North America Polybutylene Succinate Pbs Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

44.59 Million

USD

80.13 Million

2025

2033

USD

44.59 Million

USD

80.13 Million

2025

2033

| 2026 –2033 | |

| USD 44.59 Million | |

| USD 80.13 Million | |

|

|

|

|

북미 폴리부틸렌 석시네이트(PBS) 시장, 제품별(기존 폴리부틸렌 석시네이트(PBS) 및 바이오 기반 폴리부틸렌 석시네이트(PBS)), 공정(트랜스 에스테르화 및 직접 에스테르화), 응용 분야(가방, 멀치 필름, 포장 필름, 플러시 가능 위생 제품, 어망, 커피 캡슐, 목재 플라스틱 복합재 및 기타), 용도(일회용 및 재사용 가능), 포장 층(1차 포장, 2차 포장 및 3차 포장), 최종 용도(포장, 농업, 섬유, 소비재, 전기 및 전자, 자동차 및 기타) 국가(미국, 캐나다, 멕시코) 산업 동향 및 2028년까지의 예측

시장 분석 및 통찰력: 북미 폴리부틸렌 석시네이트(PBS) 시장

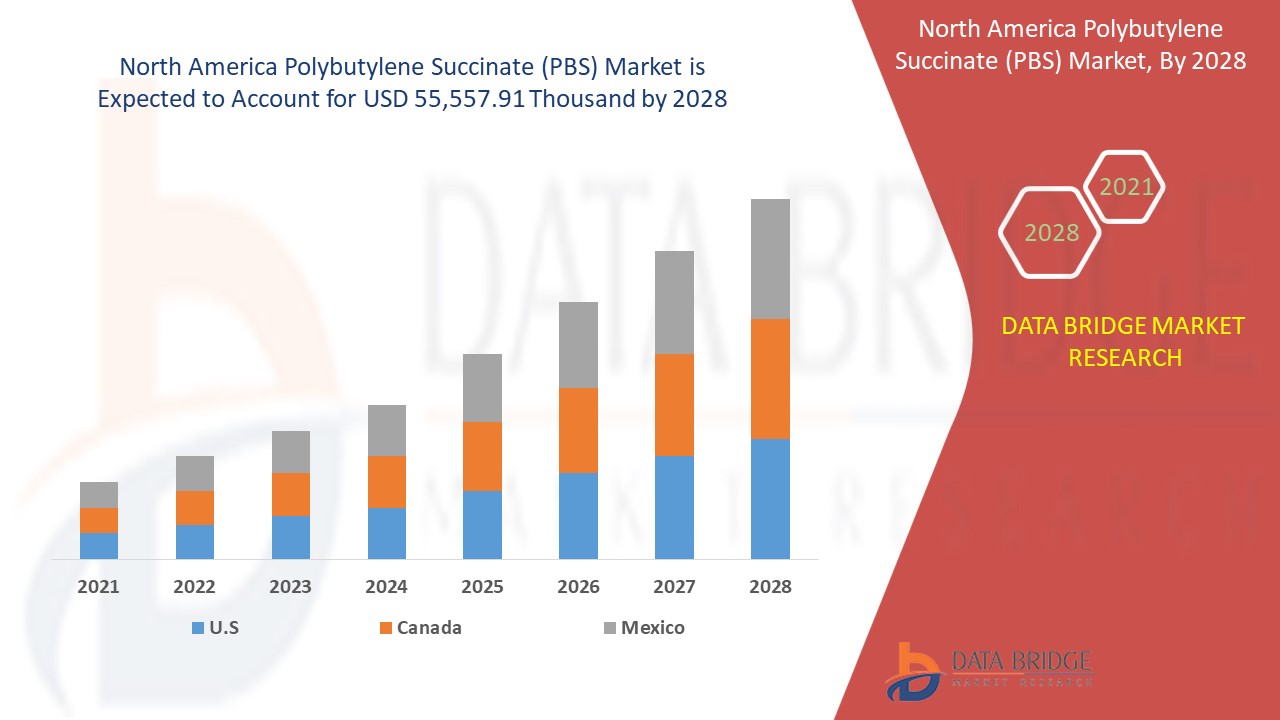

폴리부틸렌 석시네이트(PBS) 시장은 2021년부터 2028년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2021년부터 2028년까지의 예측 기간 동안 7.6%의 CAGR로 성장하고 있으며 2028년까지 55,557.91천 달러에 도달할 것으로 예상한다고 분석합니다.

폴리부틸렌 석시네이트(PBS)는 폴리에스터 계열의 열가소성 폴리머 수지입니다. PBS는 폴리프로필렌과 비슷한 특성을 가진 생분해성 지방족 폴리에스터의 한 종류입니다. 비교적 높은 용융 온도와 좋은 인성을 가진 생분해성 또는 분해성 폴리머입니다. 반결정 구조를 가진 다재다능한 반결정성 폴리머입니다.

폴리부틸렌 석시네이트(PBS) 시장과 관련된 여러 부스터에는 포장용 친환경 및 생분해성 제품에 대한 선호도 증가와 자동차 인테리어용 PBS 수요 증가가 포함됩니다. 석유 및 가스 산업 분야에서 폴리부틸렌 석시네이트(PBS) 제품에 대한 증가하는 수요를 충족하기 위해 일부 회사는 생산 용량을 확장하고 다양한 지역에서 계약을 체결하고 있습니다. 폴리부틸렌 석시네이트(PBS) 시장에 영향을 미칠 수 있는 주요 제약은 강도 특성을 저하시킬 수 있는 빠른 결정화 반응과 예측할 수 없는 원자재 가격입니다. 원자재 가격의 변동은 향후 시장 성장에 영향을 미칠 수 있습니다.

