북미 산업용 보일러 시장 , 튜빙 방식(캐리어 화관 보일러, 수관 보일러), 증기 압력(고압 보일러, 중압 보일러, 저압 보일러), 증기 사용(공정 보일러, 유틸리티 보일러, 선박 보일러), 용광로 위치(외부 연소 보일러, 내부 연소 보일러), 셸 축(수평 보일러, 수직 보일러), 보일러의 튜브(다중 튜브 보일러, 단일 보일러), 보일러의 물 및 증기 순환(강제 순환 보일러, 자연 순환 보일러), 연료 유형(석탄 연소 보일러, 석유 연소 보일러, 가스 연소 보일러, 바이오매스 보일러, 기타), 제품 유형(응축 온수 보일러, 통합 응축 온수 보일러, 통합 응축 증기 보일러, 분할 응축 증기 보일러, 전기 가열 증기) 보일러, 전기 온수 보일러, 기타), 보일러 마력(10-150 BHP, 151-300 BHP, 301-600 BHP), 산업(식품 산업, 양조장, 세탁 및 청소 회사, 건설, 제약, 자동차, 펄프 및 제지, 병원, 농업, 포장, 기타) – 2029년까지의 산업 동향 및 예측

시장 분석 및 규모

인구의 급속한 증가로 인해 전 세계적으로 발전에 대한 필요성이 증가하고 있습니다. 산업용 보일러는 금속 및 광업, 화학, 정제, 식품 등 다양한 분야에서 많이 활용되고 있습니다.

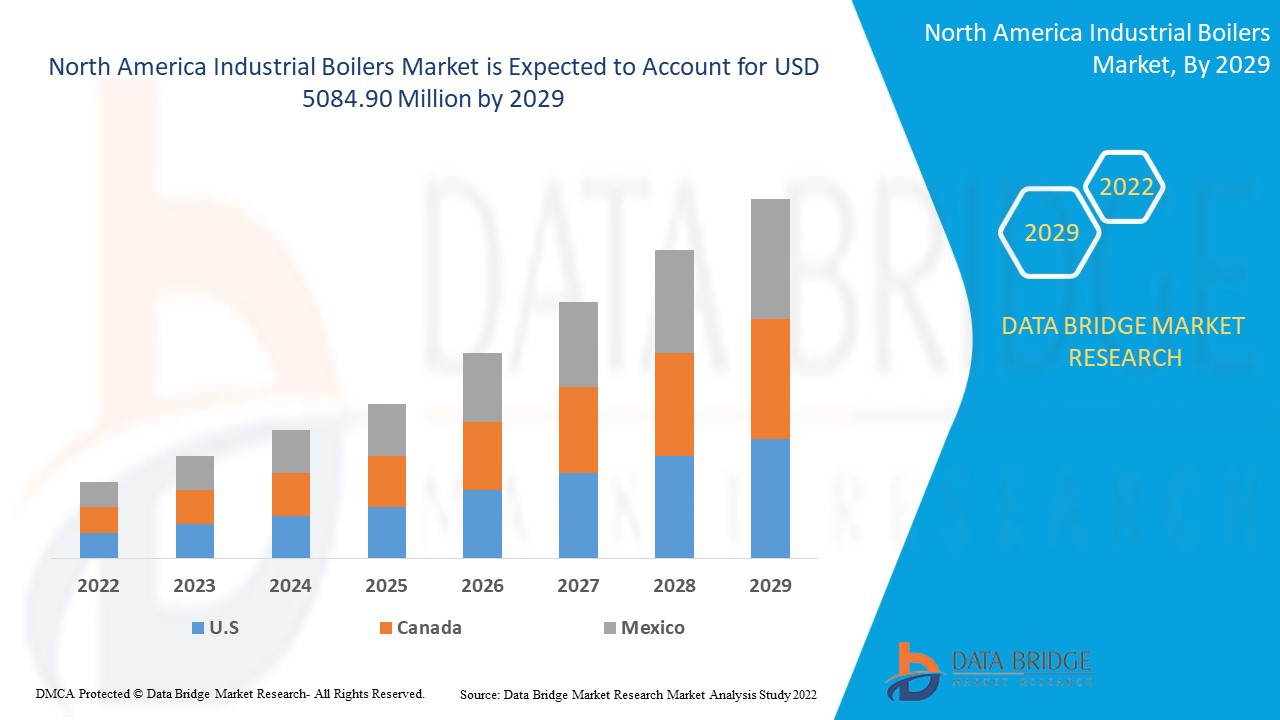

북미 산업용 보일러 시장은 2021년에 29억 6,222만 달러로 평가되었으며, 2029년까지 50억 8,490만 달러에 도달할 것으로 예상되며, 2022-2029년 예측 기간 동안 5.90%의 CAGR을 기록할 것입니다. 식품 산업은 제빵 제품과 패스트푸드의 소비로 인해 해당 시장에서 가장 큰 최종 사용 부문 세그먼트를 차지합니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석 및 페슬 분석이 포함되어 있습니다.

