Global Intercom Devices Market, By System Type (Wired and Wireless), Component (Hardware, Software, and Services), Device Type (Door Entry Systems, Handheld Devices, and Video Baby Monitors), Material (Aluminum, Stainless Steel, Tempered Glass, Plastic, and Others), Power Supply (Less Than 20 W and More Than 20 W), Access Control (Cards, Fingerprint Readers, Proximity Cards, Password Access, Face Recognition, and Others), Technology (Analog and IP-Based), Keypad (Mechanical Button and Touch Pad), Communication Type (Audio/Video and Only Audio)), Price Category (Low (Below USD 100), Medium (USD 100- USD 500), and High (Above USD 500)), Communication (Push-To-Talk and Hands-Free Or Handset (Duplex)), Application (Outdoor and Indoor), Installation (Flush and Surface), End User (Commercial, Residential, Industries, and Government), Distribution Channel (Offline and Online) - Industry Trends and Forecast to 2030.

Intercom Devices Market Analysis and Insights

The global intercom devices market is the collective and worldwide industry encompassing the production, distribution, and utilization of communication systems designed to facilitate two-way voice and often, video communication between individuals across different locations within buildings, facilities, or confined spaces. This market includes a diverse range of intercom solutions, both traditional and technologically advanced, utilized across residential, commercial, industrial, institutional, and public sectors. The market involves the development of hardware, software, and integrated systems that contribute to enhancing communication efficiency, security, and convenience, thereby addressing a variety of needs and applications across various global industries and settings.

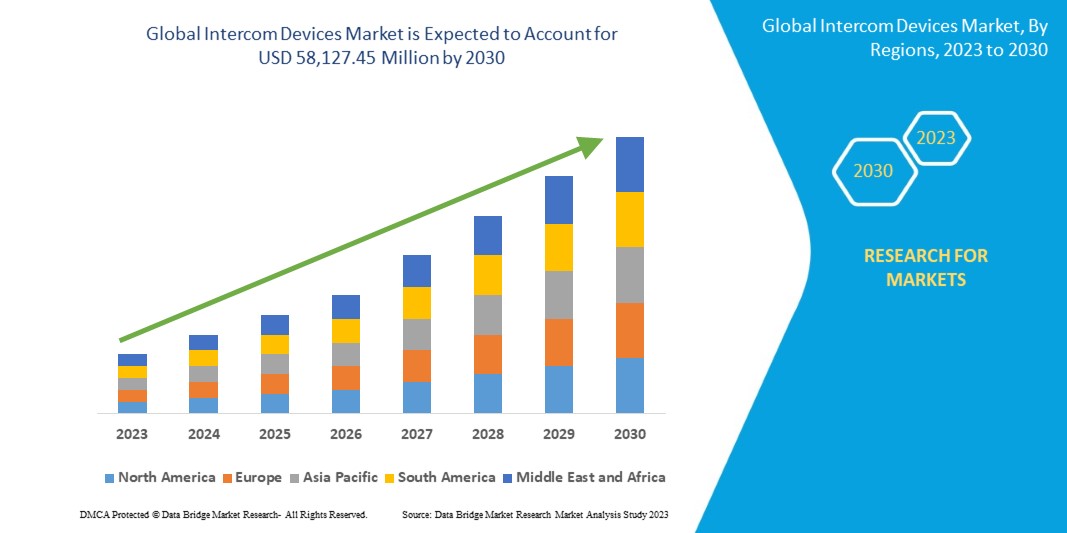

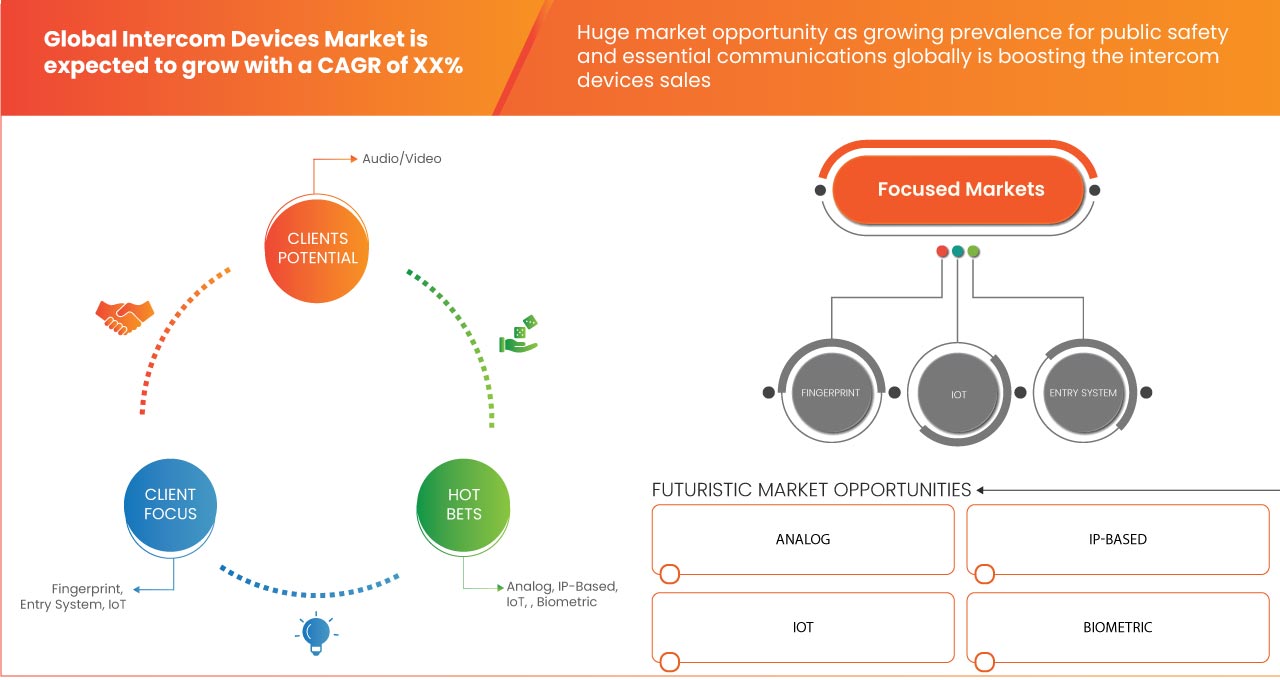

Data Bridge Market Research analyzes that the global intercom devices market is expected to reach a value of USD 58,127.45 million by 2030, growing with a CAGR of 12.7 % during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

