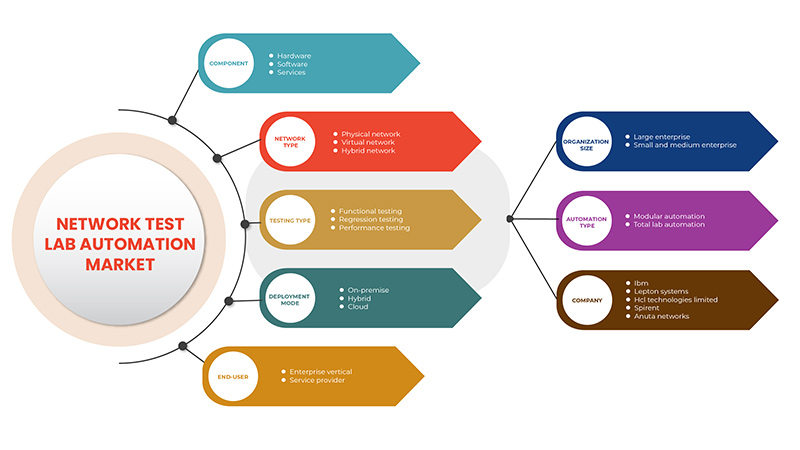

북미 네트워크 테스트 랩 자동화 시장, 구성 요소별(하드웨어, 소프트웨어, 서비스), 네트워크 유형(물리적 네트워크, 가상 네트워크, 하이브리드 네트워크), 테스트 유형(기능 테스트, 회귀 테스트, 성능 테스트), 배포 모드(클라우드, 온프레미스, 하이브리드), 최종 사용자(엔터프라이즈 수직, 서비스 제공자), 조직 규모(대기업, 중소기업), 자동화 유형(모듈식 자동화, 전체 랩 자동화) - 2029년까지의 산업 동향 및 예측

시장 분석 및 규모

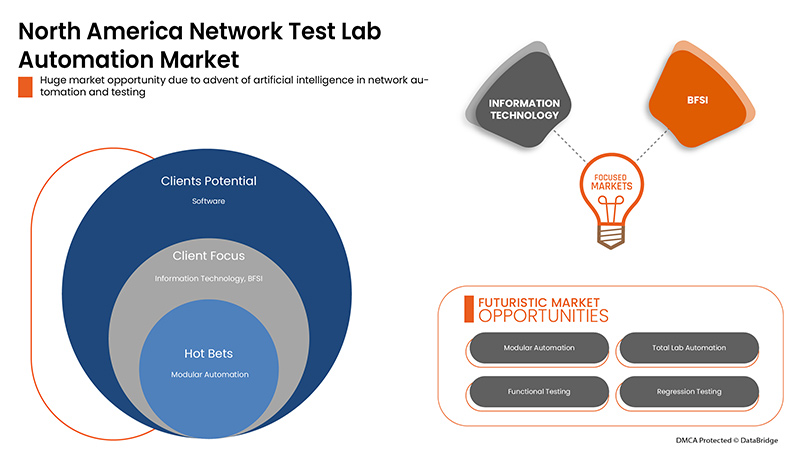

산업과 기업이 디지털 혁신 이니셔티브를 가속화함에 따라 새로운 제품 및 기술 주기가 점점 짧아지고 있습니다. 기존 운영 환경에서 새로운 기술 도입의 성공을 보장하려면 실제 세계의 신뢰성, 성능 및 상호 운용성을 위해 장치, 제품 또는 솔루션을 광범위하게 테스트하고 검증할 수 있는 적절한 리소스를 보유하는 것이 중요합니다. 시뮬레이션 환경에서 테스트하는 것은 상당한 미래 위험을 초래하기 때문에 대부분의 기업은 랩 인프라와 전문 지식을 구축하거나 네트워크 테스트 랩 자동화 서비스 제공업체에서 테스트를 받는 데 상당한 투자를 합니다. 산업과 기업의 이러한 새로운 기술과 제품은 이전보다 더 복잡하고 기업은 네트워킹, 테스트, 모니터링 및 자동화에서 기술 격차에 직면하기 때문에 서비스 제공업체가 기업을 대신하여 테스트를 수행합니다. 서비스 제공업체는 제안된 제품에 대해 기능, 성능 또는 회귀와 같은 테스트 유형을 사용하고 테스트에서 다양한 도구의 도움을 받을 수 있습니다. 인공 지능의 도래와 IoT 및 5G와의 통합은 모든 산업에서 디지털 제품의 비율을 높이고 출시 전에 테스트해야 합니다. 이를 통해 앞으로 북미 네트워크 테스트 랩 자동화 시장이 꽃을 피울 것입니다.

