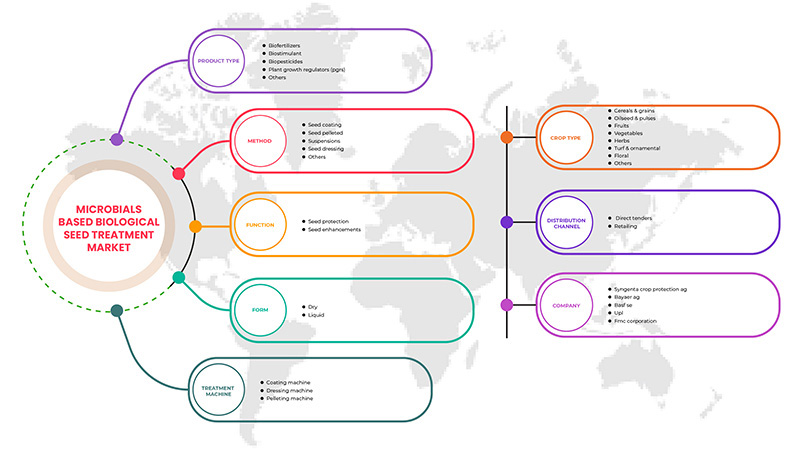

North America Microbial Based Biological Seed Treatment Market, By Product (Biofertilizers, Biostimulants, Biopesticides, Plant Growth Regulators (PGRs), and Others), Form (Dry, and Liquid), Method (Seed Coating, Seed Pelleted, Suspensions, Seed Dressing, and Others.), Treatment Machine (Coating Machine, Dressing Machine, and Pelleting Machine), Function (Seed Protection, and Seed Enchantments), Distribution Channel (Direct Tenders, and Retailing), Crop Type (Cereals & Grains, Oilseed & Pulses, Fruits, Vegetables, Herbs, Turf & Ornamental, Floral, and others) Industry Trends and Forecast to 2029.

North America Microbial Based Biological Seed Treatment Market Analysis and Insights

The rising prevalence of allergies associated with chemically cultivated food, increasing acquisitions, and mergers. Launches of manly organic and bio-based seed treatment products such as biopesticides, biostimulants, and others with major global players by many companies to expand their presence and make the product available all over the region are expected to drive the growth of the market.

For instance,

- In February 2022, Valent BioSciences created a new biostimulant operating unit supporting parent company Sumitomo chemical's goal of carbon neutrality by 2050. This new operating unit is designed to expand its biostimulant line with new internally and externally developed products for the U.S. and global markets in this important and rapidly growing crop production segment

Acquisition and partnerships boost the market growth in the years ahead. Whereas the high rates of organic food, naturally cultivated, and bio-based pesticides are likely to restrict the market growth in the region.

