North America Hydroxyl Terminated Polybutadiene Htpb Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

53.56 Million

USD

83.35 Million

2024

2032

USD

53.56 Million

USD

83.35 Million

2024

2032

| 2025 –2032 | |

| USD 53.56 Million | |

| USD 83.35 Million | |

|

|

|

North America Hydroxyl-Terminated Polybutadiene (HTPB) Market Segmentation, By Product (Low Molecular Weight Hydroxyl Terminated Polybutadienes and Conventional Hydroxyl Terminated Polybutadienes), Application (Rocket Fuel, Polyurethane, Paint, Rubber Material, and Others), End Use (Aerospace & Defense, Automotive, Building & Construction, Electrical & Electronics, Packaging, and Others) – Industry Trends and Forecast to 2032.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Analysis

There has been a rapid rise in air passenger traffic and increased exports and imports of goods in the last decade, which is expected to drive the demand for aerospace components. Most aerospace parts manufacturers have decided to adjust their operations to achieve maximum flexibility with modernization investments, spanning the entire organization. These initiatives might include simple processes and product designs that involve the application of hydroxyl-terminated polybutadiene on a large scale during the manufacturing of the components.

Propellants are chemical compounds or mixtures that, on the ignition, exhibit self-sustained combustion and generate large volumes of hot gases at controlled, predetermined rates. The technological development of propellants, which are used in a solid and hybrid rocket motor, uses hydroxyl-terminated polybutadiene (HTPB) as a binder in the manufacturing process of the rocket motor.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Size

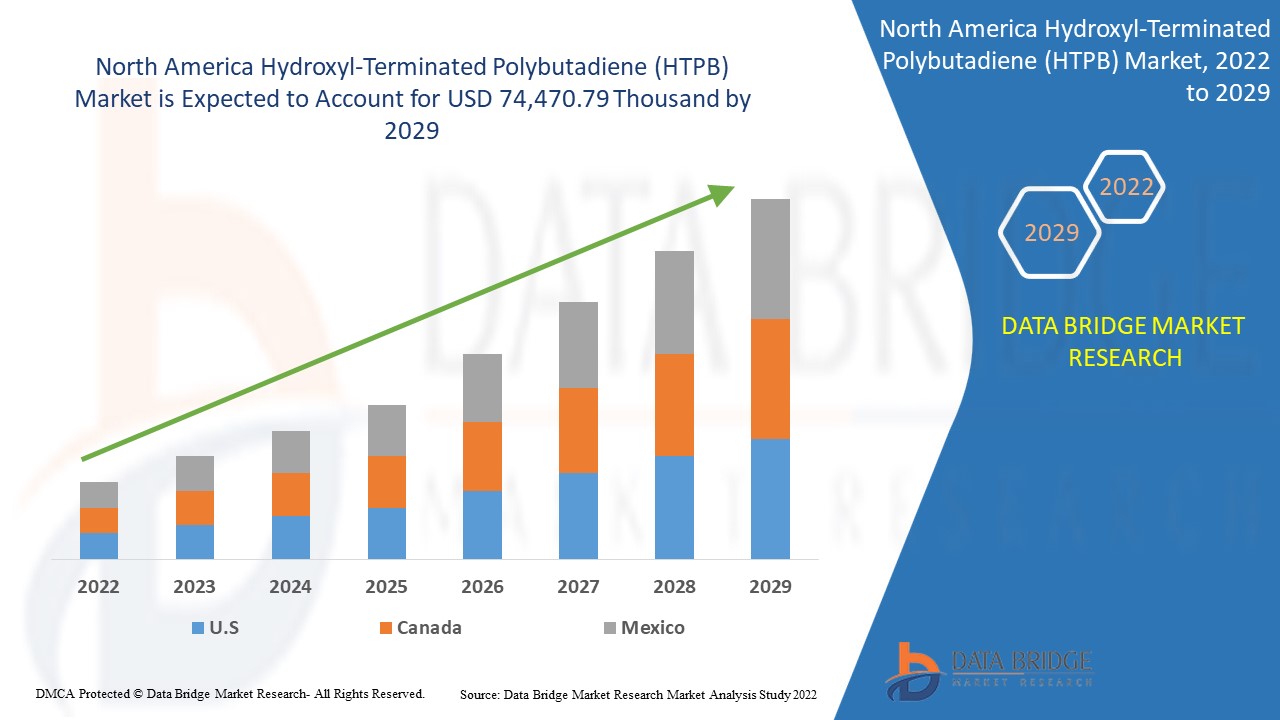

North America Hydroxyl-Terminated Polybutadiene (HTPB) market size was valued at USD 53.56 million in 2024 and is projected to reach USD 83.35 million by 2032, with a CAGR of 5.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Hydroxyl-Terminated Polybutadiene (HTPB) Market Trends