시장 정의

산업용 보일러는 가연성 가스, 바이오매스, 오일 또는 석탄을 연료로 사용하는 증기 또는 고온 물 주전자입니다. 현대 보일러는 내부의 물을 가열하거나 냉각하여 라인 구조를 통해 고객에게 분배합니다.

보고 범위 및 시장 세분화

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

튜빙 방식(캐리어 화관 보일러, 수관 보일러), 증기 압력(고압 보일러, 중압 보일러, 저압 보일러), 증기 사용(공정 보일러, 유틸리티 보일러, 선박 보일러), 용광로 위치(외부 연소 보일러, 내부 연소 보일러), 쉘 축(수평 보일러, 수직 보일러), 보일러의 튜브(다중 튜브 보일러, 단일 보일러), 보일러의 물 및 증기 순환(강제 순환 보일러, 자연 순환 보일러), 연료 유형(석탄 연소 보일러, 석유 연소 보일러, 가스 연소 보일러, 바이오매스 보일러, 기타), 제품 유형(응축 온수 보일러, 통합 응축 온수 보일러, 통합 응축 증기 보일러, 분할 응축 증기 보일러, 전기 가열 증기 보일러, 전기 온수 보일러, 기타), 보일러 마력(10-150 BHP, 151-300 BHP, 301-600 BHP), 산업(식품 산업, 양조장, 세탁 및 청소 회사, 건설, 제약, 자동차, 펄프 및 제지, 병원, 농업, 포장, 기타) |

|

적용 국가 |

북미에서는 미국, 캐나다, 멕시코. |

|

시장 참여자 포함 |

Babcock & Wilcox Enterprises, Inc.(미국), John Wood Group PLC(영국), Bharat Heavy Electricals Limited(인도), IHI Corporation(일본), Mitsubishi Hitachi Power Systems, Ltd.(유럽), Thermax Limited(인도), ANDRITZ(오스트리아), Siemens(독일), ALFA LAVAL(스웨덴), General Electric Company(미국), Hurst Boiler & Welding Co, Inc.(미국), Bryan Steam(미국), Superior Boiler Works, Inc.(미국), Vapor Power(미국), Sofinter Spa(이탈리아), Cleaver-Brooks, Inc(미국), ZOZEN boiler Co., Ltd.(중국) 등이 있습니다. |

|

시장 기회 |

|

북미 산업용 보일러 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

운전자

- 기술의 발전

시장은 주정부와 연방 정부의 확장 프로그램에 따른 산업 시설의 견고한 성장으로 자극을 받을 것입니다.

- 엄격한 정부 규제

온실가스 배출을 줄이기 위한 엄격한 정부 규정과 연료 사용량 감소에 대한 집중적인 관심은 시장을 강화할 것입니다.

- 효율적인 단위의 채택 증가

안전한 작동, 높은 효율성, 낮은 유지관리 비용 등의 이유로 효율적인 장치에 대한 화학 산업의 수용이 증가함에 따라 제품 도입이 촉진되어 시장 성장에 더욱 영향을 미칠 것입니다.

기회

또한, 공장 운영에 새로운 스마트 보일러 기술을 도입하는 경우가 늘어나고 공급업체의 꾸준한 개발로 인해 2022년에서 2029년까지의 예측 기간 동안 시장 참여자에게 수익성 있는 기회가 확대될 것입니다.

제약/도전

반면, 초기 투자 증가는 시장 성장을 방해할 것으로 예상됩니다. 또한 부식, 필요한 수명을 달성하지 못함, 기타 기술적 문제로 인해 연구 및 개발 노력에 대한 더 많은 연구와 투자가 필요하여 2022-2029년 예측 기간 동안 중앙 진공 청소기 시장에 도전할 것으로 예상됩니다.

