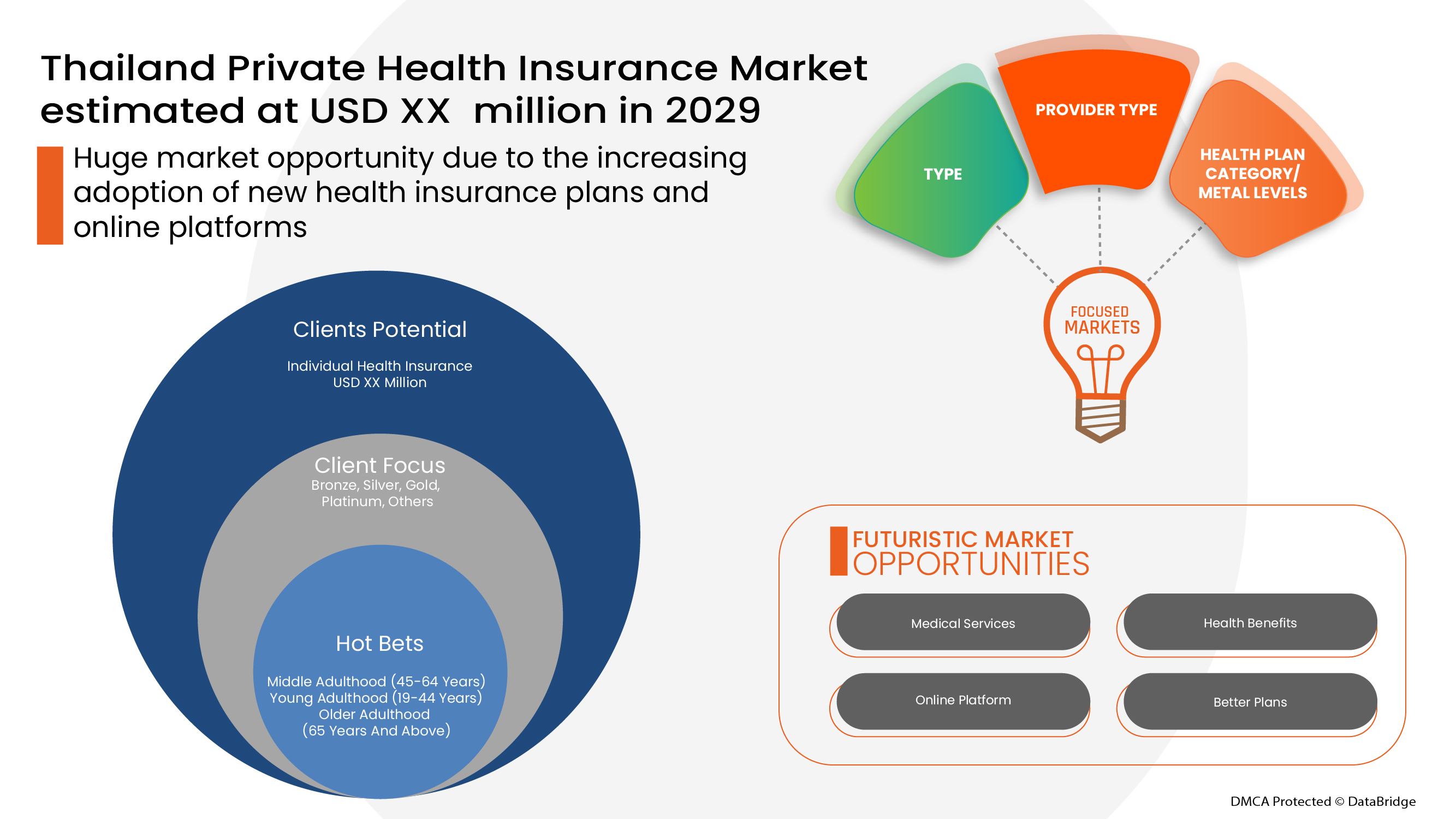

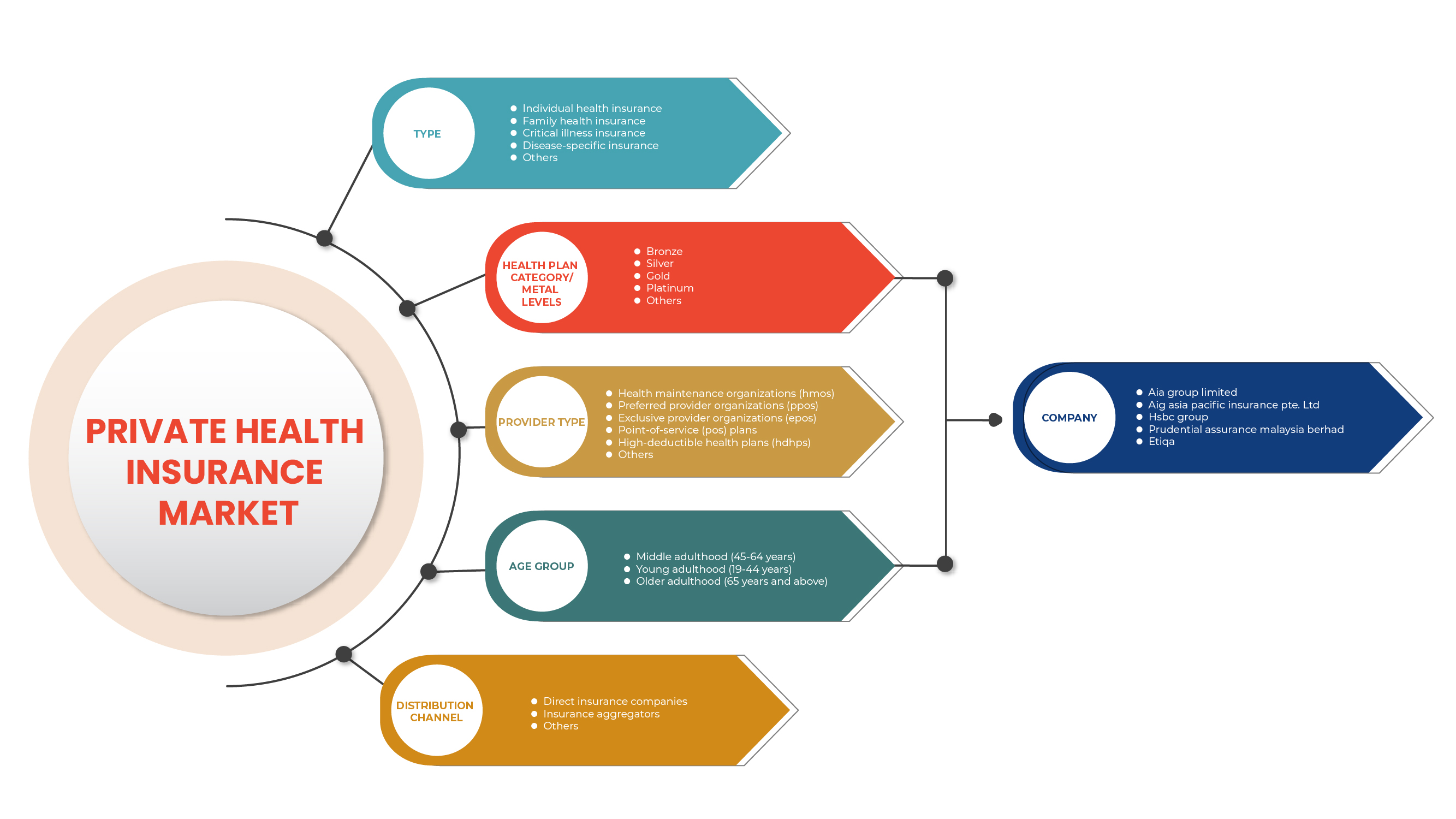

태국 민간 건강 보험 시장, 유형별(중증 질환 보험, 개인 건강 보험, 가족 건강 보험, 질병별 보험 및 기타), 건강 보험 범주/메탈 레벨(브론즈, 실버, 골드 플래티넘 및 기타), 공급자 유형(건강 유지 기관(HMOS), 우선 공급자 기관(PPOS), 전속 공급자 기관(EPOS), 서비스 시점(POS) 플랜, 고가 공제 건강 보험(HDHPS) 및 기타), 연령대(청년기(19~44세), 중년기(45~64세), 노년기(65세 이상)), 유통 채널(직접 보험 회사, 보험 통합업체 및 기타) 산업 동향 및 2029년까지의 예측.

