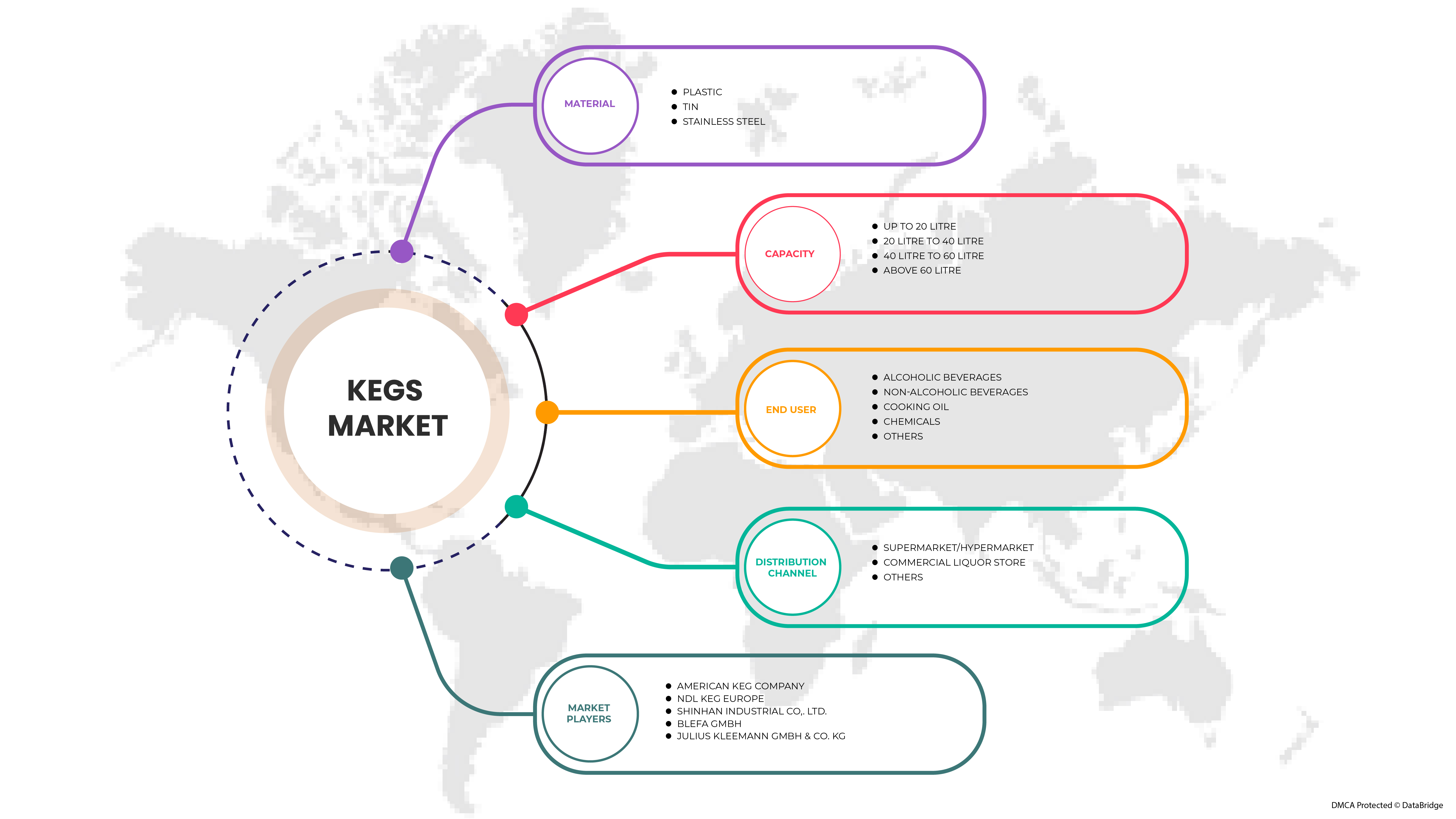

North America Kegs Market, By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non- Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others) Industry Trends and Forecast to 2029.

