North America Machine Control System Market, By Technology (Global Navigation Satellite System (GNSS), Laser Scanners, GIS Collectors, Total Stations, Airborne Systems, and Others), Vehicle Equipment (Excavators, Loaders, Dozers, Scrapers, Graders, Rollers, Drillers and Pillars, Pavers and Cold Planers, and Others), Controller Type (Computer Numerical Control (CNC), Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), Personal Computer (PC), Motion Controllers, and Others), Application (Motion and Control, Guidance and Automation, Mass Excavation, Spot-Bulldozing, and Others), Industry (Building and Construction, Agriculture, Mining, Transportation, Aerospace and Defense, Automotive, Marine, Waste Management, Utilities, and Others) Industry Trends and Forecast to 2029.

North America Machine Control System Market Analysis and Size

Manufacturers were continuously trying to increase the precision of work, enhance services, safety, and work with growing technology. The requirement for these reasons is being fulfilled by implementing the machine control system as they are used to provide enhanced, uninterrupted, free, and timely services at the industrial operations. The machine control system in various industries is being used widely due to the rising adoption of digital technologies in the industrial sector. It enables industries to enhance their operations and productivity. Machine control systems help end-users make better decisions around supply chain, machinery, assets performance, drilling, and others. The North America machine control system market is growing rapidly due to increasing digitization in various industries, which drives the demand for the machine control system. The companies are even launching new products to gain a larger market share.

