North America Lung Cancer Surgery Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1,350.62 Million

USD

2,128.15 Million

2021

2029

USD

1,350.62 Million

USD

2,128.15 Million

2021

2029

| 2022 –2029 | |

| USD 1,350.62 Million | |

| USD 2,128.15 Million | |

|

|

|

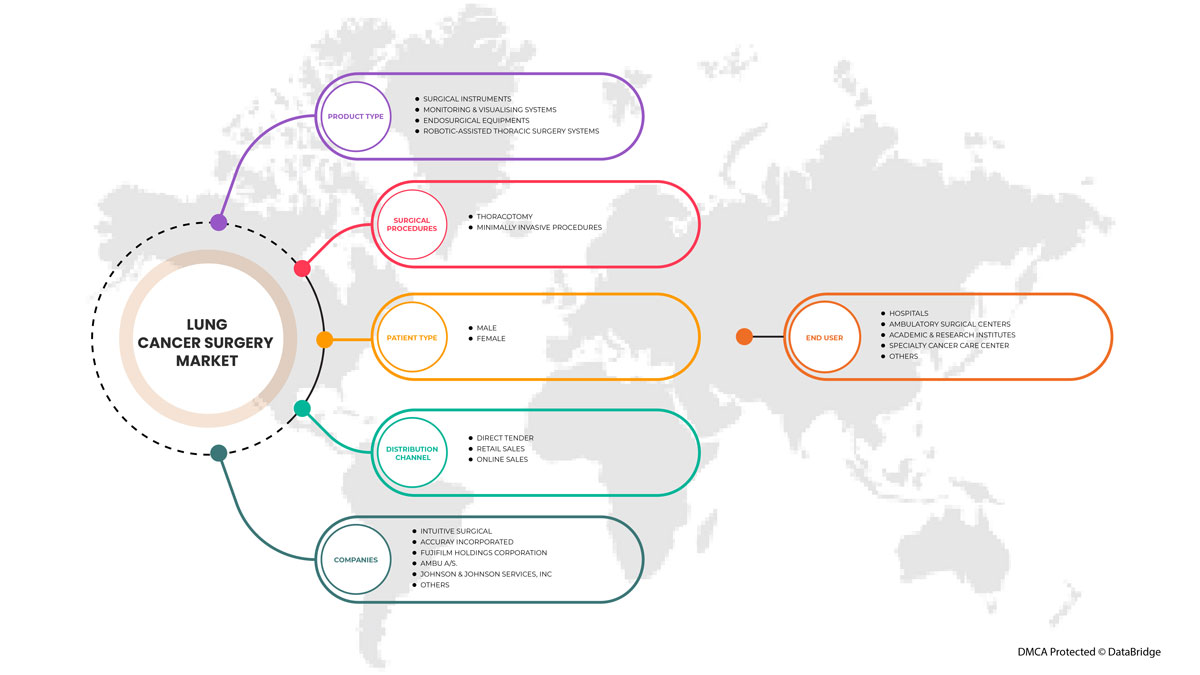

North America Lung Cancer Surgery Market, By Product Type (Surgical Instruments, Monitoring & Visualizing System, Endosurgical Equipment, Robotic-Assisted Thoracic Surgery Systems And Others), Surgical Procedure (Thoracotomy And Minimally Invasive Surgery), Patient Type (Male And Female), End User (Hospitals, Ambulatory Surgical Centres, Academic & Research Laboratories, Speciality Cancer Care Centres And Others), Distribution Channel (Direct Tender, Retail Sales, Online Sales and Others) - Industry Trends and Forecast to 2029.

North America Lung Cancer Surgery Market Analysis and Insights

A wedge surgery is a procedure used to remove lung cancer along with a little amount of good tissue. Segmental resection refers to the removal of a bigger portion of the lung. A lobectomy is a procedure to remove one of the five lobes of the lung. Pneumonectomy is the surgical removal of the whole lung.

