Us Office Household Supplies Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

9.74 Billion

USD

11.35 Billion

2024

2032

USD

9.74 Billion

USD

11.35 Billion

2024

2032

| 2025 –2032 | |

| USD 9.74 Billion | |

| USD 11.35 Billion | |

|

|

|

U.S. Office/Household Supplies Market Segmentation, By Product (Luggage/Backpacks, Lunch Box, Teaching Supplies, Calculators, Scissors, Clips, Cash Registers, Signs, and Others), Price Range (Mid Range, Economy, Premium, and Luxury), Distribution Channel (Retail and Direct) – Industry Trends and Forecast to 2031.

Office/Household Supplies Market Analysis

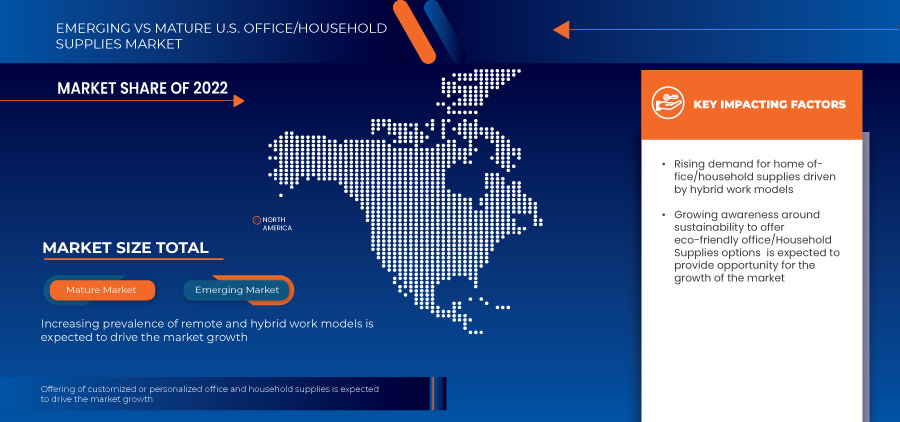

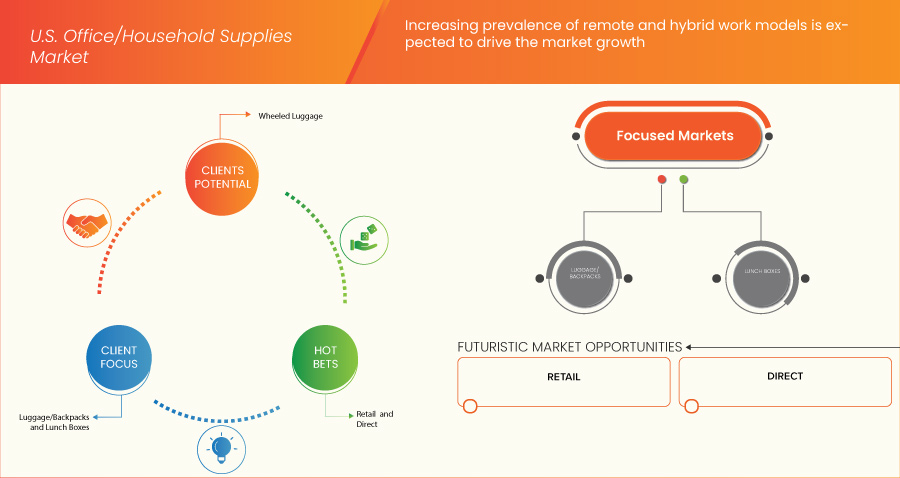

The increasing prevalence of remote and hybrid work models has significantly impacted the U.S. office and household supplies market, particularly in categories such as luggage, backpacks, lunch boxes, teaching supplies, calculators, and cash registers. This shift in work dynamics has spurred notable changes in consumer behavior and demand across these sectors.

The rise in remote and hybrid work has led to a surge in the need for practical and efficient home office setups. As many employees work from home or split their time between home and the office, there is a growing demand for office supplies that enhance productivity and comfort. Luggage and backpacks have seen increased demand as professionals seek versatile and durable options for commuting between their home and office spaces. These products have evolved to include features like padded compartments for laptops and organizational pockets, catering to the needs of today’s hybrid workers.

Office/Household Supplies Market Size

Data Bridge Market Research analyses that the U.S. office/household supplies market size was valued at 9.74 billion in 2024 and is projected to reach USD 11.14 billion by 2031, with a CAGR of 2.03% during the forecast period of 2025 to 2031.

