북미 가공육 시장, 제품 유형별( 쇠고기돼지고기 , 염소고기, 양고기, 닭고기 , 칠면조, 오리고기, 생선 ), 유형별(신선 가공육, 냉동육, 냉장육 , 통조림 육 , 건조/반건조육, 발효육, 기타), 범주별(양념, 미양념), 특성별(일반, 유기 ), 포장 유형별(트레이, 파우치, 상자, 통조림, 기타), 포장재(플라스틱, 유리 , 종이/골판지, 금속, 기타), 최종 사용자(식품 서비스 부문, 가정), 유통 채널(매장 기반 소매업체, 비매장 기반 소매업체), 국가별(미국, 캐나다, 멕시코) 산업 동향 및 2029년까지의 예측.

시장 분석 및 통찰력 : 북미 가공육 시장

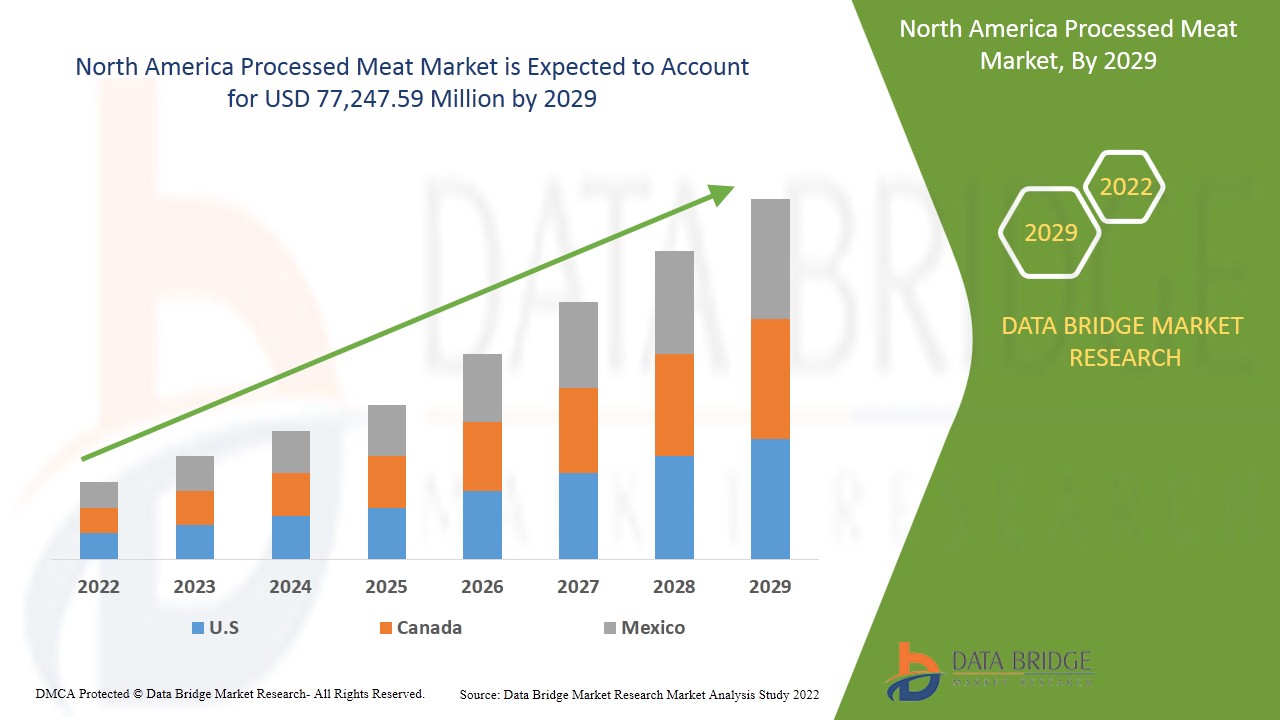

북미 가공육 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 4.8%의 CAGR로 성장하고 있으며 2029년까지 77,247.59백만 달러에 도달할 것으로 예상된다고 분석했습니다. 식품 및 제약 산업에서 가공육에 대한 수요 증가는 북미 가공육 시장의 성장을 촉진할 수 있습니다.