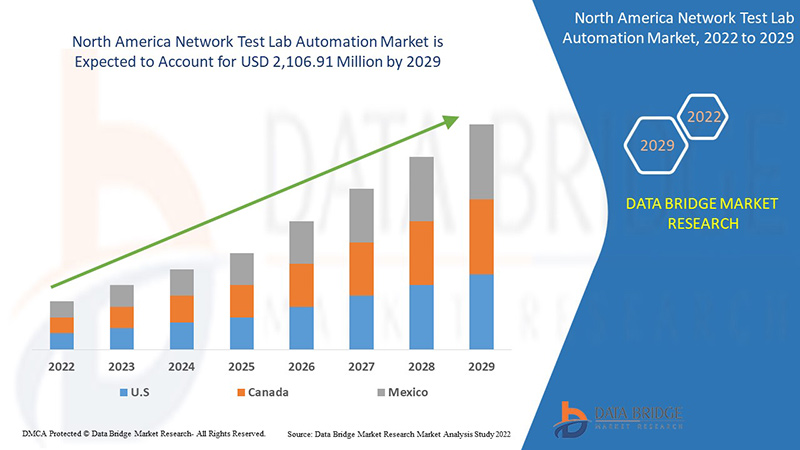

Data Bridge Market Research는 북미 네트워크 테스트 랩 자동화 시장이 2029년까지 2,106.91백만 달러 규모에 도달할 것으로 분석했습니다. 네트워크 테스트 랩 자동화 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

구성 요소(하드웨어, 소프트웨어, 서비스), 네트워크 유형(물리적 네트워크, 가상 네트워크, 하이브리드 네트워크), 테스트 유형(기능 테스트, 회귀 테스트, 성능 테스트), 배포 모드(클라우드, 온프레미스, 하이브리드), 최종 사용자(기업 수직, 서비스 공급자), 조직 규모(대기업, 중소기업), 자동화 유형(모듈식 자동화, 전체 랩 자동화) |

|

적용 국가 |

북미의 미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Calient Technologies, Fiber Smart Networks, Fiber Mountain, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Kentik, HCL Technologies. |

시장 정의

네트워크에서 가상 및 물리적 장치의 구성, 운영, 배포, 테스트 및 관리를 자동화하는 프로세스를 네트워크 자동화라고 합니다. 일상적인 기능과 네트워크 테스트, 반복적인 절차가 자동으로 처리되고 제어됨에 따라 네트워크 서비스의 가용성이 증가합니다. 모든 네트워크는 네트워크 자동화의 이점을 누릴 수 있습니다. 기업, 서비스 제공업체 및 데이터 센터는 소프트웨어 및 하드웨어 기반 솔루션을 사용하여 네트워크를 자동화하여 운영 비용을 낮추고 인적 오류를 줄이며 생산성을 높일 수 있습니다.

네트워크 테스트 랩 자동화 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 자동화 및 원활한 고객 경험을 위한 솔루션에 대한 수요 증가

오늘날, 연구 및 병리학 실험실은 지난 20년 동안 상당한 진화를 거쳤습니다. 실험실에서는 기술적으로 진보된 자동화된 기기와 실험실 시스템에 대한 수요가 증가하고 있습니다. 실험실 자동화를 포함한 여러 혁신은 진단, 약물 발견 및 연구를 개선하려는 욕구에 의해 주도되고 있습니다.

