북미 수동 방화 코팅 시장 , 제품 유형(시멘트 재료, 팽창성 코팅, 방화 클래딩, 기타), 기술(수성 보호 코팅, 용제 기반 보호 코팅), 응용 분야(석유 및 가스, 건설, 항공 우주, 전기 및 전자, 자동차, 섬유, 가구, 창고, 기타), 최종 사용자(건물 및 건설 , 석유 및 가스, 운송, 기타)별 산업 동향 및 2029년까지의 예측.

북미 수동 방화 코팅 시장 분석 및 규모

수동 방화 코팅은 무색, 무취, 점성이 있는 액체로 모든 농도에서 물에 녹습니다. 이산화황 용액을 산화시켜 만든 강산으로, 산업 및 실험실 시약으로 대량으로 사용됩니다. 수동 방화 코팅 또는 수동 방화 코팅은 황산 오일이라고도 하며, 분자식은 H2SO4이고 녹는점은 10°C, 끓는점은 337°C인 황, 산소, 수소로 구성된 무기산입니다.

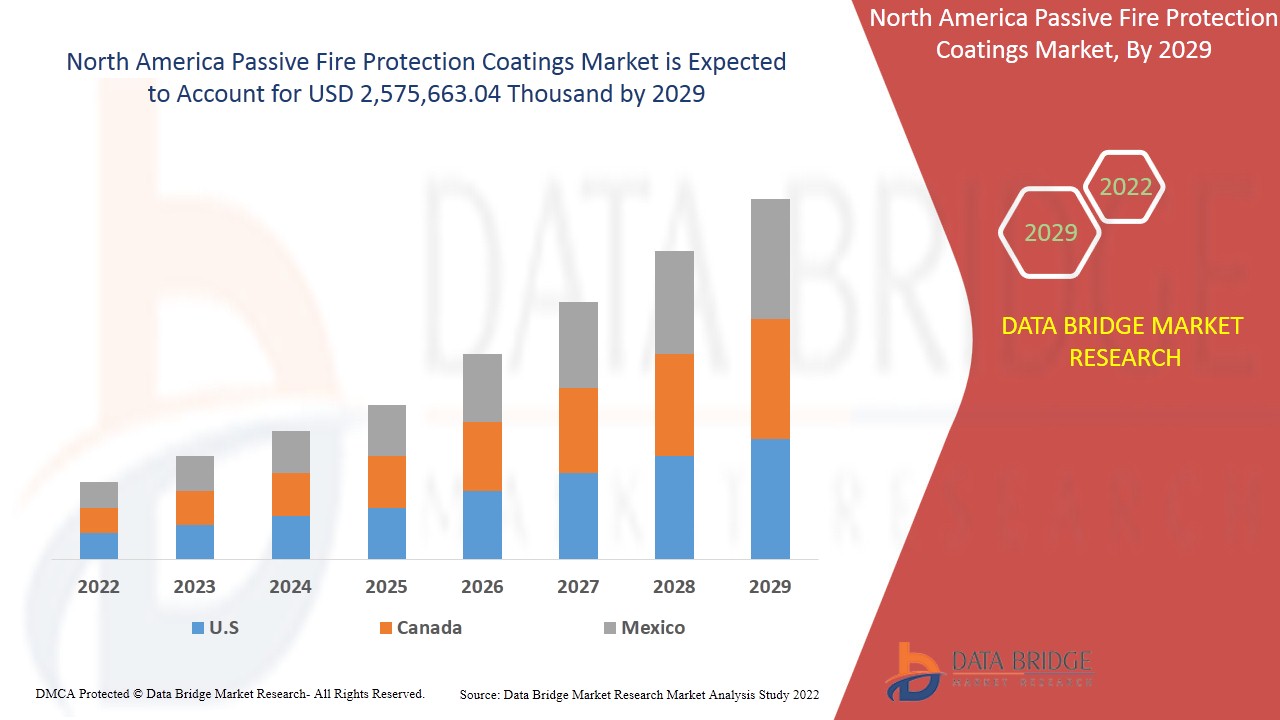

농업 산업에서 비료에 대한 수요가 증가하고 다양한 산업에서 수동 방화 코팅에 대한 수요가 증가하는 것은 시장에서 수동 방화 코팅 수요를 촉진하는 요인 중 일부입니다. Data Bridge Market Research는 유황 시장이 예측 기간 동안 4.0%의 CAGR로 2029년까지 2,575,663.04천 달러에 도달할 것으로 분석합니다. "원소 유황"은 전 세계적으로 유황이 풍부하게 공급되기 때문에 해당 분야에서 가장 두드러진 원자재 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 기후 사슬 시나리오가 포함되어 있습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 USD 천, 볼륨은 천 kg, 가격은 USD |

