북미 건강 검진 시장, 검사 유형별(콜레스테롤 검사, 당뇨 검사, 암 검진, 일반 검진 검사, 성병, 혈압 검사 및 기타), 패키지 유형(기본 건강 검진, 노인 프로필, 여성 건강 검진, 남성 건강 검진, 심장 검진, 당뇨 검진 및 기타), 패널 유형(다중 검사 패널 및 단일 검사 패널), 샘플 유형(혈액, 소변, 혈청 , 타액 및 기타), 기술(면역 검사, 의료 영상, QPCR(정량적 중합효소 연쇄 반응), Q-FISH(정량적 형광, 현장 교잡), TRF(말단 제한 단편), STELA(단일 텔로미어 길이 분석) 및 기타), 상태(심혈관 질환, 대사 장애, 암, 염증 상태, 근골격계 질환, 신경계 상태, C형 간염 합병증, 면역 관련 조건 및 기타), 검체 수집 장소(병원, 가정, 진단 실험실, 사무실 및 기타), 유통 채널(직접 입찰, 소매 판매 및 기타), 국가(미국, 캐나다 및 멕시코) 산업 동향 및 2028년까지의 예측.

시장 분석 및 통찰력: 북미 건강 검진 시장

시장 분석 및 통찰력: 북미 건강 검진 시장

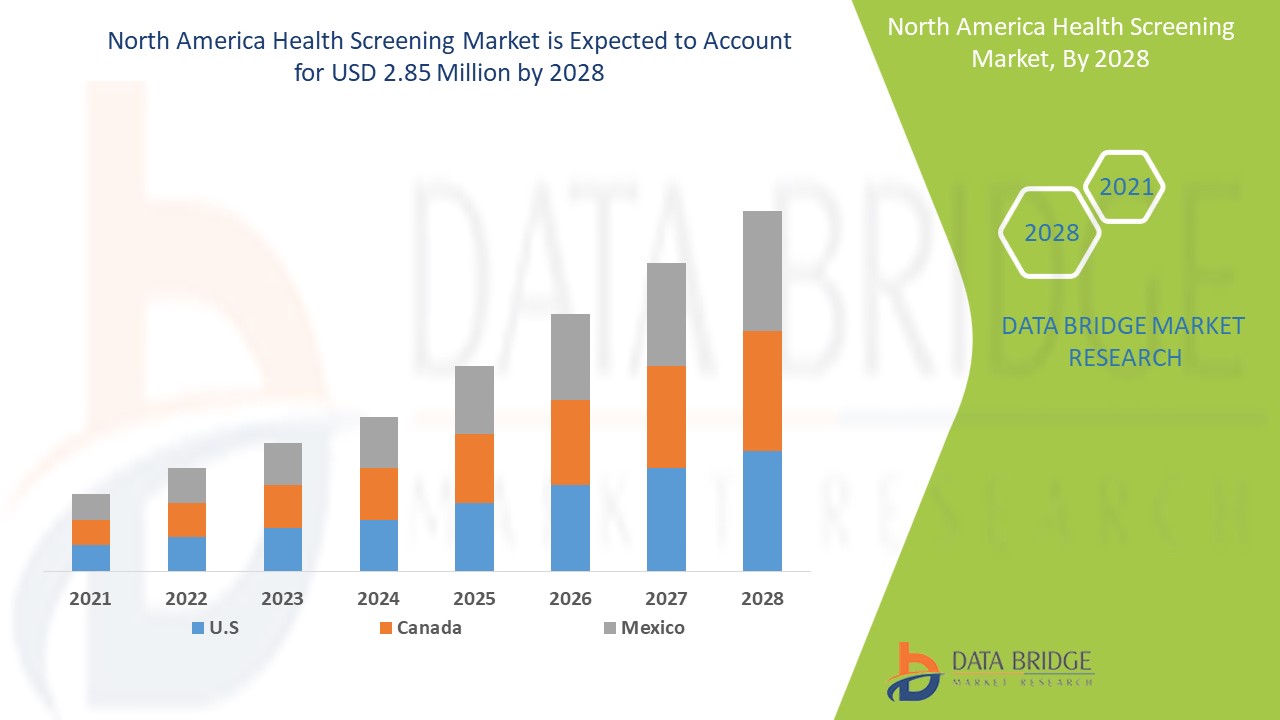

북미 건강 검진 시장은 2021년부터 2028년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2021년부터 2028년까지의 예측 기간 동안 12.1%의 CAGR로 성장하고 있으며 2028년까지 285만 달러에 도달할 것으로 예상한다고 분석했습니다. 만성 질환의 증가, 노령 인구, 질병의 조기 발견 및 치료에 대한 인식 증가는 예측 기간 동안 시장 수요를 촉진한 주요 요인입니다.