System Type (Wired and Wireless), Component (Hardware, Software, and Services), Device Type (Door Entry Systems, Handheld Devices, and Video Baby Monitors), Material (Aluminum, Stainless Steel, Tempered Glass, Plastic, and Others), Power Supply (Less Than 20 W and More Than 20 W), Access Control (Cards, Fingerprint Readers, Proximity Cards, Password Access, Face Recognition, and Others), Technology (Analog and IP-Based), Keypad (Mechanical Button and Touch Pad), Communication Type (Audio/Video and Only Audio)), Price Category (Low (Below USD 100), Medium (USD 100- USD 500), and High (Above USD 500)), Communication (Push-To-Talk and Hands-Free Or Handset (Duplex)), Application (Outdoor and Indoor), Installation (Flush and Surface), End User (Commercial, Residential, Industries, and Government), Distribution Channel (Offline and Online) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Netherlands, Russia, Switzerland, Denmark, Sweden, Poland, Belgium, Turkey, Norway, Finland, Rest of Europe, China, Japan, South Korea, India, Malaysia, Taiwan, Australia & Zealand, Singapore, Indonesia, Thailand, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, U.A.E., Kuwait, Qatar, Egypt, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH (A Subsidiary of TKH GROUP), Siedle, URMET S.p.A., Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB (A Subsidiary of Canon Group), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD, Schneider Electric, Alpha Communications, COMELIT S.p.A., FERMAX ELECTRÓNICA, S.A.U., TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co.,Ltd., and COMMAX among others |

Market Definition

Intercom devices facilitate real-time communication and are widely adopted in residential, commercial, and industrial settings. In homes, intercoms provide enhanced security and convenient internal communication. Industrial applications involve intercoms for secure access control. The market is driven by the growing demand for security equipment and technological advancements, including wireless and IP-based solutions, which improve communication range. However, challenges such as privacy concerns and integration complexities could restrain market growth. One significant market opportunity lies in the integration of intercom devices with smart home ecosystems. Moreover, the ongoing technological advancements in video and audio quality, and the integration of AI and cloud services, further elevate the market's potential.

