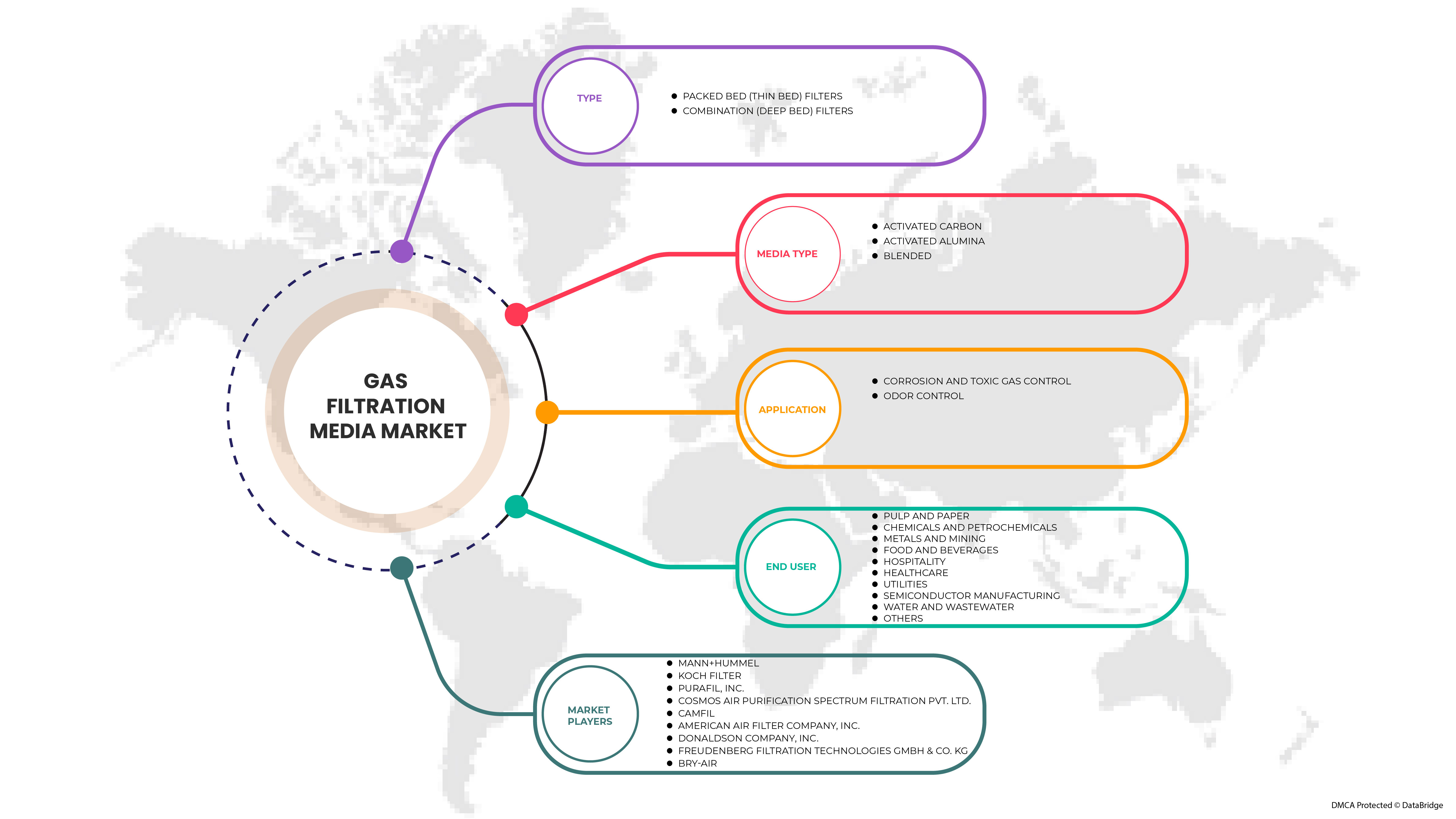

North America Gas Filtration MediaMarket, By Type (Packed Bed (Thin Bed) Filters, and Combination (Deep Bed) Filters), Media Type (Activated Carbon, Activated Alumina, and Blended), Application (Corrosion And Toxic Gas Control, and Odor Control), End User (Pulp And Paper, Chemicals And Petrochemicals, Metals And Mining, Food And Beverages, Hospitality, Healthcare, Utilities, Semiconductor Manufacturing, Water And Wastewater, and Others) Industry Trends and Forecast to 2029.

