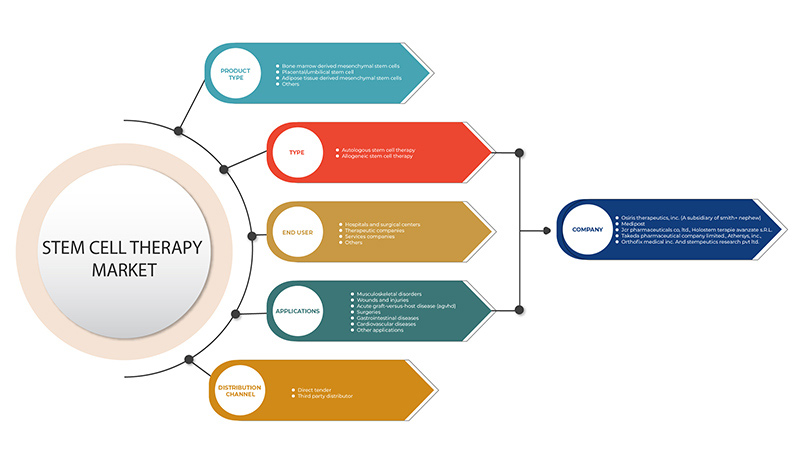

북미 줄기세포 치료 시장, 제품 유형별(골수 유래 중간엽 세포, 태반 또는 탯줄 줄기세포, 지방 조직 유래 중간엽 줄기세포 및 기타), 유형(이종 줄기세포 치료 및 자가 줄기세포 치료), 응용 분야(근골격계 질환, 급성 이식편대숙주병(AGVHD), 상처 및 부상, 심혈관 질환, 수술, 위장 질환 및 기타), 최종 사용자(병원 및 수술 센터, 치료 회사, 서비스 회사 및 기타), 유통 채널(직접 입찰, 제3자 유통업체) 산업 동향 및 2029년까지의 예측

시장 분석 및 규모

암, 근골격계 질환 및 신경계 질환, 만성 부상, 심혈관 및 위장관 질환을 포함한 만성 질환은 입원, 장기 장애, 삶의 질 저하 및 사망으로 이어질 수 있습니다.

중간엽 줄기 세포는 여러 장기에 침투하여 통합되고, 심혈관, 폐, 척수 손상을 치료하고, 자가면역 질환, 간, 뼈 및 연골 질환의 상태를 개선합니다. 줄기 세포는 염증, 면역 체계 부전 및 조직 변성으로 인한 감염을 치료하는 강력한 도구입니다.