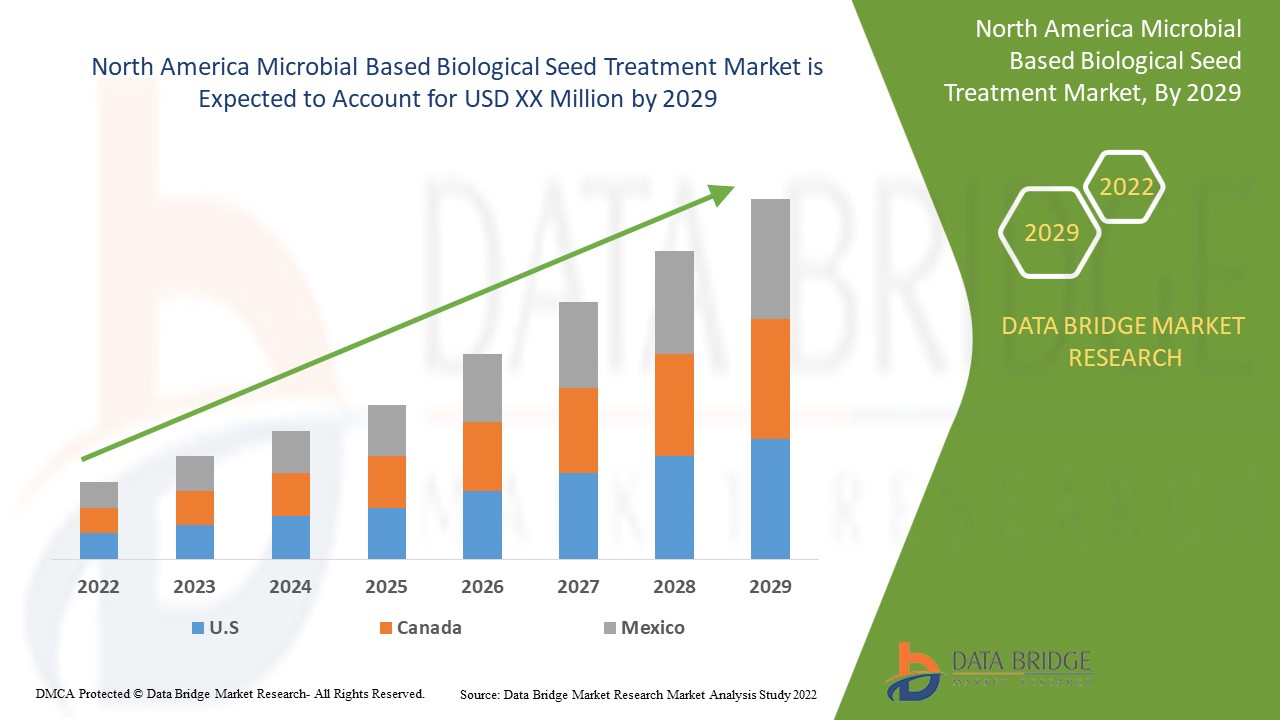

Data Bridge Market Research analyses that the North America microbials based biological seed treatment market will grow at a CAGR of 11.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product (Biofertilizers, Biostimulants, Biopesticides, Plant Growth Regulators (PGRs), and Others), Form (Dry, and Liquid), Method (Seed Coating, Seed Pelleted, Suspensions, Seed Dressing, and Others.), Treatment Machine (Coating Machine, Dressing Machine, and Pelleting Machine.), Function (Seed Protection, and Seed Enchantments), Distribution Channel (Direct Tenders, and Retailing), Crop Type ( Cereals & Grains, Oilseed & Pulses, Fruits, Vegetables, Herbs, Turf & Ornamental, Floral, and others). |

|

Regions Covered |

U.S, Canada, and Mexico. |

|

Market Players Covered |

Syngenta Crop Protection AG, Bayer AG, BASF SE, UPL, FMC Corporation, ADAMA, Albaugh, LLC., Arysta LifeScience Corporation, BioWorks Inc., Croda International Plc, Germains Seed Technology, Hello Nature International, Koppert, Marrone Bio Innovations, Inc., Novozymes, Plant Health Care plc., T.Stanes and Company Limited, Tagros Chemicals India Pvt. Ltd., Valent BioSciences LLC, Verdesian Life Sciences 등이 있습니다. |

시장 정의

생물학적 종자 처리제는 살아있는 미생물, 식물 추출물, 발효 제품, 식물 호르몬, 심지어 경질 화학 물질을 포함한 활성 성분이 포함된 광범위한 제품군입니다. 생물학적 물질은 분말 또는 액체 형태로 종자에 적용됩니다. 균일한 코팅이 종자 전체를 덮습니다. 종자는 이런 방식으로 필요할 때 유익한 성분을 이용할 수 있습니다. 생물학적 종자 처리의 활성제에는 곰팡이 및 박테리아와 같은 미생물과 식물 추출물 및 조류 추출물이 포함될 수 있습니다. 아르부스큘라 균근균, 트리코더마 속, 근류균 및 기타 박테리아의 유익한 미생물은 발아를 개선하기 위해 파종 전에 종자에 적용됩니다. 생물학적 종자로 처리된 작물은 생물 자극제 역할을 하여 더 강하고 생산적입니다. 이 처리제는 작물 수확량을 늘리는 동시에 식물이 질병을 물리치고 생물학적 스트레스를 줄이는 데 도움이 됩니다. 식물 성장을 지원하는 미생물은 뿌리를 식민지화하고 전체 재배 기간 동안 작물을 보호합니다. 미생물 기반 생물학적 종자 처리의 적용 분야는 다양합니다.

