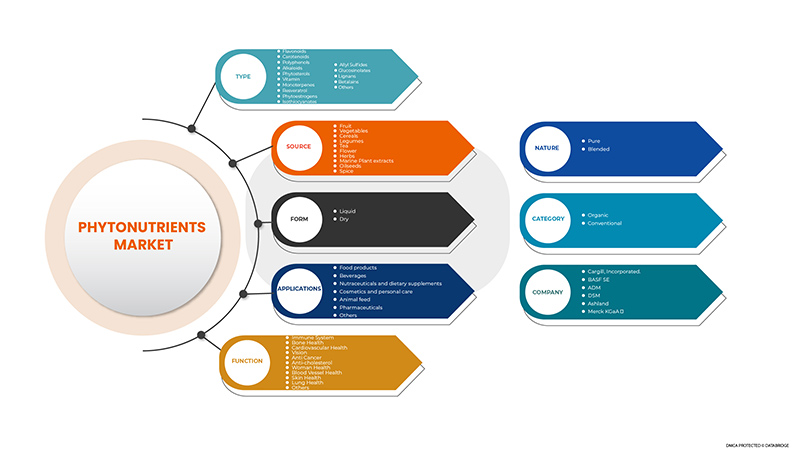

North America Phytonutrients Market, By Type (Flavonoids, Carotenoids, Polyphenols, Alkaloids, Phytosterols, Vitamins, Monoterpenes, Resveratrol, Phytoestrogens, Isothiocyanates, Allyl Sulfides, Glucosinolates, Lignans, Betalains, and Others), Function (Immune System, Vision, Skin Health, Bone Health, Cardiovascular Health, Anti-Cancer, Lung Health, Blood Vessel Health, Woman Health, Anti-Cholesterol, and Others), Source (Spice, Herb, Flower, Tea, Fruit, Vegetables, Cereals, Legumes, Oilseeds, Marine Plant Extracts), Form (Liquid, Dry), Category (Organic, Conventional), Nature (Blended, Pure), Application (Food Products, Beverages, Nutraceuticals, and Dietary Supplements, Cosmetics and Personal Care, Animal Feed, Pharmaceuticals, Others) Industry Trends and Forecast to 2029.

