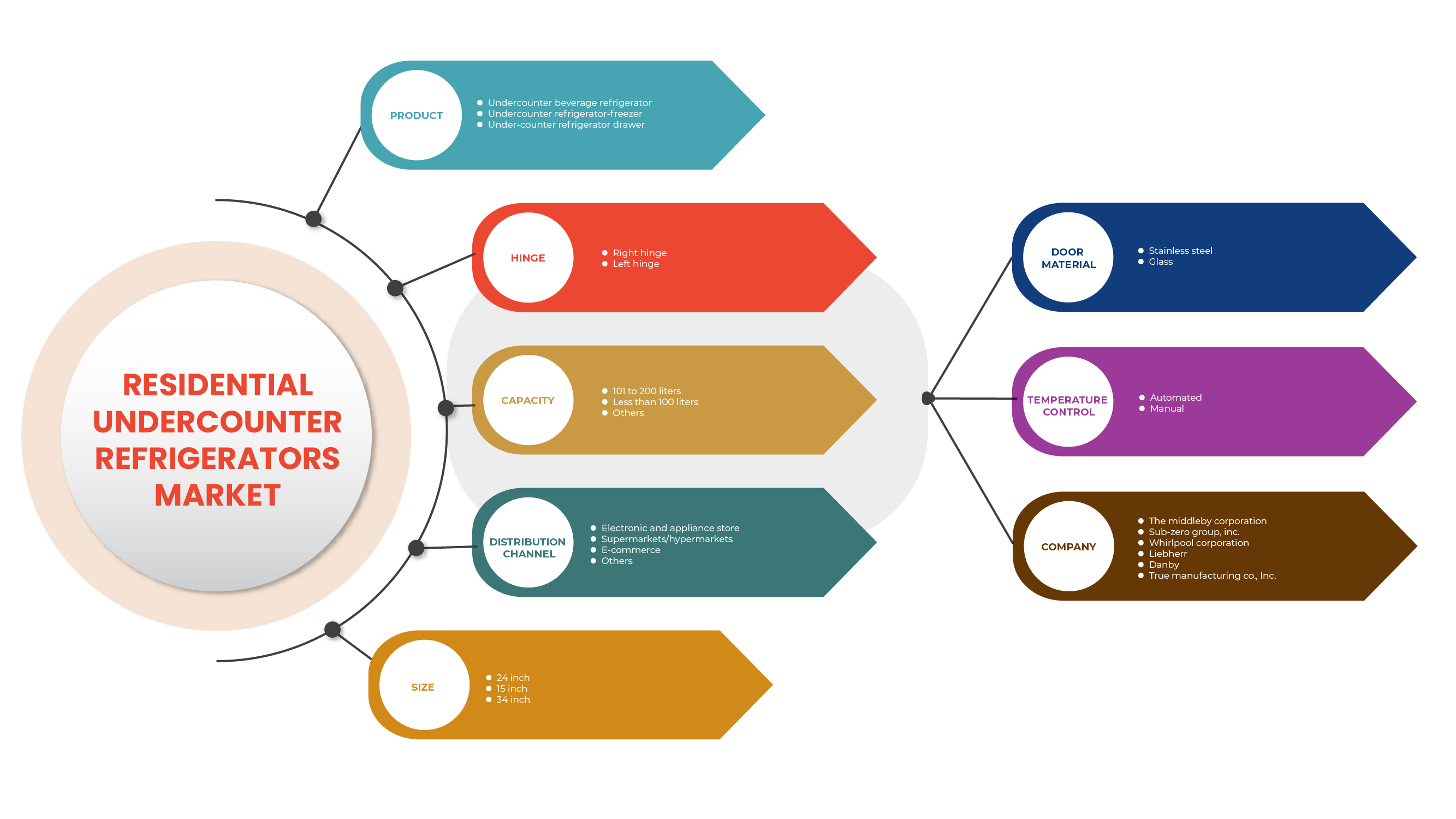

미국 주거용 언더카운터 냉장고 시장, 제품별(언더카운터 음료 냉장고, 언더카운터 냉장고 서랍, 언더카운터 냉장고 냉동고), 힌지(오른쪽 힌지, 왼쪽 힌지), 용량(100리터 미만, 101~200리터, 기타), 크기(15인치, 24인치, 34인치), 도어 소재(유리, 스테인리스 스틸), 온도 제어(자동, 수동), 유통 채널(슈퍼마켓/하이퍼마켓, 전자 및 가전제품 매장, 전자상거래, 기타), 업계 동향 및 2029년까지의 예측