North America Gas Filtration Media Market Analysis and Insights

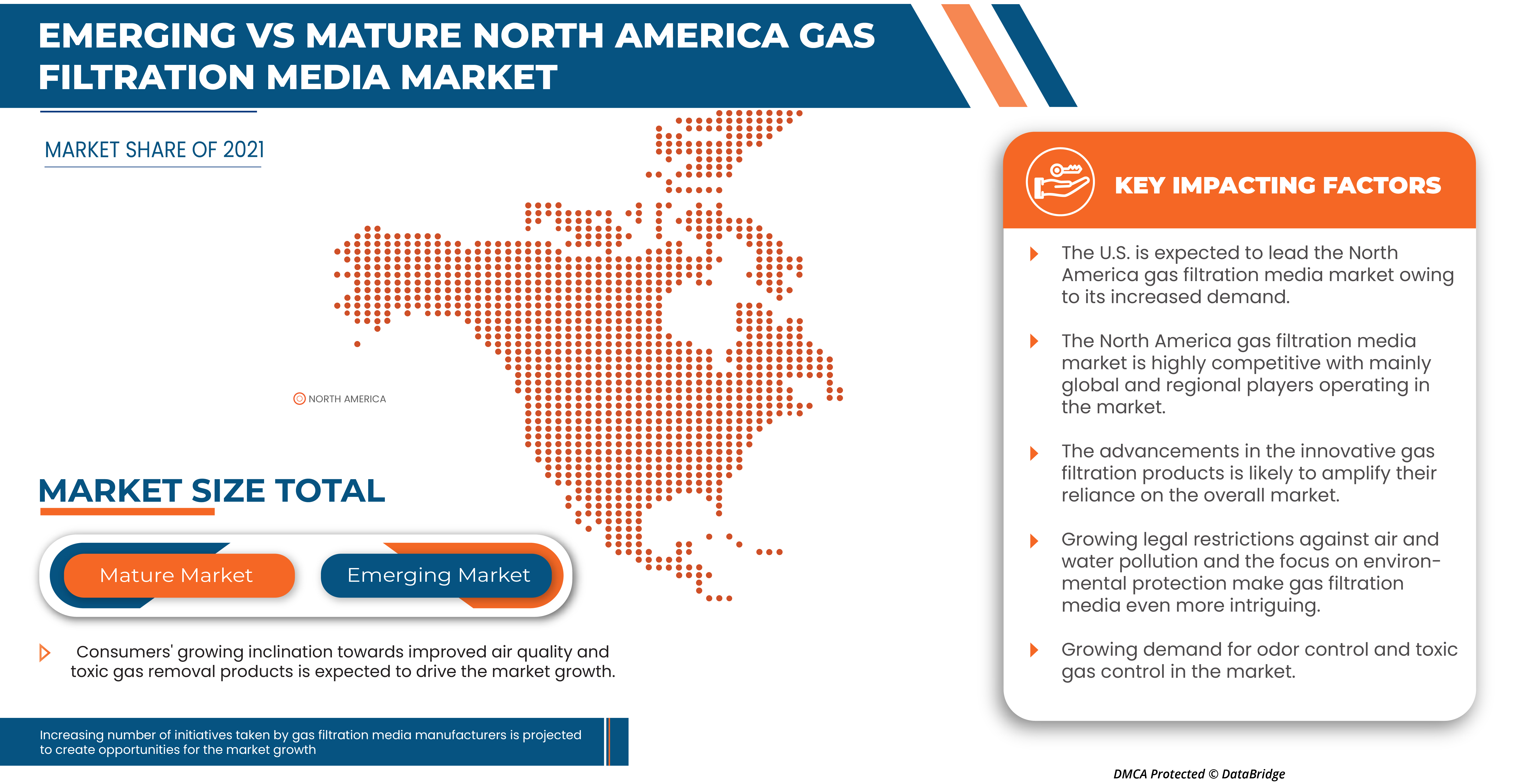

The North America gas filtration media market is gaining significant growth due to the number of harmful effects associated with impure air, and toxic gases have increased the demand for gas filtration media in the region. In addition, consumers' growing inclination, especially after COVID-19, toward air filtration products to stay healthy and avoid medical conditions. Furthermore, the growing legal restrictions against air and water pollution in the North America region and the increased focus on environmental protection make gas filtration media even more intriguing. Thus, this will help the market grow in the coming years.