North America Phytonutrients Market Analysis and Insights

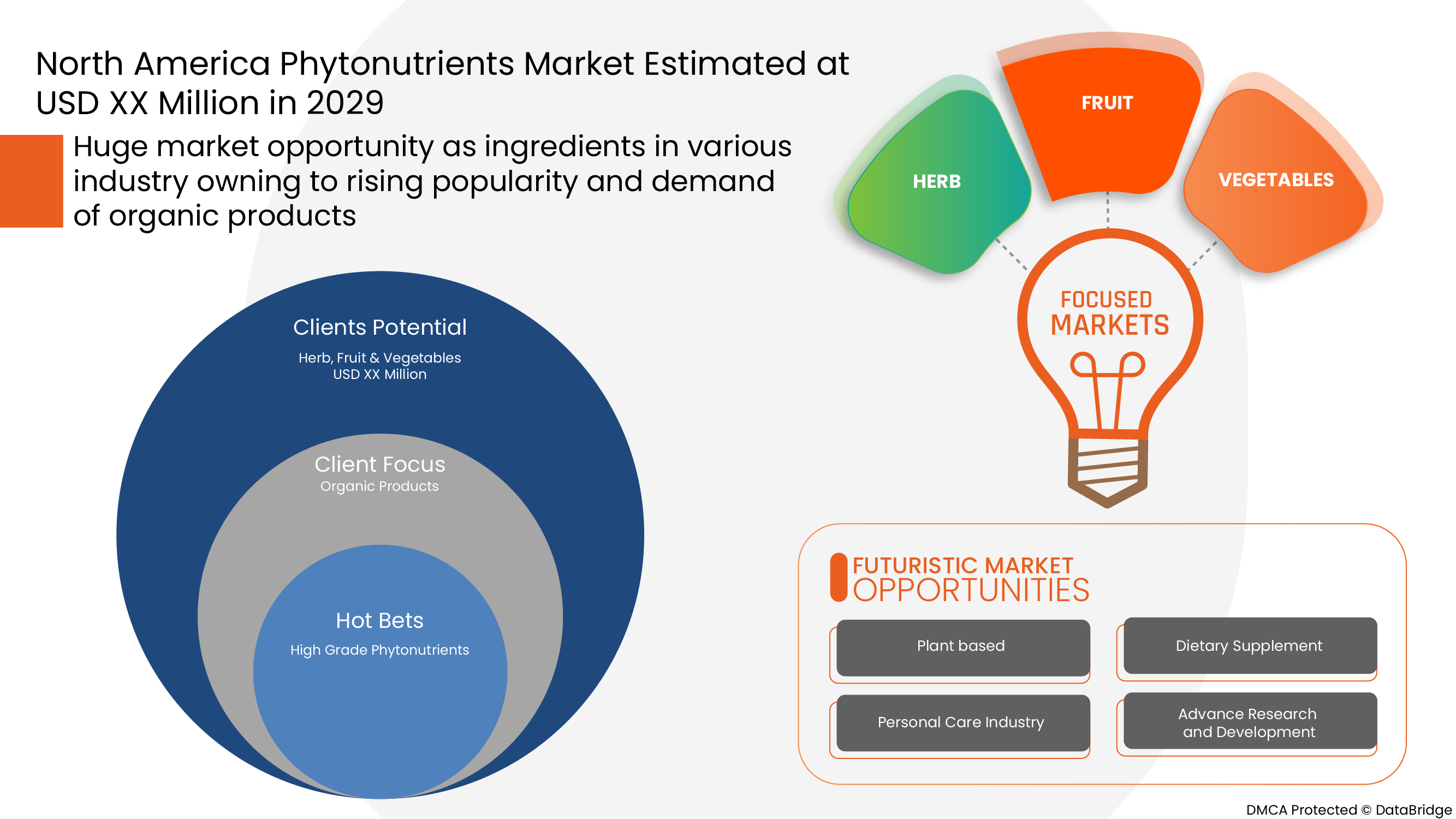

Increasing demand for phytonutrients in the food and beverage industries will accelerate the market demand. The rising focus on pharmaceutical industries to reduce cancer, diabetes, and heart disease will also enhance the global phytonutrients market's growth. Additionally, the need for phytonutrients in the feed and cosmetics industries is also expected to drive the market. The increase in demand for ayurvedic products is expected to act as an opportunity for the market.

The standard quality determination technique of phytonutrients and their products is inadequate, which is expected to restrain the growth of the North America phytonutrients market. Additionally, the phytonutrient supplements are insufficient in regulating products that involve marketing and promotion, which are the other factors anticipated to inhibit the development of the North America phytonutrients market through the forecast term. The manufacturers of the phytonutrients focus on the R&D work on the extraction process of phytonutrients that may challenge competitors in the market.