이 북미 산업용 보일러 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 북미 산업용 보일러 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

COVID-19가 북미 산업용 보일러 시장 에 미치는 영향

COVID-19는 산업용 보일러 시장에 부정적인 영향을 미쳤습니다. COVID-19 전염병으로 인해 인프라 건설, 재편 및 리노베이션을 포함한 여러 이니셔티브가 연기되었습니다. 기회가 생길 때 운영을 개선하여 영향을 과도하게 보상하는 데 대한 정부의 관심이 높아지면 산업 성장이 가속화될 것입니다. 반면 주요 산업, 제조 시설 및 인프라 프로젝트를 재개하기 위한 정부 조치는 기업 성장을 지원할 것입니다.

최근 개발 사항

2020년 1월, 약 500만 달러 규모의 새로운 계약이 Babcock & Wilcox Enterprises, Inc.에 보일러 장비 개조를 위한 계약을 체결했습니다. 이 혁신적인 기술은 미국 석탄 화력 발전소의 보일러 장비를 개조하는 데 사용되고 있습니다. 이 계약은 이 조직이 미국에서 시장 입지를 확대하고 고객 기반을 확대하는 데 도움이 되었습니다.

북미 산업용 보일러 시장 범위 및 시장 규모

북미 산업용 보일러 시장은 튜빙 방법, 증기 압력, 증기 사용, 퍼니스 위치, 셸 축, 보일러의 튜브, 보일러의 물과 증기 순환, 연료 유형, 제품 유형, 보일러 마력 및 산업을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

튜빙 방법

- 캐리어 화관 보일러

- 수관 보일러

증기 압력

- 고압 보일러

- 중압 보일러

- 저압 보일러

스팀 사용

- 공정 보일러

- 유틸리티 보일러

- 선박 보일러

로 위치

- 외부 연소 보일러

- 내부 연소 보일러

쉘 축

- 수평 보일러

- 수직 보일러

보일러의 튜브

- 멀티 튜브 보일러

- 단일 보일러

보일러의 물과 증기 순환

- 강제 순환 보일러

- 자연 순환 보일러

연료 유형

- 석탄 연소 보일러

- 석유 연소 보일러

- 가스 연소 보일러

- 바이오매스 보일러

- 기타

제품 유형

- 응축 온수 보일러

- 통합 응축 온수 보일러

- 통합 응축 증기 보일러

- 스플릿 응축 스팀 보일러

- 전기 가열 증기 보일러

- 전기 온수 보일러

- 기타

보일러 마력

- 10-150마력

- 151-300마력

- 301 - 600마력

산업

- 식품 산업

- 양조장

- 세탁 및 청소 회사

- 건설

- 제약

- 자동차

- 펄프 및 종이

- 병원

- 농업

- 포장

- 기타

북미 산업용 보일러 시장 지역 분석/통찰력

북미 산업용 보일러 시장을 분석하고, 위에 언급된 대로 국가, 튜빙 방법, 증기 압력, 증기 사용량, 퍼니스 위치, 셸 축, 보일러의 튜브, 보일러의 물과 증기 순환, 연료 유형, 제품 유형, 보일러 마력 및 산업별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 산업용 보일러 시장 보고서에서 다루는 국가는 북미의 미국, 캐나다, 멕시코입니다.

미국은 신기술이나 자본금 증가에 필요한 기술을 수용할 수 있는 튼튼한 재정적 여력을 갖추고 있어 북미 산업용 보일러 시장을 장악하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 트렌드 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 산업용 보일러 시장

북미 산업용 보일러 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 있습니다. 위에 제공된 데이터 포인트는 북미 산업용 보일러 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 산업용 보일러 시장에서 운영되는 주요 업체 중 일부는 다음과 같습니다.

- Babcock & Wilcox Enterprises, Inc. (미국)

- 존 우드 그룹 PLC(영국)

- Bharat Heavy Electricals Limited(인도)

- IHI 주식회사(일본)

- 미쓰비시 히타치 파워 시스템 주식회사(유럽)

- Thermax Limited(인도)

- ANDRITZ(오스트리아)

- Siemens (Germany)

- ALFA LAVAL (Sweden)

- General Electric Company (US)

- Hurst Boiler & Welding Co, Inc. (US)

- Bryan Steam (US)

- Superior Boiler Works, Inc. (US)

- Vapor Power (US)

- Sofinter S.p.a (Italy)

- Cleaver-Brooks, Inc (US)