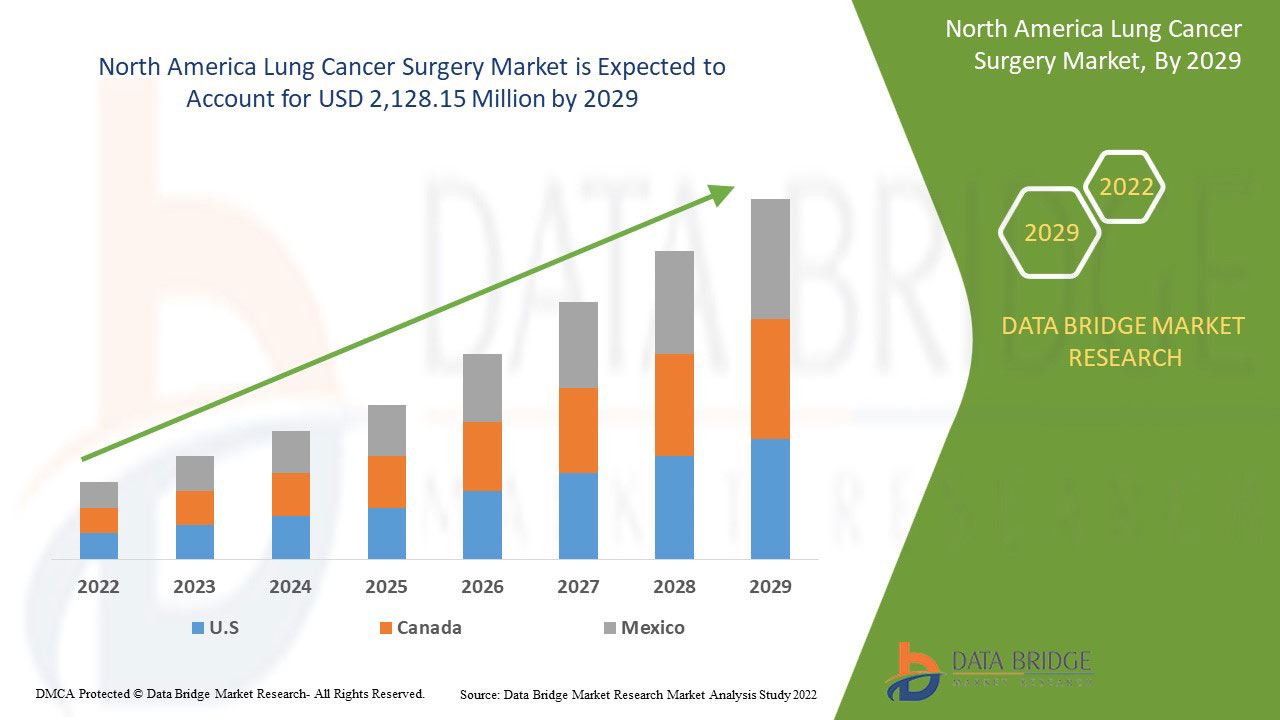

North America lung cancer surgery market is expected to gain significant market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.6% in the forecast period of 2022 to 2029 and is expected to reach USD 2,128.15 million by 2029 from USD 1,350.62 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Surgical Instruments, Monitoring & Visualizing System, Endosurgical Equipment, Robotic-Assisted Thoracic Surgery Systems And Others), Surgical Procedure (Thoracotomy And Minimally Invasive Surgery), Patient Type (Male And Female), End User (Hospitals, Ambulatory Surgical Centres, Academic & Research Laboratories, Speciality Cancer Care Centres And Others), Distribution Channel (Direct Tender, Retail Sales, Online Sales and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

The major companies which are dealing in the market are AngioDynamics, Intuitive Surgical, FusionKraft, Surgical Holdings, GerMedUSA, Medtronic, Accuray Incorporated, Teleflex Incorporated, Richard Wolf GmbH, Sontec Instruments, Inc., asap endoscopic products GmbH, FUJIFILM Holdings America Corporation, Ambu A/S., Johnson & Johnson Services, Inc, Olympus Corporation among others. |

Market Definition

Depending on the kind, location, and stage of their lung cancer as well as any other medical issues, certain people may be candidates for lung cancer surgery. This kind of surgery is used to treat lung cancer. It involves removing the tumour, some lung tissue around it, and frequently some lymph nodes as well. When lung cancer is limited and not anticipated to have spread, surgery to remove the tumour is thought to be the best option. This includes carcinoid tumours and non-small cell lung cancer in its early stages.