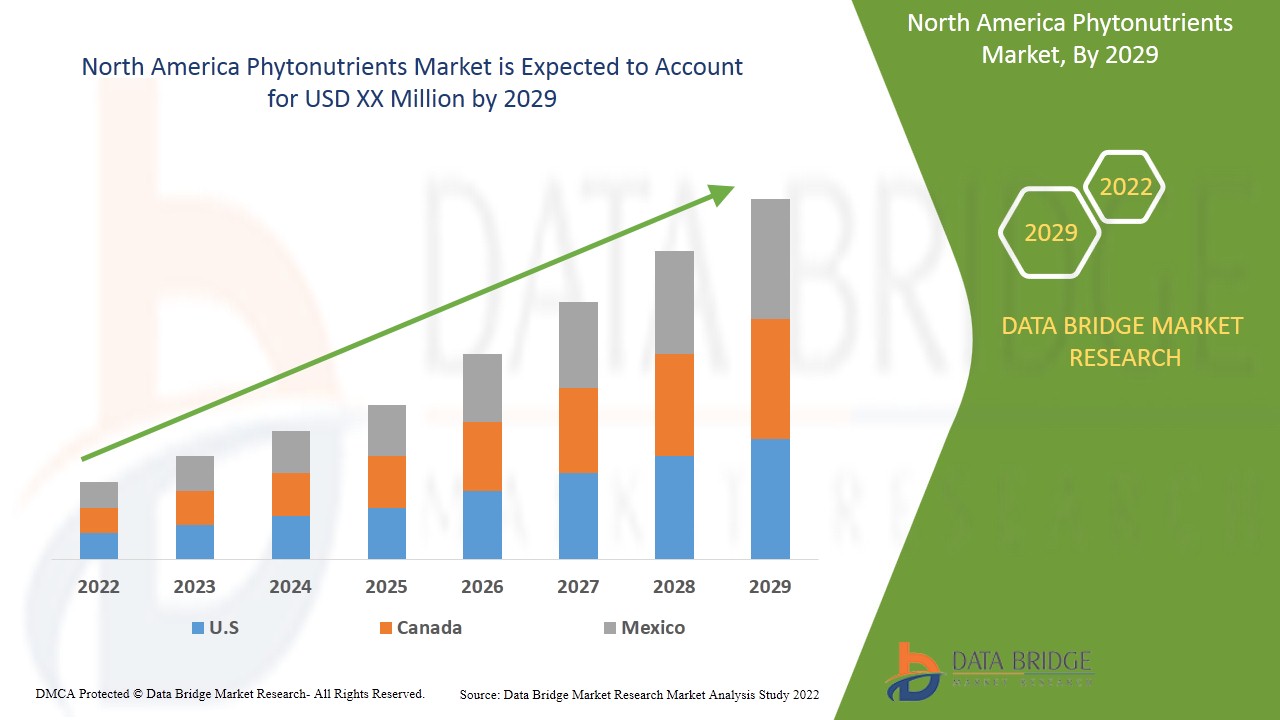

Data Bridge Market Research analyses that the North America phytonutrients market will grow at a CAGR of 7.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019- 2015) |

|

Quantitative Units |

Revenue in USD Million, Volume in Units, Pricing in USD |

|

Segments Covered |

유형별( 플라보노이드 , 카로티노이드, 폴리페놀, 알칼로이드, 식물스테롤, 비타민 , 모노테르펜, 레스베라트롤, 식물에스트로겐, 이소티오시아네이트, 알릴 설파이드, 글루코시놀레이트, 리그난, 베타라인 및 기타), 기능별(면역 체계, 시력, 피부 건강, 뼈 건강, 심혈관 건강, 항암, 폐 건강, 혈관 건강, 여성 건강, 항콜레스테롤 및 기타), 출처별(향신료, 허브, 꽃, 차, 과일, 채소, 곡물, 콩류 , 유지종자, 해양 식물 추출물), 형태별(액상, 건조), 범주별(유기농, 재래식), 특성별(혼합, 순수), 응용 분야별(식품, 음료 , 건강기능식품 및 건강보조식품, 화장품 및 개인 관리, 동물 사료, 제약품, 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Arboris, DSM, Merck KGaA, DÖHLER GMBH, Lycored, MANUS AKTTEVA BIOPHARMA LLP, NutriScience Innovations, LLC, ExcelVite, Aayuritz Phytonutrients Pvt.Ltd., BTSA, Kothari Phytochemicals International, Hindustan Herbals, Vitae Caps SA, Brlb International, Bio-India Biologicals (BIB) Corporation, ADM, BASF SE, Cargill, Incorporated., Matrix Fine Sciences Pvt.Ltd, Cyanotech Corporation, Sabinsa, Ashland, IFF Nutrition & Biosciences, ConnOils LLC, PhytoSource, Inc., Prinova Group LLC. 등 |

북미 식물 영양소 시장 동향

운전자

- 식품 및 음료 제품에 대한 수요 증가

세계 인구 증가로 인한 식품 및 음료에 대한 수요 증가는 산업에서 식물 영양소에 대한 수요를 견인할 것으로 예상됩니다. 또한 식품 및 음료 제품의 품질과 영양가에 대한 우려가 커지면서 천연 성분 기반 식품 및 음료 제품에 대한 수요가 증가함에 따라 식품 및 음료 산업에서 식물 영양소에 대한 수요가 견인될 것으로 예상됩니다.

