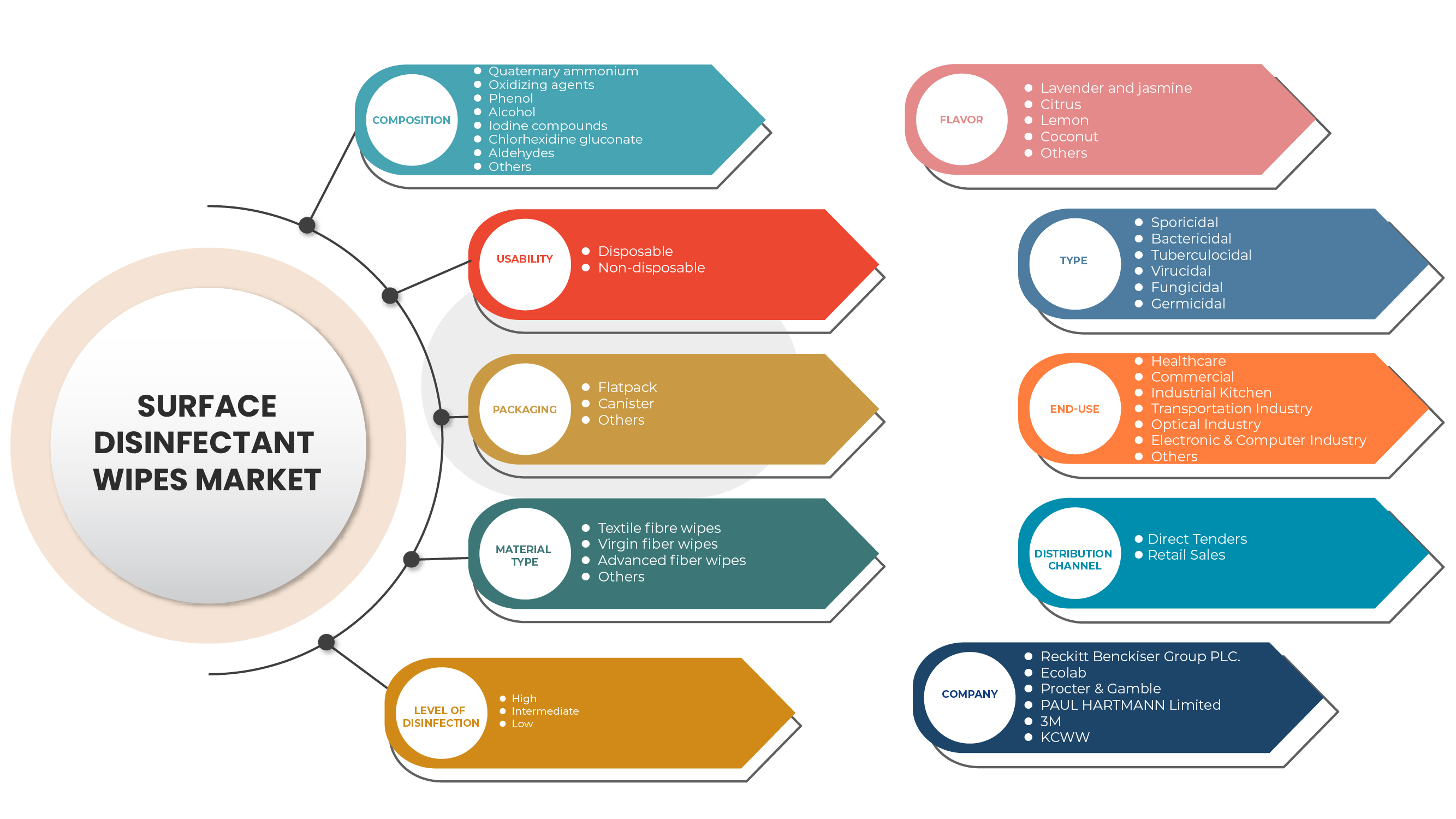

북미 표면 살균 물티슈 시장, 구성(4급 암모늄, 산화제, 페놀, 알코올, 염소 화합물, 요오드 화합물, 클로로헥시딘 글루코네이트, 알데히드 및 기타), 사용성( 일회용 및 비일회용), 포장(플랫팩, 캐니스터 및 기타), 재료 유형(섬유 섬유 물티슈, 순수 섬유 물티슈, 고급 섬유 물티슈 및 기타), 살균 수준(높음, 중간 및 낮음), 풍미(라벤더 및 재스민, 감귤, 레몬, 코코넛 및 기타), 유형(포자 살균, 살균, 결핵 살균, 살바이러스, 살균 및 살균), 최종 사용(헬스케어, 상업, 산업용 주방, 운송 산업, 광학 산업, 전자 및 컴퓨터 산업 및 기타), 유통 채널(직접 입찰 및 소매 판매), 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력

