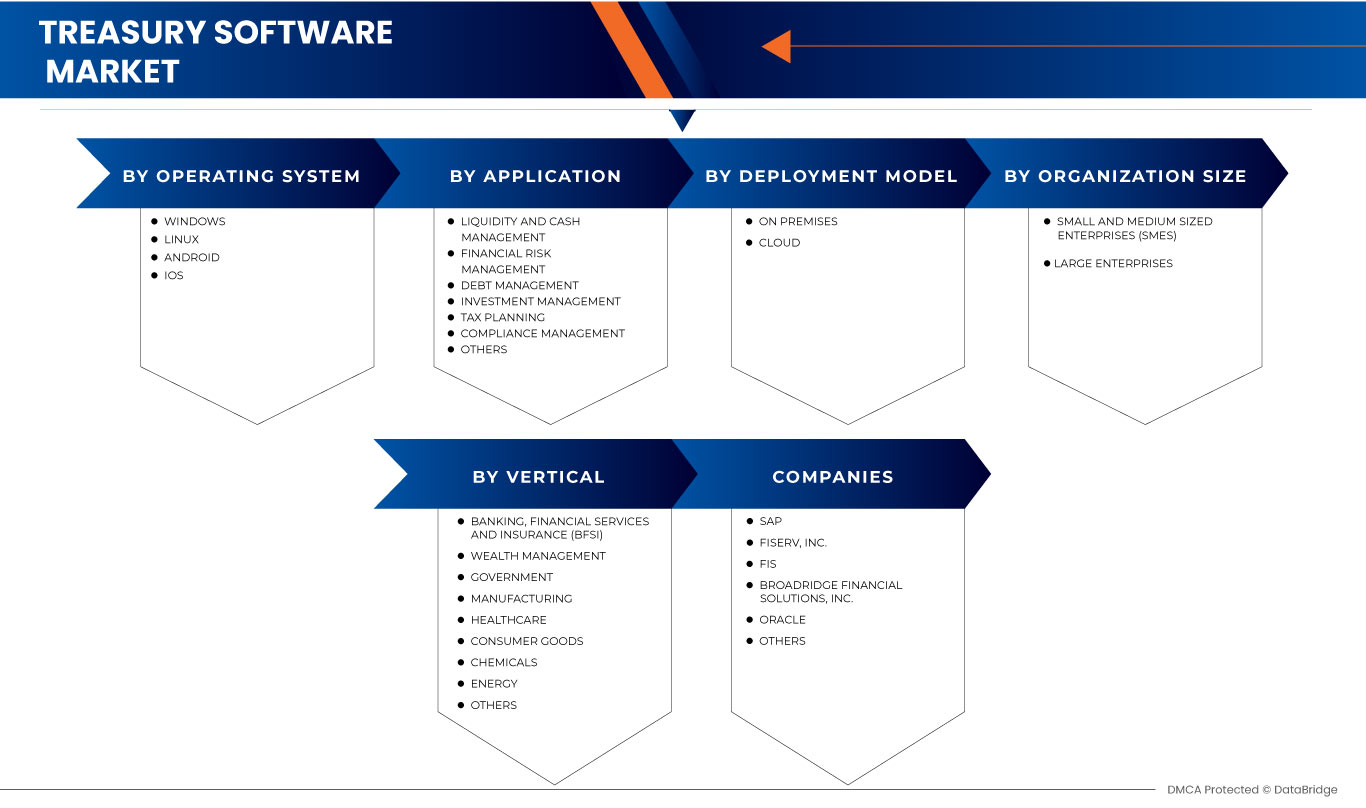

북미 재무 소프트웨어 시장, 운영 체제(Windows, Linux, IOS, Android, MAC), 애플리케이션(유동성 및 현금 관리, 투자 관리, 부채 관리, 재무 위험 관리, 규정 준수 관리, 세무 계획, 기타), 배포 모드(온프레미스, 클라우드), 조직 규모(대기업 및 중소기업), 수직(은행, 금융 서비스 및 보험, 정부, 제조, 의료, 소비재, 화학 , 에너지 및 기타) - 산업 동향 및 2030년까지의 전망.