시장 분석 및 규모

지난 몇 년 동안 주거용 언더카운터 냉장고는 소비자들의 증가하는 요구에 부응하기 위해 진화하면서 소비자들에게 인기를 얻었습니다. 소비자들의 라이프스타일 변화로 인해 주거용 시장에서 언더카운터 냉장고에 대한 수요가 증가하고 있습니다. 또한, 팬데믹과 봉쇄로 인해 사람들이 실내에 머물러야 했고, 그때 사람들은 밖으로 나가는 것을 피하기 위해 음료를 비축하면서 주거용 언더카운터 냉장고에 대한 필요성을 느꼈습니다. 게다가, 많은 사람들이 주거용 언더카운터 냉장고를 사용하여 충족되는 홈 바를 만들 가능성이 높습니다.

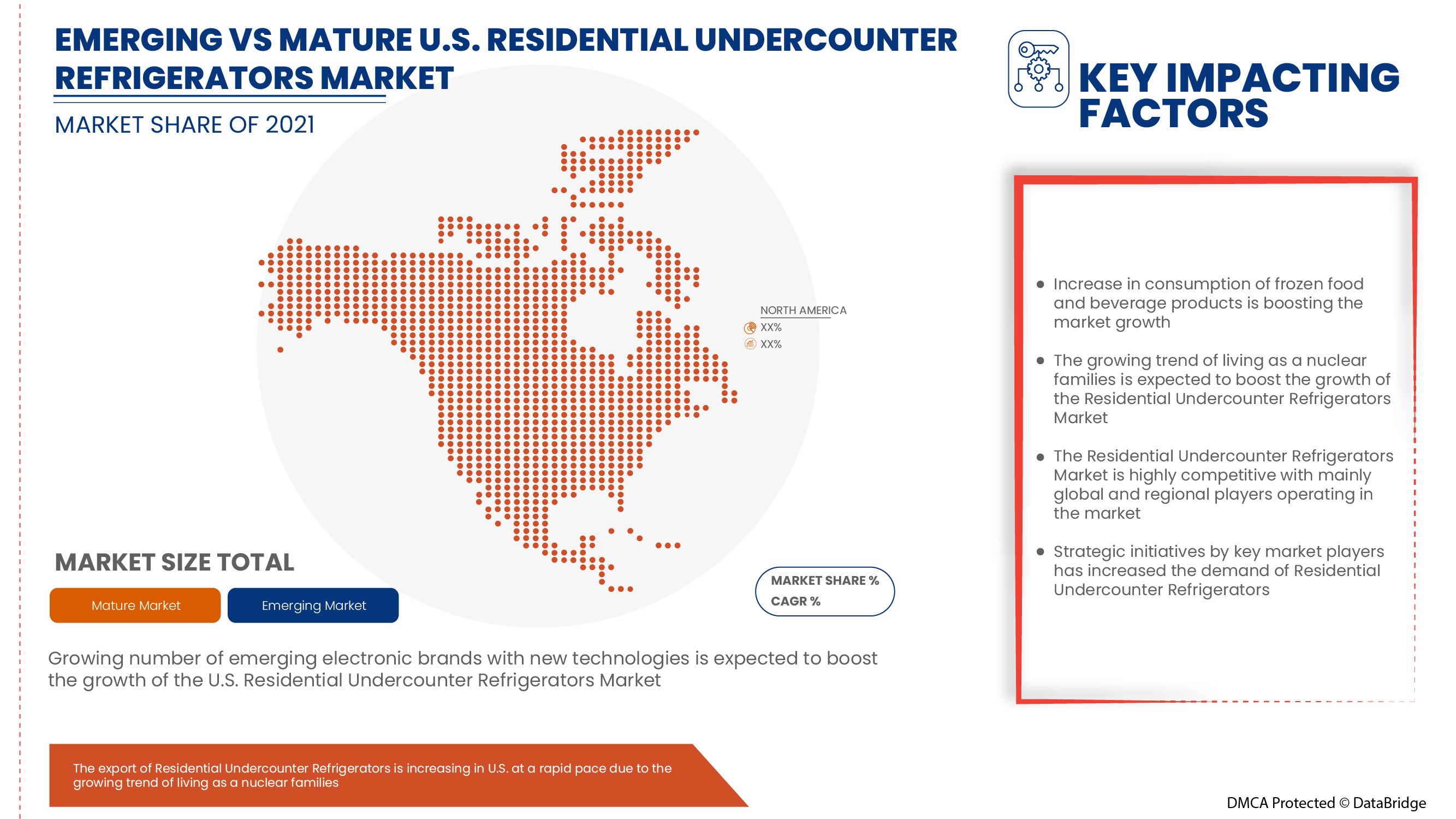

냉동식품 및 음료 제품 소비 증가, 소비자 가처분 소득 증가, 핵가족으로 사는 추세 증가는 주거용 언더카운터 냉장고의 시장 수요를 촉진하는 요인 중 일부입니다. 그러나 언더카운터 냉장고의 높은 유지 관리 및 서비스 비용은 시장 성장을 제한하고 있습니다.