North America Kegs Market Analysis and Size

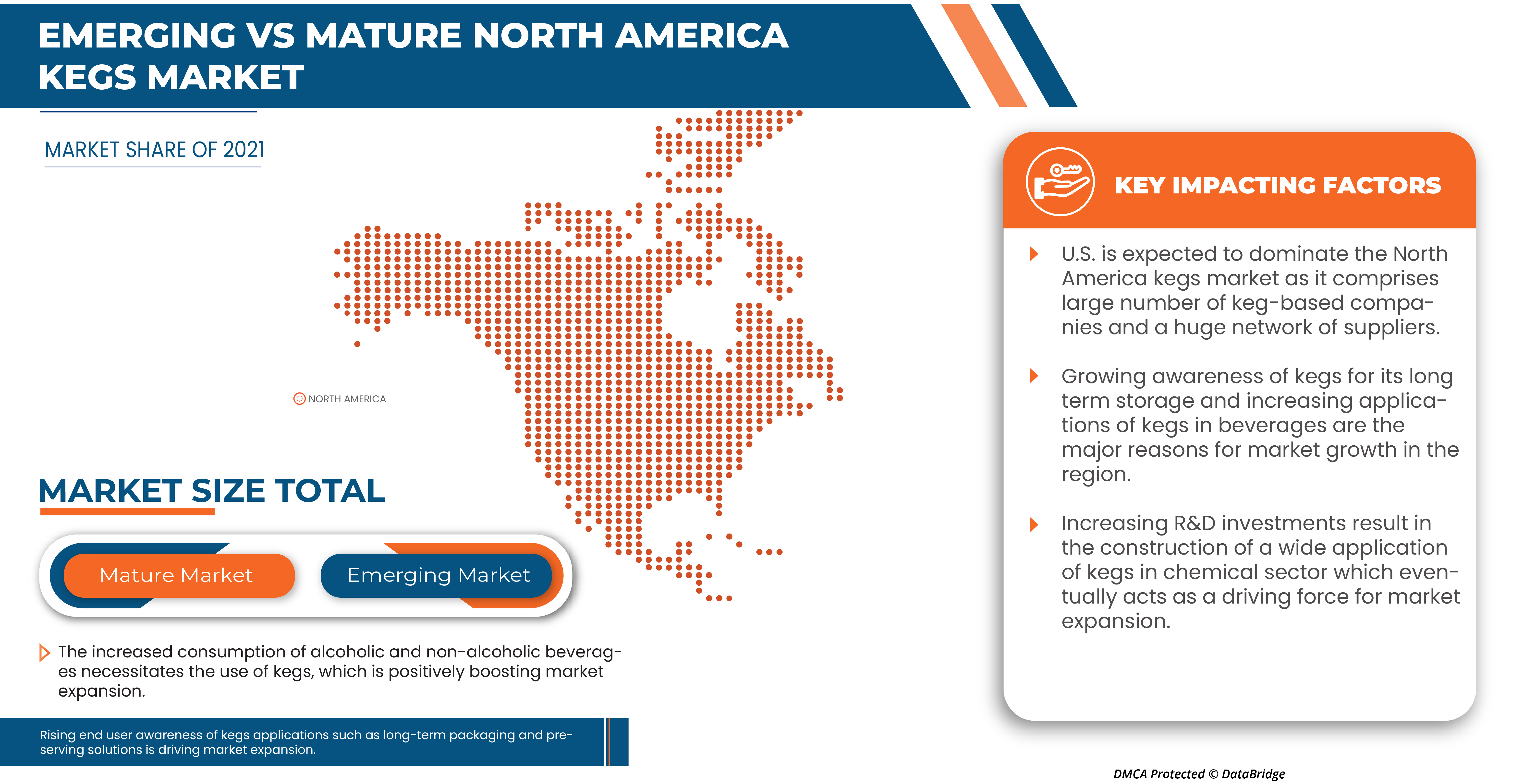

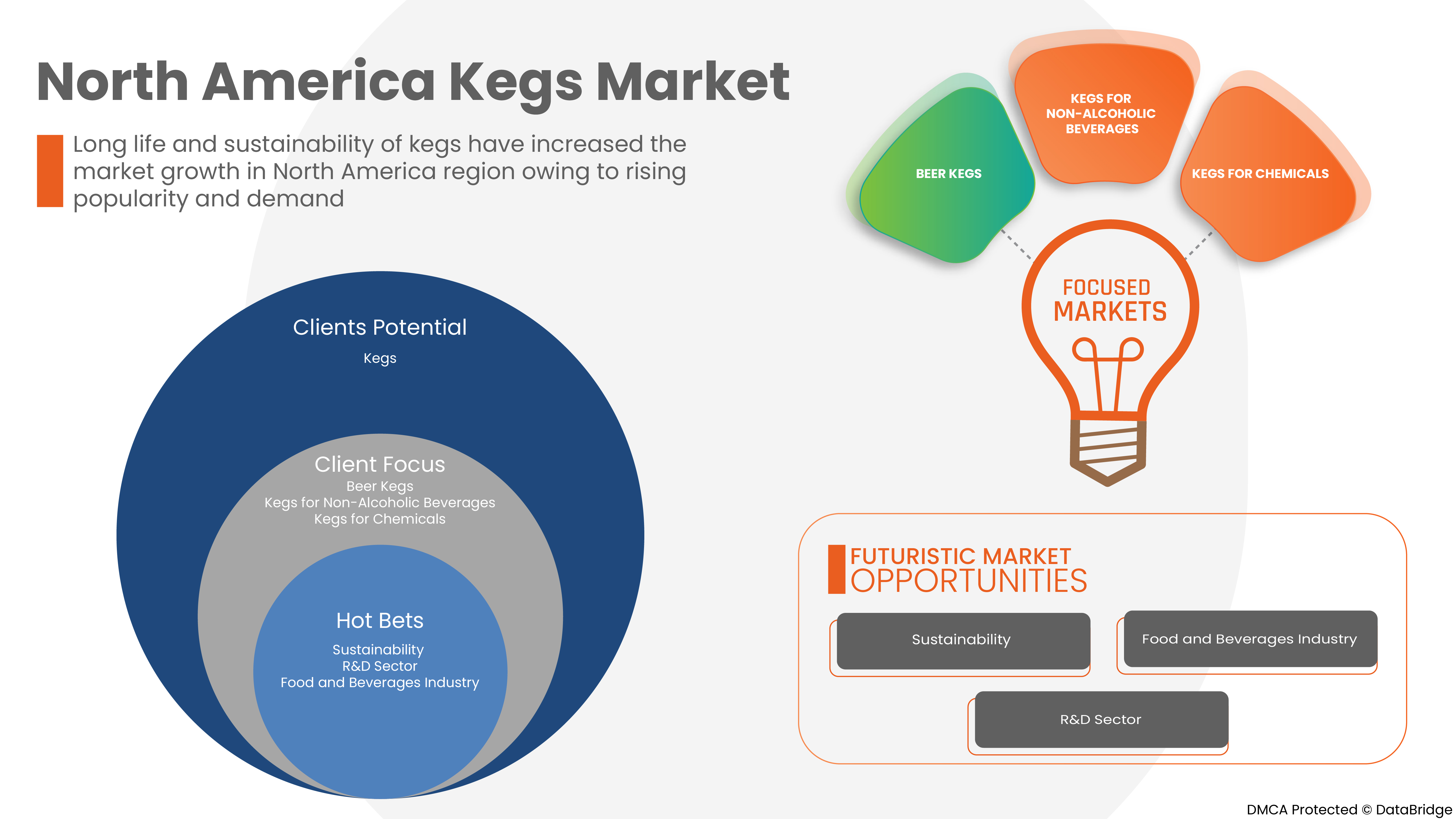

The North America kegs market is being driven by the increase in applications for kegs across industries. Additionally, the growth of the market is fueled by rising demand for alcoholic and non-alcoholic beverages. However, the primary factors limiting the market growth are the high costs associated with commercial kegs. As a result of the rising demand for kegs, manufacturers are putting more effort into launching new products with cut-edge technology and certified by authorized institutes. The market's expansion is ultimately aided by these choices.

Some of the factors driving the market growth are growing applications of kegs in chemical sector and food & beverages sector and increasing consumption of beverages due to gradual lifestyle changes. However, limitations in terms of slow replacement of kegs due to their prolonged lifespan are expected to hamper the market growth.