- 동물사료 수요 증가

동물 사료 산업에서 식물 영양소는 동물 사료의 항산화제로 사용되어 동물의 성장을 촉진하고 자유 라디칼로 인한 산화적 손상으로부터 동물을 보호합니다. 식물 영양소는 동물, 특히 가금류의 선천적 면역을 강화하는 데 도움이 됩니다. 동물 사료에서 식물 영양소의 성장은 전 세계적으로 육류에 대한 수요 증가, 가금류 육류 소비 증가와 같은 몇 가지 요인에 기인하며, 다른 요인은 동물 사료에 대한 수요를 촉진할 것으로 예상되며, 이는 결과적으로 동물 사료 산업에서 식물 영양소에 대한 수요가 예측 기간 동안 증가할 가능성이 높습니다.

기회

- 화장품 수요 증가

천연 또는 유기농 제품의 이점에 대한 소비자 인식이 커지면서 천연 스킨케어 및 화장품에 대한 수요가 증가할 것으로 예상됩니다. 또한 환경 문제가 증가함에 따라 향후 몇 년 동안 제품 수요가 증가할 가능성이 높습니다. 또한 피부 노화에 대처하기 위해 화장품 제형에 사용되는 커큐민, 레스베라트롤, 에피카테킨, 엘라그산, 아피게닌과 같은 스킨케어 및 화장품의 식물 화학 물질에 대한 수요가 증가합니다. 따라서 천연 스킨케어 및 화장품에 대한 수요 증가는 북미 식물 영양소 시장에 기회가 될 것으로 예상됩니다.

제약/도전

- 식물 영양소 과다 섭취의 부작용

식물 영양소는 인체에 건강합니다. 그러나 일부 식물 영양소를 과도하게 섭취하면 부작용이 있을 수 있습니다. 인간에게 독성이 있는 식물 화학 물질은 식물 독소로 알려져 있습니다. 일부 식물 화학 물질은 영양소 흡수를 방해하는 항영양소 특성을 가지고 있습니다. 그리고 폴리페놀과 플라보노이드와 같은 일부 식물 영양소는 고용량으로 섭취하면 산화 촉진제입니다.

따라서 식물 영양소의 과도한 섭취로 인해 발생하는 부작용은 북미 식물 영양소 시장 수요에 도전할 것으로 예상됩니다.

이 북미 식물 영양소 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 북미 식물 영양소 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드릴 것입니다.

COVID-19 이후 북미 식물 영양소 시장 에 미치는 영향

COVID-19 팬데믹의 영향으로 대부분의 국가에서 바이러스 확산을 제한하기 위해 봉쇄가 이루어졌으며, 이는 모든 유형의 산업에 큰 영향을 미쳤습니다. 전 세계적으로 북미 식물 영양소 시장이 성장하면서 COVID-19가 발생하여 극심한 불확실성이 생겼습니다. 식품 사슬을 따라 식품 이동을 유지하는 것은 식품 및 음료 산업에 필수적입니다. 대부분의 회사는 정부 지침 이후 운영을 재개했으며, 이는 향후 몇 년 동안 북미 식물 영양소 시장의 성장에 긍정적인 영향을 미쳤습니다.

최근 개발

- 2021년 2월, IFF(International Flavor & Fragrances)는 Dupont Nutrition & Biosciences와 합병을 완료했습니다. 이 조치는 회사의 사업을 확장하기 위해 취해졌습니다.

북미 식물 영양소 시장 범위

북미 식물 영양소 시장은 유형, 출처, 특성, 범주, 형태, 기능 및 응용 분야로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

유형

- 플라보노이드

- 카로티노이드

- 폴리페놀

- 알칼로이드

- 식물스테롤

- 비타민

- 모노테르펜

- 레스베라트롤

- 식물성 에스트로겐

- 이소티오시아네이트

- 알릴 설파이드

- 글루코시놀레이트

- 리그난

- 베타라인

- 기타.

북미 식물 영양소 시장은 유형을 기준으로 플라보노이드, 카로티노이드, 폴리페놀, 알칼로이드, 식물 스테롤, 비타민, 모노테르펜, 레스베라트롤, 식물 에스트로겐, 이소티오시아네이트, 알릴 설파이드, 글루코시놀레이트, 리그난, 베탈라인 등으로 구분됩니다.

형태

- 마른

- 액체

북미 식물 영양소 시장은 형태에 따라 건조형과 액상으로 구분됩니다.

범주

- 본질적인

- 전통적인

북미 식물 영양소 시장은 범주별로 유기농과 재래식으로 구분됩니다.