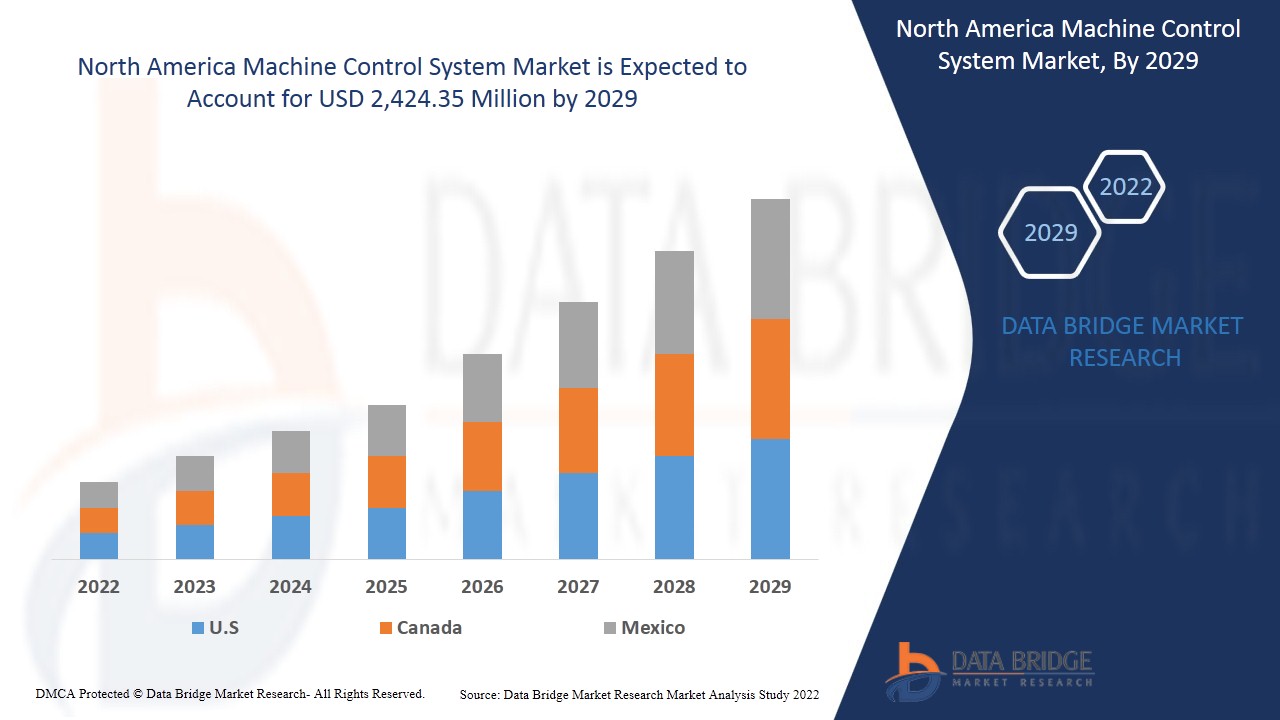

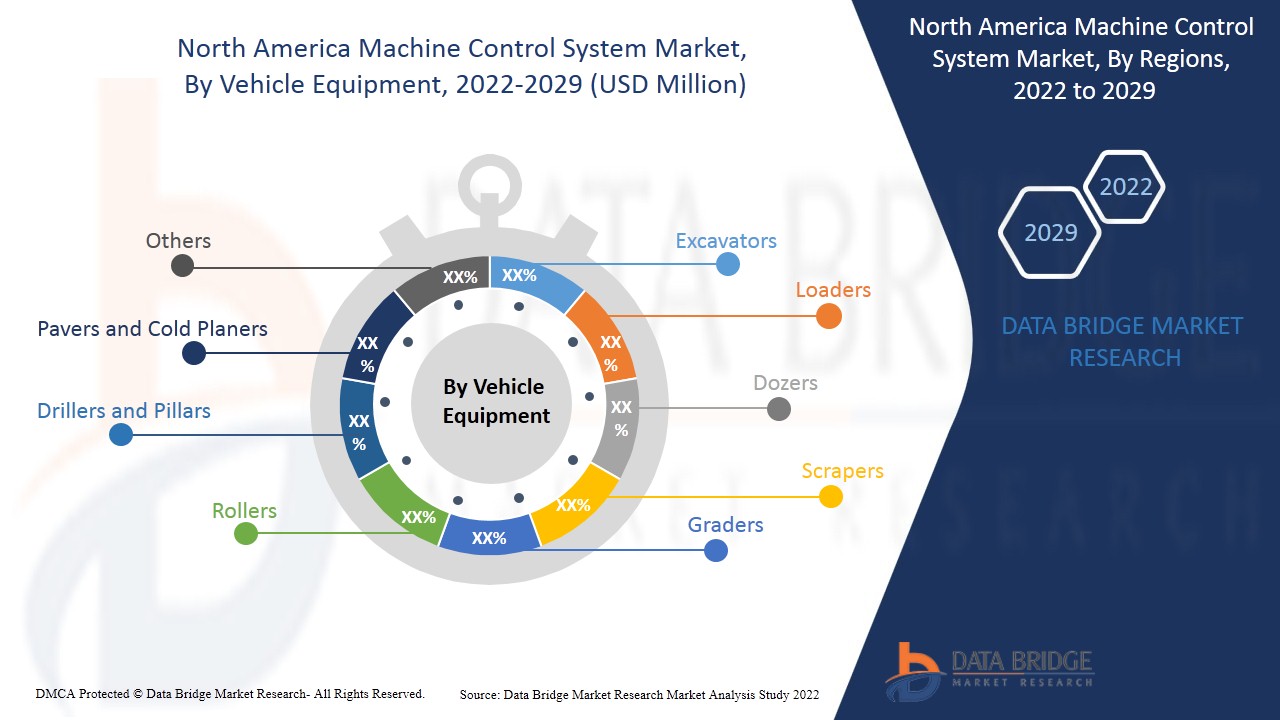

Data Bridge Market Research analyses that the North America machine control system market is expected to reach the value of USD 2,424.35 million by 2029, at a CAGR of 7.5% during the forecast period. Excavators are expected to dominate the North America machine control system market due to the capability of sensing the precise location of an excavator at all times relative to its environment, also helping the operator dig in the right spot.

North America Machine Control System Market Definition

Machine control system refers to carrying out industrial and commercial activities with a digital touch. It includes various solutions and services which are developed to optimize and manage industrial, infrastructural operations, and production activities. It helps to automate various application-based activities such as record management, data storage, monitoring, streamlining production activities, supply chain management, asset management, risk management, and others. It also includes technologies such as plant control systems, GPS technologies, mobile broadband, automated haulage, AI, blockchain, digital twin, and others.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Technology (Global Navigation Satellite System (GNSS), Laser Scanners, GIS Collectors, Total Stations, Airborne Systems, and Others), Vehicle Equipment (Excavators, Loaders, Dozers, Scrapers, Graders, Rollers, Drillers and Pillars, Pavers and Cold Planers, and Others), Controller Type (Computer Numerical Control (CNC), Programmable Logic Controller (PLC), Programmable Automation Controller (PAC), Personal Computer (PC), Motion Controllers, and Others), Application (Motion and Control, Guidance and Automation, Mass Excavation, Spot-Bulldozing, and Others), Industry (Building and Construction, Agriculture, Mining, Transportation, Aerospace and Defense, Automotive, Marine, Waste Management, Utilities, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