|

다루는 세그먼트 |

제품 유형별(시멘트 재료, 팽창성 코팅, 방화 클래딩, 기타), 기술별(수성 보호 코팅, 용매 기반 보호 코팅), 응용 분야별(석유 및 가스, 건설, 항공우주, 전기 및 전자, 자동차, 섬유, 가구, 창고, 기타), 최종 사용자별(건물 및 건설, 석유 및 가스, 운송, 기타) |

|

국가 커버 |

북미의 미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

LANXESS(쾰른, 독일), Brenntag GmbH(Brenntag SE의 자회사)(에센, 독일), Boliden Group(스톡홀름, 스웨덴), Adisseo(앙토니, 프랑스), Veolia(파리, 프랑스), Univar Solutions Inc(일리노이, 미국), NORAM Engineering & Construction Ltd.(밴쿠버, 캐나다), Nouryon(암스테르담, 네덜란드), International Raw Materials LTD(펜실베이니아, 미국), Eti Bakir(카스타모누, 터키), ACIDEKA SA(비스카야, 스페인), Airedale Chemical Company Limited.(노스요크셔, 영국), BASF SE(루트비히스하펜, 독일), Aguachem Ltd(렉섬, 영국), Feralco AB(위드네스, 영국), Fluorsid(밀라노, 이탈리아), Aurubis AG(함부르크, 독일), Nyrstar(부델, 네덜란드), Merck KGaA(다름슈타트, 독일), Shrieve(텍사스, 우리를) |

시장 정의

수동 방화 코팅은 흡습성과 산화성이 있는 강산입니다. 비료, 화학 , 합성 섬유 및 안료 산업에서 사용됩니다. 다른 응용 분야로는 배터리 제조, 금속 피클링, 기타 산업 제조 공정이 있습니다. 시장에서 수동 방화 코팅은 98%, 96.5%, 76%, 70% 및 38%와 같은 다양한 농도 등급으로 제공됩니다. 대량의 수동 방화 코팅은 황산 칼륨과 비료를 생산합니다. 농업 산업에서 비료에 대한 수요가 증가하고 다양한 산업에서 수동 방화 코팅에 대한 수요가 증가하는 것은 시장에서 수동 방화 코팅 수요를 촉진하는 요인 중 일부입니다. 전 세계적으로 수동 방화 코팅의 소비가 증가함에 따라 주요 업체는 시장에서 입지를 강화하기 위해 다양한 국가에서 생산 능력을 확대하고 있습니다.

규제 프레임워크

- DHHS(1994)와 EPA는 삼산화황 또는 수동 방화 코팅을 발암 효과에 대해 분류하지 않았습니다. IARC는 수동 방화 코팅을 함유한 강력한 무기 미스트에 대한 직업적 노출을 인간에게 발암성(그룹 1)으로 간주합니다(IARC 1992). ACGIH는 수동 방화 코팅을 의심되는 인간 발암 물질(그룹 A2)로 분류했습니다(ACGIH 1998).

수동 방화 코팅은 '비상 계획 및 지역 사회의 알 권리법 제3조 13항에 따른 독성 화학물질'(EPA 1998f) 목록에 포함되어 있습니다.

수동 방화 코팅의 직업적 허용 노출 한계(PEL)는 1mg/m3(OSHA 1998)입니다. NIOSH 권장 노출 한계(REL)도 1mg/m3(NIOSH 1997)입니다. ACGIH는 임계값 한계값 시간 가중 평균(TLV-TWA)을 1mg/m3, 단기 노출 한계(STEL)를 3mg/m3(ACGIH 1998)로 권장합니다.

COVID-19는 북미 수동 방화 코팅 시장에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 산업에 영향을 미쳐 작업장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 그러나 북미 운영 및 공급망의 수동 방화 코팅에 상당한 영향이 나타났으며, 여러 제조 시설이 여전히 운영 중입니다. 서비스 제공업체는 COVID 이후 시나리오에서 위생 및 안전 조치에 따라 수동 방화 코팅을 계속 제공했습니다.

북미 수동 방화 코팅 시장의 시장 역학은 다음과 같습니다.

- 농업 산업에서 비료에 대한 수요 증가

작물 재배를 위한 고품질 비료에 대한 수요가 증가함에 따라 북미 수동 방화 코팅 시장이 활성화되고 있습니다.

