North America Frozen Fruit And Vegetables Mix Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.13 Billion

USD

1.19 Billion

2024

2032

USD

1.13 Billion

USD

1.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 1.19 Billion | |

|

|

|

|

북미 냉동 과일 및 야채 믹스 시장 세분화, 유형별(과일 믹스 및 야채 믹스), 기술(IQF, 급속 냉동, 극저온 냉동, 유동층, 등적 냉동, 기타), 제품 범주(생 냉동, 스팀 블랜칭 후 IQF, 생 IQF, 구운 후 IQF, 구운 후 IQF, 절인 또는 코팅 냉동, 소스가 포함된 냉동 믹스, 삶은 후 냉동, 재수화 후 냉동, 미리 양념한 후 IQF, 기타), 형태(전체, 슬라이스, 다이스, 반으로 자른 것, 퓌레, 다진 것, 으깬 것, 부순 것, 나선형으로 자른 것, 줄리엔으로 자른 것, 으깬 것, 껍질을 벗긴 것, 과립화된 것, 코팅된 것 및 기타), 범주(재래식 및 유기농), 출처(재래식, 수경 재배, 재생 농업 출처, 수직 농장 기반, 생체 역학적 및 기타), 라벨링 및 인증(클린 라벨, 비GMO 검증, 채식주의자용) 글루텐 무함유, 살충제 무함유, 알레르겐 무함유, 코셔, 할랄, 공정 무역 인증 등), 포장 형태(파우치, 진공 밀봉, 1회용 큐브, 대량 기관용 포장, 다중 칸막이 트레이, 박스형 포장, 클럽 매장 대량 포장, 소매용 브릭 포장, 창문이 있는 파우치, 플라스틱 용기), 포장 크기(소매용 포장 크기, 식품 서비스/기관용 포장 크기), 유통 기한(≤6개월, 6-9개월, 9-12개월, 12-15개월, 15-24개월, 24개월), 적용 분야(소매 소비자용, 식품 서비스(HORECA), 밀키트 회사, 식품 서비스 산업, 이유식 제조업체, 영양 보충제 제조업체, 기관용 주방, 소매용 신선 냉동 콤보 팩, 기타), 유통 채널(B2B, B2C(매장 기반, 비매장 기반)), - 2032년까지의 산업 동향 및 예측

북미 냉동 과일 및 채소 믹스 시장 규모

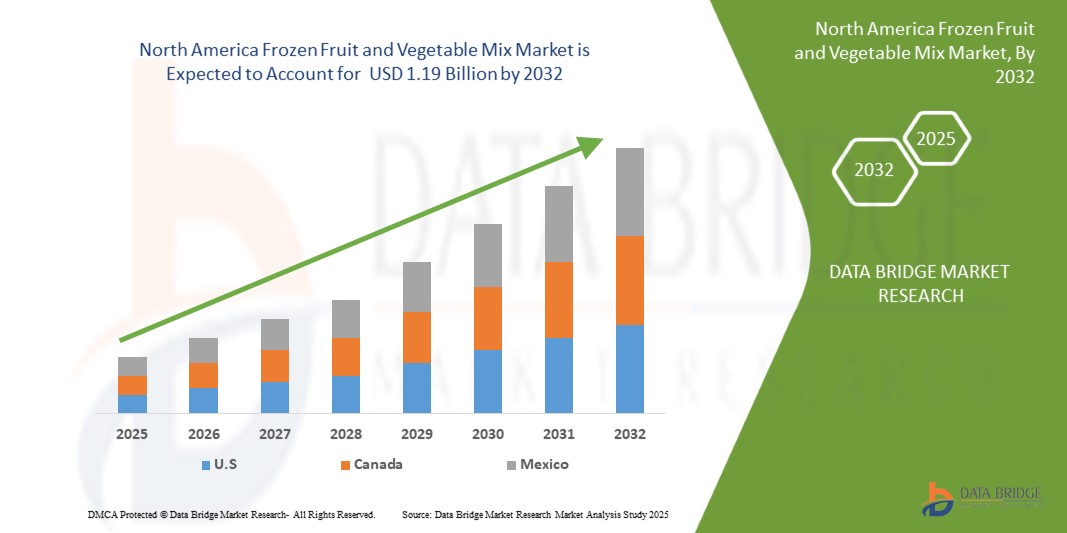

- 북미 냉동 과일 및 야채 믹스 시장 규모는 2024년에 11억 3천만 달러 로 평가되었으며 예측 기간 동안 6.8%의 CAGR 로 2032년까지 11억 9천만 달러 에 도달할 것으로 예상됩니다 .

- 시장 성장은 바쁜 생활 방식과 이중 소득 가구로 인해 편리하고 조리가 간편한 식사 옵션에 대한 수요 증가에 크게 힘입어 이루어졌습니다.

- 또한 계절별 가용성에 대한 인식 증가, 식품 낭비 감소, 영양가 보존은 냉동 대체 식품으로의 전환을 더욱 뒷받침합니다.

북미 냉동 과일 및 채소 믹스 시장 분석

- 건강에 대한 관심이 높아지고 간편하게 조리할 수 있는 식사 솔루션에 대한 수요가 증가하면서 냉동 과일 및 채소 믹스의 인기가 높아졌습니다. 이러한 제품은 유통기한이 길고 영양가가 유지되어 클린 라벨, 비GMO, 최소 가공 식품을 선호하는 소비자의 기호에 부합합니다.

- 외식 및 소매 부문은 핵심 성장 동력으로, 운영 효율성과 계절적 일관성을 위해 냉동 믹스를 활용하고 있습니다. 레스토랑, 카페테리아, 슈퍼마켓, 특히 자체 브랜드 제품을 중심으로 냉동 믹스 도입이 확대되면서 시장 도달 범위가 확대되고 연중 꾸준한 수요를 유지하고 있습니다.

- 미국은 첨단 냉장 유통 인프라, 편의식품에 대한 소비자 수요 증가, 계절별 농산물의 연중 공급에 대한 선호도 증가로 인해 북미 냉동 과일 및 채소 시장을 장악했으며, 이로 인해 지역 전체에서 강력한 시장 성장이 촉진되었습니다.

- 미국은 즉석식품 수요 증가, 바쁜 라이프스타일, 제품 가용성 및 접근성을 지원하는 강력한 유통 네트워크로 인해 북미 냉동 과일 및 채소 시장에서 가장 빠르게 성장하는 국가입니다.