시장 분석 및 규모

건강 보험 정책은 여러 유형의 특징과 혜택으로 구성되어 있습니다. 특정 치료에 대한 보험 계약자에게 재정적 보장을 제공하고, 무현금 입원, 입원 전후 보장, 환불 및 다양한 추가 혜택을 포함한 이점을 제공하는 건강 보험 정책입니다.

건강 보험 플랜에는 현금이 필요 없는 또는 환불 청구인 여러 유형의 보장이 있습니다. 현금이 필요 없는 혜택은 보험 계약자가 보험 회사의 네트워크 병원에서 치료를 받을 때 제공됩니다. 보험 계약자가 목록에 없는 병원에서 치료를 받는 경우, 보험 계약자는 모든 의료비를 지불한 다음 모든 의료비를 제출하여 보험 회사에 환불을 청구합니다.

이러한 개인 건강 보험은 보험자가 치료를 위해 입원할 때 모든 의료비를 보장하므로 보험자에게 재정적 지원을 제공합니다. Data Bridge Market Research는 개인 건강 보험 시장이 예측 기간 동안 2.1%의 CAGR로 2029년까지 4,831.07백만 달러에 도달할 것으로 분석했습니다. "개인 건강 보험"은 개인 건강 보험의 증가로 인해 해당 시장에서 가장 눈에 띄는 유형 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 기후 사슬 시나리오가 포함되어 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

유형별(중증질환보험, 개인건강보험, 가족건강보험, 질병특화보험 등), 건강보험 종류/메탈레벨(브론즈, 실버, 골드플래티넘 등), 제공자 유형(건강유지기관(HMOS), 우선제공기관(PPOS), 독점제공기관(EPOS), 서비스지점(POS) 계획, 고가공제 건강보험(HDHPS) 등), 연령대(청년기(19~44세), 중년기(45~64세), 노년기(65세 이상)), 유통채널(직접보험사, 보험대리점 등) |

|

적용 국가 |

태국 |

|

시장 참여자 포함 |

Aetna Inc. (CVS Health의 자회사) (미국), Cigna (미국), AIA Group Limited (홍콩), Allianz (독일), HSBC Group (홍콩), Pacific Cross (필리핀), Great Eastern Holdings Limited (말레이시아), ASSICURAZIONI GENERALI SPA (이탈리아), AXA (프랑스), Income (호주) |

시장 정의

건강 보험은 모든 유형의 수술 비용과 질병이나 부상으로 인한 치료 비용을 보장하는 보험 유형입니다. 건강 보험은 포괄적이거나 제한된 범위의 의료 서비스에 적용되며 특정 서비스의 전체 또는 부분 비용을 보장합니다. 건강 보험은 보험자가 치료를 위해 입원할 때 모든 의료 비용을 보장하므로 보험자에게 재정적 지원을 제공합니다. 건강 보험은 입원 전과 입원 후 비용도 보장합니다.

규제 프레임워크

태국의 보험 규정에 따라 재무부(OIC)의 감독 하에 보험 위원회 사무국이 규제하며 보험사, 중개인 및 대리점을 규제합니다.

재무부는 승인(궁극적으로 장관 재량에 따라 발급)을 신청할 때 충족해야 하는 요건을 명시한 통지문을 발행하여 >49%의 외국 주식 보유를 허용했습니다. 여기에는 다음이 포함됩니다. (i) 충분한 자본 적정 비율 입증; (ii) 보험 회사 또는 보험 산업의 안정성을 증진하기 위한 사업 계획 수립; (iii) 제안된 외국 주주의 최소 자격 증명(산업 경험 및 재무 상태 포함) 확립. 모든 승인은 또한 규정된 최소 자본 요건(비생명보험사의 경우 10억 바트, 생명보험사의 경우 40억 바트), 특정 상황에서 대다수 외국 주주의 후속 주식 양도에 대한 사전 장관 승인 요건, 대다수 외국 주주가 둘 이상의 생명보험 또는 비생명보험에 가입하도록 하는 사전 장관 승인 요건, 장관이 적합하다고 판단하는 기타 조건의 적용을 받습니다.