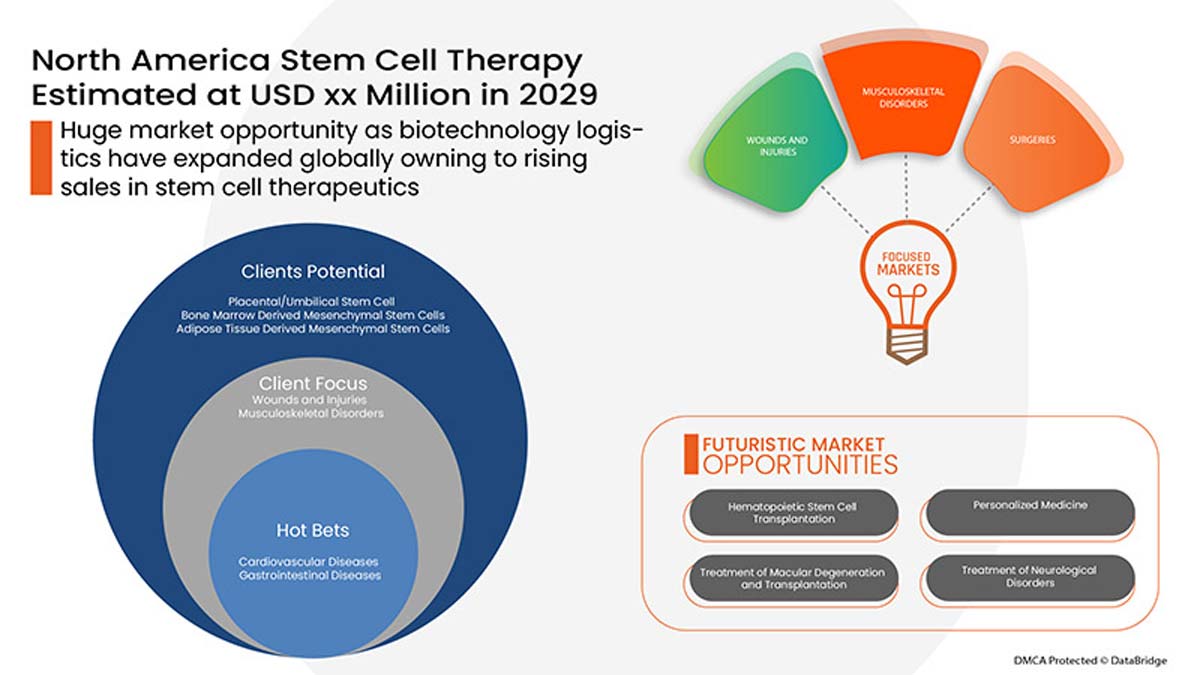

북미 줄기세포 치료 시장 성장을 주도하는 요인은 만성 질환 발병률 증가, 세포 치료 생산 시설에 대한 GMP 인증 승인 증가, 생명공학 부문 성장, 줄기세포 기반 치료에 대한 임상 시험 증가입니다. 그러나 시장 성장을 억제할 것으로 예상되는 요인은 줄기세포 기반 연구 비용 증가, 줄기세포 치료를 받는 동안 직면하는 위험, 대안의 가용성입니다.