- 화학 산업의 상당한 성장

지속 가능성을 위한 화학 전략으로 북미 지역에서 화학 생산을 늘리는 것은 화학 산업의 성장을 강화하고 유해 화학 물질 사용을 피하고 안전하고 지속 가능한 대안 개발을 위한 혁신을 장려하기 위한 Green Deal의 중요한 부분입니다. 따라서 화학 산업의 지속 가능성 전략은 화학 산업의 상당한 성장을 유지하고 향후 몇 년 동안 북미 수동 방화 코팅 시장을 추진하는 데 도움이 될 수 있습니다.

- 다양한 산업 분야에서 수동 방화 코팅에 대한 수요 증가

제약, 섬유, 종이, 펄프 등 다양한 산업 분야에서 수동 방화 코팅에 대한 수요가 점점 더 늘어날 것으로 예상되며, 이는 북미 수동 방화 코팅 시장을 활성화할 것으로 전망됩니다.

- 자동차 산업에서 배터리에 대한 수요 증가

폐인쇄회로기판을 회수하여 금, 은, 철, 구리 등 다양한 금속을 회수하는 수동 방화 코팅을 사용한 회수 수요가 증가함에 따라 북미 수동 방화 코팅 시장이 성장할 것으로 예상됩니다.

- 헬스케어 산업의 상당한 성장

자동차 및 전기 자동차의 배터리와 기타 기계에 사용되는 수동 방화 코팅의 이점이 커지면서 수동 방화 코팅에 대한 수요가 증가하고 있습니다. 이는 북미 수동 방화 코팅 시장이 미래에 더욱 높은 성장을 기록할 수 있는 기회를 만들어내고 있습니다.

- 원료로서의 풍부한 유황

또한, 오늘날 유황은 전 세계 석유 및 천연 가스 산업에서 산업용으로 생산됩니다. 따라서 전 세계적으로 풍부한 유황 매장량은 북미 수동 방화 코팅 시장의 성장 기회를 만들어냅니다.

북미 수동 방화 코팅 시장이 직면한 제약/과제

- 수동 방화 코팅과 관련된 건강 위험

피부, 눈 및 기타 장기에 수동 방화 코팅을 사용함에 따라 발생하는 건강 위험이 증가함에 따라 북미 수동 방화 코팅 시장 수요가 감소할 가능성이 높습니다.

- 수동 방화 코팅 과잉 공급으로 인한 판매 감소

북미 수동 방화 코팅 시장에서 수동 방화 코팅의 공급 부족은 시장에서 활동하는 주요 제조업체가 직면한 가장 큰 문제로, 다른 생산자와의 공급 과잉으로 인해 가격이 하락함에 따라 판매 및 이익 마진에 직접적인 영향을 미치고 있습니다. 이는 북미 수동 방화 코팅 시장 성장에서 가장 큰 과제로 작용하고 있습니다.

이 수동 방화 코팅 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 수동 방화 코팅 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드릴 것입니다.

최근 개발

- 2020년 11월, Airedale Chemical Company Limited는 알루미늄 광택제와 전처리 세척제를 포함한 다양한 금속 처리 솔루션을 제공하는 Alutech를 인수했습니다. 이러한 개발은 회사가 수동 방화 코팅에 대한 수요를 늘리는 데 도움이 되었으며, 이로 인해 수익이 증가했습니다.

- 2017년 5월, BASF SE는 독특한 기하학적 모양으로 인해 선호되는 새로운 수동 방화 코팅 촉매를 출시했습니다. 이 업데이트는 회사가 생산 용량을 늘리는 데 도움이 되며, 이는 미래에 수익을 창출합니다.

북미 수동 방화 코팅 시장 범위

북미 수동 방화 코팅 시장은 제품 유형, 기술, 응용 분야 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품 유형

- 시멘트질 재료

- 팽창성 코팅

- 방화 클래딩

- 기타

제품 유형을 기준으로 북미 수동 방화 코팅 시장은 시멘트 재료, 팽창성 코팅, 방화 클래딩 및 기타로 세분화됩니다. 팽창성 코팅 세그먼트는 북미 지역을 지배할 것으로 예상되며, 팽창성 코팅은 건설 및 건물 산업에서 더 광범위한 소비자 선호도로 인해 시장을 지배할 것으로 예상됩니다.

기술

- 수성 보호 코팅

- 용매 기반 보호 코팅

기술을 기준으로 볼 때, 북미 수동 방화 코팅 시장은 수성 보호 코팅과 용제 기반 보호 코팅으로 구분됩니다.