COVID-19는 민간 건강 보험 시장 에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 및 서비스 제공 산업에 영향을 미쳐 직장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 그러나 수요와 공급 간의 불균형과 가격에 미치는 영향은 단기적인 것으로 간주되며 이 팬데믹이 끝나면서 회복될 것으로 예상됩니다. 전 세계적으로 COVID-19가 발생하여 개인 건강 보험에 대한 수요가 엄청나게 증가했습니다. 또한 팬데믹에 대한 두려움과 의료 서비스 비용 증가로 인해 팬데믹 동안 건강 보험 시장이 성장했습니다. 또한 건강 보험 회사는 COVID-19에 감염된 보험사를 치료하는 데 드는 의료비를 충당하기 위한 패키지와 솔루션을 도입했습니다 . 따라서 다른 산업이 COVID-19 발생 동안 많은 피해를 입었음에도 불구하고 개인 건강 보험 산업은 상당히 성장했습니다.

개인 건강 보험 시장의 시장 역학은 다음과 같습니다.

개인 건강 보험 시장의 동인/기회

- 의료 서비스 비용 증가

건강 보험은 심각한 질병이나 사고의 경우 재정적 지원을 제공합니다. 수술 및 입원에 대한 의료 서비스 비용의 증가는 전 세계적으로 새로운 재정적 전염병을 만들어냈습니다. 의료 서비스 비용은 수술 비용, 의사 수수료, 입원 비용, 응급실 비용, 진단 검사 비용 등으로 구성됩니다. 따라서 의료 서비스 비용의 증가는 시장 성장을 촉진합니다.

- 증가하는 보육 절차 수

데이케어 시술은 주로 병원에 머무는 시간이 적게 필요한 의료 시술 또는 수술 유형입니다. 데이케어 시술을 받는 환자는 단기간 병원에 머물러야 합니다. 대부분의 건강 보험 회사는 현재 보험 플랜에서 데이케어 시술을 보장하고 있으며, 이러한 유형의 수술을 청구할 때 보험을 청구하기 위한 최소 병원 체류 시간인 24시간을 병원에서 보내야 할 의무가 없습니다. 대부분의 건강 보험 플랜은 병원 체류와 대수술을 보장하지만, 보험 가입자는 건강 보험 정책에 따라 데이케어 시술을 청구할 수도 있어 시장 수요가 촉진됩니다.

- 공공 및 민간 부문에서 건강 보험 선택은 필수

건강 보험 정책을 구매하는 것은 공공 부문과 민간 부문의 직원에게 의무적인 조항입니다. 건강 보험은 직원이 기업에서 일하는 동안 이용할 수 있는 주요 의료 혜택을 제공합니다. 응급 상황이나 의료 문제가 발생하는 경우 건강 보험 범위는 치료 비용을 충당하는 데 매우 유용합니다. 직원의 건강 보험은 개별 고용주가 직원에게 제공하는 확장된 혜택입니다 . 제공되는 건강 보험은 직원뿐만 아니라 동일한 정책 계획에 따라 가족 구성원도 포함합니다. 또한 특정 경우에 고용주가 건강 보험 정책의 보험료 또는 보험 범위의 일부를 지불할 수 있습니다.

- 노령인구 증가

노령층은 노화와 면역 체계 약화로 인해 더 아프거나 건강 문제가 생길 가능성이 높습니다. 치과 문제, 심장 문제, 암 문제 및 말기 질환과 같은 건강 문제입니다. 좋은 노인 건강 보험은 노인들이 미래의 재정적 걱정을 줄이기 위해 좋은 건강 보험 서비스를 선택하는 데 도움이 될 수 있습니다. 따라서 노령 인구의 증가는 건강 보험 시장에 대한 수요를 증가시킬 수 있습니다.