이 폴리부틸렌 석시네이트(PBS) 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 기회 분석을 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

북미 폴리부틸렌 석시네이트(PBS) 시장 범위 및 시장 규모

폴리부틸렌 석시네이트(PBS) 시장은 제품, 공정, 응용 분야, 용도, 포장 층, 최종 사용으로 세분화됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 제품 기준으로 폴리부틸렌 석시네이트(PBS) 시장은 기존 폴리부틸렌 석시네이트(PBS)와 바이오 기반 폴리부틸렌 석시네이트(PBS)로 세분화됩니다. 2021년에는 기존 폴리부틸렌 석시네이트(PBS) 세그먼트가 시장을 지배할 것으로 예상되는데, 기존 폴리부틸렌 석시네이트(PBS)는 환경에 영향을 미치지 않고 토양에서 쉽게 분해될 수 있기 때문에 전 세계적으로 수요가 증가하기 때문입니다.

- 공정 기준으로 폴리부틸렌 석시네이트(PBS) 시장은 트랜스 에스테르화와 직접 에스테르화로 세분화됩니다. 2021년에는 트랜스 에스테르화 공정이 대량 생산에 사용될 수 있기 때문에 트랜스 에스테르화 부문이 전 세계적으로 시장을 지배할 것으로 예상되며, 이는 폴리부틸렌 석시네이트(PBS)에 대한 트랜스 에스테르화 공정 수요를 증가시킵니다.

- 응용 프로그램을 기준으로, 폴리부틸렌 석시네이트(PBS) 시장은 가방, 멀치 필름, 포장 필름 , 플러시블 위생 제품, 어망, 커피 캡슐, 목재 플라스틱 복합재 등으로 세분화됩니다. 2021년에는 멀치 필름 부문이 시장을 지배할 것으로 예상되며, 전 세계적으로 농산물에 대한 수요가 증가함에 따라 전 세계적으로 그 수요가 증가하고 있습니다.

- 사용 기준으로 폴리부틸렌 석시네이트(PBS) 시장은 일회용 및 재사용으로 세분화됩니다. 2021년에는 재사용 가능한 세그먼트가 전 세계적으로 우세할 것으로 예상되는데, 재사용 가능한 PBS 제품이 일회용 PBS 제품보다 비용 효율적이기 때문입니다.

- 포장 층을 기준으로 폴리부틸렌 석시네이트(PBS) 시장은 1차 포장, 2차 포장, 3차 포장으로 세분화됩니다. 2021년에는 1차 포장 부문이 시장을 지배할 것으로 예상되는데, 1차 포장이 더 많은 상품을 구매하도록 더 많은 고객을 유치하기 때문에 1차 포장이 시장에서 지배적인 위치를 차지하게 됩니다.

- 최종 용도에 따라 폴리부틸렌 석시네이트(PBS) 시장은 포장, 농업, 섬유 , 소비재, 전기 및 전자, 자동차 및 기타로 세분화됩니다. 2021년에는 모든 산업에서 포장 제품에 대한 수요가 증가함에 따라 포장 부문이 시장을 지배할 것으로 예상되며, 포장이 시장에서 지배적인 위치를 차지하게 됩니다.

글로벌 폴리부틸렌 석시네이트(PBS) 시장 국가 수준 분석

폴리부틸렌 석시네이트(PBS) 시장을 분석하고, 국가, 제품, 공정, 응용 분야, 용도, 포장 층, 최종 용도별로 시장 규모 정보를 제공합니다.

북미 폴리부틸렌 석시네이트(PBS) 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 이 지역에서 일회용 플라스틱 제품에 대한 정책이 더욱 엄격해지면서 북미 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

유아용 기저귀에 PBS를 광범위하게 사용

폴리부틸렌 석시네이트(PBS) 시장은 또한 모든 국가의 산업 성장에 대한 자세한 시장 분석을 제공합니다. 여기에는 판매, 구성 요소 판매, 아기 기저귀의 기술 개발 영향, 폴리부틸렌 석시네이트(PBS) 시장에 대한 지원과 함께 규제 시나리오의 변화가 포함됩니다. 이 데이터는 2010년부터 2019년까지의 과거 기간에 대한 것입니다.

경쟁 환경 및 폴리부틸렌 석시네이트(PBS) 시장 점유율 분석

폴리부틸렌 석시네이트(PBS) 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 임상 시험 파이프라인, 브랜드 분석, 제품 승인, 특허, 제품 폭 및 호흡, 응용 분야 우세, 기술 수명선 곡선이 포함됩니다. 위에 제공된 데이터 포인트는 폴리부틸렌 석시네이트(PBS) 시장과 관련된 회사의 초점에만 관련됩니다.

폴리부틸렌 석시네이트(PBS) 시장에 참여하는 주요 시장 주체로는 Mitsubishi Chemical Corporation, BASF SE, Wacker Chemie AG, Eastman Chemical Company, SHOWA DENKO KK, Roquette Frères., BioAmber Inc., FILLPLAS, NaturePlast 및 Bio-disposable(Inchel Technology Group Limited의 자회사) 등이 있습니다.

예를 들어,

- 2021년 4월, 미쓰비시 케미컬 코퍼레이션은 BioPBS의 해양 생분해성 형태를 개발했습니다. 이 회사는 식물 유래 폴리부틸렌 석시네이트(PBS) 제품의 BioPBS 라인을 보장하기 위한 개발 계획을 수립하고 있습니다. 이 개발은 회사가 매출과 제품 포트폴리오를 늘리는 데 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.