가공육은 산미제, 미네랄, 소금 및 기타 다양한 조미료 및 향미제와 같은 여러 가지 첨가물 및 방부제로 보충된 고기로 정의할 수 있습니다. 고기는 주로 품질을 향상시키고, 변성을 방지하고, 원래 구성에 풍미를 더하기 위해 가공됩니다. 돼지, 가금류, 소 또는 해양 동물 고기의 붉은 고기 또는 흰 고기일 수 있습니다.

쇠고기, 돼지고기, 칠면조, 닭고기, 양고기와 같은 고기는 일반적으로 가공육을 생산하는 데 사용됩니다. 다양한 가공육 제품에는 페퍼로니, 육포, 핫도그, 소시지가 있습니다. 특정 방부제는 박테리아와 다른 유기체가 부패하는 것을 방지하기 위해 고기에 첨가됩니다.

예측 기간 동안 북미 가공육 시장 성장을 촉진할 것으로 예상되는 주요 요인은 가처분 소득의 증가입니다. 또한 바쁜 라이프스타일로 인해 집에서 고기를 요리하는 데 걸리는 시간이 감소한 것도 북미 가공육 시장 성장을 보완할 것으로 추산됩니다.

- 반면, 가공육 기반 제품의 높은 소비로 인한 비만 발생률의 증가는 타임라인 기간 동안 북미 가공육 시장의 성장을 방해할 것으로 예상됩니다. 또한, 패스트푸드와 레스토랑 체인의 성장은 향후 몇 년 동안 가공육 시장 성장에 대한 잠재적 기회를 더욱 제공할 수 있습니다. 그러나 엄격한 정부 규제는 북미 가공육 시장의 성장에 더욱 도전할 수 있습니다.

북미 가공육 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 북미 가공육 시장 시나리오를 이해하려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

북미 가공육 시장 범위 및 시장 규모

북미 가공육 시장은 제품 유형, 유형, 범주, 특성, 포장 유형, 포장 재료, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 가공 유형에 따라 북미 가공육 시장은 신선 가공육, 냉동육, 냉장육, 통조림육, 건조/반건조육, 발효육 등으로 세분화됩니다. 2022년에는 신선 가공육 세그먼트가 L-카르니틴, 단백질, 미네랄, 비타민, 철분, 항산화제 등 영양소가 풍부하여 신선 가공육에 대한 소비자 선호도가 높아짐에 따라 시장을 지배할 것으로 예상됩니다.

- 제품 유형에 따라 북미 가공육 시장은 소고기, 돼지고기, 염소고기, 양고기, 닭고기, 칠면조고기, 오리고기, 생선으로 세분화됩니다. 2022년에는 닭고기의 인기가 높아짐에 따라 닭고기 부문이 시장을 지배할 것으로 예상됩니다.

- 카테고리 기준으로 북미 가공육 시장은 경화육과 비경화육으로 구분됩니다. 2022년에는 경화육의 유통기한이 비경화육에 비해 길기 때문에 경화육 세그먼트가 시장을 지배할 것으로 예상됩니다.

- 북미 가공육 시장은 자연에 따라 유기농과 재래식으로 구분됩니다. 2022년에는 재래식 육류 가격이 낮아져 재래식 세그먼트가 시장을 지배할 것으로 예상됩니다.

- 포장 유형을 기준으로 북미 가공육 시장은 트레이, 파우치, 상자, 캐니스터 등으로 세분화됩니다. 2022년에는 파우치의 무게가 가벼워 파우치 부문이 시장을 지배할 것으로 예상됩니다.

- 포장재 기준으로 북미 가공육 시장은 플라스틱, 유리, 종이/골판지, 금속 등으로 세분화됩니다. 2022년에는 플라스틱 세그먼트가 시장을 지배할 것으로 예상되며, 플라스틱 포장의 취급하기 쉬운 특성

- 최종 사용자를 기준으로 북미 가공육 시장은 가정 및 식품 서비스 부문으로 세분화됩니다. 2022년에는 북미 지역에서 식품 서비스 부문의 확장이 확대됨에 따라 식품 서비스 부문 세그먼트가 주도할 것으로 예상됩니다.