표면 감염 물티슈는 거의 모든 종류의 딱딱하고 투과성이 없는 표면을 사용하기 위해 깨끗하게 유지하고, 살균하고, 물건이나 표면을 닦는 간단한 방법을 제공하며, 문지른 영역이 건조되기 전에 약 30초 동안 축축하게 유지되도록 합니다. 선반, 기구, 싱크대, 설비(조명과 물), 문 손잡이, 출입구 손잡이, 난간, 타일, 바위, 토기 제품, 전화기, 장난감 및 콘솔은 표면 살균 물티슈를 사용하여 세척 및 살균할 수 있는 일반적인 물건이나 영역입니다.

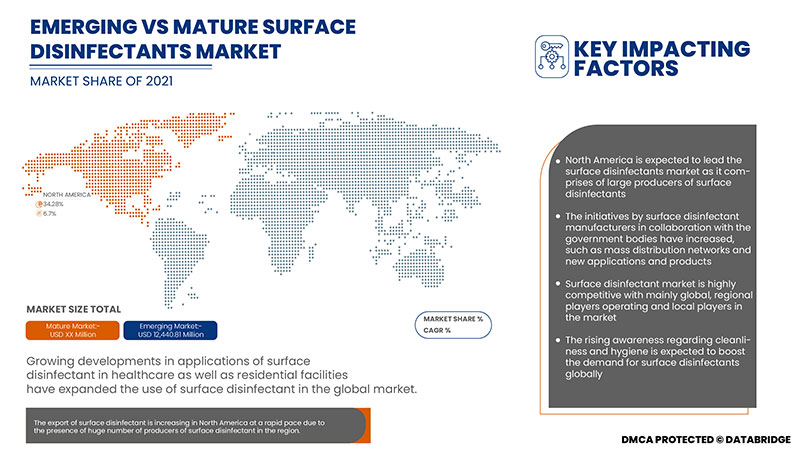

병원, F&B 부문, 기관 및 가정용 제품과 같은 상업적 분야에서 표면 소독 물티슈에 대한 수요가 증가하는 것은 표면 소독 물티슈 시장 성장을 촉진하는 주요 요인입니다.

