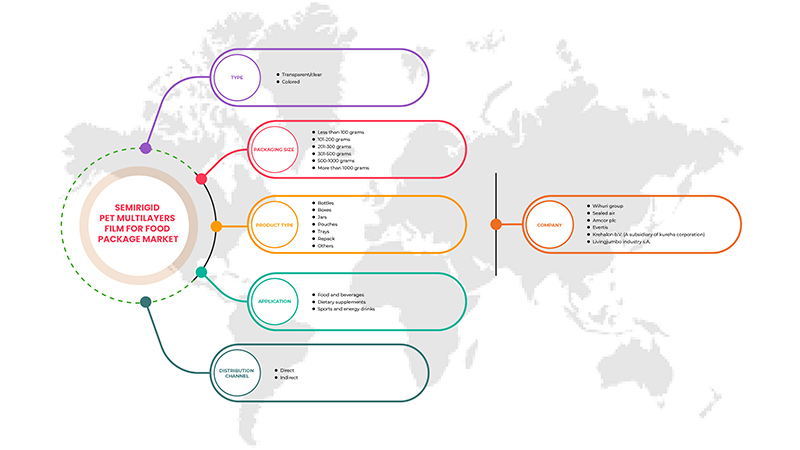

North America Semirigid PET Multilayers Film for Food Package Market, By Type (Transparent/Clear and Colored), Product Type (Bottles, Boxes, Jars, Pouches, Trays, Repack, and Others), Packaging Size (Less Than 100 Grams, 101-200 Grams, 201-300 Grams, 301-500 Grams, 500-1000 Grams, and More Than 1000 Grams), Application (Food and Beverages, Dietary Supplements, Sports and Energy Drinks), Distribution Channel (Direct and Indirect) Industry Trends and Forecast to 2029.

North America Semirigid PET Multilayers Film for Food Package Market Analysis and Insights

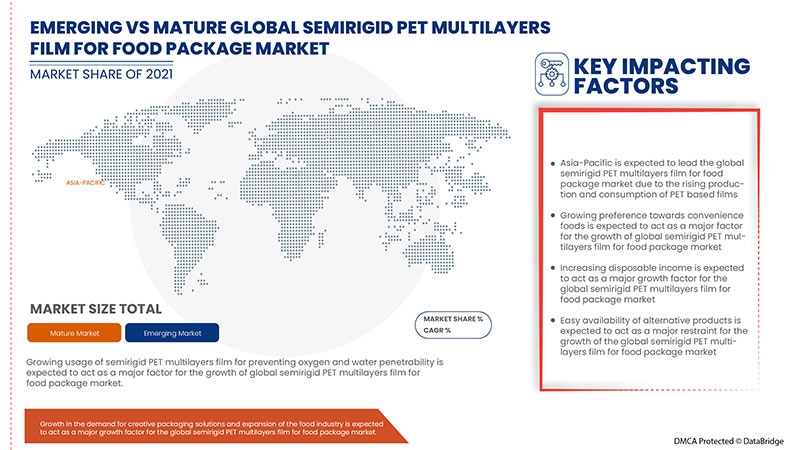

Growth in usage of semirigid pet multilayer packaging film for preventing oxygen and water penetrability and increase in demand and awareness for semirigid multilayer films for shelf-life are expected to drive the demand for the North America semirigid PET multilayers film for food package market. However, volatility in the prices of raw materials and the availability of alternative products may further restrict the market's growth.