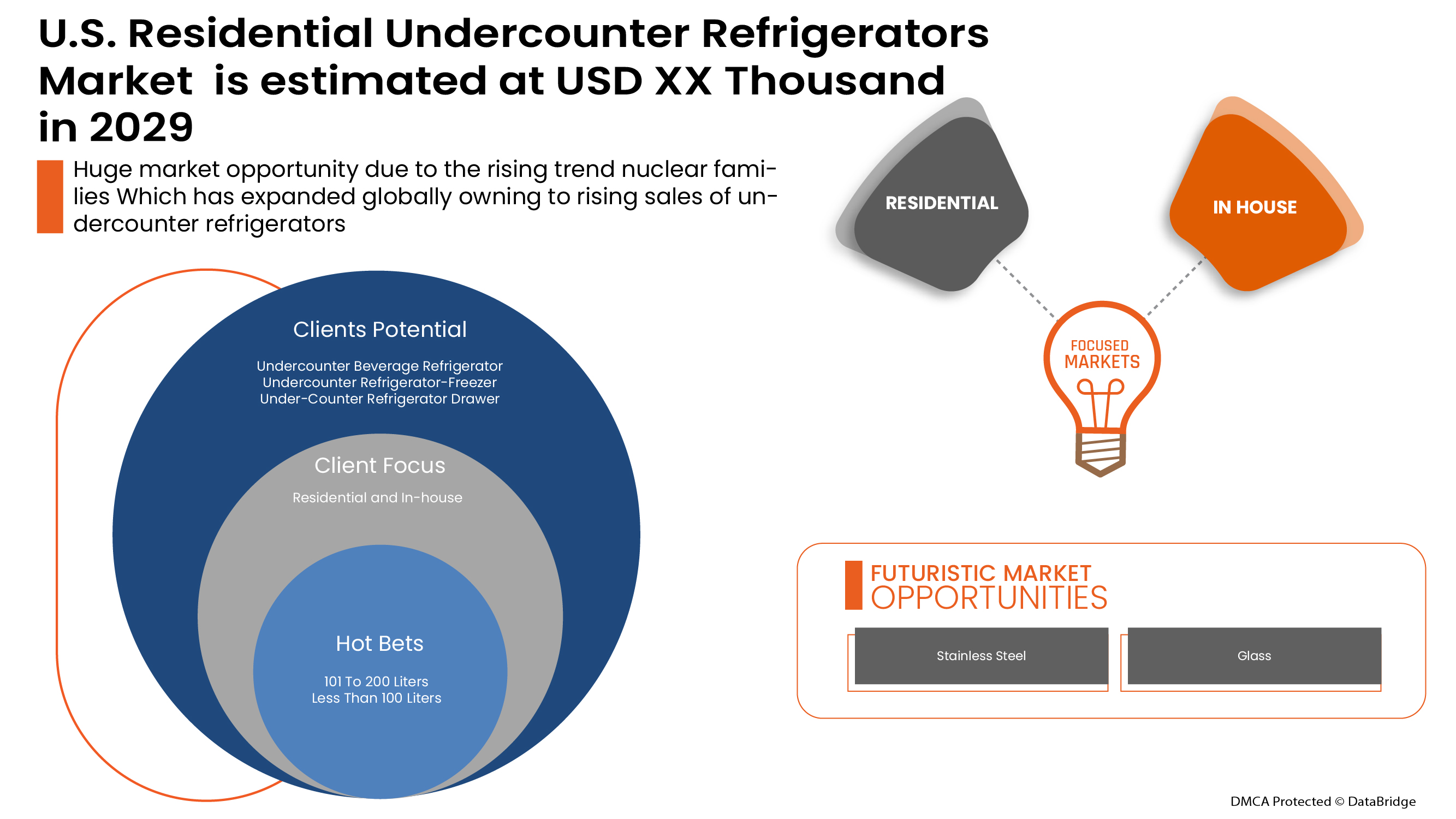

Data Bridge Market Research는 주거용 언더카운터 냉장고 시장이 예측 기간 동안 2.8%의 CAGR로 성장할 것으로 분석했습니다. "언더카운터 음료 냉장고"는 홈 바의 추세 상승으로 인해 해당 시장에서 가장 눈에 띄는 제품 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 기후 사슬 시나리오가 포함되어 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (USD 천) |

|

다루는 세그먼트 |

제품별(언더카운터 음료 냉장고, 언더카운터 냉장고 서랍, 언더카운터 냉장고 냉동고), 힌지(오른쪽 힌지, 왼쪽 힌지), 용량(100리터 미만, 101~200리터, 기타), 크기(15인치, 24인치, 34인치), 도어 소재(유리, 스테인리스 스틸), 온도 제어(자동, 수동), 유통 채널(슈퍼마켓/하이퍼마켓, 전자 및 가전제품 매장, 전자상거래, 기타) |

|

적용 국가 |

우리를 |

|

시장 참여자 포함 |

LIEBHERR(바덴뷔르템베르크, 독일), True Manufacturing Co., Inc.(미주리, 미국), Summit Appliance(FELIX STORCH, INC.의 브랜드)(뉴욕, 미국), The Middleby Corporation(일리노이, 미국), Perlick Corporation(위스콘신, 미국)(), Whirlpool Corporation(미시간, 미국), Haier Group(칭다오, 중국), Danby(온타리오, 캐나다), Smeg SpA(과스탈라, 이탈리아), Sub-Zero Group, Inc.(위스콘신, 미국) 등이 있습니다. |

시장 정의