Therefore, the rising standards and regulations laid by governmental bodies must be followed by the manufacturer to sell their products into the market and ensure consumer demands will boost the market's growth. The lack of technical expertise in small enterprises is likely to restrict the market growth in the region.

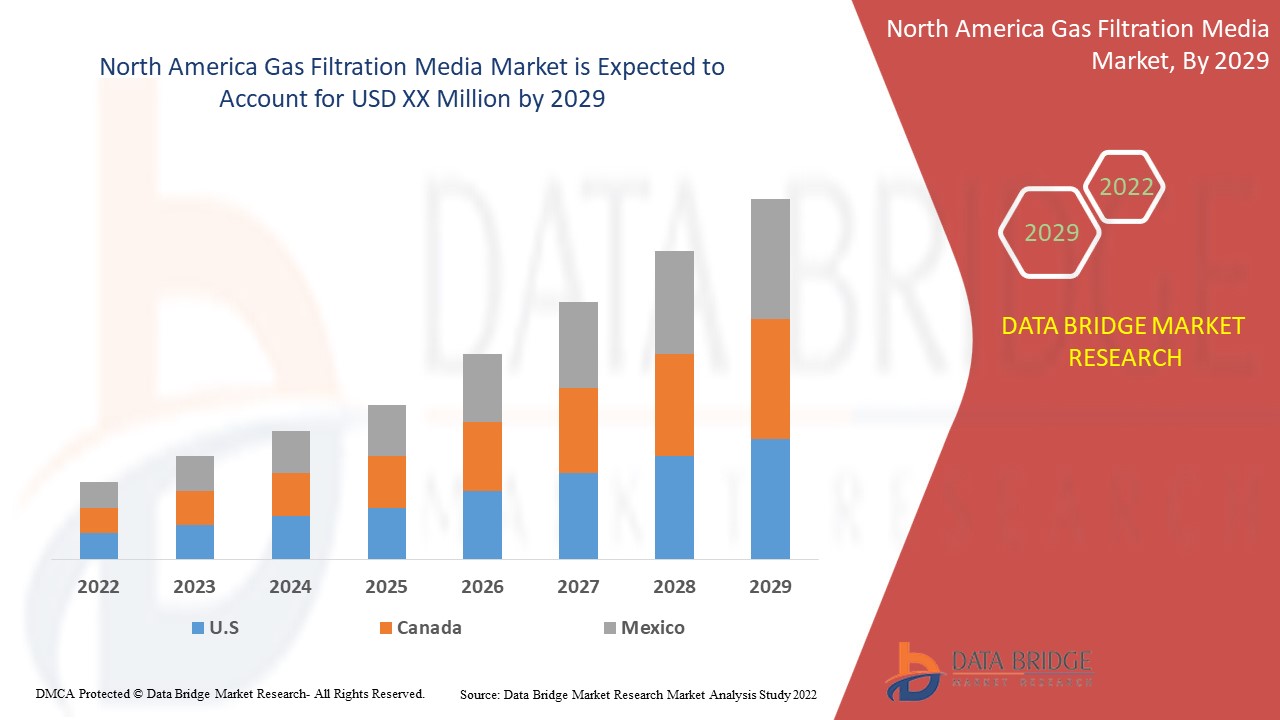

Data Bridge Market Research analyses that the North America gas filtration media market will grow at a CAGR of 5.3% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Billion, Pricing in USD |