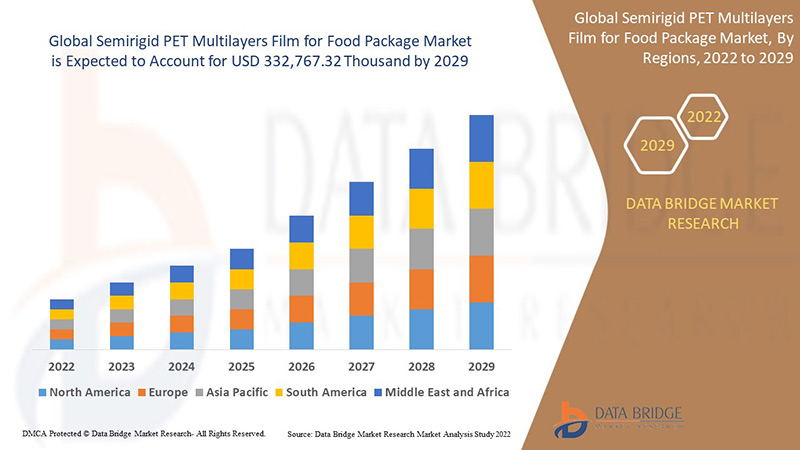

Data Bridge Market Research analyses that the North America semirigid PET multilayers film for food package market is expected to reach the value of USD 93,296.20 thousand by 2029, at a CAGR of 3.6% during the forecast period. Transparent/clear accounts for the largest type segment in the North America semirigid PET multilayers film for food package market. The North America semirigid PET multilayers film for food package market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Transparent/Clear and Colored), Product Type (Bottles, Boxes, Jars, Pouches, Trays, Repack, and Others), Packaging Size (Less Than 100 Grams, 101-200 Grams, 201-300 Grams, 301-500 Grams, 500-1000 Grams, and More Than 1000 Grams), Application (Food and Beverages, Dietary Supplements, Sports and Energy Drinks), Distribution Channel (Direct and Indirect) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Wihuri Group, Evertis, Sealed Air, Amcor plc, and Krehalon B.V. (A subsidiary of KUREHA CORPORATION), among others |

Market Definition

Polyethylene Terephthalate is a clear, strong, lightweight plastic belonging to the polyester family. It is widely used as a food packaging material because it is hygienic, strong, lightweight, shatterproof, and retains freshness. The semirigid PET multilayers film has a combination of several layers. This significantly increases the shelf life by controlling oxygen, carbon dioxide, and moisture transmission rate.

제조업체와 포장 설계자는 안전하고, 튼튼하고, 투명하며, 다재다능하기 때문에 반경성 PET 다층 필름을 선호합니다. 이러한 특성은 포장 디자인과 성능 측면에서 뛰어난 혁신을 가능하게 합니다. 식품의 무결성, 신선도 및 맛을 보호하는 데 도움이 됩니다. 소비자는 가벼운 무게, 재봉인성, 깨짐 방지 및 혁신적인 스타일로 인해 이를 높이 평가합니다. 포장 내용물을 보호하고 보존하는 우수한 차단 특성을 가지고 있습니다. 쉽게 재활용할 수 있으며 PET 소재는 광범위한 응용 분야에 다시 사용할 수 있습니다.

북미 반경성 PET 다층 필름 식품 포장 시장 동향

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

- 산소 및 수분 침투 방지를 위한 반경성 PET 다층 포장 필름의 사용 증가

현재 상황에서 소비자의 선호도가 포장 식품으로 바뀌면서 다층 기반 포장 필름에 대한 수요가 엄청나게 늘고 있습니다. 이러한 필름은 다층 공압출 공정을 통해 만들어지기 때문에 공압출됩니다. 반경성 PET 다층 포장 필름은 여러 겹의 PET와 필름의 기계적 및 물리적 특성(예: 펑크, 찢어짐, 내열성)을 향상시키고 산소, 습기 및 이산화탄소와 같은 다른 가스와의 상호 작용을 방지하고 미네랄 오일 및 자외선의 영향을 제한하는 기타 재료로 구성됩니다. 따라서 가스와 습기로부터 포장 제품을 보호하기 위해 식품 포장용 반경성 PET 다층 필름 사용이 증가함에 따라 이러한 다층 필름에 대한 수요가 증가할 것으로 예상되며, 그 결과 북미 식품 포장용 반경성 PET 다층 필름 시장이 성장할 것으로 예상됩니다.

- 선반 수명을 위한 반경성 다층 필름에 대한 수요와 인지도 증가

증가하는 소비자의 바쁜 현대적 라이프스타일과 그에 따른 편리한 식품 포장에 대한 수요는 반경성 PET 다층 필름에 대한 수요를 지속적으로 견인하고 있습니다. 이는 반경성 PET 다층 필름이 포장의 제품 수명을 연장하는 데 도움이 되기 때문입니다. 여러 폴리머 층을 혼합하면 산소, 이산화탄소 및 수분 전달 속도와 포장 내부의 산소 농도를 제어하여 유통기한을 크게 늘려 신선한 농산물의 신선도를 장기간 보존합니다. 사람들은 환경적 우려가 커지면서 더 긴 유통기한을 위해 반경성 PET 다층 필름 식품 포장에 대해 점점 더 관심을 갖게 되었습니다. 게다가 전 세계 대부분 국가에서 COVID-19가 확산되면서 소비자들이 장기 유통기한 식품을 찾으면서 포장 식품에 대한 수요가 평소보다 3배나 증가했습니다.

- 포장식품 소비로 소비자 선호도 전환

바로 먹을 수 있는 식품 의 엄청난 세계적 인기는 소비자들이 포장 상품으로 전환하는 데 영향을 미치고 있습니다. 바쁜 일과 삶의 균형을 이루고 업무량이 증가하는 직장인들이 포장 식품에 대한 수요를 높이고 있습니다. 따라서 포장 식품에 대한 수요 증가는 식품 포장을 위한 북미 반경성 PET 다층 필름 시장을 개발하는 데 도움이 될 것으로 예상됩니다. 취급 및 보관 중 식품 부패도 향후 몇 년 동안 포장 PET 다층 필름의 채택을 촉진할 것으로 예상됩니다. 불침투성 특성으로 인해 포장 식품을 보관하는 데 이상적이기 때문입니다. 더 바쁜 소비자 라이프스타일과 포장을 통한 편의 식품에 대한 수요로 인해 시장 성장이 가속화될 수 있습니다.

