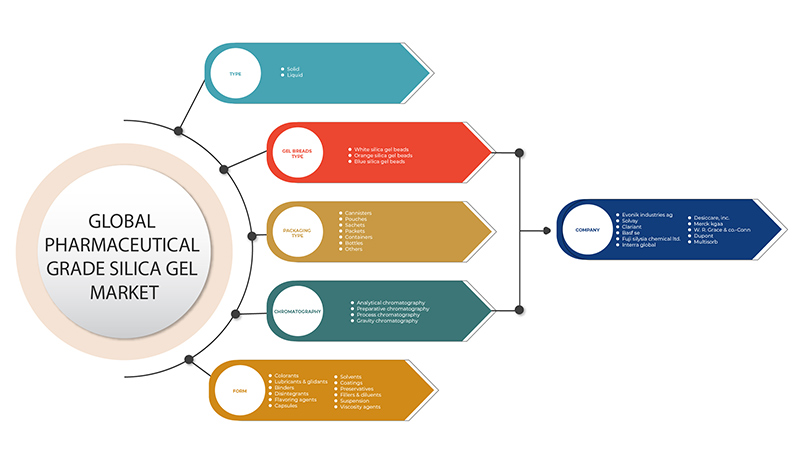

North America Pharmaceutical Grade Silica Gel Market, By Type (Liquid, and Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents, and Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) Industry Trends and Forecast to 2029.