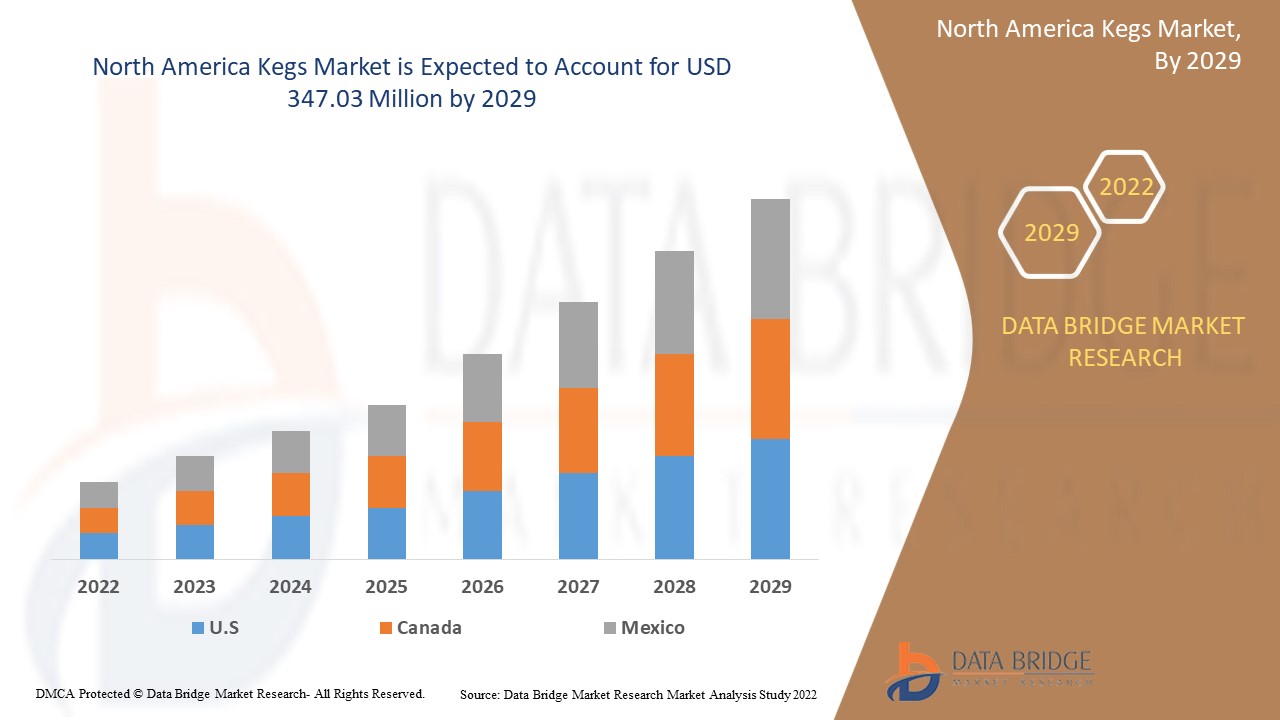

Data Bridge Market Research analyzes that the North America kegs market is expected to reach a value of USD 347.03 million by 2029, at a CAGR of 4.4% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Million Units, and Pricing in USD |

|

Segments Covered |

By Material (Plastic, Tin, and Stainless Steel), Capacity (Up To 20 Litre, 20 Litre To 40 Litre, 40 Litre To 60 Litre, and Above 60 Litre), End User (Alcoholic Beverages, Non-Alcoholic Beverages, Cooking Oil, Chemicals, and Others), Distribution Channel (Supermarket/Hypermarket, Commercial Liquor Store, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

AMERICAN KEG COMPANY, BLEFA GmbH, Petainer Ltd., Schaefer Container Systems, among KeyKeg |

Market Definition

Kegs are little barrels. Beverages, chemicals, oils, and various liquids are transported and stored in kegs constructed with various raw materials. A keg is generally often made of stainless steel, however, aluminum can also be used if it has an interior plastic coating. Beer is frequently transported, served, and stored in it. A keg can also hold additional alcoholic and non-alcoholic beverages that are carbonated or not. It is common practice to maintain the pressure of carbonated beverages to keep carbon dioxide in the solution and prevent the beverage from going flat.