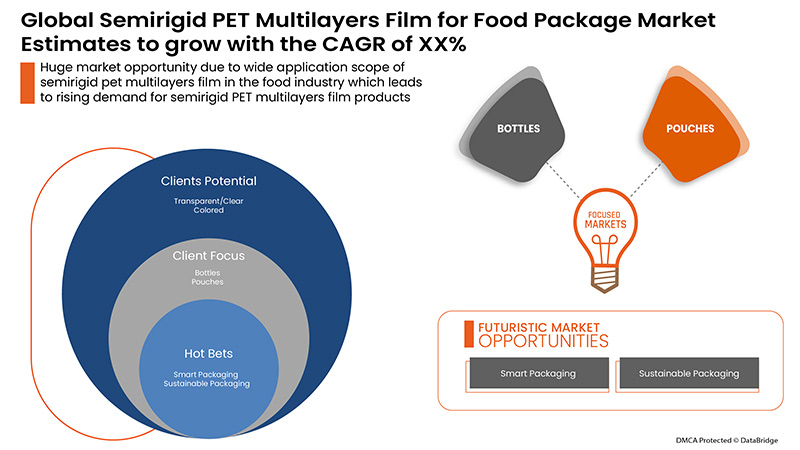

- 식품 산업에서 반경성 애완동물 다층 필름의 광범위한 적용 범위

PET 필름은 고유한 광학적, 물리적, 기계적, 열적 및 화학적 특성으로 인해 많은 응용 분야에서 사용됩니다. 주로 식품 및 의약품에서 산업 및 소비재에 이르기까지 광범위한 반경성 PET 다층 필름 포장 응용 분야에서 사용됩니다. 장벽의 경우 금속 접착은 적층 접착, 압출 코팅 접착, 인쇄 또는 밀봉이며, 일반 또는 금속화, 성형 가능, 열 수축 가능 및 코팅됩니다. PET 다층 필름은 포장 시장에 뛰어난 특성을 가지고 있습니다. 반경성 PET 다층 필름은 육류, 가금류, 생선, 유제품, 간식, 음료, 탈수 식품 및 시리얼, 제빵 제품, 과자, 애완동물 사료 등 식품 산업에서 광범위한 응용 분야가 있습니다. 반경성 PET 다층 필름은 빵 봉지, 파스타 봉지, 간식 및 영양 바, 고온/전자레인지/끓인 봉지 포장, 애완동물 사료 포장 및 파우치/스탠드업 파우치/재밀폐 파우치 또는 트레이 등 식품 포장에서 광범위한 응용 분야가 있습니다.

기회

-

새로운 디자인 아이디어로 창의적인 포장 솔루션 확대

포장은 새로운 소재, 기술 및 공정으로 끊임없이 변화하고 있습니다. 이러한 변화는 향상된 제품 품질, 생산성, 물류, 환경 성과 및 끊임없이 변화하는 소비자 선호도에 대한 필요성 때문입니다. 식품 산업에서 대부분의 포장 작업은 자동 또는 반자동입니다. 소비자에게 개인화된 포장 솔루션을 제공하기 위해 새롭고 진보된 인쇄 기술을 채택하는 것이 증가하고 있습니다. 이를 통해 기업은 시장에서 브랜드 가치를 높이고 제품 포장에 대한 고객 참여를 강화할 수 있었습니다. 따라서 경쟁 우위를 창출하고 유지하기 위한 새로운 디자인과 혁신을 갖춘 포장 솔루션의 성장, 소비자 행동의 변화 충족, 새로운 소재 및 기술의 가용성은 북미 반경성 PET 다층 필름 식품 포장 시장에 다양한 성장 기회를 제공할 수 있습니다.

