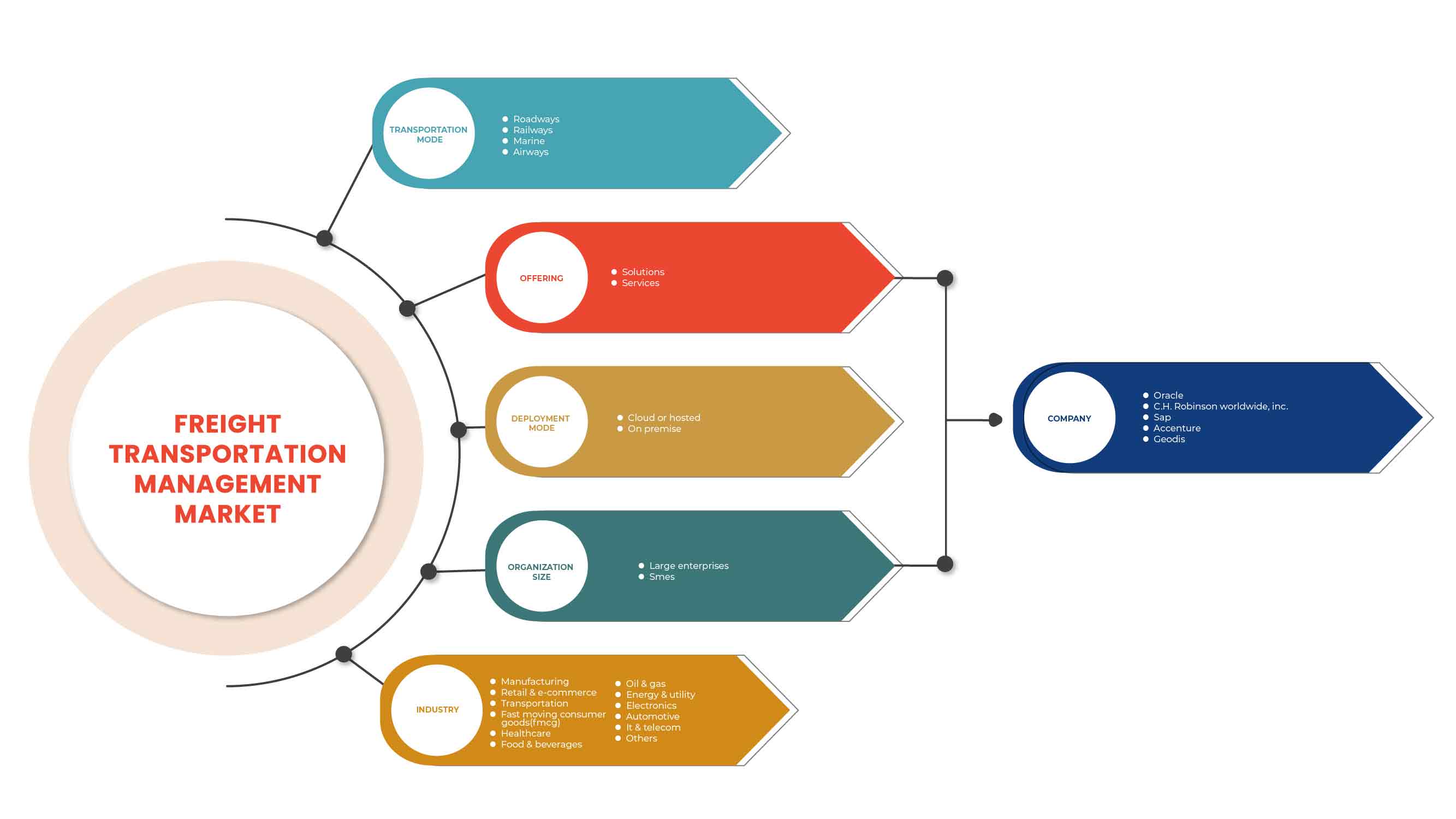

북미 화물 운송 관리 시장, 운송 모드(도로, 철도, 해상 및 항공), 제공 항목(솔루션 및 서비스), 배포 모드(클라우드 또는 호스팅 및 온프레미스), 조직 규모(대기업 및 중소기업), 산업(제조, 소매 및 전자 상거래 , 운송, 일용소비재(FMCG), 의료, 식품 및 음료, 석유 및 가스, 에너지 및 유틸리티, 전자, 자동차, IT 및 통신 및 기타) - 산업 동향 및 2029년까지의 예측.

북미 화물 운송 관리 시장 분석 및 규모

화물 운송 관리에는 화물 효율성과 상업적 운송 효율성을 높이기 위한 다양한 전략 수립이 포함됩니다. 화물 운송 관리에서는 혼잡이나 오염 영향과 같은 사회적 비용을 고려하면서 운송업체 비용을 줄이는 데 중점을 둡니다. 화물 운송 관리에서 제공하는 높은 이점으로 인해 시장에서 화물 운송 관리 솔루션에 대한 수요가 증가하고 있습니다. 글로벌 화물 운송 관리 시장은 세계화로 인해 화물 운송이 늘어나면서 빠르게 성장하고 있습니다. 기업들은 시장 점유율을 높이기 위해 신제품을 출시하기도 합니다.