실험실 자동화를 통해 다양한 실험실 과학자와 전문가는 연구 및 보고서 생성에서 차세대 속도, 일관성 및 정밀성을 달성할 수 있습니다. 또한 실험실 자동화의 발전으로 오류 수를 줄이는 데 도움이 되는 프로세스가 표준화되었습니다. 따라서 자동화 기술의 도움으로 실시간 결과를 평가하는 것이 증가하고 진단 사례가 증가함에 따라 고급 소프트웨어와 최첨단 자동화 시스템에 대한 수요가 크게 증가했습니다.

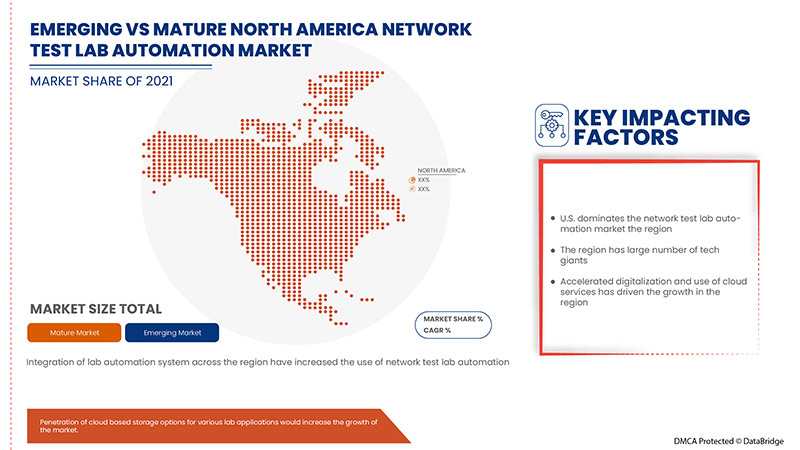

- 다양한 실험실 애플리케이션을 위한 클라우드 기반 스토리지 옵션의 침투

지난 수십 년 동안 90%의 기업이 더 나은 통찰력, 더 쉬운 협업, 조직의 비용 절감과 같은 이점을 위해 기존 컴퓨팅 및 데이터 저장 방법 대신 클라우드 기반 솔루션을 선택했다고 보고되었습니다. 그러나 클라우드 사용이 증가함에 따라 기업은 운영 효율성을 관리하고 복잡성을 줄이기 위해 클라우드 인프라를 보다 효율적으로 관리해야 합니다. 클라우드 자동화는 소프트웨어와 프로세스를 사용하여 가상 네트워크 생성, 가상 머신 배포, 부하 분산, 성능 모니터링과 같은 클라우드 컴퓨팅 워크로드 및 서비스의 프로비저닝 및 관리를 자동화하는 것을 말합니다. 클라우드 자동화를 사용하면 IT 관리자는 수동 프로세스를 줄이거나 제거하여 관리 오버헤드를 낮추고 리소스 제공 속도를 높일 수 있습니다.