ABB, Topcon, Eos Positioning Systems, Inc. (Eos), maximatecc, Kobelco Construction Machinery Co., Ltd., SATEL, Trimble Inc., Hemisphere GNSS, Inc., MOBA MOBILE AUTOMATION AG, Belden Inc., Hexagon, RIB Group, James Fisher and Sons plc, Carlson Software, Challenger Geomatics Ltd., LIEBHERR, Schneider Electric, MITSUI & CO., LTD., Rockwell Automation, Inc., Komatsu Ltd., Coperion GmbH, Otto Bihler Maschinenfabrik GmbH & Co. KG, OMRON Corporation, ANDRITZ, Siemens, Honeywell International Inc., Machine Control Systems, among others |

North America Machine Control System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

- Rising Need for Accuracy and Precision in Control Systems

Machine control solutions increase worksite quality by simplifying, automating, and integrating solutions, resulting in fewer errors and more time on the job. Machine control solutions enable operators to gain digital knowledge while reducing the risk of making mistakes. Intuitive 3D graphical interfaces with custom-centered design help operators feel more secure in their ability to do jobs, which improves performance.

- Increase in Growth of Cordless Machine Control Systems

북미 인구가 전례 없는 속도로 증가하고 있다는 것은 잘 알려진 사실입니다. 기업들은 최종 사용자와 전문가를 위한 최적의 솔루션을 제공하기 위해 무선 기술에 막대한 투자를 하고 있습니다. 산업이 발전함에 따라 더 나은 성능과 작업 유연성을 위해 무선 장비에 대한 초점이 더욱 커질 것입니다. 기계 제어 시스템이 장착된 이러한 무선 배터리의 개발은 기계 제어 시스템 시장을 활성화할 것으로 예상됩니다.

- 신흥국에서 기계 가이드 기술에 대한 수요 증가

자동화와 인공지능(AI)은 산업을 변화시키고 생산성을 높여 경제 발전을 촉진할 것입니다. 전 세계적으로 디지털화는 에너지 시스템의 안전성, 생산성, 접근성 및 지속 가능성을 개선하는 데 도움이 되고 있습니다. 건설 부문은 신흥국의 경제 발전에 매우 중요합니다. 그 결과, 많은 국가에서 건설 활동을 모니터링하고 건설 현장의 기능을 전문화하기 위해 여러 전담 기관이 설립되었습니다. 여기에는 건설 산업 개발 위원회(미국), 일리노이 주 자본 개발 위원회(미국)가 포함됩니다. 건설 부문에서는 안전하고 고품질이며 지속 가능하고 친근한 건설 환경을 제공하기 위해 비용 효율적이고 시간 효율적인 접근 방식을 사용해야 합니다. 그 결과, 기계 제어 시스템은 개발 도상국의 건설 현장에서 안전성과 품질을 보장하는 데 중요한 역할을 합니다.

기계 가이드 기술은 일반적으로 기계 또는 기계의 일부를 작동하고 유지 관리하는 데 중점을 둡니다. 오늘날 기계 에서 수행되는 작동 및 유지 관리 활동은 인공 지능(AI), 머신 러닝(ML) 등과 같은 다양한 기술의 도움으로 완전히 모니터링됩니다. 이 기술 채택으로 인해 인간의 개입이 줄어들고 시장에 기계 가이드 기술에 대한 필요성이 증가하여 북미 기계 제어 시스템 시장에 기회가 되었습니다.

- 높은 초기 투자 요구 사항

기계 제어 시스템은 산업에 안전 예방 조치와 GNSS, GIS, 레이저 스캐닝, 로봇 등과 같은 다양한 방법을 제공합니다. 산업과 함께 운영하는 회사는 원자재를 한 장소에서 다른 장소로 옮기기 위해 기계 제어 시스템이 필요합니다. 제어 시스템 장비를 효과적으로 구현하려면 높은 비용이 필요하며, 궁극적으로 안전한 공장을 보장하는 데 필요하기 때문에 총 설치 비용이 증가합니다. 이러한 계측기는 더 높은 위험과 중요한 운영 환경을 처리하는 것을 포함합니다. 그러나 시스템의 초기 비용은 상당히 높고 라이센스, 인증, 설치, 유지 관리 에너지 비용 및 기술 노동과 관련된 비용과 같은 간접 비용이 있습니다.