언더카운터 냉장고는 주거 공간의 주방 카운터 아래나 다른 카운터 아래에 놓을 만큼 작습니다. 언더카운터 냉장고는 다양한 온도와 크기로 제공되어 소규모에서 중규모 용도로 사용할 수 있습니다. 와인, 주스, 청량 음료 , 스무디 등과 같은 음료를 보관하고 보존하는 데 사용됩니다. 미니 냉장고로도 사용할 수 있으며 식품도 보관할 수 있습니다. 언더카운터 냉장고는 언더카운터 음료 냉장고, 언더카운터 냉장고 서랍, 언더카운터 냉장고 냉동고 등 세 가지 유형으로 제공됩니다.

규제 프레임워크

국가 에너지 보존 및 정책법(NEPCA): 이 법은 연방 정부가 연방 건물에서 에너지 보존 및 태양열 난방 및 냉방 사용을 촉진할 책임이 있다는 미국의 정책을 명시합니다. 이 법의 목적은 주간 상거래 규제를 제공하고, 미국의 에너지 수요 증가를 줄이며, 상업 및 주거 부문에서 생산되는 비재생 에너지 자원을 보존하는 것입니다.

미국 주거용 언더카운터 냉장고 시장의 시장 역학은 다음과 같습니다.

미국 주거용 언더카운터 냉장고 시장의 드라이버/기회

- 냉동식품 및 음료제품 소비 증가

냉동 식품 및 음료 품목에는 미리 씻은, 조리한, 대부분 포장된, 바로 먹을 수 있는 식품이 포함됩니다. 서양 문화는 모든 것이 빠르고 쉬운 촉박한 일정으로 인해 소비자에게 큰 영향을 미칩니다. 사람들은 시중의 다른 식품 및 간단한 간식보다 더 빠르고, 준비하기 쉽고, 더 건강한 옵션을 찾고 있습니다.

또한 냉동식품은 식료품에서 가장 빠르게 성장하는 카테고리 중 하나이며, 소비자의 냉동식품에 대한 선호도가 계속 증가할 것이라는 명확한 징후가 있습니다. 전 세계 소비자는 편리하고, 접근이 쉽고, 쉽게 온라인에서 구매할 수 있는 옵션을 원합니다. 이는 차례로 식품을 보관하고 보존하기 위한 소형 호환 냉장고에 대한 수요를 증가시킵니다.