북미 미생물 기반 생물학적 종자 처리 시장 역학

이 섹션에서는 시장 동인, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

-

농업용 생물학적 식물 생장 제품 출시 증가

생물 살충제, 생물 살충제, 생물 살균제, 생물 제초제 등과 같은 생물 살충제 제조업체의 출시 횟수 증가는 시장 성장의 주요 원동력 중 하나입니다. 농업 관행을 위한 유기 또는 천연 및 생물학적 제품에 대한 수요는 화학 살충제가 작물과 환경에 미치는 해로운 영향에 대한 인식이 높아짐에 따라 농부들 사이에서 증가하고 있습니다. 이 요인은 시장 성장을 촉진할 것입니다. 농부들은 생산성을 높이고 오염을 줄임으로써 환경을 지원하기 위해 천연 자원에서 추출하고 쉽게 분해되는 살충제를 채택하고 있습니다.

예를 들어,

-

Meister Media Worldwide에 따르면 2021년 3월 Botanical Solution Inc.와 Syngenta는 Botrytis cinerea를 제어하는 데 도움이 되는 BotriStop이라는 생물 살균제 제품을 멕시코에서 출시했습니다.

-

2020년 3월, AgroSpectrum India에 따르면 Bayer AG는 중국에서 생물 살균제인 Serenade를 출시했습니다.

-

2020년 4월, Syngenta는 Novozymes와 협력하여 TAEGRO라는 생물 살균제를 상용화했습니다.

지속 가능한 농업 관행을 지원하기 위해 농부들 사이에서 천연 및 생물학적 종자 처리 제품에 대한 수요가 증가함에 따라 주요 제조업체가 출시하는 제품 수가 증가함에 따라 미생물 기반 생물학적 종자 처리 시장이 성장할 가능성이 있습니다.

기회

- 기업이 취한 전략적 이니셔티브

미생물을 생물학적 대안으로 사용하는 것은 화학 살충제 사용을 줄이려는 대중과 규제 기관의 압력이 커지면서 점점 더 중요해지고 있습니다. 미생물은 생물 자극제 역할을 할 수 있으며, 식물이 토양에 결합된 영양소에 접근하고 흡수하기 쉽게 만들어 다양한 해충에 효과적으로 대항하고, 환경 스트레스에 대한 내성을 높이고, 다양한 성장 단계에서 식물을 돕습니다.

기업들은 소비자 수요를 충족하고 지속 가능한 농업에 대한 인식을 높이기 위해 전략, 출시 및 계획을 수립하고 있으며, 이를 통해 제조업체가 사업을 확장할 수 있는 더 많은 기회를 제공하고 있습니다.

베트남의 기업들은 농부들이 일상 활동에서 어려움을 극복하고 동시에 환경 친화적이면서도 작물 수확량과 품질을 높이는 데 도움이 되는 혁신적인 솔루션을 도입하는 데 항상 집중해 왔습니다. 새로운 제품과 기술을 출시하여 혁신을 활용하고 농업의 과제를 해결합니다.

예를 들어,

- 2022년 6월, 신젠타는 새로운 종자 처리 제품인 VICTRATO를 출시했습니다. 혁신적인 선충류 방제 제품인 VICTRATO는 신젠타의 TYMIRIUMTM 기술을 기반으로 하며 어려운 문제에 대한 창의적인 접근 방식을 제공합니다. 모든 주요 선충류 종과 곰팡이 질병은 토양이나 식물의 건강을 해치지 않고 효율적으로 방제됩니다. 최소한의 활성 성분 복용량을 가진 매우 간단한 제품입니다.

- 2022년 3월, Evonik은 종자 처리 응용 분야를 위한 BREAK-THRU 제품을 출시했습니다. BREAK-THRU BP 787은 기존 바인더 용액을 대체하는 생분해성, 미세 플라스틱 없는 대체 제품입니다. BREAK-TRHU BP 787은 물과의 혼합성 때문에 실리카(예: Aerosil 200)와 결합하면 결합 성분으로 기능합니다.