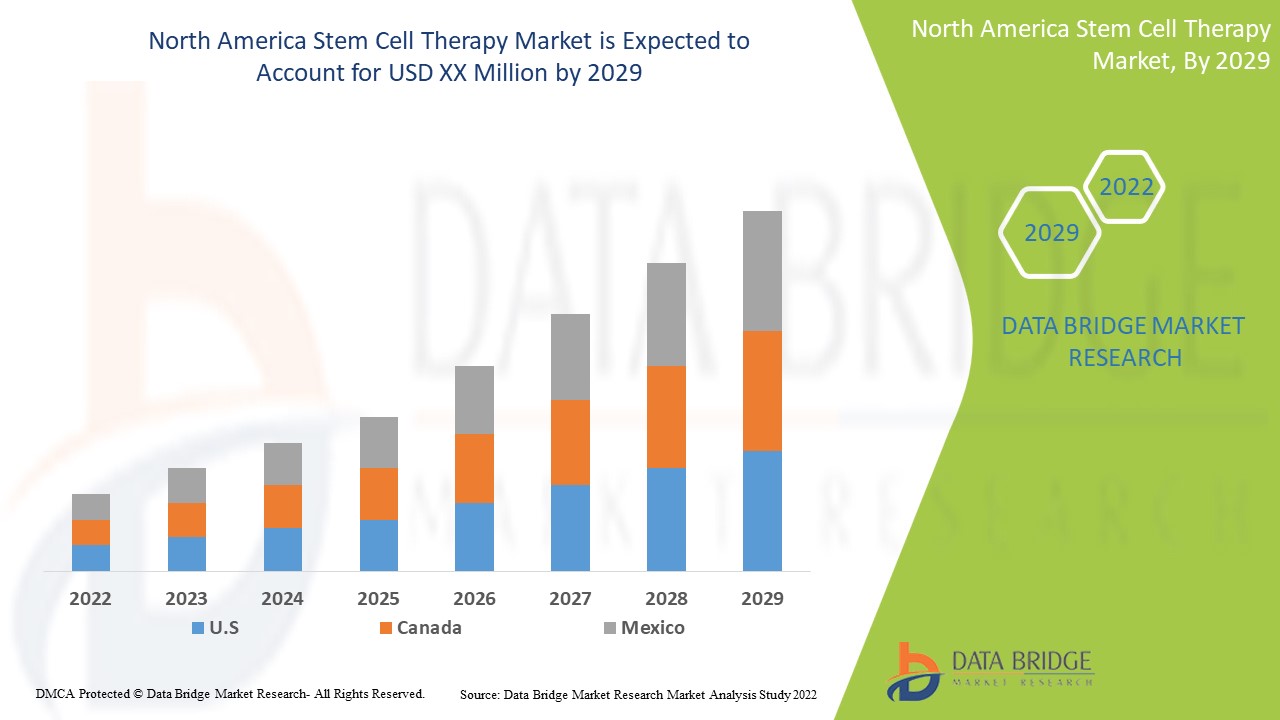

북미 줄기세포 치료는 보조적이며 증상의 심각성을 줄이는 것을 목표로 합니다. Data Bridge Market Research는 북미 줄기세포 치료 시장이 2022년에서 2029년까지의 예측 기간 동안 1억 9,691만 달러의 가치에 도달하고 8.6%의 CAGR로 성장할 것으로 분석했습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

제품 유형별(골수유래 중간엽 줄기세포, 태반 또는 탯줄 줄기세포, 지방조직유래 중간엽 줄기세포 및 기타), 유형별( 이종 줄기세포 치료 및 자가 줄기세포 치료), 적용 분야(근골격계 질환, 급성 이식편대숙주병(AGVHD), 상처 및 부상, 심혈관 질환, 수술, 위장관 질환 및 기타), 최종 사용자(병원 및 수술 센터, 치료 회사, 서비스 회사 및 기타), 유통 채널(직접 입찰, 제3자 유통업체) |

|

적용 국가 |

미국, 캐나다 |

|

시장 참여자 포함 |

Osiris Therapeutics, Inc. (Smith+Nephew의 자회사), Orthofix Medical Inc., Takeda Pharmaceutical Company Limited, US Stem Cell, Inc., BrainStorm Cell Limited, International Stemcell Corporation, Athersys, Inc., BioRestorative Therapies, Inc., JCR Pharmaceuticals Co., Ltd, ANTEROGEN.CO., LTD, MEDIPOST, Mesoblast Ltd, PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD 등 |

시장 정의

줄기세포는 신체의 초기 물질로, 특수 기능을 가진 다른 모든 세포가 생성됩니다. 신체 또는 실험실에서 적절한 조건 하에 줄기세포는 분열하여 더 많은 딸세포라고 불리는 세포를 형성합니다. 딸세포는 혈액 세포, 뇌 세포, 심장 근육 세포 또는 뼈 세포와 같이 더 구체적인 기능을 가진 새로운 줄기세포 또는 특수 세포(분화)가 됩니다. 줄기세포에 대한 많은 관심은 연구 과학자들 사이에서 관심을 불러일으켰습니다. 줄기세포를 사용하여 질병이 어떻게 발병하고 발생하는지 이해하고, 세포를 대체할 건강한 세포를 생성하고, 신약의 안전성과 효능을 테스트하는 것이 줄기세포 치료제가 사용되는 과학적 이유입니다.

줄기세포 치료는 줄기세포 또는 파생물을 사용하여 기능 장애 또는 손상된 조직 복구 반응을 촉진합니다. 장기 이식의 다음 장이며 공급이 제한적인 기증 장기 대신 세포를 사용합니다. 지방 조직 유래 중간엽 줄기세포, 골수 유래 중간엽 줄기세포, 태반 또는 탯줄 줄기세포와 같은 성인 줄기세포는 대부분 조직에서 적은 수로 발견됩니다. 배아 줄기세포는 3~5일 된 배아에서 유래합니다. 새로운 징후는 성인 줄기세포가 다양한 유형의 세포를 생성할 수 있음을 나타냅니다.