North America Kegs Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

DRIVER

Growing application of kegs in chemical sectors

A chemical storage keg is a high-quality storage container used by a wide range of industries to hold various types of chemical substances. They are available in a range of forms and sizes and have always been popular. An industrial chemical storage keg is a significant chemical storage system. Because chemicals are corrosive, they must be stored in a secure location. Chemical kegs are chemical storage containers that are frequently utilized in the chemical industry. They are available in a range of sizes and shapes and are used for static storage, processing, mixing, and transportation of both raw materials and finished chemical products.

Nowadays, most keg and chemical enterprises are investing in research and development, which leads to a surge in the applications of kegs in the chemical sector.

For instance,

- In November 2020, Indian Chemical New published an article titled “Role of R&D in Making Chemical Industry Aatma Nirbhar”. It said that according to the most recent statistics available, the Indian chemical industry spends roughly 2-3% of its total sales on R&D, compared to 9-10% for MNCs in other nations. According to Oxford Economics, the chemical industry spent USD 51 billion on R&D in 2017. China had the highest chemical R&D budget at USD 14.6 billion, followed by the U.S. and Japan at USD 12.1 and USD 6.9 billion, respectively. India was rated 7th with USD 1.8 billion investment in R&D in 2017. To compete with the international chemicals sector, the industry must make significant investments in R&D. In addition, the Indian government provides numerous tax breaks to stimulate R&D investments.

- In February 2018, the CEO of a business using IoT to empower brewers envisions tens of millions of "smart kegs."

Increasing R&D investments result in the construction of a wide application of kegs in the chemical sector, which eventually acts as a driving force for market expansion.

RESTRAINT

- Slow replacement of kegs due to their prolonged lifespan

Kegs have a longer lifespan, so customers purchase the product less frequently. Since it takes a lot of time to switch from old kegs to new ones, this time lag could act as a barrier to market expansion.

For instance,

- In March 2020, Keg Works published an article entitled “How Long Does a Keg Stay Fresh?”. It mentioned that a keg of pasteurized beer has a shelf life of around 90-120 days (or 3-4 months) and unpasteurized draught beer has a shelf life of about 45-60 days (or 6-8 weeks) when stored at the right temperature.

Life span of various kegs is mentioned in the table given below:

|

Product Name |

Life span |

|

Wine Keg |

6-8 weeks |

|

Unpasteurized Beer Keg |

6-8 weeks |

|

Pasteurized Keg |

3-4 weeks |

|

Cocktail Kegs |

Approx. 2 months |

|

Cider Kegs |

6-8 weeks |

Although kegs with a longer lifespan may assist end users, the slowdown replacement of kegs may function as a barrier to market growth.

OPPORTUNITY

- Increasing advancements in technologies in kegs such as cutting-edge technology

Automation and technological developments have made keg manufacturing more efficient. These facilities may better manage their costs and key systems, thanks to smart keg tracking sensors linked to the Internet of Things (IoT) using both GPS and RFID technology, and temperature controls among other things. Keg automation technologies include smart sensors, mobile tablets and smartphones, software, APIs, and cloud databases. Technology-driven automation in kegs among other things enhances fulfillment and improves storage and transportation of alcoholic or non-alcoholic drinks, carbonated or non-carbonated, and other beverages.

The quick increase in R&D and technological progress in keg manufacturing will help in providing an opportunity for market growth and expansion. As a result, opportunities in the North America kegs market are anticipated to arise from ongoing technological developments in keg manufacturing.

CHALLENGE

- Growing stiff competition among players

Since there is intense competition among the current kegs industry players, this will result in lower prices and less overall profitability for the sector. Kegs is a highly competitive packaging and container market. The organization's total long-term profitability is affected by this competition. Due to the intense rivalry, businesses primarily concentrate on increasing the number of product releases, campaigns, and marketing to attract consumers. So, this competition among the players will be a challenge for the market growth.

Companies that produce and supply comparable goods are more competitive with one another, which could threaten the market due to large supply and low demand.