Global Intercom Devices Market Dynamics

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전사

- 첨단 보안 오디오비주얼 시스템의 등장

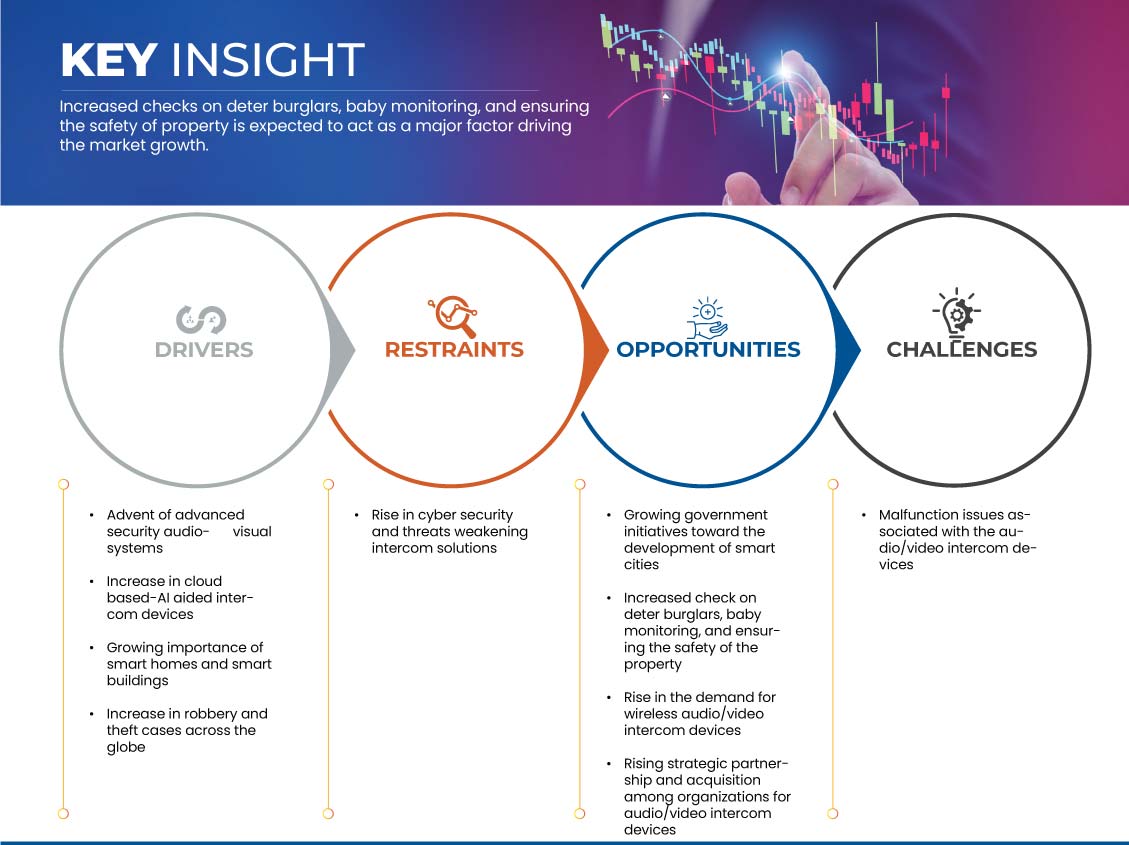

고급 보안 오디오비주얼 시스템의 등장은 시장의 풍경을 크게 바꾸어 놓았으며, 향상된 커뮤니케이션, 감시 및 보안 기능의 새로운 시대를 열었습니다. 이러한 기술적 진화는 인터컴 장치의 놀라운 혁신을 촉진하여 다양한 산업과 지역에서 수요가 증가했습니다. 기존의 인터컴 시스템은 주로 오디오 커뮤니케이션에 초점을 맞추었습니다. 그러나 고급 보안 오디오비주얼 시스템의 통합은 오디오와 비디오 요소를 모두 결합하여 혁신적인 변화를 가져왔습니다. 이러한 융합은 사용자가 소통하는 사람을 들을 수 있을 뿐만 아니라 볼 수도 있는 능력을 부여했습니다. 보안 맥락에서 이는 직원이 출입을 허가하기 전에 방문자의 신원을 시각적으로 확인할 수 있기 때문에 향상된 검증 프로세스로 이어집니다. 이러한 강화된 검증 수준은 보안 프로토콜을 강화하여 인터컴 장치를 현대식 출입 통제 및 감시 시스템의 필수 구성 요소로 만들어 시장 성장을 촉진할 것으로 예상됩니다.

제지

- 사이버 보안 증가 및 Intercom 솔루션을 약화시키는 위협

사이버범죄/해킹 및 사이버보안 문제는 모든 부문에서 팬데믹 동안 600% 증가했습니다. 네트워크 또는 소프트웨어 보안의 결함은 해커가 시스템 내에서 승인되지 않은 작업을 수행하는 데 악용하는 약점입니다. Purple Sec LLC에 따르면 2018년 모바일용 모바일 맬웨어 변종이 54% 증가했으며, 이 중 98%의 모바일 맬웨어가 Android 기기를 대상으로 합니다. 보안 산업을 포함하여 기업의 25%가 크립토재킹의 피해를 입은 것으로 추정됩니다. 예를 들어, Rambus Company는 IoT 기기의 약 80%가 사이버 공격을 받기 쉽다고 밝혔습니다. 해킹은 보호되지 않은 스마트 홈 기기 및 스마트 잠금 장치 , 스마트 비디오 도어 잠금 장치, 생체 인식 장치 등과 같은 인터넷 연결 기기의 정보를 해킹하여 신원을 도용하는 것일 수 있습니다. 보호 방화벽과 강력한 사이버 보안 애플리케이션이 없으면 스마트 보안이 제대로 작동하지 않을 수도 있습니다.

기회

- 스마트 시티 개발을 향한 정부 이니셔티브 확대

스마트 시티와 커뮤니티에서 정부가 취한 이니셔티브는 산업, 도시, 시민 사회의 고위 대표로 구성된 유럽 위원회(EC)에 자문하는 고위급 그룹과 스마트 시티 이해 관계자 플랫폼인 두 개의 거버넌스 기구에서 수행합니다. 이 플랫폼은 다양한 개발자의 솔루션과 요구 사항을 파악하는 데 중점을 둡니다. 스마트 시티 는 기술과 데이터 기반 솔루션을 활용하여 주민의 삶의 질을 향상시키고 지속 가능성을 개선하며 도시 관리를 간소화하는 도시 지역입니다. 통신, 보안 및 통합 기능을 갖춘 Intercom 장치는 이러한 스마트 시티의 통신 인프라를 형성하는 데 중요한 역할을 하며, 이는 시장 성장의 기회를 제공할 것으로 예상됩니다.

도전

- 인터컴 장치와 관련된 오작동 문제

인터컴 장치는 통신, 보안 및 편의성 측면에서 수많은 이점을 제공하지만, 기술적 결함과 오작동은 장치의 효과를 떨어뜨리고 고객 신뢰를 떨어뜨릴 수 있습니다. 이러한 문제는 시장의 다양한 측면에 영향을 미치고 제조업체와 공급업체가 해결해야 할 장애물을 만들 수 있습니다. 인터컴 장치는 통신, 보안 및 액세스 제어 목적으로 사용됩니다. 통화 끊김, 오디오 품질 저하 또는 비디오 지연과 같은 오작동은 장치의 안정성에 대한 우려로 이어질 수 있습니다. 사용자는 중요한 기능을 위해 인터컴 시스템에 의존하는 것을 주저하여 신뢰를 떨어뜨리고 잠재적으로 대체 솔루션을 찾게 될 수 있습니다.

오작동하는 인터컴 장치는 열악한 사용자 경험, 사용자를 좌절시키고 전반적인 만족도를 떨어뜨릴 수 있습니다. 의사소통을 시작하는 데 어려움이 있거나, 응답이 지연되거나, 오디오가 불분명하면 사용자 불만과 기술에 대한 부정적인 인식으로 이어질 수 있습니다. 불만족스러운 고객은 다른 사람에게 인터컴 장치를 추천할 가능성이 낮아 입소문 추천과 잠재적 성장에 영향을 미칠 수 있습니다.

최근 개발 사항

- 2022년 9월, Hangzhou Hikvision Digital Technology Co., Ltd.는 MinMoe 홍채 인식 단말기를 출시하여 출입 통제 보안의 새로운 기준을 제시했습니다. 개인의 독특하고 안정적인 홍채 패턴을 활용한 이 혁신적인 단말기는 최대 70cm 거리에서도 단 1초 이내에 정확한 식별과 구별을 보장합니다. 컬러 이미징과 비디오 위조 방지 기능을 통합하여 정확성을 더욱 보장합니다. 홍채 인식, 얼굴 인식, 지문 및 카드를 포함한 단말기의 다중 방법 인증은 출입 통제 솔루션의 유연성과 보안을 강화합니다.

