North America Meat Poultry And Seafood Processing Equipment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

5.57 Billion

USD

8.36 Billion

2024

2032

USD

5.57 Billion

USD

8.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 8.36 Billion | |

|

|

|

|

북미 육류, 가금류 및 해산물 가공 장비 시장 세분화, 장비 유형별(분할 장비, 튀김 장비, 여과 장비, 코팅 장비, 조리 장비, 훈제 장비, 도축/살육 장비, 냉장 장비, 고압 가공(고압 프로세서), 마사지 장비 등), 공정(크기 감소, 크기 확대, 균질화, 혼합 등), 작동 모드(자동, 반자동 및 수동), 응용 분야(신선 가공, 생육, 사전 조리, 생육 발효, 건조육, 경화, 냉동 등), 기능(절단, 혼합, 연화, 충전, 양념, 슬라이싱, 분쇄, 훈제, 도축 및 깃털 제거, 뼈 제거 및 껍질 벗기기, 내장 제거, 내장 제거, 필레팅 등), 가공 제품 유형(육류, 가금류 및 해산물) - 산업 동향 및 2032년까지의 예측

북미 육류, 가금류 및 해산물 가공 장비 시장 규모와 성장률은 어떻습니까?

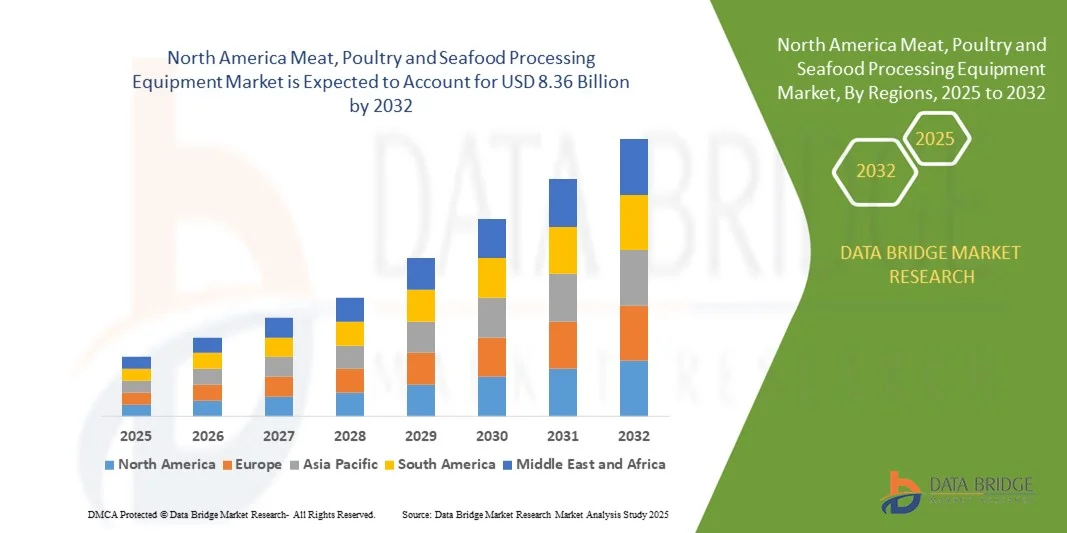

- 북미 육류, 가금류 및 해산물 가공 장비 시장 규모는 2024년에 55억 7천만 달러 로 평가되었으며 예측 기간 동안 5.2%의 CAGR 로 2032년까지 83억 6천만 달러 에 도달할 것으로 예상됩니다 .

- 가공육, 가금류, 해산물 소비 증가와 패스트푸드 및 레스토랑 체인점의 증가는 더 나은 가공육 및 기타 제품에 대한 수요를 증가시키고 있습니다. 또한, 특히 육류, 가금류, 해산물 분야의 장비 시장 기술 발전은 현재 시장 가치를 증가시켰습니다.

- 시장 성장을 저해하는 요인으로는 높은 자본 투자, 장비 수명이 길어 장비 교체가 느리다는 점 등이 있다.

육류, 가금류 및 해산물 가공 장비 시장의 주요 내용은 무엇입니까?

- 식품 가공 산업의 자동화 증가는 육류, 가금류 및 해산물 가공 장비 시장에 최고의 기회가 될 수 있습니다.

- 개발도상국의 높은 기계 비용, 낮은 인프라, 가공 및 파이프라인 청소 중 과도한 물 사용은 시장에 위협이 될 수 있습니다.

