북미 RFID(무선 주파수 식별) 시장, 제공 품목(하드웨어, 소프트웨어 및 서비스), 연결성(블루투스, 초광대역 및 기타), 재료 유형(플라스틱, 금속, 종이, 유리 및 기타), 최종 사용자(소매/상업, 산업, 의료, 소비자 패키지 상품, 자동차, 항공우주, 감시 및 보안, 물류 및 운송, 스포츠, 국방, 교육, 가축 및 야생 동물 및 기타) - 산업 동향 및 2030년까지의 예측.

북미 RFID(무선 주파수 식별) 시장 분석 및 규모

RFID 기술은 전자기장을 사용하여 제품에 부착된 태그를 감지합니다. 태그에는 전자적으로 저장된 정보가 포함되어 있으며 제품, 동물 및 사람에게 부착할 수 있습니다. 주로 RFID 태그는 공급망의 바코드를 대체하기 위해 개발되었습니다. RFID 태그는 무선으로 시야 없이 읽을 수 있습니다. RFID는 섬유 및 의류 산업이 언제든지 위치한 다양한 품목의 정확한 데이터를 제공함으로써 수십억 달러를 절약하는 데 도움이 된 빠르게 성장하는 무선 기술입니다. 생산성을 개선하기 위해 제조 단위에 RFID 시스템 설치를 늘려 시장 성장을 크게 촉진했습니다. 스마트 카드에서 전자 신분증과 RFID 태그의 수용이 증가함에 따라 북미 RFID(무선 주파수 식별) 시장 성장이 촉진되고 있습니다.