북미 줄기세포 치료 시장 역학

운전자

- 만성질환의 유병률 및 발생률 증가

만성 질환은 전 세계적으로 흔한 건강 문제입니다. 전 세계적으로 성인 3명 중 1명이 만성 질환을 앓고 있습니다. 만성 질환은 많은 시민의 건강과 삶의 질에 영향을 미쳤습니다. 암, 근골격계 질환 및 신경계 질환, 만성 손상, 심혈관 및 위장관 질환을 포함한 만성 질환은 입원, 장기 장애, 삶의 질 저하 및 사망으로 이어질 수 있습니다.

중간엽 줄기 세포는 여러 장기에 침투하여 통합되고, 심혈관, 폐 및 척수 손상을 치료하고, 자가면역 질환, 간, 뼈 및 연골 질환의 상태를 개선합니다. 줄기 세포는 염증, 면역 체계 부전 및 조직 변성으로 인한 질병을 치료하는 강력한 도구입니다.

예를 들어,

- 2022년 미국 뼈 및 관절 이니셔티브의 데이터에 따르면 근골격계 질환은 미국에서 18세 이상 인구 2명 중 1명 이상, 65세 이상 인구 4명 중 3명에게 영향을 미칩니다. 외상, 허리 통증, 관절염은 보고된 가장 흔한 근골격계 질환 3가지이며, 매년 의사 진료실, 응급실, 병원을 방문하는 건강 관리 방문이 발생합니다.

- 연구개발의 증가

줄기세포 연구는 국립보건원(NIH) 예산으로 지원됩니다. 민간 부문도 줄기세포 연구에 자금을 지원하지만, 이러한 투자는 일반적으로 나중에, 테스트 및 개발 단계에서, 그 다음 초기 기초 연구에서 이루어집니다. 줄기세포 치료법이 매우 새로운 분야이기 때문에 편견 없는 정부 기관이 이를 감독하는 것이 중요합니다. FDA는 신중하고 철저하지만, 그들은 끊임없이 자금 조달에 어려움을 겪고 있으며, 지불을 잠재적인 미래 수혜자와 일치시키는 장기 투자를 하고 있습니다.

예를 들어,

- 2022년 3월, MEDIPOST는 북미의 세포 유전자 치료 제품과 줄기세포 치료와 같은 미국의 임상 시험을 위한 계약 개발 및 제조 회사(CDMO)에 투자했습니다. CARTISTEM은 퇴행성 골관절염 치료를 위한 줄기세포 치료 시술입니다.

- 성장하는 생명공학 분야

사람들은 건강에 대해 더 많이 알게 되고 있으며 예방적 건강 관리에 대한 경각심도 높아지고 있습니다. 건강 관리에 대한 강조가 인기를 얻고 있습니다. 질병과 증상에 대한 인식은 의료 시스템에서 사용 가능한 첨단 기술(예: 의료 제공자가 생존율을 높이는 데 도움이 되는 줄기 세포 기술)로 인해 감염을 선별하고 조기에 감지하는 데 필수적입니다. 줄기 세포 기반 치료법 개발에 중점을 둔 많은 생명 공학 회사가 시장 성장을 주도할 것으로 예상됩니다.

예를 들어,

미국 생명공학 분야와 전체 글로벌 시장에 30%를 차지하는 거대한 기여자로서 생명공학은 또한 노동력에 대한 수요를 증가시켰으며 미국 시민들에게 많은 기회를 열어주었습니다.

기회

- 의료비 지출 증가

게다가 정부와 민간 기관의 연구 개발 활동이 늘어나고 투자도 늘어나면서 시장 성장률에 새로운 기회가 생길 것입니다.