|

Segments Covered |

By Type (Packed Bed (Thin Bed) Filters, and Combination (Deep Bed) Filters), Media Type (Activated Carbon, Activated Alumina, and Blended), Application (Corrosion And Toxic Gas Control, and Odor Control), End User (Pulp And Paper, Chemicals And Petrochemicals, Metals And Mining, Food And Beverages, Hospitality, Healthcare, Utilities, Semiconductor Manufacturing, Water And Wastewater, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico. |

|

Market Players Covered |

Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, among others. |

Market Definition

Gas-phase filtration media are those that are used in the process of removing pollutants and impurities from the air using chemical agents and specialized filter media. More specifically, sodium permanganates or activated carbon, highly preferred by a vast base of consumers, make up filter media in most cases. Typically, sorbent materials, also known as gas-phase filtering systems, are used to absorb chemical contaminants and remove them from indoor air accurately. Packed beds and combination filters are the most common products to stop air contamination. Additionally, it aids in the removal of industrial waste, and hazardous toxic gaseous pollutants are discharged into the environment, harming the air quality and endangering human health. Gas phase filtering is becoming increasingly important to increase the effectiveness of lowering aberrant gases and regulating odors in industrial applications.

North America Gas Filtration Media Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing awareness toward the impact of both indoor and outdoor air quality

A tremendous number of resources (such as electricity, water, and food) are needed in society to sustain human activities, given the growing population expansion and the economy's rapid development. Various forms of pollution have been created as a result. Due to its pervasive nature, the harm it causes to the environment, and the health risks it poses to people, air pollution is one of the many pollution issues that has generated significant concern around the globe. The chemicals and contaminants in the air that make it dirty can have a negative impact on health. People are becoming more aware of the importance of indoor and outdoor air quality to avoid these health concerns.

For instance,

- In May 2021, the National Library of Medicine published an article on "Outdoor Air Quality Awareness, Perceptions, and Behaviors among U.S. Children Aged 12–17 Years, 2015–2018". It concluded that the awareness about air quality is increasing gradually

Raising public awareness of air quality issues is essential for maintaining a sustainable lifestyle at the forefront of people's thoughts and also presents a chance to inform and inspire people to contribute to the preservation of nature. An important tool for bringing about change is education.

Thus, the rising awareness about the significance of indoor and outdoor air quality among people is expected to drive the market's growth.

- Shifting inclination toward air quality trends

Clean air can reduce the risk of lung cancer, heart disease, stroke, and acute and chronic respiratory disorders such as asthma. Lower air pollution levels improve both long- and short-term heart and respiratory health. People are becoming more aware of the significance of pure air, which is reflected in trends in air quality. Consequently, individuals are drawn to trends in air quality.

Global air pollution has significantly changed as a result of lockdown measures taken to contain the COVID-19 epidemic. Globally, air quality has improved as a result of the COVID-19 (SARS-CoV-2) pandemic-related statewide lockdown in various nations. Reduced vehicle traffic and industrial and construction activity contributed to a decrease in exhaust, and non-exhaust emissions, primarily suspended dust. Therefore, this benefit to air quality during lockdown makes individuals more conscious of air quality trends.

For instance,

- In June 2022, U.S. environmental protection agency released a report on "National Air Quality: Status and Trends of Key Air Pollutants." It mentioned that air pollution emissions still have a big impact on a lot of problems with air quality

Thus this shifting inclination towards air quality trends is expected to act as a driver of the market's growth.