- 미국은 2025년 북미 육류, 가금류 및 해산물 가공 장비 시장을 장악하여 급속한 산업화, 자동화 도입 증가, 첨단 식품 가공 기술에 대한 투자 증가에 힘입어 42.6%의 가장 큰 매출 점유율을 차지했습니다.

- 캐나다 육류, 가금류 및 해산물 가공 장비 시장은 가공 및 냉동 육류, 가금류 및 해산물 제품에 대한 수요 증가와 식품 가공 부문 현대화를 위한 정부 이니셔티브에 힘입어 11.2%의 가장 빠른 성장률을 보일 것으로 예상됩니다.

- 절단 및 분할 장비 부문은 2025년에 42.8%의 시장 점유율로 시장을 장악했으며, 이는 대규모 육류 및 해산물 가공 공장에서 정밀 슬라이싱, 분할 제어 및 자동 트리밍에 대한 수요 증가에 따른 것입니다.

보고서 범위 및 육류, 가금류 및 해산물 가공 장비 시장 세분화

|

속성 |

육류, 가금류 및 해산물 가공 장비 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

포함 국가 |

북아메리카

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 가격 분석, 브랜드 점유율 분석, 소비자 설문 조사, 인구 통계 분석, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함되어 있습니다. |

육류, 가금류 및 해산물 가공 장비 시장의 주요 동향은 무엇입니까?

자동화 및 지속 가능한 처리 기술

- 육류, 가금류 및 해산물 가공 장비 시장을 형성하는 주요 트렌드는 효율성 향상, 폐기물 감소, 식품 안전 강화를 위해 설계된 자동화 및 지속 가능한 가공 시스템의 빠른 도입입니다. 에너지 효율적인 운영과 위생적인 설계에 대한 중요성이 커짐에 따라 제조업체들은 친환경 혁신을 추구하고 있습니다.

- 기업들은 뼈 제거, 절단 및 포장 프로세스를 간소화하고 정밀성을 보장하며 인적 오류를 줄이기 위해 로봇 공학, AI 기반 검사 및 IoT 지원 모니터링 시스템을 점점 더 통합하고 있습니다.

- 또한, 가공업체들이 지속 가능성 규정을 충족하고 운영 비용을 낮추기 위해 물 절약 및 폐기물 감소 기술을 사용하는 것이 점차 확산되고 있습니다.

- 주목할 만한 사례로는 스마트 자동화, 효율적인 냉각 및 폐기물 회수 시스템을 통합하여 육류 및 해산물 생산을 최적화하는 지속 가능한 가공 라인을 도입한 GEA Group Aktiengesellschaft(독일)가 있습니다.

- 지능적이고 친환경적이며 에너지 절약적인 솔루션으로의 이러한 전환은 생산성, 안전성 및 지속 가능성을 균형 있게 유지하는 차세대 장비에 대한 투자를 장려하여 산업을 변화시키고 있습니다.

육류, 가금류 및 해산물 가공 장비 시장의 주요 동인은 무엇입니까?

- 단백질이 풍부한 식품의 전 세계 소비 증가와 가공육 및 해산물 제품에 대한 수요 증가가 시장 성장을 견인하는 주요 요인입니다. 소비자들은 편리하고 안전하며 위생적으로 가공된 식품을 찾고 있으며, 이로 인해 장비 현대화가 촉진되고 있습니다.

- 예를 들어, 2025년에 Marel(아이슬란드)은 가금류 및 해산물 가공에서 수확량 정확도와 제품 일관성을 향상시키는 자동화된 분할 및 슬라이싱 시스템으로 제품 라인을 확장했습니다.

- 또한 이 산업은 식품 안전 규정 및 수출 인프라에 대한 정부 투자로 인해 혜택을 받으며, 이로 인해 고급 가공 기계에 대한 수요가 촉진됩니다.

- 또한, RTE(즉석식품) 및 냉동식품의 증가로 포장, 냉장 및 보관 기능을 개선하기 위한 장비 업그레이드가 가속화되었습니다.

- AI 기반 분류 시스템, 위생 컨베이어, 진공 밀봉 기술과 같은 혁신은 제품 품질을 더욱 향상시키고 유통기한을 연장하며 산업 및 상업 부문 전반에 걸쳐 시장 확장을 촉진하고 있습니다.

육류, 가금류 및 해산물 가공 장비 시장 성장을 저해하는 요인은 무엇입니까?