-

고객 친화적 포장에 대한 수요 급증

식품 포장 혁신에 중요한 주요 요인은 편의성에 대한 소비자의 수요 증가입니다. 최신 포장 솔루션은 많은 편의성 속성을 제공합니다. 여기에는 접근 및 개봉의 용이성, 폐기 및 취급, 제품 가시성, 재봉인 기능, 전자 레인지 기능 및 연장된 유통기한이 포함됩니다. 편의 식품 소비에 대한 경향도 있었습니다. 빠른 속도의 라이프스타일 변화로 인해 바로 먹을 수 있는 식품에 대한 수요가 증가했습니다. 이로 인해 식품을 포장, 배송 및 보관하기 위한 반경성 PET 다층 필름에 대한 필요성이 증가합니다. 따라서 끊임없이 변화하는 소비자 선호도, 전자 상거래 산업의 추세, 고객 친화적인 포장 제품에 대한 수요로 인해 반경성 PET 다층 필름 포장 솔루션 공급업체가 시장 점유율을 높이기 위해 혁신적인 기술과 디자인을 채택할 수 있는 충분한 기회가 열렸습니다.

-

식품산업 확대, 포장필름에도 영향

식품 서비스 포장의 진화는 식품 산업 확장의 주요 원인입니다. 식품 서비스는 소비자 지출의 중요한 부분으로 성장했습니다. 식품 서비스 산업에는 레스토랑, 호텔, 카페 및 케이터링 서비스가 포함됩니다. 이러한 추세가 증가함에 따라 식품 포장에 미치는 영향도 증가합니다. 포장은 식품 안전을 보장하고 소비자에게 편의성을 제공하는 데 중요한 역할을 합니다. 또한 세계화, 생활 수준 변화, 건강 및 웰빙, 가처분 소득 증가 등의 요인이 식품 산업에서 수요를 창출하고 있습니다. 식품 산업은 최근 급격한 발전을 거쳤습니다. 따라서 산업의 성장과 발전은 북미 반경성 PET 다층 필름 식품 포장 시장 성장에 새로운 기회를 제공할 수 있습니다.

제약/도전

- 원자재 가격의 변동성

PET는 제조된 합성 섬유입니다. 그러나 그 원료는 여전히 재생 불가능한 천연 자원인 자연에서 유래합니다. 그것은 일반적으로 석유에서 유래된 플라스틱의 한 유형입니다. 재활용 플라스틱, 작물 또는 심지어 폐기물로 만든 것과 같은 석유 유래 PET의 대안이 있습니다. 원유 가격 상승은 반경성 PET 다층 필름과 같은 천연 오일 파생물에 의존하는 산업에 우려를 불러일으키고 있습니다. 반경성 PET 다층 필름의 판매 가격은 원유에서 PET를 만드는 데 사용되는 기본 원료인 정제 테레프탈산(PTA)과 모노 에틸렌 글리콜(MEG)의 가격 변화로 인해 변동합니다. PTA 및 MEG 가격은 원유 가격과 환율에 크게 영향을 받습니다. 반경성 PET 다층 필름의 일부 소비자는 변동하는 가격 추세를 받아들이는 것처럼 보이지만 대부분의 소비자는 그렇지 않습니다. 결과적으로 식품 포장용 북미 반경성 PET 다층 필름 시장의 성장이 심각하게 방해를 받고 있습니다.

- 대체 제품의 가용성

사람들은 최근 몇 년 동안 플라스틱 생산 및 사용에 반대하는 전례 없는 글로벌 캠페인을 목격해 왔습니다. 플라스틱 폐기물은 여론에 영향을 미쳤고, 이러한 새로운 소비자 취약성으로 인해 국제 입법자들은 일회용 플라스틱 사용에 대한 제한적인 법률을 통과시켜 현재의 석유 기반 PET 필름 생산을 대체할 수 있는 새로운 공정과 폴리머를 만들고 있습니다. 따라서 이미 시장에 출시된 PET 대체품과 개발 중인 대체품은 BIO-PET, 기타 비생분해성 폴리머, 천연 및 생분해성 폴리머입니다. 폴리에틸렌 푸로에이트(PEF)와 폴리트리메틸렌 푸란 디카복실레이트는 현재 사용 가능한 두 가지 대체 폴리머(PTF)입니다. 이들은 100% 재생 가능한 소스에서 얻을 수 있는 푸란 폴리머입니다. 전통적으로 플라스틱과 관련된 모든 유형의 응용 분야에 대한 생분해성 폴리머를 개발하는 것과 관련된 전 세계적 활동이 엄청나게 많습니다.

- 다층필름 재활용에 대한 우려

제조업체는 다층 포장 솔루션을 개발하는 동안 다양한 재료와 층 조합을 선택할 수 있습니다. 이를 통해 개별 재료 그룹을 명확하게 분리하는 예방책이 마련되었습니다. 사용 후 플라스틱 폐기물을 재활용하는 데 있어 가장 큰 과제는 다층 포장을 분류하는 것입니다. 다층 포장은 식별하기 어렵고 재활용하기도 어렵습니다. 식별 기술을 사용하여 다양한 표면 특성을 식별해야 합니다. 다층 포장은 사용 후 오염되는 다른 재료의 복잡한 혼합물입니다. 따라서 다층 포장 솔루션을 위한 대규모 산업 분류 및 재활용 프로세스가 부족하면 북미 반경성 PET 다층 필름 식품 포장 시장 성장에 어려움이 있을 수 있습니다.