Office/Household Supplies Market Trends

“Growing Consumer Awareness Regarding Environmental Sustainability”

The growing consumer awareness regarding environmental sustainability is increasingly driving demand for eco-friendly office and household supplies in the U.S. market. This shift reflects a broader societal trend where consumers are making more conscientious choices about the products they purchase, including those used daily in both personal and professional settings. This heightened environmental consciousness is influencing various categories, including luggage, backpacks, lunch boxes, teaching supplies, calculators, and cash registers.

In the realm of luggage and backpacks, there is a noticeable trend towards eco-friendly materials. Consumers are now favoring products made from recycled plastics, organic cotton, and many other sustainable materials. These environmentally conscious choices are not only driven by a desire to reduce waste but also by a preference for brands that align with sustainable practices. As people increasingly look for ways to minimize their carbon footprint, eco-friendly luggage and backpacks have become popular for their reduced environmental impact and durability, driving growth in the US Office/Household Supplies market.

Report Scope and Market Segmentation

|

Attributes |

Office/Household Supplies Key Market Insights |

|

Segments Covered |

By Product: (Luggage/Backpacks, Lunch Box, Teaching Supplies, Calculators, Scissors, Clips, Cash Registers, Signs, and Others), By Price Range: Economy, Mid, Range, Premium, and Luxury By Distribution Channel: Retail and Direct |

|

Countries Covered |

U.S. |

|

Key Market Players |

Canon U.S.A., Inc. (U.S.), sharpcalculators (U.S.), CITIZEN SYSTEMS JAPAN CO., LTD. (Japan), Samsonite IP Holdings S.àr.l (Luxembourg), Nike, Inc (U.S.), Adidas (Germany), VF Corporation (U.S.), Etienne Aigner AG (Germany), Antler USA (U.S.), Bric's industria valigeria fine spa (Italy), DELSEY PARIS (U.S.), United States Luggage Company, LLC. (U.S.), MCM Worldwide (Germany), Zojirushi America Corporation (Japan), Travelpro Products, Inc (U.S.), Targus. (U.S.), Valigeria Roncato S.p.a (Italy), Osprey (U.S.), Bentology (U.S.), CASIO Computer Co., Ltd (Japan), LVMH (France), PackIt (U.S.), Thermos L.L.C. (U.S.), OmieLife (U.S.), GlassLock (Germany), monbento (France), EKOBO USA (U.S.), TUPPERWARE (Dart Industries Inc.) (U.S.), California Pak, LLC. (U.S.), Herschel Supply Company (Canada), Texas Instruments Incorporated (U.S.), HP Development Company, L.P. (U.S.), Bentgo. A Bear Down Brands, LLC. (U.S.), and Planet Box. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Office/Household Supplies Market Definition

The U.S. office/household supplies market encompasses products used for both professional and personal settings, including items such as stationery, writing instruments, cleaning supplies, and organizational tools. This market serves a wide range of consumers, from businesses requiring bulk supplies for operations to households needing essential items for daily tasks. It includes traditional office supplies like paper, pens, and file organizers, as well as household products like cleaning agents and kitchen tools. Driven by factors such as workplace trends, technological advancements, and consumer preferences, this market reflects the evolving needs and demands of both commercial and domestic environments.

Office/Household Supplies Market Dynamics

Drivers

- Integration of Smart Technologies into Office and Household Supplies

The integration of smart technologies into office and household supplies is revolutionizing the way consumers interact with everyday products, driving significant growth in the U.S. market. As consumers increasingly demand convenience, efficiency, and connectivity, manufacturers are responding by embedding advanced technologies into traditional products, transforming them into multifunctional tools that enhance productivity and organization.

In the luggage and backpacks sector, smart technology integration has led to the development of products equipped with features like GPS tracking, built-in charging ports, and RFID-blocking compartments. These innovations cater to the needs of modern travelers and professionals who require secure and efficient ways to manage their belongings while on the go. The ability to charge devices, track lost items, and protect personal information from digital theft has made smart luggage and backpacks highly desirable, especially in a fast-paced, tech-driven world.