건강 검진은 특정 질환을 조기에 발견하는 중요한 방법입니다. 검진 검사는 종종 예방 의학에서 개인이 질환의 위험 요인에 대한 조기 징후를 보이는지 확인하는 데 사용됩니다. 검진을 통해 발견할 수 있는 질병에는 암, 당뇨병, 고콜레스테롤, 고혈압 및 골다공증이 있습니다. 만성 질환, 노령 인구의 급증, 질병의 조기 발견 및 치료에 대한 인식 증가는 건강 검진 시장의 성장을 촉진하고 있습니다.

질병의 조기 발견 및 치료에 대한 사람들의 인식이 높아지고 건강 지출이 증가함에 따라 건강 검진에 대한 수요가 증가하고 있으며 이는 시장을 견인하는 원동력으로 작용하고 있습니다.

건강 검진의 효능으로 인한 건강 검진 수요 증가, 서비스 제공자 수 증가, 민간 및 공공 기관의 건강 검진 인식 캠페인 증가는 예측 기간 동안 건강 검진 시장 성장을 촉진하고 기회로 작용하고 있습니다. 그러나 검진 검사의 높은 비용은 예측 기간 동안 시장 성장을 방해할 수 있습니다.

북미 건강 검진 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 당사에 문의하세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

북미 건강 검진 시장 범위 및 시장 규모

북미 건강 검진 시장 범위 및 시장 규모

북미 건강 검진 시장은 테스트 유형, 패키지 유형, 패널 유형, 샘플 유형, 기술, 상태, 샘플 수집 사이트, 유통 채널 등 8가지 주요 세그먼트를 기준으로 세분화됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 북미 건강 검진 시장은 검사 유형에 따라 콜레스테롤 검사, 당뇨병 검사, 암 검진, 일반 검진 검사, 성병, 혈압 검사 등으로 세분화됩니다. 2021년에는 콜레스테롤 관련 장애의 유병률이 증가하고 이러한 검사의 위험을 증가시키는 부적절한 식습관으로 인해 콜레스테롤 검사 부문이 시장을 지배할 것으로 예상됩니다.

- 패키지 유형에 따라 북미 건강 검진 시장은 기본 건강 검진, 노인 프로필, 여성 건강 검진, 남성 건강 검진, 심장 검진, 당뇨병 검진 등으로 세분화됩니다. 2021년에는 다양한 실험실에서 환자가 실험실에서 검진을 받도록 유도하기 위해 패키지를 제공함으로써 시장 경쟁이 치열해짐에 따라 기본 건강 검진 부문이 시장을 지배할 것으로 예상됩니다.

- 패널 유형에 따라 북미 건강 검진 시장은 다중 검사 패널과 단일 검사 패널로 세분화됩니다. 2021년에는 다양한 실험실과 진단 센터에서 다중 검사 패널을 사용하여 검진하고 현재 상황에서는 질병이 증상, 발생으로 상호 연결되어 있어 동시에 여러 검사를 검진하기 위해 다중 패널 사용이 증가함에 따라 다중 검사 패널 세그먼트가 시장을 지배할 것으로 예상됩니다.