- 인체공학적이고 가벼운 기계 제어 시스템 설계

기계 제어 시스템은 쉽게 운반하고 효율적으로 사용하기 위해 크기가 작고 가벼워야 합니다. 크기가 작으면 작업자가 다양한 움직임을 할 수 있고 기계 제어 시스템의 정밀도가 높아집니다. 도구가 가벼우면 현장에서 쉽게 운반할 수 있습니다. 기본적인 과제는 기계 제어 시스템이 무겁게 제작되었다는 것입니다. 무선 전동 공구에도 배터리 슬롯이 있어 부피가 크고 운반하기 어렵습니다.

기계 제어 시스템은 사용자에게 다양한 건강 문제를 일으킬 수 있습니다. 철거 제어 시스템은 작동 중에 높은 진동을 일으키고, 사용자가 약간 잘못 움직이면 사용자의 척추가 부러지고 심각한 손상을 입을 수 있습니다. 샌더와 커터는 먼지와 작은 조각을 생성할 수 있으며, 이는 사용자에게 해를 끼칠 수 있습니다. 기계 제어 시스템의 인체 공학은 사용자를 그러한 사고로부터 보호하기 위해 특별히 중요해야 합니다.

기계 제어 시스템은 사고와 건강 문제를 심각하게 일으킬 수 있으며, 기계 제어 시스템의 무거운 본체는 완전한 효율성으로 작동하기 어렵게 만드는 경향이 있습니다. 이러한 요소는 북미 기계 제어 시스템 시장에 큰 과제로 작용할 수 있습니다.

COVID-19 이후 북미 기계 제어 시스템 시장에 미치는 영향

COVID-19는 거의 모든 국가가 필수품 생산을 다루는 곳을 제외한 모든 생산 시설에 대한 폐쇄를 선택함에 따라 기계 제어 시스템 시장에 큰 영향을 미쳤습니다. 정부는 COVID-19의 확산을 막기 위해 비필수품 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황에서 거래하는 유일한 사업은 프로세스를 열고 실행할 수 있는 필수 서비스입니다.

북미 기계 제어 시스템 시장의 성장은 상업 및 주거 건설 및 인프라 프로젝트 증가, 주거/DIY 목적으로 가정에서 전동 공구 도입, 제조 설비 증가, 전 세계적으로 수리 및 유지 관리 작업 증가에 기인합니다. 그러나 기계 제어 시스템의 부적절한 사용으로 인한 안전 위험 및 우려 증가와 같은 요인이 시장 성장을 제한하고 있습니다. 팬데믹 동안 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 기계 제어 시스템에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급적이고 정확한 컨트롤러를 제공할 것입니다. 또한 정부 기관에서 수자원 관리, 농업 목적, 해양학, 수문학, 방위 및 보안 분야에서 기계 제어 시스템을 사용하면서 시장이 성장했습니다.

최근 개발

- 2021년 12월, Honeywell International Inc.는 US Digital Designs, Inc.를 인수하여 공공 안전 커뮤니케이션 역량을 확대할 계획이었습니다. 이 인수로 회사의 솔루션 라인이 확장되었습니다. 이 인수는 회사가 제품 포트폴리오를 확장하고 회사 수익을 높이는 데 도움이 되었습니다.

북미 기계 제어 시스템 시장 범위

북미 기계 제어 시스템 시장은 기술, 차량 장비, 컨트롤러 유형, 애플리케이션 및 산업을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

기술

- 글로벌 항법 위성 시스템(GNSS)

- 레이저 스캐너

- GIS 수집가

- 총 스테이션

- 공중 시스템

- 기타

기술을 기준으로 북미 기계 제어 시스템 시장은 글로벌 항법 위성 시스템(GNSS), 레이저 스캐너, GIS 수집기, 토탈스테이션, 항공 시스템 및 기타로 구분됩니다.