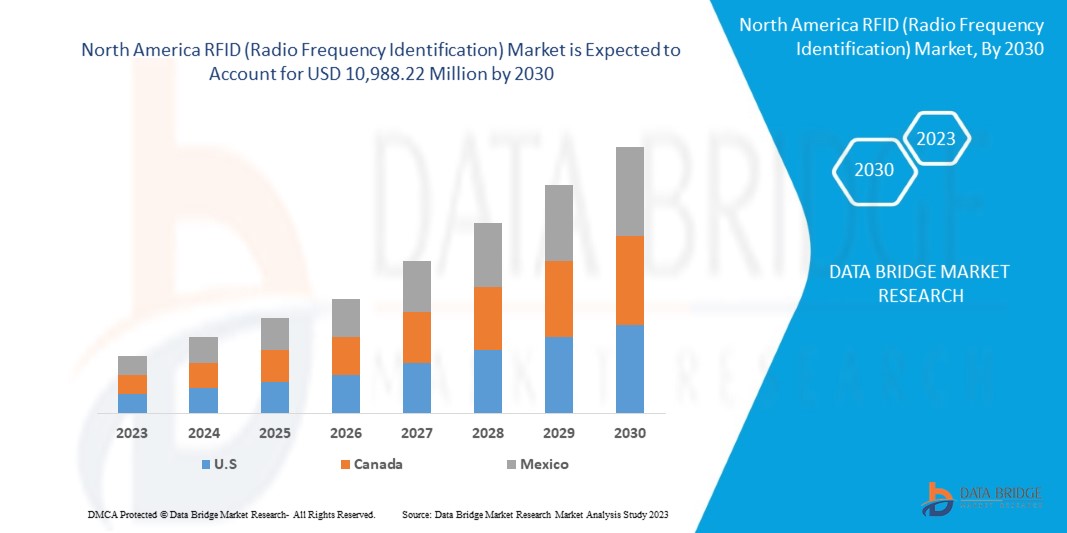

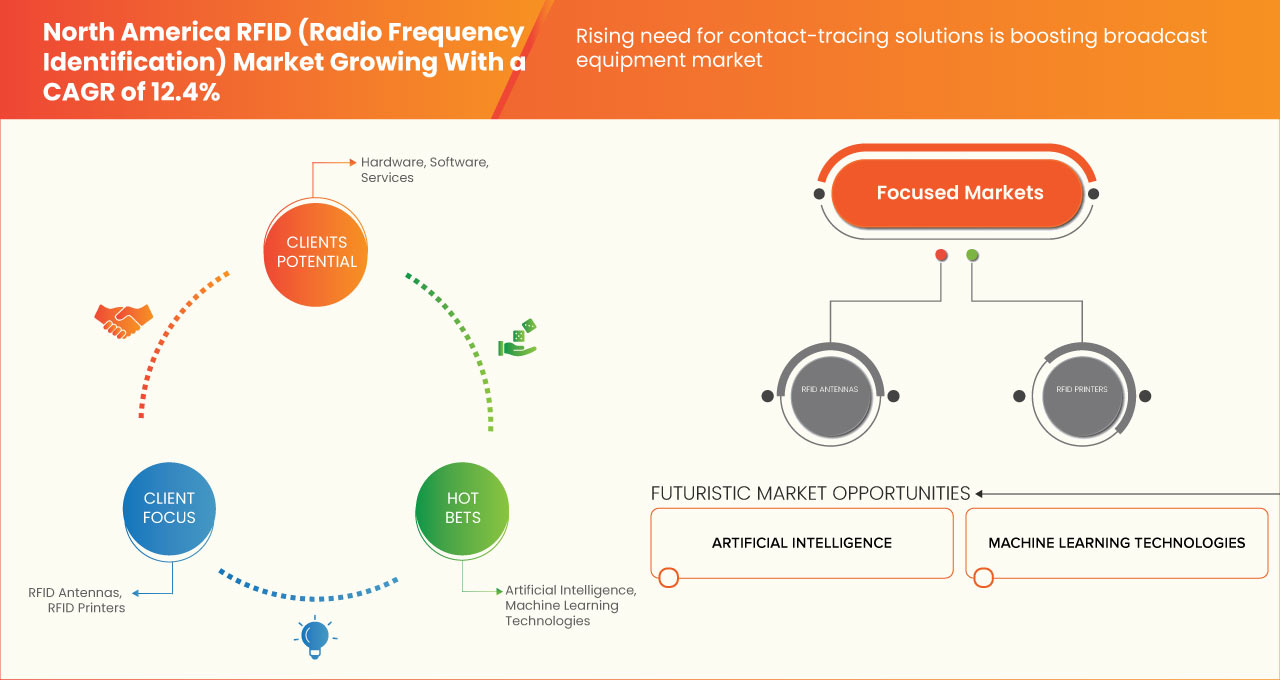

Data Bridge Market Research는 북미 RFID(무선 주파수 식별) 시장이 2030년까지 10,988.22백만 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 12.4%가 될 것으로 분석했습니다. 북미 RFID(무선 주파수 식별) 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2023년부터 2030년까지 |

|

기준 연도 |

2022 |

|

역사적 연도 |

2021 (2015-2020으로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

제공(하드웨어, 소프트웨어 및 서비스), 연결성(블루투스, 초광대역 및 기타), 재료 유형(플라스틱, 금속, 종이, 유리 및 기타), 최종 사용자(소매/상업, 산업, 의료, 소비자 패키지 상품, 자동차, 항공우주, 감시 및 보안, 물류 및 운송, 스포츠, 국방, 교육, 가축 및 야생 동물 및 기타) |

|

국가 커버 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, ASSA ABLOY의 일부 등 |

시장 정의

RFID(무선 주파수 식별)는 무선 주파수 기술을 사용하여 품목을 식별하기 위해 스마트 바코드를 사용하는 추적 시스템의 일부입니다. 무선파는 태그에서 판독기로 데이터를 전송하고, 수신된 데이터는 RFID 컴퓨터 프로그램에 정보로 전송됩니다. RFID 태그에는 제품과 포장에 부착할 수 있는 집적 회로와 안테나가 장착되어 있습니다 . RFID 태그는 무선파를 통해 데이터를 전송하고, RFID 판독기는 이를 변환하여 백엔드에서 분석되는 보다 사용 가능한 형태의 데이터를 형성합니다.