Lung Cancer Surgery Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

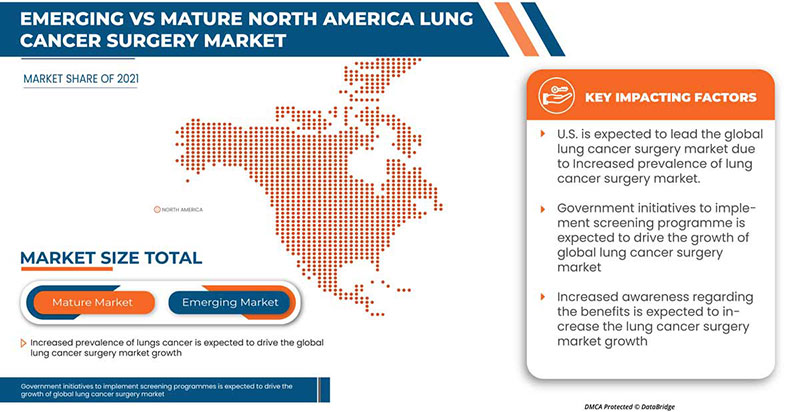

- Increased Prevalence Of Lung Cancer Diseases

Lung cancer is the most common leading cause of death in men and women globally. The incidence and mortality from lung cancer increasing globally due to the commencement of the tobacco epidemic in various countries and populations in the developing world. Lung cancer, including trachea and bronchus cancer, is widely regarded as a threat to global health, causing a heavy burden on individuals and families. Lung cancer is a malignant tumor characterized by the uncontrolled growth of cell tissues in the lung. It is the second most commonly diagnosed and has the highest mortality rate of all cancers in both men and women. According to the GLOBOCAN, Lung cancer is the most common malignancy diagnosed worldwide, with an age-standardized incidence rate of 22.5 per 100,000 person-years. Men have a higher chance of developing lung cancer than women. However, since the middle of the 1990s, male patient incidence rates have decreased in most developed countries, while female patient incidence rates have steadily grown.