- 높은 자본 투자 및 유지 관리 비용은 특히 중소 규모 가공업체의 도입을 제한하는 주요 과제로 남아 있습니다. 자동 발골기 및 진공 충진기와 같은 장비는 상당한 초기 투자가 필요합니다.

- 예를 들어, 2025년에는 스테인리스 스틸과 전자 부품 가격 상승으로 인해 BAADER(독일) 및 JBT Corporation(미국)과 같은 주요 업체의 장비 제조 비용이 증가하여 이익 마진에 영향을 미쳤습니다.

- 또한 복잡한 세척 및 위생 요구 사항으로 인해 가동 중지 시간이 길어져 생산 효율성에 영향을 미칠 수 있습니다.

- 환경 및 에너지 규정은 또한 기업이 배출량을 줄이고 물 사용량을 줄이기 위해 지속적으로 시스템을 업그레이드하도록 요구합니다.

- 이러한 장벽에도 불구하고 GEA Group Aktiengesellschaft와 Key Technology(US)와 같은 기업들은 모듈식, 에너지 효율적이고 청소가 용이한 설계를 통해 이러한 문제를 해결하고 있습니다. 비용, 규정 준수, 그리고 지속가능성의 균형을 맞추는 것은 시장에서 장기적인 성장과 경쟁력을 확보하는 데 여전히 필수적입니다.

육류, 가금류 및 해산물 가공 장비 시장은 어떻게 세분화되어 있습니까?

육류, 가금류 및 해산물 가공 장비 시장은 장비 유형, 공정, 작동 모드, 응용 분야, 기능 및 가공 제품 유형을 기준으로 세분화됩니다.

- 장비 유형별

장비 유형에 따라 시장은 분할 장비, 튀김 장비, 여과 장비, 코팅 장비, 조리 장비, 훈제 장비, 도축 장비, 냉장 장비, 고압 처리(HPP) 장비, 마사지 장비 등으로 세분화됩니다. 절단 및 분할 장비 부문은 2025년 시장 점유율 42.8%로 시장을 장악했으며, 이는 대규모 육류 및 해산물 가공 공장에서 정밀 슬라이싱, 분할 제어, 자동 트리밍에 대한 수요 증가에 힘입은 것입니다. 이러한 시스템은 효율성을 높이고, 낭비를 최소화하며, 일관된 제품 품질을 유지합니다.

고압 가공(HPP) 장비 부문은 2026년부터 2033년까지 가장 빠른 CAGR을 기록할 것으로 예상되며, 이는 영양가나 질감을 손상시키지 않으면서 저장 수명을 늘리고 병원균이 없는 육류 및 해산물을 보장하기 위한 비열 보존 기술의 도입이 증가함에 따라 촉진될 것입니다.

- 프로세스별로

육류, 가금류 및 해산물 가공 장비 시장은 공정에 따라 크기 축소, 크기 확대, 균질화, 혼합 및 기타로 분류됩니다. 크기 축소 부문은 2025년 시장 점유율 49.5%로 시장을 장악했습니다. 분쇄, 절단, 다지기는 육류 가공의 중요한 초기 단계로, 소시지, 패티 및 해산물 기반 제품의 일관된 질감과 제품 균일성을 보장합니다. 최신 크기 축소 시스템의 효율성은 처리량과 품질을 최적화하는 데 도움이 됩니다.

믹싱 부문은 혼합 육류 제품, 양념장, 가공 해산물에 대한 수요 증가에 힘입어 2026년부터 2033년까지 가장 빠른 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 균일한 재료 분배, 풍미 균일성, 그리고 제품 안정성 향상을 위해 첨단 진공 믹서 및 패들 믹서의 도입이 점차 증가하고 있습니다.

- 작동 모드별

시장은 작동 방식에 따라 자동, 반자동, 수동으로 구분됩니다. 자동 부문은 2025년 시장 점유율 56.7%로 시장을 장악했으며, 이는 인건비 절감, 생산 효율성 향상, 위생 규정 준수를 위한 자동화 도입 증가에 힘입은 것입니다. 자동화 시스템은 로봇, 센서, 소프트웨어를 통합하여 발골 및 포장과 같은 복잡한 작업을 정밀하게 수행합니다.

반자동 부문은 중소 규모 가공업체들이 자동화의 이점과 경제성의 균형을 모색함에 따라 2026년부터 2033년까지 가장 빠른 연평균 성장률을 기록할 것으로 예상됩니다. 반자동 시스템은 유연성, 운영 복잡성 감소, 그리고 다양한 생산 규모에 대한 적응성을 제공합니다.