기회

- 디지털 전환을 위한 네트워크 자동화 및 테스트에 대한 증가하는 요구

디지털 혁신은 디지털 기술을 사용하여 기존의 전통적이고 비디지털 비즈니스 프로세스와 서비스를 혁신하거나 새로운 프로세스를 만들어 변화하는 시장과 고객 기대에 부응하는 프로세스입니다. 따라서 기업이 관리되고 운영되는 방식과 고객에게 가치를 제공하는 방식을 완전히 바꾸고 있습니다. 디지털 혁신은 조직이 끊임없이 변화하는 산업에 적응하고 그에 따라 운영을 지속적으로 개선할 수 있도록 해주기 때문에 중요합니다. 모든 디지털 혁신 이니셔티브에는 고유한 목표가 있습니다. 모든 디지털 혁신의 주요 목적은 현재 프로세스를 개선하는 것입니다. 그러나 조직의 디지털 혁신에는 광범위한 계획, 적절한 리소스 관리, 막대한 자본 투자가 필요한 제품 및 소프트웨어의 테스트 및 개발이 필요합니다. 그렇지 않으면 소프트웨어와 비즈니스 모델을 구현하는 데 오랜 시간이 걸려 조직의 자본과 시간 손실로 이어질 수 있습니다. Bain & Company의 연구에 따르면 글로벌 기업의 8%만이 디지털 기술에 대한 투자를 통해 목표 비즈니스 성과를 달성할 수 있었습니다. 따라서 성공적인 디지털 혁신을 위해서는 네트워크 자동화와 테스트를 통합하는 것이 매우 중요합니다.

제약/도전

- 실험실 자동화 시스템의 복잡성 증가로 인해 가동 중지 위험 증가

네트워크 랩 자동화 프로세스는 인간 직원의 필요성을 줄이고 대신 자동화된 기계 프로세스를 구현하여 반복적인 작업을 수행하는 이점을 얻기 위해 전 세계적으로 구현되었습니다. 그러나 시스템의 복잡성이 높을수록 시스템 장애로 인해 실험실 기능에 심각한 결과가 초래될 위험이 커집니다. 특히 조립 라인과 관련된 많은 중요한 시스템 장애는 샘플 관리(예: 수동 분류, 원심 분리)를 위한 수동 절차를 복원해야 합니다. 그러나 대부분의 실험실에서 리소스가 개발 및 테스트에 제한 요소인 것으로 나타났습니다. 실험실을 관리하고 일정을 조정하는 기존 방식은 패치 패널을 사용하고 연결을 수동으로 변경하는 것입니다. 그러나 이 접근 방식은 확장성이 없고 많은 경우 비효율적입니다.

- 숙련된 인력과 경험적 전문성이 부족합니다.

인공 지능(AI), 머신 러닝(ML), 사물 인터넷(IoT), 자동화는 향후 10년 동안 네트워크 테스트 산업을 혁신할 잠재력이 있는 새로운 기술입니다. 이러한 기술적 추세는 COVID-19 팬데믹이 기술 중심 환경을 변화시키면서 더욱 중요해졌습니다. 글로벌 팬데믹이 인력 역학을 변화시키면서 최첨단 소프트웨어, 웹 및 모바일 애플리케이션에 대한 의존도가 상당히 증가했습니다. 이러한 끊임없이 증가하는 수요를 지원하기 위해 기업은 기술을 사용하여 최종 사용자에게 완벽한 기능, 풍부한 기능, 완벽한 제품과 소프트웨어를 출시해야 할 필요성을 높였습니다. 그 결과 테스트 자동화가 도입되어 광범위한 테스트 범위, 과학적 테스트 정확성, 간소화된 테스트 운영, 낮은 비용 및 향상된 리소스 효율성이 약속되었습니다. 이로 인해 업계에서 증가하는 수요를 충족하기 위해 많은 숙련된 인력이 필요하게 되었습니다. 숙련된 근로자는 업무에 적용할 수 있는 특별한 기술, 교육 또는 지식을 보유한 모든 근로자입니다. 네트워크 테스트 산업에 필요한 기술에는 다양한 프로그래밍 언어에 대한 능숙함, 선도적인 자동화 테스트 도구(코드리스 도구 포함)에 대한 숙달, 수동 테스트 경험 및 비즈니스 요구 사항에 대한 이해와 함께 테스트 관리 도구에 대한 지식이 포함될 수 있습니다. 이러한 요구 사항은 산업의 숙련된 노동력 수를 줄였고, 또한 이 역할에 대한 수요는 산업에 자격이 부족한 노동력이 증가함에 따라 증가하고 있습니다.