- 건강보험의 혜택에 대한 인식 증가

의료 비상 상황에 직면했을 때, 건강 보험은 소비자가 건강 보험을 통해 의료비와 관련된 스트레스를 잊고 치료에 집중할 수 있도록 해줍니다. 의료 비상 상황은 현재 건강 상태나 규율 있는 라이프스타일과 관계없이 언제든지 발생할 수 있습니다. 따라서 특히 집에 노부모가 있는 경우 감염이나 기타 질병에 더 취약하므로 예상치 못한 의료 상황을 대비하고 가족과 자신을 보호하는 것이 중요합니다.

민간 건강 보험 시장이 직면한 제약/과제

- 높은 보험료 비용

건강 보험은 모든 유형의 치료 비용을 보장합니다. 보험자가 치료를 위해 입원할 때 모든 의료비를 보장하므로 보험자에게 재정적 지원을 제공합니다. 건강 보험은 입원 전과 입원 후 비용도 보장합니다. 건강 보험을 구매하려면 보험자가 건강 보험 정책을 활성화하기 위해 정기적으로 보험료를 지불해야 합니다. 대부분의 경우 보험 플랜에 따라 보험료 비용이 높아 시장 성장을 방해하고 있습니다.

- 건강보험에 대한 인식 부족

의료 분야에서 세계 인구의 상당수는 여전히 건강 보험 정책의 이점을 알지 못합니다. 의료 비용은 전 세계적으로 증가하고 있으며 이 분야의 발전이 이루어지고 있습니다. 기술의 발전을 통해 의료 분야는 성장하는 부문 중 하나이지만 건강 보험 정책의 보급률은 건강 보험 정책이 제공하는 이점에 대한 인식 부족으로 인해 낮은 수준을 유지하고 있습니다.

이 개인 건강 보험 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 주머니, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 개인 건강 보험 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드릴 것입니다.

최근 개발 사항

- 2022년 3월, 세계 최대 규모의 부동산 투자 관리자 중 하나인 Allianz Real Estate는 Allianz Real Estate Asia-Pacific Japan Multi-Family Fund를 대신하여 도쿄의 주요 멀티패밀리 주거 자산 포트폴리오를 약 9,000만 달러에 인수하기로 계약을 체결했습니다. 이를 통해 회사는 장기적으로 더 많은 수익을 창출할 수 있었습니다.

- 2020년 3월, Aetna Inc.는 유럽, 중동 및 아프리카의 중소기업 고용주 플랜 스폰서가 Summit 그룹 건강 보험 정책을 2020년 5월 1일부터 2020년 7월 1일 또는 그 이전에 갱신하면 COVID-19 팬데믹으로 인해 고객이 겪고 있는 재정적 및 기타 압박을 완화하기 위한 Aetna의 지속적인 노력의 일환으로 1개월 동안 무료 건강 보험을 제공한다고 발표했습니다. 이러한 발전으로 회사는 많은 충성 고객을 확보할 수 있었습니다.

태국 민간 건강 보험 시장 범위

민간 건강 보험 시장은 유형, 건강 보험 범주/메탈 수준, 제공자 유형, 연령대 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 중증질환보험

- 개인 건강 보험

- 가족 건강 보험

- 질병별 보험

- 기타

시장은 유형을 기준으로 중증질환 보험, 개인 건강보험, 가족 건강보험, 질병별 보험 등으로 구분됩니다.

건강 계획 범주/금속 수준

- 청동

- 은

- 금

- 백금

- 기타

건강 보험 범주/메탈 수준을 기준으로 시장은 청동, 실버, 골드 플래티넘 및 기타로 구분됩니다.

제공자 유형

- 건강 유지 기관(HMOS)

- 선호 공급자 조직(PPOS)

- 독점 공급자 조직(EPOS)

- POS(Point-of-Service) 계획

- 고가공제 건강보험(HDHPS)

- 기타

공급자 유형을 기준으로 시장은 건강 유지 기관(HMOS), 우선 공급자 기관(PPOS), 독점 공급자 기관(EPOS), 서비스 시점(POS) 플랜, 고액 공제 건강 플랜(HDHPS) 및 기타로 구분됩니다.