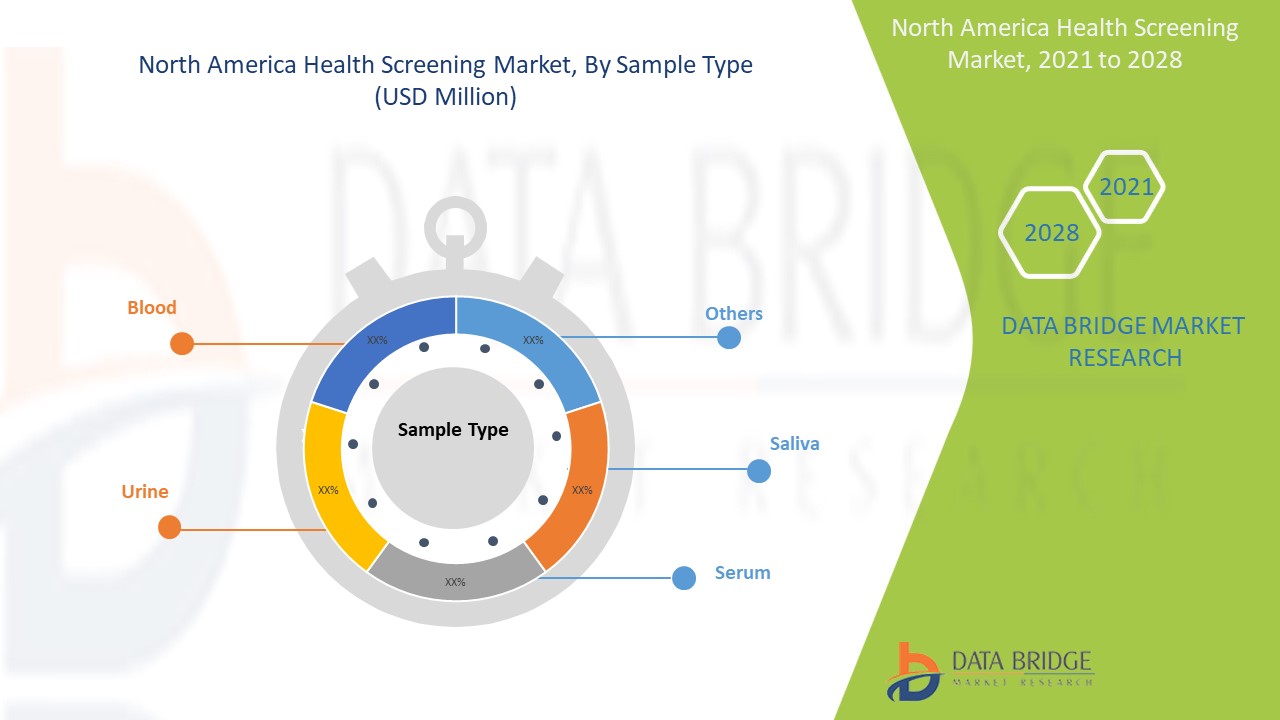

- 샘플 유형을 기준으로 북미 건강 검진 시장은 혈액, 소변, 혈청, 타액 및 기타로 세분화됩니다. 2021년에는 혈액 세그먼트가 시장을 지배할 것으로 예상되는데, 이는 검진 및 진단에 가장 쉽고 편리한 방법이기 때문입니다.

- 기술에 따라 북미 건강 검진 시장은 면역 검정, 의료 영상, QPCR(정량적 중합효소 연쇄 반응), Q-FISH(정량적 형광, 현장 교잡), TRF(말단 제한 단편), STELA(단일 텔로미어 길이 분석) 등으로 세분화됩니다. 2021년에는 면역 검정 부문이 시장을 지배할 것으로 예상되는데, 면역 검정이 혈액 수혈, 유전자 치료, 임플란트 수술, 감염성 질환 검진 등 다양한 응용 분야에 기여하고 있기 때문입니다. 또한 미국, 캐나다는 신기술의 주요 시장이며 기존 기술의 발전을 믿고 있으며, 이는 부문이 성장하는 주요 요인이기도 합니다.

- 북미 건강 검진 시장은 상태에 따라 심혈관 질환, 대사 장애, 암, 염증성 질환, 근골격계 질환, 신경계 질환, C형 간염 합병증, 면역 관련 질환 등으로 세분화됩니다. 2021년 북미 지역의 심혈관 질환 세그먼트 유병률은 개인의 약 3%가 새로운 또는 재발성 심장마비를 앓았기 때문에 예측 기간 동안 이 세그먼트가 성장할 수 있습니다.

- 샘플 수집 장소를 기준으로 북미 건강 검진 시장은 병원, 가정, 진단 실험실, 사무실 등으로 세분화됩니다. 2021년에는 병원 부문이 시장을 지배할 것으로 예상되는데, 병원에는 질병을 진단하고 치료할 수 있는 모든 시설이 있기 때문입니다.

- 유통 채널을 기준으로 북미 건강 검진 시장은 직접 입찰, 소매 판매 및 기타로 세분화됩니다. 2021년에는 건강 검진 프로그램의 전체 판매가 증가함에 따라 직접 입찰 부문이 시장을 지배할 것으로 예상됩니다.

북미 건강 검진 시장 국가 수준 분석

북미 건강 검진 시장을 분석하고, 테스트 유형, 패키지 유형, 패널 유형, 샘플 유형, 기술, 조건, 샘플 수집 사이트 및 유통 채널에 대한 시장 규모 정보를 제공합니다. 북미 건강 검진 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

북미 지역에서는 노령 인구의 증가와 질병의 조기 발견 및 치료에 대한 인식이 높아짐에 따라 2021년에서 2028년까지의 예측 기간에 미국이 가장 높은 성장률을 기록하며 성장할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

전 세계적으로 암, 당뇨병, 심혈관 질환과 같은 만성 질환의 증가와 노령 인구 증가로 인해 북미 건강 검진 시장이 성장하고 있습니다.

북미 건강 검진 시장은 또한 약물 판매, 진보의 영향, 기술, 규제 시나리오의 변화와 건강 검진 시장에 대한 지원을 통해 검진 제품 산업에서 모든 국가의 성장에 대한 자세한 시장 분석을 제공합니다. 이 데이터는 2010년부터 2019년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 북미 건강 검진 시장 점유율 분석

북미 건강 검진 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭 및 범위, 응용 프로그램 우세, 기술 수명선 곡선입니다. 위에 제공된 데이터 포인트는 실버 디아민 플루오라이드(SDF) 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 심장 검진 시장을 다루는 주요 기업으로는 Quest Diagnostics Incorporated, Laboratory Corporation of America, Sonic Healthcare Limited, Exact Sciences Corporation, Healius Limited, GRAIL, Eurofins Scientific, SYNLAB International GmbH, UNILABS, LabPLUS, BioReference Laboratories, , ACM Global Laboratories, Cerba Healthcare, Quidel Corporation, Innova Medical Group, AMEDES Holding GmbH, RadNet, Inc., Natera, Inc., Trinity Biotech, Nuffield Health, RepeatDx, NeoGenomics Laboratories, HU Group Holdings, Inc., Lifelabs, ARUP Laboratories, Q2 Solutions, Genova Diagnostics, Life Length, DNA Labs India, , Telomere Diagnostics, Charles River Laboratories, Ambry Genetics, SpectraCell Laboratories, Inc., Dr. Lal PathLabs 등이 있습니다.