예를 들어,

- 2021년 건강보험 가격 지수(HCPI)에 따르면 미국 전체 의료 예산은 3.4% 증가했습니다. 성장 증가는 연방 정부 지출이 2020년 287,000백만 달러에서 2021년 170,000백만 달러로 전년 대비 상당히 감소했음을 나타냅니다.

- 시장 참여자들의 전략적 이니셔티브

줄기세포 치료에 대한 수요는 만성 질환의 시기적절한 치료로 인해 미국에서 수요를 증가시켰습니다. 이러한 유리한 요인은 약물에 대한 필요성을 높이고 시장 수요를 달성하기 위해 소규모 및 대규모 시장 참여자는 다양한 전략을 활용하고 있습니다.

주요 기업들은 또한 사업을 원활하게 운영하고, 위험을 피하고, 시장 판매의 장기적 성장을 높이기 위해 제품 출시, 인수, 승인, 확장, 파트너십 등의 구체적인 전략을 고안하려고 노력하고 있습니다.

예를 들어,

- 2022년 5월, ViaCyte, Inc.는 SQZ Biotechnologies와 협력하여 검색-사용 전용(RUO) 마이크로유체 세포 내 전달 시스템을 개발하고 상용화했습니다. 이 협력을 통해 두 시장 참여자는 mRNA를 사용하여 조혈 줄기 세포에서 새로운 세포 엔지니어링 데이터를 제시할 수 있습니다.

인수, 컨퍼런스, 집중된 세그먼트 제품 출시를 포함한 시장 참여자들의 이러한 전략적 이니셔티브는 회사가 성장하고 회사의 제품 포트폴리오를 개선하는 데 도움이 되며 궁극적으로 더 많은 수익 창출로 이어집니다. 따라서 시장 참여자들의 이러한 전략적 이니셔티브는 시장 성장을 촉진하는 데 도움이 되는 기회를 제공합니다.

제약/도전

- 줄기세포 기반 치료 연구 비용 증가

줄기세포 치료는 여러 질환을 치료하기 위한 개발되고 새로운 치료 옵션입니다. 때때로 치료 비용은 여러 질환에 대한 우려 사항입니다. 줄기세포 치료 치료 절차. 줄기세포 분야는 여전히 매우 전문화되어 있으며 주류 및 보험 회사에서 채택하지 않았습니다. 줄기세포 치료 기반 연구 치료 비용은 의료 보험에서 보장되지 않습니다. 이러한 비용은 환자에게 부담이 됩니다. 따라서 현재의 높은 비용은 감소 추세를 보일 것으로 예상됩니다.

예를 들어,

- Bioinformant의 데이터에 따르면 2022년 미국에서 자가줄기세포 치료 비용은 약 15만 달러입니다.

- 숙련된 전문가의 부족

숙련된 전문성의 부족이나 부족은 한 곳에서 회복과 성장의 속도에 도전할 것입니다. 종종 한 곳의 실업자는 다른 곳에서는 부족한 기술을 가지고 있습니다. 게다가 이 분야의 급속한 기술 발전은 전문성 부족으로 이어집니다.

줄기세포 치료는 현대 기술을 사용하여 손상된 세포를 건강한 새로운 세포로 대체합니다. 오늘날 줄기세포 치료는 신경 질환, 당뇨병, 뇌 손상 및 척수 손상과 같은 광범위한 질병으로 고통받는 환자에게 상당한 이점을 제공합니다.

줄기세포 치료를 다루는 혈액학자는 적절한 줄기세포 치료 투여 교육을 받았어야 합니다. 그들은 치료의 특정 응급 투여를 위한 현장의 잘 조직된 시스템에 익숙해야 합니다. 줄기세포 치료 코디네이터는 환자가 치료를 받을 때 모든 관련 인력에게 알려야 함을 보장합니다. 코디네이터는 주 등록 간호사를 포함한 의료 전문가가 될 수 있습니다.