북미 RFID(무선 주파수 식별) 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래에서 자세히 설명합니다.

운전자

생산성 향상을 위해 제조업에 RFID 시스템 설치 확대

제조업체는 항상 운영을 최적화하고 비용을 절감할 수 있는 고급 방법을 찾고 있습니다. RFID(무선 주파수 식별) 기술은 자재 흐름을 개선하고 손상을 추적하여 공급망을 최적화할 수 있습니다. 스마트 가젯과 RFID와 같은 관련 무선 네트워크의 광범위한 가용성과 결합된 자동화 증가는 전례 없는 수준의 유연성과 효율성을 제공합니다. RFID 기술은 더 나은 제품 모니터링, 더 정확한 WIP 상태, 더 적은 제조 오류 및 더 높은 품질의 제품과 같은 수많은 이점을 제공하기 때문에 제조에 널리 사용됩니다. RFID는 생산 프로세스를 원활하게 운영하는 데 필수적인 자재 및 자산을 실시간으로 볼 수 있게 해줍니다.

스마트 카드에 있는 전자 신분증과 RFID 태그의 수용이 확대되고 있습니다.

2023년 2월, 보안 기술 연합 기구는 미국 정부와 기관이 취한 스마트 카드 이니셔티브에 대한 자세한 보고서를 발표했습니다. 이 보고서에서 그들은 미국 연방 정부가 직원 및 계약자 신분증에 대한 스마트 카드를 규제하기 위해 스마트 카드 프로그램을 시작했다고 언급했습니다. 그들은 또한 새로운 신원 프로그램에서 시민, 운송 근로자 및 응급 대응자를 위한 스마트 카드를 지정합니다 . 미국 연방 정부가 취한 이 조치는 스마트 카드에서 전자 신분증과 RFID 태그의 수용을 촉진하고 있습니다.

기회

접촉 추적 솔루션에 대한 수요 증가

접촉 추적은 감염병 의 발생과 확산을 예방하고 모니터링하기 위한 모든 전략에서 중요하고 인정받는 부분입니다 . 무선 주파수 식별(RFID) 기술은 전자기장을 사용하여 사람이나 사물에 부착된 태그를 자동으로 식별하고 추적하여 실시간 위치 시스템을 만듭니다. COVID-19의 영향은 의료 산업에서 사람, 공급망 및 자산을 효과적으로 모니터링하기 위해 추적 가능성과 표준화의 중요성을 보여줍니다. COVID-19 발생은 위조 의약품의 글로벌 무역으로 인한 위험을 높였습니다.

제지/도전

높은 구매, 설치 및 유지 관리 비용

모든 산업에서 RFID 시스템을 도입하려면 RFID 태그, 리더, 소프트웨어의 구매 비용과 교체 서비스 및 전기와 관련된 비용을 포함하여 높은 투자가 필요합니다. 시스템의 지속적인 정확도 검사, IoT 통합, 교육 비용과 같은 추가 기능으로 인해 RFID 솔루션 비용이 더 많이 듭니다. 이로 인해 RFID 시스템 도입률이 낮아집니다. RFID 태그는 액티브와 패시브의 두 가지 유형이 있으며 패시브 RFID 태그는 액티브 RFID 태그에 비해 비용이 저렴하지만 패시브 RFID 태그의 인프라는 매우 비쌉니다.

COVID-19 이후 북미 RFID(무선 주파수 식별) 시장에 미치는 영향

COVID-19는 글로벌 물류 및 운송을 중단하고 시스템 테스트가 부족함에 따라 북미 RFID(무선 주파수 식별) 시장에 부정적인 영향을 미쳤습니다.