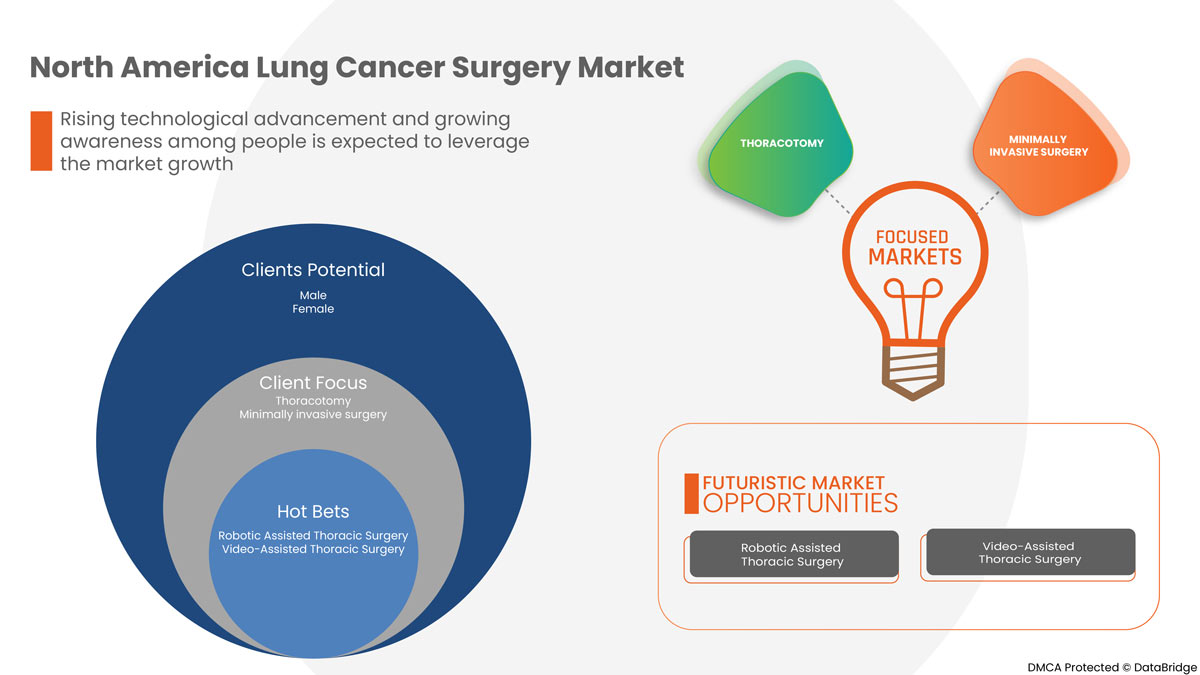

- Technological Advancement In The Field Of Healthcare

Technology advancement are of immense importance in the surgery of lung cancer. The importance of technological advancement has now taken almost every aspect of our lives. However, the most significant benefits are due to technological advances in health care. By developing new methodologies for treatment, the health system's technology becomes more effective. Recent technological advances have saved millions of lives and increased the quality of life.

In the people of all ages lung cancer is a well-known and prevalent disorder. The cutting –edge technology helps in providing better options for screening the disease. Thus, introduction of technological advanced products for the treatment of lung cancer acts as a driver for the growth of the market

- Increased Awareness Regarding The Benefits

The growing awareness programs of lung cancer by non-profit, private and public organization is leveraging to boost the market growth. These initiatives aim to reducing stigma and prejudice, prevent diseases and promoting research.

The above statement show that awareness among the population regarding lung cancer has increased as there are many awareness programs by different organizations, people know about lung cancer that can be cured if diagnosed at early stages. Thus, raising awareness among populations is acting as a driver for the lung cancer surgery market.

Opportunities

-

Rise of Minimally Invasive Techniques in Lung Cancer Surgery

Surgery is the standard of therapy for early-stage non-small cell lung cancer (NSCLC). Minimally invasive surgery (MIS), is now preferred to conventional open surgery. It has been shown that MIS procedures like video-assisted thoracoscopic surgery (VATS) and robot-assisted thoracoscopic surgery (RATS) lessen postoperative problems and decrease hospital stays. Therefore, there are launches of new minimally invasive techniques.

Growing demand for minimally invasive technique is also beneficial for further economic growth and healthcare sector growth and it is primarily fruitful as it significantly affects the development of better and advanced medical technique in the market. Thereby surge in minimally techniques in lung cancer surgery is a greater opportunity for the lung cancer surgery market.

Restraints/Challenges

However, the barriers to the lung cancer surgery techniques and high cost of lung cancer surgery process in some of the regions may impede the less growth of the lung cancer surgery hampering the growth of the market. Additionally, high competition in medical technology industries and long lead time for the overseas qualification can be the challenging factors for the growth of the market

This lung cancer surgery market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on lung cancer surgery market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Lung Cancer Surgery Market

All industries, including healthcare, medical device services, automotive, pharmaceutical, and many more have been severely disrupted by the new coronavirus. The epidemic has caused supply chain disruptions and shutdowns of large-scale manufacturing, which have had an effect on the economics of almost every country in the world. The non-small cell lung cancer diagnostic sector was also impacted by the pandemic. Patients choose to stay at home rather than receive diagnosis and treatment out of fear of contracting the virus. Worldwide, during the COVID-19 pandemic, many people had COVID-19 and post-COVID-19 sequelae such cardiovascular disease, diabetes, and kidney issues. The healthcare system changed its emphasis on containing COVID-19 as cases increased, delaying the diagnosis and treatment of other chronic illnesses like cancer in the process. As a result, the pandemic scenario is predicted to have a negative effect on the lung cancer diagnostics industry. As a result, COVID-19 patients occupied all available beds in hospitals and clinics, whereas lung cancer patients received less attention. Additionally, the market growth has been affected by clinic accessibility issues, social exclusion, and population lockdown, all of which slow down referrals and patient flow.

The market for lung cancer surgery, however, may see growth due to a slight easing in COVID-19 cases, which will result in increased demand for lung cancer diagnosis and surgery with patients coming forward to clinics and hospitals for treatment. Cases of COVID-19 are declining in number, and vaccination against it is increasing across the North-America region.

Recent Development

- In May 2021, Olympus announced today the market launch of the FDA 510(k)-cleared BF-UC190F endobronchial ultrasound (EBUS) bronchoscope, the newest addition to its robust EBUS portfolio of devices for minimally invasive lung cancer diagnosis and staging via needle biopsy.