- 2021년 7월, Rizobacter와 Marrone Bio는 브라질에서 새로운 종자 처리를 제공하기 위해 전략적 제휴를 확대했습니다. 선충류와 토양에 사는 곤충을 위한 생물학적 종자 처리제인 Rizonem은 확대된 유통 계약을 통해 브라질의 작물에서 사용할 수 있습니다. 대두와 옥수수의 중요한 선충류 종에 대한 Rizonema의 효과는 브라질의 수많은 규제 시험에서 입증되었습니다.

따라서 소비자 수요를 충족하기 위한 기업의 전략적 혁신과 신제품은 예측 기간 동안 시장 성장을 촉진합니다.

제약/도전

- 생물학적 종자 처리 제품에 대한 정부 규제 장벽

국가와 지역마다 활성 생물학적 성분에 대한 규제 환경이 다릅니다. 일부 국가에서는 생물학적 제품을 특정 법률에 따라 등록해야 하거나 화학 식물 보호 제품과 유사하게 등록할 수 있습니다. 때로는 데이터 요구 사항이 적고, 때로는 명확하게 정의된 등록 절차가 없을 수도 있습니다. EU는 생물 살충제 제품의 효능을 정량화하고 라벨 주장을 뒷받침하도록 입증해야 한다고 요구합니다. 허가된 생물 살충제만 작물 보호에 합법적으로 사용할 수 있습니다. OECD 권장 사항에 따르면 생물 살충제는 위험이 거의 없는 경우에만 승인해야 합니다.

또한 규제 기관이 요구하는 생물 살충제 등록 데이터 포트폴리오는 일반적으로 기존 화학 살충제에 대한 기존 데이터 포트폴리오의 수정된 버전입니다. 규제 기관이 위험 평가를 수행하는 데 사용합니다. 여기에는 작용 방법, 독성학 및 생태 독성학 평가, 숙주 범위 테스트 및 기타 요소에 대한 세부 정보가 포함되어 있습니다. 이 데이터를 생성하는 데 드는 비용은 종종 틈새 시장 제품인 생물 살충제를 상용화하지 못하도록 기업을 낙담시킬 수 있습니다.

따라서 생물농약 등록을 위한 적절한 시스템이 없어도 안전성이 보장되고, 상업화를 저해하여 미생물 기반 생물학적 종자 처리 시장에 부정적인 영향을 미치는 일이 없습니다.

COVID-19 이후 북미 미생물 기반 생물학적 종자 처리 시장에 미치는 영향

팬데믹 이후, 이동에 제한이 없기 때문에 생물학적 종자 처리에 대한 수요가 증가했기 때문에 제품 공급이 쉬울 것입니다. 또한, 생물 기반 유기 및 천연 종자 처리 제품을 사용하는 추세가 증가함에 따라 시장 성장이 촉진될 수 있습니다.

미생물 기반 생물학적 종자 처리에 대한 수요 증가로 인해 제조업체는 혁신적이고 다기능적인 종자 처리 제품을 출시할 수 있게 되었고, 결과적으로 미생물 기반 생물학적 종자 처리에 대한 수요가 늘어나 시장이 성장하는 데 도움이 되었습니다.

또한 생물학적 종자 처리 제품에 대한 높은 수요가 시장 성장을 견인할 것입니다. 나아가 COVID-19 팬데믹 이후 유기농 및 천연 제품에 대한 수요 증가로 인해 소비자들이 건강에 대해 더 우려함에 따라 시장이 성장했습니다. 또한 새로운 기술과 다목적 제품에 대한 소비자들의 관심은 북미 미생물 기반 생물학적 종자 처리 시장의 성장을 촉진할 것으로 예상됩니다.

최근 개발 사항

- 2022년 3월, UPL은 Kimitec의 MAAVi 혁신 센터와 협력하여 북미 바이오자극제 제품을 상용화했습니다. 이 회사와 R&D 센터 MAAVi와의 협력은 UPL이 지속 가능한 식량 생산을 지원하는 동시에 재배자의 수익성을 높이기 위해 제공할 제품을 확대합니다.