COVID-19 팬데믹은 북미 RFID(무선 주파수 식별) 시장에 어느 정도 부정적인 영향을 미쳤습니다. 그러나 RAIN이라는 단어는 UHF RFID와 클라우드 간의 링크 역할을 하는 무선 주파수 식별에서 파생되었습니다. 클라우드는 인터넷을 통해 추가로 공유할 수 있는 데이터를 저장하고 관리하는 데 도움이 됩니다. 따라서 RAIN RFID는 수십억 개의 일상 용품을 인터넷에 연결하는 데 도움이 되는 무선 기술로, 여러 소비자가 각 품목을 추가로 식별하고, 찾고, 인증하고, 사용할 수 있습니다. 다양한 산업에서 자동화가 증가하고 연결된 장비 사용이 증가함에 따라 제조업체는 더 큰 시장 점유율을 확보하기 위해 RAIN RFID 태그를 개발하고 있으며, 따라서 시장 성장이 증가하고 있습니다.

시장 참여자들은 액세서리에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 발전과 혁신을 가져올 것입니다. 또한 RFID에 대한 정부 자금 지원이 시장 성장을 이끌었습니다.

최근 개발 사항

- 2023년 8월, HL은 회사가 새로운 UHF RFID 산업용 전원 커넥터를 출시했다고 발표했습니다. 이 단계를 통해 회사는 북미 무선 주파수 식별 기술 시장에서 제품 포트폴리오를 늘리고 유럽과 북미에서 더 광범위한 소비자 범위를 제공할 수 있었습니다.

- CCL Industries는 회사가 의료 분야를 위한 새로운 임상 시스템을 출시했다고 발표했습니다. 이 시스템은 차세대 임상 라벨링을 위한 새로운 디지털 기능을 포함할 것입니다. 이 회사는 이번 출시를 통해 북미 무선 주파수 식별 기술 시장에서 지배력을 강화했습니다.

북미 RFID(무선 주파수 식별) 시장 범위

북미 RFID(무선 주파수 식별) 시장은 제공, 연결성, 소재 유형 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

북미 RFID(무선 주파수 식별) 시장, 제공 방식

- 하드웨어

- 소프트웨어

- 서비스

제공 항목을 기준으로 시장은 하드웨어, 소프트웨어, 서비스로 구분됩니다.

북미 RFID(무선 주파수 식별) 시장, 연결성별

- 블루투스 밴드

- 초광대역

- 기타

연결성을 기준으로 시장은 블루투스와 초광대역으로 구분됩니다.

북미 RFID(무선 주파수 식별) 시장, 재료 유형별

- 플라스틱

- 금속

- 종이

- 유리

- 기타

재료 유형을 기준으로 시장은 플라스틱, 금속, 종이, 유리 및 기타로 구분됩니다.

북미 RFID(무선 주파수 식별) 시장, 최종 사용자별

- 소매/상업

- 산업

- 건강 관리

- 소비재 패키지 상품

- 자동차

- 항공우주

- 감시 및 보안

- 물류 및 운송

- 정보기술(IT)

- 스포츠

- 방어

- 야생 생물

- 교육

- 가축

- 기타

최종 사용자를 기준으로 시장은 소매/상업, 산업, 의료, 소비재, 자동차, 항공우주, 감시 및 보안, 물류 및 운송, 정보 기술(IT), 스포츠, 국방, 야생 동물, 교육, 가축 및 기타로 세분화됩니다.

국가 분석/통찰력

북미 RFID(무선 주파수 식별) 시장을 분석하고, 위에 언급된 대로 국가, 유형, 유통 채널, 인구 통계 및 가격 범위별로 시장 규모 통찰력과 추세를 제공합니다. 북미 RFID(무선 주파수 식별) 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다. 미국은 다른 지역에 비해 산업 4.0, IoT, 스마트 제조를 위한 RFID 태그 채택이 증가하고 있기 때문에 시장을 지배할 것으로 예상됩니다. 보고서의 국가 섹션은 또한 시장의 현재 및 미래 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제 변경 사항을 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세의 영향, 무역 경로가 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 RFID(무선 주파수 식별) 시장 점유율 분석