북미 재무 소프트웨어 시장 분석 및 규모

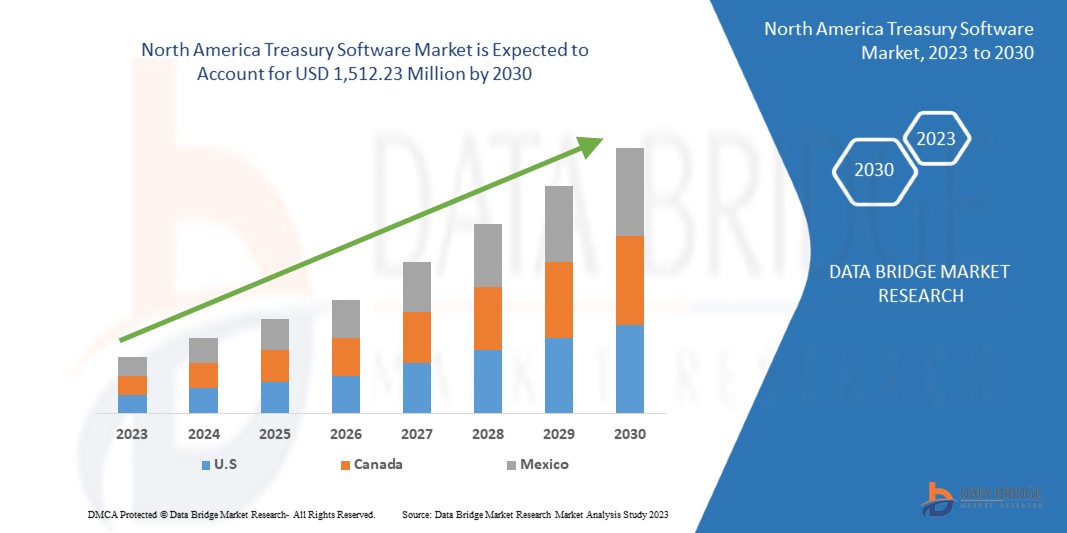

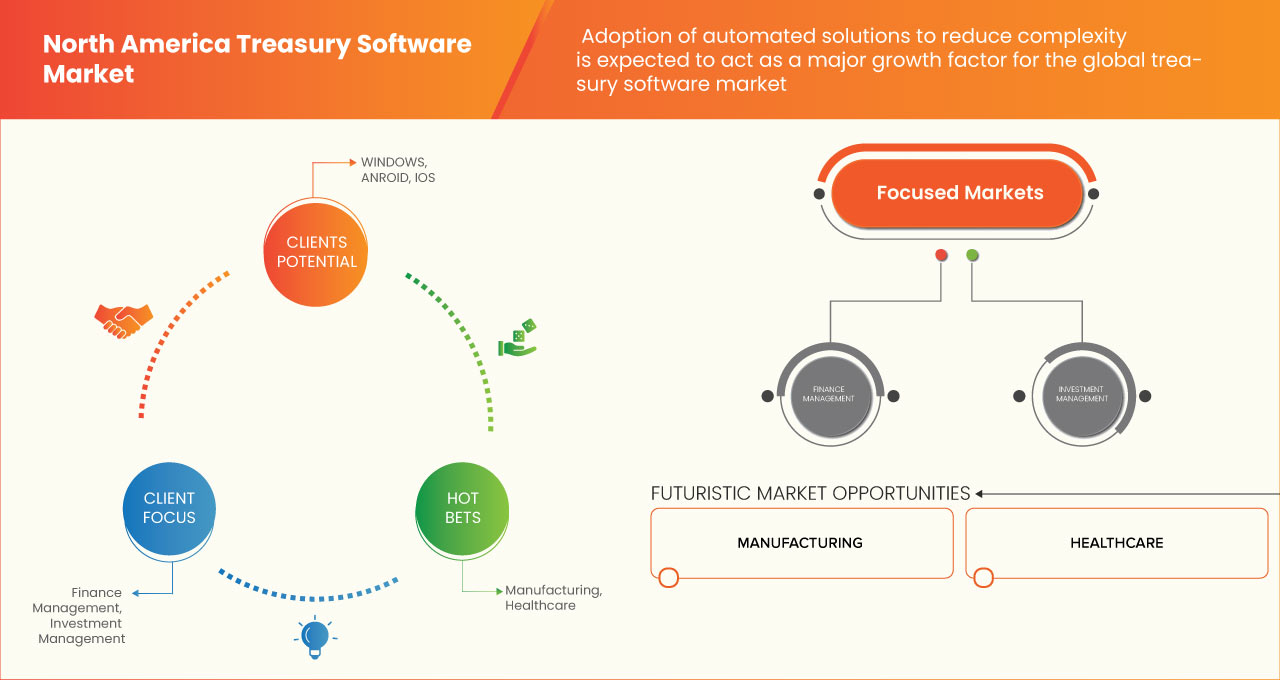

북미 재무 소프트웨어 시장은 2023년부터 2030년까지 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2023년부터 2030년까지 연평균 성장률(CAGR) 3.3%로 성장할 것으로 분석하며, 2030년까지 15억 1,223만 달러에 이를 것으로 예상합니다. 생명공학 분야에서 신속한 의사 결정 프로세스에 대한 수요 증가는 시장 성장을 크게 촉진할 것으로 예상됩니다.

북미 재무 소프트웨어 시장 보고서는 시장 점유율, 신규 개발 및 제품 파이프라인 분석, 국내 및 현지 시장 참여자의 영향, 신규 매출 창출 기회 분석, 시장 규제 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장 기술 혁신에 대한 세부 정보를 제공합니다. 분석 및 시장 시나리오를 이해하시려면 Data Bridge Market Research에 문의하여 분석 브리핑을 요청하십시오. 저희 팀은 귀사의 목표 달성을 위한 수익 창출 솔루션을 구축할 수 있도록 도와드리겠습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적인 해 |

2021 (2020-2016년으로 맞춤 설정 가능) |

|

양적 단위 |

매출은 천 달러, 가격은 달러입니다. |

|

다루는 세그먼트 |

운영 체제(Windows, Linux, IOS, Android, MAC), 애플리케이션(유동성 및 현금 관리, 투자 관리, 부채 관리, 재무 위험 관리, 규정 준수 관리, 세무 계획, 기타), 배포 모드(온프레미스, 클라우드), 조직 규모(대기업 및 중소기업), 수직 시장(은행, 금융 서비스 및 보험, 정부, 제조, 의료, 소비재, 화학, 에너지 및 기타) |