- 과일 믹스 부문은 2025년에 76.47%의 점유율로 냉동 과일 및 야채 믹스 시장을 지배할 것으로 예상됩니다. 이는 뛰어난 이온 교환 용량, 제어된 약물 전달 잠재력, 치료 효능을 향상시키는 능력에 힘입어 고급 치료 제형 및 연구 응용 분야에서 점점 더 많이 채택될 것으로 예상됩니다.

보고서 범위 및 북미 냉동 과일 및 채소 믹스 시장 세분화

|

속성 |

북미 냉동 과일 및 채소 믹스 주요 시장 통찰력 |

|

다루는 세그먼트 |

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보 세트 |

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 업체 등 시장 시나리오에 대한 통찰력 외에도 수입 수출 분석, 생산 능력 개요, 생산 소비 분석, 가격 추세 분석, 기후 변화 시나리오, 공급망 분석, 가치 사슬 분석, 원자재/소모품 개요, 공급업체 선택 기준, PESTLE 분석, Porter 분석 및 규제 프레임워크가 포함됩니다. |

북미 냉동 과일 및 채소 믹스 시장 동향

바쁜 라이프스타일로 인해 편리한 식사 솔루션에 대한 선호도가 높아졌습니다.

- 오늘날처럼 빠르게 변화하는 세상에서 소비자들은 바쁜 업무 일정, 가족 책임, 사회적 책임 사이에서 점점 더 많은 시간을 허비하고 있으며, 이로 인해 식사 계획과 준비에 할애할 시간이 부족합니다. 결과적으로 영양이나 맛에 타협하지 않으면서도 편리하고 시간을 절약할 수 있는 식품에 대한 선호도가 높아지고 있습니다. 냉동 과일과 채소는 이러한 라이프스타일 변화에 완벽하게 부합하며, 씻고, 껍질을 벗기고, 다지고, 잦은 장보기 없이도 건강한 식습관을 유지할 수 있는 빠르고 간편한 솔루션을 제공합니다.

- 냉동 농산물은 소비자가 준비 시간을 단축하고 제철 과일과 채소를 연중 내내 공급받을 수 있도록 도와줍니다. 스무디에 넣거나, 볶음 요리에 넣거나, 수프와 샐러드에 넣든, 냉동 식품은 다재다능하고, 질감이 좋으며, 낭비를 최소화합니다. 이러한 편의성은 특히 건강 목표에 맞는 효율적인 식사 솔루션을 찾는 도시 거주자, 직장인, 대학생, 젊은 가족에게 매력적입니다.

- 또한, 냉동 과일과 채소는 대부분 익었을 때 급속 냉동되어 영양소와 풍미가 그대로 보존되어 가공식품이나 테이크아웃 식품 대신 영양가 있는 대안을 찾는 건강에 민감한 사람들에게 어필합니다. 낱개 포장과 미리 혼합된 블렌드의 성장은 간편한 식사 준비와 1회 제공량 조절을 더욱 용이하게 하며, 이동 중에도 간편하게 섭취할 수 있는 형태에 대한 수요에 부응합니다.

북미 냉동 과일 및 채소 믹스 시장 동향

운전사

냉동 기술의 발전으로 제품 품질 보존이 향상됩니다.

- 냉동 기술의 발전으로 냉동 과일과 채소의 품질, 유통기한, 그리고 소비자 인식이 크게 향상되었습니다. 영양소 손실, 눅눅한 질감, 그리고 색상 저하에 대한 기존 우려는 개별 급속 냉동(IQF)과 같은 혁신 기술을 통해 해결되었습니다. IQF는 농산물을 빠르고 개별적으로 냉동하여 뭉침을 방지하고 자연스러운 질감, 풍미, 그리고 영양 성분을 보존합니다.

- 또한, 액체 질소나 이산화탄소를 이용한 극저온 냉동은 베리류나 허브와 같이 섬세한 품목의 세포 구조를 보호하는 초고속 냉동을 제공합니다. 이러한 냉동 방식은 얼음 결정 형성을 줄여 냉동된 제품이 시각적으로나 질감적으로 신선한 농산물과 거의 같은 상태를 유지하도록 합니다. 또한, 냉동 전 전처리 과정인 데치기(blanching) 공정을 개선하여 전통적인 끓이는 방식 대신 증기를 조절하여 비타민 C와 항산화제와 같은 영양소의 함량을 더욱 높였습니다.

- 또한, 재밀봉 파우치와 방습 필름과 같은 첨단 포장 솔루션은 냉동고 손상을 방지하고 신선도를 유지하여 제품 품질을 더욱 향상시킵니다. 이러한 혁신을 통해 냉동 과일과 채소는 영양가는 그대로 유지하면서도 편리함을 중시하는 건강에 관심 있는 바쁜 소비자들을 위한 제품입니다.

제지/도전

냉동식품이 덜 신선하다는 인식

- 냉동 기술의 발전과 편리한 식품 솔루션에 대한 수요 증가에도 불구하고, 냉동 식품, 특히 과일과 채소가 신선 식품보다 덜 신선하다는 인식은 시장 성장을 저해하고 있습니다. 많은 소비자들이 냉동 농산물을 영양가가 낮고, 맛이 변하며, 질감이 좋지 않다고 생각하는 경향이 있는데, 이러한 우려는 점점 더 시대에 뒤떨어지고 있습니다.

- 이러한 인식은 "신선함"이 더 건강하고 고품질이라는 오랜 습관과 가정에서 비롯됩니다. 수십 년 동안 냉동 과일과 채소는 2류 식품으로 여겨졌으며, 신선한 농산물을 구할 수 없을 때만 주로 사용되었습니다. 개별 급속 냉동(IQF)이나 극저온 냉동과 같은 최신 냉동 기술은 이제 대부분의 영양소를 보존하고 식감 저하를 방지하지만, 많은 소비자, 특히 고령층이나 식품 기술에 대한 지식이 부족한 소비자의 사고방식은 여전히 변함이 없습니다.

- 더욱이, 포장 외관, 냉동실 화상, 또는 냉동 제품의 뭉침 현상은 해당 식품이 과도하게 가공되었거나 인공적으로 보존 처리되었다는 믿음을 강화할 수 있습니다. 시장이나 식료품 매장에서 시각적으로 선명한 신선 농산물을 선호하는 경향이 있는데, 이는 마케팅 및 소매 레이아웃에서 냉동 식품보다 신선 농산물을 우선시하는 경우가 많기 때문입니다.