“Gaining Popularity of Hydroxyl-Terminated Polybutadiene (HTPB) In the Automotive Industry”

The North American Hydroxyl-Terminated Polybutadiene (HTPB) market is experiencing a notable surge in demand driven primarily by the increasing adoption of HTPB across the automotive industry. This specialized liquid rubber offers several performance advantages that align closely with the evolving needs of automotive manufacturers, including durability, high flexibility, and low-temperature stability.

HTPB’s unique properties make it an ideal component in the formulation of polyurethane adhesives, sealants, and elastomers used extensively within the automotive sector. As vehicle manufacturers continue to prioritize lighter weight, improved fuel efficiency, and enhanced durability in their designs, HTPB's capacity to reduce weight without compromising strength makes it particularly attractive. Its ability to adhere to a range of materials, including metals, plastics, and composites, further drives its usage in automotive assembly processes. Moreover, the rising demand for Electric Vehicles (EVs) in North America is further boosting the growth of HTPB usage. HTPB's compatibility with advanced EV battery components, thanks to its heat resistance and insulating properties, contributes to safer and longer-lasting battery systems. As automakers strive to innovate in EV design and safety, HTPB’s properties make it a key enabler of high-performance solutions, reinforcing market demand.

Sustainability considerations also bolster HTPB's appeal. Given the industry’s shift towards sustainable practices and materials, HTPB’s low environmental impact in comparison to traditional materials makes it a favored choice for eco-conscious automotive projects. This trend aligns well with regulatory measures and consumer preferences pushing for greener vehicles, further contributing to HTPB’s market penetration.

Report Scope and Hydroxyl-Terminated Polybutadiene (HTPB) Market Segmentation

|

Attributes |

Hydroxyl-Terminated Polybutadiene (HTPB) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Evonik Industries AG (Germany), Idemitsu Kosan Co., Ltd. (Japan), NIPPON SODA CO., LTD. (Japan), Resin Solutions, LLC (U.S.), Island Pyrochemical Industries (IPI) (U.S.), Polymer Source. Inc. (Canada), and CRS Chemicals (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

하이드록실 말단 폴리부타디엔(HTPB) 시장 정의

히드록실 말단 폴리부타디엔(HTPB)은 사슬 끝에 반응성 히드록실(-OH) 그룹이 있는 액체 텔레켈릭 폴리머입니다. 다양한 이소시아네이트로 경화되거나 가교되어 고체 폴리머, 엘라스토머 또는 고무 재료를 형성할 수 있는 다재다능한 프리폴리머 역할을 합니다. HTPB는 뛰어난 기계적 특성, 저온 유연성, 소수성 및 내화학성을 나타내어 항공우주, 접착제, 실란트 및 엘라스토머 응용 분야에서 널리 사용됩니다. 방위 산업에서 복합 추진제 및 폭발물의 바인더 역할을 하여 기계적 무결성과 성능을 향상시킵니다. 조정 가능한 특성과 다양한 제형 요구 사항과의 호환성으로 인해 가치가 있습니다.

하이드록실 말단 폴리부타디엔(HTPB) 시장 동향

운전자

- 혁신적인 항공우주 부품에 대한 수요 증가

지난 10년 동안 항공 여객 교통량이 급격히 증가했고 상품 수출입도 증가했으며, 이는 항공우주 부품에 대한 수요를 견인할 것으로 예상됩니다. 대부분의 항공우주 부품 제조업체는 조직 전체에 걸쳐 현대화 투자를 통해 최대한의 유연성을 확보하기 위해 운영을 조정하기로 결정했습니다. 이러한 이니셔티브에는 구성 요소를 제조하는 동안 대규모로 하이드록실 말단 폴리부타디엔을 적용하는 간단한 프로세스와 제품 설계가 포함될 수 있습니다.

항공우주 부품은 일반적으로 히드록실 말단 폴리부타디엔, 티타늄 합금, 니켈 기반 초합금 및 기타 세라믹을 포함한 고급 소재로 만들어집니다. 항공기 제조업체는 재료 과학의 발전으로 인해 상당한 혜택을 얻었습니다. 따라서 항공우주 기술에 사용되는 히드록실 말단 폴리부타디엔은 항공기 날개의 효율성을 개선하고 항공기를 더 가볍고 연료 효율적으로 만듭니다.