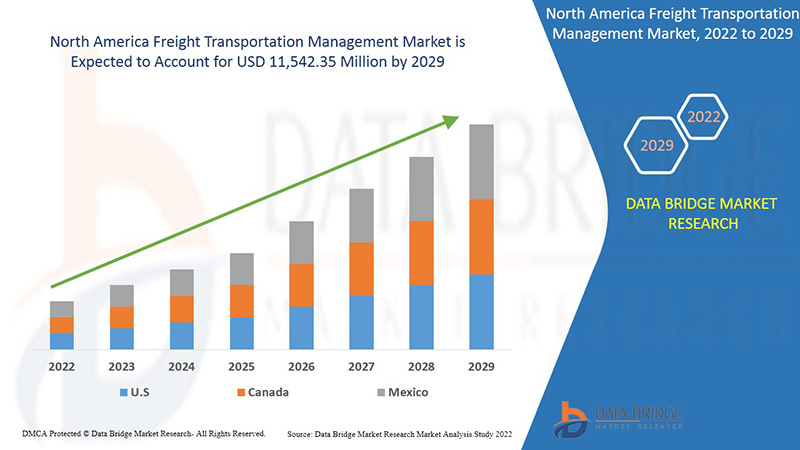

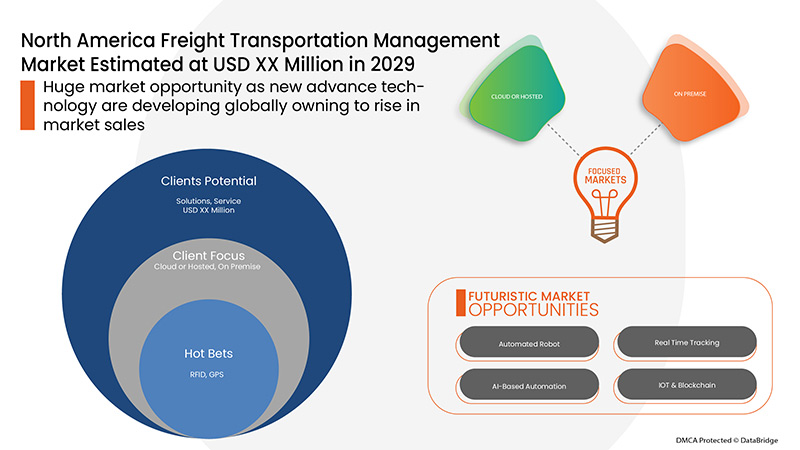

Data Bridge Market Research는 화물 운송 관리 시장이 2029년까지 11,542.35백만 달러에 도달할 것으로 예상하며, 예측 기간 동안 CAGR은 8.2%입니다. "도로"는 자본 투자가 덜 필요하고, 도어투도어 분산 관리를 제공할 수 있기 때문에 가장 눈에 띄는 운송 모드 세그먼트를 차지합니다. 화물 운송 관리 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

미국 달러 백만 |

|

다루는 세그먼트 |

운송 모드별(도로, 철도, 해상 및 항공), 제공 항목별(솔루션 및 서비스), 배포 모드별(클라우드 또는 호스팅 및 온프레미스), 조직 규모별(대기업 및 중소기업), 산업별(제조, 소매 및 전자 상거래, 운송, FMCG(빠르게 움직이는 소비재), 의료, 식품 및 음료, 석유 및 가스, 에너지 및 유틸리티, 전자, 자동차, IT 및 통신 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

CTSI-GLOBAL, GEODIS, THE DECARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate 등 |

시장 정의

화물 운송 관리에는 화물의 효율성과 상업적 운송 효율성을 높이기 위한 다양한 전략 수립이 포함됩니다. 화물 운송 관리에서는 교통 체증이나 오염 영향과 같은 사회적 비용을 고려하면서 운송업체 비용을 줄이는 데 중점을 둡니다. 운송업체가 올바른 운송 수단을 사용하도록 돕습니다. 예를 들어, 철도와 수상 운송은 장거리 운송에 트럭을 사용하는 것보다 매우 효율적입니다. 적재율을 높이고 화물 차량 마일리지를 줄이기 위해 경로와 일정을 개선하는 데 도움이 됩니다. 각 여행에 최적의 크기의 차량을 사용하고 차량 마일리지를 줄이며 차량이 외부 비용을 줄이는 방식으로 운영되고 유지되도록 하는 차량 관리 프로그램을 구현하는 데 도움이 됩니다.