애플리케이션

- 석유 및 가스

- 건설

- 항공우주

- 전기 및 전자

- 자동차

- 직물

- 가구

- 창고

- 기타

적용 기준으로 북미 수동 방화 코팅 시장은 석유 및 가스, 건설, 항공우주, 전기 및 전자, 자동차, 섬유, 가구, 창고 및 기타로 세분화됩니다. 아시아 태평양 지역에서 자동차는 건물 내에서 위험에 처할 수 있는 잠재적으로 취약한 사람들을 줄여주기 때문에 시장을 지배할 것으로 예상됩니다.

최종 사용자

- 건물 및 건설

- 석유 및 가스

- 운송

- 기타

최종 사용자를 기준으로 북미 수동 방화 코팅 시장은 건물 및 건설, 석유 및 가스, 운송 및 기타로 세분화됩니다. 아시아 태평양 지역에서는 가장 큰 건설 프로젝트가 이 지역에서 시작되었기 때문에 건물 및 건설 부문이 시장을 지배할 것으로 예상됩니다.

북미 수동 방화 코팅 지역 분석/통찰력

북미 수동 방화 코팅 시장을 분석하고, 위에 언급된 대로 제품 유형, 기술, 응용 분야 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 수동 방화 코팅 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 수동 방화 코팅 시장 점유율 분석

북미 수동 방화 코팅 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 제공된 위의 데이터 포인트는 북미 수동 방화 코팅 시장과 관련된 회사의 초점에만 관련이 있습니다.

수동 방화 코팅 시장에서 운영되는 주요 기업으로는 LANXESS, Brenntag GmbH(Brenntag SE의 자회사), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA, Shrieve 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION PROCESS

4.1.1 INTRODUCTION

4.1.2 FUNCTION

4.1.3 KEYS ELEMENTS

4.1.4 PROCESS

4.2 POTENTIAL COLLABORATION OPPORTUNITIES

4.3 COMPARATIVE ANALYSIS WITH POTENTIAL SUBSTITUTES

4.4 REGIONAL SUMMARY

4.4.1 NORTH AMERICA

4.4.2 ASIA-PACIFIC

4.4.3 EUROPE

4.4.4 NORTH AMERICA

4.4.5 MIDDLE-EAST & AFRICA

4.4.6 SOUTH AMERICA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING CONSTRUCTION INDUSTRY

5.1.2 ESCALATING APPLICATION SCOPE OF PASSIVE FIRE PROTECTION COATING IN VARIOUS INDUSTRIES

5.1.3 RISING DEMAND FOR WATER-BASED FIRE PROTECTION COATINGS

5.1.4 IMPOSITION OF FAVORABLE GOVERNMENT GUIDELINES AND FIRE SAFETY STANDARDS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAPER ALTERNATIVES

5.2.2 VOLATILITY IN THE RAW MATERIAL COSTS

5.3 OPPORTUNITIES

5.3.1 INCREASING INDIVIDUALS DISPOSABLE INCOME

5.3.2 RISING OIL AND GAS EXPLORATION ACTIVITIES

5.3.3 ADVANCEMENT IN THE CONSTRUCTION INDUSTRY TO BRING LUCRATIVE OPPORTUNITIES

5.3.4 RISING USAGES OF FIRE PROTECTION COATINGS IN RENOVATION PROJECTS

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG POTENTIAL END-USERS

5.4.2 HIGH INSTALLATION AND MAINTENANCE COST

6 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE

6.1 OVERVIEW

6.2 INTUMESCENT COATING

6.2.1 CELLULOSIC FIRE PROTECTION

6.2.2 HYDROCARBON FIRE PROTECTION

6.3 CEMENTITIOUS MATERIAL

6.3.1 HYDRAULIC CEMENT

6.3.2 SUPPLEMENTARY CEMENTITIOUS MATERIALS (SCMS)

6.4 FIREPROOFING CLADDING

6.5 OTHERS

7 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 WATER-BASED PROTECTION COATING