예를 들어,

산업 전망 보고서 2021에 따르면, 안보 위협이 증가함에 따라 북대서양 조약 기구(NATO) 국가의 감시 항공기 및 전투기용 항공우주 부품 수요가 증가하고 있습니다.

- 고체 로켓 추진제에서의 하이드록실 말단 폴리부타디엔(HTPB)의 사용

최근 들어, 우주 역량 강화에 대한 정부의 적극적인 참여와 관심이 커지면서 하이드록실 말단 폴리부타디엔에 대한 수요가 증가했습니다. 게다가, 통신 목적으로 위성 발사가 증가하는 것과 더불어, 일부 지역에서는 우주 기관, 연구 센터, 심지어 민간 기업에서도 무인 우주선을 발사하기 위한 노력과 이니셔티브가 증가하면서 하이드록실 말단 폴리부타디엔에 대한 수요도 증가했습니다. 따라서 글로벌 항공우주 산업의 성장은 하이드록실 말단 폴리부타디엔(HTPB) 시장의 성장에 직접적인 영향을 미칩니다.

하이드록실 말단 폴리부타디엔(HTPB)은 고체 로켓 추진제(SRP)에 널리 사용됩니다. 중요한 기계적 및 탄도적 특성을 지닌 필수 추진제입니다. 이 소재는 로켓 모터에서 복합 추진제의 라이너 및 바인더로 사용됩니다. HTPB는 추진제 구성 및 로켓 모터의 라이너 코팅에 적용됩니다.

예를 들어,

2023년 11월, 상하이 Theorem Chemical Technology Co., Ltd. 웹사이트에 게재된 기사에 따르면, 하이드록실 말단 폴리부타디엔(HTPB)은 로켓 추진제에서 중요한 역할을 하며 향상된 안전성과 고성능을 제공합니다. HTPB 기반 추진제는 충격과 충격에 덜 민감하여 취급 안전성을 개선합니다. 이들은 뛰어난 탄성과 기계적 강도를 나타내며 연소 중 고압과 가속을 견딥니다. 높은 비추력은 더 큰 추력과 효율성을 보장하므로 HTPB는 항공우주 추진에 이상적인 선택입니다.

기회

- 신흥 국가를 위한 정부 이니셔티브의 증가

북미 하이드록실 말단 폴리부타디엔(HTPB) 시장은 이 지역 전체의 인프라 및 건설 부문의 성장으로 상당한 혜택을 볼 수 있습니다. 인프라 업그레이드, 신규 건설 프로젝트 및 친환경 건물 이니셔티브에 상당한 투자가 집중됨에 따라 HTPB는 구조적 성능과 수명을 향상시키는 고유한 특성으로 인해 매력적인 기회를 제공합니다.

HTPB 기반 접착제, 실런트 및 코팅은 높은 유연성, 내구성 및 습기, 화학 물질 및 극한 온도 와 같은 환경 요인에 대한 저항성을 제공하여 현대 건설에서 중요한 역할을 합니다 . 이러한 특성으로 인해 HTPB는 조인트 밀봉, 중요한 구조적 구성 요소 접합 및 혹독한 조건에 노출된 표면 코팅에 선호되는 선택이 되었습니다. 교량, 고속도로 및 건물을 포함한 인프라 프로젝트가 내구성과 유지 관리 비용 절감을 우선시함에 따라 HTPB 솔루션에 대한 수요가 급증할 것으로 예상됩니다.

예를 들어,

2023년 2월, 미국 교통부가 발표한 기사에 따르면, 미국 정부의 인프라에 대한 1조 2,000억 달러 투자에는 도로, 교량, 대중교통, 수자원 시스템, 광대역에 대한 자금이 포함됩니다. 이러한 자본 유입은 극한의 조건을 견뎌내고 장기적 내구성을 제공할 수 있는 고급 건축 자재에 대한 수요를 촉진합니다. HTPB 기반 코팅 및 실런트는 교량 유지 관리 프로젝트에서 부식을 방지하고 수명을 연장하는 데 사용되어 중요한 인프라 업그레이드에서 그 가치를 보여줍니다.