Post-COVID-19 Impact on North America Kegs Market

Post-pandemic, the demand for kegs increased as there were no restrictions on movement, hence, the supply of products was easy. The persistence of COVID-19 for a longer period affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially increasing the demand for products. However, post-COVID-19, the demand for kegs increased significantly owing to good nutrient content and other nutritional availability.

Recent Developments

- In September 2022, Sonneveld and KeyKeg introduced the Easy Go Keg system to the professional baking community in North America at IBIE in Las Vegas. This innovative system uses a constant spray pattern of release agents for high-quality bakery products, resulting in a perfect release at a low cost-of-use, a longer shelf-life, and fewer rejects. Bakers can efficiently apply consistent, concentrated doses of release agent on baking moulds, tins, trays, and conveyor belts, thanks to the system's convenient spray gun and adjustable pressure settings. The spray pattern also helps to keep the bakery clean and hygienic by reducing fogging.

- In January 2020, American Keg and Blefa Kegs announced Substantial Equity and Technological Investment by Blefa in American Keg to ensure future growth. This agreement ensures American Keg's rapid growth in production and employment.

North America Kegs Market Scope

The North America kegs market is segmented into four notable segments based on material, capacity, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Plastic

- Tin

- Stainless Steel

Based on material, the market is segmented into plastic, tin, and stainless steel.

Capacity

- Up To 20 Litre

- 20 Litre To 40 Litre

- 40 Litre To 60 Litre

- Above 60 Litre

Based on capacity, the market is segmented into up to 20 litre, 20 litre to 40 litre, 40 litre to 60 litre, and above 60 litre.

End User

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cooking Oil

- Chemicals

- Others

Based on end user, the market is segmented into alcoholic beverages, non-alcoholic beverages, cooking oil, chemicals, and others.

Distribution Channel

- Supermarket/Hypermarket

- Commercial Liquor Store

- Others

Based on distribution channel, the market is segmented into supermarket/hypermarket, commercial liquor store, and others.

North America Kegs Market Regional Analysis/Insights

The North America kegs market is analyzed and market size insights and trends are provided by country, material, capacity, end user, and distribution channel as referenced above.

The countries covered in the North America kegs market report are the U.S., Canada, and Mexico.

The U.S. is dominating the kegs market in North America region. U.S. is the largest market for kegs. Growing demand for beverages is the major reason for market growth. Moreover, the beverages market is growing progressively in the region. The growth of this market will directly impact the growth of the kegs market. However, high cost of commercial kegs is likely to restrict market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Kegs Market Share Analysis

The North America kegs market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the market.

Some of the major players operating in the market are AMERICAN KEG COMPANY, BLEFA GmbH, Petainer Ltd., Schaefer Container Systems, and KeyKeg among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA KEGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MATERIAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 IMPORT-EXPORT ANALYSIS

4.4 LIST OF KEY BUYERS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

7 SUPPLY CHAIN ANALYSIS

7.1 RAW MATERIAL

7.2 SUPPLYING/MANUFACTURING

7.3 DISTRIBUTION

7.4 END-USERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TREND OF LONG-TERM PACKAGING AND PRESERVING SOLUTIONS

8.1.2 INCREASING CONSUMPTION OF BEVERAGES DUE TO CHANGE IN GRADUAL LIFESTYLE

8.1.3 GROWING APPLICATION OF KEGS IN CHEMICAL SECTORS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH COMMERCIAL KEGS