전 세계 기업들이 다양한 이벤트, 협정, 웨비나를 주도하면서 북미 건강검진 시장도 활성화되고 있습니다.

예를 들어,

- 2021년 4월, Ambry Genetics는 2021ACMG 연례 임상 유전학 회의에서 발표를 했다고 발표했습니다. 이를 통해 회사는 회사의 사업 아이디어를 선보일 수 있는 플랫폼을 제공했습니다.

- 2021년 9월, ARUP Laboratories는 항공편 및 기타 시설에 혈액을 공급하여 환자에게 의료 시설을 제공하기 위해 Air med와 파트너십을 맺었다고 발표했습니다. 이를 통해 예측 기간 동안 실험실을 도울 서비스 제공자의 환자 풀이 늘어날 것입니다.

협업, 제품 출시, 사업 확장, 수상 및 인정, 합작 투자, 그리고 다른 시장 참여자들은 북미 건강 검진 시장에서 회사 시장을 확대하며, 이를 통해 조직이 건강 검진 약물에 대한 제공을 개선하는 데에도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HEALTH SCREENING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TEST TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DISTRIBUTION CHANNELUSER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATIONS

5.1 WORLD HEALTH ORGANIZATION

5.2 NORTH AMERICA

5.3 EUROPE

6 INDUSTRIAL INSIGHTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CHRONIC DISEASES

7.1.2 GROWING GERIATRIC POPULATION

7.1.3 GOVERNMENT INITIATIVES UNDERTAKEN TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

7.1.4 RISING PER CAPITA INCOME AND HEALTHCARE EXPENDITURE

7.1.5 GRWOING NUMBER OF SCREENING PROGRAMS WORLDWIDE

7.2 RESTRAINTS

7.2.1 SCRACITY OF TECHNICALLY-SKILLED PROFESSIONALS

7.2.2 RISKS ASSOCIATED WITH SCREENING

7.2.3 LACK OF ACCESSIBILITY

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN HEALTH SCREENING

7.3.2 ACQUSITIONS AND MERGERS AMONG THE MARKET

7.3.3 NEW PRODUCT LAUNCHES IN THE MARKET

7.4 CHALLENGES

7.4.1 HIGHER COST OF HEALTH SCREENING

7.4.2 OPERATIONAL BARRIERS FACED IN CONDUCTING SCREENING TESTS

8 COVID-19 IMPACT ON NORTH AMERICA HEALTH SCREENING MARKET

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISIONS FOR MANUFACTURERS

8.5 CONCLUSION

9 NORTH AMERICA HEALTH SCREENING MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 CHOLESTEROL TESTS

9.2.1 TOTAL CHOLESTEROL TESTS

9.2.2 TRIGLYCERIDES

9.2.3 LOW-DENSITY LIPOPROTEIN (LDL) CHOLESTEROL

9.2.4 HIGH-DENSITY LIPOPROTEIN (LDL) CHOLESTEROL

9.3 DIABETES TEST

9.3.1 FASTING/RANDOM BLOOD SUGAR TEST

9.3.2 A1C TEST

9.3.3 GLUCOSE TOLERANCE TEST

9.4 CANCER SCREENING

9.4.1 LIQUID BIOPSY

9.4.2 MAMMOGRAMS, OSTEOPOROSIS, BREAST MRI AND PAP SMEAR TESTS

9.4.3 LOW-DOSE HELICAL COMPUTED TOMOGRAPHY

9.4.4 COLORECTAL CANCER SCREENING TEST (STOOL TESTS, SIGMOIDOSCOPY, COLONOSCOPY, BLOOD-BASED DNA TEST, DOUBLE-CONTRAST BARIUM ENEMA (DCBE), AND SINGLE-SPECIMEN GFOBT)