- 응용 프로그램별

육류, 가금류 및 해산물 가공 장비 시장은 용도에 따라 신선 가공, 생육, 반조리, 생발효, 건조육, 숙성육, 냉동육 및 기타로 구분됩니다. 신선 가공 부문은 소시지, 너겟, 패티 등 첨단 절단, 블렌딩 및 코팅 기계가 필요한 최소 가공 육류 및 해산물 제품의 높은 소비량으로 인해 2025년에 51.2%의 시장 점유율을 기록하며 가장 큰 시장 점유율을 기록했습니다. 신선하고 맛있는 즉석 조리 식품에 대한 소비자 선호도가 이러한 수요를 뒷받침합니다.

냉동식품 부문은 전 세계적으로 냉동 해산물과 간편식의 인기 증가에 힘입어 2026년부터 2033년까지 가장 빠른 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 냉동 기술과 콜드체인 물류의 발전으로 유통기한 연장과 식감 및 풍미 보존이 가능해지고 있습니다.

- 기능별

기능은 절단, 블렌딩, 연육, 충전, 양념, 슬라이싱, 분쇄, 훈제, 도축 및 깃털 제거, 뼈 제거 및 박피, 내장 제거, 내장 제거, 필레팅 및 기타로 분류됩니다. 절단 및 슬라이싱 부문은 거의 모든 육류 및 해산물 가공 작업에서 핵심 기능을 담당하며 2025년 시장 점유율 46.4%로 시장을 장악했습니다. 정밀 절단 및 슬라이싱 시스템에 대한 수요는 균일한 두께 확보, 폐기물 감소, 제품 무결성 유지에 대한 필요성으로 인해 증가합니다.

뼈 제거 및 껍질 벗기기 부문은 2026년부터 2033년까지 가장 빠른 CAGR을 보일 것으로 예상되며, 특히 가금류 및 생선 가공 라인에서 수동 노동을 최소화하고 수확량을 늘리고 위생을 강화하는 고효율 시스템에 대한 필요성에 따라 성장이 촉진될 것입니다.

- 가공 제품 유형별

가공 제품 유형을 기준으로 시장은 육류, 가금류, 해산물로 구분됩니다. 육류 부문은 2025년 시장 점유율 54.9%로 시장을 장악했으며, 이는 특히 북미와 남미 지역에서 소시지, 베이컨, 햄과 같은 가공육 제품의 소비 증가에 기인합니다. 육류 가공 라인은 안전성과 품질을 보장하기 위해 정교한 분쇄, 염지, 포장 시스템을 필요로 합니다.

해산물 부문은 가공된 생선, 새우, 조개류에 대한 전 세계 수요 증가에 힘입어 2026년부터 2033년까지 가장 빠른 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다. 해산물 수출 증가와 필레팅 및 냉동 기술의 발전은 전 세계 해산물 가공 시설의 자동화 및 생산 능력 확대를 촉진하고 있습니다.

어느 지역이 육류, 가금류, 해산물 가공 장비 시장에서 가장 큰 점유율을 차지하고 있습니까?

- 미국은 2025년 북미 육류, 가금류 및 해산물 가공 장비 시장을 장악하여 급속한 산업화, 자동화 도입 증가, 첨단 식품 가공 기술에 대한 투자 증가에 힘입어 42.6%의 가장 큰 매출 점유율을 차지했습니다.

- 강력한 제조 기반과 식품 안전 및 품질 기준에 대한 규제 강화는 현대적인 육류, 가금류, 해산물 가공 장비의 광범위한 생산 및 활용을 지원합니다. 국내외 유수 기업들은 에너지 효율적이고 자동화되며 추적 가능한 시스템에 투자하여 시장을 선도하고 있습니다.

- 전반적으로 혁신, 인프라 및 기술 도입 분야에서 미국이 보여준 리더십은 미국을 북미 육류, 가금류 및 해산물 가공 장비 시장에서 지배적인 국가로 자리매김하게 했습니다.

캐나다 육류, 가금류 및 해산물 가공 장비 시장 통찰력

캐나다 육류, 가금류 및 해산물 가공 장비 시장은 가공 및 냉동 육류, 가금류 및 해산물 제품에 대한 수요 증가와 식품 가공 부문 현대화를 위한 정부 정책에 힘입어 11.2%의 가장 빠른 성장률을 기록할 것으로 예상됩니다. 캐나다 제조업체들은 운영 효율성을 높이고 식품 안전 규정을 준수하기 위해 자동화된 절단, 발골, 양념 및 포장 솔루션에 대한 투자를 확대하고 있습니다. 에너지 효율적인 냉장 및 물 사용량 절감을 포함한 지속가능성 조치는 성장에 더욱 기여하고 있습니다. 캐나다는 혁신, 자동화 및 품질 보증에 중점을 두고 있으며, 이를 통해 북미 지역의 핵심 성장 동력으로 자리매김하고 있습니다.