Market Analysis and Insights

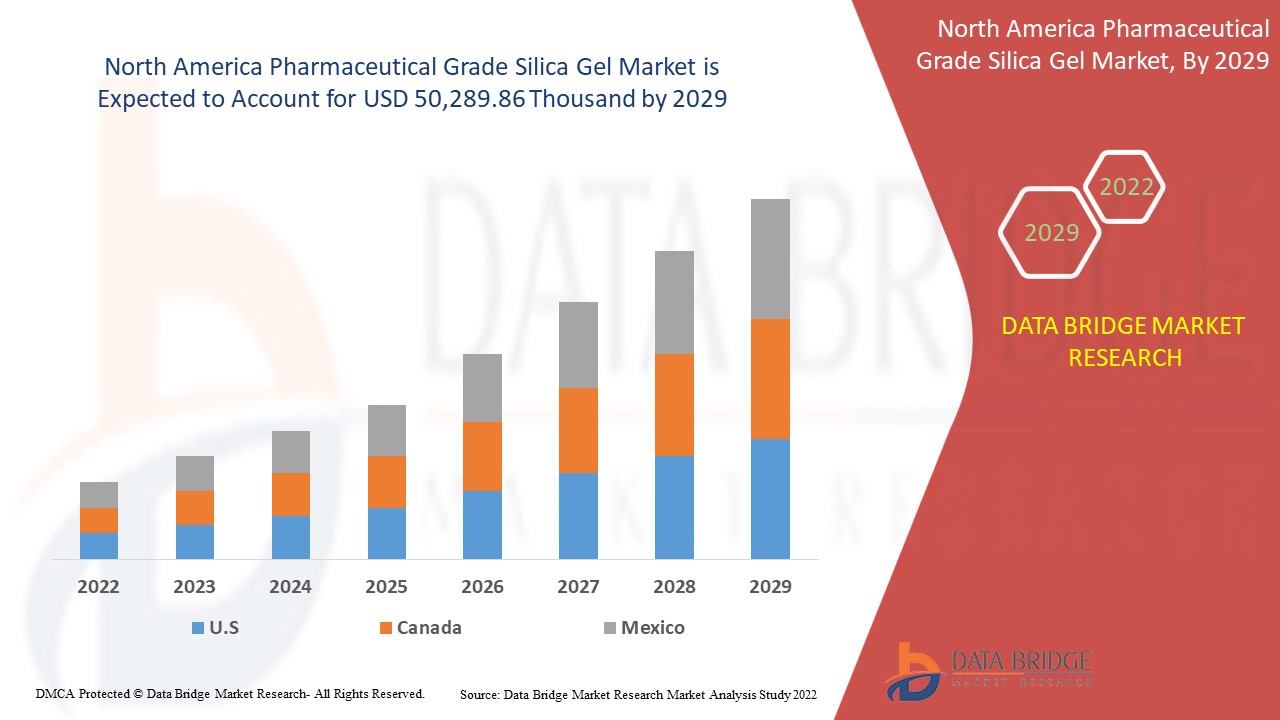

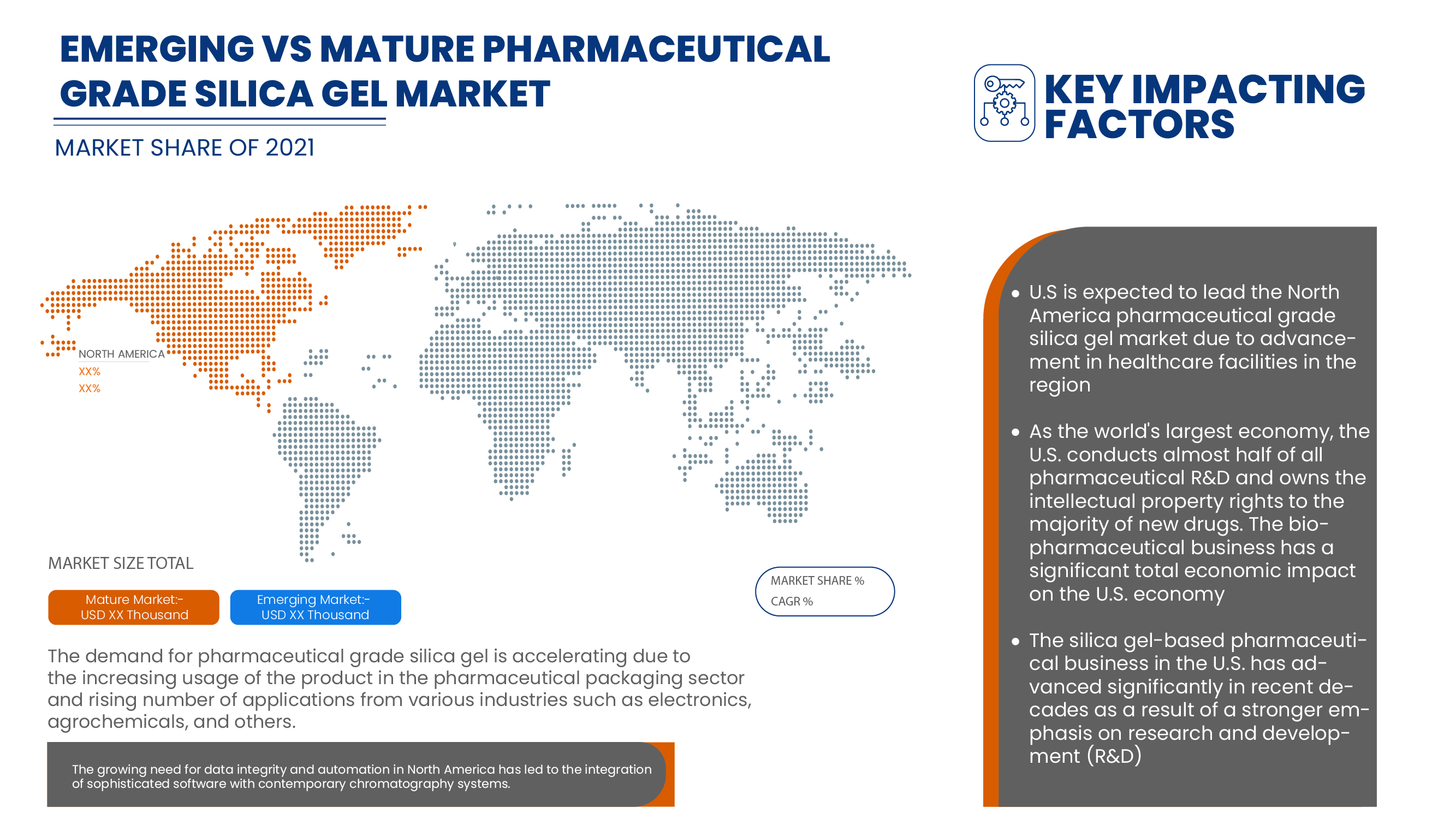

North America pharmaceutical grade silica gel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.2% in the forecast period of 2022 to 2029 and is expected to reach USD 50,289.86 thousand by 2029.