북미 냉동 과일 및 채소 믹스 시장 범위

시장은 유형, 기술, 제품 범주, 형태, 범주, 출처, 라벨 및 인증, 포장 형식, 포장 크기, 유통기한, 응용 분야 및 유통 채널을 기준으로 세분화됩니다.

제품 유형별

제품 유형에 따라 시장은 야채 믹스, 과일 믹스, 그리고 과일과 야채 혼합 믹스로 구분됩니다. 2025년에는 야채 믹스 부문이 편의성, 유통기한 연장, 풍미 및 영양 보존력 향상에 대한 수요 증가에 힘입어 76.67%의 시장 점유율을 기록하며 시장을 주도할 것으로 예상됩니다.

야채 믹스 부문은 2025년부터 2032년까지 연평균 성장률 6.8%로 가장 빠른 성장을 보일 것으로 예상됩니다. 이는 건강하고 바로 조리할 수 있는 식사에 대한 소비자 선호도 증가, 채식주의 및 비건주의 트렌드 증가, 영양이 풍부한 냉동 식품 대체 식품의 인기 증가에 따른 것입니다.

기술로

기술에 따라 시장은 IQF, 급속 냉동, 극저온 냉동, 유동층 냉동, 등적 냉동, 기타 냉동으로 구분됩니다. 2025년에는 IQF 부문이 우수한 제품 품질, 긴 유통기한, 부패 감소, 그리고 소매 및 외식 산업 모두에서 개별 급속 냉동 과일 및 채소에 대한 수요 증가에 힘입어 시장을 주도할 것으로 예상됩니다.

IQF 부문은 고품질 냉동식품에 대한 수요 증가, 질감과 영양소의 보존 개선, 바로 먹을 수 있는 식품과 가공식품의 사용 증가로 인해 2025~2032년 동안 7.0%의 가장 빠른 CAGR로 성장할 것으로 예상됩니다.

제품 카테고리별

제품 카테고리별로 시장은 생냉동, 스팀 블랜치 후 IQF, 생 IQF, 구운 후 IQF, 로스팅 후 IQF, 양념 또는 코팅 냉동, 소스를 곁들인 냉동 믹스, 데친 후 냉동, 재수화 후 냉동, 미리 양념한 후 IQF, 기타 등으로 세분화됩니다. 2025년에는 조리된 식사 솔루션과 증가하는 가정 요리 트렌드에 힘입어 생 IQF 부문이 시장을 주도할 것으로 예상됩니다.

Raw IQF 부문은 최소한으로 가공된 식품에 대한 소비자 선호도 증가, 영양소 보존력 향상, 건강 중심 및 바로 조리 가능한 식사 제품에 대한 응용 프로그램 증가로 인해 2025~2032년 동안 가장 높은 CAGR 7.9%로 성장할 것으로 예상됩니다.

형태로

북미 냉동 과일 및 채소 믹스 시장은 형태에 따라 통째, 슬라이스, 깍둑썰기, 반으로 자른 것, 퓌레, 다진 것, 으깬 것, 부순 것, 나선형으로 자른 것, 채 썬 것, 으깬 것, 껍질을 벗긴 것, 과립화된 것, 코팅된 것 등으로 세분화됩니다. 2025년에는 천연 미가공 제품에 대한 소비자 선호도 증가, 더 나은 식감 유지, 그리고 다양한 요리 용도에 대한 적합성으로 인해 이 세그먼트 전체가 북미 냉동 과일 및 채소 믹스 시장을 장악할 것으로 예상됩니다.

2025~2032년 동안 전체 부문은 7.9%의 가장 높은 CAGR로 성장할 것으로 예상됩니다. 이는 지역 전체의 냉동 과일 및 채소 가공에서 확립된 대규모 농업 인프라, 낮은 생산 비용, 그리고 기존 공급원에 대한 소비자와 업계의 폭넓은 수용 때문입니다.

카테고리별

북미 냉동 과일 및 채소 믹스 시장은 카테고리별로 일반 제품과 유기농 제품으로 구분됩니다. 2025년에는 일반 제품이 북미 냉동 과일 및 채소 믹스 시장을 상당한 점유율로 장악할 것으로 예상됩니다. 이는 광범위한 공급, 유기농 제품 대비 낮은 가격, 그리고 모든 유통 채널에서 높은 소비자 수용도를 바탕으로 합니다.

기존 부문은 2025~2032년 동안 가장 높은 CAGR(6.9%)로 성장할 것으로 예상됩니다. 이는 대규모 농업 인프라가 확립되고, 생산 비용이 낮아지고, 지역 전체에서 냉동 과일 및 채소 가공에 기존 공급원을 사용하는 소비자와 업계가 널리 수용되고 있기 때문입니다.

출처별

북미 냉동 과일 및 채소 믹스 시장은 원산지 기준으로 일반 농법, 수경 재배법, 재생 농업법, 수직 농장법, 바이오다이내믹 농법 등으로 구분됩니다. 2025년에는 일반 농법이 저렴한 가격, 폭넓은 소비자 수용도, 소매점에서의 높은 구매력, 그리고 가정 및 외식 서비스 분야에서의 높은 수요로 인해 북미 냉동 과일 및 채소 믹스 시장을 주도할 것으로 예상됩니다.

기존 부문은 2025~2032년 동안 7.1%의 가장 높은 CAGR로 성장할 것으로 예상됩니다. 이는 대규모 농업 인프라가 확립되고, 생산 비용이 낮아지고, 지역 전체에서 냉동 과일 및 채소 가공에 기존 공급원을 사용하는 소비자와 산업이 널리 수용되고 있기 때문입니다.

라벨링 및 인증을 통해

라벨 및 인증을 기준으로 시장은 비GMO 인증, 글루텐 프리, 코셔, 할랄, 비건, 공정 무역 인증, 클린 라벨, 무농약, 알레르겐 프리 및 기타로 세분화됩니다. 2025년에는 비GMO 인증 부문이 북미 전역에서 식품 안전에 대한 소비자 인식이 높아지고 클린 라벨 제품에 대한 선호도가 높아지며 조달 및 성분 품질에 대한 투명성에 대한 수요가 증가함에 따라 시장을 지배할 것으로 예상됩니다.