제약/도전

- 하이드록실 말단 폴리부타디엔(HTPB)의 높은 변형률 속도 및 충격 특성

하이드록실 말단 폴리부타디엔(HTPB)은 폴리머 본딩 폭발물(PBX) 및 고체 로켓 추진제에서 널리 사용되는 폴리머 바인더입니다. 소량으로 사용하더라도 이 탄성 바인더는 충격 에너지의 대부분을 흡수합니다. 따라서 PBX가 큰 변형률과 변형률 속도에 노출될 때의 반응을 정확하게 시뮬레이션하기 위해 기계적 거동을 신중하게 모델링해야 합니다.

최근 몇 년 동안 고변형률 실험 및 모델링 분야가 크게 확장되어 고속 진단이 증가했습니다. HTPB의 정상 응답은 단축 응력 및 단축 변형 하중 하에서 특성화되었지만, HTPB의 큰 압력 및 큰 전단 변형률 하에서 전단 강도 측정은 지금까지 이루어지지 않았습니다. 이러한 측정은 국소화를 모델링하는 데 중요하여 PBX의 고장과 핫스팟 형성의 정확한 예측으로 이어집니다.

- 대체 제품의 존재

북미 하이드록실 말단 폴리부타디엔(HTPB) 시장은 대체 제품의 존재로 인해 점점 더 큰 어려움에 직면하고 있으며, 이는 상당한 경쟁을 야기하고 HTPB 시장 성장을 제한할 위협이 됩니다. 에폭시, 실리콘, 폴리우레탄과 같은 대체 소재는 자동차, 항공우주, 가전제품을 포함하여 전통적으로 HTPB에 의존해 온 산업에서 널리 사용됩니다. 이러한 대체 소재는 높은 기계적 강도, 내열성, 사용자 정의 가능성과 같은 매력적인 이점을 제공하여 시장 분열을 촉진합니다.

지속 가능하고 친환경적인 소재에 대한 강조가 커지면서 HTPB에도 과제가 제기됩니다. 일부 대체 제품은 탄소 발자국이 낮거나 재활용성이 향상되어 산업이 보다 친환경적인 관행으로 전환함에 따라 매력적인 옵션이 되었습니다. 이러한 초점의 변화로 인해 HTPB 생산자는 종종 더 높은 비용으로 진화하는 환경 표준에 혁신하고 적응해야 합니다.

예를 들어,

2023년 8월, Performance Plastics LTD에서 발행한 기사에 따르면 에폭시는 우수한 접착력과 구조적 특성을 제공하여 항공우주 산업에서 중요한 역할을 합니다. 이러한 고성능 수지는 복합 재료를 결합하여 뛰어난 기계적 강도, 열 안정성 및 극한 온도 및 화학 물질 노출과 같은 혹독한 조건에 대한 저항성을 제공합니다.

이 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

원자재 부족 및 운송 지연의 영향 및 현재 시장 시나리오

Data Bridge Market Research는 시장에 대한 고수준 분석을 제공하고 원자재 부족과 운송 지연의 영향과 현재 시장 환경을 고려하여 정보를 제공합니다. 이는 전략적 가능성을 평가하고, 효과적인 행동 계획을 수립하고, 기업이 중요한 결정을 내리는 데 도움을 주는 것으로 해석됩니다.

표준 보고서 외에도 예상 배송 지연 등의 조달 수준에 대한 심층 분석, 지역별 유통업체 매핑, 상품 분석, 생산 분석, 가격 매핑 추세, 소싱, 카테고리 성과 분석, 공급망 위험 관리 솔루션, 고급 벤치마킹 및 조달 및 전략적 지원을 위한 기타 서비스를 제공합니다.

경제 침체가 제품 가격 및 가용성에 미치는 영향 예상

경제 활동이 둔화되면 산업이 어려움을 겪기 시작합니다. 경기 침체가 제품의 가격 책정 및 접근성에 미치는 예상 효과는 DBMR에서 제공하는 시장 통찰력 보고서 및 인텔리전스 서비스에서 고려됩니다. 이를 통해 고객은 일반적으로 경쟁사보다 한 발 앞서 나가고, 매출과 수익을 예측하고, 손익 지출을 추정할 수 있습니다.