- 유통 채널을 기준으로 북미 가공육 시장은 매장 기반 소매업체와 비매장 기반 소매업체로 세분화됩니다. 2022년에는 매장 기반 소매업체 부문이 슈퍼마켓과 하이퍼마켓에서 훈련된 회사 담당자를 확보할 수 있어 시장을 지배할 것으로 예상됩니다.

북미 가공육 시장 국가 수준 분석

북미 가공육 시장은 제품 유형, 유형, 범주, 특성, 포장 유형, 포장 재료, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다.

북미 가공육 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 닭고기, 돼지고기 등 다양한 가공육에 대한 인기와 수요가 지역에서 증가하고 있기 때문에 북미 가공육 시장을 지배할 것으로 예상됩니다. 캐나다는 도시화의 증가와 식품 서비스의 급속한 확장으로 인해 이 지역을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

주요 시장 참여자들의 전략적 활동이 확대되면서 북미 가공육 시장 성장이 촉진되고 있습니다.

북미 가공육 시장은 또한 특정 시장에서 모든 국가의 성장에 대한 자세한 시장 분석을 제공합니다. 또한 시장 참여자의 전략과 지리적 입지에 대한 자세한 정보를 제공합니다. 데이터는 2011년부터 2020년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 북미 가공육 시장 점유율 분석

북미 가공육 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 범위, 응용 분야 우세, 기술 수명선 곡선입니다. 위에 제공된 데이터 포인트는 북미 가공육 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 가공육을 취급하는 주요 기업으로는 Cargill, Incorporated, JBS Foods, Tyson Foods, Inc., Smithfield Foods, Inc., Hormel Foods Corporation, NH Foods Ltd., Louis Dreyfus Company, Koch Foods, HKScan, Gruppo Veronesi, OSI Group, Charoen Pokphand Foods PCL., Perdue Farms Inc., Sanderson Farms, Incorporated., National Beef Packing Company LLC, Marfrig, Danish Crown AMBA, The Kraft Heinz Company 등이 있습니다. DBMR 분석가는 경쟁 우위를 이해하고 각 경쟁사에 대한 경쟁 분석을 별도로 제공합니다.

전 세계 기업들이 많은 계약과 협정을 체결하면서 북미 가공육 시장이 급속히 성장하고 있습니다.

예를 들어,

- 2021년 12월, Smithfield Foods, Inc.는 맞춤형 건조 조미료 블렌드, 소스, 드레싱 및 유약 사업인 Saratoga Food Specialties를 출시했으며, 이는 사우스 네바다에서 사업 영역을 거의 두 배로 늘릴 것입니다. 이를 통해 회사는 지역 확장에 도움이 될 것입니다.

협력, 제품 출시, 사업 확장, 수상 및 인정, 합작 투자 및 시장 참여자의 기타 전략을 통해 북미 가공육 시장에서 회사의 입지를 강화하고, 이는 조직의 수익 성장에도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROCESSED MEAT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS (VOLUME %)

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 NORTH AMERICA PROCESSED MEAT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.2.1 GROWING UTILIZATION OF NEW TECHNOLOGIES IN MEAT PROCESSING

4.2.2 GROWING COLLABORATIONS AND PARTNERSHIPS

4.2.3 CONSUMER OPTING FOR HEALTHEIR MEAT PRODUCTS WITH DECREASED FAT LEVEL, CHOLESTEROL,

5 NORTH AMERICA PROCESSED MEAT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS

6.1.2 PREFERENCE FOR ANIMAL-BASED PROTEINS OVER PLANT-BASED PROTEINS

6.1.3 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.4 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

6.2 RESTRAINTS

6.2.1 HIGH INVESTMENT COST IN POULTRY BUSINESS

6.2.2 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 GROWING FAST FOOD AND RESTAURANT CHAINS

6.3.2 INCREASING AUTOMATION IN MEAT PROCESSING INDUSTRY

6.3.3 GROWING PREFERENCE FOR ORGANIC MEAT

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT REGULATIONS

6.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7 COVID-19 IMPACT ON NORTH AMERICA PROCESSED MEAT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST NORTH AMERICA PROCESSED MEAT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 NORTH AMERICA PROCESSED MEAT MARKET, BY TYPE