자연

- 블렌딩 식

- 순수한

북미 식물 영양소 시장은 자연에 따라 혼합형과 순수형으로 구분됩니다.

기능

- 면역 체계

- 비전

- 피부 건강

- 뼈 건강

- 심혈관 건강

- 항암

- 폐 건강

- 혈관 건강

- 여성 건강

- 항콜레스테롤

- 기타

북미 식물 영양소 시장은 기능을 기준으로 면역 체계, 시력, 피부 건강, 뼈 건강, 심혈관 건강, 항암, 폐 건강, 혈관 건강, 여성 건강, 항콜레스테롤 및 기타로 구분됩니다.

원천

- 기미

- 목초

- 꽃

- 차

- 과일

- 채소

- 시리얼

- 콩류

- 유채종자

- 해양식물추출물

북미 식물 영양소 시장은 자연에 따라 향신료, 허브, 꽃, 차, 과일, 채소, 곡물, 콩과식물, 유지종자, 해양 식물 추출물로 구분됩니다.

애플리케이션

- 식품 제품

- 음료수

- 건강기능식품

- 식이 보충제

- 화장품 및 개인 관리

- 동물사료

- 제약품

- 기타

응용 프로그램을 기준으로 북미 식물 영양소 시장은 식품, 음료, 건강 보조 식품 및 식이 보충제, 화장품 및 개인 관리, 동물 사료, 제약품, 기타로 세분화됩니다.

북미 식물 영양소 시장 지역 분석/통찰력

북미 식물 영양소 시장을 분석하고, 위에 언급된 대로 국가, 유형, 출처, 특성, 범주, 형태, 기능 및 응용 분야를 기반으로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 시장 보고서에서 다루는 국가로는 미국, 캐나다, 멕시코가 있습니다.

미국은 시장 점유율과 시장 수익 측면에서 북미 식물 영양소 시장을 지배할 것으로 예상되며 예측 기간 동안 지배력을 계속 유지할 것입니다. 이 지역의 성장은 식품 및 음료, 제약 및 기타와 같은 다양한 산업의 성장에 기인합니다. 식물성 제품 사용에 대한 소비자 추세가 증가함에 따라 시장 성장이 더욱 촉진되었습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 식물 영양소 시장 점유율 분석

북미 식물 영양소 시장 경쟁 구도는 경쟁업체의 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위의 데이터 포인트는 회사가 북미 식물 영양소 시장에 집중하는 것과만 관련이 있습니다.

북미 식물 영양소 시장의 주요 시장 주체로는 Arboris, DSM, Merck KGaA, DÖHLER GMBH, Lycored, MANUS AKTTEVA BIOPHARMA LLP, NutriScience Innovations, LLC, ExcelVite, Aayuritz Phytonutrients Pvt.Ltd., BTSA, Kothari Phytochemicals International, Hindustan Herbals, Vitae Caps SA, Brlb International, Bio-India Biologicals (BIB) Corporation, ADM, BASF SE, Cargill, Incorporated., Matrix Fine Sciences Pvt. Ltd, Cyanotech Corporation, Sabinsa, Ashland, IFF Nutrition & Biosciences, ConnOils LLC, PhytoSource, Inc., Prinova Group LLC 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PHYTONUTRIENTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKETING STRATEGIES

4.1.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.1.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.1.3 A VAST NETWORK OF DISTRIBUTION