비GMO 검증 부문은 지속 가능하고 윤리적으로 조달된 제품에 대한 소비자 수요 증가와 건강 및 클린 라벨 인증에 대한 인식 제고에 힘입어 2025년부터 2032년까지 연평균 성장률 8.7%로 빠르게 확대될 것으로 예상됩니다.

포장 형식별

포장 형태에 따라 시장은 파우치, 진공 밀봉, 1회용 큐브, 대량 기관용 포장, 다용도 트레이, 백인박스, 클럽 스토어용 대량 포장, 소매용 브릭 포장, 창문형 파우치, 플라스틱 용기 등으로 세분화됩니다. 2025년에는 가볍고 재밀봉이 가능한 디자인, 긴 유통기한, 보관 용이성, 그리고 편리하고 지속 가능한 포장 솔루션에 대한 소비자 선호도 증가로 파우치 부문이 시장을 주도할 것으로 예상됩니다.

파우치 부문은 가볍고 휴대하기 편리하며 친환경적인 포장재에 대한 수요가 증가하고, 냉동식품에서 재봉인이 가능하고 사용하기 쉬운 형태를 선호하는 소비자가 늘어나면서 2025년부터 2032년까지 가장 빠르게 성장할 것으로 예상됩니다.

포장 크기별

포장 크기를 기준으로 시장은 소매 포장 크기와 외식/기관 포장 크기로 구분됩니다. 2025년에는 가정 소비 트렌드에 힘입어 소매 포장 크기 부문이 시장 점유율을 크게 확대할 것으로 예상됩니다.

소매용 포장 크기 부문은 레스토랑과 식사 서비스 제공업체의 수요 증가로 인해 2025년부터 2032년까지 6.90%의 빠른 성장이 예상됩니다.

유통기한별

유통기한을 기준으로 시장은 6개월 이하, 6~9개월, 9~12개월, 12~15개월, 15~24개월, 24개월 이상으로 구분됩니다. 2025년에는 유통 물류 및 신선도 인식 측면에서 6개월 이하 제품이 시장을 주도할 것으로 예상됩니다.

≤6개월 부문은 제품 신선도 유지, 품질 유지, 재고 관리의 유연성으로 인해 2025년에서 2032년 사이에 가장 빠르게 성장할 것으로 예상됩니다. 이는 냉동 과일 및 채소 믹스 시장 내 소매업체의 운영적 선호도와 소비자 구매 패턴과 일치합니다.

응용 프로그램별

시장은 용도별로 소매 소비자용, 외식 서비스(HORECA), 밀키트 회사, 외식 산업, 유아식 제조업체, 영양 보충제 제조업체, 기관용 주방, 소매 신선 냉동 콤보팩 및 기타로 세분화됩니다. 2025년에는 소매 소비자용 부문이 시장 점유율을 크게 확대할 것으로 예상됩니다. 이는 편리하고 시간을 절약하며 영양가 있는 가정용 냉동 과일 및 채소 믹스에 대한 소비자 수요 증가와 더불어 건강에 대한 인식 제고, 바쁜 라이프스타일, 그리고 지역 내 전자상거래 및 슈퍼마켓 소매 채널 확대에 힘입은 것입니다.

소매 소비자 사용 부문은 개인화된 영양과 식품 기술에 대한 수요 증가로 인해 2025~2032년 동안 가장 빠른 CAGR(7.0%)로 성장할 것으로 예상됩니다.

유통 채널별

유통 채널을 기준으로 시장은 B2B와 B2C(매장 기반, 비매장 기반)로 구분됩니다. 2025년에는 B2B 부문이 광범위한 소매 범위와 소비자 침투율을 바탕으로 시장을 주도할 것으로 예상됩니다.

B2B 부문은 예측 기간 동안 가장 빠른 성장률(6.80%)을 보일 것으로 예상되며, 이는 소비자들이 편리하고 건강한 식품 옵션에 대한 수요와 지역 전체에 걸친 조직화된 소매점의 확산에 힘입어 냉동 과일 및 채소 믹스를 소매점, 슈퍼마켓, 온라인 식료품 플랫폼을 통해 직접 구매하는 것을 선호하기 때문입니다.

북미 냉동 과일 및 채소 믹스 시장 지역 분석

- 미국은 냉동 과일 및 야채 믹스 시장에서 가장 큰 매출 점유율을 차지하며 시장을 장악할 것으로 예상되며, 정맥 질환의 유병률 증가, 압박 요법에 대한 높은 인지도, 의료 및 운동 부문의 강력한 수요에 힘입어 2025년에는 6.8%의 가장 빠른 CAGR로 성장할 것으로 전망됩니다.

- 이 지역의 풍부한 의료 인프라, 유리한 보험급여 정책, 그리고 증가하는 노령 인구는 시장 확장을 더욱 촉진합니다. 또한, 피트니스 트렌드의 증가와 예방적 웰빙에 대한 인식 또한 비의료적 수요 증가에 기여하고 있습니다.

- 미국과 캐나다와 같은 주요 경제국은 시장 성장에 중요한 역할을 하며, 미국은 진보된 의료 시스템, 높은 의료비 지출, 오프라인과 온라인 채널에서 쉽게 구할 수 있는 제품 덕분에 가장 큰 비중을 차지합니다.

미국 냉동 과일 및 채소 믹스 시장 분석

미국은 2025년 북미 지역에서 가장 큰 시장 수익 점유율을 차지할 것으로 예상되는데, 이는 만성 정맥 질환의 높은 유병률, 진보된 의료 인프라, 수술 후 치료에 압박 요법을 도입하는 증가, 기술적으로 진보된 압박 솔루션을 제공하는 주요 시장 참여자의 강력한 입지에 기인합니다.

캐나다. 냉동 과일 및 채소 믹스 시장 분석

미국은 예방 건강 관리에 대한 인식 제고, 노령층과 활동적인 인구의 압박복 수요 증가, 전자 상거래 침투 확대, 소재 기술 및 제품 디자인의 지속적인 혁신에 힘입어 2025년부터 2032년까지 이 지역에서 가장 빠른 CAGR을 기록할 것으로 예상됩니다.

북미 냉동 과일 및 채소 믹스 시장 점유율

냉동 과일 및 야채 믹스 산업은 주로 다음을 포함한 잘 확립된 회사들이 주도하고 있습니다.