- ZOZEN boiler Co., Ltd. (China)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TUBING METHODS TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS

5.1.2 GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS

5.1.3 RISING DEMAND FROM THE FOOD AND BEVERAGES INDUSTRY

5.1.4 RAPID ADOPTION OF INDUSTRIAL BOILER FROM ASIAN COUNTRIES

5.2 RESTRAINT

5.2.1 HIGH INVESTMENT COST

5.3 OPPORTUNITIES

5.3.1 DIGITALISATION OF THE INDUSTRIAL BOILER FOR IMPROVING EFFICIENCY

5.3.2 GROWING DEMAND FOR THE BIOMASS BOILERS

5.3.3 ADVENT OF PORTABLE, RENTAL AND TEMPORARY INDUSTRIAL BOILERS

5.4 CHALLENGES

5.4.1 TECHNICAL CHALLENGES TO IMPROVE THE PERFORMANCE AND LIFE

5.4.2 UNCERTAINTY AMONGST CUSTOMERS ABOUT INDUSTRIAL BOILER SAFETY AT PLANT

6 IMPACT ANALYSIS OF COVID-19 ON THE MARKET

6.1 IMPACT ON THE MANUFACTURING INDUSTRY AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MARKET PLAYERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 CONSLUSION

7 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS

7.1 OVERVIEW

7.2 WATER TUBE BOILERS

7.3 FIRE TUBE BOILERS

8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE

8.1 OVERVIEW

8.2 HIGH PRESSURE BOILERS

8.3 MEDIUM PRESSURE BOILERS

8.4 LOW PRESSURE BOILERS

9 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE

9.1 OVERVIEW

9.2 PROCESS BOILERS

9.3 UTILITY BOILERS

9.4 MARINE BOILERS

10 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION

10.1 OVERVIEW

10.2 EXTERNALLY FIRED BOILERS

10.3 INTERNALLY FIRED BOILERS

11 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS

11.1 OVERVIEW

11.2 HORIZONTAL BOILERS

11.3 VERTICAL BOILERS

12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS

12.1 OVERVIEW

12.2 MULTI TUBE BOILERS

12.3 SINGLE TUBE BOILERS

13 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS

13.1 OVERVIEW

13.2 FORCED CIRCULATION BOILERS

13.3 NATURAL CIRCULATION BOILERS

14 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BYFUEL TYPE

14.1 OVERVIEW

14.2 GAS FIRED BOILERS

14.3 COAL FIRED BOILERS

14.4 BIOMASS BOILERS

14.5 OIL FIRED BOILERS

14.6 OTHERS

15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE

15.1 OVERVIEW

15.2 CONDENSING HOT WATER BOILER

15.3 INTEGRATED CONDENSING HOT WATER BOILER

15.4 INTEGRATED CONDENSING STEAM BOILER

15.5 SPLIT CONDENSING STEAM BOILER

15.6 ELECTRIC HEATED STEAM BOILER

15.7 ELECTRIC HOT WATER BOILERS

15.8 OTHERS

16 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER

16.1 OVERVIEW

16.2-150 BHP

16.3 -300 BHP

16.4 - 600 BHP

17 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY

17.1 OVERVIEW

17.2 FOOD INDUSTRY

17.2.1 CONDENSING HOT WATER BOILER

17.2.2 INTEGRATED CONDENSING HOT WATER BOILER

17.2.3 SPLIT CONDENSING STEAM BOILER

17.2.4 INTEGRATED CONDENSING STEAM BOILER

17.2.5 ELECTRIC HEATED STEAM BOILER

17.2.6 ELECTRIC HOT WATER BOILERS

17.2.7 OTHERS

17.3 BREWERIES

17.3.1 CONDENSING HOT WATER BOILER

17.3.2 INTEGRATED CONDENSING HOT WATER BOILER

17.3.3 SPLIT CONDENSING STEAM BOILER

17.3.4 INTEGRATED CONDENSING STEAM BOILER

17.3.5 ELECTRIC HEATED STEAM BOILER

17.3.6 ELECTRIC HOT WATER BOILERS

17.3.7 OTHERS

17.4 LAUNDRIES AND CLEANING FIRM

17.4.1 SPLIT CONDENSING STEAM BOILER

17.4.2 INTEGRATED CONDENSING STEAM BOILER

17.4.3 CONDENSING HOT WATER BOILER

17.4.4 INTEGRATED CONDENSING HOT WATER BOILER

17.4.5 ELECTRIC HEATED STEAM BOILER

17.4.6 ELECTRIC HOT WATER BOILERS

17.4.7 OTHERS

17.5 PHARMACEUTICAL

17.5.1 INTEGRATED CONDENSING HOT WATER BOILER

17.5.2 CONDENSING HOT WATER BOILER

17.5.3 INTEGRATED CONDENSING STEAM BOILER

17.5.4 ELECTRIC HOT WATER BOILERS

17.5.5 ELECTRIC HEATED STEAM BOILER

17.5.6 SPLIT CONDENSING STEAM BOILER

17.5.7 OTHERS

17.6 HOSPITALS

17.6.1 INTEGRATED CONDENSING STEAM BOILER

17.6.2 CONDENSING HOT WATER BOILER

17.6.3 INTEGRATED CONDENSING HOT WATER BOILER

17.6.4 ELECTRIC HOT WATER BOILERS

17.6.5 ELECTRIC HEATED STEAM BOILER

17.6.6 SPLIT CONDENSING STEAM BOILER

17.6.7 OTHERS

17.7 CONSTRUCTION

17.7.1 INTEGRATED CONDENSING STEAM BOILER

17.7.2 CONDENSING HOT WATER BOILER

17.7.3 INTEGRATED CONDENSING HOT WATER BOILER

17.7.4 ELECTRIC HEATED STEAM BOILER

17.7.5 SPLIT CONDENSING STEAM BOILER

17.7.6 ELECTRIC HOT WATER BOILERS

17.7.7 OTHERS

17.8 PULP AND PAPER

17.8.1 CONDENSING HOT WATER BOILER

17.8.2 SPLIT CONDENSING STEAM BOILER

17.8.3 INTEGRATED CONDENSING HOT WATER BOILER

17.8.4 ELECTRIC HOT WATER BOILERS

17.8.5 ELECTRIC HEATED STEAM BOILER

17.8.6 INTEGRATED CONDENSING STEAM BOILER

17.8.7 OTHERS

17.9 AUTOMOTIVE

17.9.1 CONDENSING HOT WATER BOILER

17.9.2 INTEGRATED CONDENSING HOT WATER BOILER

17.9.3 INTEGRATED CONDENSING STEAM BOILER

17.9.4 ELECTRIC HOT WATER BOILERS

17.9.5 ELECTRIC HEATED STEAM BOILER

17.9.6 SPLIT CONDENSING STEAM BOILER

17.9.7 OTHERS

17.1 AGRICULTURE

17.10.1 SPLIT CONDENSING STEAM BOILER

17.10.2 INTEGRATED CONDENSING HOT WATER BOILER

17.10.3 CONDENSING HOT WATER BOILER

17.10.4 INTEGRATED CONDENSING STEAM BOILER

17.10.5 ELECTRIC HEATED STEAM BOILER

17.10.6 ELECTRIC HOT WATER BOILERS

17.10.7 OTHERS

17.11 PACKAGING

17.11.1 ELECTRIC HEATED STEAM BOILER

17.11.2 INTEGRATED CONDENSING STEAM BOILER

17.11.3 SPLIT CONDENSING STEAM BOILER