- 2022년 6월, ABB는 최첨단 Welcome IP 포트폴리오로 글로벌 인터컴 장치 시장을 계속 확대하여 단독 주택에서 다중 주택 단위(MDU)에 이르기까지 출입문 제어를 재정의했습니다. 이 혁신적인 제품군에는 오디오/비디오 전송, 인터컴, 출입 제어, IP 카메라 통합을 포함한 다양한 기능이 포함됩니다. 유연한 IP 인프라는 손쉬운 계획, 높은 확장성, 강력한 사이버 보안을 용이하게 합니다. 특히, 플래그십 Welcome IP 스테이션은 직관적인 사용자 상호 작용을 보장하는 5인치 터치 디스플레이를 자랑합니다. IP Touch 내부 터치스크린과 ABB Welcome 앱은 외부 장치와 완벽하게 통합되어 통합된 디자인을 제공합니다. ABB의 Welcome IP 제품군은 현대성, 다재다능함, 향상된 기능을 구현하여 다양한 주거 및 상업적 요구 사항을 충족합니다.

글로벌 인터컴 장치 시장 범위

글로벌 인터콤 장치 시장은 시스템 유형, 구성 요소, 장치 유형, 재료, 전원 공급, 출입 통제, 기술, 키패드, 통신 유형, 가격 범주, 통신, 애플리케이션, 설치, 최종 사용자 및 유통 채널을 기준으로 15개의 주요 세그먼트로 구분됩니다.

시스템 유형

- 열광한

- 무선 전화

시스템 유형을 기준으로 시장은 유선과 무선으로 구분됩니다 .

요소

- 하드웨어

- 소프트웨어

- 서비스

구성 요소를 기준으로 시장은 하드웨어, 소프트웨어, 서비스로 구분됩니다.

장치 유형

- 도어 진입 시스템

- 핸드헬드 장치

- 비디오 베이비 모니터

장치 유형을 기준으로 시장은 출입문 진입 시스템, 핸드헬드 장치, 비디오 베이비 모니터로 구분됩니다.

재료

- 알류미늄

- 스테인리스 스틸

- 강화 유리

- 플라스틱

- 기타

시장은 재료를 기준으로 알루미늄, 스테인리스 스틸, 강화 유리, 플라스틱 등으로 구분됩니다.

전원 공급 장치

- 20W 미만

- 20W 이상

전력 공급을 기준으로 시장은 20W 미만과 20W 초과로 구분됩니다.

접근 제어

- 카드

- 지문 판독기

- 근접 카드

- 비밀번호 접근

- 얼굴 인식

- 기타

출입 통제를 기준으로 시장은 카드, 지문 판독기, 근접 카드, 비밀번호 출입, 얼굴 인식 및 기타로 구분됩니다 .

기술

- 비슷한 물건

- IP 기반

기술 기준으로 시장은 아날로그와 IP 기반으로 구분됩니다.

키패드

- 기계식 버튼

- 터치패드

키패드를 기준으로 시장은 기계식 버튼과 터치패드로 구분됩니다.

커뮤니케이션 유형

- 오디오만

- 오디오/비디오

커뮤니케이션 유형을 기준으로 시장은 오디오/비디오와 오디오 전용 시장으로 세분화됩니다.

가격 카테고리

- 낮음 (USD 100 미만)

- 중간 (USD 100-USD 500)

- 높음 (USD 500 이상)

가격대를 기준으로 시장은 저가(100달러 미만), 중가(100달러~500달러), 고가(500달러 이상)로 구분됩니다.

의사소통

- 푸시투톡

- 핸즈프리 또는 핸드셋(듀플렉스)

통신 방식을 기준으로 시장은 푸시투토크와 핸즈프리 또는 핸드셋(듀플렉스)으로 구분됩니다.

애플리케이션

- 실내

- 집 밖의

시장은 적용 분야를 기준으로 실외용과 실내용으로 구분됩니다.

설치

- 플러시

- 표면

설치 방식을 기준으로 시장은 플러시와 표면으로 구분됩니다.

최종 사용자

- 광고

- 주거용

- 산업

- 정부

최종 사용자를 기준으로 시장은 상업, 주거, 산업 및 정부로 구분됩니다.

유통 채널

- 오프라인

- 온라인

유통 채널을 기준으로 시장은 오프라인과 온라인으로 구분됩니다.

글로벌 인터컴 장치 시장지역 분석/통찰력

글로벌 인터콤 장치 시장은 시스템 유형, 구성 요소, 장치 유형, 재료, 전원 공급, 출입 통제, 기술, 키패드, 통신 유형, 가격 범주, 통신, 애플리케이션, 설치, 최종 사용자 및 유통 채널을 기준으로 15개의 주요 세그먼트로 구분됩니다.

이 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 스페인, 이탈리아, 네덜란드, 러시아, 스위스, 덴마크, 스웨덴, 폴란드, 벨기에, 터키, 노르웨이, 핀란드, 유럽의 기타 국가, 중국, 일본, 한국, 인도, 말레이시아, 대만, 호주 및 뉴질랜드, 싱가포르, 인도네시아, 태국, 필리핀, 베트남, 아시아 태평양의 기타 국가, 브라질, 아르헨티나, 남미의 기타 국가, 남아프리카 공화국, 사우디 아라비아, UAE, 쿠웨이트, 카타르, 이집트, 이스라엘, 그리고 중동 및 아프리카의 기타 국가입니다.