|

포함 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited(Infosys의 전액 자회사), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD 등 |

시장 정의

재무 소프트웨어는 현금 흐름, 자산, 투자 등 기업의 재무 활동을 자동화하는 애플리케이션입니다. 기업이 재무적 의무 이행을 위해 자산을 현금으로 전환하는 능력을 추적하는 재무 관리 시스템을 제공합니다. 재무 관리자와 회계 담당자는 재무 관리 소프트웨어를 사용하여 유동성과 재무적 의무 이행을 위한 자산의 현금 전환 능력을 모니터링합니다. 이 소프트웨어는 재무 관리 기능을 자동화하고 간소화하여 재무 및 평판 위험을 줄이고, 비용을 절감하며, 운영 효율성과 효과를 향상시킵니다. 재무 관리 시스템이 제공하는 향상된 가시성, 분석 및 예측 기능은 의사 결정을 개선하고 조직의 재무 전략 수립에 도움을 줍니다.

북미 재무 소프트웨어 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약, 그리고 과제를 이해하는 데 중점을 둡니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 고객 경험 향상을 위한 고급 재무 관리 시스템에 대한 수요 증가

재무 관리 시스템(TMS)은 수동 재무 프로세스를 자동화하는 데 도움이 되는 소프트웨어입니다. 현금 및 유동성에 대한 가시성을 높이고 은행 계좌를 관리하며, 규정 준수를 유지하고, 금융 거래를 관리함으로써 고객 만족도를 향상시켰습니다. 재무 관리 시스템은 기본적으로 조직의 역량을 향상시킬 수 있는 7가지 핵심 이점을 제공하며, 여기에는 다음이 포함됩니다.

- 생산성 향상

- 실시간 및 정확한 데이터 가용성

- 수동 입력 및 계산 오류 감소

- 중복된 은행 및 외환 비용을 제한합니다.