북미 줄기세포 치료 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 주머니, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 북미 줄기세포 치료 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드릴 것입니다.

환자 역학 분석

- 2017년 세계질병부담(GBD) 자료에 따르면 요통이 가장 많은 발병률을 보였으며, 그 다음으로 근골격계 질환(21.5%) 순이었다.

북미 줄기세포 치료 시장은 또한 환자 분석, 예후 및 치료법에 대한 자세한 시장 분석을 제공합니다. 유병률, 발생률, 사망률 및 준수율은 보고서에서 사용할 수 있는 일부 데이터 변수입니다. 시장 성장에 대한 역학의 직접 또는 간접 영향 분석을 분석하여 성장 기간 동안 시장을 예측하기 위한 보다 견고하고 코호트 다변량 통계 모델을 만듭니다.

COVID-19가 북미 줄기세포 치료 시장에 미치는 영향

팬데믹 동안 줄기세포 치료는 COVID-19 환자의 사망률과 이환율을 줄이는 데 놀라운 효과가 있었습니다. 이러한 결과를 승인하려면 더 많은 대규모 연구가 필요합니다. 최상의 임상 결과를 달성하기 위해 COVID-19 감염에서 줄기세포 치료에 대한 프로토콜을 정의해야 합니다. COVID-19 동안 임상 시험이 수행되었습니다.

최근 개발

- 2020년 3월, 팬데믹 기간 동안 MEDIPOST는 말레이시아에서 무릎 골관절염 치료제 CARTISTEM에 대한 승인을 받았습니다. 승인은 제품의 상용화를 촉진하는 결과를 가져올 것입니다.

북미 줄기세포 치료 시장 범위

북미 줄기세포 치료 시장은 제품 유형, 유형, 응용 분야, 최종 사용자 및 유통 채널을 기준으로 5개 세그먼트로 구분됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품 유형

- 골수유래 중간엽줄기세포

- 태반 또는 탯줄 줄기 세포

- 지방조직 유래 중간엽 줄기세포

- 기타

북미 줄기세포 치료 시장은 제품 유형을 기준으로 골수 유래 중간엽 줄기세포, 태반 또는 태아줄기세포, 지방 조직 유래 중간엽 줄기세포 및 기타로 구분됩니다.

유형

- 동종 줄기 세포 치료

- 자가줄기세포 치료

북미 줄기세포 치료 시장은 유형을 기준으로 동종줄기세포 치료와 자가줄기세포 치료로 구분됩니다.

애플리케이션

- 근골격계 질환

- 상처와 부상

- 급성 이식편대숙주병(AGVHD)

- 수술

- 위장관 질환

- 심혈관 질환

- 기타

북미 줄기세포 치료 시장은 응용 분야별로 근골격계 질환, 상처 및 부상, 급성 이식편대숙주병(AGVHD), 수술, 위장관 질환, 심혈관 질환 등으로 구분됩니다.

최종 사용자

- 병원 및 수술 센터

- 치료 회사

- 서비스 회사

- 기타

북미 줄기세포 치료 시장은 최종 사용자를 기준으로 병원 및 수술 센터, 치료 회사, 서비스 회사 및 기타로 구분됩니다.

유통 채널

- 직접 입찰

- 제3자 유통업체

북미 줄기세포 치료 시장은 유통 채널을 기준으로 직접 입찰과 제3자 유통업체로 구분됩니다.

북미 줄기세포 치료 시장 지역 분석/통찰력

북미 줄기세포 치료 시장을 분석하고, 지역, 제품 유형, 유형, 응용 프로그램, 최종 사용자 및 유통 채널별로 시장 규모 통찰력과 추세를 제공합니다. 위에 참조된 대로.