- 아르도(벨기에)

- 와워나 냉동식품(미국)

- 타이탄 프로즌 프루트(미국)

- 어스바운드 농장(미국)

- Dole Packaged Foods LLC(미국)

- 네이처스 터치(캐나다)

- SunOpta(미국)

- JR 심플롯 회사(미국)

- 오리건 과일 회사(미국)

- 그린야드(벨기에)

- 시닉 프루트 컴퍼니(미국)

- 스탈부시 아일랜드 팜(미국)

- 밀른 과일 제품(미국)

- 알래스코(캐나다)

- 프루트 도르(캐나다)

북미 냉동 과일 및 채소 믹스 시장의 최신 동향

- 2024년 10월, SunOpta는 대형 커피 체인점과의 파트너십을 통해 Dream Oatmilk 매장을 6,700개로 확장한다고 발표했습니다. 이러한 확장은 Dream Oatmilk의 소매점 입지를 크게 확대하고 커피 채널에서 식물성 음료에 대한 수요 증가에 발맞추는 것입니다. 이를 통해 SunOpta는 경쟁이 치열한 오트밀크 부문에서 입지를 강화하는 동시에 북미 전역에서 식물성 음료 포트폴리오의 성장을 지원할 수 있습니다.

- 2024년 6월, SunOpta는 캘리포니아주 모데스토에 위치한 식물성 음료 가공 시설 확장에 260억 달러를 투자했습니다. 이번 시설 확장을 통해 귀리, 아몬드, 콩 음료의 생산 용량이 확대되어 식물성 제품에 대한 수요 증가에 대응할 수 있게 되었습니다. 이번 시설 확장은 운영 효율성과 확장성을 높이는 동시에, 성장하는 북미 식물성 음료 시장에 고품질 클린 라벨 제품을 제공하겠다는 SunOpta의 의지를 더욱 강화하는 계기가 될 것입니다.

- 2025년 3월, 슬리그로 푸드 그룹(Sligro Food Group)과 그린야드(Greenyard)는 벨기에 내 신선 과일, 채소, 감자 공급을 위한 전략적 파트너십을 체결했습니다. 그린야드 프레시 벨기에(Greenyard Fresh Belgium)는 매년 51억 개 이상의 품목에 대한 조달 및 배송을 담당하며, 지속 가능한 지역 농산물과 단축된 공급망을 우선시합니다. 이번 협력은 슬리그로의 푸드 서비스 제공을 강화하는 동시에 그린야드의 통합적이고 장기적인 고객 관계 구축 비전에 부합합니다.

- 2025년 2월, 오리건 프루트 컴퍼니(Oregon Fruit Company)는 시차 브루잉(Xicha Brewing)과 협력하여 수제 음료에 특화된 무균 과일 퓨레를 출시했습니다. 이 개발로 양조업체는 제품 안전성과 일관성을 유지하면서도 고품질 과일 향을 구현할 수 있게 되었습니다. 이는 오리건 프루트의 수제 음료 시장 성장을 뒷받침하는 동시에, 경쟁이 치열한 시장에서 독특하고 클린 라벨 맛에 대한 소비자 수요 증가에 발맞춰 혁신적이고 과일 향이 풍부한 음료를 선보이며 시차 브루잉의 제품력을 강화합니다.

- 2025년 5월, Dot Foods는 공급업체가 GDSN 표준을 준수하고 고객에게 서비스를 제공할 수 있도록 데이터를 작성하고 개선하는 데 도움이 되는 새로운 올인원 제품 콘텐츠 솔루션을 발표했습니다. Dot Data Services는 또한 유통업체와 운영자에게 제품 콘텐츠 및 이를 유지 관리하는 데 필요한 도구를 제공합니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.4.1 RAW MATERIAL COSTS AND SUPPLY CHAIN DYNAMICS

4.4.2 MARKET DEMAND AND CONSUMER PREFERENCES

4.4.3 COMPETITIVE LANDSCAPE AND PRICING STRATEGIES

4.4.4 TECHNOLOGICAL ADVANCEMENTS AND PRODUCTION EFFICIENCY

4.4.5 REGULATORY INFLUENCES AND ENVIRONMENTAL CONSIDERATIONS

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 PROCESSING & MANUFACTURING

4.5.3 PACKAGING & LABELING

4.5.4 DISTRIBUTION & COLD CHAIN LOGISTICS

4.5.5 RETAIL & FOODSERVICE CHANNELS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARITIVE ANALYSIS OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

4.7.2 PRODUCT VS BRAND OVERVIEW

4.7.2.1 PRODUCT OVERVIEW

4.7.2.2 BRAND OVERVIEW

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.2 INDUSTRY RESPONSE

4.8.3 GOVERNMENT’S ROLE

4.8.4 ANALYST RECOMMENDATIONS

4.9 CONSUMERS BUYING BEHAVIOUR

4.9.1 HEALTH-CONSCIOUS PURCHASING

4.9.2 CONVENIENCE-DRIVEN DECISIONS

4.9.3 PRICE VS. VALUE CONSCIOUSNESS

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 DIGITAL INFLUENCE AND BRAND TRANSPARENCY

4.1 COST ANALYSIS BREAKDOWN

4.11 INDUSTRY ECO-SYSTEM ANALYSIS

4.11.1 PROMINENT COMPANIES

4.11.2 SMALL & MEDIUM SIZE COMPANIES

4.11.3 END USERS

4.12 THE USA TARIFFS (TRUMP) WILL HAVE AN IMPACT ON SUPPLY CHAINS. WILL CANADIAN CARGO BE DIVERTED AWAY FROM THE USA TO EUROPEAN COUNTRIES

4.12.1 U.S. TARIFFS AND SUPPLY‑CHAIN DISRUPTION

4.12.2 LIMITATIONS TO REROUTING CANADIAN EXPORTS TO EUROPE

4.13 PRODUCTION CONSUMPTION ANALYSIS

4.14 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.14.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.14.1.1 JOINT VENTURES

4.14.1.2 MERGERS AND ACQUISITIONS

4.14.1.3 LICENSING AND PARTNERSHIP

4.14.1.4 TECHNOLOGY COLLABORATIONS

4.14.1.5 STRATEGIC DIVESTMENTS

4.14.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.14.3 STAGE OF DEVELOPMENT

4.14.4 TIMELINES AND MILESTONES

4.14.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.14.6 RISK ASSESSMENT AND MITIGATION