북미 RFID(무선 주파수 식별) 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 북미 RFID(무선 주파수 식별) 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 RFID(무선 주파수 식별) 시장의 주요 기업으로는 CCL Industries, Honeywell International Inc., HL, Smart Label Solutions, Omnia Technologies, SES RFID GmbH, Invengo Technology Pte. Ltd., RFID4U, AVERY DENNISON CORPORATION, Jadak – A Novanta Company, Alien Technology, LLC, CoreRFID, Impinj, Inc., Nedap NV, NXP Semiconductors, Zebra Technologies Corp., Pepperl+Fuchs SE, SimplyRFID, Identiv, Inc., HID Global Corporation, ASSA ABLOY의 일부 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN THE MANUFACTURING INDUSTRY TO IMPROVE PRODUCTIVITY

5.1.2 RISE IN ACCEPTANCE OF ELECTRONIC IDENTITY CARDS AND RFID TAGS LOCATED IN SMART CARDS

5.1.3 INCREASE IN REGULATIONS AND GOVERNMENT INITIATIVES FOR VARIOUS INDUSTRIES

5.1.4 GROWTH IN THE USAGE OF RFID TAGS IN DIFFERENT INDUSTRIES

5.2 RESTRAINTS

5.2.1 HIGH PURCHASE, INSTALLATION, AND MAINTENANCE COSTS

5.2.2 CYBER ATTACKS AND DATA BREACHES WITH RFID

5.3 OPPORTUNITIES

5.3.1 RISE IN NEED FOR CONTACT-TRACING SOLUTIONS

5.3.2 INCREASE IN ADOPTION OF RFID TAGS FOR INDUSTRY 4.0, IOT, AND SMART MANUFACTURING

5.3.3 INCREASE IN DEVELOPMENTS IN RAIN RFID

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS ABOUT RFID SOLUTIONS AND EXPERT WORKFORCE

6 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 TAGS

6.2.1.1 BY PRODUCT TYPE

6.2.1.1.1 INLAY TAGS

6.2.1.1.2 COMPOSITE TAGS

6.2.1.1.3 CERAMIC TAGS

6.2.1.2 BY TYPE

6.2.1.2.1 PASSIVE TAGS

6.2.1.2.2 ACTIVE TAGS

6.2.1.2.3 BATTERY-ASSISTED PASSIVE (BAP) RFID TAGS

6.2.1.3 BY WAFER SIZE

6.2.1.3.1 300MM

6.2.1.3.2 200MM

6.2.1.3.3 OTHERS

6.2.1.4 BY FREQUENCY

6.2.1.4.1 LOW FREQUENCY

6.2.1.4.2 ULTRA-HIGH FREQUENCY

6.2.1.4.3 HIGH FREQUENCY

6.2.1.5 BY APPLICATION

6.2.1.5.1 RETAIL

6.2.1.5.2 ASSET MANAGEMENT

6.2.1.5.3 ACCESS CONTROL/ TICKETING

6.2.1.5.4 LOGISTICS

6.2.1.5.5 AIRLINES

6.2.1.5.6 HEALTHCARE

6.2.1.5.7 PEOPLE MANAGEMENT

6.2.1.5.8 EMBEDDED SYSTEMS

6.2.1.5.9 OTHERS

6.2.1.6 BY FORM FACTOR

6.2.1.6.1 CARD

6.2.1.6.2 IMPLANT

6.2.1.6.3 KEY FOB

6.2.1.6.4 LABEL

6.2.1.6.5 PLASTIC MOULDING

6.2.1.6.6 WRISTBAND

6.2.1.6.7 BUTTONS

6.2.1.6.8 BADGES

6.2.1.6.9 OTHERS

6.2.1.7 BY MATERIAL TYPE

6.2.1.7.1 PLASTIC

6.2.1.7.2 PAPER

6.2.1.7.3 GLASS

6.2.1.7.4 METAL

6.2.1.7.5 OTHERS

6.2.2 READERS

6.2.2.1 BY PRODUCT TYPE

6.2.2.1.1 FIXED RFID READERS

6.2.2.1.2 PORTABLE/HANDHELD RFID

6.2.2.1.2.1 HANDHELD TABLET READERS

6.2.2.1.2.2 HANDHELD PDA/EDA READERS

6.2.2.1.2.3 HANDHELD PISTOL GRIP READERS

6.2.2.1.3 USB RFID READERS

6.2.2.1.4 BLUETOOTH RFID READERS

6.2.2.1.5 RUGGED & VEHICLE MOUNTED RFID READERS

6.2.2.1.6 GPS RFID READERS

6.2.2.1.7 OTHERS

6.2.2.2 BY TECHNOLOGY

6.2.2.2.1 RAIN RFID READER

6.2.2.2.2 ANDROID RFID READER

6.2.2.2.3 IPHONE RFID READER

6.2.2.2.4 OTHER

6.2.2.3 BY FREQUENCY

6.2.2.3.1 LOW FREQUENCY READERS

6.2.2.3.2 ULTRA-HIGH FREQUENCY READERS

6.2.2.3.3 HIGH FREQUENCY READERS

6.2.2.4 BY APPLICATION

6.2.2.4.1 RETAIL

6.2.2.4.2 ASSET MANAGEMENT

6.2.2.4.3 ACCESS CONTROL/TICKETING

6.2.2.4.4 LOGISTICS

6.2.2.4.5 AIRLINES

6.2.2.4.6 HEALTHCARE

6.2.2.4.7 PEOPLE MANAGEMENT

6.2.2.4.8 EMBEDDED SYSTEMS

6.2.2.4.9 OTHERS

6.2.3 RFID ANTENNAS

6.2.4 RFID PRINTERS

6.2.4.1 DESKTOP PRINTER

6.2.4.2 MOBILE PRINTER

6.3 SOFTWARE

6.3.1 OPERATING SYSTEM

6.3.1.1 ANDROID

6.3.1.2 WINDOW

6.3.1.3 IOS

6.3.1.4 WEB

6.3.1.5 OTHERS

6.3.2 BY DEPLOYMENT

6.3.2.1 ON-PREMISE

6.3.2.2 CLOUD

6.3.3 BY APPLICATION

6.3.3.1 ACCESS CONTROL RFID SOFTWARE

6.3.3.2 ASSET TRACKING RFID SOFTWARE

6.3.3.3 PARKING CONTROL RFID SOFTWARE

6.3.3.4 PERSONAL TRACKING RFID SOFTWARE

6.3.3.5 AUTO-ID ENGINE

6.3.3.6 OTHERS

6.4 SERVICES

6.4.1 SYSTEM IMPLEMENTATION/MAINTENANCE

6.4.2 SYSTEM DESIGNING/DEVELOPMENT/TESTING

6.4.3 CONSULTING, SELECTION GUIDANCE