9.4.5 PROSTATE SPECIFIC ANTIGEN (PSA) TEST

9.4.6 NEW-EARLY DETECTION CANCER TESTS

9.4.7 ALPHA FETOPROTEIN BLOOD TEST

9.4.8 CA-125 TEST

9.4.9 OTHERS

9.5 GENERAL CHECK UP TEST

9.5.1 REGULAR CHECK UP

9.5.1.1 REGULAR BLOOD TEST

9.5.1.2 X-RAYS

9.5.1.3 ECG

9.5.1.4 FECALYSIS

9.5.1.5 URINALYSIS

9.5.1.6 BMI

9.5.1.7 OTHERS

9.5.2 EYE CHECK UP

9.5.3 DENTAL TEST

9.5.4 HEARING TEST

9.6 STD’S

9.6.1 CHLAMYDIA

9.6.2 GONORRHEA

9.6.3 HPV

9.6.4 HIV

9.6.5 OTHERS

9.7 BLOOD PRESSURE TEST

9.8 OTHERS

9.8.1 LIVER FUNCTION TESTS

9.8.2 KIDNEY PROFILE

9.8.3 OTHERS

10 NORTH AMERICA HEALTH SCREENING MARKET, BY PANEL TYPE

10.1 OVERVIEW

10.2 MULTI-TEST PANELS

10.3 SINGLE-TEST PANELS

10.3.1 INFLAMMATION TESTS

10.3.2 OXIDATIVE STRESS TESTS

10.3.3 HEAVY METAL TESTS

10.3.4 TELOMERE

11 NORTH AMERICA HEALTH SCREENING MARKET, BY PACKAGE TYPE

11.1 OVERVIEW

11.2 BASIC HEALTH SCREENING

11.3 SENIOR CITIZEN PROFILE

11.4 WOMEN HEALTH CHECK

11.5 MEN HEALTH CHECK

11.6 HEART CHECK

11.7 DIABETES CHECK

11.8 OTHERS

12 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE TYPE

12.1 OVERVIEW

12.2 BLOOD

12.3 URINE

12.4 SERUM

12.5 SALIVA

12.6 OTHERS

13 HEALTH SCREENING MARKET, BY TECHNOLOGY

13.1 OVERVIEW

13.2 IMMUNOASSAYS

13.3 MEDICAL IMAGING

13.4 QPCR

13.4.1 MMQPCR (MONOCHROME MULTIPLEX QPCR)

13.4.2 ATLQPCR (ABSOLUTE TELOMERE LENGTH QPCR)

13.5 Q-FISH

13.5.1 PRINS (PRIMED IN SITU SUBTYPE OF Q-FISH)

13.5.2 FLOW-FISH

13.5.3 HT Q-FISH (HIGH THROUGHPUT Q-FISH)

13.6 TRF (TERMINAL RESTRICTION FRAGMENT)

13.7 STELA (SINGLE TELOMERE LENGTH ANALYSIS)

13.8 OTHERS

14 NORTH AMERICA HEALTH SCREENING MARKET, BY CONDITION

14.1 OVERVIEW

14.2 CARDIOVASCULAR DISEASE

14.2.1 CORONARY HEART DISEASE

14.2.2 ATHEROSCLEROSIS

14.3 METABOLIC DISORDERS

14.3.1 DIABETES MELLITUS

14.3.2 OBESITY

14.4 CANCER

14.5 INFLAMMATORY CONDITIONS

14.5.1 AUTOIMMUNE CONDITIONS

14.5.2 ALLERGIES

14.5.3 ARTHRITIS

14.5.4 ASTHMA

14.5.5 INFLAMMATORY DIGESTIVE PROBLEMS

14.6 MUSCULOSKELETAL DISORDERS

14.6.1 OSTEOPOROSIS

14.6.2 RHEUMATOID ARTHRITIS

14.7 NEUROLOGICAL CONDITIONS

14.7.1 CHRONIC STRESS

14.7.2 ALZHEIMER'S DISEASE

14.8 IMMUNOLOGY-RELATED CONDITIONS

14.9 HEPATITIS C COMPLICATIONS

14.1 OTHERS

15 HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 DIRECT TENDERS

15.3 RETAIL SALES

15.4 OTHERS

16 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES

16.1 OVERVIEW

16.2 HOSPITAL

16.2.1 ACUTE CARE HOSPITALS

16.2.2 LONG-TERM CARE HOSPITALS

16.2.3 NURSING FACILITIES

16.2.4 REHABILITATION CENTERS

16.3 HOME

16.4 DIAGNOSTIC LABORATORIES

16.5 OFFICES

16.6 OTHERS

17 NORTH AMERICA HEALTH SCREENING MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA HEALTH SCREENING MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 QUEST DIAGNOSTICS INCORPORATED

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 SONIC HEALTHCARE LIMITED

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 LABORATORY CORPORATION OF AMERICA

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 EUROFINS SCIENTIFIC

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 EXACT SCIENCES CORPORATION

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 ACM NORTH AMERICA LABORATORIES