- 2022년 2월, Valent BioSciences는 모회사인 Sumitomo chemical의 2050년까지 탄소 중립 목표를 지원하는 새로운 생물 자극제 운영 부문을 만들었습니다. 이 새로운 운영 부문은 이 중요하고 빠르게 성장하는 작물 생산 부문에서 미국 및 글로벌 시장을 위해 내부 및 외부에서 새롭게 개발된 제품으로 생물 자극제 라인을 확장하도록 설계되었습니다.

북미 미생물 기반 생물학적 종자 처리 시장 범위

북미 미생물 기반 생물학적 종자 처리 시장은 제품, 형태, 방법, 처리 기계, 기능, 유통 채널 및 작물 유형을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 주요 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 생물비료

- 생체 자극제

- 생물 살충제

- 식물 생장 조절제(PGR)

- 기타

북미 미생물 기반 생물학적 종자 처리 시장은 제품을 기준으로 생물 비료, 생물 자극제, 생물 살충제, 식물 생장 조절제(PGR) 및 기타로 구분됩니다.

형태

- 마른

- 액체

북미 미생물 기반 생물학적 종자 처리 시장은 형태에 따라 건식 및 액상으로 구분됩니다.

방법

- 씨앗 코팅

- 씨앗 펠릿

- 서스펜션

- 씨앗 드레싱

- 기타

방법을 기준으로 북미 미생물 기반 생물학적 종자 처리 시장은 종자 코팅, 종자 펠릿, 현탁액, 종자 드레싱 및 기타로 구분됩니다.

치료 기계

- 코팅기

- 드레싱 머신

- 펠렛화 기계

북미 미생물 기반 생물학적 종자 처리 시장은 처리 기계를 기준으로 코팅 기계, 드레싱 기계, 펠렛화 기계로 구분됩니다.

기능

- 종자 보호

- 종자 강화

기능을 기준으로 북미 미생물 기반 생물학적 종자 처리 시장은 종자 보호와 종자 강화로 구분됩니다.

유통 채널

- 직접 입찰

- 소매업

북미 미생물 기반 생물학적 종자 처리 시장은 유통 채널을 기준으로 직접 입찰과 소매로 구분됩니다.

작물 유형

- 시리얼 & 곡물

- 유채 및 콩류

- 과일

- 채소

- 허브

- 잔디 및 장식용

- 꽃

- 기타

작물 유형을 기준으로 북미 미생물 기반 생물학적 종자 처리 시장은 곡물 및 곡식, 유채 및 콩과식물, 과일, 채소, 허브, 잔디 및 관상용 식물, 화훼 및 기타로 구분됩니다.

북미 미생물 기반 생물학적 종자 처리 시장 지역 분석/통찰력

북미 미생물 기반 생물학적 종자 처리 시장을 분석하고, 위에 참조된 내용을 바탕으로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 미생물 기반 생물학적 종자 처리 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 시장 점유율과 수익 측면에서 북미 미생물 기반 생물학적 종자 처리 시장을 지배할 것으로 예상됩니다. 화학적으로 재배된 식품과 관련된 알레르기 증가, 북미 지역에서 인수 및 합병 증가로 인해 예측 기간 동안 지배력을 유지할 것으로 추정됩니다.

보고서의 지역 섹션은 또한 시장의 현재 및 미래 추세에 영향을 미치는 개별 시장 영향 요인과 규정 변경 사항을 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 미생물 기반 생물학적 종자 처리 시장 점유율 분석

경쟁적인 북미 미생물 기반 생물학적 종자 처리 시장은 경쟁자에 대한 세부 정보를 제공합니다. 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세가 포함됩니다. 위의 데이터 포인트는 북미 미생물 기반 생물학적 종자 처리 시장에 대한 회사의 초점과만 관련이 있습니다.