17.11.4 INTEGRATED CONDENSING HOT WATER BOILER

17.11.5 CONDENSING HOT WATER BOILER

17.11.6 ELECTRIC HOT WATER BOILERS

17.11.7 OTHERS

17.12 OTHERS

18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY GEOGRAPHY

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

19 NORTH AMERICA INDUSTRIAL BOILERS MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

20 NORTH AMERICA INDUSTRIAL BOILERS MARKET, SWOT

21 COMPANY PROFILE

21.1 GENERAL ELECTRIC

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 COMPANY SHARE ANALYSIS

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

21.2.1 COMPANY SNAPSHOT

21.2.2 COMPANY PROFILE

21.2.3 PRODUCT PORTFOLIO

21.2.4 RECENT DEVELOPMENTS

21.3 ANDRITZ

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 COMPANY SHARE ANALYSIS

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 ALFA LAVAL

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 COMPANY SHARE ANALYSIS

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 IHI CORPORATION

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 COMPANY SHARE ANALYSIS

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 THERMAX LIMITED

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 RECENT DEVELOPMENTS

21.7 AB&CO GROUP

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 RECENT DEVELOPMENT

21.8 BABCOCK & WILCOX ENTERPRISES, INC.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 RECENT DEVELOPMENTS

21.9 BHARAT HEAVY ELECTRICALS LIMITED

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 RECENT DEVELOPMENTS

21.1 BRYAN STEAM

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 RECENT DEVELOPMENTS

21.11 CLEAVER-BROOKS, INC

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 RECENT DEVELOPMENTS

21.12 DEC

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 RECENT DEVELOPMENTS

21.13 HURST BOILER & WELDING CO, INC.

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 RECENT DEVELOPMENTS

21.14 JOHN WOOD GROUP PLC

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 RECENT DEVELOPMENTS

21.15 SIEMENS

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 RECENT DEVELOPMENT

21.16 SOFINTER S.P.A

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 RECENT DEVELOPMENTS

21.17 SUPERIOR BOILER WORKS, INC.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 RECENT DEVELOPMENTS

21.18 SUZHOU HAILU HEAVY INDUSTRY CO., LTD

21.18.1 COMPANY SNAPSHOT

21.18.2 PRODUCT PORTFOLIO

21.18.3 RECENT DEVELOPMENTS

21.19 VAPOR POWER

21.19.1 COMPANY SNAPSHOT

21.19.2 PRODUCT PORTFOLIO

21.19.3 RECENT DEVELOPMENT

21.2 ZOZEN BOILER CO., LTD.

21.20.1 COMPANY SNAPSHOT

21.20.2 PRODUCT PORTFOLIO

21.20.3 RECENT DEVELOPMENTS

22 QUESTIONNAIRE

23 RELATED REPORTS

표 목록

LIST OF TABLES

TABLE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA WATER TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 3 NORTH AMERICA FIRE TUBE BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA HIGH PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM PRESSURE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA PROCESS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 10 NORTH AMERICA UTILITY BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 11 NORTH AMERICA MARINE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 12 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA EXTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 14 NORTH AMERICA INTERNALLY FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA HORIZONTAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 17 NORTH AMERICA VERTICAL BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA MULTI TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 20 NORTH AMERICA SINGLE TUBE BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA FORCED CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 NORTH AMERICA NATURAL CIRCULATION BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA GAS FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 26 NORTH AMERICA COAL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 27 NORTH AMERICA BIOMASS BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 28 NORTH AMERICA OIL FIRED BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 32 NORTH AMERICA INTEGRATED CONDENSING HOT WATER BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 33 NORTH AMERICA INTEGRATED CONDENSING STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 34 NORTH AMERICA SPLIT CONDENSING STEAM BOILERIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 35 NORTH AMERICA ELECTRIC HEATED STEAM BOILER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 36 NORTH AMERICA ELECTRIC HOT WATER BOILERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 38 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA 10-150 BHP IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 40 NORTH AMERICA 151 -300 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 41 NORTH AMERICA 301 - 600 BHPIN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 42 NORTH AMERICA INDUSTRIAL BOILERS MARKET, BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 43 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 