북미 줄기세포 치료 시장 보고서에 포함된 국가 중 일부는 미국과 캐나다입니다. 만성 질환의 발생률 증가, 의료비 지출, 진행 중인 임상 시험 및 치료 회사로 인해 미국이 시장을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 줄기세포 치료 시장 점유율 분석

북미 줄기세포 치료 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 북미 줄기세포 치료 시장과 관련된 회사의 초점에만 관련이 있습니다.

Some of the major players operating in the North America stem cell therapy market are Osiris Therapeutics, Inc. (A subsidiary of Smith+Nephew), Orthofix Medical Inc., Takeda Pharmaceutical Company Limited, U.S. Stem Cell, Inc., BrainStorm Cell Limited, International Stemcell Corporation, Athersys, Inc., BioRestorative Therapies, Inc., JCR Pharmaceuticals Co., Ltd, ANTEROGEN.CO., LTD, MEDIPOST, Mesoblast Ltd, PHARMICELL Co., Ltd., STEMPEUTICS RESEARCH PVT LTD, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or can drop down your inquiry. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America versus Regional, and Vendor Share Analysis. To know more about the research methodology, drop an inquiry to speak to our industry experts.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA STEM CELL THERAPY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA STEM CELL THERAPY MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 PIPELINE ANALYSIS FOR THE NORTH AMERICA STEM CELL THERAPY MARKET

7 NORTH AMERICA STEM CELL THERAPY MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN PREVALENCE AND INCIDENCE OF CHRONIC DISEASES

8.1.2 RISE IN INVESTMENT IN RESEARCH AND DEVELOPMENT AND AVAILABILITY OF FUNDING FOR STEM CELL RESEARCH

8.1.3 GROWING BIOTECHNOLOGY SECTOR

8.1.4 RISE IN GMP CERTIFICATION APPROVALS FOR CELL THERAPY PRODUCTION FACILITIES

8.1.5 RISE IN CLINICAL TRIALS FOR STEM-CELL-BASED THERAPIES

8.2 RESTRAINTS

8.2.1 THE RISE IN COST OF STEM-CELL-BASED THERAPY RESEARCH

8.2.2 THE RISKS FACED WHILE UNDERGOING STEM CELL THERAPY

8.2.3 ETHICAL CONCERNS RELATED TO STEM CELL THERAPY RESEARCH

8.2.4 AVAILABILITY OF ALTERNATIVES

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.3.3 THE EMERGENCE OF INDUCED PLURIPOTENT STEM CELLS (IPSCS)

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR STEM CELL THERAPY

8.4.2 STRINGENT REGULATIONS

9 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BONE MARROW DERIVED MESENCHYMAL STEM CELLS

9.3 PLACENTAL/UMBILICAL STEM CELL

9.4 ADIPOSE TISSUE DERIVED MESENCHYMAL STEM CELLS

9.5 OTHERS

10 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE

10.1 OVERVIEW

10.2 ALLOGENEIC STEM CELL THERAPY

10.2.1 MUSCULOSKELETAL DISORDERS

10.2.2 WOUNDS AND INJURIES

10.2.3 ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD)

10.2.4 SURGERIES

10.2.5 GASTROINTESTINAL DISEASES

10.2.6 OTHER APPLICATION

10.3 AUTOLOGOUS STEM CELL THERAPY

10.3.1 CARDIOVASCULAR DISEASES

10.3.2 GASTROINTESTINAL DISEASES

10.3.3 OTHER APPLICATION

11 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MUSCULOSKELETAL DISORDERS

11.3 WOUNDS AND INJURIES

11.4 ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD)

11.5 SURGERIES

11.6 GASTROINTESTINAL DISEASES

11.7 CARDIOVASCULAR DISEASES

11.8 OTHER APPLICATION

12 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL AND SURGICAL CENTERS

12.3 THERAPEUTIC COMPANIES

12.4 SERVICES COMPANIES

12.5 OTHERS

13 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

14 NORTH AMERICA STEM CELL THERAPY MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

15 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 OSIRIS THERAPEUTICS, INC. (A SUBSIDIARY OF SMITH+NEPHEW) (2021)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 JCR PHARMACEUTICALS CO., LTD ( (2021)