네트워크 테스트 랩 자동화 시장에 대한 COVID-19 이후의 영향

COVID-19는 원격 작업과 클라우드 인프라의 빠른 도입으로 인해 네트워크 테스트 랩 자동화 시장에 긍정적인 영향을 미쳤습니다.

COVID-19 팬데믹은 네트워크 테스트 랩 자동화 시장에 어느 정도 긍정적인 영향을 미쳤습니다. 기업에서 인공 지능과 머신 러닝을 채택하고 활용하는 것이 증가하면서 팬데믹 기간과 이후에 시장이 성장하는 데 도움이 되었습니다. 또한 COVID-19 이후 시장이 개방된 후에도 성장이 높았으며, 산업 4.0과 자동화 기술에 대한 수요가 높아져 이 부문에서 상당한 성장이 있을 것으로 예상됩니다.

솔루션 제공업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체들은 네트워크 테스트 랩 자동화에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 첨단 기술을 제공할 것입니다. 또한 자동화 기술 사용을 위한 정부 이니셔티브로 인해 시장이 성장했습니다.

최근 개발

- 2022년 4월, Keysight Technologies, Inc.는 Xiaomi가 자동화된 현장-실험실 디바이스 테스트 플랫폼 솔루션을 선택했다고 발표했습니다. Xiaomi는 다양한 네트워크 신호 및 무선 채널 환경에서 5G 디바이스 성능을 검증하기 위해 Keysight의 테스트 도구를 선택했습니다. 고급 5G 테스트 솔루션을 개발하기 위해 Keysight는 실험실 및 현장 기반 테스트 기능을 효과적으로 결합했습니다. 이 협업은 고객 포트폴리오와 회사의 입지를 강화할 것입니다.

- 2022년 1월, Spirent는 WiFi 테스트 기능을 확장하기 위해 octoScope를 인수했습니다. octoScope의 테스트 솔루션은 최신 WiFi 6 및 WiFi 6E 기술을 포함하여 에뮬레이션된 실제 환경과 같은 자동화된 Wi-Fi 및 5G 테스트를 포함합니다. 이 인수는 무선 네트워크 테스트 솔루션 회사가 WiFi 테스트 기능을 확장하고 전 세계적으로 서비스를 개선하고 브랜드를 재편하는 데 도움이 될 것입니다.

북미 네트워크 테스트 랩 자동화 시장 범위

네트워크 테스트 랩 자동화 시장은 구성 요소, 네트워크 유형, 테스트 유형, 배포 모드, 최종 사용자, 조직 규모, 자동화 유형을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

요소

- 하드웨어

- 소프트웨어

- 서비스

구성 요소를 기준으로 북미 네트워크 테스트 랩 자동화 시장은 하드웨어, 소프트웨어, 서비스로 구분됩니다.

네트워크 유형

- 물리적 네트워크

- 가상 네트워크

- 하이브리드 네트워크

네트워크 유형을 기준으로 북미 네트워크 테스트 랩 자동화 시장은 물리적 네트워크, 가상 네트워크, 하이브리드 네트워크로 구분되었습니다.

테스트 유형

- 기능 테스트

- 회귀 테스트

- 성능 테스트

테스트 유형을 기준으로 북미 네트워크 테스트 랩 자동화 시장은 기능 테스트, 회귀 테스트, 성능 테스트로 구분됩니다.

배포 모드

- 구름

- 잡종

- 온프레미스

배포 모드를 기준으로 북미 네트워크 테스트 랩 자동화 시장은 클라우드, 하이브리드, 온프레미스로 구분됩니다.

최종 사용자

- 기업 수직

- 서비스 제공자

최종 사용자를 기준으로 북미 네트워크 테스트 랩 자동화 시장은 기업용 수직형, 서비스 제공업체로 세분화되었습니다.

조직 규모

- 대기업

- 중소기업

조직 규모를 기준으로 북미 네트워크 테스트 랩 자동화 시장은 대기업, 중소기업으로 구분됩니다.