- 핵가족으로 생활하는 추세가 확대되고 있습니다

핵가족은 냉장고 사용 방식을 바꾸었습니다. 이는 음료, 물, 우유 및 기타 간식을 보관할 수 있는 미니 냉장고의 개념을 제공했습니다. 작은 냉장고는 뛰어난 냉각 효과로 물건을 적절히 보관할 수 있으며, 냉동실 칸으로 얼릴 수도 있습니다.

- 스마트 홈 컨셉에 대한 긍정적인 전망

스마트 홈은 홈 네트워킹을 통해 기술과 서비스를 통합하여 더 나은 삶의 질을 제공하고, 사용자의 삶을 다양한 방식으로 용이하게 하며, 기술을 사용하여 더욱 편안하게 만듭니다. 스마트 홈 기능의 주요 목적은 원격 제어 장치를 사용하여 더 큰 보안과 효율성을 보장하는 것과 함께 삶의 질을 개선하고 집에서 편의성을 제공하는 것입니다. 미니 호환 냉장고와 같은 스마트 주방 기기는 자체 제어가 가능하고 쉽게 조작할 수 있는 주방 기기 중 하나입니다.

- 에너지 효율형 가전제품에 대한 정부 이니셔티브

스마트 가전제품에는 첨단 가정 및 주방 자동화 기술이 포함되어 있으며, 이를 통해 정부가 전국의 주거 지역에서 기계, 난방, 냉방 및 조명 시스템을 모니터링하고 제어하는 방식을 개선하여 이러한 시스템의 효율성을 높입니다. 최근 몇 년 동안 미국 정부는 장기적으로 에너지 효율이 더 높은 스마트 언더카운터 냉장고와 같은 혁신적이고 진보된 가정 및 주방 가전제품을 개발하기 위해 다양한 연구 활동과 투자를 했습니다.

미국 주거용 언더카운터 냉장고 시장의 제약/과제

- 언더카운터 냉장고의 높은 유지관리 및 서비스 비용

언더카운터 냉장고를 운영하는 데 드는 비용은 매일 얼마나 많은 전력을 소모하는지에 따라 달라집니다. 크기와 냉장고 기능 등의 요인이 사용되는 전력에 영향을 미치지만, 비용의 상당 부분은 미니 냉장고에 지출해야 하는 유지 관리 및 서비스 비용에도 따라 달라집니다. 미니 냉장고는 냉장고 내부의 냄새나 잠재적인 박테리아 증식을 처리하기 위해 일주일에 한 번 청소해야 합니다.

- 폐기물 및 가스 재활용의 어려움

전자제품 제조 과정에서 발생하는 폐기물과 금속으로 만든 중고 전자제품에서 발생하는 폐기물은 환경에 더 큰 피해를 줍니다. 매일 산업 공정에서 많은 양의 금속이 사용되며, 언더카운터 냉장고부터 다양한 전자 소재에 이르기까지 다양한 가전제품을 생산하는 데 널리 사용됩니다. 최근 들어 금속은 다양한 특성, 화학 성분, 용도를 가진 없어서는 안 될 다재다능한 제품이 되었고, 그 결과 폐기 시 문제가 발생합니다.

COVID-19는 미국 주거용 언더카운터 냉장고 시장에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 및 서비스 제공 산업에 영향을 미쳐 직장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 그러나 수요와 공급 간의 불균형과 가격에 미치는 영향은 단기적인 것으로 간주되며 이 팬데믹이 끝나면 회복될 것으로 예상됩니다. 전 세계적으로 COVID-19가 발생하여 주거용 언더카운터 냉장고에 대한 수요가 감소했습니다. 따라서 전기 제품 산업은 팬데믹 동안 많은 피해를 입었지만 주거용 언더카운터 냉장고 산업은 프랑스에서 제한이 해제됨에 따라 성장할 것으로 기대됩니다.

최근 개발 사항

- 2021년 5월, Whirlpool Corporation은 미국 제조 역량을 더욱 강화하고 이 지역에 더 많은 혁신, 최고 순위의 소비자 제품 및 고품질 일자리를 제공하기 위한 회사의 지속적인 노력의 일환으로 오클라호마주 털사에 있는 자사 공장에 1,500만 달러를 투자한다고 발표했습니다. 투자와 관련하여 Whirlpool Corporation은 Business Expansion Investment Program(BEIP)을 통해 오클라호마주에서 추가로 100만 달러를 지원받을 예정입니다.