The major factor driving the growth of the pharmaceutical grade silica gel market are growing demand for medicinal drugs, Extensive deployment or R&D in the pharma sector, and rising spending on biotechnology using chromatography for detecting molecular components.

Silica gel as a stationary phase is largely accepted as one of the top adsorbents used in column chromatography as well as other separation techniques. One of the major advantages is its tremendous affinity for adsorption. Additionally, it is commercially very readily available in several different sizes and types. The major significant reason for silica gel used as a stationary phase in column chromatography is that it has feasible to obtain the extract essential size of the particle size for a particular method.

Silica gel is a polar adsorbent that is slightly acidic and has a strong capacity to adsorb the basic substance. The silica gel is most widely used in reversed-phase partition chromatography and it has broad applications that consist of the separation of steroids, amino acids, lipids, alkaloids, and several pharmaceutical processes.

North America pharmaceutical grade silica gel market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

양적 단위 |

매출은 천 달러, 양은 킬로톤, 가격은 달러로 표시 |

|

다루는 세그먼트 |

유형별(액체 및 고체), 겔 브레드 유형(화이트 실리카겔 브레드, 오렌지 실리카겔 브레드 및 블루 실리카겔 브레드), 형태별(착색제, 윤활제 및 활택제, 결합제, 붕괴제, 향미제, 캡슐, 용매, 코팅제, 방부제, 필러 및 희석제, 현탁액, 점도제 및 기타), 포장 유형별(캐니스터, 파우치, 사쉐, 패킷, 용기, 병 및 기타), 크로마토그래피(분석 크로마토그래피, 제조 크로마토그래피, 공정 크로마토그래피 및 중력 크로마토그래피) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

제약 등급 실리카겔 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 의약품에 대한 수요 증가

성장하는 제약 산업은 약물 생산의 성장을 촉진했으며, 이는 수년에 걸쳐 실리카겔 소비를 증가시켰습니다. 실리카겔을 사용하여 크로마토그래피를 수행할 수 있기 때문에 실리카겔에 대한 수요는 더욱 증가할 것으로 예상됩니다. 실리카겔 컬럼 크로마토그래피는 제약 산업에서 다양한 약물 성분을 수집하거나 분리하는 데 널리 사용됩니다.

- 제약 부문에서의 광범위한 R&D 전개

데이터 무결성과 자동화에 대한 필요성이 커지면서 정교한 소프트웨어와 현대 크로마토그래피 시스템이 통합되었습니다. 개선된 시스템, 혁신적이고 일회용 컬럼, 성능이 더 좋은 수지 및 기타 액세서리를 개발하기 위한 이러한 기술의 발전은 시장이 상당히 성장하는 데 도움이 될 수 있습니다.

- 크로마토그래피를 이용한 분자 성분 탐지 생명공학 지출 증가

바이오캡슐화는 세포, 효소, 약물, 자성 물질 등과 같은 둘러싸인 생물학적 구조를 보호하기 위해 반투과성 막으로 조직이나 생물학적으로 활성인 물질을 감싸는 것을 포함합니다. 바이오테크 쪽에서 크로마토그래피와 같은 실리카겔 기반 기술의 지속적인 연구 및 개발은 북미 제약 등급 실리카겔 시장의 성장으로 이어질 것입니다.

기회

- 사내 R&D에 대한 수익성 있는 전망

크로마토그래피는 끊임없이 발전하는 기술이며, 연구 개발을 위한 크로마토그래피 장비와 시약에 대한 수요 증가는 북미 제약용 실리카겔 시장의 성장과 수요를 견인하는 주요 요인입니다.

- 잘 확립된 전략적 파트너를 통한 원자재의 쉬운 가용성

비정질 형태의 이산화규소는 제약 기반 실리카겔을 제조하는 데 사용됩니다. 지구 표면에서 다양한 원료의 엄청난 가용성과 이러한 원료를 합성적으로 생산할 수 있는 능력, 제약 등급 실리카겔을 생산하는 회사와 함께 다양한 공급업체 및 파트너와의 확고한 파트너십은 실리카겔 생산을 위해 이러한 업체에 지속적으로 고급 원료를 공급합니다.