북미 미생물 기반 생물학적 종자 처리 시장의 주요 기업으로는 Syngenta Crop Protection AG, Bayer AG, BASF SE, UPL, FMC Corporation, ADAMA, Albaugh, LLC., Arysta LifeScience Corporation, BioWorks Inc., Croda International Plc, Germains Seed Technology, Hello Nature International, Koppert, Marrone Bio Innovations, Inc., Novozymes, Plant Health Care plc., T.Stanes and Company Limited, Tagros Chemicals India Pvt. Ltd., Valent BioSciences LLC, Verdesian Life Sciences 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER BUYING BEHAVIOR

4.2.1 RECOMMENDATIONS FROM FAMILY, FRIENDS, AND DEALERS -

4.2.2 RESEARCH

4.2.3 IMPULSIVE

4.2.4 ADVERTISEMENT:

4.2.4.1 TELEVISION ADVERTISEMENT

4.2.4.2 ONLINE ADVERTISEMENT

4.2.4.3 IN-STORE ADVERTISEMENT

4.2.4.4 OUTDOOR ADVERTISEMENT

4.3 FACTORS INFLUENCING PURCHASING DECISION

4.3.1 SUSTAINABLE AGRICULTURE

4.3.2 NEW COMBINATIONS

4.3.3 BIOSTIMULANTS

4.4 NEW PRODUCT LAUNCH STRATEGY

4.4.1 OVERVIEW

4.4.2 NUMBER OF PRODUCT LAUNCHES

4.4.2.1 LINE EXTENSION

4.4.2.2 NEW PACKAGING

4.4.2.3 RE-LAUNCHED

4.4.2.4 NEW FORMULATION

4.4.3 DIFFERENTIAL PRODUCT OFFERING

4.4.4 MEETING CONSUMER REQUIREMENT

4.4.5 PACKAGE DESIGNING

4.4.6 PRODUCT POSITIONING

4.4.7 CONCLUSION

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING PROCESS

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 REGULATORY FRAMEWORK

6.1 BIOSCIENCE SOLUTIONS

6.1.1 U.S.

6.1.2 NCBI

6.1.3 FSSAI

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES

7.1.2 INCREASE IN LAUNCHES OF BIOLOGICAL PLANT GROWTH PRODUCTS FOR AGRICULTURE

7.1.3 INCLINATION TOWARD THE SUSTAINABLE AGRICULTURE

7.1.4 GROWING ADOPTION OF ORGANIC FARMING

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF MICROBES

7.2.2 GOVERNMENT REGULATORY BARRIERS FOR BIOLOGICAL SEED TREATMENT PRODUCTS

7.3 OPPORTUNITIES

7.3.1 BIOENCAPSULATION TECHNOLOGY FOR BIOLOGICAL SEED TREATMENT

7.3.2 RISE IN ENVIRONMENTAL POLLUTION CAUSED BY CHEMICAL PESTICIDES

7.3.3 RISE IN AWARENESS ABOUT BIOSTIMULANTS

7.3.4 STRATEGIC INITIATIVES TAKEN BY COMPANIES

7.4 CHALLENGES

7.4.1 HIGH PRICES OF BIOPESTICIDES

7.4.2 AVAILABILITY OF CHEMICAL-BASED SUBSTITUTES

8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BIO PESTICIDES

8.2.1 BIO INSECTICIDES

8.2.1.1 BACILLUS THURINGIENSIS

8.2.1.2 METARHIZIUM ANISOPLIAE

8.2.1.3 BEAUVERIA BASSIANA

8.2.1.4 VERTICILLIUM LECANII

8.2.1.5 BACULOVIRUS

8.2.1.6 OTHERS

8.2.2 BIO FUNGICIDES

8.2.2.1 BACILLUS

8.2.2.2 TRICHODERMA VIRIDE

8.2.2.3 PSEUDOMONAS

8.2.2.4 STREPTOMYCES

8.2.2.5 TRICHODERMA HARZIANUM

8.2.2.6 OTHERS

8.2.3 BIONEMATICIDES

8.2.3.1 BACILLUS FIRMUS

8.2.3.2 OTHERS

8.2.4 BIO HERBICIDES

8.3 BIO STIMULANTS

8.4 BIO FERTILIZERS

8.4.1 NITROGEN FIXING BIO FERTILIZERS

8.4.1.1 RHIZOBIA BACTERIA

8.4.1.2 AZOSPIRILLUM