7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY

7.1 OVERVIEW

7.2 BLUETOOTH

7.3 ULTRA WIDE BAND

7.4 OTHER

8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PLASTIC

8.3 PAPER

8.4 GLASS

8.5 METAL

8.6 OTHERS

8.6.1 SILICON

8.6.2 CERAMIC

8.6.3 RUBBER

9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER

9.1 OVERVIEW

9.2 RETAIL/COMMERCIAL

9.2.1 APPAREL

9.2.2 JEWELLER TRACKING

9.2.3 KIOSK

9.2.4 IT ASSET TRACKING

9.2.5 ADVERTISEMENT

9.2.6 LAUNDRY

9.2.7 OTHER

9.3 LOGISTICS AND TRANSPORTATION

9.4 SURVEILLANCE AND SECURITY

9.5 AUTOMOTIVE

9.6 INDUSTRIAL

9.7 AEROSPACE/AVIATION

9.7.1 BAGGAGE TRACKING

9.7.2 MATERIALS MANAGEMENT

9.7.3 FLY PARTS TRACKING

9.7.4 LIFETIME TRACEABILITY

9.7.5 MRO

9.7.6 OTHER

9.8 CONSUMER PACKAGE GOODS

9.9 HEALTHCARE

9.9.1 PATIENTS MANAGEMENT

9.9.2 WASTE MANAGEMENT

9.9.3 DRUGS MANAGEMENT

9.9.4 LABORATORY MANAGEMENT

9.9.5 EQUIPMENT MANAGEMENT

9.9.6 OTHER

9.1 LIVESTOCK & WILDLIFE

9.11 SPORTS

9.12 EDUCATION

9.13 DEFENSE

9.13.1 BORDER SECURITY

9.13.2 WEAPON MANAGEMENT TRACKING

9.13.3 SOLDIER MOVEMENT TRACKING

9.13.4 OTHER

9.14 OTHER

10 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILING

13.1 ZEBRA TECHNOLOGIES CORP.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 AVERY DENNISON CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 HONEYWELL INTERNATIONAL INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 CCL INDUSTRIES

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 IMPINJ, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALIEN TECHNOLOGY, LLC

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 CORERFID

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 HID GLOBAL CORPORATION, PART OF ASSA ABLOY

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HL

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IDENTIV, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 INVENGO TECHNOLOGY PTE. LTD.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JADAK – A NOVANTA COMPANY

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 NEDAP N.V.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 NXP SEMICONDUCTORS

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 OMNIA TECHNOLOGIES

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PEPPERL+FUCHS SE

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 RFID4U

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 SES RFID GMBH

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 SIMPLYRFID

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SMART LABEL SOLUTION

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET, BY OFFERING, 2023-2030 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 3 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 4 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 5 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2023-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2023-2030 (USD MILLION)

TABLE 9 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 12 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

TABLE 13 NORTH AMERICA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2023-2030 (USD MILLION)

TABLE 14 NORTH AMERICA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 15 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 16 NORTH AMERICA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SERVICES IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2023-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2023-2030

TABLE 21 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2023-2030

TABLE 22 NORTH AMERICA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2023-2030