하이드록실 말단 폴리부타디엔(HTPB) 시장 범위

시장은 제품, 응용 프로그램 및 최종 용도를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

응용 프로그램

- 로켓연료

- 폴리우레탄

- 응용 프로그램으로

- 접착제 및 실런트

- 멤브레인

- 표면 코팅

- 포팅 및 캡슐화

- 기타

- 응용 프로그램으로

- 페인트

- 고무 소재

- 기타

최종 사용

- 항공우주 및 방위

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

- 자동차

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

- 건물 및 건설

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

- 전기 및 전자

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

- 포장

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

- 기타

- 제품별로

- 저분자량 히드록실 말단 폴리부타디엔

- 기존의 히드록실 말단 폴리부타디엔

- 제품별로

하이드록실 말단 폴리부타디엔(HTPB) 시장 지역 분석

시장을 분석하고, 위에 언급된 대로 제품, 응용 분야, 최종 용도에 대한 시장 규모 통찰력과 추세를 제공합니다.

이 시장에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 항공우주 및 방위 응용 분야에서 선도적인 국가이기 때문에 시장을 지배할 것으로 예상됩니다. HTPB는 고체 로켓 추진제와 미사일 및 우주 발사체와 같은 기타 고급 응용 분야에서 널리 사용됩니다. 이러한 분야에 대한 정부의 지속적인 투자는 HTPB에 대한 강력한 수요를 제공합니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 트렌드 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

하이드록실 말단 폴리부타디엔(HTPB) 시장 점유율

시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 시장과 관련된 회사의 초점에만 관련이 있습니다.

시장에서 운영되는 하이드록실 말단 폴리부타디엔(HTPB) 시장 리더는 다음과 같습니다.

- Evonik Industries AG(독일)

- Idemitsu Kosan Co., Ltd.(일본)

- NIPPON SODA 주식회사(일본)

- 레진 솔루션, LLC (미국)

- Island Pyrochemical Industries (IPI) (미국)

- Polymer Source. Inc. (캐나다)

- CRS 케미컬(미국)

하이드록실 말단 폴리부타디엔(HTPB) 시장의 최신 동향

- 2024년 1월, Evonik Industries AG는 독일 Marl 공장의 Hydroxyl-Terminated Polybutadienes(HTPB) 생산 용량을 50% 확대했습니다. 이 개발은 항공우주 및 특수 접착제와 같은 산업에서 증가하는 HTPB에 대한 글로벌 수요를 충족하는 것을 목표로 합니다. 확대된 용량은 공급 안정성을 높이고 Evonik을 이 부문의 선도적 공급업체로 더욱 확립할 것으로 기대됩니다.

- 2024년 2월, Resin Solutions, LLC는 TotalEnergies로부터 폴리부타디엔 수지 제품군 인수를 완료했습니다. 이 전략적 인수는 역량을 확장하고 접착제 및 코팅 시장에서의 입지를 강화합니다. 이 움직임은 포트폴리오를 개선하고 고객에게 혁신적인 솔루션을 제공하려는 지속적인 노력과 일치합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 VENDOR SELECTION CRITERIA

4.4.1 PRODUCT QUALITY AND CONSISTENCY

4.4.2 TECHNICAL EXPERTISE AND CUSTOMIZATION CAPABILITIES

4.4.3 SUPPLY CHAIN RELIABILITY AND LEAD TIMES

4.4.4 COST COMPETITIVENESS AND VALUE PROPOSITION

4.4.5 SUSTAINABILITY AND ENVIRONMENTAL CONSIDERATIONS

4.4.6 REGULATORY COMPLIANCE AND CERTIFICATIONS

4.4.7 CUSTOMER SERVICE AND AFTER-SALES SUPPORT

4.4.8 INNOVATION AND MARKET LEADERSHIP

4.4.9 CONCLUSION

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST’S RECOMMENDATIONS

4.6 HTPB AND ITS PROCUREMENT BY DEPARTMENT OF DEFENSE (DOD)

4.6.1 DEPARTMENT OF DEFENSE PROCUREMENT IN THE HTPB MARKET

4.6.1.1 MISSILE DEFENSE SYSTEMS

4.6.1.2 TACTICAL AND THEATER MISSILES

4.6.1.3 HYPERSONIC AND ADVANCED WEAPONS DEVELOPMENT

4.6.2 ROLE AND OPERATIONS OF RESIN SOLUTIONS (FORMERLY CRAY VALLEY)

4.6.3 HTPB MARKET DYNAMICS AND SUPPLY CHAIN

4.6.4 MARKET TRENDS AND FUTURE OUTLOOK

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9.1 ENHANCED POLYMERIZATION TECHNIQUES