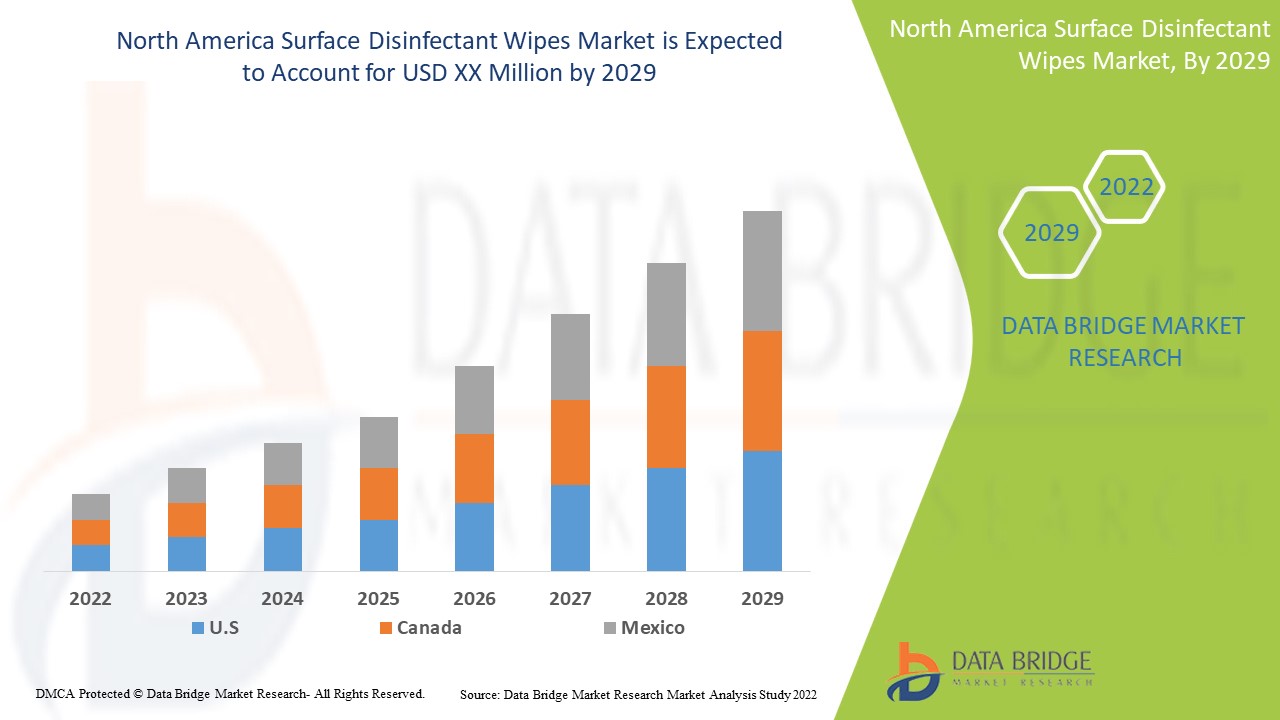

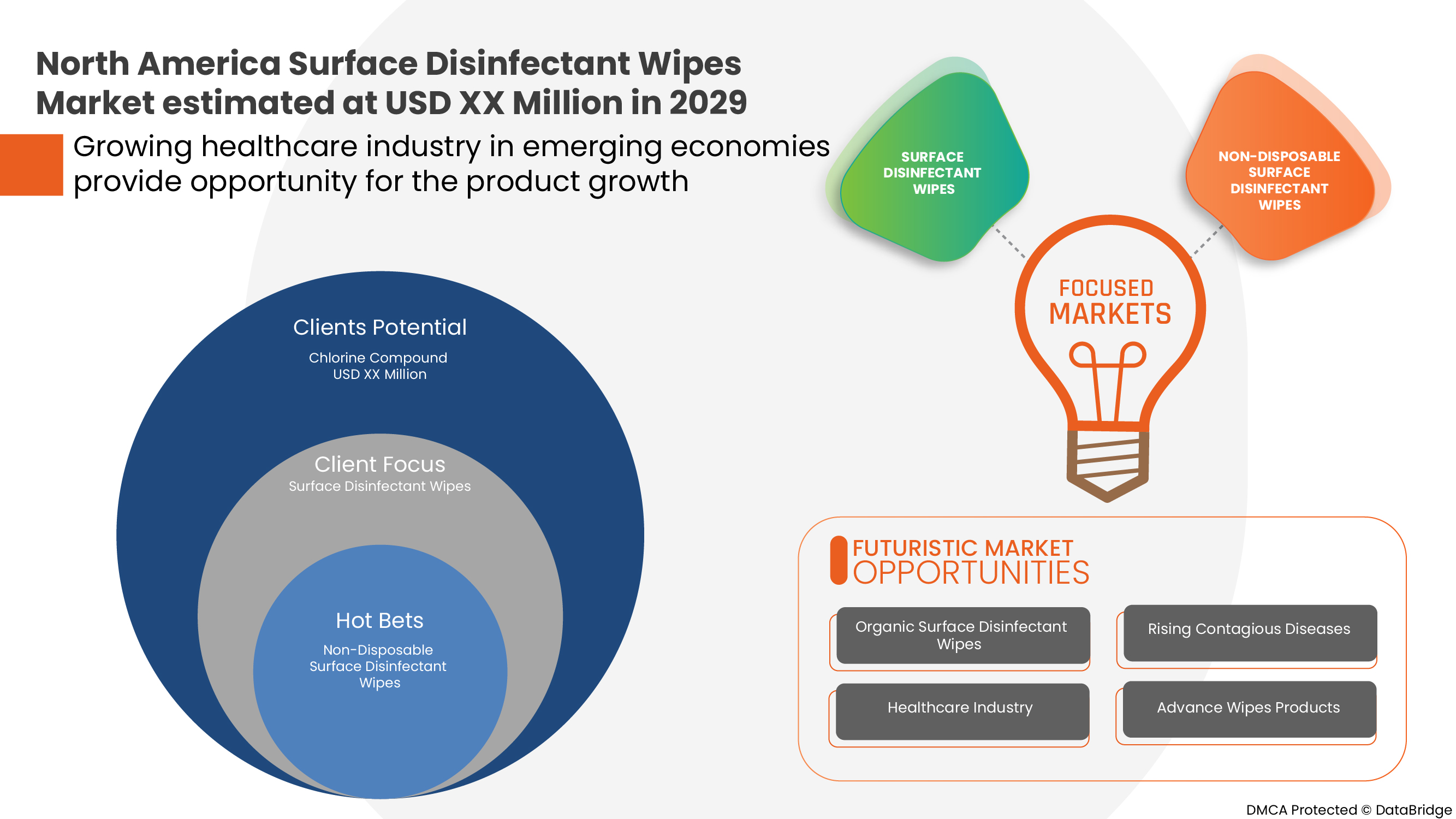

Data Bridge Market Research에 따르면 표면 살균 물티슈는 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 6.8%로 성장할 것으로 분석됩니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2020-2015까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

구성(4급 암모늄, 산화제, 페놀, 알코올, 염소 화합물, 요오드 화합물, 클로로헥시딘 글루콘산염, 알데히드 및 기타), 사용성(일회용 및 비일회용), 포장(플랫팩, 캐니스터 및 기타), 재료 유형(섬유 섬유 물티슈, 순수 섬유 물티슈, 고급 섬유 물티슈 및 기타), 소독 수준(높음, 중간 및 낮음), 풍미(라벤더 및 재스민, 감귤, 레몬, 코코넛 및 기타), 유형(포자 살균, 살균, 결핵 살균, 살바이러스, 살균 및 살균), 최종 사용(헬스케어, 상업, 산업용 주방, 운송 산업, 광학 산업, 전자 및 컴퓨터 산업 및 기타), 유통 채널(직접 입찰 및 소매 판매), 산업 동향 및 2029년까지의 예측 |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Zep Inc., Whiteley, The Claire Manufacturing Company, STERIS, Spartan Chemical Company, Inc., Seventh Generation Inc., SC Johnson & Son, Inc., Reckitt Benckiser Group PLC., Procter & Gamble, PDI, Inc., Pal International, Ecolab, 3M, Cantel Medical., Contec, Inc., Betco, CleanWell, GOJO Industries, Inc., PDI, Inc, Parker Laboratories, Inc., Metrex Research, LLC., Diversey Holdings LTD., Dreumex USA Inc., KCWW, Inc 및 Medline Industries, LP. 등이 있습니다. |

시장 정의

예를 들어, 황색포도상구균과 살모넬라균과 같은 흙과 미생물을 제거하기 위해 표면을 청소하는 데 사용되는 작고 미리 적신 수건이나 물티슈를 음식, 사람 또는 동물로부터 영향을 받은 표면에 놓았을 수 있습니다. 종종 감귤이나 소나무와 같은 기분 좋은 냄새가 나는 것을 물티슈라고 합니다.