연령대

- 청년기(19-44세)

- 중년기(45-64세)

- 노년기(65세 이상)

연령대를 기준으로 보면 시장은 청년기(19~44세), 중년기(45~64세), 노년기(65세 이상)로 구분됩니다.

유통 채널

- 직접 보험 회사

- 보험 통합업체

- 기타

유통 채널을 기준으로 보면 시장은 직접 보험회사, 보험 대행사 등으로 세분화됩니다.

경쟁 환경 및 개인 건강 보험 시장 점유율 분석

개인 건강 보험 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 태국 현존, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 개인 건강 보험 시장과 관련된 회사의 초점에만 관련이 있습니다.

민간 건강보험 시장의 주요 기업으로는 Aetna Inc. (CVS Health의 자회사) (미국), Cigna (미국), AIA Group Limited (홍콩), Allianz (독일), HSBC Group (홍콩), Pacific Cross (필리핀), Great Eastern Holdings Limited (말레이시아), ASSICURAZIONI GENERALI SPA (이탈리아), AXA (프랑스), Income (호주) 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THAILAND PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 AGE GROUP LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET- PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SOUTH EAST ASIA INSURANCE SCENARIO VS GLOBAL

4.4 CUSTOMIZED DELIVERABLE

4.4.1 HOW ARE INSURANCE CLAIMS EVALUATED (I.E., PROCESS FOR FILING FROM HOSPITALS, PHYSICIAN JUSTIFICATION)

4.4.2 DATA INTERPRETATION

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS:-

5.1.1 AGE

5.1.2 GENDER

5.1.3 OCCUPATION

5.1.4 FAMILY SIZE

5.2 NUMBER OF CLAIMS BY TYPE

5.2.1 CASHLESS VS. REIMBURSEMENT CLAIMS

5.3 EXTRA CARE/TOP-UP INSURANCE OFFERINGS BY COMPANIES

5.4 INVESTMENT & FUNDING

5.5 PENETRATION OF PRIVATE INSURANCE & DENSITY

5.6 INTERVIEWS WITH KEY HOSPITALS AND INSURANCE COMPANIES

5.7 POLICY SUPPORT FOR LIFE INSURANCE IN SOUTH EAST ASIA

5.7.1 MALAYSIA

5.7.2 PHILIPPINES

5.7.3 THAILAND

5.7.4 VIETNAM

5.8 PUBLIC VS PRIVATE HEALTH INSURANCE

5.9 OTHER KOL SNAPSHOTS

5.1 PREMIUM/COPAY/COINSURANCE

6 REGULATORY FRAMWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING COST FOR MEDICAL SERVICES

7.1.2 GROWING NUMBER OF DAY CARE PROCEDURES

7.1.3 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR

7.1.4 INCREASING OLD AGE POPULATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF PREMIUM

7.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS ABOUT THE BENEFITS OF HEALTH INSURANCE

7.3.2 INCREASING HEALTH CARE EXPENDITURE

7.3.3 GROWING MEDICAL TOURISM AMONG COUNTRIES

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS REGARDING HEALTH INSURANCE

8 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 INDIVIDUAL HEALTH INSURANCE

8.3 FAMILY HEALTH INSURANCE

8.4 CRITICAL ILLNESS INSURANCE

8.5 DISEASE-SPECIFIC INSURANCE

8.6 OTHERS

9 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

9.6 OTHERS

10 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

10.1 OVERVIEW

10.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

10.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

10.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

10.5 POINT-OF-SERVICE (POS) PLANS

10.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

10.7 OTHERS

11 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 MIDDLE ADULTHOOD (45-64 YEARS)

11.3 YOUNG ADULTHOOD (19-44 YEARS)

11.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

12 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT INSURANCE COMPANIES

12.3 INSURANCE AGGREGATORS

12.4 OTHERS

13 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY

13.1 THAILAND

14 THAILAND PRIVATE HEALTH INSURANCE THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: THAILAND

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CIGNA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 AIA GROUP LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATE

16.4 HCF

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 ALLIANZ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SUNCORP GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 MEDIBANK PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DAI-ICHI LIFE VIETNAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 HSBC GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATE

16.1 ACCURO HEALTH INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 AIG ASIA PACIFIC INSURANCE PTE. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 ASSICURANZIONI GENERALI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 FINANCIAL ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 AXA

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATE

16.14 BNI LIFE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 BUPA GLOBAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 ETIQA

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 GREAT EASTERN HOLDINGS LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 HONG LEONG ASSURANCE BERHAD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 INCOME

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 MANULIFE HOLDINGS BERHAD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

16.21 NIB NZ LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATE

16.22 NOW HEALTH INTERNATIONAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PACIFIC CROSS

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT UPDATE

16.24 PARTNERS LIFE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT UPDATES

16.25 PRUDENTIAL ASSURANCE MALAYSIA BERHAD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT UPDATE

16.26 RAFFLES MEDICAL GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT UPDATE

16.27 SOUTHERN CROSS

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 THE ROYAL AUTOMOBILE CLUB OF WA (INC.).

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT UPDATES

16.29 TOKIO MARINE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT UPDATE

16.3 UNIMED

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 ZURICH

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

표 목록

TABLE 1 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY AGE GROUP, MILLION, 2021

TABLE 2 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY INSURANCE COMPANY, MILLION, 2021

TABLE 3 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY PROVIDER TYPE, MILLION, 2021

TABLE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 5 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 6 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 7 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 8 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 9 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 10 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 11 DETAILS OF CIGNA OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 12 DETAILS OF CIGNA OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 13 DETAILS OF CIGNA OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 14 DETAILS OF CIGNA OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 15 DETAILS OF CIGNA OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 16 DETAILS OF CIGNA OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 17 DETAILS OF AIA GROUP LIMITED OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 18 DETAILS OF AIA GROUP LIMITED OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 19 DETAILS OF AIA GROUP LIMITED OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 20 DETAILS OF AIA GROUP LIMITED OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 21 DETAILS OF AIA GROUP LIMITED OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 22 DETAILS OF AIA GROUP LIMITED OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 23 CHIEF MEDICAL OFFICER

TABLE 24 LIST OF DAY CARE PROCEDURES

TABLE 25 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 27 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 28 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 29 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 32 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 33 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 34 THAILAND PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 THAILAND PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 THAILAND PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 THAILAND PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 THAILAND PRIVATE HEALTH INSURANCE MARKET: THAILAND VS. REGIONAL MARKET ANALYSIS

FIGURE 5 THAILAND PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THAILAND PRIVATE HEALTH INSURANCE MARKET: THE AGE GROUP LIFE LINE CURVE

FIGURE 7 THAILAND PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 THAILAND PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 THAILAND PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 THAILAND PRIVATE HEALTH INSURANCE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 THAILAND PRIVATE HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 THAILAND PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR IS DRIVING THE THAILAND PRIVATE HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 INDIVIDUAL HEALTH INSURANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE THAILAND PRIVATE HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET: PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THAILAND PRIVATE HEALTH INSURANCE MARKET

FIGURE 17 HEALTHCARE EXPENDITURE IN MALAYSIA, (RM MILLION)

FIGURE 18 MALAYSIA REVENUE TRAVEL INDUSTRY SIZE, BY REVENUE (RM MILLION)

FIGURE 19 THAILAND PRIVATE HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 20 THAILAND PRIVATE HEALTH INSURANCE MARKET: BY HEALTH PLAN CATEGORY/METAL LEVELS, 2021

FIGURE 21 THAILAND PRIVATE HEALTH INSURANCE MARKET: BY PROVIDER TYPE, 2021

FIGURE 22 THAILAND PRIVATE HEALTH INSURANCE MARKET: BY AGE GROUP, 2021

FIGURE 23 THAILAND PRIVATE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 THAILAND PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.