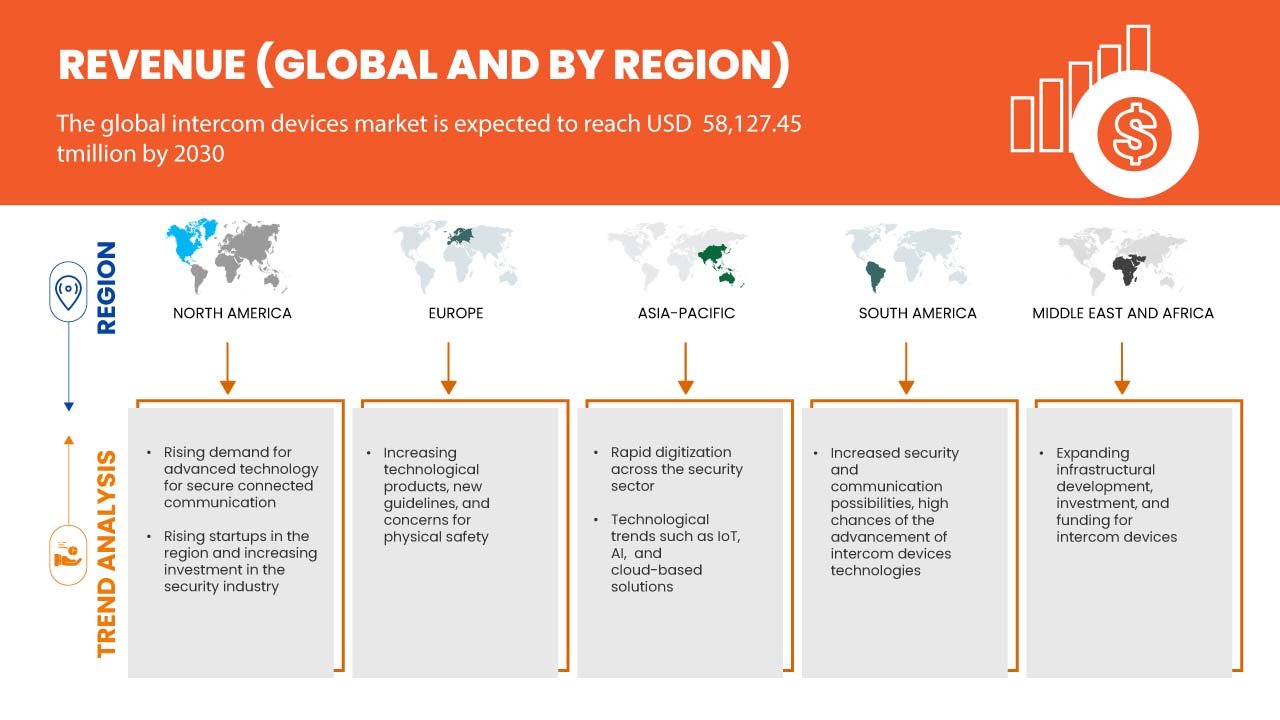

북미는 GDP가 높은 가장 큰 소비자 시장에 주요 시장 참여자가 존재하기 때문에 시장을 지배할 것으로 예상됩니다. 미국은 주요 참여자의 강력한 존재감으로 인해 북미 지역을 지배할 것으로 예상됩니다. 독일은 신흥 시장의 수요 증가와 확장으로 인해 유럽 지역을 지배할 것으로 예상됩니다. 중국은 녹음 장치에 대한 고객 성향이 증가함에 따라 아시아 태평양 지역을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 국내 시장의 개별 시장 영향 요인과 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 글로벌 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 글로벌 인터컴 장치 시장 점유율 분석

글로벌 인터컴 장치 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, R&D 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 승인, 제품 폭과 범위, 애플리케이션 우세, 제품 유형 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 회사가 시장에 집중하는 것과만 관련이 있습니다.

글로벌 인터컴 장치 시장의 주요 기업으로는 Hangzhou Hikvision Digital Technology Co., Ltd, SAMSUNG ELECTRONICS CO., LTD., Panasonic Holdings Corporation, Schneider Intercom GmbH(TKH GROUP 자회사), Siedle, URMET SpA, Zicom, ABB, Aiphone Corporation, Godrej & Boyce Manufacturing Company Limited, Axis Communications AB(Canon Group 자회사), Gira, Zenitel, The Akuvox Company, Hager Group, GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD, Schneider Electric, Alpha Communications, COMELIT SpA, FERMAX ELECTRÓNICA, SAU, TCS TürControlSysteme AG, TOA Corporation, Honeywell International Inc., Dahua Technology Co., Ltd, Legrand Group, Xiamen Leelen Technology Co.,Ltd., COMMAX 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SYSTEM TYPE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY AND THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECKS ON DETER BURGLARS, BABY MONITORING, AND ENSURING THE SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE INTERCOM DEVICES