자동화 유형

- 모듈식 자동화

- 전체 실험실 자동화

자동화 유형을 기준으로 북미 네트워크 테스트 랩 자동화 시장은 모듈식 자동화, 전체 랩 자동화로 구분됩니다.

네트워크 테스트 랩 자동화 시장 지역 분석/통찰력

네트워크 테스트 랩 자동화 시장을 분석하고, 위에 언급된 대로 국가, 구성 요소, 네트워크 유형, 테스트 유형, 배포 모드, 최종 사용자, 조직 규모 및 자동화 유형별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

네트워크 테스트 랩 자동화 시장 보고서에서 다루는 국가는 북미의 미국, 캐나다, 멕시코입니다. 미국은 북미 지역에서 우위를 점하고 있는데, 전 세계의 많은 기술 거대 기업이 본거지이기 때문에 시스템, 애플리케이션 및 업데이트를 테스트해야 할 필요가 끊임없이 있기 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 네트워크 테스트 랩 자동화 시장 점유율 분석

네트워크 테스트 랩 자동화 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 사이트 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 네트워크 테스트 랩 자동화 시장과 관련된 회사의 초점에만 관련이 있습니다.

네트워크 테스트 랩 자동화 시장의 주요 기업으로는 Qualisystems Ltd., Spirent Communications, Lepton, Pluribus Networks, Polatis, Calient Technologies, Fiber Smart Networks, Fiber Mountain, Cisco, Sedona Systems, Anuta Networks, Versa Networks, Netbrain, Juniper Networks, Netscout, Keysight Technologies, ZPE Systems, Inc., Bell Integrator, Danaher, Great Software Laboratory, Accuver, Wipro, Appviewx, Kentik, HCL Technologies 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL TRENDS