Opportunity

-

Environment concerns leading to more stringent regulations for clean air and water

The government has implemented stringent regulations to control rising environmental pollution and global warming. Excessive exposure to nitrogen oxide and sulfur dioxide can aggravate or cause the development of asthma and respiratory illnesses. The two substances also help to create acid rain, which harms the ecosystem by decreasing the release of carbon dioxide (CO2), sulfur oxides, nitrogen oxides, and particulate matter into the atmosphere. Automotive emission rules are being introduced worldwide. The gas phase filters can remove gaseous contaminants and volatile organic carbons from the air. The quest for more eco-friendly energy is another factor driving the filtration market. Furthermore, growing concerns regarding environmental pollution and its toxic effect on human health are expected to drive the market's growth. Moreover, the government passing strict rules for the emission of gases into the environment and promoting filtration equipment's use in industries and households is propelling market growth.

For instance,

-

In November 2021, according to Auto Express, in mass-produced petrol and diesel cars, the Euro 6 emissions standard seeks to lower levels of harmful exhaust emissions from cars and vans

-

In January 2020, according to European Commission, in response to growing environmental concerns, including those caused partly by harmful emissions from ships, the International Maritime Organization (IMO) will enforce a new global sulfur cap on fuel composition of 0.5 percent from the current 3.5 percent

-

In January 2022, according to the United States Pharmacopeial Convention, the requirements include regular particle monitoring and measurements to guarantee that locations with the greatest potential for risk satisfy air cleanliness standards. USP 797 establishes guidelines to prevent patient damage from contaminated or incorrectly manufactured compounded sterile preparations (CSPs)

Thus, the use of gas filtration media for air purification and modern research and developments in technology are anticipated to provide lucrative opportunities for the North America gas filtration media market.

Restraints/Challenges

- Fluctuating prices

The high costs of filtration products are due to high R&D costs, production, and manufacturing costs. The increased price burden impacts consumers' preferences as they choose substitutes for air- filtration due to difficulties affording gas filtration solutions. The high prices may challenge the manufacturers to balance their costs for R&D, production, investments, and others. In addition, consumers always shift towards products with low costs and more benefits. Russia's invasion of Ukraine has added to market disruption, and weather and supply-chain problems have complicated delivery in some markets. The high prices of raw materials are challenging in the North America gas filtration media market.

For instance,

- In December 2021, Freudenberg Performance Materials increased its prices for non-woven performance materials for filtration applications. The prices are increased of filtration applications by double-digit depending on product types

- In April 2020, Universal Air Filter (UAF) announced a price hike for customers in all categories. Prices for the majority of UAF products hiked globally between 11 and 15 percent, depending on the complexity and product specifications

Thus, the high prices of filtration media may incline consumers toward other products, which may affect the market and, thus, may challenge the market growth. However, nowadays, consumers are aware of the wide range of activities and the effect of gas filtration media on controlling toxic gases and odors and purchasing them despite the high prices.

Post-COVID-19 Impact on North America Gas Filtration Media Market

Post the pandemic, the demand for gas filtration media has increased as there won't be any more restrictions on movement, so the supply of products would be easy. In addition, the growing trend of using air and water filtration products may propel the market's growth.

The increased demand for gas filtration media enables manufacturers to launch innovative and multifunctional products, which ultimately increases the demand for gas filtration media and has helped the market grow.

Moreover, the high demand for gas filtration media products will drive the market's growth. Furthermore, the demand for products that can purify the air and remove toxic gases after the COVID-19 pandemic has increased as consumers were more concerned about their health, resulting in market growth. Additionally, consumers' interest in new technologies and multipurpose products is expected to fuel the growth of the North America gas filtration media market.

Recent Developments

- In December 2021, Camfil announced plans to start a new manufacturing facility in Texas. The new facility will produce a full range of air filtration products.

- In October 2021, Freudenberg Filtration Technologies announced opening of a new manufacturing facility in China. The new worldwide R&D and manufacturing base will make air purifier filters and other products.