4.9.2 CUSTOMIZED PROPERTIES FOR SPECIALIZED APPLICATIONS

4.9.3 SUSTAINABILITY AND GREEN CHEMISTRY

4.9.4 IMPROVED MANUFACTURING EFFICIENCY AND AUTOMATION

4.9.5 ADVANCES IN PRODUCT TESTING AND QUALITY CONTROL

4.9.6 CONCLUSION

5 REGULATION COVERAGE

5.1 U.S. REGULATIONS

5.2 CANADIAN REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR INNOVATIVE AEROSPACE COMPONENTS

6.1.2 GAINING POPULARITY OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN THE AUTOMOTIVE INDUSTRY

6.1.3 USE OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) IN SOLID ROCKET PROPELLANT

6.1.4 POSITIVE OUTLOOK TOWARD CONSUMER ELECTRONIC GOODS

6.2 RESTRAINTS

6.2.1 HIGH STRAIN RATE AND SHOCK PROPERTIES OF HYDROXYL-TERMINATED POLYBUTADIENE (HTPB)

6.2.2 HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) GRAIN CAN NOT BE RESHAPED, REUSED, OR RECYCLED

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL PROGRESS IN PROPELLANTS USING HYDROXYL-TERMINATED POLYBUTADIENE

6.3.2 RISING GOVERNMENT INITIATIVES FOR EMERGING NATIONS

6.4 CHALLENGES

6.4.1 DIFFICULTIES IN HANDLING THE RESINS

6.4.2 PRESENCE OF SUBSTITUTE PRODUCTS

7 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT

7.1 OVERVIEW

7.1.1 OW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES

7.1.2 CONVENTIONAL HYDROXYL TERMINATED POLYBUTADIENES

8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ROCKET FUEL

8.3 POLYURETHANE

8.3.1 POLYURETHANE, BY APPLICATION

8.4 PAINT

8.5 RUBBER MATERIAL

8.6 OTHERS

9 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE

9.1 OVERVIEW

9.2 AEROSPACE & DEFENSE

9.2.1 AEROSPACE & DEFENSE, BY PRODUCT

9.3 AUTOMOTIVE

9.3.1 AUTOMOTIVE, BY PRODUCT

9.4 BUILDING & CONSTRUCTION

9.4.1 BUILDING & CONSTRUCTION, BY PRODUCT

9.5 ELECTRICAL & ELECTRONICS

9.5.1 ELECTRICAL & ELECTRONICS, BY PRODUCT

9.6 PACKAGING

9.6.1 PACKAGING, BY PRODUCT

9.7 OTHERS

9.7.1 OTHERS, BY PRODUCT

10 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 EVONIK INDUSTRIES AG

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 IDEMITSU KOSAN CO., LTD.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 NIPPON SODA CO., LTD.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATE

13.4 RESIN SOLUTIONS, LLC

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATES

13.5 ISLAND PYROCHEMICAL INDUSTRIES (IPI)

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATE

13.6 CRS CHEMICALS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATE

13.7 POLYMER SOURCE. INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATE

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 RAW MATERIAL PRODUCTION COVERAGE

TABLE 2 REGULATIONS ACROSS VARIOUS REGIONS AND COUNTRIES

TABLE 3 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 5 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (PRICE (USD/KG)

TABLE 6 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE MARKET, PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 17 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 19 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 28 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 29 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 30 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 CANADA POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 CANADA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 33 CANADA AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 CANADA AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 35 CANADA BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 36 CANADA ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 37 CANADA PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 CANADA OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (KILO TONS)

TABLE 41 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO POLYURETHANE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 44 MEXICO AEROSPACE & DEFENSE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO AUTOMOTIVE IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO BUILDING & CONSTRUCTION IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO ELECTRICAL & ELECTRONICS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO PACKAGING IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO OTHERS IN HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

FIGURE 2 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: REGIONAL VS COUNTRIES MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET, BY PRODUCT (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING DEMAND FOR INNOVATIVE AEROSPACE COMPONENTS IS EXPECTED TO DRIVE THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN THE FORECAST PERIOD

FIGURE 16 THE LOW MOLECULAR WEIGHT HYDROXYL TERMINATED POLYBUTADIENES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR THE NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET

FIGURE 20 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY PRODUCT, 2024

FIGURE 21 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY APPLICATION, 2024

FIGURE 22 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: BY END USE, 2024

FIGURE 23 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: SNAPSHOT (2024)

FIGURE 24 NORTH AMERICA HYDROXYL-TERMINATED POLYBUTADIENE (HTPB) MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.