- 자세한 활동 모니터링

- 은행 및 연결성 유연성

- 규정 준수 및 위험 완화

Coupa Software Inc.에 따르면 TMS 솔루션을 도입하면 환율 변동성이 52%, 현금 흐름 및 재무 위험 노출이 43%, 현금 환수가 40%, 부적절한 재무 인프라가 30%, 북미 세금 개혁의 영향이 24%, 기존 방식으로 인한 운영 및 사기 위험이 20%, 재무 운영 비용이 12%, 기타 요소가 12% 감소하는 등 다양한 요인에 영향을 받을 수 있습니다.

- 재무 관리에 인공지능 도입 급증

최근 인공지능(AI)은 전 세계 산업의 강화와 혁신에 중요한 역할을 해왔습니다. 정부 기관, 대기업부터 소규모 온라인 기업에 이르기까지, 전 세계 여러 기관에서 다양한 플랫폼을 통해 인공지능(AI)을 활용하고 있습니다.

NewVantage가 실시한 설문조사에 따르면 2020년 상위 기업의 91.5%가 AI에 막대한 투자를 하고 있었습니다. AI에 투자한 기업들이 AI 기술을 사용하는 비율은 낮지만, 조직 내에서 AI 기술을 광범위하게 사용하는 기업은 14.6%에 불과합니다. 그중 절반 이상인 51.2%가 AI를 제한적인 생산에 적용했으며, 26.8%는 시범 운영 중입니다. 이는 AI 기술의 중요성이 커지고 있으며, 기업들의 AI 도입이 급증하고 있음을 시사합니다.

인공지능(AI)은 이미 재무 관리 분야의 현금 관리 및 예측 분야에서 놀라운 잠재력을 보여주었습니다. AI는 이전에는 인간의 개입으로만 해결될 수 있다고 여겨졌던 문제들을 해결하려고 시도합니다.

기회

- 은행 부문에서 고급 분석 솔루션의 침투

오늘날 은행들은 경쟁 우위를 확보하고 정보 및 데이터 수집을 기반으로 결론과 통찰력을 도출하기 위해 분석을 점점 더 많이 활용하고 있습니다. 고급 분석은 고객 행동과 선호도를 예측하고 위험 평가를 개선하는 데 활용될 수 있습니다. 은행 및 금융 업계에서 생성되는 데이터는 규모가 방대하여 기존 데이터베이스로는 처리하기 어려운 경우가 있습니다. 따라서 분석은 금융 업계가 한 번에 대량의 데이터를 처리할 수 있는 길을 열어주었습니다.

디지털 세계는 은행 업계에 혁명을 일으켰습니다. 대부분의 은행용 고급 분석 솔루션은 보고, 설명 분석, 예측 분석, 처방 분석의 네 가지 구성 요소로 구성됩니다. 금융 기관은 이제 고객이 지점에 방문할 때뿐만 아니라 지속적으로 고객을 타겟팅하고 참여를 유도할 수 있습니다. 이제 모바일 앱, ATM, 온라인 뱅킹 앱을 사용하는 고객까지 도달 범위에 포함됩니다. 은행은 또한 분석을 활용하여 고객의 프로필과 이력을 기반으로 맞춤형 상품, 서비스, 혜택을 제공할 수 있습니다. 더 나아가, 은행 업계의 분석은 사기를 식별하고 예방하는 데에도 도움이 됩니다. 은행은 고급 분석을 활용하여 고객의 사용 패턴을 자체 사기 지표와 비교하고 잠재적 사기 활동이 감지되면 즉시 조치를 취할 수 있습니다. 은행 업계에서 분석의 전반적인 보급률은 다른 산업에 비해 여전히 상대적으로 낮습니다. 그러나 은행 부문의 분석 보급률은 재무 소프트웨어 시장의 성장에 많은 기회를 창출하고 있습니다.

제약/도전

- 증가하는 사이버 위협과 데이터 침해

COVID-19로 인해 2020년 사이버 범죄와 사이버 보안 문제가 600% 증가했습니다. 해커는 네트워크 보안의 결함을 악용하여 시스템 내에서 무단 작업을 수행합니다.