멕시코 육류, 가금류 및 해산물 가공 장비 시장 통찰력

멕시코 육류, 가금류, 해산물 가공 장비 시장은 가공 단백질 제품의 국내 소비 증가와 미국 및 기타 중남미 국가로의 수출 수요 증가에 힘입어 꾸준히 성장하고 있습니다. 멕시코 제조업체들은 위생 기준을 충족하고 생산성을 향상시키기 위해 현대식 도축, 슬라이스, 포장 및 분할 장비를 도입하고 있습니다. 가공 공장 현대화를 지원하는 정부 인센티브와 콜드체인 인프라 투자 증가는 시장 도입을 더욱 가속화하고 있습니다. 전략적 위치, 숙련된 노동력, 그리고 성장하는 산업 기반을 갖춘 멕시코는 북미 육류, 가금류, 해산물 가공 장비 시장을 강화하는 데 중요한 역할을 하고 있습니다.

육류, 가금류, 해산물 가공 장비 시장의 최고 기업은 어디인가요?

육류, 가금류 및 해산물 가공 장비 산업은 주로 다음을 포함한 잘 정립된 회사가 주도하고 있습니다.

- Equipamientos Cárnicos, SL(스페인)

- BRAHER INTERNACIONAL, SA(스페인)

- RZPO(폴란드)

- 미네르바 오메가 그룹 srl(이탈리아)

- GEA 그룹 Aktiengesellschaft(독일)

- RISCO SpA(이탈리아)

- PSS SVIDNÍK, (슬로바키아)

- Metalbud(폴란드)

- 바더(독일)

- JBT Corporation(미국)

- 마렐(아이슬란드)

- 핵심 기술(미국)

- 일리노이 툴 웍스 주식회사(미국)

- 미들비 코퍼레이션(미국)

- Bettcher Industries, Inc.(미국)

- 비제르바(독일)

북미 육류, 가금류 및 해산물 가공 장비 시장의 최근 동향은 무엇입니까?

- 2025년 2월, JBT Marel은 Ace Aquatec과 전략적 제휴를 맺고, 식품 가공 기계용 생선 기절 솔루션의 우선 공급업체로 지정했습니다. 이 협력을 통해 JBT Marel은 지속 가능한 해산물 가공 분야에서 입지를 강화하고 혁신적인 기계 포트폴리오를 확장할 수 있게 되었습니다.

- 2025년 1월, 미국 JBT는 Marel을 완전히 인수하여 새로운 법인인 JBT Marel Corporation을 설립했습니다. 이 합병을 통해 식품 가공 기술 분야의 강력한 글로벌 리더가 탄생하여 다양한 식품 분야의 효율성과 혁신을 강화합니다.

- 2024년 11월, Fortifi Food Processing Solutions는 단백질 가공 시스템의 주요 제조업체인 JWE-BANSS GmbH(독일)의 지적 재산권, 고객 관계, 일부 재고 및 고정 자산 인수를 발표했습니다. 이번 인수를 통해 Fortifi는 육류 가공 분야의 전문성을 강화하고 북미 시장에서의 입지를 강화할 수 있게 되었습니다.

- 2024년 7월, 로스 인더스트리즈(Ross Industries)는 수제 및 중소 규모 육류 가공업체의 운영 효율성과 최종 제품 품질을 개선하기 위해 맞춤 제작된 솔루션인 AMS 400 멤브레인 스키너(Membrane Skinner)를 출시했습니다. 이번 출시는 중소 규모 식품 생산업체의 끊임없이 변화하는 자동화 요구에 부응하는 데 주력하는 로스 인더스트리즈의 노력을 보여줍니다.

- 2024년 3월, Fortifi Food Processing Solutions는 5개 대륙에 걸쳐 운영되는 식품 가공 및 자동화 브랜드의 통합 글로벌 플랫폼으로 공식 출범했습니다. 이번 설립은 단백질, 유제품, 과일 및 채소 가공 산업 전반에 걸쳐 통합 솔루션을 제공하기 위한 전략적 진전을 의미합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.