8.1 FRESH PROCESSED MEAT

8.2 FROZEN MEAT

8.3 CHILLED MEAT

8.4 CANNED MEAT

8.5 DRIED/SEMI DRIED MEAT

8.6 FERMENTED MEAT

9 NORTH AMERICA PROCESSED MEAT MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW:

9.2 BEEF

9.3 PORK

9.4 GOAT

9.5 LAMB

9.6 CHICKEN

9.7 TURKEY

9.8 DUCK

9.9 FISH

10 NORTH AMERICA PROCESSED MEAT MARKET, BY PACKAGING TYPE

10.1 TRAYS

10.2 POUCHES

10.3 BOXES

10.4 CANNISTERS

10.5 OTHERS

11 NORTH AMERICA PROCESSED MEAT MARKET, BY END USER:

11.1 OVERVIEW:

11.2 HOUSEHOLD

11.3 FOOD SERVICE SECTOR

12 NORTH AMERICA PROCESSED MEAT MARKET, BY CATEGORY:

12.1 OVERVIEW:

12.2 CURED

12.3 UNCURED

13 NORTH AMERICA PROCESSED MEAT MARKET, BY NATURE:

13.1 OVERVIEW:

13.2 ORGANIC

13.3 CONVENTIONAL

14 NORTH AMERICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL

14.1 STORE BASED RETAILER

14.2 NON-STORE BASED RETAILER

15 NORTH AMERICA PROCESSED MEAT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 MEXICO

15.1.3 CANADA

16 NORTH AMERICA PROCESSED MEAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 JBS FOODS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUS ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TYSON FOODS, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VION FOOD GROUP

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CARGILL, INCORPORATED

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 DANISH CROWN A.M.B.A

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CHAROEN POKPHAND FOODS PUBLIC CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 SMITHFIELD FOODS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 TÖNNIES GROUP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HORMEL FOODS CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUS ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 NATIONAL BEEF PACKING COMPANY L.L.C.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GAUSEPOHL FLEISCH DEUTSCHLAND GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GROUPE BIGARD

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GRUPPO VERONESI

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUS ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 HKSCAN

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUS ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KOCH FOODS.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LOUIS DREYFUS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARFRIG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MÜLLER GRUPPE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 NH FOODS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUS ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 OSI GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 PERDUE FARMS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SANDERSON FARMS, INCORPORATED.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TERRENA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THE KRAFT HEINZ COMPANY

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 WESTFLEISCH SCE MBH

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

그림 목록

FIGURE 1 NORTH AMERICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROCESSED MEAT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROCESSED MEAT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROCESSED MEAT MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA PROCESSED MEAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROCESSED MEAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROCESSED MEAT MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA PROCESSED MEAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE NORTH AMERICA PROCESSED MEAT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS IS DRIVING THE GROWTH OF NORTH AMERICA PROCESSED MEAT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PROCESSED MEAT MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA PROCESSED MEAT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PROCESSED MEAT MARKET

FIGURE 15 NORTH AMERICA PROCESSED MEAT MARKET, BY TYPE (2021)

FIGURE 16 NORTH AMERICA PROCESSED MEAT MARKET, BY PRODUCT TYPE (2021)

FIGURE 17 NORTH AMERICA PROCESSED MEAT MARKET, BY PACKAGING TYPE (2021)

FIGURE 18 NORTH AMERICA PROCESSED MEAT MARKET, BY END-USER (2021)

FIGURE 19 NORTH AMERICA PROCESSED MEAT MARKET, BY CATEGORY

FIGURE 20 NORTH AMERICA PROCESSED MEAT MARKET, BY NATURE (2021)

FIGURE 21 NORTH AMERICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL (2021)

FIGURE 22 NORTH AMERICA SNAPSHOT, 2021

FIGURE 23 NORT AMERICA SUMMARY, 2021

FIGURE 24 NORTH AMERICA SUMMARY, 2022 & 2029

FIGURE 25 NORTH AMERICA SUMMARY, 2021 & 2029

FIGURE 26 NORTH AMERICA SUMMARY, BY PRODUCT, 2022 - 2029

FIGURE 27 NORTH AMERICA PROCESSED MEAT MARKET: COMPANY SHARE 2021 (VOLUME %)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.