7.3 SOLVENT-BASED PROTECTION COATING

8 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE

8.3 OIL & GAS

8.4 CONSTRUCTION

8.4.1 HOSPITALS

8.4.2 SKYSCRAPERS

8.4.3 COLLEGES

8.4.4 RESTAURANTS

8.4.5 RESIDENTIAL BUILDINGS

8.4.6 COMMERCIAL BUILDINGS

8.4.7 OFFICES

8.4.8 OTHERS

8.5 AEROSPACE

8.6 ELECTRICAL AND ELECTRONICS

8.7 TEXTILE

8.8 FURNITURE

8.9 WAREHOUSING

8.1 OTHERS

9 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, END USER

9.1 OVERVIEW

9.2 BUILDING & CONSTRUCTION

9.2.1 INTUMESCENT COATING

9.2.2 CEMENTITIOUS MATERIAL

9.2.3 FIREPROOFING CLADDING

9.2.4 OTHERS

9.3 OIL & GAS

9.3.1 INTUMESCENT COATING

9.3.2 CEMENTITIOUS MATERIAL

9.3.3 FIREPROOFING CLADDING

9.3.4 OTHERS

9.4 TRANSPORTATION

9.4.1 INTUMESCENT COATING

9.4.2 CEMENTITIOUS MATERIAL

9.4.3 FIREPROOFING CLADDING

9.4.4 OTHERS

9.5 OTHERS

9.5.1 INTUMESCENT COATING

9.5.2 CEMENTITIOUS MATERIAL

9.5.3 FIREPROOFING CLADDING

9.5.4 OTHERS

10 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 MERGER & ACQUISITION

11.3 RECENT UPDATE

11.4 PRODUCT LAUNCH

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 3M

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT UPDATE

13.2 GCP APPLIED TECHNOLOGIES INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT UPDATE

13.3 AKZO NOBEL N.V.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT UPDATE

13.4 THE SHERWIN-WILLIAMS COMPANY

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT UPDATE

13.5 HILTI

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 ETEX GROUP

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 KANSAI PAINT CO.,LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATE

13.8 JOTUN

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 CARBOLINE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 CONTEGO INTERNATIONAL INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATE

13.11 EASTMAN CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATE

13.12 ENVIROGRAF PASSIVE FIRE PRODUCTS

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 HEMPEL A/S

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATE

13.14 ISOLATEK INTERNATIONAL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 NO BURN, INC

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

13.16 PPG INDUSTRIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATE

13.17 RUDOLF HENSEL GMBH

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT UPDATE

13.18 SHARPFIBRE LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT UPDATE

13.19 SVT GROUP OF COMPANIES

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT UPDATE

13.2 TEKNOS GROUP

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT UPDATE

13.21 VIJAY SYSTEMS ENGINEERS PVT LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORT

표 목록

TABLE 1 IMPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 842410 FIRE EXTINGUISHERS WHEATHER OR NOT CHANGE… (USD THOUSAND)

TABLE 3 POTENTIAL COLLABORATION OPPORTUNITIES

TABLE 4 POTENTIAL SUBSTITUTES

TABLE 5 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 7 NORTH AMERICA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 9 NORTH AMERICA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 12 NORTH AMERICA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA FIREPROOFING CLADDING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 15 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (THOUSAND KG)

TABLE 17 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA WATER-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA SOLVENT-BASED PROTECTION COATING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA AUTOMOTIVE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA AEROSPACE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA ELECTRICAL AND ELECTRONICS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA TEXTILE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA FURNITURE IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA WAREHOUSING IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY COUNTRY, 2020-2029 (THOUSAND KG)

TABLE 42 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029(THOUSAND KG)

TABLE 44 NORTH AMERICA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 56 U.S. INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 59 U.S. PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 U.S. CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 U.S. PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 62 U.S. BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 U.S. OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 U.S. TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 U.S. OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 68 CANADA INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 CANADA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 71 CANADA PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 CANADA CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 CANADA PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 74 CANADA BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 CANADA OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 CANADA TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 CANADA OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (THOUSAND KG)

TABLE 80 MEXICO INTUMESCENT COATING IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 MEXICO CEMENTITIOUS MATERIAL IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 FRANCE PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2020-2029 (USD THOUSAND)

TABLE 83 MEXICO PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 MEXICO CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 MEXICO PASSIVE FIRE PROTECTION COATING MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 86 MEXICO BUILDING & CONSTRUCTION IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 MEXICO OIL & GAS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 MEXICO TRANSPORTATION IN PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 MEXICO OTHERS IN PASSIVE FIRE PROTECTION COATING MARKET, PRODUCT TYPE, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 GROWING CONSTRUCTION INDUSTRY IS DRIVING THE NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 INTUMESCENT COATING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINT, OPPORTUNITY, AND CHALLENGES OF NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET

FIGURE 18 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY PRODUCT TYPE, 2021

FIGURE 19 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, BY TECHNOLOGY, 2021

FIGURE 20 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, APPLICATION, 2021

FIGURE 21 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET, END USER, 2021

FIGURE 22 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET : SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 27 NORTH AMERICA PASSIVE FIRE PROTECTION COATING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.