표면 살균 물티슈는 거의 모든 종류의 딱딱하고 투과성이 없는 표면을 사용하기 위해 깨끗하게 유지하고, 살균하고, 물건이나 표면을 닦고, 문지른 영역을 약 30초 동안 축축하게 유지한 다음 건조시키는 간단한 방법을 제공합니다. 선반, 기구, 싱크대, 설비(조명과 물), 문 손잡이, 출입구 손잡이, 난간, 타일, 바위, 토기 제품, 전화기, 장난감, 콘솔은 표면 살균 물티슈를 사용하여 세척 및 살균할 수 있는 일반적인 물건이나 영역 중 일부 입니다 .

북미 표면 살균 물티슈 시장 동향

운전자

-

상업적 응용 분야에서 표면 소독 물티슈 사용 증가

표면 소독제는 소독이라는 과정을 통해 병원균 과 기타 미생물을 파괴하는 데 사용되는 화학 화합물입니다 . 표면 소독 물티슈는 박테리아, 바이러스, 곰팡이와 같은 병원균의 성장을 억제하는 데 도움이 되며, 이는 다양한 형태의 오염과 감염으로 이어집니다. 이러한 표면 소독제는 4차 암모늄 또는 콰트, 염소 화합물, 페놀 화합물 , 산화제, 알코올, 양쪽성 화합물, 심지어 이들의 조합과 같은 다양한 화학 화합물로 구성됩니다. 표면 소독 물티슈의 급증은 오염을 방지하기 위해 주택, 주방, 식품 및 농업 부문, 호텔업 등 다양한 상업적 응용 분야에서 나타납니다.

-

위생 및 예방 의료에 대한 소비자 인식 증가

대중을 민감하게 만들고 교육하는 것은 전염병과 기타 오염원의 세계적 부담을 줄이기 위한 노력의 중요한 측면입니다. 사람들이 올바른 인식을 갖게 되면 건강과 위생의 중요성을 훨씬 일찍 이해하게 되어 감염 가능성을 줄일 수 있습니다. 예방이 치료보다 낫다는 말이 있듯이, 다양한 정부 및 비정부 기관에서 위생과 예방적 건강 관리에 대한 인식을 확산하기 위해 많은 노력을 기울이고 있습니다. 따라서 위생과 예방적 건강 관리에 대한 소비자 인식이 높아짐에 따라 표면 소독 물티슈 시장 수요가 증가하고 있습니다.

-

병원 내 감염(HAI)의 높은 유병률

병원 감염(HAI)은 병원 내 감염이라고도 합니다. 이러한 감염은 일반적으로 의료 시설과 병원 등을 방문하여 발생합니다. 대부분의 사람들은 중환자실(ICU)에서 병원 내 감염에 접촉했습니다. 항생제 사용과 함께 의료 서비스가 증가함에 따라 병원 내 감염 사례가 증가하는 것으로 관찰되었습니다.

기회

-

주요 시장 참여자들의 전략

표면 소독 물티슈에 대한 수요는 위생과 예방적 건강 관리에 대한 소비자 인식이 높아짐에 따라 전 세계적으로 크게 급증했습니다. 최근 COVID-19의 팬데믹 발발로 인해 표면 소독 물티슈에 대한 글로벌 수요가 급증했습니다. 게다가 전 세계의 많은 병원에서 표면 소독 물티슈에 대한 필요성이 크게 높아졌습니다. 이러한 긍정적인 요인은 표면 소독 물티슈에 대한 수요를 높이고 있으며, 시장 수요를 달성하기 위해 소규모 및 대규모 시장 참여자는 다양한 전략을 활용하고 있습니다.