제약/도전

- 정부의 엄격한 규제

USP의 약물 표준은 미국에서 식품의약국(FDA)에 의해 시행되며 전 세계 140개국 이상에서도 사용됩니다. 인도의 1948년 약국법에는 약물의 구성에 관한 다양한 엄격한 규정이 있으며, 약사/화학자는 정부의 승인을 받기 위해 다양한 절차와 심사를 거쳐야 합니다. 이러한 엄격한 규칙과 규정은 북미 제약 등급 실리카겔 시장이 직면한 가장 큰 제약 중 하나일 수 있습니다.

- 대체품의 가용성

실리카 표면의 자유 실라놀은 이러한 화합물과 고정상의 해로운 상호작용을 담당합니다. 이들은 나쁜 피크 모양과 낮은 효율성을 보입니다. 이는 또한 제조업체가 시중에 있는 대체품을 선택하는 경향이 있습니다. 이러한 이유로 실라놀을 감소시키거나 차폐한 비실리카 고정상과 같은 여러 가지 새로운 고정상이 시중에 출시되고 있습니다.

- 제약품은 엄격한 품질 관리 및 성능 표준을 충족합니다.

전 세계적으로 모든 정부는 총 건강 예산의 상당 부분을 의약품과 제약품에 할당합니다. 개발도상국에서는 환자와 소비자가 품질에 대한 타협 없이 효과적인 양질의 의약품을 받을 수 있도록 상당한 행정 및 기술적 노력을 기울이고 있습니다.

- 비휘발성 화합물에 대한 제한된 적용 범위

휘발성 화합물에 실리카겔을 사용하는 시스템의 온도는 화합물이 매우 빠르게 증발하지 않고 실리카겔 플레이트에 의해 활용되고 분리되기 전에 샘플이 완전히 손실되도록 낮은 수준으로 유지되어야 합니다. 따라서 실리카겔의 적용 범위는 비휘발성 화합물로 제한되며, 이는 북미 제약 등급 실리카겔 시장의 성장에 도전할 수 있습니다.

최근 개발

- 2022년 2월, DuPont는 생물공정 산업 구매자의 요구에 맞는 새로운 온라인 판매 포털을 출시했습니다. DuPont 생물공정은 치료제에 대한 정교한 분리 및 정제를 가능하게 하며, AmberChrom 및 AmberLite와 같은 다양한 DuPont 브랜드는 생물제약 산업에서 매우 확고하게 자리 잡았습니다.