Similarly, the lunch box market is experiencing a shift towards smart solutions that offer more than just food storage. Smart lunch boxes now come with temperature control features, allowing users to keep their meals warm or cold for extended periods. Some models are even equipped with app connectivity, enabling users to monitor food freshness and receive alerts when it's time to eat. These advancements are particularly appealing to health-conscious consumers who prioritize fresh, well-preserved meals throughout their busy day

For instance,

- In October 2023, according to blog of business tech weekly, the future of work is being transformed by smart offices. These innovative workspaces utilize advanced technology such as IoT devices, automated systems, and AI to enhance productivity, improve comfort, and streamline operations. The shift towards smart offices promises a more efficient and flexible work environment, aligning with evolving business needs

Offering of Customized or Personalized Office and Household Supplies

The U.S. office and home supplies market is experiencing significant growth, driven by the increasing demand for customized and personalized products. In today’s consumer-centric market, individuals and businesses are seeking products that reflect their unique identities, needs, and preferences. This trend is especially noticeable in categories like luggage and backpacks, lunch boxes, teaching supplies, and calculators, where customization not only improves functionality but also provides a personal touch that appeals to consumers.

In the realm of luggage and backpacks, personalization has become a key differentiator. Consumers are no longer satisfied with generic designs; they seek products that can be customized with their initials, favorite colors, or unique patterns. This trend is especially prominent among younger consumers and professionals who view their backpacks and luggage as extensions of their personal style. The ability to choose specific features, such as the number of compartments or the type of material, further enhances the appeal of these products. Brands that offer customization options are thus able to cater to a broader audience, driving sales and fostering brand loyalty.

For instance,

- In June 2023, PackIt introduced a new line of freezable lunch boxes just in time for Back-to-School season. These Playtime Lunch Boxes feature a kid-friendly design with a rounded shape and bright colors, catering specifically to preschoolers. Eco-friendly and reusable, they combine fun and functionality, reflecting the growing trend towards personalized, practical products in the lunch box market

Opportunities

- Rapidly Growing E-Commerce Industry

The rapidly growing e-commerce industry presents substantial opportunities for the U.S. office and household supplies market, the expansion of online retail platforms offers numerous benefits, including broader market reach, enhanced consumer convenience, and innovative sales strategies.

Teaching supplies benefit significantly from the growth of e-commerce. Online stores provide educators, schools, and parents with convenient access to a wide range of educational materials and tools. E-commerce platforms allow suppliers to offer bulk purchasing options, subscription services, and easy reordering, making it simpler for educational institutions to maintain stock and manage budgets. The ability to reach a broader audience also allows for the introduction of innovative educational products and resources that might not be available locally.

For calculators, e-commerce offers an opportunity to showcase advanced features and applications that might not be well-understood in physical stores. Detailed online product listings can highlight unique functionalities and educational benefits, helping consumers and institutions select the right calculators for their needs. The ability to easily compare models and prices also helps buyers make informed choices.

금전 등록기도 마찬가지로 전자상거래의 영향을 받는데, 디지털 및 모바일 POS 시스템의 성장으로 온라인 판매에 새로운 기회가 창출되기 때문입니다. 전자상거래 플랫폼을 통해 공급업체는 하드웨어, 소프트웨어 및 통합 서비스를 포함한 포괄적인 POS 솔루션을 제공할 수 있습니다. 이러한 접근 방식은 기업이 현대 소매 환경에 적응하도록 지원하고 효율적으로 거래를 처리하는 능력을 향상시킵니다.

예를 들어,

- 2024년 7월, 미국 전자상거래 수익은 90,069백만 달러에 도달하여 2024년 6월 대비 5.9% 증가했습니다. 지난해 12월 2023년 총 수익의 10.1%로 가장 높은 월 수익 점유율을 기록한 반면, 2024년 2월 2024년 총 수익의 7.4%로 가장 낮은 점유율을 기록했습니다.

소규모 및 재택 사업의 성장

소규모 및 재택 사업의 성장은 미국 사무용품 및 가정용품 시장에 상당한 기회를 제공합니다. 기업가 정신과 원격 근무의 증가에 의해 주도되는 이 급성장하는 부문은 여행 가방, 백팩, 도시락, 교육용품, 계산기, 금전 등록기 등 여러 범주에 걸쳐 새로운 수요를 창출합니다.