제지/도전

표면 살균 물티슈 시장의 시장 참여자들은 원자재 가격의 큰 변동 위험을 예상하는 데 어려움을 겪습니다. 원자재 가격의 증가는 종종 원자재 가격의 증가로 인해 제조가 직접적으로 방해를 받기 때문에 제품 판매에 상당한 영향을 미칩니다. 따라서 제품이나 회사의 성공은 변동하는 원자재 비용과 감염성 가격 관리로 인해 크게 위태로워집니다. 경쟁 기업은 원자재 가격의 변동에 대처하기 위해 다양한 전략을 채택하는데, 여기에는 성분을 다른 성분으로 대체하는 것도 포함됩니다.

COVID-19 이후 표면 살균 물티슈 시장 에 미치는 영향

COVID-19 팬데믹으로 인해 청결과 살균이 인간의 라이프스타일에서 가장 중요한 필수 요소가 되었습니다. 개인 위생은 COVID-19로부터 사람을 보호할 가능성을 높여서 필수적이 되었고, 좋은 습관이라기보다는 생존 전략이 되었습니다. 백신이 개발 단계에 있기 때문에 전 세계의 과학자와 연구자들은 바이러스 확산을 통제하기 위한 다양한 조치를 취하고 있습니다. 무균 환경, 표면 소독제 사용, 제품 안전 준수 등이 바이러스 확산을 방지하기 위해 채택되었습니다. 따라서 COVID-19는 소독 물티슈 시장에 대한 수요를 크게 촉진하고 있습니다.

최근 개발 사항

- 2020년 11월, The Clorox Company는 2020 회계연도 1분기 실적에서 살균 및 세척 제품을 구성하는 건강 및 웰빙 부문의 매출이 28% 증가했다고 발표했습니다. 이러한 증가는 주로 COVID-19의 출현으로 인해 건강과 위생이 중요해진 데 따른 것입니다.

- 2020년 10월, 레킷벤키저 그룹(Reckitt Benckiser Group plc)은 상반기 실적을 발표했는데, 위생 부문의 매출이 크게 증가했으며, 시장에서 다양한 살균 물티슈와 용품에 대한 수요가 증가하고 있음을 보여줍니다.

- 2020년 4월, Schülke & Mayr GmbH는 중국 상하이에 개인 관리 및 산업 위생에 중점을 둔 Schulke Chemical (Shanghai) Co, Ltd.라는 새로운 자회사를 출범했다고 발표했습니다. COVID-19 팬데믹이 발생하는 동안 회사가 개설한 이 새로운 자회사는 시장에서의 신뢰도를 높여 향후 매출과 수익 증가로 이어졌습니다.

빠르게 돌아가는 일상과 사람들의 바쁜 일정은 혁신으로 이어진다. 표면 소독 물티슈는 소독 측면에서 어떤 혁신보다 못지않다. 게다가, COVID-19의 출현은 가장 스트레스가 많은 시기에 편리한 소독에 대한 수요를 더욱 증가시켰다. 표면 소독제는 다양한 표면에 존재하는 해로운 세균, 박테리아 및 기타 병원균이나 미생물을 죽이거나 없애는 데 사용되는 항균제이므로 바닥 타일, 화장실, 가구, 의료 기구 등과 같은 표면을 소독하는 데 가장 일반적으로 사용된다.