North America lung cancer surgery market Scope

North America lung cancer surgery market is segmented into product type, surgical procedure, patient type, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Surgical Instruments

- Monitoring & Visualizing System

- Endosurgical Equipment

- Robotic-Assisted Thoracic Surgery Systems

- Others

On the basis of product type, the North America lung cancer surgery market is segmented into surgical instruments, monitoring & visualizing system, endosurgical equipment, robotic-assisted thoracic surgery systems and others.

Surgical Procedure

- Thoracotomy

- Minimally Invasive Surgery

On the basis of surgical procedure, the North America lung cancer surgery market is segmented into thoracotomy and minimally invasive surgery.

Patient Type

- Male

- Female

On the basis of patient type, the North America lung cancer surgery market is segmented into male and female.

End User

- Hospitals

- Ambulatory & Surgical Centers

- Academic & Research Institutes

- Specialty Cancer Care Center

- Others

On the basis of end user, the North America lung cancer surgery market is segmented into hospitals, ambulatory & surgical centres, academic & research institutes, speciality cancer care centers and others.

Distribution Channel

- Direct Tender

- Retail Sales

- Online Sales

- Others

On the basis of distribution channel, the North America lung cancer surgery market is segmented into direct tender, retail sales, online sales and others.

Lung Cancer Surgery Market Regional Analysis/Insights

The lung cancer surgery market is analyzed and market size insights and trends are provided by country, product type, surgical procedure, patient type, end user and distribution channel as referenced above.

The U.S. dominates the North America lung cancer surgery market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to rising need of the verification and validation of oncological surgical processes in the country and rapid research development.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Lung Cancer Surgery Market Share Analysis

The lung cancer surgery market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on lung cancer surgery market.

Some of the major players operating in the lung cancer surgery market are AngioDynamics, Ackermann, Scanlan International, KLS Martin Group, Wexler Surgical, Lepu Medical Technology (Beijing) Co., Ltd., Intuitive Surgical, FusionKraft, Surgical Holdings, GerMedUSA, Medtronic, Accuray Incorporated, Teleflex Incorporated, KARL STORZ SE & Co. KG, TROKAMED GmbH, Richard Wolf GmbH, Sontec Instruments, Inc., asap endoscopic products GmbH, FUJIFILM Holdings America Corporation, Ambu A/S., Johnson & Johnson Services, Inc., Olympus Corporation and among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