- 환경 문제와 엄격한 정부 규제

PET는 가장 일반적으로 사용되는 플라스틱 중 하나입니다. 플라스틱 오염과 그에 따른 부정적인 환경 영향의 심각한 문제에 대한 우려가 커지고 있습니다. 그것은 공기, 토양 및 수질에 영향을 미쳐 여러 면에서 환경을 교란합니다. PET 소재를 태우면 일산화질소, 이산화황 및 염화불화탄소와 같은 유해 가스가 방출됩니다. PET의 생산 공정은 에너지 집약적인 공정입니다. 공정에서 발생하는 배출물은 많은 오염 물질로 수원을 심각하게 오염시킵니다. 게다가 부적절한 관리와 엄격한 정부 규제로 인해 개발도상국에서 이러한 제품에 대한 수요가 더욱 감소합니다. 이는 차례로 북미 반경성 PET 다층 필름 식품 포장 시장의 성장에 도전할 수 있습니다.

COVID-19 이후 북미 반경성 PET 다층 필름 식품 포장 시장에 미치는 영향

COVID-19는 2020-2021년에 다양한 제조 산업에 영향을 미쳐 직장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 봉쇄로 인해 북미 반경성 PET 다층 필름 식품 포장 시장은 지난 몇 년 동안 레스토랑과 음식 서비스 매장이 문을 닫으면서 매출이 크게 감소했습니다.

그러나 북미 반경성 PET 다층 필름 식품 포장 시장이 팬데믹 이후 성장한 것은 푸드 조인트 개장, 식료품 구매, 소비자 지출 덕분입니다. 주요 시장 참여자들은 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 참여자들은 위생적이고 지속 가능한 식품 포장 솔루션을 통해 제품을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다.

최근 개발 사항

- 2022년 6월, Winpak Ltd.는 재활용 콘텐츠 사용에 대한 ISCC(International Sustainability and Carbon Certification) PLUS 인증서를 받았습니다. 이 인증은 공급망을 따라 추적 가능성을 제공하고 회사가 환경 및 사회적 표준을 충족하는지 확인합니다. ISCC PLUS 인증은 회사가 재활용 콘텐츠 사용에 사용하는 프로세스가 정의되고 투명한 규칙을 따른다는 것을 증명합니다. 이 인증은 시장에서 회사의 이미지를 향상시키고 경쟁 우위를 확보하는 데 도움이 될 것입니다.

- 2022년 5월, Sealed Air는 디지털 인쇄, 디자인 및 스마트 패키징 솔루션의 새로운 포트폴리오를 출시했습니다. 이러한 제품은 새로운 브랜드인 prismiq에서 발견되었습니다. 이 브랜드는 디지털 패키징 솔루션을 통해 고객에게 가치를 창출하는 것을 목표로 합니다. 이 새로운 제품 출시는 회사가 미래의 디지털 패키징 및 그래픽을 활용하는 데 도움이 되어 시장에서 제품 제공을 강화할 것입니다.

북미 반경성 PET 다층 필름 식품 포장 시장 범위

북미 반경성 PET 다층 필름 식품 포장 시장은 유형, 제품 유형, 포장 크기, 응용 분야 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

유형

- 투명/클리어

- 색깔있는

북미 반경성 PET 다층 필름(식품 포장용) 시장은 유형을 기준으로 투명/투명 및 유색으로 구분됩니다.

제품 유형

- 병

- 상자

- 항아리

- 파우치

- 트레이

- 다시 포장하다

- 기타

제품 유형을 기준으로 볼 때, 북미 반경성 PET 다층 필름 식품 포장 시장은 병, 상자, 항아리, 파우치, 트레이, 재포장 및 기타로 구분됩니다.

포장 크기

- 100그램 미만

- 101-200그램

- 201-300그램

- 301-500그램

- 500-1000그램

- 1000그램 이상

포장 크기를 기준으로, 북미 반경성 PET 다층 필름 식품 포장 시장은 100g 미만, 101~200g, 201~300g, 301~500g, 500~1000g, 1000g 이상으로 구분됩니다.

애플리케이션

- 음식과 음료

- 식이 보충제

- 스포츠 및 에너지 드링크

북미 반경성 PET 다층 필름 식품 포장 시장은 응용 분야를 기준으로 식품 및 음료, 건강 보조식품, 스포츠 및 에너지 음료로 구분됩니다.

유통 채널

- 직접

- 간접적

유통 채널을 기준으로 볼 때, 북미 식품 포장용 반경성 PET 다층 필름 시장은 직접 및 간접으로 구분됩니다.