북미 표면 살균 물티슈 시장 범위

북미 표면 살균 물티슈 시장은 구성, 사용성, 포장, 재료 유형, 살균 수준, 풍미, 유형, 최종 용도 및 유통 채널을 기준으로 9개의 주요 세그먼트로 세분화됩니다. 이러한 세그먼트 간의 성장은 주요 산업 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

구성

- 염소화합물

- 4차 암모늄

- 산화제

- 페놀

- 술

- 요오드 화합물

- 클로르헥시딘글루콘산염

- 알데히드

- 기타

구성에 따라 북미 표면 소독 물티슈 시장은 염소 화합물, 4차 암모늄, 산화제, 페놀, 알코올, 요오드 화합물, 알데히드, 클로르헥시딘 글루코네이트 및 기타로 세분화됩니다.

사용성

- 일회용의

- 일회용이 아닌

사용성을 기준으로 북미 표면 살균 물티슈 시장은 일회용과 비일회용 제품으로 구분됩니다.

포장

- 플랫팩

- 깡통

- 기타

북미 표면 살균 물티슈 시장은 포장을 기준으로 플랫팩, 캐니스터팩 및 기타 포장으로 구분됩니다.

재료 유형

- 섬유 물티슈

- 버진 파이버 와이프

- 고급 섬유 물티슈

- 기타

재료 유형을 기준으로 북미 표면 살균 물티슈 시장은 섬유 물티슈, 순수 섬유 물티슈, 고급 섬유 물티슈 등으로 구분됩니다.

소독 수준

- 높은

- 중급

- 낮은

북미 표면 소독 물티슈 시장은 소독 수준을 기준으로 높음, 중간, 낮음으로 구분됩니다.

맛

- 라벤더와 재스민

- 감귤류

- 레몬

- 코코넛

- 기타

북미 표면 소독 물티슈 시장은 풍미에 따라 라벤더와 재스민, 감귤, 레몬, 코코넛 등으로 구분됩니다.

유형

- 포자살충제

- 살균제

- 결핵살해

- 살바이러스성

- 살균제

- 살균제

북미 표면 살균 물티슈 시장은 유형에 따라 포자 살균, 살균, 결핵 살균, 바이러스 살균, 진균 살균, 살균으로 구분됩니다.

최종 사용

- 헬스케어

- 광고

- 산업용 주방

- 운송 산업

- 광학 산업

- 전자 및 컴퓨터 산업

- 기타

최종 사용 세그먼트를 기준으로 북미 표면 소독 물티슈 시장은 의료, 상업, 산업용 주방, 운송 산업, 광학 산업, 전자 및 컴퓨터 산업 등으로 세분화됩니다.

유통 채널

- 직접 입찰

- 소매 판매

유통 채널을 기준으로 북미 표면 소독 물티슈 시장은 직접 입찰과 소매 판매로 구분됩니다.

북미 표면 살균 물티슈 시장 지역 분석/통찰력

북미 표면 살균 물티슈 시장을 분석하고, 구성, 사용성, 포장, 재료 유형, 살균 수준, 풍미, 유형, 최종 용도 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

미국은 예측 기간 동안 북미 표면 살균 물티슈 시장을 지배할 것입니다 .

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Surface Disinfectant Wipes Market Share Analysis

The surface disinfectant wipes market competitive landscape provides details of the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the surface disinfectant wipes market.

Some major players operating in the North America surface disinfectant wipes market are Zep Inc., Whiteley, The Claire Manufacturing Company, STERIS, Spartan Chemical Company, Inc., Seventh Generation Inc., S. C. Johnson & Son, Inc., Reckitt Benckiser Group PLC., Procter & Gamble, PDI, Inc., Pal International, Ecolab, 3M, Cantel Medical., Contec, Inc., Betco, CleanWell, GOJO Industries, Inc., PDI, Inc, Parker Laboratories, Inc., Metrex Research, LLC., Diversey Holdings LTD., Dreumex USA Inc., KCWW, Inc and Medline Industries, LP., among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

표 목록

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 U.S. SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 U.S. SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 U.S. SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 U.S. SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 U.S. SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 U.S. SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 CANADA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 CANADA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 CANADA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 CANADA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 CANADA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 CANADA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 CANADA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.