- 리프헤어는 2021년 3월, 새로운 HydroBreeze 기능을 탑재한 차세대 냉장 가전제품에 기술 혁신, 에너지 효율성, 지능형 기능에 중점을 둔 완전 통합형 가전제품의 새로운 라인을 출시했습니다.

미국 주거용 언더카운터 냉장고 시장 범위

주거용 언더카운터 냉장고 시장은 제품, 힌지, 용량, 크기, 도어 소재, 온도 조절 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 언더카운터 음료 냉장고

- 언더카운터 냉장고 서랍

- 언더카운터 냉장고 냉동고

미국 주택용 언더카운터 냉장고 시장은 제품을 기준으로 언더카운터 음료 냉장고, 언더카운터 냉장고 서랍, 언더카운터 냉장고 냉동고로 구분됩니다.

돌쩌귀

- 오른쪽 힌지

- 왼쪽 힌지

미국 주택용 언더카운터 냉장고 시장은 힌지를 기준으로 오른쪽 힌지와 왼쪽 힌지로 구분됩니다.

용량

- 100리터 미만

- 101 ~ 200리터

- 기타

미국 주택용 언더카운터 냉장고 시장은 용량을 기준으로 100L 미만, 101~200L 및 기타로 구분됩니다.

크기

- 15인치

- 24 인치

- 34인치

미국 주택용 언더카운터 냉장고 시장은 크기에 따라 15인치, 24인치, 34인치로 구분됩니다.

문 소재

- 유리

- 스테인리스 스틸

미국 주택용 언더카운터 냉장고 시장은 도어 소재를 기준으로 유리와 스테인리스 스틸로 구분됩니다.

온도 조절

- 자동화됨

- 수동

온도 제어를 기준으로, 미국 주거용 언더카운터 냉장고 시장은 자동식과 수동식으로 구분됩니다.

유통 채널

- 슈퍼마켓/하이퍼마켓

- 전자제품 및 가전제품 매장

- 전자상거래

- 기타

미국 주거용 언더카운터 냉장고 시장은 유통 채널을 기준으로 슈퍼마켓/하이퍼마켓, 전자제품 및 가전제품 매장, 전자상거래 및 기타로 구분됩니다.

경쟁 환경 및 주거용 언더카운터 냉장고 시장 점유율 분석

미국 주거용 언더카운터 냉장고 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 미국 내 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 있습니다. 위에 제공된 데이터 포인트는 주거용 언더카운터 냉장고 시장과 관련된 회사의 초점에만 관련이 있습니다.

미국 주거용 언더카운터 냉장고 시장에 참여하는 주요 기업으로는 LIEBHERR, True Manufacturing Co., Inc., Summit Appliance(FELIX STORCH, INC.의 브랜드), The Middleby Corporation, Perlick Corporation, Whirlpool Corporation, Haier Group, Danby, Smeg SpA, Sub-Zero Group, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT CATEGORY LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 IMPORT-EXPORT DATA

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VENDOR SELECTION CRITERIA

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRICING ANALYSIS

4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 REGULATION COVERAGE

4.6 PESTEL ANALYSIS

4.6.1 OVERVIEW

4.6.2 POLITICAL FACTORS

4.6.3 ENVIRONMENTAL FACTORS

4.6.4 SOCIAL FACTORS

4.6.5 TECHNOLOGICAL FACTORS

4.6.6 ECONOMICAL FACTORS

4.6.7 LEGAL FACTORS

4.6.8 CONCLUSION

4.7 CONSUMER BEHAVIOR ANALYSIS

4.7.1 OVERVIEW

4.7.2 CONSUMER TRENDS AND PREFERENCES

4.7.3 FACTORS AFFECTING BUYING DECISION

4.7.3.1 PURCHASING POWER

4.7.3.2 MARKETING

4.7.3.3 SOCIAL FACTORS

4.7.3.4 PSYCHOLOGICAL FACTORS

4.7.3.5 ECONOMIC CONDITIONS

4.7.3.6 CONSUMER'S EXPERIENCE

4.7.3.7 PURCHASE DECISION AND WILLINGNESS TO PAY

4.7.4 CONSUMER PRODUCT ADOPTION

4.7.4.1 PERSONAL INFLUENCE

4.7.4.2 PRODUCT INNOVATION CHARACTERISTICS

4.7.4.3 WILLINGNESS TO EMBRACE NEW PRODUCTS

4.7.4.4 CONCLUSION

4.8 COUNTRY ANALYSIS (2021-22)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN CONSUMPTION OF FROZEN FOOD AND BEVERAGE PRODUCTS