Purple Sec LLC에 따르면, 2018년 모바일용 악성코드 변종이 54% 증가했으며, 그중 98%가 다양한 안드로이드 스마트 기기를 표적으로 삼았습니다. 25%의 기업이 크립토재킹의 피해를 입은 것으로 추정됩니다. 이러한 기업에는 은행, 다양한 기업/산업의 재무 관리팀 등이 포함됩니다.

최근 기업/산업은 디지털화를 적극적으로 도입하고 있습니다. 은행, 쇼핑, 여행 등 다양한 산업이 고객 경험 향상을 위해 디지털 모델로 전환하고 있습니다. 디지털화는 막대한 양의 고객 데이터와 정보를 생성합니다. 이는 보안 문제를 야기하며, 이러한 데이터는 사이버 공격 및 데이터 유출 위험이 항상 높아져 왔습니다. 이러한 정보와 데이터를 통해 사기꾼과 사이버 공격자는 개인의 신원을 쉽게 모방하거나 도용하여 다양한 범죄에 악용할 수 있습니다.

S&P 북미가 2016년부터 2021년까지 지난 5년간 북미에서 발생한 사이버 공격 사고의 비중을 조사한 연구에 따르면, 금융 기관이 26%로 가장 많은 사이버 보안 사고를 발생시켰고, 그 뒤를 이어 의료(11%), 소프트웨어 및 기술 서비스(7%), 소매(6%) 순으로 나타났습니다.

COVID-19 이후 북미 재무 소프트웨어 시장에 미치는 영향

COVID-19 팬데믹은 북미 재무 소프트웨어 시장에 상당한 영향을 미쳤습니다. 이 팬데믹으로 인해 북미 지역 공급망, 금융 시장, 그리고 경제 활동에 큰 차질이 발생하여 전 세계 재무부의 우선순위와 전략이 변화했습니다.

팬데믹이 재무 소프트웨어 시장에 미친 가장 큰 영향 중 하나는 클라우드 기반 솔루션에 대한 수요 증가였습니다. 팬데믹으로 인해 많은 기업이 재택근무로 빠르게 전환해야 했고, 이는 안전하고 접근성이 뛰어나며 확장 가능한 클라우드 기반 재무 솔루션의 중요성을 다시 한번 강조했습니다. 그 결과, 클라우드 기반 재무 소프트웨어 솔루션에 대한 수요가 크게 증가했습니다.

팬데믹이 재무 소프트웨어 시장에 미친 또 다른 영향은 현금 예측 및 유동성 관리에 대한 관심이 높아졌다는 것입니다. 팬데믹은 기업에 상당한 불확실성과 위험을 초래했으며, 이로 인해 정확한 현금 예측과 유동성 관리가 기업의 생존에 필수적이 되었습니다. 정확하고 실시간으로 현금 예측, 유동성 관리 및 위험 평가를 제공하는 재무 소프트웨어 솔루션의 중요성이 점점 더 커지고 있습니다.

전반적으로 COVID-19 팬데믹은 디지털 재무 솔루션 도입을 가속화하여 북미 재무 소프트웨어 시장의 상당한 성장을 이끌었습니다. 기업들이 민첩성, 복원력, 그리고 효율성을 개선하고자 노력함에 따라, 클라우드 기반 솔루션, 현금 예측 및 유동성 관리, 그리고 고급 자동화 및 통합 기능에 대한 수요는 팬데믹 이후에도 지속될 것으로 예상됩니다.

최근 개발 사항

- 2022년 3월, ZenTreasury와 현지 파트너사인 MCA는 Redington Gulf에 IFRS-16 리스 회계 소프트웨어를 제공했습니다. 이제 고객은 여러 소스에서 데이터를 가져와 여러 플랫폼에 저장할 필요가 없습니다. 모든 것이 하나의 소프트웨어로 완료됩니다.

- 2022년 9월, TIS와 Delega는 고객에게 차세대 자동화된 다중 은행 서명자 권한 관리 서비스를 제공하기 위해 협력했습니다. TIS와 Delega 고객은 이번 협약을 통해 차세대 전자 은행 계좌 관리(eBAM) 기능을 활용할 수 있습니다.

북미 재무 소프트웨어 시장 범위

북미 재무 소프트웨어 시장은 운영 체제, 애플리케이션, 배포 모델, 조직 규모 및 업종별로 세분화됩니다. 이러한 세그먼트의 성장은 업계 내 저조한 성장 세그먼트를 분석하고, 사용자에게 핵심 시장 애플리케이션을 파악하기 위한 전략적 의사 결정에 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 될 것입니다.