짐과 백팩의 경우, 소규모 및 재택 사업의 확장으로 실용적이고 세련된 여행 솔루션에 대한 필요성이 커졌습니다. 기업가와 원격 근무자는 종종 출장, 일상 통근, 가정과 사무실 간 이동을 위해 고품질의 다재다능한 짐과 백팩이 필요합니다. 이 성장하는 시장 부문은 역동적인 작업 환경에 맞는 내구성 있고 기능적인 제품이 필요한 전문가에 의해 주도됩니다. 제조업체와 소매업체는 소규모 사업주와 프리랜서의 요구 사항에 맞게 노트북 친화적인 칸막이와 인체공학적 기능과 같은 특수 디자인을 제공하여 이러한 수요를 활용할 수 있습니다.

소규모 및 재택 사업의 성장은 교육 용품 수요에도 긍정적인 영향을 미칩니다. 더 많은 사람들이 교육, 워크숍 또는 온라인 교육과 관련된 사업을 시작함에 따라 교육 자료와 리소스에 대한 수요가 증가하고 있습니다. 여기에는 화이트보드와 마커에서 디지털 도구와 교육 키트에 이르기까지 모든 것이 포함됩니다. 교육 용품 공급업체는 다양한 교육 방법과 학습 환경을 지원하는 제품을 제공하여 이 시장에 진출할 수 있으며, 교육 세션이나 교육 프로그램을 진행하는 기업가의 고유한 요구 사항을 충족할 수 있습니다.

금전 등록기는 소규모 및 재택 사업의 성장에 의해 비슷하게 영향을 받습니다. 재택에서 소매 또는 서비스 지향 사업을 시작하는 기업가에게는 효율적인 POS 시스템이 필요합니다. 전자 상거래 플랫폼과 소규모 소매 운영에는 종종 작고 저렴하며 사용하기 쉬운 금전 등록기 또는 디지털 지불 시스템이 필요합니다. 제조업체는 다른 비즈니스 도구와 완벽하게 통합되고 성장하는 운영에 확장성을 제공하는 솔루션을 제공하여 이러한 추세를 활용할 수 있습니다.

예를 들어,

- kmaland에 따르면 전국의 중소기업이 인상적인 성장을 경험하고 있습니다. 이 보고서는 지역 기업가 정신의 급증과 시장 기회의 증가를 강조하며, 국가 경제에 크게 기여하는 활기차고 확장 중인 중소기업 부문을 반영합니다.

제약/도전

- 원자재 비용 상승

원자재 가격 상승은 미국 사무용 및 가정용품 시장에 상당한 제약으로 작용하며, 비용 증가는 제조업체와 소비자 모두에게 어려움을 안겨주어 가격 책정, 생산 전략, 시장 역학에 영향을 미칩니다.

교육용품의 경우, 종이, 잉크, 플라스틱과 같은 원자재 가격 상승은 필수 교육 도구의 구매 가능성과 가용성에 영향을 미칩니다. 종종 예산이 부족한 학교와 교육자는 재정적 제약을 초과하지 않고 필요한 용품을 조달하는 데 어려움을 겪을 수 있습니다. 이러한 상황은 학생과 교육 기관의 비용을 증가시켜 잠재적으로 교육의 질과 용품 접근성에 영향을 미칠 수 있습니다.

계산기와 금전 등록기도 원자재 가격 상승의 영향을 받습니다. 전자 부품, 플라스틱, 금속을 포함한 이러한 기기에 사용되는 구성 요소의 가격이 상당히 상승했습니다. 계산기의 경우, 이는 소매 가격 상승으로 이어질 수 있으며, 이는 소비자와 기관의 구매 결정에 영향을 미칠 수 있습니다. 특히 기업에서 사용하는 금전 등록기의 경우, 비용 상승은 POS 시스템의 전체 예산에 영향을 미쳐 장비 업그레이드 또는 유지 관리와 관련된 선택에 영향을 미칠 수 있습니다.

예를 들어,

- CCI가 게시한 블로그에 따르면, 2023년 6월 글로벌 비즈니스 환경은 불확실성이 높아지고 있으며, 제조업체들은 수많은 어려움에 직면해 있습니다. 높은 에너지 가격과 예측할 수 없는 원자재 비용 변동으로 인해 상당한 장애물이 생겨 생산 안정성과 비용 관리에 영향을 미치고 있습니다.

플라스틱 및 기타 폐기물 감소를 목표로 한 엄격한 환경 규정

플라스틱 및 기타 폐기물을 줄이기 위한 엄격한 환경 규정은 미국 사무용품 및 가정용품 시장에 상당한 과제를 안겨줍니다. 규제 프레임워크가 더욱 엄격해짐에 따라 제조업체와 소매업체는 진화하는 소비자 기대에 부응하는 동시에 복잡한 규정 준수 요구 사항을 탐색해야 합니다.