차량 장비

- 굴삭기

- 로더

- 불도저

- 스크레이퍼

- 채점자

- 롤러

- 드릴러와 필러

- 포장기 및 콜드 플레이너

- 기타

북미 기계 제어 시스템 시장은 자동차 장비를 기준으로 굴삭기, 로더, 불도저, 스크레이퍼, 그레이더, 롤러, 드릴 및 필러, 포장기 및 콜드 플레이너, 기타로 구분됩니다.

컨트롤러 유형

- 컴퓨터 수치 제어(CNC)

- 프로그래밍 가능 논리 컨트롤러(PLC)

- 프로그래밍 가능 자동화 컨트롤러(PAC)

- 개인용 컴퓨터(PC)

- 모션 컨트롤러

- 기타

컨트롤러 유형을 기준으로 북미 기계 제어 시스템 시장은 컴퓨터 수치 제어(CNC), 프로그래밍 가능 논리 컨트롤러(PLC), 프로그래밍 가능 자동화 컨트롤러(PAC), 개인용 컴퓨터(PC), 모션 컨트롤러 및 기타로 구분됩니다.

애플리케이션

- 모션 및 제어

- 안내 및 자동화

- 대량 발굴

- 스팟 불도저

- 기타

북미 기계 제어 시스템 시장은 응용 분야별로 동작 및 제어, 유도 및 자동화, 대량 굴착, 현장 불도저 작업 및 기타로 구분됩니다.

산업

- 건축 및 건설

- 농업

- 채광

- 운송

- 항공우주 및 방위

- 자동차

- 선박

- 폐기물 관리

- 유용

- 기타

산업별로 보면 북미 기계 제어 시스템 시장은 건물 및 건설, 농업, 광업, 운송, 항공우주 및 방위, 자동차, 해양, 폐기물 관리, 유틸리티 및 기타로 구분됩니다.

북미 기계 제어 시스템 시장 지역 분석/통찰력

북미 기계 제어 시스템 시장을 분석하고, 위에 언급된 대로 국가, 기술, 차량 장비, 컨트롤러 유형, 애플리케이션 및 산업별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 기계 제어 시스템 시장 보고서에서 다루는 국가로는 미국, 캐나다, 멕시코 등이 있습니다.

미국은 북미 기계 제어 시스템 시장을 지배할 가능성이 높은데, 이는 이 지역의 건설 및 건설 산업과 농업 기술의 발전에 기인합니다. 또한, 캐나다에서 고속도로 건설 프로젝트에 이러한 시스템을 사용하는 것이 확대되었습니다. 이 지역의 수요는 건설 프로젝트에서 자동화 및 프로세스 계측에 대한 수요 증가에 의해 주도될 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세의 영향 및 무역 경로가 국가 데이터의 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 기계 제어 시스템 시장 점유율 분석

북미 기계 제어 시스템 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭 및 범위, 애플리케이션 우세입니다. 위의 데이터 포인트는 회사가 북미 기계 제어 시스템 시장에 집중하는 것과만 관련이 있습니다.

북미 기계 제어 시스템 시장에서 활동하는 주요 기업은 다음과 같습니다.

- 씨줄

- 탑콘

- Eos Positioning Systems, Inc. (Eos)

- 최대화하다

- 코벨코건설기계(주)

- 사텔

- 트림블 주식회사

- 헤미스피어 GNSS 주식회사

- MOBA 모바일 오토메이션 AG

- 벨든 주식회사

- 육각형

- RIB 그룹

- 제임스 피셔 앤 선스 주식회사

- 칼슨 소프트웨어

- 챌린저 지오매틱스 유한회사

- 리프헤어

- 슈나이더 일렉트릭

- 미쓰이물산주식회사

- 로크웰 오토메이션 주식회사

- 주식회사 고마츠

- 코페리온 GmbH

- Otto Bihler Maschinenfabrik GmbH & Co. KG

- 오므론 주식회사

- 안드리츠

- 지멘스

- 허니웰 인터내셔널 주식회사

- 기계 제어 시스템

연구 방법론: 북미 기계 제어 시스템 시장

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용을 알아보려면 분석가에게 전화를 요청하거나 문의 사항을 드롭 다운하세요.