5.1 INCIDENCE OF LUNG CANCER, BY COUNTRY

5.2 TREATMENT RATE BY GENDER

5.3 MORTALITY BY GENDER

6 REGULATIONS OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASED PREVALENCE OF LUNG CANCER DISEASES

7.1.2 TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF HEALTHCARE

7.1.3 INCREASED AWARENESS REGARDING THE BENEFITS

7.1.4 GOVERNMENT INITIATIVES TO IMPLEMENT SCREENING PROGRAMS FOR VARIOUS DISEASES

7.1.5 RISE IN AIR POLLUTION AND SURGE IN SMOKING

7.2 RESTRAINTS

7.2.1 HIGH COST OF LUNG CANCER SURGERY

7.2.2 INSUFFICIENT FUNDING FOR CANCER AND ASSOCIATED DISORDERS

7.2.3 STRINGENT REGULATORY FRAMEWORKS

7.3 OPPORTUNITIES

7.3.1 RISE OF MINIMALLY INVASIVE TECHNIQUES IN LUNG CANCER SURGERY

7.3.2 STRATEGIC INITIATIVES OF KEY PLAYERS

7.3.3 INCREASE IN RESEARCH AND DEVELOPMENT EFFORTS IN THE HEALTHCARE INDUSTRY

7.4 CHALLENGES

7.4.1 DEARTH OF SKILLED ONCOLOGISTS

7.4.2 HEALTH RISK OF LUNG CANCER SURGERIES

8 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 SURGICAL INSTRUMENTS

8.2.1 HAND INSTRUMENTS

8.2.1.1 STAPLER

8.2.1.2 FORCEPS

8.2.1.3 ELECTRIC HOOK

8.2.1.4 RETRACTORS

8.2.1.5 CLAMPS

8.2.1.6 SCISSORS

8.2.1.7 ELEVATORS

8.2.1.8 HEMOCLIP APPLIERS

8.2.1.9 ULTRASOUND SCALPEL

8.2.1.10 RIB SHEARS

8.2.1.11 CUTTERS

8.2.1.12 NEEDLE HOLDER

8.2.1.13 TROCAR

8.2.1.14 OTHERS

8.2.2 POWERED SURGICAL EQUIPMENT

8.2.2.1 ADVANCED ENERGY INSTRUMENTS

8.2.2.1.1 ADVANCED BIPOLAR INSTRUMENTS

8.2.2.1.2 OTHERS

8.2.2.2 BASIC ENERGY INSTRUMENTS

8.2.2.2.1 BIPOLAR INSTRUMENTS

8.2.2.2.2 MONOPOLAR INSTRUMENTS

8.3 MONITORING & VISUALISING SYSTEM

8.3.1 CAMERAS & VIDEO SUPPORT

8.3.2 BRONCHOSCOPES

8.3.3 ENDOSCOPIC TROCARS WITH OPTICAL VIEWS

8.3.4 THORACOSCOPES

8.3.5 MEDIASTINOSCOPES

8.3.6 OTHERS

8.4 ENDOSURGICAL EQUIPMENTS

8.5 ROBOTIC ASSISTED SURGERY SYSTEMS

8.6 OTHERS

9 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE

9.1 OVERVIEW

9.2 THORACOTOMY

9.2.1 LOBECTOMY

9.2.1.1 SURGICAL INSTRUMENTS

9.2.1.2 MONITORING & VISUALISING SYSTEMS

9.2.1.3 ENDOSURGICAL EQUIPMENT

9.2.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.1.5 OTHERS

9.2.2 SLEEVE RESECTION

9.2.2.1 SURGICAL INSTRUMENTS

9.2.2.2 MONITORING & VISUALISING SYSTEMS

9.2.2.3 ENDOSURGICAL EQUIPMENT

9.2.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.2.5 OTHERS

9.2.3 SEGMENTECTOMY

9.2.3.1 SURGICAL INSTRUMENTS

9.2.3.2 MONITORING & VISUALISING SYSTEMS

9.2.3.3 ENDOSURGICAL EQUIPMENT

9.2.3.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.3.5 OTHERS

9.2.4 PNEUMONECTOMY

9.2.4.1 SURGICAL INSTRUMENTS

9.2.4.2 MONITORING & VISUALISING SYSTEMS

9.2.4.3 ENDOSURGICAL EQUIPMENT

9.2.4.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.2.4.5 OTHERS

9.2.5 OTHERS

9.3 MINIMALLY INVASIVE SURGERIES

9.3.1 VIDEO-ASSISTED THORACIC SURGERY (VATS)

9.3.1.1 SURGICAL INSTRUMENTS

9.3.1.2 MONITORING & VISUALISING SYSTEMS

9.3.1.3 ENDOSURGICAL EQUIPMENT

9.3.1.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.1.5 OTHERS

9.3.2 ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS)

9.3.2.1 SURGICAL INSTRUMENTS

9.3.2.2 MONITORING & VISUALISING SYSTEMS

9.3.2.3 ENDOSURGICAL EQUIPMENT

9.3.2.4 ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS

9.3.2.5 OTHERS

10 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PATIENT TYPE

10.1 OVERVIEW

10.2 MALE

10.2.1 GERIATRIC

10.2.1.1 THORACOTOMY

10.2.1.2 MINIMALLY INVASIVE SURGERIES

10.2.2 ADULTS

10.2.2.1 THORACOTOMY

10.2.2.2 MINIMALLY INVASIVE SURGERIES

10.2.3 PEDIATRIC

10.2.3.1 THORACOTOMY

10.2.3.2 MINIMALLY INVASIVE SURGERIES

10.3 FEMALE

10.3.1 GERIATRIC

10.3.1.1 THORACOTOMY

10.3.1.2 MINIMALLY INVASIVE SURGERIES

10.3.2 ADULTS

10.3.2.1 THORACOTOMY

10.3.2.2 MINIMALLY INVASIVE SURGERIES

10.3.3 PEDIATRIC

10.3.3.1 THORACOTOMY

10.3.3.2 MINIMALLY INVASIVE SURGERIES

11 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 ONLINE SALES

11.5 OTHERS

12 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 PUBLIC HOSPITALS

12.2.2 PRIVATE HOSPITALS

12.3 AMBULATORY SURGICAL CENTERS

12.4 SPECIALTY CANCER CARE CENTERS

12.5 ACADEMIC AND RESEARCH LABORATORIES

12.6 OTHERS

13 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LUNG CANCER SURGERY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 JOHNSON & JOHNSON SERVICES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ACCURAY INCORPORATED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 INTUITIVE SURGICAL