북미 반경성 PET 다층 필름 식품 포장 시장

북미 식품 포장용 반경성 PET 다층 필름 시장을 분석하고, 위에 언급된 대로 국가, 유형, 제품 유형, 포장 크기, 응용 분야 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 반경성 PET 다층 필름 식품 포장 시장은 미국, 캐나다, 멕시코와 같은 국가를 포함합니다. 미국은 북미 반경성 PET 다층 필름 식품 포장 시장을 지배할 것으로 예상되는데, 포장 시장은 성능을 저하시키지 않으면서 재료 사용량을 줄여 포장 재료의 무게를 줄이는 방식으로 주도되고 있기 때문입니다. 또한, 식품 폐기물과 식품 안전은 특히 미국, 캐나다, 멕시코의 규제 기관에 더욱 중요한 과제가 되고 있습니다.

북미 반경성 PET 다층 필름 식품 포장 시장 보고서의 국가 섹션은 또한 시장의 현재 및 미래 추세에 영향을 미치는 개별 시장 영향 요인과 국내 규정 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 중요한 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제와 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 반경성 PET 다층 필름 식품 포장 시장 점유율 분석

북미 반경성 PET 다층 필름 식품 포장 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 솔루션 출시, 제품 폭과 범위, 응용 분야 우위가 포함됩니다. 위의 데이터 포인트는 회사가 북미 반경성 PET 다층 필름 식품 포장 시장에 집중하는 것과만 관련이 있습니다.

북미 식품 포장용 반경성 PET 다층 필름 시장의 주요 기업으로는 Wihuri Group, Evertis, Sealed Air, Amcor plc, Krehalon BV(KUREHA CORPORATION의 자회사) 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THE THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.3 BRAND OUTLOOK

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 RAW MATERIAL PRODUCTION COVERAGE

4.11 REGULATORY FRAMEWORK AND GUIDELINES

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN USAGE OF SEMIRIGID PET MULTILAYER PACKAGING FILM FOR PREVENTING OXYGEN AND WATER PENETRABILITY

6.1.2 INCREASE IN DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE

6.1.3 SHIFT IN CONSUMER PREFERENCES TOWARDS THE CONSUMPTION OF PACKAGED FOODS

6.1.4 WIDE APPLICATION SCOPE OF SEMIRIGID PET MULTILAYERS FILM IN THE FOOD INDUSTRY

6.2 RESTRAINTS

6.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF CREATIVE PACKAGING SOLUTIONS WITH NEW DESIGN IDEAS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.3.3 EXPANSION OF THE FOOD INDUSTRY INFLUENCES PACKAGING FILMS