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 AMEDES

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AMBRY GENETICS

20.8.1 COMPANY SNAPSHOT

20.8.2 SERVICE PORTFOLIO

20.8.3 RECENT DEVELOPMENTS

20.9 ARUP LABORATORIES

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENTS

20.1 BIOREFRENCE LABORATORIES

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENTS

20.11 CHARLES RIVER

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 CERBA HEALTHCARE

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 DNA LABS INDIA

20.13.1 COMPANY SNAPSHOT

20.13.2 SERVICE PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 DR LAL PATH LABS

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 GENOVA DIGNOSTICS

20.15.1 COMPANY SNAPSHOT

20.15.2 SERVICE PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 GRAIL

20.16.1 COMPANY SNAPSHOT

20.16.2 SERVICE PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 HEALIUS LIMITED

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENTS

20.18 H.U. GROUP HOLDINGS, INC.

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENTS

20.19 INNOVA MEDICAL GROUP

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 LABPLUS

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 LIFELABS

20.21.1 COMPANY SNAPSHOT

20.21.2 SERVICE PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 LIFE LENGTH

20.22.1 COMPANY SNAPSHOT

20.22.2 SERVICE PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 NATERA, INC.

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 NEOGENOMICS LABORATORIES

20.24.1 COMPANY SNAPSHOT

20.24.2 REVENUE ANALYSIS

20.24.3 PRODUCT PORTFOLIO

20.24.4 RECENT DEVELOPMENTS

20.25 NUFFIELD HEALTH

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

20.26 Q2 SOLUTIONS

20.26.1 COMPANY SNAPSHOT

20.26.2 SERVICE PORTFOLIO

20.26.3 RECENT DEVELOPMENTS

20.27 QUIDEL CORPORATION

20.27.1 COMPANY SNAPSHOT

20.27.2 REVENUE ANALYSIS

20.27.3 PRODUCT PORTFOLIO

20.27.4 RECENT DEVELOPMENTS

20.28 REPEATDX

20.28.1 COMPANY SNAPSHOT

20.28.2 PRODUCT PORTFOLIO

20.28.3 RECENT DEVELOPMENT

20.29 SONIC HEALTHCARE LIMITED

20.29.1 COMPANY SNAPSHOT

20.29.2 REVENUE ANALYSIS

20.29.3 PRODUCT PORTFOLIO

20.29.4 RECENT DEVELOPMENTS

20.3 SPECTRACELL LABORATORIES, INC.

20.30.1 COMPANY SNAPSHOT

20.30.2 SERVICE PORTFOLIO

20.30.3 RECENT DEVELOPMENT

20.31 SYNLAB INTERNATIONAL GMBH

20.31.1 COMPANY SNAPSHOT

20.31.2 PRODUCT PORTFOLIO

20.31.3 RECENT DEVELOPMENT

20.32 TELOMERE DIAGNOSTICS

20.32.1 COMPANY SNAPSHOT

20.32.2 SERVICE PORTFOLIO

20.32.3 RECENT DEVELOPMENT

20.33 TRINITY BIOTECH

20.33.1 COMPANY SNAPSHOT

20.33.2 REVENUE ANALYSIS

20.33.3 PRODUCT PORTFOLIO

20.33.4 RECENT DEVELOPMENT

20.34 UNILABS

20.34.1 COMPANY SNAPSHOT

20.34.2 PRODUCT PORTFOLIO

20.34.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

표 목록

TABLE 1 NUMBER OF PEOPLE WITH DIABETES AMONG 20–79 YEARS OLD (IN MILLION)

TABLE 2 NEW CANCER CASES FOR AGE 85+ IN U.S.

TABLE 3 ACCORDING TO THE UNITED NATIONS, IN 2019, THE TOTAL POPULATION OF AGED PEOPLE ABOVE 65 WAS 703 MILLION AND IS EXPECTED TO REACH 1.5 BILLION BY 2050.

TABLE 4 PER CAPITA AMOUNTS: THE UNITED STATES (1960–2017)

TABLE 5 NORTH AMERICA HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA DIABETES TEST IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA DIABETES TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA CANCER SCREENING IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA CANCER SCREENING IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA REGULAR CHECK UP IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA STD’S IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA STD’S IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA BLOOD PRESSURE TEST IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA MULTI-TEST PANELS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA HEALTH SCREENING MARKET, BY PACKAGE TYPE, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA BASIC HEALTH SCREENING IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA SENIOR CITIZEN PROFILE IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA WOMEN HEALTH CHECK IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA MEN HEALTH CHECK IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA HEART CHECK IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA DIABETES CHECK IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE TYPE, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA BLOOD IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA URINE IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA SERUM IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA SALIVA IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA IMMUNOASSAYS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA MEDICAL IMAGING IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA QPCR IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA QPCR IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA Q-FISH IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA Q-FISH IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA TRF (TERMINAL RESTRICTION FRAGMENT) IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA STELA (SINGLE TELOMERE LENGTH ANALYSIS) IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA CANCER IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 58 NORTH AMERICA NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 59 NORTH AMERICA NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 60 NORTH AMERICA IMMUNOLOGY-RELATED CONDITIONS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 61 NORTH AMERICA HEPATITIS-C COMPLICATIONS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 62 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 63 NORTH AMERICA HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 64 NORTH AMERICA DIRECT TENDERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 65 NORTH AMERICA RETAIL SALES IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 67 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 68 NORTH AMERICA HOSPITAL IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITAL IN HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 70 NORTH AMERICA HOME IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 71 NORTH AMERICA DIAGNOSTIC LABORATORIES IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 72 NORTH AMERICA OFFICES IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 73 NORTH AMERICA OTHERS IN HEALTH SCREENING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 74 NORTH AMERICA HEALTH SCREENING MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 75 NORTH AMERICA HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 76 NORTH AMERICA CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 77 NORTH AMERICA DIABETES TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 78 NORTH AMERICA CANCER SCREENING IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 79 NORTH AMERICA GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 80 NORTH AMERICA REGULAR CHECK UP IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 81 NORTH AMERICA STD'S IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 82 NORTH AMERICA OTHER TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 83 NORTH AMERICA HEALTH SCREENING MARKET, BY PACKAGE TYPE, 2019-2028 (USD MILLION)