8.4.1.3 FRAMKIA

8.4.2 OTHERS

8.5 PLANT GROWTH REGULATORS (PGRS)

8.6 OTHERS

9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM

9.1 OVERVIEW

9.2 DRY

9.2.1 WETTABLE POWDER

9.2.2 DRY GRANULES

9.2.3 WATER DIPS

9.3 LIQUID

9.3.1 SUSPENSION CONCENTRATE

9.3.2 EMULSIFIABLE CONCENTRATE

9.3.3 SOLUBLE LIQUID CONCENTRATE

10 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD

10.1 OVERVIEW

10.2 SEED DRESSING

10.3 SEED COATING

10.3.1 FILM COATED

10.3.2 BIOPRIMED

10.3.3 SLURRY COATED

10.4 SEED PELLETED

10.5 SUSPENSIONS

10.5.1 BACTERIAL SUSPENSION

10.5.2 SPORE SUSPENSION

10.5.3 CONIDIAL SUSPENSION

10.6 OTHERS

11 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINE

11.1 OVERVIEW

11.2 DRESSING MACHINE

11.3 COATING MACHINE

11.4 PELLETING MACHINE

12 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 SEED PROTECTION

12.2.1 DISEASE CONTROL

12.2.2 INVERTEBRATE PEST CONTROL

12.2.3 WEED CONTROL

12.3 SEED ENHANCEMENTS

12.3.1 SEED PRIMING

12.3.1.1 IMPROVED YIELD

12.3.1.2 DROUGHT RESISTANCE

12.3.1.3 SALINITY RESISTANCE

12.3.1.4 OTHERS

12.3.2 SEED DISINFECTION

13 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAILING

14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE

14.1 OVERVIEW

14.2 CEREALS & GRAINS

14.2.1 WHEAT

14.2.2 RICE

14.2.3 MAIZE

14.2.4 BARLEY

14.2.5 OTHER

14.3 OILSEED & PULSES

14.3.1 SOYBEAN

14.3.2 COTTONSEED

14.3.3 PEANUT

14.3.4 RAPESEED

14.3.5 PEA

14.3.6 GRAM

14.3.7 CHICKPEAS

14.3.8 LENTIL

14.3.9 OTHERS

14.4 FRUITS

14.4.1 BANANA

14.4.2 APPLE

14.4.3 ORANGE

14.4.4 GRAPES

14.4.5 STRAWBERRIES

14.4.6 PINEAPPLE

14.4.7 MANGOES

14.4.8 POMEGRANATE

14.4.9 PEACH

14.4.10 PASSIONFRUIT

14.4.11 WATERMELON

14.4.12 OTHERS

14.5 VEGETABLES

14.5.1 SOLANAECEOUS

14.5.1.1 EGGPLANT

14.5.1.2 PEPPER

14.5.1.3 TOMATO

14.5.1.4 OTHERS

14.5.2 CUCURBITS

14.5.2.1 CUCUMBER

14.5.2.2 ZUCCHINI

14.5.2.3 BITTERGOURD

14.5.2.4 BOTTLEGOURD

14.5.2.5 SQUASH

14.5.2.6 OTHERS

14.5.3 ROOT & BULB

14.5.3.1 CARROTS

14.5.3.2 BEET ROUTE

14.5.3.3 ONION

14.5.3.3.1 RED ONION

14.5.3.3.2 WHITE ONION

14.5.3.4 RADISHES

14.5.3.5 RUTABAGA

14.5.3.6 OTHERS

14.5.4 BRASSICA

14.5.4.1 CABBAGE

14.5.4.2 PAK CHOI

14.5.4.3 SPINACH

14.5.4.4 CAULIFLOWER

14.5.4.5 LETTUCE

14.5.4.6 BROCCOLI

14.5.4.7 ARUGULA

14.5.4.8 MUSTARD

14.5.4.9 OTHERS

14.5.5 LARGE CROPS

14.5.5.1 BEAN

14.5.5.2 SWEETCORN

14.5.5.3 BABYCORN

14.5.5.4 OTHERS

14.6 HERBS

14.6.1 BASIL

14.6.2 CILANTRO

14.6.3 PARSLEY

14.6.4 DILL

14.6.5 OTHERS

14.7 FLORAL

14.8 TURF & ORNAMENTAL

14.9 OTHERS

15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SYNGENTA CROP PROTECTION AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BAYER AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 BASF SE