6 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL

6.1 OVERVIEW

6.2 CARDS

6.3 FINGERPRINT READERS

6.4 PROXIMITY CARDS

6.5 PASSWORD ACCESS

6.6 FACE RECOGNITION

6.7 OTHERS

7 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ANALOG

7.3 IP-BASED

8 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD

8.1 OVERVIEW

8.2 MECHANICAL BUTTON

8.3 TOUCH PAD

9 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE

9.1 OVERVIEW

9.2 DOOR ENTRY SYSTEMS

9.3 HANDHELD DEVICES

9.4 VIDEO BABY MONITORS

10 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 ALUMINUM

10.3 STAINLESS STEEL

10.4 TEMPERED GLASS

10.5 PLASTIC

10.6 OTHERS

11 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY

11.1 OVERVIEW

11.2 LESS THAN 20 W

11.3 MORE THAN 20 W

12 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY

12.1 OVERVIEW

12.2 LOW (BELOW USD 100)

12.3 MEDIUM (USD 100- USD 500)

12.4 HIGH (ABOVE USD 500)

13 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION

13.1 OVERVIEW

13.2 PUSH-TO-TALK

13.3 HANDS-FREE OR HANDSET (DUPLEX)

14 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 OUTDOOR

14.3 INDOOR

15 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE

15.1 OVERVIEW

15.2 AUDIO/VIDEO

15.2.1 ON THE BASIS OF SCREEN SIZE

15.2.1.1 BELOW 3 INCHES

15.2.1.2 2-5 INCHES

15.2.1.3 5-7 INCHES

15.2.1.4 ABOVE 7 INCHES

15.3 ONLY AUDIO

16 GLOBAL INTERCOM DEVICES MARKET, BY END USER

16.1 OVERVIEW

16.2 COMMERCIAL

16.2.1 COMMERCIAL, TYPE

16.2.1.1 HOTEL

16.2.1.2 AIRPORT

16.2.1.3 BANKS AND FINANCIAL INSTITUTION

16.2.1.4 PRISONS AND POLICE STATION

16.2.1.5 OFFICES

16.2.1.6 HEALTCARE

16.2.1.7 SCHOOL AND UNIVERSITIES

16.2.1.8 PARKING GARAGE

16.2.1.9 OTHERS

16.2.2 DEVICE TYPE

16.2.2.1 DOOR ENTRY SYSTEMS

16.2.2.2 HANDHELD DEVICES

16.2.2.3 VIDEO BABY MONITORS

16.3 RESIDENTIAL

16.3.1 TYPE

16.3.1.1 APARTMENTS

16.3.1.2 SINGLE OR MULTI-FAMILY HOMES

16.3.1.3 HOSTEL

16.3.1.4 CONDOMINIUMS

16.3.1.5 OTHERS

16.3.2 DEVICE TYPE

16.3.2.1 DOOR ENTRY SYSTEMS

16.3.2.2 HANDHELD DEVICES

16.3.2.3 VIDEO BABY MONITORS

16.4 INDUSTRIES

16.4.1 DEVICE TYPE

16.4.1.1 DOOR ENTRY SYSTEMS

16.4.1.2 HANDHELD DEVICES

16.4.1.3 VIDEO BABY MONITORS

16.5 GOVERNMENT

16.5.1 DEVICE TYPE

16.5.1.1 DOOR ENTRY SYSTEMS

16.5.1.2 HANDHELD DEVICES

16.5.1.3 VIDEO BABY MONITORS

17 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION

17.1 OVERVIEW

17.2 FLUSH

17.3 SURFACE

18 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 OFFLINE

18.2.1 SPECIALITY STORES

18.2.2 SUPERMARKET/HYPERMARKET

18.2.3 WHOLESALER

18.2.4 OTHERS

18.3 ONLINE

18.3.1 E-COMMERCE

18.3.2 COMPANY WEBSITE

19 GLOBAL INTERCOM DEVICES MARKET, BY SYSTEM TYPE

19.1 OVERVIEW

19.2 WIRED

19.2.1 2-WIRE SYSTEM

19.2.2 CAT-5 SYSTEM

19.2.3 4-WIRE SYSTEM

19.2.4 OTHERS

19.3 WIRELESS

19.3.1 WIFI

19.3.2 RADIO FREQUENCY

19.3.3 OTHERS

20 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT

20.1 OVERVIEW

20.2 HARDWARE

20.2.1 CAMERAS

20.2.1.1 LESS THAN 2 MM

20.2.1.2 2 MM-3 MM

20.2.1.3 MORE THAN 3 MM

20.2.2 LCD SCREEN

20.2.2.1 CAPACITIVE

20.2.2.2 RESISTIVE

20.2.3 READER

20.2.4 SENSOR

20.2.4.1 IMAGE SENSOR

20.2.4.2 PROXIMITY SENSOR

20.2.4.3 OTHERS

20.2.5 SWITCHES

20.2.6 ACCESSORIES

20.2.7 OTHERS

20.3 SOFTWARE

20.4 SERVICES

20.4.1 INSTALLATION

20.4.2 SUPPORT AND MAINTENANCE

20.4.3 TESTING

21 GLOBAL INTERCOM DEVICES MARKET, BY REGION

21.1 OVERVIEW

21.2 NORTH AMERICA

21.2.1 U.S.

21.2.2 CANADA

21.2.3 MEXICO

21.3 EUROPE

21.3.1 U.K.

21.3.2 GERMANY

21.3.3 FRANCE

21.3.4 ITALY

21.3.5 SPAIN

21.3.6 RUSSIA

21.3.7 NETHERLANDS

21.3.8 SWITZERLAND

21.3.9 TURKEY

21.3.10 BELGIUM

21.3.11 DENMARK

21.3.12 SWEDEN

21.3.13 POLAND

21.3.14 NORWAY

21.3.15 FINLAND

21.3.16 REST OF EUROPE

21.4 ASIA-PACIFIC

21.4.1 CHINA

21.4.2 JAPAN

21.4.3 SOUTH KOREA

21.4.4 INDIA

21.4.5 MALAYSIA

21.4.6 AUSTRALIA & NEW ZEALAND

21.4.7 TAIWAN

21.4.8 SINGAPORE

21.4.9 INDONESIA

21.4.10 THAILAND

21.4.11 PHILIPPINES

21.4.12 VIETNAM

21.4.13 REST OF ASIA-PACIFIC

21.5 MIDDLE EAST AND AFRICA

21.5.1 U.A.E.

21.5.2 SAUDI ARABIA

21.5.3 SOUTH AFRICA

21.5.4 EGYPT

21.5.5 ISRAEL

21.5.6 QATAR

21.5.7 KUWAIT

21.5.8 REST OF MIDDLE EAST AND AFRICA

21.6 SOUTH AMERICA

21.6.1 BRAZIL

21.6.2 ARGENTINA

21.6.3 REST OF SOUTH AMERICA

22 GLOBAL INTERCOM DEVICES MARKET: COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23 SWOT ANALYSIS

24 COMPANY PROFILINGS

24.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

24.1.1 COMPANY SNAPSHOT

24.1.2 REVENUE ANALYSIS

24.1.3 COMPANY SHARE ANALYSIS

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 SAMSUNG ELECTRONICS CO., LTD.