6.4 CHALLENGES

6.4.1 CONCERNS ABOUT THE RECYCLING OF MULTILAYER FILMS

6.4.2 ENVIRONMENTAL CONCERNS AND STRICT GOVERNMENT REGULATION

7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TRANSPARENT/CLEAR

7.3 COLORED

8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BOTTLES

8.3 BOXES

8.4 JARS

8.5 POUCHES

8.6 TRAYS

8.7 REPACK

8.8 OTHERS

9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE

9.1 OVERVIEW

9.2 LESS THAN 100 GRAMS

9.3 101-200 GRAMS

9.4 201-300 GRAMS

9.5 301-500 GRAMS

9.6 500-1000 GRAMS

9.7 MORE THAN 1000 GRAMS

10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD AND BEVERAGES

10.2.1 FOOD

10.2.1.1 DAIRY

10.2.1.1.1 CHEESE

10.2.1.1.2 ICE CREAM

10.2.1.1.3 MILK POWDER

10.2.1.1.4 DAIRY SPREAD

10.2.1.1.5 YOGURT

10.2.1.1.6 OTHERS

10.2.1.1.7 DAIRY, BY TYPE

10.2.1.1.7.1 TRANSPARENT/CLEAR

10.2.1.1.7.2 COLORED

10.2.1.1.8 DAIRY, BY PRODUCT TYPE

10.2.1.1.8.1 BOTTLES

10.2.1.1.8.2 BOXES

10.2.1.1.8.3 JARS

10.2.1.1.8.4 POUCHES

10.2.1.1.8.5 TRAYS

10.2.1.1.8.6 REPACK

10.2.1.1.8.7 OTHERS

10.2.1.2 BAKERY

10.2.1.2.1 BREADS & ROLLS

10.2.1.2.2 CAKES & PASTRIES

10.2.1.2.3 BISCUITS

10.2.1.2.4 MUFFINS

10.2.1.2.5 COOKIES

10.2.1.2.6 DOUGHNUTS

10.2.1.2.7 OTHERS

10.2.1.2.8 BAKERY, BY TYPE

10.2.1.2.8.1 TRANSPARENT/CLEAR

10.2.1.2.8.2 COLORED

10.2.1.2.9 BAKERY, BY PRODUCT TYPE

10.2.1.2.9.1 BOTTLES

10.2.1.2.9.2 BOXES

10.2.1.2.9.3 JARS

10.2.1.2.9.4 POUCHES

10.2.1.2.9.5 TRAYS

10.2.1.2.9.6 REPACK

10.2.1.2.9.7 OTHERS

10.2.1.3 PROCESSED FOOD

10.2.1.3.1 READY MEALS

10.2.1.3.2 SAUCES, DRESSINGS AND CONDIMENTS

10.2.1.3.3 SOUPS

10.2.1.3.4 JAMS, PRESERVES AND MARMALADES

10.2.1.3.5 OTHERS

10.2.1.3.6 PROCESSED FOOD, BY TYPE

10.2.1.3.6.1.1 TRANSPARENT/CLEAR

10.2.1.3.6.1.2 COLORED

10.2.1.3.7 PROCESSED FOOD, BY PRODUCT TYPE

10.2.1.3.7.1.1 BOTTLES

10.2.1.3.7.1.2 BOXES

10.2.1.3.7.1.3 JARS

10.2.1.3.7.1.4 POUCHES

10.2.1.3.7.1.5 TRAYS

10.2.1.3.7.1.6 REPACK

10.2.1.3.7.1.7 OTHERS

10.2.1.4 CONFECTIONARY

10.2.1.4.1 HARD-BOILED SWEETS

10.2.1.4.2 MINTS

10.2.1.4.3 GUMS & JELLIES

10.2.1.4.4 CHOCOLATE

10.2.1.4.5 CHOCOLATE SYRUPS

10.2.1.4.6 CARAMELS & TOFFEES

10.2.1.4.7 OTHERS

10.2.1.5 CONFECTIONARY, BY TYPE

10.2.1.5.1 TRANSPARENT/CLEAR

10.2.1.5.2 COLORED

10.2.1.6 CONFECTIONARY, BY PRODUCT TYPE

10.2.1.6.1 BOTTLES

10.2.1.6.2 BOXES

10.2.1.6.3 JARS

10.2.1.6.4 POUCHES

10.2.1.6.5 TRAYS

10.2.1.6.6 REPACK

10.2.1.6.7 OTHERS

10.2.1.7 FROZEN DESSERTS

10.2.1.7.1 GELATO

10.2.1.7.2 CUSTARD

10.2.1.7.3 SORBET

10.2.1.7.4 OTHERS

10.2.1.8 FROZEN DESSERTS,BY TYPE

10.2.1.8.1 TRANSPARENT/CLEAR

10.2.1.8.2 COLORED

10.2.1.9 FROZEN DESSERTS, BY PRODUCT TYPE

10.2.1.9.1 BOTTLES

10.2.1.9.2 BOXES

10.2.1.9.3 JARS

10.2.1.9.4 POUCHES

10.2.1.9.5 TRAYS

10.2.1.9.6 REPACK

10.2.1.9.7 OTHERS

10.2.1.10 FUNCTIONAL FOODS

10.2.1.10.1 TRANSPARENT/CLEAR

10.2.1.10.2 COLORED

10.2.1.10.3 BOTTLES

10.2.1.10.4 BOXES

10.2.1.10.5 JARS

10.2.1.10.6 POUCHES

10.2.1.10.7 TRAYS

10.2.1.10.8 REPACK

10.2.1.10.9 OTHERS

10.2.1.11 CONVENIENCE FOOD

10.2.1.11.1 INSTANT NOODLES

10.2.1.11.2 PASTA

10.2.1.11.3 SNACKS AND EXTRUDED SNACKS

10.2.1.11.4 OTHERS

10.2.1.12 CONVENIENCE FOOD, BY TYPE

10.2.1.12.1 TRANSPARENT/CLEAR

10.2.1.12.2 COLORED

10.2.1.13 CONVENIENCE FOOD, BY PRODUCT TYPE

10.2.1.13.1 BOTTLES

10.2.1.13.2 BOXES

10.2.1.13.3 JARS

10.2.1.13.4 POUCHES

10.2.1.13.5 TRAYS

10.2.1.13.6 REPACK

10.2.1.13.7 OTHERS

10.2.1.14 MEAT PRODUCTS

10.2.1.14.1 BEEF MEAT

10.2.1.14.2 PORK MEAT

10.2.1.14.3 POULTRY MEAT

10.2.1.14.4 OTHERS

10.2.1.15 MEAT PRODUCTS, BY TYPE

10.2.1.15.1 TRANSPARENT/CLEAR

10.2.1.15.2 COLORED

10.2.1.16 MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.16.1 BOTTLES

10.2.1.16.2 BOXES

10.2.1.16.3 JARS

10.2.1.16.4 POUCHES

10.2.1.16.5 TRAYS

10.2.1.16.6 REPACK

10.2.1.16.7 OTHERS

10.2.1.17 PROCESSED MEAT PRODUCTS

10.2.1.17.1 BACON

10.2.1.17.2 MEAT SNACKS

10.2.1.17.3 SAUSAGE

10.2.1.17.4 HOT DOGS

10.2.1.17.5 DELI MEAT

10.2.1.17.6 OTHERS

10.2.1.18 PROCESSED MEAT PRODUCTS, BY TYPE

10.2.1.18.1 TRANSPARENT/CLEAR

10.2.1.18.2 COLORED

10.2.1.19 PROCESSED MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.19.1 BOTTLES

10.2.1.19.2 BOXES

10.2.1.19.3 JARS

10.2.1.19.4 POUCHES

10.2.1.19.5 TRAYS

10.2.1.19.6 REPACK

10.2.1.19.7 OTHERS

10.2.2 BEVERAGES

10.2.2.1 BEVERAGES, BY APPLICATION

10.2.2.1.1 SMOOTHIES

10.2.2.1.2 JUICES

10.2.2.1.3 SPORTS DRINKS

10.2.2.1.4 ENERGY DRINKS

10.2.2.1.5 DAIRY BASED DRINKS

10.2.2.1.5.1 DAIRY BASED DRINKS, BY APPLICATION

10.2.2.1.5.1.1 REGULAR PROCESSED MILK

10.2.2.1.5.1.2 FLAVORED MILK

10.2.2.1.5.1.3 MILK SHAKES

10.2.2.1.5.1.4 FUNCTIONAL BEVERAGES

10.2.2.2 BEVERAGES, BY TYPE

10.2.2.2.1 TRANSPARENT/CLEAR