North America Gas Filtration Media Market Scope

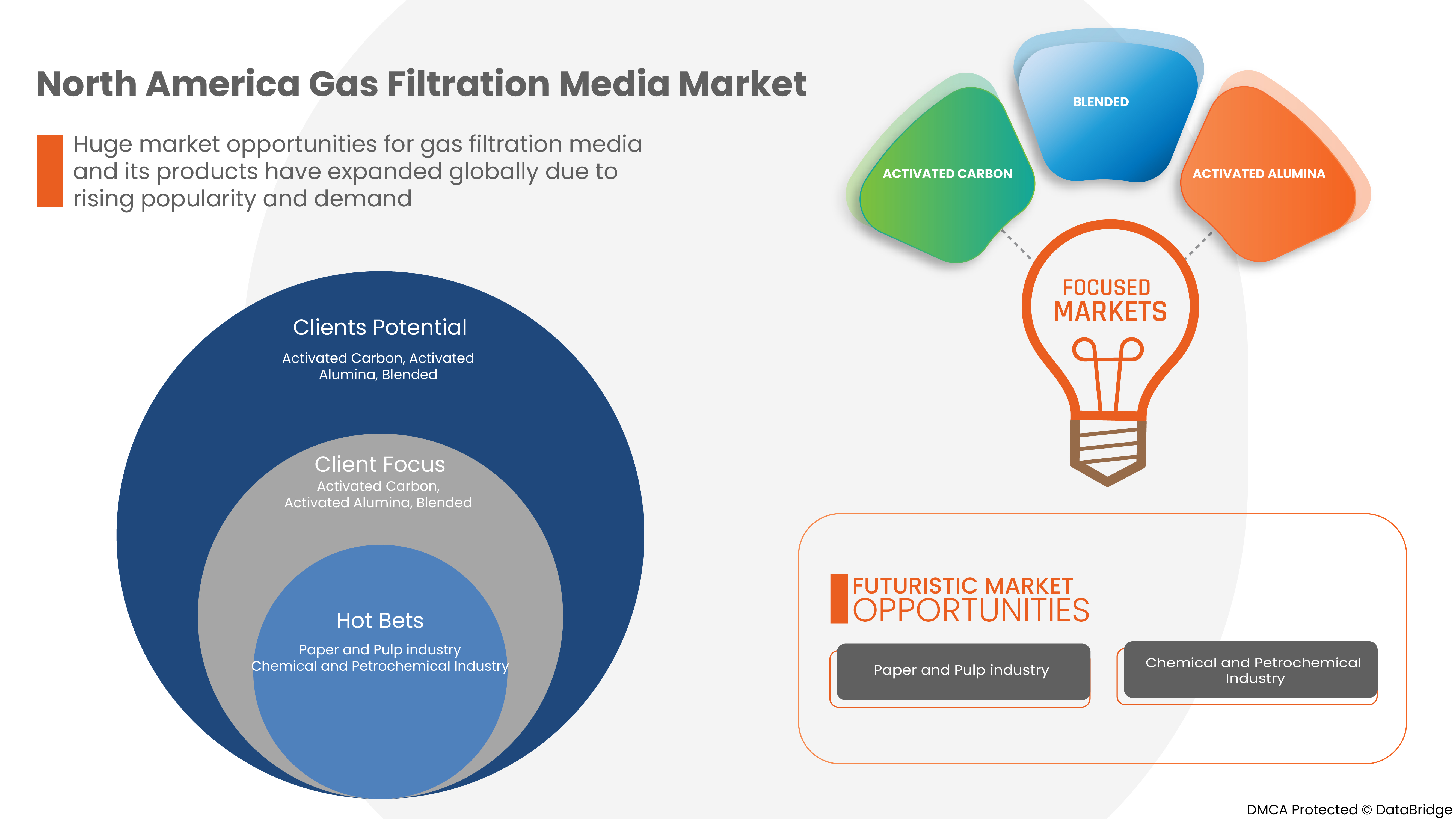

The North America gas filtration media market is segmented by type, media type, application, and end user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Packed Bed (Thin Bed) Filters

- Combination (Deep Bed) Filters

On the basis of type, the North America gas filtration media market is segmented into packed bed (thin bed) filters, and combination (deep bed) filters.

