쟁이 심화되거나 부족해짐에 따라 직면하는 과제, 국내 관세 및 무역 경로의 영향 등을 고려하여 국가별 데이터를 예측 분석합니다.

알루미늄 호일 시장 점유율

알루미늄 호일 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 여기에는 회사 개요, 회사 재무 상태, 매출 창출, 시장 잠재력, 연구 개발 투자, 신규 시장 진출, 글로벌 입지, 생산 시설 및 설비, 생산 능력, 회사의 강점과 약점, 제품 출시, 제품 종류 및 범위, 응용 분야별 우위 등이 포함됩니다. 위에 제시된 데이터는 해당 회사들이 알루미늄 호일 시장에 집중하는 분야와 관련된 내용입니다.

알루미늄 호일 시장에서 활동하는 선두주자는 다음과 같습니다.

- Amcor PLC(스위스)

- 콘스탄티아 플렉서블스(오스트리아)

- 노벨리스 알루미늄(미국)

- Raviraj Foils Ltd(인도)

- 노벨리스 알루미늄(미국)

- Ampco metal(스위스)

- 모든 힐랄 그룹(사우디 아라비아)

- 캐터팩(남아프리카공화국)

- 알콘(스위스)

- 후이 알루미늄 주식회사(UAE)

- 코스모플라스트(UAE)

- Symetal(미국)

- 알루미늄 호일 변환기(남아프리카)

- 유니팩(US)

- 익스프레스 그룹(UAE)

- 에람코(사우디 아라비아)

알루미늄 호일 시장의 최신 동향

- 2021년 11월, ProAmpac은 모회사인 IFP Investments Limited가 Irish Flexible Packaging과 Fispak을 개발했다고 발표했습니다. Fispak은 아일랜드에 본사를 둔 지속 가능한 유연 포장재 생산 및 공급업체로, 아일랜드와 전 세계의 수산물, 유제품, 제빵, 육류 및 치즈 시장에 서비스를 제공합니다.

- 2021년 9월, 유연 포장재 기업 Uflex의 필름 제조 계열사인 Flex Films는 BOPET 고차단성 필름 F-UHB-M을 출시했습니다. 이 필름은 유연 포장재에서 알루미늄 호일을 대체하여 취약한 무결성, 재료 가용성, 높은 재료 가격 등의 문제를 해결할 것으로 예상됩니다. 이러한 대체재 시장으로 인해 식품 생산 업체들이 제품 포장에 알루미늄 호일을 대체하게 되어 시장 성장에 어려움을 겪을 것으로 예상됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO (BY COUNTRY)

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 PRODUCTION CAPACITY OUTLOOK