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 UPL

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 FMC CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ADAMA

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 ALBAUGH, LLC.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 ARYSTA LIFESCIENCE CORPORATION

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 BIOWORKS INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 CRODA INTERNATIONAL PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 GERMAINS SEED TECHNOLOGY

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HELLO NATURE INTERNATIONAL

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 KOPPERT

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 MARRONE BIO INNOVATIONS, INC.

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 NOVOZYMES

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 PLANT HEALTH CARE PLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 TAGROS CHEMICALS INDIA PVT. LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 T.STANES AND COMPANY LIMITED

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENTS

18.19 VALENT BIOSCIENCES LLC

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 VERDESIAN LIFE SCIENCES

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

표 목록

TABLE 1 PRICES OF BIOPESTICIDES

TABLE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BIO STIMULANTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT GROWTH REGULATORS (PGRS) IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 14 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SEED DRESSING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SEED PELLETED IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SUSPENSION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DRESSING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA COATING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA PELLETING MACHINE IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SEED PROTECTION IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SEED PRIMING IN MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIRECT TENDERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETAILING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION))

TABLE 45 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA FLORAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA TURF & ORNAMENTAL IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA OTHERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 60 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 97 U.S. BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 U.S. BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 100 U.S. DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 101 U.S. LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 102 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 103 U.S. SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 104 U.S. SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 105 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 106 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 107 U.S. SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 108 U.S. SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 109 U.S. SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 110 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 U.S. MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 118 U.S. ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.S. ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 120 U.S. BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 121 U.S. LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.S. HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 CANADA BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 CANADA NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 126 CANADA BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 127 CANADA BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 128 CANADA BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 129 CANADA BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 131 CANADA DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 132 CANADA LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 133 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 134 CANADA SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 135 CANADA SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 136 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 137 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 138 CANADA SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 139 CANADA SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 140 CANADA SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 141 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 CANADA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 150 CANADA ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 151 CANADA BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 153 CANADA HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 155 MEXICO BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 MEXICO NITROGEN FIXING BIO FERTILIZERS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 MEXICO BIO PESTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 158 MEXICO BIO INSECTICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 159 MEXICO BIO FUNGICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 160 MEXICO BIONEMATICIDES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 161 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 162 MEXICO DRY IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 163 MEXICO LIQUID IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 164 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 165 MEXICO SEED COATING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 166 MEXICO SUSPENSIONS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 167 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY TREATMENT MACHINES, 2020-2029 (USD MILLION)

TABLE 168 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 169 MEXICO SEED PROTECTION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 170 MEXICO SEED ENHANCEMENTS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 171 MEXICO SEED PRIMING IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 172 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 MEXICO MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO CEREALS & GRAINS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO OILSEED & PULSES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO FRUITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO VEGETABLES IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SOLANAECEOUS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO CUCURBITS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO ROOT & BULB IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO ONION IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO BRASSICA IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO LARGE CROPS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO HERBS IN MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET, BY CROP TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: DBMR SAFETY MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN THE NUMBER OF APPROVALS FOR BIOPESTICIDES BY GOVERNMENTAL BODIES DRIVING THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 11 BIOPESTICIDES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET

FIGURE 15 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT, 2021

FIGURE 16 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY FORM, 2021

FIGURE 17 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY METHOD, 2021

FIGURE 18 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY TREATMENT MACHINES, 2021

FIGURE 19 NORTH AMERICA MICROBIAL BASED BIOLOGICAL SEED TREATMENT MARKET: BY FUNCTION, 2021

FIGURE 20 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 21 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY CROP TYPE, 2021

FIGURE 22 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: BY PRODUCT (2022-2029)

FIGURE 27 NORTH AMERICA MICROBIALS BASED BIOLOGICAL SEED TREATMENT MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.