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 FUJIFILM HOLDINGS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AMBU A/S.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ANGIODYNAMICS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 ACKERMANN

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 ASAP ENDOSCOPIC PRODUCTS GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCTPORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 FUSIONKRAFT

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 GERMED USA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 KLS MARTIN GROUP

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 KARL STORZ SE & CO. KG

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MEDTRONICS (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 OLYMPUS CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTPORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 RICHARD WOLF GMBH.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SURGICAL HOLDINGS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SONTEC INSTRUMENTS, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 SCANLAN INTERNATIONAL

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TELEFLEX INCORPORATED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCTPORTFOLIO

16.20.4 RECENT DEVELOPMENT

16.21 TROKAMED GMBH.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 WEXLER SURGICAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 THE BELOW TABLE SHOWS REGION-SPECIFIC INCIDENCE AGE-STANDARDIZED RATES PER 100,000 BY SEX FOR LUNG CANCER AMONG MEN AND WOMEN IN 2020

TABLE 2 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SURGICAL INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAND INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 7 NORTH AMERICA POWERED SURGICAL EQUIPMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ADVANCED ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BASIC ENERGY INSTRUMENTS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 11 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MONITORING & VISUALISING SYSTEMS IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (VOLUME IN THOUSAND UNITS)

TABLE 14 NORTH AMERICA ENDOSURGICAL EQUIPMENT IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ROBOTIC-ASSISTED THORACIC SURGERY SYSTEMS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA THORACOTOMY IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LOBECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SLEEVE RESECTION IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SEGMENTECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA PNEUMONECTOMY IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA MINIMALLY INVASIVE SURGERIES IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA VIDEO-ASSISTED THORACIC SURGERY (VATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ROBOTICALLY-ASSISTED THORACIC SURGERY (RATS) IN LUNG CANCER SURGERY MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA MALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA FEMALE IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMALE IN LUNG CANCER SURGERY MARKET, BY PATIENT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA GERIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ADULTS IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PEDIATRIC IN LUNG CANCER SURGERY MARKET, BY SURGICAL PROCEDURE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA DIRECT TENDER IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA RETAIL SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE SALES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HOSPITALS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HOSPITALS IN LUNG CANCER SURGERY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA SPECIALTY CANCER CARE CENTERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ACADEMIC AND RESEARCH LABORATORIES IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION))

TABLE 50 NORTH AMERICA OTHERS IN LUNG CANCER SURGERY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA LUNG CANCER SURGERY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA LUNG CANCER SURGERYMARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LUNG CANCER SURGERY MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA LUNG CANCER SURGERYMARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA LUNG CANCER SURGERY MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA LUNG CANCER SURGERY MARKET: BOTTOM UP APPROACH

FIGURE 6 NORTH AMERICA LUNG CANCER SURGERY MARKET: TOP DOWN APPROACH

FIGURE 7 NORTH AMERICA LUNG CANCER SURGERY MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA LUNG CANCER SURGERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA LUNG CANCER SURGERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LUNG CANCER SURGERY MARKET: END USER COVERAGE GRID

FIGURE 11 NORTH AMERICA LUNG CANCER SURGERY MARKET SEGMENTATION

FIGURE 12 GROWING PREVALENCE OF CANCER DISEASES, RISE IN AIR POLLUTION, AND SURGE IN SMOKING HABIT IS EXPECTED TO DRIVE THE NORTH AMERICA LUNG CANCER SURGERY MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 SURGICAL INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LUNG CANCER SURGERY MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA LUNG CANCER SURGERY MARKET

FIGURE 15 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2021

FIGURE 20 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY SURGICAL PROCEDURE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2021

FIGURE 24 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PATIENT TYPE, LIFELINE CURVE

FIGURE 27 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA LUNG CANCER SURGERY MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA LUNG CANCER SURGERY MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA LUNG CANCER SURGERY MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.