DBMR 연구팀이 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석, 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 표준, 북미 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 남겨 산업 전문가에게 문의하세요.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA MACHINE CONTROL SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 VALUE CHAIN ANALYSIS

4.1.1 OVERVIEW OF VALUE CHAIN ANALYSIS

4.1.2 VALUE CHAIN ANALYSIS FRAMEWORK

4.2 PESTLE ANALYSIS

4.3 PORTER’S FIVE FORCES MODEL

4.4 EVOLUTION OF MACHINE CONTROL SYSTEM WITH ARTIFICIAL INTELLIGENCE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS

5.1.2 INCREASE IN GROWTH OF CORDLESS MACHINE CONTROL SYSTEMS

5.1.3 INCREASE IN GROWTH OF INFRASTRUCTURE PROJECTS NORTH AMERICALY

5.1.4 EXPANSION OF MOTOR VEHICLE MAINTENANCE MARKET AS VEHICLE OWNERSHIP RATE INCREASES

5.2 RESTRAINTS

5.2.1 REQUIREMENT OF HIGH INITIAL INVESTMENT

5.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

5.2.3 LACK OF TECHNICAL EXPERTISE

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND FOR MACHINE-GUIDED TECHNOLOGIES IN EMERGING NATIONS

5.3.2 SMART CONNECTIVITY IN MACHINE CONTROL SYSTEMS

5.3.3 TECHNOLOGICAL INNOVATIONS IN INDUSTRY 4.0

5.3.4 MACHINE CONTROL SYSTEMS MADE AVAILABLE ON E-COMMERCE PLATFORMS

5.4 CHALLENGES

5.4.1 DESIGNING ERGONOMIC AND LIGHTWEIGHT MACHINE CONTROL SYSTEMS

5.4.2 REGULATORY COMPLIANCE AND MACHINE CONTROL SYSTEM SAFETY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA MACHINE CONTROL SYSTEM MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 NORTH AMERICA NAVIGATION SATELLITE SYSTEM (GNSS)

7.3 LASER SCANNERS

7.4 GIS COLLECTORS

7.5 TOTAL STATIONS

7.6 AIRBORNE SYSTEM

7.7 OTHERS

8 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT

8.1 OVERVIEW

8.2 EXCAVATORS

8.3 LOADERS

8.4 DOZERS

8.5 SCRAPERS

8.6 GRADERS

8.7 ROLLERS

8.8 DRILLERS AND PILERS

8.9 PAVERS AND COLD PLANERS

8.1 OTHERS

9 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE

9.1 OVERVIEW

9.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

9.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

9.4 MOTION CONTROLLERS

9.5 COMPUTER NUMERICAL CONTROL (CNC)

9.6 PERSONAL COMPUTER (PC)

9.7 OTHERS

10 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 MONITORING AND CONTROL

10.3 GUIDANCE AND AUTOMATION

10.4 MASS EXCAVATION

10.5 SPOT-BULLDOZING

10.6 OTHERS

11 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BUILDING AND CONSTRUCTION

11.2.1 MONITORING AND CONTROL

11.2.2 GUIDANCE AND AUTOMATION

11.2.3 MASS EXCAVATION

11.2.4 SPOT-BULLDOZING

11.2.5 OTHERS

11.3 AGRICULTURE

11.3.1 MONITORING AND CONTROL

11.3.2 GUIDANCE AND AUTOMATION

11.3.3 MASS EXCAVATION

11.3.4 SPOT-BULLDOZING

11.3.5 OTHERS

11.4 MINING

11.4.1 MONITORING AND CONTROL

11.4.2 GUIDANCE AND AUTOMATION

11.4.3 MASS EXCAVATION

11.4.4 SPOT-BULLDOZING

11.4.5 OTHERS

11.5 TRANSPORTATION

11.6 AEROSPACE AND DEFENSE

11.7 AUTOMOTIVE

11.8 MARINE

11.8.1 MONITORING AND CONTROL

11.8.2 GUIDANCE AND AUTOMATION

11.8.3 MASS EXCAVATION

11.8.4 SPOT-BULLDOZING

11.8.5 OTHERS

11.9 WASTE MANAGEMENT

11.9.1 MONITORING AND CONTROL

11.9.2 GUIDANCE AND AUTOMATION

11.9.3 MASS EXCAVATION

11.9.4 SPOT-BULLDOZING

11.9.5 OTHERS

11.1 UTILITIES

11.10.1 MONITORING AND CONTROL

11.10.2 GUIDANCE AND AUTOMATION

11.10.3 MASS EXCAVATION

11.10.4 SPOT-BULLDOZING

11.10.5 OTHERS

11.11 OTHERS

12 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MITSUI & CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 TRIMBLE INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ROCKWELL AUTOMATION, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TOPCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BELDEN INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABB

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ANDRITZ

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARLSON SOFTWARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CHALLENGER GEOMATICS LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 COPERION GMBH

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 EOS POSITIONING SYSTEMS, INC. (EOS)

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HEMISPHERE GNSS, INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 HONEYWELL INTERNATIONAL INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 JAMES FISHER AND SONS PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 KOMATSU LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 LIEBHERR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 L5 NAVIGATION SYSTEMS AB

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 MAXIMATECC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MACHINE CONTROL SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 MICROVERSE AUTOMATION PVT. LTD.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 MOBA MOBILE AUTOMATION AG

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 OMRON CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 OTTO BIHLER MASCHINENFABRIK GMBH & CO. KG

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 RAPTORTECH.COM

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 RIB GROUP

15.27.1 COMPANY SNAPSHOT

15.27.2 REVENUE ANALYSIS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENT

15.28 SATEL

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SCHNEIDER ELECTRIC

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 SIEMENS

15.30.1 COMPANY SNAPSHOT

15.30.2 REVENUE ANALYSIS

15.30.3 PRODUCT PORTFOLIO

15.30.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA NAVIGATION SATELLITE SYSTEM (GNSS) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA LASER SCANNERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA GIS COLLECTORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TOTAL STATIONS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA AIRBORNE SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EXCAVATORS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA LOADERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA DOZERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SCRAPERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA GRADERS SYSTEM IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA DRILLERS AND PILERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PAVERS AND COLD PLANERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA PROGRAMMABLE LOGIC CONTROLLER (PLC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PROGRAMMABLE AUTOMATION CONTROLLER (PAC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA MOTION CONTROLLERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA COMPUTER NUMERICAL CONTROL (CNC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PERSONAL COMPUTER (PC) IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA MONITORING AND CONTROL IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA GUIDANCE AND AUTOMATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MASS EXCAVATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SPOT-BULLDOZING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MINING IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA TRANSPORTATION IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA AEROSPACE AND DEFENSE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA AUTOMOTIVE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA OTHERS IN MACHINE CONTROL SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 U.S. MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 62 U.S. MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 U.S. MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 65 U.S. BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 CANADA MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 73 CANADA MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 CANADA MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 76 CANADA BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO MACHINE CONTROL SYSTEM MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 83 MEXICO MACHINE CONTROL SYSTEM MARKET, BY VEHICLE EQUIPMENT, 2020-2029 (USD MILLION)

TABLE 84 MEXICO MACHINE CONTROL SYSTEM MARKET, BY CONTROLLER TYPE, 2020-2029 (USD MILLION)

TABLE 85 MEXICO MACHINE CONTROL SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 MEXICO MACHINE CONTROL SYSTEM MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 87 MEXICO BUILDING AND CONSTRUCTION IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO AGRICULTURE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MEXICO MINING IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO MARINE IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO WASTE MANAGEMENT IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO UTILITIES IN MACHINE CONTROL SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: SEGMENTATION

FIGURE 11 RISING NEED FOR ACCURACY AND PRECISION IN CONTROL SYSTEMS IS EXPECTED TO DRIVE NORTH AMERICA MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 TECHNOLOGY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA MACHINE CONTROL SYSTEM MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE NORTH AMERICA MACHINE CONTROL SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA MACHINE CONTROL SYSTEM MARKET

FIGURE 15 REGIONAL SHARE OF NORTH AMERICA INFRASTRUCTURE INVESTMENT

FIGURE 16 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY, 2021

FIGURE 17 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY VEHICLE EQUIPMENT, 2021

FIGURE 18 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY CONTROLLER TYPE, 2021

FIGURE 19 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY INDUSTRY, 2021

FIGURE 21 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: BY TECHNOLOGY (2022-2029)

FIGURE 26 NORTH AMERICA MACHINE CONTROL SYSTEM MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.