10 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

10.1 OVERVIEW

10.2 FOIL WRAPPERS

10.2.1 FOOD PACKAGING

10.2.2 PHARMACEUTICAL PACKAGING

10.2.3 COSMETIC PACKAGING

10.3 POUCHES

10.3.1 STAND-UP POUCHES

10.3.2 FLAT POUCHES

10.3.3 OTHERS

10.4 BLISTER PACKS

10.4.1 PHARMACEUTICAL BLISTERS

10.4.1.1. TABLET BLISTERS

10.4.1.2. CAPSULE BLISTERS

10.4.1.3. MEDICINE STRIPS

10.4.1.4. OTHERS

10.4.2 CONSUMER GOODS BLISTERS

10.4.3 OTHERS

10.5 COLLAPSIBLE TUBES

10.5.1 COSMETIC TUBES

10.5.2 PHARMACEUTICAL TUBES

10.5.3 FOOD TUBES

10.5.4 OTHERS

10.6 TRAYS/CONTAINERS

10.6.1 FOOD TRAYS

10.6.2 MEDICAL TRAYS

10.6.3 OTHERS

10.7 CAPSULES

10.7.1 PHARMACEUTICAL CAPSULES

10.7.2 NUTRACEUTICAL CAPSULES

10.7.3 OTHERS

10.8 LAMINATED LIDS

10.8.1 FOOD LIDS

10.8.2 PHARMACEUTICAL LIDS

10.8.3 OTHERS

10.9 FOIL LINED BAGS

10.9.1 FOOD BAGS

10.9.2 ELECTRONICS BAGS

10.9.3 OTHERS

10.1 CHOCOLATE FOILS

10.10.1 WRAPPED CHOCOLATES

10.10.2 CONFECTIONERY PACKAGING

10.10.3 OTHERS

10.11 FOIL ROUND SEALS

10.11.1 FOOD SEALS

10.11.2 PHARMACEUTICAL SEALS

10.12 OTHERS

11 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY TYPE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 PRINTED ALUMINUM FOIL