4.14.7 FUTURE OUTLOOK

4.15 PROFIT MARGINS SCENARIO

4.15.1 MARGIN RANGE BY PRODUCT TYPE

4.15.2 KEY FACTORS INFLUENCING MARGINS

4.15.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.16 RAW MATERIAL COVERAGE

4.16.1 KEY RAW MATERIALS AND GROWING REGIONS

4.16.2 COLD CHAIN & PROCESSING INFRASTRUCTURE

4.16.3 ORGANIC, NON-GMO, AND SUSTAINABILITY SOURCING

4.16.4 IMPORT DEPENDENCY AND DIVERSIFIED SOURCING

4.16.5 CLIMATE RISK AND AGRONOMIC INNOVATIONS

4.17 SUPPLY CHAIN ANALYSIS

4.17.1 OVERVIEW

4.17.2 LOGISTICS COST SCENARIO

4.17.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.18 TECHNOLOGICAL ADVANCEMENTS

4.18.1 INDIVIDUAL QUICK FREEZING (IQF) TECHNOLOGY EVOLUTION

4.18.2 AI AND MACHINE VISION IN SORTING AND QUALITY CONTROL

4.18.3 COLD CHAIN MONITORING AND IOT INTEGRATION

4.18.4 SUSTAINABLE PACKAGING INNOVATIONS

4.18.5 DATA-DRIVEN DEMAND FORECASTING AND INVENTORY MANAGEMENT

4.19 IMPORT ANALYSIS FROM FROZEN CARGOS, BY COAST (FROZEN FRUITS & VEGETABLES)

4.19.1 EAST COAST

4.19.2 WEST COAST

5 TARIFFS AND THEIR IMPACT ON MARKET

5.1 CURRENT TARIFF RATES IN TOP COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCE ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUT

5.7.4.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATORY COVERAGE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING HEALTH AWARENESS BOOSTS DEMAND FOR NUTRITIOUS OPTIONS

