북미 약물 발견을 위한 의약 화학 시장, 프로세스별( 대상 선택, 대상 검증, Hit-To-Lead 식별, 리드 최적화 및 후보 검증), 설계(단편 기반 변형, 구조 기반 약물 설계, 다양성 지향 합성, 화학 유전체학, 천연물 및 기타), 약물 유형(소분자 및 생물학적 제제), 치료 영역( 종양학 , 신경학, 감염 및 면역 체계 질환, 심혈관 질환, 소화기 질환 및 기타), 최종 사용자(계약 연구 기관, 제약 및 생명 공학 회사, 학술 및 연구 기관 및 기타), 국가별(미국, 캐나다, 멕시코) 산업 동향 및 2029년까지의 예측.

시장 분석 및 통찰력 : 북미 약물 발견을 위한 의약 화학 시장

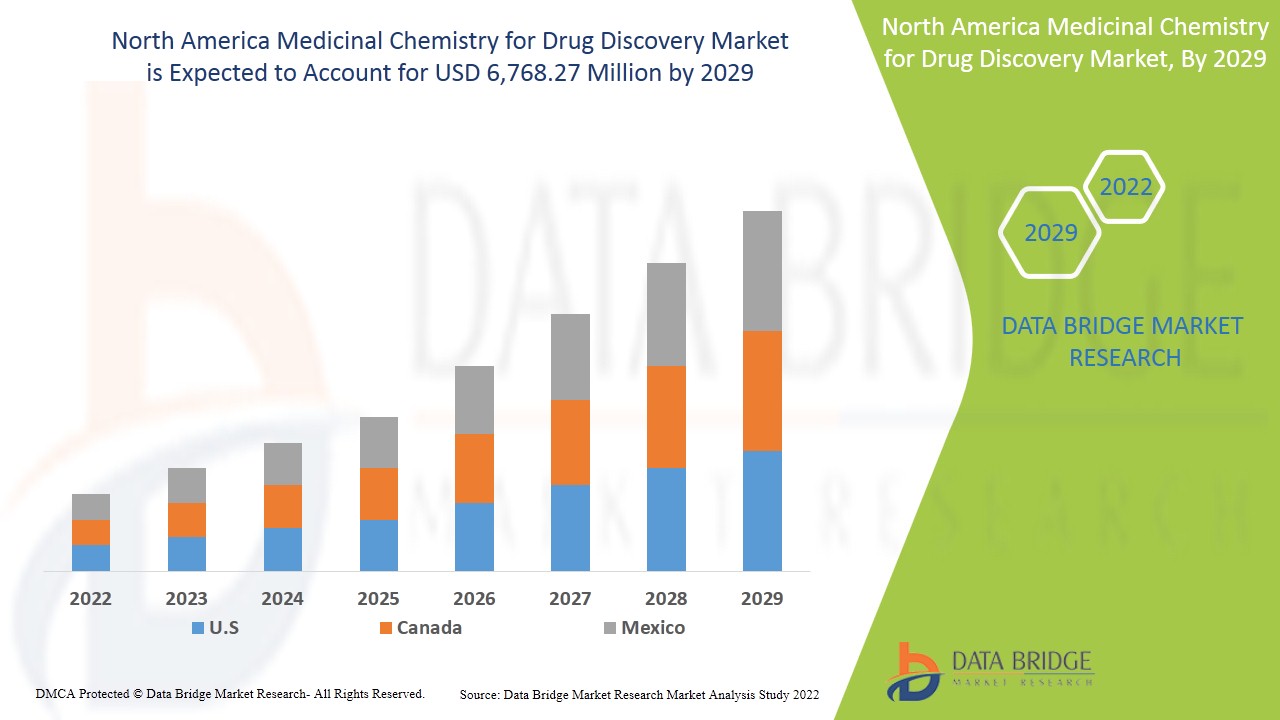

북미 약물 발견을 위한 의약 화학 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 14.0%의 CAGR로 성장하고 있으며 2029년까지 6,768.27백만 달러에 도달할 것으로 예상한다고 분석합니다. 특수 의약품에 대한 수요 증가와 라이프스타일 지향적 질병의 급증은 예측 기간 동안 시장 수요를 촉진한 주요 원동력입니다.

약물 발견을 위한 의약 화학은 안전하고 효과적인 약물에 대한 수요 증가와 같은 특징을 포함하며, 이는 제조업체가 시장에 새로운 제품을 출시하는 데 영향을 미쳐 수요를 증가시키고 새로운 약물 분자의 발견 및 개발을 위한 연구 및 개발 투자가 증가하여 시장 성장으로 이어집니다. 현재 다양한 연구가 진행 중이며, 이는 약물 발견을 위한 의약 화학 시장에서 다양한 다른 기회를 제공할 것으로 예상됩니다. 그러나 제형 약물의 비용 상승과 엄격한 규제는 예측 기간 동안 시장 성장을 제한할 것으로 예상됩니다.