북미 재무부 소프트웨어 시장(운영 체제별)

- 스코틀랜드 사람

- 윈도우

- 아이오에스

- 기계적 인조 인간

- 리눅스

운영 체제를 기준으로 북미 재무 소프트웨어 시장은 윈도우, 리눅스, MAC, 안드로이드, iOS로 구분됩니다.

북미 재무부 소프트웨어 시장(응용 프로그램별)

- 유동성 및 현금 관리

- 재무 위험 관리

- 부채 관리

- 투자 관리

- 세금 계획

- 규정 준수 관리

- 기타

응용 프로그램을 기준으로 북미 재무 소프트웨어 시장은 유동성 및 현금 관리, 투자 관리, 부채 관리, 재무 위험 관리, 규정 준수 관리, 세무 계획 등으로 세분화됩니다.

배포 모델별 북미 재무부 소프트웨어 시장

- 구내

- 구름

배포 모드를 기준으로 북미 재무 소프트웨어 시장은 클라우드와 온프레미스로 구분됩니다.

북미 재무 소프트웨어 시장(조직 규모별)

- 중소기업(SME)

- 대기업

조직 규모를 기준으로 북미 재무 소프트웨어 시장은 대기업과 중소기업으로 구분됩니다.

북미 재무부 소프트웨어 시장(수직별)

- 은행, 금융 서비스 및 보험(BFSI)

- 자산 관리

- 정부

- 조작

- 헬스케어

- 소비재

- 약

- 에너지

- 기타

수직적 기준으로 북미 재무 소프트웨어 시장은 은행, 금융 서비스 및 보험(BFSI), 정부, 제조, 의료, 소비재, 화학, 에너지 및 기타로 구분됩니다.

북미 재무 소프트웨어 시장 지역 분석/통찰력

북미 재무 소프트웨어 시장을 분석하고, 위에 언급된 대로 국가, 운영 체제, 애플리케이션, 배포 모델, 조직 규모 및 수직별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 재무 소프트웨어 시장 보고서에 포함된 국가는 미국, 캐나다, 멕시코입니다.

미국은 첨단 기술의 도입률이 높고 해당 지역에 주요 기업이 많기 때문에 북미 지역을 지배할 것으로 예상됩니다.

보고서의 국가별 섹션은 현재 및 미래 시장 동향에 영향을 미치는 개별 시장 영향 요인과 시장 규제 변화도 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 동향, 포터의 5가지 경쟁 요인 분석, 사례 연구 등의 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 활용됩니다. 또한, 북미 브랜드의 존재 및 가용성, 그리고 국내 및 국내 브랜드와의 경쟁이 심화되거나 부족하여 직면하는 과제, 국내 관세 및 무역 경로의 영향 등을 고려하여 국가별 데이터를 예측 분석합니다.

경쟁 환경 및 북미 재무 소프트웨어 시장 점유율 분석

북미 재무 소프트웨어 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 여기에는 회사 개요, 회사 재무 상태, 매출 창출, 시장 잠재력, 연구 개발 투자, 신규 시장 계획, 북미 지역 사업 현황, 생산 시설 및 설비, 생산 능력, 회사의 강점과 약점, 제품 출시, 제품 종류 및 범위, 애플리케이션 지배력 등이 포함됩니다. 위에 제시된 데이터는 북미 재무 소프트웨어 시장과 관련된 해당 회사의 주요 관심 분야와 관련된 정보입니다.

북미 재무 소프트웨어 시장에서 활동하는 주요 기업으로는 Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited(Infosys의 전액 자회사), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TREASURY SOFTWARE MARKET

7 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 NORTH AMERICA TREASURY SOFTWARE MARKET , BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 U.S. TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 U.S. CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 CANADA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 CANADA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 CANADA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MEXICO TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 MEXICO TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 MEXICO TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 MEXICO CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TREASURY SOFTWARE MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 NORTH AMERICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 NORTH AMERICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 NORTH AMERICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 NORTH AMERICA TREASURY SOFTWARE MARKET : SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.