4.1.4 STRATEGIC DECISIONS BY KEY PLAYERS

4.2 PATENT ANALYSIS OF NORTH AMERICA PHYTONUTRIENTS MARKET

4.2.1 DBMR ANALYSIS

4.2.2 COUNTRY LEVEL ANALYSIS

4.2.3 YEARWISE ANALYSIS

4.3 EXTRACTION PROCESS

4.4 CERTIFICATION

4.5 TECHNOLOGICAL CHALLENGES

4.6 LIST OF SUBSTITUTES

4.7 HEALTH CLAIMS OF PHYTONUTRIENTS

4.8 NUTRITIONAL FACTS OF PHYTONUTRIENTS

4.8.1 RECOMMENDED INTAKE OF PHYTONUTRIENTS

4.9 RAW MATERIAL PRICING ANALYSIS

4.9.1 GEOGRAPHICAL PRICING

4.9.2 DEMAND FACTOR IN PRICING

4.9.3 GEOGRAPHICAL PRICING

4.9.4 DEMAND FACTOR IN PRICING

4.1 CONSUMPTION ANALYSIS FOR PHYTONUTRIENT INTAKES IN EUROPEAN COUNTRIES

4.11 IMPORT-EXPORT ANALYSIS

4.12 NORTH AMERICA PHYTONUTRIENTS MARKET: SUPPLY CHAIN ANALYSIS

4.13 VALUE CHAIN ANALYSIS: NORTH AMERICA PHYTONUTRIENTS MARKET

4.14 IMPORT-EXPORT ANALYSIS

5 NORTH AMERICA PHYTONUTRIENTS MARKET: REGULATIONS

5.1 FDA REGULATIONS

5.2 EU REGULATIONS

5.3 USDA REGULATIONS

5.4 FAO REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR FOOD & BEVERAGE PRODUCTS

6.1.2 INCREASING DEMAND FOR ANIMAL FEED

6.1.3 INCREASING DEMAND FOR NUTRACEUTICAL PRODUCTS

6.1.4 NUMEROUS HEALTH BENEFITS ASSOCIATED WITH PHYTONUTRIENTS

6.2 RESTRAINTS

6.2.1 AVAILABILITY OF SUBSTITUTES

6.2.2 QUALITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROWING DEMAND FOR NATURAL FOOD PRODUCTS

6.3.2 INCREASING DEMAND FOR CAROTENOIDS IN VARIOUS END-USE INDUSTRIES

6.3.3 GROWING DEMAND FOR NATURAL SKINCARE AND COSMETIC PRODUCTS

6.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

6.4 CHALLENGES

6.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

6.4.2 SIDE EFFECTS OF EXTRA CONSUMPTION OF PHYTONUTRIENTS

7 NORTH AMERICA PHYTONUTRIENTS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLAVONOIDS

7.3 CAROTENOIDS

7.4 POLYPHENOLS

7.5 ALKALOIDS

7.6 PHYTOSTEROLS

7.7 VITAMIN

7.8 MONOTERPENES

7.9 RESVERATROL

7.1 PHYTOESTROGENS

7.11 ISOTHIOCYANATES

7.12 ALLYL SULFIDES

7.13 GLUCOSINOLATES

7.14 LIGNANS

7.15 BETALAINS

7.16 OTHERS

8 NORTH AMERICA PHYTONUTRIENTS MARKET, BY SOURCE

8.1 OVERVIEW

8.2 FRUIT

8.3 VEGETABLES

8.4 CEREALS

8.5 LEGUMES

8.6 TEA

8.7 FLOWER

8.8 HERBS

8.9 MARINE PLANT EXTRACTS

8.1 OILSEEDS

8.11 SPICE

9 NORTH AMERICA PHYTONUTRIENTS MARKET, BY FORM

9.1 OVERVIEW

9.2 LIQUID

9.3 DRY

10 NORTH AMERICA PHYTONUTRIENTS MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA PHYTONUTRIENTS MARKET, BY NATURE

11.1 OVERVIEW

11.2 BLENDED

11.3 PURE

12 NORTH AMERICA PHYTONUTRIENTS MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 IMMUNE SYSTEM

12.3 BONE HEALTH

12.4 CARDIOVASCULAR HEALTH

12.5 VISION

12.6 ANTI-CANCER

12.7 ANTI-CHOLESTEROL

12.8 WOMEN HEALTH

12.9 BLOOD VESSEL HEALTH

12.1 SKIN HEALTH

12.11 LUNG HEALTH

12.12 OTHERS

13 NORTH AMERICA PHYTONUTRIENTS MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 FOOD PRODUCTS

13.3 BEVERAGES

13.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

13.5 COSMETICS AND PERSONAL CARE

13.6 PHARMACEUTICALS

13.7 ANIMAL FEED

13.8 OTHERS

14 NORTH AMERICA PHYTONUTRIENTS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA PHYTONUTRIENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MERCK KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUS ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUS ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 BASF SE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUS ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUS ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 IFF NUTRITION & BIOSCIENCES

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 KOTHARI PHYTOCHEMICALS INTERNATIONAL

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 ASHLAND

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 AAYURITZ PHYTONUTRIENTS PVT.LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 AOM