약물 발견을 위한 의약 화학 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 주머니, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 시장 시나리오를 이해하려면 분석가 브리핑을 위해 저희에게 연락하세요. 저희 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드릴 것입니다.

약물 발견을 위한 글로벌 의약 화학 시장 범위 및 시장 규모

약물 발견을 위한 의약 화학 시장은 프로세스, 설계, 약물 유형, 치료 영역, 최종 사용자를 기준으로 세분화됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

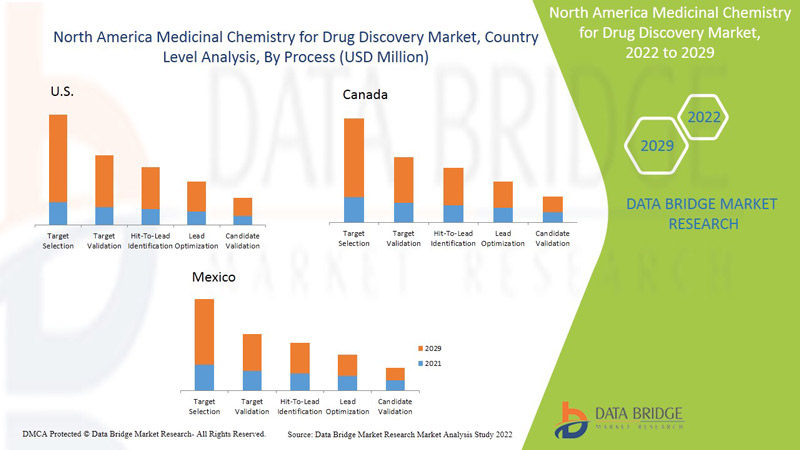

- 프로세스에 따라 북미 약물 발견을 위한 약리화학 시장은 타겟 선택, 타겟 검증, 히트 투 리드 식별, 리드 최적화, 후보 검증으로 세분화됩니다. 2022년에는 타겟 선택 세그먼트가 연구 개발 프로세스의 효율성과 효과성을 향상시켜 시장을 지배할 것으로 예상됩니다.

- 설계에 따라 북미 약물 발견을 위한 약리 화학 시장은 단편 기반 변형, 구조 기반 약물 설계, 다양성 지향 합성, 케모게노믹스, 천연물 등으로 세분화됩니다. 2022년에는 단편 기반 변형 세그먼트가 생명공학, 제약 및 학술 기관에서 임상 시험 중인 많은 수의 화합물과 출시가 필요한 약물을 식별하는 데 널리 사용되기 때문에 시장을 지배할 것으로 예상됩니다.

- 약물 유형을 기준으로, 북미 약물 발견을 위한 약리 화학 시장은 소분자와 생물학 으로 세분화됩니다 . 2022년에는 소분자 세그먼트가 시장을 지배할 것으로 예상되는데, 이러한 분자는 더 높은 특이성, 효능 및 긴 작용 지속 시간을 보이기 때문입니다.

- 치료 영역을 기준으로 북미 약물 발견을 위한 약리 화학 시장은 종양학, 감염 및 면역 체계 질환, 신경학, 심혈관 질환, 소화계 질환 및 기타로 세분화됩니다. 2022년에는 암 유병률 증가와 첨단 치료 분자 발견을 위한 연구 개발 증가로 인해 종양학 부문이 시장을 지배할 것으로 예상됩니다.

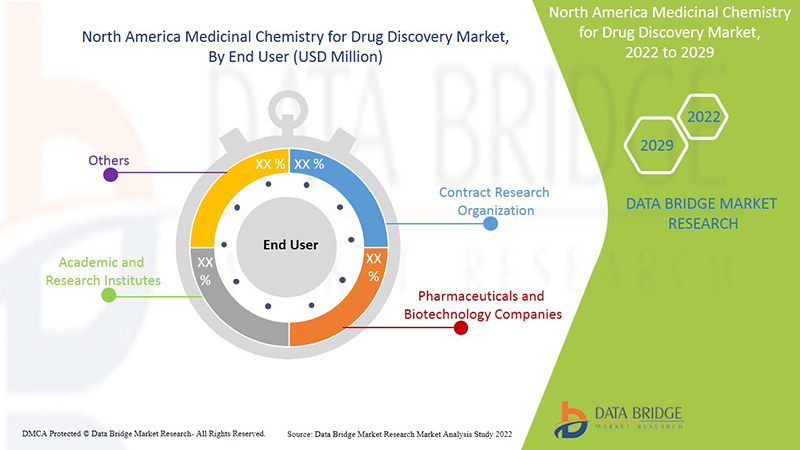

- 최종 사용자를 기준으로, 북미 약물 발견을 위한 의약 화학 시장은 계약 연구 기관, 학술 및 연구 기관, 제약 및 생명 공학 회사 등으로 세분화됩니다. 2022년에는 CRO 수가 증가하고 CRO 서비스를 주도하기 위한 제약 연구 및 개발에 대한 투자가 증가함에 따라 계약 연구 기관이 시장을 지배할 것으로 예상됩니다.