TABLE 84 NORTH AMERICA HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 85 NORTH AMERICA SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 86 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE TYPES, 2019-2028 (USD MILLION)

TABLE 87 NORTH AMERICA HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 88 NORTH AMERICA QPCR IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 89 NORTH AMERICA Q-FISH (QUANTITATIVE FLUORESCENCE IN SITU HYBRIDIZATION) IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 90 NORTH AMERICA HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 91 NORTH AMERICA CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 92 NORTH AMERICA METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 93 NORTH AMERICA INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 94 NORTH AMERICA MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 95 NORTH AMERICA NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 96 NORTH AMERICA HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 97 NORTH AMERICA HOSPITALS IN HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 98 NORTH AMERICA HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 99 U.S. HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 100 U.S. CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 101 U.S. DIABETES TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 102 U.S. CANCER SCREENING IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 103 U.S. GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 104 U.S. REGULAR CHECK UP IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 105 U.S. STD'S IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 106 U.S. OTHER TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 107 U.S. HEALTH SCREENING MARKET, BY PACKAGE TYPE, 2019-2028 (USD MILLION)

TABLE 108 U.S. HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 109 U.S. SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 110 U.S. HEALTH SCREENING MARKET, BY SAMPLE TYPES, 2019-2028 (USD MILLION)

TABLE 111 U.S. HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 112 U.S. QPCR IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 113 U.S. Q-FISH (QUANTITATIVE FLUORESCENCE IN SITU HYBRIDIZATION) IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 114 U.S. HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 115 U.S. CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 116 U.S. METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 117 U.S. INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 118 U.S. MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 119 U.S. NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 120 U.S. HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 121 U.S. HOSPITALS IN HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 122 U.S. HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 123 CANADA HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 124 CANADA CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 125 CANADA DIABETES TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 126 CANADA CANCER SCREENING IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 127 CANADA GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 128 CANADA REGULAR CHECK UP IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 129 CANADA STD'S IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 130 CANADA OTHER TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 131 CANADA HEALTH SCREENING MARKET, BY PACKAGE TYPE, 2019-2028 (USD MILLION)

TABLE 132 CANADA HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 133 CANADA SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 134 CANADA HEALTH SCREENING MARKET, BY SAMPLE TYPES, 2019-2028 (USD MILLION)

TABLE 135 CANADA HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 136 CANADA QPCR IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 137 CANADA Q-FISH (QUANTITATIVE FLUORESCENCE IN SITU HYBRIDIZATION) IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 138 CANADA HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 139 CANADA CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 140 CANADA METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 141 CANADA INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 142 CANADA MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 143 CANADA NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 144 CANADA HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 145 CANADA HOSPITALS IN HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 146 CANADA HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 147 MEXICO HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 148 MEXICO CHOLESTEROL TESTS IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 149 MEXICO DIABETES TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 150 MEXICO CANCER SCREENING IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 151 MEXICO GENERAL CHECK UP TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 152 MEXICO REGULAR CHECK UP IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 153 MEXICO STD'S IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 154 MEXICO OTHER TEST IN HEALTH SCREENING MARKET, BY TEST TYPE, 2019-2028 (USD MILLION)

TABLE 155 MEXICO HEALTH SCREENING MARKET, BY PACKAGE TYPE, 2019-2028 (USD MILLION)

TABLE 156 MEXICO HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 157 MEXICO SINGLE-TEST PANELS IN HEALTH SCREENING MARKET, BY PANEL TYPE, 2019-2028 (USD MILLION)

TABLE 158 MEXICO HEALTH SCREENING MARKET, BY SAMPLE TYPES, 2019-2028 (USD MILLION)

TABLE 159 MEXICO HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 160 MEXICO QPCR IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 161 MEXICO Q-FISH (QUANTITATIVE FLUORESCENCE IN SITU HYBRIDIZATION) IN HEALTH SCREENING MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 162 MEXICO HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 163 MEXICO CARDIOVASCULAR DISEASE IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 164 MEXICO METABOLIC DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 165 MEXICO INFLAMMATORY CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 166 MEXICO MUSCULOSKELETAL DISORDERS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 167 MEXICO NEUROLOGICAL CONDITIONS IN HEALTH SCREENING MARKET, BY CONDITION, 2019-2028 (USD MILLION)

TABLE 168 MEXICO HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 169 MEXICO HOSPITALS IN HEALTH SCREENING MARKET, BY SAMPLE COLLECTION SITES, 2019-2028 (USD MILLION)

TABLE 170 MEXICO HEALTH SCREENING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA HEALTH SCREENING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEALTH SCREENING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEALTH SCREENING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEALTH SCREENING MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEALTH SCREENING MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEALTH SCREENING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEALTH SCREENING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEALTH SCREENING MARKET: MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 9 NORTH AMERICA HEALTH SCREENING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEALTH SCREENING MARKET: SEGMENTATION