도시락 상자 카테고리도 비슷한 과제에 직면해 있습니다. 일회용 플라스틱과 재활용 불가능한 재료는 규제 압력이 증가하고 있으며, 이는 보다 지속 가능한 옵션으로의 전환을 촉진합니다. 규제로 인해 제조업체는 스테인리스 스틸, 대나무, 실리콘과 같은 재료를 채택해야 하는데, 이는 환경적 영향은 적지만 생산 비용은 증가할 수 있습니다. 또한 회사는 제품이 환경 친화적일 뿐만 아니라 안전 및 내구성 표준을 충족해야 하며, 규정 준수 노력에 또 다른 복잡성이 추가됩니다.

전통적으로 플라스틱과 전자 부품으로 만든 계산기는 전자 폐기물과 플라스틱 사용과 관련된 규제 문제에 직면해 있습니다. 규제는 환경 영향을 최소화하는 설계를 추진하고 있으며, 여기에는 재활용 가능한 재료를 사용하고 재활용 불가능한 부품의 사용을 줄이는 것이 포함될 수 있습니다. 제조업체는 또한 전자 폐기물의 폐기 및 재활용을 해결하여 제품이 수명 주기 내내 환경 기준을 충족하도록 해야 합니다. 이는 회사가 규정을 준수하고 지속 가능한 제품을 만들기 위해 노력함에 따라 연구 개발 비용이 증가할 수 있습니다.

예를 들어,

- 바이든-해리스 행정부는 미국 환경 보호청(EPA)에서 자세히 설명한 대로 전국적으로 플라스틱 오염에 맞서기 위한 새로운 조치를 발표했습니다. 이러한 조치는 강화된 규정, 재활용 이니셔티브 증가, 지속 가능한 대안에 대한 지원을 통해 플라스틱 폐기물을 크게 줄이는 것을 목표로 하며, 환경 보호 노력에 있어 중요한 진전을 나타냅니다.

원자재 부족 및 운송 지연의 영향 및 현재 시장 시나리오

Data Bridge Market Research는 시장에 대한 고수준 분석을 제공하고 원자재 부족과 운송 지연의 영향과 현재 시장 환경을 고려하여 정보를 제공합니다. 이는 전략적 가능성을 평가하고, 효과적인 행동 계획을 수립하고, 기업이 중요한 결정을 내리는 데 도움을 주는 것으로 해석됩니다.

표준 보고서 외에도 예상 배송 지연 등의 조달 수준에 대한 심층 분석, 지역별 유통업체 매핑, 상품 분석, 생산 분석, 가격 매핑 추세, 소싱, 카테고리 성과 분석, 공급망 위험 관리 솔루션, 고급 벤치마킹 및 조달 및 전략적 지원을 위한 기타 서비스를 제공합니다.

경제 침체가 제품 가격 및 가용성에 미치는 영향 예상

경제 활동이 둔화되면 산업이 어려움을 겪기 시작합니다. 경기 침체가 제품의 가격 책정 및 접근성에 미치는 예상 효과는 DBMR에서 제공하는 시장 통찰력 보고서 및 인텔리전스 서비스에서 고려됩니다. 이를 통해 고객은 일반적으로 경쟁사보다 한 발 앞서 나가고, 매출과 수익을 예측하고, 손익 지출을 추정할 수 있습니다.