약물 발견 시장을 위한 의약 화학 국가 수준 분석

약물 발견을 위한 의약화학 시장을 분석하고, 프로세스, 설계, 약물 유형, 치료 영역 및 최종 사용자를 기반으로 시장 규모 정보를 제공합니다.

약물 발견을 위한 의약화학 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 희귀 질환 및 고아 약물에 대한 연구 이니셔티브가 증가하고 의료비가 증가함에 따라 북미 약물 발견 시장에서 의약 화학을 선도하고 있습니다. 캐나다는 다양한 만성 질환에 대한 임상 시험 및 연구 개발이 증가함에 따라 북미 약물 발견 시장에서 의약 화학이 성장하고 있습니다. 멕시코는 만성 질환에 대한 치료법 개발에 대한 인식이 증가함에 따라 북미 약물 발견 시장에서 의약 화학이 성장하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

기술의 발전과 희귀 및 희귀 약물에 대한 연구 이니셔티브의 증가는 약물 발견을 위한 의약 화학 시장 성장을 촉진하고 있습니다.

약물 발견을 위한 의약 화학 시장은 또한 약물 발견을 위한 의약 화학 산업의 모든 국가 성장, 약물 발견을 위한 의약 화학 판매, 약물 발견을 위한 의약 화학 기술 발전의 영향, 약물 발견을 위한 의약 화학 시장에 대한 지원과 함께 규제 시나리오의 변화에 대한 자세한 시장 분석을 제공합니다. 이 데이터는 2011년부터 2020년까지의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 약물 발견 시장 점유율 분석을 위한 의약 화학

약물 발견을 위한 의약 화학 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭 및 호흡, 응용 프로그램 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 약물 발견을 위한 의약 화학 시장과 관련된 회사의 초점에만 관련이 있습니다.

약물 발견 시장을 위한 의약 화학 분야에서 거래하는 주요 기업으로는 Eurofins Scientific, Covance Inc.(현재 LabCorp Group의 일부), WuXi Apptec, Charles River, Evotec SE, Piramal Pharma Solutions, Pfizer, Inc., Certara, USA, Sygnature Discovery Limited, Malvern Panalytical Ltd(모회사 Spectris PLC), Jubilant Biosys Ltd.(Jubilant Pharmova Limited Company), Taros Chemicals GmbH & Co. KG, Genscript Biotech Corporation, Nereid Therapeutics Inc., BioBlocks, Inc., Charnwood Molecular LTD, Domainex, Aurigene Pharmaceutical Services Ltd.(Dr. Reddy's Laboratories Ltd.의 자회사), Selvita, Nanosyn, Drug Discovery Alliances Inc. 등이 있습니다.

다양한 시장 참여자들이 약물 발견을 위한 최신 의약 화학 기술을 제공하고 있으며, 이는 약물 발견을 위한 의약 화학 시장을 가속화하고 있습니다.

예를 들어,

- 2021년 2월, 셀비타는 약물 발견을 위한 새로운 세포 기반 표현형 검정 플랫폼을 출시했습니다. 출시된 플랫폼은 섬유성 질환, 신경 염증성 질환 등 여러 질병의 치료에 치료적 잠재력이 있는 새로운 화합물을 테스트하는 데 사용됩니다. 출시된 플랫폼을 통해 회사는 약물 발견 서비스 포트폴리오에서 더 많은 수익을 창출할 수 있었습니다.

- 2020년 8월, Piramal Pharma Solutions는 Epirium Bio와 협력하여 희귀의약품을 위한 독점적 통합 개발 및 제조 프로그램을 진행했습니다. 이 통합 프로그램에는 제형 개발, 약물 물질 및 약물 제품 제조가 포함됩니다. 이 협력은 약물 발견을 위한 회사의 기존 의약 화학 포트폴리오를 강화했습니다.