5.1.2 THE GROWING TREND OF LIVING AS A NUCLEAR FAMILY

5.1.3 POSITIVE OUTLOOK TOWARD THE SMART HOME CONCEPT

5.2 RESTRAINT

5.2.1 HIGH MAINTENANCE AND SERVICE COST OF UNDERCOUNTER REFRIGERATORS

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES TOWARD ENERGY-EFFICIENT HOME APPLIANCES

5.3.2 GROWING NUMBER OF EMERGING ELECTRONIC BRANDS WITH NEW TECHNOLOGIES

5.4 CHALLENGE

5.4.1 DIFFICULTIES IN RECYCLING OF WASTE MATERIALS AND GAS

6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 UNDERCOUNTER BEVERAGE REFRIGERATOR

6.3 UNDERCOUNTER REFRIGERATOR-FREEZER

6.4 UNDER-COUNTER REFRIGERATOR DRAWER

7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY HINGE

7.1 OVERVIEW

7.2 RIGHT HINGE

7.3 LEFT HINGE

8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY CAPACITY

8.1 OVERVIEW

8.2 101 TO 200 LITERS

8.3 LESS THAN 100 LITERS

8.4 OTHERS

9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY SIZE

9.1 OVERVIEW

9.2 24 INCH

9.3 15 INCH

9.4 34 INCH

10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DOOR MATERIAL

10.1 OVERVIEW

10.2 STAINLESS STEEL

10.3 GLASS

11 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY TEMPERATURE CONTROL

11.1 OVERVIEW

11.2 AUTOMATED

11.3 MANUAL

12 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 ELECTRONIC AND APPLIANCE STORE

12.3 SUPERMARKETS/HYPERMARKETS

12.4 E-COMMERCE

12.5 OTHERS

13 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.1.1 MERGER & ACQUISITION

13.1.2 EXPANSIONS AND PARTNERSHIP

13.1.3 NEW PRODUCT DEVELOPMENT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 THE MIDDLEBY CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 SUB-ZERO GROUP, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT UPDATES

15.3 WHIRLPOOL CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 DANBY

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT UPDATES

15.5 HAIER GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 LIEBHERR

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 PERLICK CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT UPDATES

15.8 SMEG S.P.A

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATES

15.9 SUMMIT APPLIANCE (BRAND OF FELIX STORCH, INC.)

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 TRUE MANUFACTURING CO., INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF HOUSEHOLD REFRIGERATORS, COMPRESSION-TYPE; HS CODE - 841821 (USD THOUSAND)

TABLE 2 EXPORT DATA OF HOUSEHOLD REFRIGERATORS, COMPRESSION-TYPE; HS CODE - 841821 (USD THOUSAND)

TABLE 3 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 5 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY HINGE, 2020-2029 (USD THOUSAND)

TABLE 6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DOOR MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY TEMPERATURE CONTROL, 2020-2029 (USD THOUSAND)

TABLE 10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: SEGMENTATION

FIGURE 2 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DATA TRIANGULATION

FIGURE 3 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DROC ANALYSIS

FIGURE 4 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: HINGE LIFE LINE CURVE

FIGURE 7 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: CHALLENGE MATRIX

FIGURE 11 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: SEGMENTATION

FIGURE 13 INCREASE IN CONSUMPTION OF FROZEN FOOD AND BEVERAGE PRODUCTS IS EXPECTED TO DRIVE THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 UNDERCOUNTER BEVERAGE REFRIGERATOR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET IN 2022 & 2029

FIGURE 15 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: PESTEL ANALYSIS

FIGURE 16 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: FACTORS AFFECTING BUYING DYNAMICS OF THE CONSUMERS

FIGURE 17 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: PRODUCT ADOPTION SCENARIO

FIGURE 18 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF THE U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET

FIGURE 19 SMART HOMES CONNECTIONS IN U.S. (MILLIONS)

FIGURE 20 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY PRODUCT, 2021

FIGURE 21 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY HINGE, 2021

FIGURE 22 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY CAPACITY, 2021

FIGURE 23 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY SIZE, 2021

FIGURE 24 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY DOOR MATERIAL, 2021

FIGURE 25 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY TEMPERATURE CONTROL, 2021

FIGURE 26 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 U.S. RESIDENTIAL UNDERCOUNTER REFRIGERATORS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.