미국 사무/가정용품 시장 범위

시장은 제품, 가격 범위, 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 짐/배낭

- 도시락

- 교육용품

- 계산기

- 가위

- 클립

- 금전등록기

- 손짓

- 기타

- 짐/배낭, 제품별

- 캐리온 스타일

- 휠러드 러기지

- 체크된 가방

- 바퀴 달린 배낭

- 휠드 더플백

- 스타일, 제품별로 계속

- 업라이트 스피너

- 배낭

- 주말

- 서류가방/ 서류가방

- 메신저 백

- 핸드백

- 학생 가방

- 가먼트백

- 체크된 가방, 제품별

- 대형 스피너

- 더플백

- 롤링백

- 대형 의류 가방

- 트렁크

- 핸드백

- 배낭

- 기타

- 휠 달린 배낭, 제품별

- 롤링 러기지

- 기타

- 짐/배낭, 목적별

- 여행 짐

- 캐주얼 러기지

- 스포츠 짐

- 기타

- 스포츠 짐, 용도별

- 훈련 및 체육관

- 농구

- 축구

- 기타

- 가방/배낭, 가격대별

- 중간

- 낮은

- 높은

- 가방/배낭, 원단별

- 겉감

- 안감 원단

- 폼 안정제

- 대조적인 원단

- 기타

- 짐/배낭, 종류별

- 패딩 탑

- 패딩 없음

- 짐/배낭, 색상별

- 검은색

- 회색

- 파란색

- 갈색

- 녹색

- 빨간색

- 주황색

- 하얀색

- 보라

- 기타

- 짐/배낭, 사용자별

- 남녀공용

- 남성

- 여성

- 도시락, 원료별

- 플라스틱

- 스테인리스 스틸

- BPA 프리

- 유리

- 알류미늄

- 세라믹

- 나무상자

- 종이 벤또 박스

- 플라스틱, 원료별

- 전자레인지 사용 가능

- 전통적인

- 도시락, 기능별

- 누수 방지

- 전자레인지 사용 가능

- 절연

- 전기 같은

- 처분

- 도시락, 최종 용도별

- 성인

- 어린이

- 성인, 최종 사용 기준

- 30-45세

- 18-30세

- 45-60세

- 60년

- 계산기, 카테고리별

- 재정적인

- 기초적인

- 과학적

- 인쇄

- 그래프화

- 기타

- 짐/배낭, 제품별

가격 범위

- 중간 범위

- 경제

- 프리미엄

- 사치

유통 채널

- 소매

- 직접

- 소매, 유통 채널별

- 온라인

- 오프라인

- 온라인, 유통 채널별

- 제3자 웹사이트

- 회사 소유

- 오프라인, 유통 채널별

- 전문점

- 슈퍼마켓과 하이퍼마켓

- 기타

- 유통 채널별 전문 매장

- 멀티 브랜드

- 모노 브랜드

- 소매, 유통 채널별

미국 사무/가정용품 시장 점유율

시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 미국 내 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 시장과 관련된 회사의 초점에만 관련이 있습니다.

시장에서 운영되는 리더는 다음과 같습니다.

- 캐논 USA, Inc. (미국)

- sharpcalculators (미국)

- CITIZEN SYSTEMS JAPAN CO., LTD. (일본)

- Samsonite IP Holdings S.àr.l(룩셈부르크)

- 나이키 주식회사(미국)

- 아디다스(독일)

- VF 코퍼레이션(미국)

- 에티엔 아이그너 AG(독일)

- 앤틀러 USA (미국)

- 브릭스 인더스트리아 발리게리아 파인 스파(이탈리아)

- 델시 파리(미국)

- United States Luggage Company, LLC. (미국)

- MCM 월드와이드(독일)

- Zojirushi America Corporation(일본)

- Travelpro Products, Inc (미국)

- 타르거스(미국)

- 발리게리아 론카토 스파(이탈리아)

- 오스프리(미국)

- 벤톨로지(미국)

- CASIO Computer Co., Ltd (일본)

- LVMH(프랑스)

- 팩잇(미국)

- Thermos LLC(미국)

- 오미라이프(미국)

- GlassLock(독일)

- 몬벤토(프랑스)

- 에코보 USA(미국)

- 터퍼웨어(Dart Industries Inc.) (미국)

- 캘리포니아 팩, LLC. (미국)

- Herschel Supply Company(캐나다)

- Texas Instruments Incorporated (미국)

- HP 개발 회사, LP(미국)

- Bentgo. A Bear Down Brands, LLC. (미국)

- 플래닛박스(미국)

사무/가정용품 시장의 최신 동향

- In August 2024, HP Renew Solutions honored with the OEM Circular Innovation Award at the ITAD Summit 2024. This accolade underscores HP's commitment to sustainable practices, enhancing brand reputation and reinforcing leadership in environmental responsibility

- In June 2023, PackIt introduced a new line of freezable lunch boxes just in time for the Back-to-School season, specifically designed for preschoolers. The Playtime Lunch Boxes feature a new rounded shape and vibrant, kid-friendly designs that cater to young children with big personalities. These lunch boxes are both eco-friendly and reusable, offering a fun and functional way to keep food organized and fresh for hours. This latest innovation by PackIt reflects the company's commitment to creating practical, stylish, and sustainable products, perfectly timed to help families prepare for the new school year

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.