24.2.1 COMPANY PROFILE

24.2.2 REVENUE ANALYSIS

24.2.3 COMPANY SHARE ANALYSIS

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 PANASONIC HOLDINGS CORPORATION

24.3.1 COMPANY SNAPSHOT

24.3.2 REVENUE ANALYSIS

24.3.3 COMPANY SHARE ANALYSIS

24.3.4 PRODUCTS PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 LEGRAND GROUP

24.4.1 COMPANY SNAPSHOT

24.4.2 REVENUE ANALYSIS

24.4.3 PRODUCTS PORTFOLIO

24.4.4 RECENT DEVELOPMENT

24.5 HONEYWELL INTERNATIONAL INC.

24.5.1 COMPANY SNAPSHOT

24.5.2 REVENUE ANALYSIS

24.5.3 PRODUCTS PORTFOLIO

24.5.4 RECENT DEVELOPMENT

24.6 ABB

24.6.1 COMPANY PROFILE

24.6.2 REVENUE ANALYSIS

24.6.3 PRODUCTS PORTFOLIO

24.6.4 RECENT DEVELOPMENTS

24.7 AIPHONE CORPORATION

24.7.1 COMPANY SNAPSHOT

24.7.2 REVENUE ANALYSIS

24.7.3 PRODUCTS PORTFOLIO

24.7.4 RECENT DEVELOPMENTS

24.8 ALPHA COMMUNICATIONS

24.8.1 COMPANY SNAPSHOT

24.8.2 PRODUCT PORTFOLIO

24.8.3 RECENT DEVELOPMENT

24.9 AXIS COMMUNICATIONS AB (A SUBSIDIARY OF CANON GROUP)

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCTS PORTFOLIO

24.9.4 RECENT DEVELOPMENTS

24.1 COMELIT GROUP S.P.A.

24.10.1 COMPANY SNAPSHOT

24.10.2 PRODUCTS PORTFOLIO

24.10.3 RECENT DEVELOPMENTS

24.11 COMMAX

24.11.1 COMPANY SNAPSHOT

24.11.2 PRODUCTS PORTFOLIO

24.11.3 RECENT DEVELOPMENT

24.12 DAHUA TECHNOLOGY CO., LTD

24.12.1 COMPANY SNAPSHOT

24.12.2 REVENUE ANALYSIS

24.12.3 PRODUCTS PORTFOLIO

24.12.4 RECENT DEVELOPMENTS

24.13 FERMAX ELECTRÓNICA, S.A.U.

24.13.1 COMPANY SNAPSHOT

24.13.2 PRODUCTS PORTFOLIO

24.13.3 RECENT DEVELOPMENTS

24.14 FUJIAN AURINE TECHNOLOGY CO., LTD.

24.14.1 COMPANY SNAPSHOT

24.14.2 PRODUCTS PORTFOLIO

24.14.3 RECENT DEVELOPMENT

24.15 GIRA

24.15.1 COMPANY SNAPSHOT

24.15.2 PRODUCTS PORTFOLIO

24.15.3 RECENT DEVELOPMENTS

24.16 GODREJ & BOYCE MANUFACTURING COMPANY LIMITED

24.16.1 COMPANY SNAPSHOT

24.16.2 REVENUE ANALYSIS

24.16.3 PRODUCT PORTFOLIO

24.16.4 RECENT DEVELOPMENT

24.17 GUANGDONG ANJUBAO DIGITAL TECHNOLOGY CO.,LTD

24.17.1 COMPANY SNAPSHOT

24.17.2 REVENUE ANALYSIS

24.17.3 PRODUCT PORTFOLIO

24.17.4 RECENT DEVELOPMENTS

24.18 HAGER GROUP

24.18.1 COMPANY SNAPSHOT

24.18.2 PRODUCTS PORTFOLIO

24.18.3 RECENT DEVELOPMENT

24.19 SCHNEIDER ELECTRIC

24.19.1 COMPANY SNAPSHOT

24.19.2 REVENUE ANALYSIS

24.19.3 PRODUCTS PORTFOLIO

24.19.4 RECENT DEVELOPMENTS

24.2 SCHNEIDER INTERCOM GMBH

24.20.1 COMPANY SNAPSHOT

24.20.2 PRODUCTS PORTFOLIO

24.20.3 RECENT DEVELOPMENTS

24.21 SIEDLE

24.21.1 COMPANY SNAPSHOT

24.21.2 PRODUCTS PORTFOLIO

24.21.3 RECENT DEVELOPMENT

24.22 TCS TÜRCONTROLSYSTEME AG

24.22.1 COMPANY SNAPSHOT

24.22.2 PRODUCTS PORTFOLIO

24.22.3 RECENT DEVELOPMENT

24.23 THE AKUVOX COMPANY

24.23.1 COMPANY SNAPSHOT

24.23.2 PRODUCTS PORTFOLIO

24.23.3 RECENT DEVELOPMENTS

24.24 TOA CORPORATION

24.24.1 COMPANY SNAPSHOT

24.24.2 REVENUE ANALYSIS

24.24.3 PRODUCT PORTFOLIO

24.24.4 RECENT DEVELOPMENTS

24.25 URMET S.P.A.

24.25.1 COMPANY SNAPSHOT

24.25.2 PRODUCTS PORTFOLIO

24.25.3 RECENT DEVELOPMENT

24.26 XIAMEN LEELEN TECHNOLOGY CO., LTD.

24.26.1 COMPANY SNAPSHOT

24.26.2 PRODUCTS PORTFOLIO

24.26.3 RECENT DEVELOPMENTS

24.27 ZENITEL

24.27.1 COMPANY SNAPSHOT

24.27.2 PRODUCTS PORTFOLIO

24.27.3 RECENT DEVELOPMENT

24.28 ZICOM

24.28.1 COMPANY SNAPSHOT

24.28.2 PRODUCT PORTFOLIO

24.28.3 RECENT DEVELOPMENTS

25 QUESTIONNAIRE

26 RELATED REPORTS

표 목록

TABLE 1 GLOBAL INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2021-2030 (USD MILLION)