10.2.2.2.2 COLORED

10.2.2.3 BEVERAGES, BY PRODUCT TYPE

10.2.2.3.1 BOTTLES

10.2.2.3.2 BOXES

10.2.2.3.3 JARS

10.2.2.3.4 POUCHES

10.2.2.3.5 TRAYS

10.2.2.3.6 REPACK

10.2.2.3.7 OTHERS

10.3 DIETARY SUPPLEMENTS

10.3.1 DIETARY SUPPLEMENTS, BY TYPE

10.3.1.1 TRANSPARENT/CLEAR

10.3.1.2 COLORED

10.3.2 DIETARY SUPPLEMENTS, BY PRODUCT TYPE

10.3.2.1 BOTTLES

10.3.2.2 BOXES

10.3.2.3 JARS

10.3.2.4 POUCHES

10.3.2.5 TRAYS

10.3.2.6 REPACK

10.3.2.7 OTHERS

10.4 SPORTS AND ENERGY DRINKS

10.4.1 SPORTS AND ENERGY DRINKS, BY TYPE

10.4.1.1 TRANSPARENT/CLEAR

10.4.1.2 COLORED

10.4.2 SPORTS AND ENERGY DRINKS, BY PRODUCT TYPE

10.4.2.1 BOTTLES

10.4.2.2 BOXES

10.4.2.3 JARS

10.4.2.4 POUCHES

10.4.2.5 TRAYS

10.4.2.6 REPACK

10.4.2.7 OTHERS

11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 COLLABORATION

13.3 CERTIFICATION

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 WIHURI GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SEALED AIR

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 EVERTIS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 KREHALON B.V. (A SUBSIDIARY OF KUREHA CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 LIVINGJUMBO INDUSTRY S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF POLYETHYLENE TEREPHTHALATE IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYETHYLENE TEREPHTHALATE, IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRANSPARENT/CLEAR IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA COLORED IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA BOTTLES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA BOXES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA JARS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA POUCHES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA TRAYS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA REPACK IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA LESS THAN 100 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA 101-200 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 201-300 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA 301-500 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA 500-1000 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA MORE THAN 1000 GRAMS SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA DIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA INDIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 106 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 U.S. FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 U.S. FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 U.S. DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 U.S. DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 150 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 CANADA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 CANADA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 CANADA DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 174 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 CANADA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 188 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 191 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 MEXICO FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 MEXICO FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 MEXICO DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 198 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 200 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 201 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 202 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 204 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 207 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 214 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 218 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 220 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 221 MEXICO DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 222 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 223 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 224 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 226 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 228 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE IS EXPECTED TO DRIVE THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE TRANSPARENT/CLEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS – NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 17 VALUE CHAIN OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 19 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PACKAGING SIZE, 2021

FIGURE 22 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.