북미 제약 등급 실리카겔 시장 범위

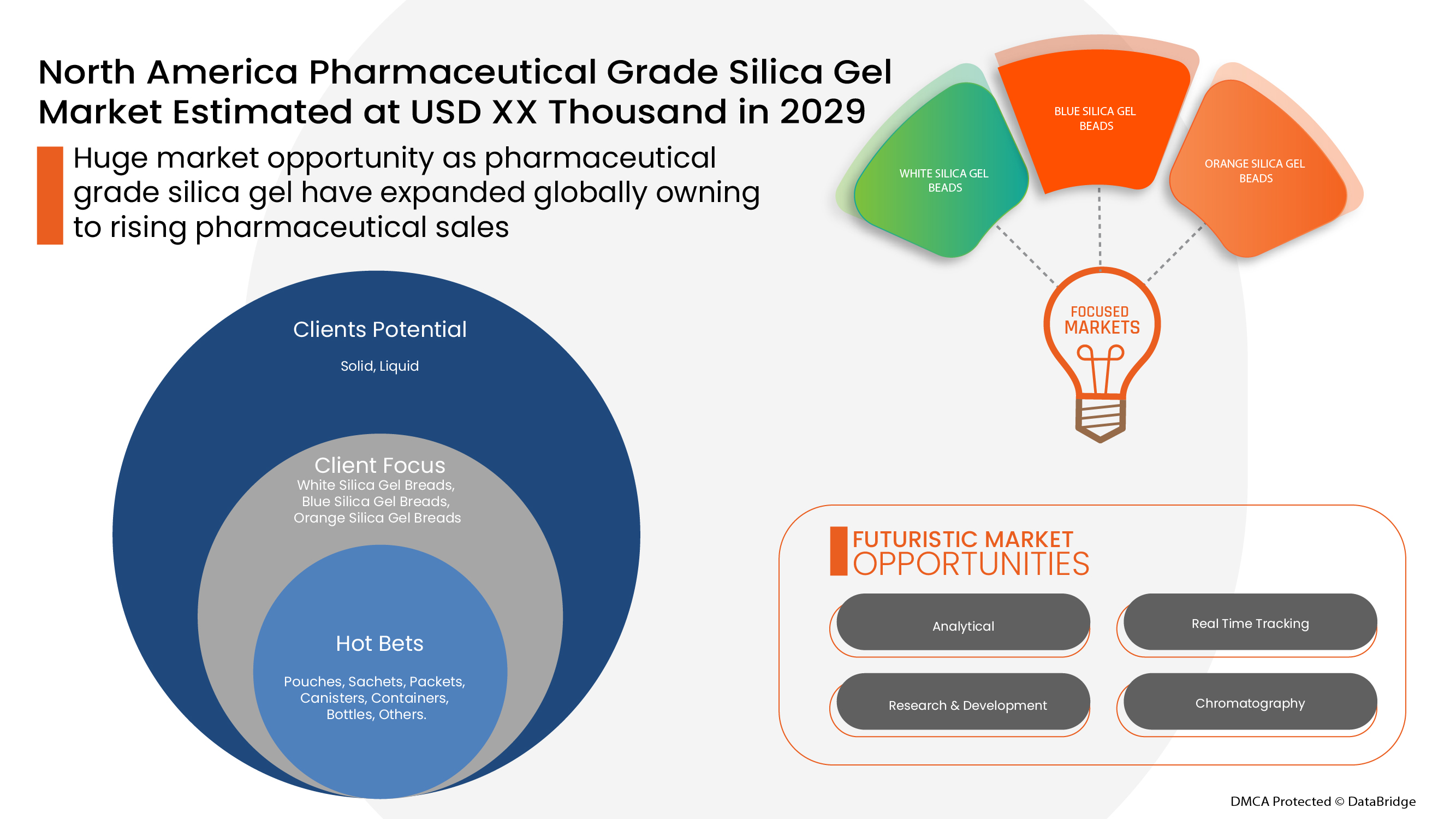

북미 제약 등급 실리카겔 시장은 유형, 겔 빵 유형, 형태, 포장 유형 및 크로마토그래피를 기준으로 분류됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 단단한

- 액체

북미 제약용 실리카겔 시장은 유형을 기준으로 고체와 액체로 구분됩니다.

젤빵 종류

- 화이트 실리카겔 빵

- 오렌지 실리카겔 빵

- 블루 실리카겔 빵

겔 빵의 유형을 기준으로 볼 때, 북미 제약용 실리카겔 시장은 흰색 실리카겔 빵, 주황색 실리카겔 빵, 파란색 실리카겔 빵으로 구분됩니다.

형태

북미 제약용 실리카겔 시장은 형태에 따라 착색제, 윤활제 및 활택제, 결합제, 붕괴제, 향미제, 캡슐, 용매, 코팅제, 방부제, 충전제 및 희석제, 현탁액, 점도제, 기타 병원 및 진료소, 진단 센터, 학술 기관 등으로 구분됩니다.

포장 유형

- 파우치

- 사쉐

- 패킷

- 캐니스터

- 컨테이너

- 병

- 기타

포장 유형을 기준으로 북미 제약용 실리카겔 시장은 캐니스터, 파우치, 사쉐, 패킷, 용기, 병 및 기타로 구분됩니다.

크로마토그래피

- 분석 크로마토그래피

- 제조 크로마토그래피

- 공정 크로마토그래피

크로마토그래피를 기준으로, 북미 제약용 실리카겔 시장은 분석 크로마토그래피, 제조 크로마토그래피, 공정 크로마토그래피, 중력 크로마토그래피로 구분됩니다.

제약 등급 실리카겔 시장 지역 분석/통찰력

제약용 실리카겔 시장을 분석하고, 위에 언급된 대로 국가, 유형, 겔빵 유형, 형태, 포장 유형 및 크로마토그래피별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미의 제약용 실리카겔 시장은 미국, 캐나다, 멕시코 등 주요 국가로 세분화됩니다.