협력, 제품 출시, 사업 확장, 수상 및 인정, 합작 투자 및 시장 참여자의 기타 전략은 약물 발견을 위한 의약 화학 분야에서 회사 시장을 강화하고 있으며, 이는 조직이 기관지확장증에 대한 제공 사항을 개선하는 데에도 도움이 됩니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 PROCESS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 POTERS FIVE FORCES

5 NORTH AMERICA MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN R&D FOR DISCOVERY AND DEVELOPMENT OF NOVEL DRUG MOLECULES

6.1.2 RISE IN CHRONIC DISEASES

6.1.3 INITIATIVES FOR RESEARCH ON RARE DISEASES AND ORPHAN DRUGS

6.1.4 GROWTH IN BIOLOGICS

6.1.5 COLLABORATIONS AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRIES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF FORMULATED DRUG

6.2.2 TECHNICAL RISKS IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.2.3 BIOETHICAL ISSUES IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN BIOCHEMICAL, TRANSLATIONAL, AND MOLECULAR STUDIES

6.3.2 RISE IN HEALTHCARE EXPENDITURE

6.3.3 USE OF ARTIFICIAL INTELLIGENCE IN MEDICINAL CHEMISTRY FOR DRUG DISCOVERY

6.4 CHALLENGES

6.4.1 BIOLOGICS NEED SPECIALIST TESTING SERVICES

6.4.2 STRINGENT REGULATIONS

7 IMPACT OF COVID-19 ON NORTH AMERICA MEDICINAL CHEMISTRY IN DRUG DISCOVERY MARKET

7.1 IMPACT ON PRICE

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS BY MANUFACTURERS

7.5 CONCLUSION

8 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS

8.1 OVERVIEW

8.2 TARGET SELECTION

8.3 TARGET VALIDATION

8.4 HIT-TO-LEAD IDENTIFICATION

8.5 LEAD OPTIMIZATION

8.6 CANDIDATE VALIDATION

9 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN

9.1 OVERVIEW

9.2 FRAGMENT-BASED VARIATION

9.3 STRUCTURE BASED DRUG DESIGN

9.4 DIVERSITY ORIENTED SYNTHESIS

9.5 CHEMOGENOMICS

9.6 NATURAL PRODUCTS

9.7 OTHERS

10 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULES

10.3 BIOLOGICS

11 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA

11.1 OVERVIEW

11.2 ONCOLOGY

11.3 NEUROLOGY

11.4 INFECTIOUS AND IMMUNE SYSTEM DISEASES

11.5 CARDIOVASCULAR DISEASES

11.6 DIGESTIVE SYSTEM DISEASES

11.7 OTHERS

12 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER

12.1 OVERVIEW

12.2 CONTRACT RESEARCH ORGANIZATION

12.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

12.4 ACADEMIC AND RESEARCH INSTITUTES

12.5 OTHERS

13 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY

13.1 OVERVIEW

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EUROFINS SCIENTIFIC

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 SERVICE PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 LABCORP DRUG DEVELOPMENT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SERVICE PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 CHARLES RIVER

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 WUXI APPTEC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 EVOTEC SE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 THERMO FISHER SCIENTIFIC INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 SERVICE PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.6.4.1 ACQUISITION

16.7 AURIGENE PHARMACEUTICAL SERVICES (A SUBSIDIARY OF DR. REDDY'S LABORATORIES)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 BIOBLOCKS INC

16.8.1 COMPANY SNAPSHOT

16.8.2 SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 CERTARA INC

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 SERVICE PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 DRUG DISCOVERY ALLIANCES

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICE PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GENSCRIPT BIOTECH

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 SERVICE PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 JUBILANT BIOSYS

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 NANOSYN

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 NEREID THERAPEUTICS

16.14.1 COMPANY SNAPSHOT

16.14.2 SERVICE PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 PFIZER INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 SERVICE PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 SELVITA

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 SERVICE PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.16.4.1 ACQUISITION

16.17 SPECTRIS PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SERVICE PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SYGNATURE DISCOVERY

16.18.1 COMPANY SNAPSHOT

16.18.2 SERVICE PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 8 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN 2020-2029 (USD MILLION)

TABLE 9 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 10 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 11 U.S. MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 12 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 13 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 14 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 15 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 16 CANADA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 18 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DESIGN, 2020-2029 (USD MILLION)

TABLE 19 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 20 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

TABLE 21 MEXICO MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET, BY END USER, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DROC ANALYSIS

FIGURE 4 MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SEGMENTATION

FIGURE 11 GROWTH IN BIOLOGICS DISCOVERY AND COLLABORATION AMONG RESEARCHERS AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PROCESS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET

FIGURE 14 ESTIMATED NEW CANCER CASES IN 2021, IN THE U.S.

FIGURE 15 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2021

FIGURE 16 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, 2020-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS, LIFELINE CURVE

FIGURE 19 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2021

FIGURE 20 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, 2020-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 23 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2021

FIGURE 24 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, 2020-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2021

FIGURE 28 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, 2020-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY THERAPEUTIC AREA, LIFELINE CURVE

FIGURE 31 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: BY PROCESS (2022-2029)

FIGURE 40 NORTH AMERICA MEDICINAL CHEMISTRY FOR DRUG DISCOVERY MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.