4.2 CASE STUDIES

4.2.1 AUTOMATION OF API TESTING FOR NETWORK APPLICATION

4.2.2 CIRCUIT SWITCHED CORE NETWORK AUTOMATION

4.3 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR AUTOMATION AND SOLUTION FOR SEAMLESS CUSTOMER EXPERIENCE

5.1.2 INTEGRATION OF LAB AUTOMATION SYSTEM ACROSS THE REGION

5.1.3 PENETRATION OF CLOUD BASED STORAGE OPTIONS FOR VARIOUS LAB APPLICATIONS

5.1.4 HIGHER ACCURACY AND QUALITY OF TESTING ASSOCIATED WITH NETWORK TEST LAB AUTOMATION

5.2 RESTRAINTS

5.2.1 HIGHER COST FOR IMPLEMENTATION OF LAB AUTOMATION SYSTEMS

5.2.2 RISE IN COMPLEXITY OF LAB AUTOMATION SYSTEMS AND THEREBY INCREASING THE RISK OF DOWNTIME

5.3 OPPORTUNITIES

5.3.1 GROWING NEED OF NETWORK AUTOMATION & TESTING FOR DIGITAL TRANSFORMATION

5.3.2 INCREASING ADVANCEMENT OF AUTOMATION IN MEDICAL SEGMENT

5.3.3 ADVENT OF ARTIFICIAL INTELLIGENCE IN NETWORK AUTOMATION AND TESTING

5.3.4 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LACK OF END USER FRIENDLY TOOLS IN TEST LAB AUTOMATION

5.4.2 LACK OF SKILLED WORKFORCE AND EXPERIENCED EXPERTISE

6 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 TEST AS A SERVICE

6.2.2 NETWORK AUTOMATION TOOLS

6.2.3 TEST LAB AS A SERVICE (LAAS)

6.2.4 INTENT-BASED NETWORKING

6.3 HARDWARE

6.4 SERVICES

6.4.1 PROFESSIONAL SERVICE

6.4.1.1 DEPLOYMENT AND INTEGRATION SERVICES

6.4.1.2 TRAINING AND SUPPORT SERVICES

6.4.1.3 ADVISORY AND CONSULTING SERVICE

6.4.2 MANAGED SERVICE

7 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE

7.1 OVERVIEW

7.2 VIRTUAL NETWORK

7.3 HYBRID NETWORK

7.4 PHYSICAL NETWORK

8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE

8.1 OVERVIEW

8.2 FUNCTIONAL TESTING

8.3 REGRESSION TESTING

8.4 PERFORMANCE TESTING

9 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISE

9.4 HYBRID

10 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER

10.1 OVERVIEW

10.2 ENTERPRISE VERTICAL

10.2.1 INFORMATION TECHNOLOGY

10.2.2 BANKING, FINANCIAL SERVICE AND INSURANCE

10.2.3 MANUFACTURING

10.2.4 HEALTHCARE

10.2.5 EDUCATION

10.2.6 ENERGY AND UTILITIES

10.2.7 OTHERS

10.3 SERVICE PROVIDER

11 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE

11.1 OVERVIEW

11.2 MODULAR AUTOMATION

11.3 TOTAL LAB AUTOMATION

12 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE

12.1 OVERVIEW

12.2 LARGE ENTERPRISE

12.3 SMALL AND MEDIUM ENTERPRISE

13 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 KEYSIGHT TECHNOLOGIES

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SOLUTION PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IBM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SPIRENT COMMUNICATIONS

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 CISCO SYSTEMS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 HCL TECHNOLOGIES LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTIONS PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACCUVER

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ANUTA NETWORKS PVT. LTD.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 APPVIEWX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BELL INTEGRATOR

16.9.1 COMPANY SNAPSHOT

16.9.2 SERVICE PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CALIENT TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 SOLUTION PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 DANAHER

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 BRAND PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 FIBER MOUNTAIN

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FIBER SMART NETWORKS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GREAT SOFTWARE LABORATORY

16.14.1 COMPANY SNAPHSOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 JUNIPER NETWORKS, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 KENTIK

16.16.1 COMPANY SNAPSHOT

16.16.2 SOLUTION PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 LEPTON SYSTEMS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 NETBRAIN TECHNOLOGIES, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NETSCOUT

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 PHOENIX DATACOM LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 SOLUTION PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 PLURIBUS NETWORKS

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 POLATIS, INC.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 QUALISYSTEMS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 SEGRON AUTOMATION S.R.O

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VERSA NETWORKS

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPRO LIMITED

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 ZPE SYSTEMS, INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 SOLUTION PORTFOLIO

16.27.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 3 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA VIRTUAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HYBRID NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PHYSICAL NETWORK IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA FUNCTIONAL TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA REGRESSION TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PERFORMANCE TESTING IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ON-PREMISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA HYBRID IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SERVICE PROVIDER IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MODULAR AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA TOTAL LAB AUTOMATION IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LARGE ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SMALL AND MEDIUM ENTERPRISE IN NETWORK TEST LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 U.S. SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 49 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 U.S. ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 U.S. NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 CANADA SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 60 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 61 CANADA ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 63 CANADA NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 MEXICO SOFTWARE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SERVICES IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO PROFESSIONAL SERVICE IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY NETWORK TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY TESTING TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 72 MEXICO ENTERPRISE VERTICAL IN NETWORK TEST LAB AUTOMATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO NETWORK TEST LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET:REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 INTEGRATION OF LAB AUTOMATION ACROSS THE REGION MAGNET IS EXPECTED TO BE KEY DRIVERS THE MARKET FOR NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES OF NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET

FIGURE 14 TYPE OF CLOUD COMPUTING SERVICE, BY SERVICE MODEL, 2021 (EUROPE)

FIGURE 15 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT, 2021

FIGURE 16 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY NETWORK TYPE, 2021

FIGURE 17 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY TESTING TYPE, 2021

FIGURE 18 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY END-USER, 2021

FIGURE 20 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 21 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 22 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: BY COMPONENT (2022-2029)

FIGURE 27 NORTH AMERICA NETWORK TEST LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.