TABLE 2 GLOBAL CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 GLOBAL PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 GLOBAL FACE RECOGNITION IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL IP-BASED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL INTERCOM DEVICES MARKET, BY KEYPAD, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL MECHANICAL BUTTON IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL TOUCH PAD IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL INTERCOM DEVICES MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 19 GLOBAL ALUMINUM IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL STAINLESS STEEL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 GLOBAL TEMPERED GLASS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 GLOBAL INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 GLOBAL OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 GLOBAL INTERCOM DEVICES MARKET, BY POWER SUPPLY, 2021-2030 (USD MILLION)

TABLE 25 GLOBAL LESS THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 GLOBAL MORE THAN 20 W IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 GLOBAL INTERCOM DEVICES MARKET, BY PRICE CATEGORY, 2021-2030 (USD MILLION)

TABLE 28 GLOBAL LOW (BELOW USD 100) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 GLOBAL MEDIUM (USD 100- USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 GLOBAL HIGH (ABOVE USD 500) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION, 2021-2030 (USD MILLION)

TABLE 32 GLOBAL PUSH-TO-TALK IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 GLOBAL HANDS-FREE OR HANDSET (DUPLEX) IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 GLOBAL INTERCOM DEVICES MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 GLOBAL OUTDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 GLOBAL INDOOR IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 GLOBAL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2021-2030 (USD MILLION)

TABLE 38 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 GLOBAL AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY SCREEN SIZE, 2021-2030 (USD MILLION)

TABLE 40 GLOBAL ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 GLOBAL INTERCOM DEVICES MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 42 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 GLOBAL COMMERCIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 45 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 GLOBAL RESIDENTIAL IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 48 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 GLOBAL INDUSTRIES IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 50 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 GLOBAL GOVERNMENT IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2021-2030 (USD MILLION)

TABLE 52 GLOBAL INTERCOM DEVICES MARKET, BY INSTALLATION, 2021-2030 (USD MILLION)

TABLE 53 GLOBAL FLUSH IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 GLOBAL SURFACE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 55 GLOBAL INTERCOM DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 GLOBAL OFFLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 GLOBAL ONLINE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 GLOBAL INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 GLOBAL WIRED IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 64 GLOBAL WIRELESS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 GLOBAL INTERCOM DEVICES MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 66 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 GLOBAL HARDWARE IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 GLOBAL CAMERAS IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 GLOBAL LCD SCREEN IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 GLOBAL SENSOR IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 GLOBAL SOFTWARE IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 72 GLOBAL GROUND IN INTERCOM DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 GLOBAL SERVICES IN INTERCOM DEVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 GLOBAL INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL INTERCOM DEVICES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL INTERCOM DEVICES MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 GLOBAL INTERCOM DEVICES MARKET: MULTIVARIATE MODELLING

FIGURE 11 GLOBAL INTERCOM DEVICES MARKET: SYSTEM TYPE

FIGURE 12 GLOBAL INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 ADVENT OF ADVANCED SECURITY AUDIO-VISUAL SYSTEMS IS EXPECTED TO BE A KEY DRIVER FOR THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 WIRED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL INTERCOM DEVICES MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL INTERCOM DEVICES MARKET

FIGURE 18 VIDEO SYSTEMS

FIGURE 19 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 20 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 21 IMPACT OF CYBER SECURITY THREAT

FIGURE 22 GLOBAL INTERCOM DEVICES MARKET: BY ACCESS CONTROL, 2022

FIGURE 23 GLOBAL INTERCOM DEVICES MARKET: BY TECHNOLOGY, 2022

FIGURE 24 GLOBAL INTERCOM DEVICES MARKET: BY KEYPAD, 2022

FIGURE 25 GLOBAL INTERCOM DEVICES MARKET: BY DEVICE TYPE, 2022

FIGURE 26 GLOBAL INTERCOM DEVICES MARKET: BY MATERIAL, 2022

FIGURE 27 GLOBAL INTERCOM DEVICES MARKET: BY POWER SUPPLY, 2022

FIGURE 28 GLOBAL INTERCOM DEVICES MARKET: BY PRICE CATEGORY, 2022

FIGURE 29 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION, 2022

FIGURE 30 GLOBAL INTERCOM DEVICES MARKET: BY APPLICATION, 2022

FIGURE 31 GLOBAL INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE, 2022

FIGURE 32 GLOBAL INTERCOM DEVICES MARKET: BY END USER, 2022

FIGURE 33 GLOBAL INTERCOM DEVICES MARKET: BY INSTALLATION, 2022

FIGURE 34 GLOBAL INTERCOM DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 GLOBAL INTERCOM DEVICES MARKET: BY SYSTEM TYPE, 2022

FIGURE 36 GLOBAL INTERCOM DEVICES MARKET: BY COMPONENT, 2022

FIGURE 37 GLOBAL INTERCOM DEVICES MARKET: SNAPSHOT (2022)

FIGURE 38 GLOBAL INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 39 NORTH AMERICA INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 40 EUROPE INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

FIGURE 41 ASIA-PACIFIC INTERCOM DEVICES MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.