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 ORTHOFIX MEDICAL INC. (2021)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MEDIPOST (2021)

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 TAKEDA PHARMACEUTICAL COMPANY LIMITED (2021)

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 CORESTEM, INC. (2021)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 PHARMICELL CO., LTD. (2021)

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ANTEROGEN.CO., LTD (2021)

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ATHERSYS, INC.(2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BRAINSTORM CELL LIMITED (2021)

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIORESTORATIVE THERAPIES, INC. (2021)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 HOLOSTEM TERAPIE AVANZATE S.R.L. (2021)

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 INTERNATIONAL STEMCELL CORPORATION (2021)

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 MESOBLAST LTD (2021)

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 PLURISTEM INC.(2021)

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 STEMPEUTICS RESEARCH PVT LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 U.S. STEM CELL, INC. (2021)

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA BONE MARROW DERIVED MESENCHYMAL STEM CELLS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA PLACENTAL/UMBILICAL STEM CELL IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ADIPOSE TISSUE DERIVED MESENCHYMAL STEM CELLS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA OTHERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MUSCULOSKELETAL DISORDERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WOUNDS AND INJURIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACUTE GRAFT-VERSUS-HOST DISEASE (AGVHD) IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SURGERIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA GASTROINTESTINAL DISEASES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARDIOVASCULAR DISEASES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER APPLICATION IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA HOSPITAL AND SURGICAL CENTERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA THERAPEUTIC COMPANIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SERVICES COMPANIES IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OTHERS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DIRECT TENDER IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN STEM CELL THERAPY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA STEM CELL THERAPY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 U.S. STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 U.S. AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 40 U.S. STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 U.S. STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 CANADA STEM CELL THERAPY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 CANADA STEM CELL THERAPY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 CANADA ALLOGENEIC STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 CANADA AUTOLOGOUS STEM CELL THERAPY IN STEM CELL THERAPY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 CANADA STEM CELL THERAPY MARKET, BY APPLICATIONS, 2020-2029 (USD MILLION)

TABLE 47 CANADA STEM CELL THERAPY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 CANADA STEM CELL THERAPY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA STEM CELL THERAPY MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA STEM CELL THERAPY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STEM CELL THERAPY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STEM CELL THERAPY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STEM CELL THERAPY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STEM CELL THERAPY MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA STEM CELL THERAPY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA STEM CELL THERAPY MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA STEM CELL THERAPY MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA STEM CELL THERAPY MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED INCIDENCE OF CHRONIC DISEASES, RISE IN CLINICAL TRIALS, GMP CERTIFICATION AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE THE NORTH AMERICA STEM CELL THERAPY MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT TYPE SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA STEM CELL THERAPY MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STEM CELL THERAPY MARKET

FIGURE 15 NUMBER AND AGES OF PEOPLE 65 OR OLDER WITH ALZHEIMER'S DEMENTIA IN 2022

FIGURE 16 INCIDENCE OF VARIOUS TYPES OF CANCER IN 2020

FIGURE 17 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 19 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 20 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, 2021

FIGURE 22 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 23 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 24 NORTH AMERICA STEM CELL THERAPY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 27 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 28 NORTH AMERICA STEM CELL THERAPY MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, 2021

FIGURE 30 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 31 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 32 NORTH AMERICA STEM CELL THERAPY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 34 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 35 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 36 NORTH AMERICA STEM CELL THERAPY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA STEM CELL THERAPY MARKET: SNAPSHOT (2021)

FIGURE 38 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2021)

FIGURE 39 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 40 NORTH AMERICA STEM CELL THERAPY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 41 NORTH AMERICA STEM CELL THERAPY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 42 NORTH AMERICA STEM CELL THERAPY MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.