44 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 46 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 47 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 48 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 49 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 50 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 52 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 53 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 54 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 55 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 56 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 57 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 58 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 60 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 61 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 62 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 64 NORTH AMERICAINDUSTRIAL BOILERS MARKET,BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 65 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 66 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 67 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 68 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 69 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 70 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 71 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 72 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 73 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 74 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 75 NORTH AMERICA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 76 NORTH AMERICA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 77 NORTH AMERICA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 78 NORTH AMERICA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 79 NORTH AMERICA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 80 NORTH AMERICA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 81 NORTH AMERICA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 82 NORTH AMERICA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 83 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 84 NORTH AMERICA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 85 NORTH AMERICA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 86 U.S. INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 87 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 88 U.S. INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 89 U.S. INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 90 U.S. INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 91 U.S. INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 92 U.S. INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 93 U.S. INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 94 U.S. INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 95 U.S. INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 96 U.S. INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 97 U.S. FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 98 U.S. BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 99 U.S. LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 100 U.S. PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 101 U.S. HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 102 U.S. CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 103 U.S. PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 104 U.S. AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 105 U.S. AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 106 U.S. PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 107 CANADA INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 108 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 109 CANADA INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 110 CANADA INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 111 CANADA INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 112 CANADA INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 113 CANADA INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 114 CANADA INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 115 CANADA INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 116 CANADA INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 117 CANADA INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 118 CANADA FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 119 CANADA BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 120 CANADA LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 121 CANADA PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 122 CANADA HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 123 CANADA CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 124 CANADA PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 125 CANADA AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 126 CANADA AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 127 CANADA PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 128 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBING METHODS, 2018-2027 (USD MILLION)