Media Type

- Activated Carbon

- Activated Alumina

- Blended

On the basis of media type, the North America gas filtration media market is segmented into activated carbon, activated alumina, and blended.

Application

- Corrosion And Toxic Gas Control

- Odor Control

On the basis of application, the North America gas filtration media market is segmented into corrosion and toxic gas control, and odor control.

End User

- Pulp And Paper

- Chemicals And Petrochemicals

- Metals And Mining

- Food And Beverages

- Hospitality

- Healthcare

- Utilities

- Semiconductor Manufacturing

- Water And Wastewater

- Others

On the basis of end user, the North America gas filtration media market is segmented into pulp and paper, chemicals and petrochemicals, metals and mining, food and beverages, hospitality, healthcare, utilities, semiconductor manufacturing, water and wastewater, and others.

North America Gas Filtration Media Market Regional Analysis/Insights

The North America gas filtration media market is analyzed, and market size insights and trends are provided based on country, type, media type, application, and end user, as referenced above.

Some countries covered in the North America gas filtration market report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America gas filtration media market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to growing health concerns regarding air quality and toxic gas's effect on human health in the North American region.

The region section of the report also provides individual market-impacting factors and changes in regulations that impact the market's current and future trends. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North American brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Gas Filtration Media Market Share Analysis

The North America gas filtration media market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the company’s focus on the North America gas filtration media market.

Some of the major players operating in the North America gas filtration media market are Circul-aire Inc., ProMark Associates, Inc., MANN+HUMMEL, Koch Filter, PURAFIL INC., Cosmos Air Purification, Camfil, American Air Filter Company, Inc., Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Bry-Air, PureAir Filtration, LLC, MAYAIR MANUFACTURING (M) SDN BHD, Molecular Products Group, Delta Adsorbents, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT-EXPORT ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.4 LIST OF KEY BUYERS_NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.5 PRICE ANALYSIS - NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.6 PRODUCTION CONSUMPTION ANALYSIS- NORTH AMERICA GAS FILTRATION MEDIA MARKET

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 RAW MATERIAL PRODUCTION COVERAGE- NORTH AMERICA GAS FILTRATION MEDIA MARKET

5 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING AWARENESS TOWARD THE IMPACT OF BOTH INDOOR AND OUTDOOR AIR QUALITY