8.2.2 SLOW REPLACEMENT OF KEGS DUE TO THEIR PROLONGED LIFESPAN

8.3 OPPORTUNITIES

8.3.1 INCREASED DEMAND FOR ECO-FRIENDLY KEGS AS A RESULT OF THE SUSTAINABILITY TREND

8.3.2 INCREASING ADVANCEMENTS IN TECHNOLOGIES IN KEGS SUCH AS CUTTING-EDGE TECHNOLOGY

8.4 CHALLENGES

8.4.1 WIDE FLUCTUATIONS IN PRICE OF RAW MATERIAL

8.4.2 GROWING STIFF COMPETITION AMONG PLAYERS

9 NORTH AMERICA KEGS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 STAINLESS STEEL

9.3 PLASTIC

9.4 TIN

10 NORTH AMERICA KEGS MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 40 LITRE TO 60 LITRE

10.3 20 LITRE TO 40 LITRE

10.4 ABOVE 60 LITRE

10.5 UP TO 20 LITRE

11 NORTH AMERICA KEGS MARKET, BY END USER

11.1 OVERVIEW

11.2 ALCOHOLIC BEVERAGES

11.2.1 BEER

11.2.2 WINE

11.2.3 SPIRITS

11.2.4 CIDER

11.3 NON-ALCOHOLIC BEVERAGES

11.3.1 SOFT-DRINKS

11.3.2 RTD-BEVERAGES

11.3.3 JUICES

11.3.4 OTHERS

11.4 CHEMICALS

11.5 COOKING OIL

11.6 OTHERS

12 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 COMMERCIAL LIQUOR STORE

12.3 SUPERMARKET / HYPERMARKET

12.4 OTHERS

13 NORTH AMERICA KEGS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 BLEFA GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 PETAINER LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 JULIUS KLEEMANN GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NDL KEG EUROPE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NEW MAISONNEUVE KEG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AMERICAN KEG COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 KEYKEG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 SCHAEFER CONTAINER SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 SHINHAN INDUSTRIAL CO,. LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SUPERMONTE GROUP ITALY, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 THE METAL DRUM COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 IMPORT OF KEGS, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF KEGS (CASKS, BARRELS, VATS, TUBS AND OTHER COOPERS' PRODUCTS PARTS THEREOF, OF WOOD, INCL. STAVES), 2020-2021, IN USD MILLION

TABLE 3 NORTH AMERICA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 5 NORTH AMERICA STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 NORTH AMERICA PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 NORTH AMERICA TIN IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TIN IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 NORTH AMERICA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 NORTH AMERICA 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 17 NORTH AMERICA ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 19 NORTH AMERICA UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 21 NORTH AMERICA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 23 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 25 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 27 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 29 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 31 NORTH AMERICA CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 33 NORTH AMERICA COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 35 NORTH AMERICA OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 37 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 39 NORTH AMERICA COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 41 NORTH AMERICA SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 43 NORTH AMERICA OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 45 NORTH AMERICA KEGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA KEGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 47 NORTH AMERICA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 49 NORTH AMERICA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 51 NORTH AMERICA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 53 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 55 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 57 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 59 U.S. KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 U.S. KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 U.S. KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 62 U.S. KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 63 U.S. KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 U.S. KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 65 U.S. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 U.S. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 67 U.S. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 U.S. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 69 U.S. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 U.S. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 71 CANADA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 CANADA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 73 CANADA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 74 CANADA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 75 CANADA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 CANADA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 77 CANADA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 CANADA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 79 CANADA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 CANADA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 81 CANADA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 CANADA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 83 MEXICO KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 85 MEXICO KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 86 MEXICO KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 87 MEXICO KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 MEXICO KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 89 MEXICO ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 MEXICO ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 91 MEXICO NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 MEXICO NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 93 MEXICO KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 MEXICO KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

그림 목록

FIGURE 1 NORTH AMERICA KEGS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA KEGS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA KEGS MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA KEGS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA KEGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA KEGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA KEGS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA KEGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA KEGS MARKET: SEGMENTATION

FIGURE 10 RISING TREND OF LONG-TERM PAKAGING&PRESERVING SOLUTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STAINLESS STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF NORTH AMERICA KEGS MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA KEGS MARKET

FIGURE 14 NORTH AMERICA KEGS MARKET, BY MATERIAL, 2021

FIGURE 15 NORTH AMERICA KEGS MARKET, BY CAPACITY, 2021

FIGURE 16 NORTH AMERICA KEGS MARKET, BY END USER, 2021

FIGURE 17 NORTH AMERICA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 18 NORTH AMERICA KEGS MARKET: SNAPSHOT (2021)

FIGURE 19 NORTH AMERICA KEGS MARKET: BY COUNTRY (2021)

FIGURE 20 NORTH AMERICA KEGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 NORTH AMERICA KEGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 NORTH AMERICA KEGS MARKET: BY MATERIAL (2022-2029)

FIGURE 23 NORTH AMERICA KEGS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.