FIGURE 11 HIGH PREVALENCE OF CHRONIC DISEASES IS EXPECTED TO DRIVE THE NORTH AMERICA HEALTH SCREENING MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 CHOLESTROL TESTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEALTH SCREENING MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA HEALTH SCREENING MARKET AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HEALTH SCREENING MARKET

FIGURE 15 PREVALENCE OF CHRONIC DISEASES

FIGURE 16 AGING POPULATION IN THE WORLD (IN MILLION)

FIGURE 17 NORTH AMERICA AGING POPULATION (IN MILLION)

FIGURE 18 EUROPE AGING POPULATION (IN MILLION)

FIGURE 19 ASIA-PACIFIC AGING POPULATION (IN MILLION)

FIGURE 20 NORTH AMERICA HEALTH SCREENING MARKET: BY TEST TYPE, 2020

FIGURE 21 NORTH AMERICA HEALTH SCREENING MARKET: BY TEST TYPE, 2021-2028 (USD MILLION)

FIGURE 22 NORTH AMERICA HEALTH SCREENING MARKET: BY TEST TYPE, CAGR (2021-2028)

FIGURE 23 NORTH AMERICA HEALTH SCREENING MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA HEALTH SCREENING MARKET: BY PANEL TYPE, 2020

FIGURE 25 NORTH AMERICA HEALTH SCREENING MARKET: BY PANEL TYPE, 2021-2028 (USD MILLION)

FIGURE 26 NORTH AMERICA HEALTH SCREENING MARKET: BY PANEL TYPE, CAGR (2021-2028)

FIGURE 27 NORTH AMERICA HEALTH SCREENING MARKET: BY PANEL TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA HEALTH SCREENING MARKET: BY PACKAGE TYPE, 2020

FIGURE 29 NORTH AMERICA HEALTH SCREENING MARKET: BY PACKAGE TYPE, 2021-2028 (USD MILLION)

FIGURE 30 NORTH AMERICA HEALTH SCREENING MARKET: BY PACKAGE TYPE, CAGR (2021-2028)

FIGURE 31 NORTH AMERICA HEALTH SCREENING MARKET: BY PACKAGE TYPE, LIFELINE CURVE

FIGURE 32 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE TYPE, 2020

FIGURE 33 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE TYPE, 2021-2028 (USD MILLION)

FIGURE 34 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE TYPE, CAGR (2021-2028)

FIGURE 35 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE TYPE, LIFELINE CURVE

FIGURE 36 NORTH AMERICA HEALTH SCREENING MARKET: BY TECHNOLOGY, 2020

FIGURE 37 NORTH AMERICA HEALTH SCREENING MARKET: BY TECHNOLOGY, 2021-2028 (USD MILLION)

FIGURE 38 NORTH AMERICA HEALTH SCREENING MARKET: BY TECHNOLOGY, CAGR (2021-2028)

FIGURE 39 NORTH AMERICA HEALTH SCREENING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 40 NORTH AMERICA HEALTH SCREENING MARKET: BY CONDITION, 2020

FIGURE 41 NORTH AMERICA HEALTH SCREENING MARKET: BY CONDITION, 2021-2028 (USD MILLION)

FIGURE 42 NORTH AMERICA HEALTH SCREENING MARKET: BY CONDITION, CAGR (2021-2028)

FIGURE 43 NORTH AMERICA HEALTH SCREENING MARKET: BY CONDITION, LIFELINE CURVE

FIGURE 44 NORTH AMERICA HEALTH SCREENING MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 45 NORTH AMERICA HEALTH SCREENING MARKET: BY DISTRIBUTION CHANNEL, 2021-2028 (USD MILLION)

FIGURE 46 NORTH AMERICA HEALTH SCREENING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 47 NORTH AMERICA HEALTH SCREENING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 48 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE COLLECTION SITES, 2020

FIGURE 49 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE COLLECTION SITES, 2021-2028 (USD MILLION)

FIGURE 50 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE COLLECTION SITES, CAGR (2021-2028)

FIGURE 51 NORTH AMERICA HEALTH SCREENING MARKET: BY SAMPLE COLLECTION SITES, LIFELINE CURVE

FIGURE 52 NORTH AMERICA HEALTH SCREENING MARKET: SNAPSHOT (2020)

FIGURE 53 NORTH AMERICA HEALTH SCREENING MARKET: BY COUNTRY (2020)

FIGURE 54 NORTH AMERICA HEALTH SCREENING MARKET: BY COUNTRY (2021 & 2028)

FIGURE 55 NORTH AMERICA HEALTH SCREENING MARKET: BY COUNTRY (2020 & 2028)

FIGURE 56 NORTH AMERICA HEALTH SCREENING MARKET: BY TEST TYPE (2021-2028)

FIGURE 57 NORTH AMERICA HEALTH SCREENING MARKET: COMPANY SHARE 2020(%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.