11.3 UNPRINTED ALUMINUM FOIL

12 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 0.07 MM

12.3 0.09 MM

12.4 0.2 MM

12.5 0.4 MM

12.6 OTHERS

13 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 PACKAGING

13.2.1 PACKAGING, BY CATEGORY

13.2.1.1. INDUSTRIAL

13.2.1.2. CONSUMER

13.2.2 PACKAGING, BY VERTICAL

13.2.2.1. FOOD PACKAGING

13.2.2.1.1. READY-TO-EAT MEALS

13.2.2.1.2. SNACK PACKAGING

13.2.2.1.2.1 CHIPS

13.2.2.1.2.2 POPCORN

13.2.2.1.2.3 OTHERS

13.2.2.1.3. CONFECTIONERY PACKAGING

13.2.2.1.3.1 CHOCOLATES

13.2.2.1.3.2 CANDIES

13.2.2.1.3.3 OTHERS

13.2.2.1.4. BAKERY PACKAGING

13.2.2.1.4.1 CAKES

13.2.2.1.4.2 PASTRIES

13.2.2.1.4.3 TARTS

13.2.2.1.4.4 OTHERS

13.2.2.1.5. FRESH PRODUCE PACKAGING

13.2.2.1.5.1 FRUITS

13.2.2.1.5.2 VEGETABLES

13.2.2.1.5.3 SEA FOOD

13.2.2.1.5.4 OTHERS

13.2.2.1.6. FROZEN FOOD PACKAGING

13.2.2.1.7. PROCESSED FOOD PACKAGING

13.2.2.1.8. OTHERS

13.2.2.2. PHARMACEUTICAL PACKAGING

13.2.2.2.1. BLISTER PACKS FOR TABLETS & CAPSULES

13.2.2.2.2. LIQUID MEDICINE PACKAGING (SYRUPS)

13.2.2.2.3. SACHETS FOR SINGLE-DOSE MEDICATIONS

13.2.2.2.4. OINTMENT AND CREAM TUBES

13.2.2.2.5. OTHERS

13.2.2.3. COSMETICS AND PERSONAL CARE

13.2.2.3.1. SKINCARE TUBES AND JARS

13.2.2.3.2. HAIRCARE PACKAGING

13.2.2.3.3. COSMETIC SAMPLE PACKAGING

13.2.2.3.4. TOOTHPASTE PACKAGING

13.2.2.3.5. DEODORANT STICK PACKAGING

13.2.2.3.6. OTHERS

13.2.2.4. BEVERAGE PACKAGING

13.2.2.4.1. BEVERAGE CANS

13.2.2.4.2. DRINK POUCHES

13.2.2.4.3. OTHERS

13.2.2.5. AGRICULTURAL PACKAGING

13.2.2.5.1. SEED PACKAGING

13.2.2.5.2. FERTILIZER BAGS

13.2.2.5.3. ORGANIC PRODUCT PACKAGING

13.2.2.5.4. OTHERS

13.2.2.6. ELECTRONICS PACKAGING

13.2.2.6.1. ANTISTATIC BAGS FOR COMPONENTS

13.2.2.6.2. PROTECTIVE ALUMINUM FOIL WRAPPING

13.2.2.6.3. OTHERS

13.2.2.7. AUTOMOTIVE PACKAGING

13.2.2.7.1. HEAT SHIELDS FOR ENGINES

13.2.2.7.2. SOUNDPROOFING PANELS FOR VEHICLES

13.2.2.7.3. OTHERS

13.2.2.8. OTHERS

13.3 INSULATION

13.3.1 THERMAL INSULATION

13.3.1.1. BUILDING INSULATION

13.3.1.1.1. WALLS

13.3.1.1.2. ROOFS

13.3.1.1.3. OTHERS

13.3.1.2. INDUSTRIAL INSULATION

13.3.1.2.1. PIPES

13.3.1.2.2. BOILERS

13.3.1.2.3. OTHERS

13.3.1.3. AUTOMOTIVE THERMAL INSULATION

13.3.1.4. OTHERS

13.3.2 ACOUSTIC INSULATION

13.3.2.1. SOUNDPROOFING FOR BUILDINGS

13.3.2.2. AUTOMOTIVE SOUND INSULATION

13.3.2.3. OTHERS

13.4 ELECTRONICS AND ELECTRICAL APPLICATIONS

13.4.1 ELECTRONICS INSULATION

13.4.1.1. CIRCUIT BOARDS PROTECTION

13.4.1.2. POWER CABLES INSULATION

13.4.1.3. OTHERS

13.4.2 ELECTRICAL SHIELDING

13.4.2.1. ELECTROMAGNETIC INTERFERENCE (EMI) SHIELDING

13.4.2.2. ELECTRICAL WIRING INSULATION

13.5 INDUSTRIAL APPLICATIONS

13.5.1 FOIL FOR INDUSTRIAL USES

13.5.1.1. RAW MATERIAL PACKAGING

13.5.1.2. BULK PRODUCT PACKAGING

13.5.1.3. PROTECTIVE FILM FOR MANUFACTURING

13.5.1.4. OTHERS

13.5.2 AUTOMOTIVE COMPONENTS

13.5.2.1. HEAT SHIELDS FOR EXHAUST SYSTEMS

13.5.2.2. SOUND INSULATION FOR VEHICLE INTERIORS

13.5.2.3. OTHERS

13.6 OTHERS

14 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (MILLION UNITS)

14.1 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 MIDDLE EAST AND AFRICA

14.2.1 SOUTH AFRICA

14.2.2 EGYPT

14.2.3 SAUDI ARABIA

14.2.4 UNITED ARAB EMIRATES

14.2.5 ISRAEL

14.2.6 QATAR

14.2.7 OMAN

14.2.8 KUWAIT

14.2.9 BAHRAIN

14.2.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15.2 MERGERS AND ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - SWOT ANALYSIS

17 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - COMPANY PROFILES

17.1 AMCOR PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 REVENUE ANALYSIS

17.1.4 RECENT UPDATES

17.2 CONSTANTIA FLEXIBLES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 REVENUE ANALYSIS

17.2.4 RECENT UPDATES

17.3 ERAMCO

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 REVENUE ANALYSIS

17.3.4 RECENT UPDATES

17.4 RAVIRAJ FOILS LIMITED

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 REVENUE ANALYSIS

17.4.4 RECENT UPDATES

17.5 CATERPACK

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 REVENUE ANALYSIS

17.5.4 RECENT UPDATES

17.6 ALUMINIUM FOIL CONVERTERS (PTY) LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 REVENUE ANALYSIS

17.6.4 RECENT UPDATES

17.7 SYMETAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 REVENUE ANALYSIS

17.7.4 RECENT UPDATES

17.8 COSMOPLAST UAE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 REVENUE ANALYSIS

17.8.4 RECENT UPDATES

17.9 EXPRESS GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 REVENUE ANALYSIS

17.9.4 RECENT UPDATES

17.1 UACJ CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 REVENUE ANALYSIS

17.10.4 RECENT UPDATES

17.11 ZHENGZHOU EMING ALUMINIUM INDUSTRY CO., LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 REVENUE ANALYSIS

17.11.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.