7.1.2 SHIFTING INCLINATION TOWARDS AIR QUALITY TRENDS

7.1.3 RISING SPENDING ON FILTRATION OF POISONOUS, CORROSIVE, AND ODOR-PRODUCING GASES IN MANY INDUSTRIES

7.1.4 GROWING HEALTH CONSCIOUSNESS AMONG PEOPLE

7.2 RESTRAINTS

7.2.1 INCREASING DEMAND FOR SUBSTITUTES OF THE GAS FILTERING MEDIA

7.2.2 LIMITED R&D SPENDING

7.3 OPPORTUNITIES

7.3.1 ENVIRONMENT CONCERNS LEADING TO MORE STRINGENT REGULATIONS FOR CLEAN AIR AND WATER

7.3.2 INCREASE IN AWARENESS ABOUT IMPURE AIR QUALITY ON HUMAN HEALTH

7.4 CHALLENGES

7.4.1 FLUCTUATING PRICES

7.4.2 DECREASED ECONOMIC GROWTH IN END USER INDUSTRY

8 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE

8.1 OVERVIEW

8.2 PACKED BED (THIN BED) FILTERS

8.3 COMBINATION (DEEP BED) FILTERS

9 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE

9.1 OVERVIEW

9.2 ACTIVATED CARBON

9.3 ACTIVATED ALUMINA

9.4 BLENDED

10 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CORROSION AND TOXIC GAS

10.3 ODOR CONTROL

11 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END USER

11.1 OVERVIEW

11.2 PULP AND PAPER

11.2.1 PACKED BED (THIN BED) FILTERS

11.2.2 COMBINATION (DEEP BED) FILTERS

11.3 CHEMICALS AND PETROCHEMICALS

11.3.1 PACKED BED (THIN BED) FILTERS

11.3.2 COMBINATION (DEEP BED) FILTERS

11.4 METALS AND MINING

11.4.1 PACKED BED (THIN BED) FILTERS

11.4.2 COMBINATION (DEEP BED) FILTERS

11.5 FOOD AND BEVERAGES

11.5.1 PACKED BED (THIN BED) FILTERS

11.5.2 COMBINATION (DEEP BED) FILTERS

11.6 HOSPITALITY

11.6.1 PACKED BED (THIN BED) FILTERS

11.6.2 COMBINATION (DEEP BED) FILTERS

11.7 HEALTHCARE

11.7.1 PACKED BED (THIN BED) FILTERS

11.7.2 COMBINATION (DEEP BED) FILTERS

11.8 UTILITIES

11.8.1 PACKED BED (THIN BED) FILTERS

11.8.2 COMBINATION (DEEP BED) FILTERS

11.9 SEMICONDUCTOR MANUFACTURING

11.9.1 PACKED BED (THIN BED) FILTERS

11.9.2 COMBINATION (DEEP BED) FILTERS

11.1 WATER AND WASTEWATER

11.10.1 PACKED BED (THIN BED) FILTERS

11.10.2 COMBINATION (DEEP BED) FILTERS

11.11 OTHERS

11.11.1 PACKED BED (THIN BED) FILTERS

11.11.2 COMBINATION (DEEP BED) FILTERS

12 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CAMFIL

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG (2021)

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMERICAN AIR FILTER COMPANY, INC

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DONALDSON COMPANY, INC. (2021)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BRY-AIR

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AQOZA

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BIOCONSERVACION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CIRCUL-AIRE INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 COSMOS AIR PURIFICATION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DELTA ADSORBENTS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 GOPANI

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 KOCH FILTER

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MANN+HUMMEL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MAYAIR MANUFACTURING (M) SDN BHD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MOLECULAR PRODUCTS GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PROMARK ASSOCIATES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PUREAIR FILTRATION, LLC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PURAFIL, INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SPECTRUM FILTRATION PVT. LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 IMPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF ACTIVATED CARBON, 2020-2021, IN USD MILLION

TABLE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA FILTRATION MEDIA MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 U.S. GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 36 U.S. PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CANADA GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CANADA GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 CANADA GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 50 CANADA PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO GAS FILTRATION MEDIA MARKET, BY MEDIA TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO GAS FILTRATION MEDIA MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 MEXICO GAS FILTRATION MEDIA MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 64 MEXICO PULP AND PAPER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO CHEMICALS AND PETROCHEMICALS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO METALS AND MINING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO FOOD AND BEVERAGES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO HOSPITALITY IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HEALTHCARE IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO UTILITIES IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO SEMICONDUCTOR MANUFACTURING IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO WATER AND WASTEWATER IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO OTHERS IN GAS FILTRATION MEDIA MARKET, BY TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GAS FILTRATION MEDIA MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA GAS FILTRATION MEDIA MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GAS FILTRATION MEDIA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GAS FILTRATION MEDIA MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA GAS FILTRATION MEDIA MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SEGMENTATION

FIGURE 10 SHIFTING INCLINATION TOWARD AIR QUALITY TRENDS AMONG PEOPLE IS EXPECTED TO DRIVE THE NORTH AMERICA GAS FILTRATION MEDIA MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 PACKED BEAD (THIN BED) FILTERS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA GAS FILTRATION MEDIA MARKET

FIGURE 13 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE, 2021

FIGURE 14 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY MEDIA TYPE, 2021

FIGURE 15 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY APPLICATION, 2021

FIGURE 16 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY END USER, 2021

FIGURE 17 NORTH AMERICA GAS FILTRATION MEDIA MARKET: SNAPSHOT (2021)

FIGURE 18 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021)

FIGURE 19 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 NORTH AMERICA GAS FILTRATION MEDIA MARKET: BY TYPE (2022-2029)

FIGURE 22 NORTH AMERICA GAS FILTRATION MEDIA MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.