TABLE 129 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM PRESSURE, 2018-2027 (USD MILLION)

TABLE 130 MEXICO INDUSTRIAL BOILERS MARKET,BY STEAM USAGE, 2018-2027 (USD MILLION)

TABLE 131 MEXICO INDUSTRIAL BOILERS MARKET,BY FURNACE POSITION, 2018-2027 (USD MILLION)

TABLE 132 MEXICO INDUSTRIAL BOILERS MARKET,BY SHELL AXIS, 2018-2027 (USD MILLION)

TABLE 133 MEXICO INDUSTRIAL BOILERS MARKET,BY TUBES IN BOILERS, 2018-2027 (USD MILLION)

TABLE 134 MEXICO INDUSTRIAL BOILERS MARKET,BY WATER AND STEAM CIRCULATION IN BOILERS, 2018-2027 (USD MILLION)

TABLE 135 MEXICO INDUSTRIAL BOILERS MARKET,BY FUEL TYPE, 2018-2027 (USD MILLION)

TABLE 136 MEXICO INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 137 MEXICO INDUSTRIAL BOILERS MARKET,BY BOILER HORSEPOWER, 2018-2027 (USD MILLION)

TABLE 138 MEXICO INDUSTRIAL BOILERS MARKET,BY INDUSTRY, 2018-2027 (USD MILLION)

TABLE 139 MEXICO FOOD INDUSTRY IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 140 MEXICO BREWERIES IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 141 MEXICO LAUNDRIES AND CLEANING FIRM IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 142 MEXICO PHARMACEUTICAL IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 143 MEXICO HOSPITALS IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 144 MEXICO CONSTRUCTION IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 145 MEXICO PULP AND PAPER IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 146 MEXICO AUTOMOTIVE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 147 MEXICO AGRICULTURE IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 148 MEXICO PACKAGING IN INDUSTRIAL BOILERS MARKET,BY PRODUCT TYPE, 2018-2027 (USD MILLION)

그림 목록

LIST OF FIGURES

FIGURE 1 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INDUSTRIAL BOILERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INDUSTRIAL BOILERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INDUSTRIAL BOILERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INDUSTRIAL BOILERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INDUSTRIAL BOILERS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR LOW EMISSION INDUSTRIAL BOILERS AND GROWING DEMAND FOR ADVANCED BOILER SOLUTION FROM INDUSTRIAL VERTICALS ARE DRIVING THE NORTH AMERICA INDUSTRIAL BOILERS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 WATER TUBE BOILERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA INDUSTRIAL BOILERS MARKET IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA INDUSTRIAL BOILERS MARKET

FIGURE 13 THERMODYNE MARKET SHARE OF FOOD INDUSTRY BOILERS

FIGURE 14 FUEL LOSS IN BOILER WITH SCALE BUILD UP

FIGURE 15 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS, 2019

FIGURE 16 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYSTEAM PRESSURE, 2019

FIGURE 17 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY STEAM USAGE, 2019

FIGURE 18 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY FURNACE POSITION, 2019

FIGURE 19 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY SHELL AXIS, 2019

FIGURE 20 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBES IN BOILERS, 2019

FIGURE 21 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY WATER AND STEAM CIRCULATION IN BOILERS, 2019

FIGURE 22 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BYFUEL TYPE, 2019

FIGURE 23 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY PRODUCT TYPE, 2019

FIGURE 24 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY BOILER HORSEPOWER, 2019

FIGURE 25 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY INDUSTRY, 2019

FIGURE 26 NORTH AMERICAINDUSTRIAL BOILERS MARKET: SNAPSHOT (2019)

FIGURE 27 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2019)

FIGURE 28 NORTH AMERICAINDUSTRIAL BOILERS MARKET: BY COUNTRY(2020& 2027)

FIGURE 29 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY COUNTRY (2019& 2027)

FIGURE 30 NORTH AMERICA INDUSTRIAL BOILERS MARKET: BY TUBING METHODS (2020-2027)

FIGURE 31 NORTH AMERICA INDUSTRIAL BOILERS MARKET: COMPANY SHARE 2019 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.