북미의 미국은 시장 점유율과 시장 수익 측면에서 제약 등급 실리카겔 시장을 지배하고 있으며 예측 기간 동안 지배력을 계속 확대할 것입니다. 이는 주요 핵심 기업이 있고 잘 발달된 의료 인프라가 국가에 존재하기 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 제약 등급 실리카겔 시장 점유율 분석

북미 제약 등급 실리카겔 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선입니다. 위에 제공된 데이터 포인트는 제약 등급 실리카겔 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 제약용 실리카겔 시장의 주요 참여 기업으로는 BASF SE, DuPont, Solvay, Merck KGAA, WR Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 북미 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGY ADVANCEMENTS

4.6 REGULATORY COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL PROCUREMENT

4.7.2.1 MANUFACTURING AND PACKING

4.7.2.2 MARKETING AND DISTRIBUTION

4.7.2.3 END USERS

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR MEDICINAL DRUGS

6.1.2 EXTENSIVE DEPLOYMENT OF R&D IN THE PHARMA SECTOR

6.1.3 RISING EXPENSES ON BIOTECHNOLOGY USING CHROMATOGRAPHY FOR DETECTING MOLECULAR COMPONENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS BY THE GOVERNMENT

6.2.2 AVAILABILITY OF SUBSTITUTES

6.2.3 RESTRICTIONS ON DERMAL AND ORAL EXPOSURE TO PHARMACEUTICAL GRADE SILICA GEL

6.2.4 HIGH PRICE OF SILICA GEL

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS IN-HOUSE R&D

6.3.2 EASY AVAILABILITY OF RAW MATERIALS THROUGH WELL-ESTABLISHED STRATEGIC PARTNERS

6.4 CHALLENGES

6.4.1 PHARMACEUTICAL ITEMS MEET STRINGENT QUALITY CONTROL AND PERFORMANCE STANDARDS

6.4.2 LIMITED APPLICATION SCOPE TO NON-VOLATILE COMPOUNDS

7 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 SOLID

7.3 LIQUID

8 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE

8.1 OVERVIEW

8.2 WHITE SILICA GEL BEADS

8.3 ORANGE SILICA GEL BEADS

8.4 BLUE SILICA GEL BEADS

9 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM

9.1 OVERVIEW

9.2 FILLERS & DILUENTS

9.3 BINDERS

9.4 DISINTEGRANTS

9.5 LUBRICANTS & GLIDANTS

9.6 COLORANTS

9.7 FLAVORING AGENTS

9.8 PRESERVATIVES

9.9 SOLVENTS

9.1 CAPSULES

9.11 VISCOSITY AGENTS

9.12 SUSPENSION

9.13 COATINGS

10 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES

10.3 SACHETS

10.4 PACKETS

10.5 CANISTERS

10.6 CONTAINERS

10.7 BOTTLES

10.8 OTHERS

11 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY

11.1 OVERVIEW

11.2 ANALYTICAL CHROMATOGRAPHY

11.3 PREPARATIVE CHROMATOGRAPHY

11.4 PROCESS CHROMATOGRAPHY

11.5 GRAVITY CHROMATOGRAPHY

12 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.1.1 COLLABORATIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 SOLVAY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 W. R. GRACE & CO.-CONN

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 EVONIK INDUSTRIES AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CLARIANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DESICCARE, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUJI SILYSIA CHEMICAL LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 INTERRA NORTH AMERICA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 MULTISORB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 NORTH AMERICA SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 NORTH AMERICA LIQUID IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA LIQUID IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA WHITE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA ORANGE SILICA GEL BEADS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA BLUE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA FILLERS & DILUENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA BINDERS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA DISINTEGRANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA LUBRICANTS & GLIDANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA COLORANTS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA FLAVORING AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA PRESERVATIVES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA SOLVENTS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA CAPSULES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA VISCOSITY AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA SUSPENSION IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA COATINGS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA POUCHES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA SACHETS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA PACKETS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA CANISTERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA CONTAINERS IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA BOTTLES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA OTHERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA ANALYTICAL CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA PREPARATIVE CHROMATOGRAPHY IN NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA PROCESS CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA GRAVITY CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 42 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 44 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 54 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 60 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 62 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MEXICO PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 GROWING DEMAND FOR MEDICINAL DRUGS IS EXPECTED TO DRIVE NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET IN THE FORECAST PERIOD

FIGURE 15 SOLID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 19 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY GEL BEADS TYPE, 2021

FIGURE 21 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY FORM, 2021

FIGURE 22 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY CHROMATOGRAPHY, 2021

FIGURE 24 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA PHARMACEUTICAL GRADE SILICA GEL MARKET: company share 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.