7.1.2 BUSY LIFESTYLES INCREASE PREFERENCE FOR CONVENIENT MEAL SOLUTIONS

7.1.3 ADVANCEMENTS IN FREEZING TECHNOLOGY IMPROVE PRODUCT QUALITY PRESERVATION

7.2 RESTRAINTS

7.2.1 PERCEPTION OF FROZEN FOODS BEING LESS FRESH

7.2.2 FLUCTUATING RAW MATERIAL PRICES IMPACT PRODUCTION STABILITY

7.3 OPPORTUNITIES

7.3.1 RISING DEMAND FROM SMOOTHIE & JUICE BARS

7.3.2 EXPANSION OF ONLINE GROCERY PLATFORMS

7.3.3 INNOVATIVE BLENDS CATER TO EVOLVING CONSUMER TASTE PREFERENCES

7.4 CHALLENGES

7.4.1 COLD CHAIN LOGISTICS REQUIRE HIGH INFRASTRUCTURE AND INVESTMENT

7.4.2 WASTE AND SUSTAINABILITY CONCERNS

8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

8.1 OVERVIEW

8.2 VEGETABLE MIXES

8.2.1 ROOT VEGETABLES

8.2.2 LEAFY GREENS

8.2.3 CRUCIFEROUS MIXES

8.2.4 NIGHTSHADE MIXES

8.2.5 LEGUME MIXES

8.2.6 ALLIUM MIXES

8.2.7 SQUASH MIXES

8.2.8 OTHERS

8.3 FRUIT MIXES

8.3.1 BERRIES ONLY MIX

8.3.1.1 TRIPLE BERRY

8.3.2 CITRUS FRUIT MIX

8.3.2.1 CITRUS FRUIT

8.3.2.2 IQF CITRUS

8.3.2.3 CITRUS PEEL

8.3.2.4 CITRUS JUICE CUBED INCLUSIONS

8.3.3 APPLE BASED MIX

8.3.4 TROPICAL FRUIT MIX

8.3.5 MELON MIX (CANTALOUPE HONEYDEW)

8.3.6 WATERMELON BASED MIX

8.3.7 STONE FRUIT MIX

8.3.8 POMEGRANATE MIX

8.3.9 OTHERS

8.4 MIXED FRUIT & VEGETABLE BLENDS

8.4.1 SMOOTHIE BLENDS

8.4.2 SALAD MIXES

8.4.3 BREAKFAST BOWL MIX

8.4.4 BABY FOOD BLENDS

8.4.5 SUPERFOOD MIXES

8.4.6 SEASONAL/ HOLIDAY MIXES

8.4.7 OTHERS

9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 IQF

9.3 BLAST FROZEN

9.4 CRYOGENIC FROZEN

9.5 ISOCHORIC FREEZING

9.6 FLUIDIZED BED

9.7 OTHERS

10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY

10.1 OVERVIEW

10.2 RAW IQF

10.3 STEAM BLANCHED THEN IQF

10.4 ROASTED THEN IQF

10.5 GRILLED THEN IQF

10.6 MARINATED OR COATED FROZEN

10.7 RAW FROZEN

10.8 PRE SEASONED THEN IQF

10.8.1 HERB SEASONED MIXES

10.8.2 SPICED MIXES

10.8.3 ASIAN INSPIRED SEASONING

10.8.4 MEDITERRANEAN BLEND

10.8.5 SWEET GLAZED MIXES

10.8.6 INDIAN STYLE MIX

10.9 SAUCE INCLUDED FROZEN MIXES,

10.1 PARBOILED THEN FROZEN

10.11 REHYDRATED THEN FROZEN

10.12 OTHERS

11 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM

11.1 OVERVIEW

11.2 WHOLE

11.3 SLICED

11.4 DICED

11.5 HALVES

11.6 PUREED

11.7 MINCED

11.8 MASHED

11.9 CRUMBLED

11.1 SPIRALIZED

11.11 JULIENNED

11.12 CRUSHED

11.13 ZESTED

11.14 GRANULATED

11.15 COATED

11.16 OTHERS

12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 CONVENTIONAL

12.3 ORGANIC

13 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE

13.1 OVERVIEW

13.2 CONVENTIONAL

13.3 HYDROPONIC

13.4 REGENERATIVE AGRICULTURE SOURCED

13.5 VERTICAL FARM BASED

13.6 BIODYNAMIC

13.7 OTHERS

14 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION

14.1 OVERVIEW

14.2 CLEAN LABEL

14.3 NON GMO VERIFIED

14.4 VEGAN

14.5 GLUTEN FREE

14.6 PESTICIDE FREE

14.7 ALLERGEN FREE

14.8 KOSHER

14.9 HALAL

14.1 FAIR TRADE CERTIFIED

14.11 OTHERS

15 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT

15.1 OVERVIEW

15.2 POUCH

15.3 VACUUM SEALED

15.4 BULK INSTITUTIONAL PACK

15.5 MULTI COMPARTMENT TRAY

15.6 BAG IN BOX

15.7 SINGLE SERVE CUBES

15.8 CLUB STORE BULK BAG

15.9 RETAIL BRICK PACK

15.1 POUCH WITH WINDOW

15.11 PLASTIC TUBS

16 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE

16.1 OVERVIEW

16.2 RETAIL PACKAGING SIZES

16.3 FOODSERVICE/INSTITUTIONAL PACKAGING SIZES

17 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE

17.1 OVERVIEW

17.2 9–12 MONTHS

17.3 6–9 MONTHS

17.4 12–15 MONTHS

17.5 15–24 MONTHS

17.6 24 MONTHS

17.7 ≤6 MONTHS

18 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION

18.1 OVERVIEW

18.2 RETAIL CONSUMER USE

18.3 FOODSERVICE (HORECA)

18.4 FOODSERVICE INDUSTRY

18.5 MEAL KIT COMPANIES

18.6 BABY FOOD MANUFACTURERS

18.7 INSTITUTIONAL KITCHENS

18.8 NUTRITIONAL SUPPLEMENTS MANUFACTURERS

18.9 RETAIL FRESH FROZEN COMBO PACKS

18.1 OTHERS

19 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 B2B

19.2.1 STORE BASED

19.2.2 NON STORE BASED

19.3 B2C

20 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET BY COUNTRIES

20.1 OVERVIEW

20.1.1 U.S.

20.1.2 CANADA

20.1.3 MEXICO

21 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

22 SWOT ANALYSIS

23 COMPANY PROFILES MANUFACTURERS

23.1 J.R. SIMPLOT COMPANY.

23.1.1 COMPANY SNAPSHOT

23.1.2 PRODUCT PORTFOLIO

23.1.3 RECENT DEVELOPMENT

23.2 SUNOPTA

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENT

23.3 ALASKO

23.3.1 COMPANY SNAPSHOT

23.3.2 PRODUCT PORTFOLIO

23.3.3 RECEENT DEVELOPMENT

23.4 STAHLBUSH ISLAND FARMS.

23.4.1 COMPANY SNAPSHOT

23.4.2 PRODUCT PORTFOLIO

23.4.3 RECENT UPDATES

23.5 GREENYARD

23.5.1 COMPANY SNAPSHOT

23.5.2 RECENT FINANCIALS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT UPDATES

23.6 ARDO

23.6.1 COMPANY SNAPSHOT

23.6.2 PRODUCT PORTFOLIO

23.6.3 RECENT DEVELOPMENTS

23.7 DOLE PACKAGED FOODS, LLC

23.7.1 COMPANY SNAPSHOT

23.7.2 PRODUCT PORTFOLIO

23.7.3 RECENT DEVELOPMENT

23.8 EARTHBOUND FARM

23.8.1 COMPANY SNAPSHOT

23.8.2 PRODUCT PORTFOLIO

23.8.3 RECENT DEVELOPMENTS

23.9 FRUIT D'OR

23.9.1 COMPANY SNAPSHOT

23.9.2 PRODUCT PORTFOLIO

23.9.3 RECENT DEVELOPMENT

23.1 MILNE FRUIT PRODUCTS, INC.

23.10.1 COMPANY SNAPSHOT

23.10.2 PRODUCT PORTFOLIO

23.10.3 RECENT DEVELOPMENT

23.11 NATURE’S TOUCH

23.11.1 COMPANY SNAPSHOT

23.11.2 PRODUCT PORTFOLIO

23.11.3 RECENT DEVELOPMENT

23.12 OREGON FRUIT COMPANY

23.12.1 COMPANY SNAPSHOT

23.12.2 PRODUCT PORTFOLIO

23.12.3 RECENT DEVELOPMENT

23.13 PACIFIC COAST PRODUCERS

23.13.1 COMPANY SNAPSHOT

23.13.2 PRODUCT PORTFOLIO

23.13.3 RECENT DEVELOPMENT

23.14 SCENIC FRUIT COMPANY

23.14.1 COMPANY SNAPSHOT

23.14.2 PRODUCT PORTFOLIO

23.14.3 RECENT UPDATES

23.15 TITAN FROZEN FRUIT

23.15.1 COMPANY SNAPSHOT

23.15.2 PRODUCT PORTFOLIO

23.15.3 RECENT DEVELOPMENTS

23.16 WAWONA FROZEN FOODS

23.16.1 COMPANY SNAPSHOT

23.16.2 PRODUCT PORTFOLIO

23.16.3 RECENT DEVELOPMENTS

23.17 WYMAN'S

23.17.1 COMPANY SNAPSHOT

23.17.2 PRODUCT PORTFOLIO

23.17.3 RECENT DEVELOPMENT

24 COMPANY PROFILES DISTRIBUTORS

24.1 COASTAL SUNBELT PRODUCE

24.1.1 COMPANY SNAPSHOT

24.1.2 PRODUCT PORTFOLIO

24.1.3 RECENT DEVELOPMENT

24.2 DOT FOOD

24.2.1 COMPANY SNAPSHOT

24.2.2 PRODUCT PORTFOLIO

24.2.3 RECENT DEVELOPMENT

24.3 GET FRESH PRODUCE

24.3.1 COMPANY SNAPSHOT

24.3.2 PRODUCT PORTFOLIO

24.3.3 RECENT DEVELOPMENT

24.4 GORDON FOOD SERVICE

24.4.1 COMPANY SNAPSHOT

24.4.2 PRODUCT PORTFOLIO

24.4.3 RECENT DEVELOPMENT

24.5 KEHE DISTRIBUTORS LLC

24.5.1 COMPANY SNAPSHOT

24.5.2 PRODUCT PORTFOLIO

24.5.3 RECENT DEVELOPMENT

24.6 ROBINSON

24.6.1 COMPANY SNAPSHOT

24.6.2 PRODUCT PORTFOLIO

24.6.3 RECENT DEVELOPMENT

24.7 SNOW CAP LTD.

24.7.1 COMPANY SNAPSHOT

24.7.2 PRODUCT PORTFOLIO

24.7.3 RECENT DEVELOPMENT

24.8 SYSCO CORPORATION

24.8.1 COMPANY SNAPSHOT

24.8.2 REVENUE ANALYSIS

24.8.3 PRODUCT PORTFOLIO

24.8.4 RECENT DEVELOPMENT

24.9 UNFI

24.9.1 COMPANY SNAPSHOT

24.9.2 REVENUE ANALYSIS

24.9.3 PRODUCT PORTFOLIO

24.9.4 RECENT DEVELOPMENT

24.1 US FOODS INC

24.10.1 COMPANY SNAPSHOT

24.10.2 REVENUE ANALYSIS

24.10.3 PRODUCT PORTFOLIO

24.10.4 RECENT DEVELOPMENT

25 QUESTIONNAIRE

26 RELATED REPORTS

표 목록

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 4 NORTH AMERICA VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (THOUSAND TONS)

TABLE 5 NORTH AMERICA ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA BERRIES ONLY MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA CITRUS FRUIT IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA IQF CITRUS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA BREAKFAST BOWL MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA SEASONAL/ HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CROP TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA FOODSERVICE IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA NON-STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 60 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 62 U.S. VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 U.S. INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 99 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 100 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 101 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 102 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 103 U.S. POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 104 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 105 U.S. RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 106 U.S. FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 107 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 108 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.S. FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 U.S. FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 U.S. INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 U.S. NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 U.S. FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 114 U.S. B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 115 U.S. STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 116 U.S. NON-STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 119 CANADA VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 CANADA LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CANADA CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 CANADA NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 CANADA LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CANADA ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 CANADA SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 CANADA FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 CANADA BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 CANADA TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 CANADA CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 CANADA CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 CANADA IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 CANADA CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 CANADA CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 CANADA APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 CANADA TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 CANADA STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 CANADA POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 CANADA MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 CANADA SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 CANADA SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 CANADA BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 CANADA BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 CANADA SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 CANADA SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 147 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 148 CANADA PRE-SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 149 CANADA HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 150 CANADA SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 151 CANADA ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 152 CANADA MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 CANADA SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 CANADA INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 155 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 156 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 157 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 158 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 159 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 160 CANADA POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 161 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 162 CANADA RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 163 CANADA FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 164 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 165 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 166 CANADA FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 CANADA FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 CANADA INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 169 CANADA NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 CANADA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 171 CANADA B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 CANADA STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 173 CANADA NON STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 174 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 176 MEXICO VEGETABLE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 MEXICO ROOT VEGETABLES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 MEXICO LEAFY GREENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 MEXICO CRUCIFEROUS MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 MEXICO NIGHTSHADE MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 MEXICO LEGUME MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 MEXICO ALLIUM MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 MEXICO SQUASH MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MEXICO FRUIT MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 MEXICO BERRIES ONLY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MEXICO TRIPLE BERRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MEXICO CITRUS FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 MEXICO CITRUS FRUITS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 MEXICO IQF CITRUS SEGMENTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 MEXICO CITRUS PEEL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MEXICO CITRUS JUICE CUBED INCLUSIONS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MEXICO APPLE BASED MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MEXICO TROPICAL FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MEXICO STONE FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MEXICO POMEGRANATE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MEXICO MIXED FRUIT & VEGETABLE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MEXICO SMOOTHIE BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 MEXICO SALAD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 MEXICO BREAKFAST BOWL MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 MEXICO BABY FOOD BLENDS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MEXICO SUPERFOOD MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 MEXICO SEASONAL/HOLIDAY MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 204 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 205 MEXICO PRE SEASONED THEN IQF IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 206 MEXICO HERB SEASONED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 207 MEXICO SPICED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 208 MEXICO ASIAN INSPIRED SEASONING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 209 MEXICO MEDITERRANEAN BLEND IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 210 MEXICO SWEET GLAZED MIXES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 211 MEXICO INDIAN STYLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PRODUCT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 212 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 213 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 214 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 215 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY LABELING & CERTIFICATION, 2018-2032 (USD THOUSAND)

TABLE 216 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 217 MEXICO POUCH IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING FORMAT, 2018-2032 (USD THOUSAND)

TABLE 218 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 219 MEXICO RETAIL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 220 MEXICO FOODSERVICE/INSTITUTIONAL PACKAGING SIZES IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY PACKAGING SIZE, 2018-2032 (USD THOUSAND)

TABLE 221 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY SHELF LIFE, 2018-2032 (USD THOUSAND)

TABLE 222 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 223 MEXICO FOODSERVICE (HORECA) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 224 MEXICO FOODSERVICE INDUSTRY IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MEXICO INSTITUTIONAL KITCHENS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 MEXICO NUTRITIONAL SUPPLEMENTS MANUFACTURERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 227 MEXICO FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 228 MEXICO B2C IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 229 MEXICO STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 230 MEXICO NON STORE BASED IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: NORTH AMERICA VS GLOBAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET : EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 TWO SEGMENTS COMPRISE THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

FIGURE 15 RISING HEALTH AWARENESS BOOSTS DEMAND FOR NUTRITIOUS OPTIONS IS EXPECTED TO DRIVE THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 VEGETABLE MIXES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN 2025 & 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, 2018-2032, AVERAGE SELLING PRICE (USD/TONS)

FIGURE 21 VALUE CHAIN OF NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NON-ALCOHOLIC BEVERAGES MARKET

FIGURE 25 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE, 2024

FIGURE 26 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CROP TYPE, 2024

FIGURE 27 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PRODUCT CATEGORY, 2024

FIGURE 28 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY FORM, 2024

FIGURE 29 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CATEGORY, 2024

FIGURE 30 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY SOURCE, 2024

FIGURE 31 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY LABELING & CERTIFICATION, 2024

FIGURE 32 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PACKAGING FORMAT, 2024

FIGURE 33 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY PACKAGING SIZE, 2024

FIGURE 34 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY SHELF LIFE, 2024

FIGURE 35 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY APPLICATION, 2024

FIGURE 36 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY DISTRIBUTION CHJANNEL, 2024

FIGURE 37 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET, SNAPSHOTS

FIGURE 38 NORTH AMERICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.