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARBORIS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 BIO-INDIA BIOLOGICALS (BIB) CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 BRLB INTERNATIONAL

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BTSA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CONNOILS LLC

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 CYANOTECH CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUS ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENT

17.17 DÖHLER GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 DYNADIS

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ELEMENTA

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 EXCELVITE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 GUSTAV PARMENTIER GMBH

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 HERBAL CREATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 HINDUSTAN HERBALS

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 LYCORED

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 MATRIX LIFE SCIENCE PVT. LTD

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 MANUS AKTTEVA BIOPHARMA LLP

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 NUTRISCIENCE INNOVATIONS, LLC

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 PHYTOSOURCE, INC.

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 PRINOVA GROUP LLC.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 SABINSA

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

17.31 VITAE CAPS S.A.

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENT

17.32 XI'AN HEALTHFUL BIOTECHNOLOGY CO., LTD

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 LIST OF SUBSTITUTE

TABLE 2 POTENTIAL BENEFITS OF PHYTONUTRIENT COMPOUNDS.

TABLE 3 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED FRUITS, YEAR (2019-2021)

TABLE 4 U.S. MONTHLY AVERAGE RETAIL PRICES: FRESH AND PROCESSED VEGETABLES, YEAR (2019-2021)

TABLE 5 EUROPEAN UNION FRUITS PRICES: (2021)

TABLE 6 EUROPEAN UNION VEGETABLES PRICES: (2021)

TABLE 7 WORLD FRUITS AND VEGETABLE PRODUCTION, (MILLION TONS), 2018

TABLE 8 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 9 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 10 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 11 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 12 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 13 IMPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 14 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN USD THOUSAND

TABLE 15 EXPORT OF 2939 VEGETABLE ALKALOIDS, NATURAL OR REPRODUCED BY SYNTHESIS, AND THEIR SALTS, ETHERS, ESTERS AND OTHER DERIVATIVES IN TONNES

TABLE 16 LIST OF SOME PHYTONUTRIENTS USED IN NUTRACEUTICAL PRODUCTS

TABLE 17 FLAVONOIDS AND SOURCES

그림 목록

FIGURE 1 NORTH AMERICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHYTONUTRIENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHYTONUTRIENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHYTONUTRIENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHYTONUTRIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHYTONUTRIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PHYTONUTRIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PHYTONUTRIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PHYTONUTRIENTS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PHYTONUTRIENTS MARKET: SEGMENTATION

FIGURE 11 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA PHYTONUTRIENTS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 INCREASING USE OF PHYTONUTRIENTS IN PERSONAL/SKINCARE PRODUCTS AND PHARMACEUTICAL DRUGS LEAD TO THE GROWTH OF THE NORTH AMERICA PHYTONUTRIENTS MARKET IN THE FORECAST PERIOD

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHYTONUTRIENTS MARKET IN 2022 & 2029

FIGURE 14 PATENT REGISTERED FOR PHYTONUTRIENTS, BY COUNTRY

FIGURE 15 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 16 VALUE CHAIN OF PHYTONUTRIENTS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHYTONUTRIENTS MARKET

FIGURE 18 POULTRY MEAT CONSUMPTION KILOGRAMS PER CAPITA GROWTH FROM 2019-2021

FIGURE 19 NORTH AMERICA PHYTONUTRIENTS MARKET, BY TYPE, 2021

FIGURE 20 NORTH AMERICA PHYTONUTRIENTS MARKET, BY SOURCE, 2021

FIGURE 21 NORTH AMERICA PHYTONUTRIENTS MARKET, BY FORM, 2021

FIGURE 22 NORTH AMERICA PHYTONUTRIENTS MARKET, BY CATEGORY, 2021

FIGURE 23 NORTH AMERICA PHYTONUTRIENTS MARKET, BY NATURE, 2021

FIGURE 24 NORTH AMERICA PHYTONUTRIENTS MARKET, BY FUNCTION, 2021

FIGURE 25 NORTH AMERICA PHYTONUTRIENTS MARKET, BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA PHYTONUTRIENTS MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA PHYTONUTRIENTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA PHYTONUTRIENTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA PHYTONUTRIENTS MARKET: BY TYPE (2022 & 2029)

FIGURE 31 NORTH AMERICA PHYTONUTRIENTS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.