TABLE 24 NORTH AMERICA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 U.S. HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 34 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 35 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 36 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 37 U.S. TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 U.S. PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 41 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 42 U.S. READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 43 U.S. RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 45 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 46 U.S. SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 U.S. SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 49 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 U.S. RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.S. AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 CANADA HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 61 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 62 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 CANADA PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 68 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 69 CANADA READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 73 CANADA SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 74 CANADA SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 76 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 79 CANADA RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 84 MEXICO HARDWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY WAFER SIZE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 89 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FORM FACTOR, 2021-2030 (USD MILLION)

TABLE 91 MEXICO TAGS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO PORTABLE/HANDHELD RFID IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 95 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY FREQUENCY, 2021-2030 (USD MILLION)

TABLE 96 MEXICO READERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RFID PRINTER IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY OPERATION SYSTEM, 2021-2030 (USD MILLION)

TABLE 99 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY DEPLOYMENT, 2021-2030 (USD MILLION)

TABLE 100 MEXICO SOFTWARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 101 MEXICO SERVICE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2021-2030 (USD MILLION)

TABLE 103 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO OTHERS IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 106 MEXICO RETAIL AND COMMERCIAL IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 MEXICO AEROSPACE AND AVIATION IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 MEXICO HEALTHCARE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 MEXICO DEFENSE IN RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY TYPE, 2021-2030 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE INSTALLATION OF RFID SYSTEMS IN MANUFACTURING UNITS TO IMPROVE PRODUCTIVITY IS EXPECTED TO DRIVE THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN THE FORECAST PERIOD

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET

FIGURE 13 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY OFFERING, 2022

FIGURE 14 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET, BY CONNECTIVITY, 2022

FIGURE 15 NORTH AMERICA RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY (RFID) MARKET: BY MATERIAL TYPE, 2022

FIGURE 16 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION TECHNOLOGY) MARKET: BY END USER, 2022

FIGURE 17 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: SNAPSHOT (2022)

FIGURE 18 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022)

FIGURE 19 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: BY OFFERING (2023-2030)

FIGURE 22 NORTH AMERICA RFID (RADIO FREQUENCY IDENTIFICATION) MARKET: COMPANY SHARE 2022 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.