화물 운송 관리(Freight transport management)는 도로, 철도, 해상, 항공 등 다양한 운송 수단에 사용됩니다. 도로 경로를 통해 이루어지는 화물 이동은 세그먼트로 불립니다. 단일 세관 문서 프로세스가 필요하기 때문에 가장 일반적인 유형의 운송 수단입니다. 철도 운송 수단은 연료 효율성이 매우 높고 '녹색' 운송 수단이라고 할 수 있습니다. 해상 운송은 석탄, 농산물, 철광석 및 원유와 가스와 같은 습식 벌크 제품과 같은 벌크 상품의 이동에 사용됩니다. 항공은 가장 빠른 운송 수단이며 '적시(just-in-time)' 재고 보충을 달성하는 데 많이 사용됩니다.

화물 운송 관리 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

- 화물 운송 관리가 제공하는 높은 혜택

수년에 걸쳐, 매우 효율적인 공급망을 갖는 것이 매우 필요해졌습니다. 이 요구 사항은 화물 운송 관리에 의해 충족됩니다. 화물 운송 관리 시스템은 기업이 비용 효율적이고 신뢰할 수 있으며 효율적인 방식으로 제품을 한 목적지에서 다른 목적지로 이동하는 데 도움이 됩니다. 이 시스템은 더 높은 가시성과 더 나은 데이터 분석을 제공하여 글로벌 화물 운송 관리 시장의 성장을 증가시킵니다.

- 철도화물 운송 수요 증가

철도화물 운송은 육상에서 화물을 운송하기 위해 철도를 활용합니다. 화학 물질 , 원자재, 농업, 자동차, 에너지(석탄, 석유, 풍력 터빈), 임산물 등 다양한 화물을 운송하는 데 사용됩니다. 철도는 철도를 통해 무거운 화물을 빠르게 운송할 수 있습니다. 철도는 가장 많이 사용되는 운송 수단 중 하나이며 전 세계적으로 거대한 인프라가 구축되어 있습니다. 운송을 위한 철도의 사용이 증가함에 따라 철도화물 운송을 관리하기 위한 화물 운송 관리의 성장이 증가합니다.

- 도로에서의 화물 운송 관리의 높은 활용

디지털화의 증가로 다양한 산업이 변모하고 전자상거래가 탄생했습니다 . 전자상거래의 성장으로 인해 회사는 공급망을 매우 효율적으로 만들고 운송 시간을 단축하며 고객에게 지체 없이 제품을 제공해야 했습니다. 이로 인해 도로를 통한 국내 운송 흐름이 증가했으며 많은 수의 트럭이 동일한 용도로 사용되고 있습니다. 도로 기술의 성장이 증가함에 따라 글로벌 화물 운송 관리 시장의 성장이 증가하고 있습니다.

- 무역로와 관련된 혼잡

도로와 수로에서 교통량과 혼잡이 증가함에 따라 화물 및 운송 서비스 운영자는 안정적인 일정을 유지하는 데 점점 더 어려움을 겪고 있습니다. 이는 공급망과 트럭에 의존하는 사업에 영향을 미치며, 각각 공공 서비스 및 민간 지역 운영자 모두에게 중요성이 커지고 있습니다. 게다가 도로에서 발생한 여러 사고나 해상에서 발생한 유류 유출 사고는 운송 시스템에 예상치 못한 문제로 작용하여 시스템을 관리하기 어렵게 만들 수 있습니다. 최근 COVID-19로 인해 여러 물류 작업이 중단되어 전체 공급망 운영에 심각한 피해가 발생했습니다. 이러한 매개변수는 글로벌 화물 운송 관리 시장 성장에 큰 제약이 됩니다.

- 무역에 대한 정부 제한 및 규정

국제 무역은 미국과 중국의 무역 전쟁과 COVID-19 팬데믹으로 인해 여러 가지 제한과 규정 변경을 겪었습니다. 국경 간 운송이 제한되고 비용이 증가하는데, 이는 운송 관리 시스템에서 예측할 수 없으며 공급망과 재고의 비효율성으로 이어져 글로벌 화물 운송 관리 시장에 큰 제약으로 작용합니다.

COVID-19 이후 화물 운송 관리 시장에 미치는 영향

COVID-19는 거의 모든 국가가 필수 상품을 생산하는 곳을 제외한 모든 생산 시설에 대한 폐쇄를 선택함에 따라 화물 운송 관리 시장에 큰 영향을 미쳤습니다. 정부는 COVID-19의 확산을 막기 위해 비필수 상품의 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황에서 거래하는 유일한 사업은 프로세스를 열고 실행할 수 있는 필수 서비스입니다.

화물 운송 관리 시장의 성장은 코로나 이후 국제 무역을 촉진하기 위한 정부 정책으로 인해 증가하고 있습니다. 또한 화물 운송 관리가 비용과 경로를 최적화하기 위해 제공하는 이점은 시장에서 화물 운송 관리에 대한 수요를 증가시키고 있습니다. 그러나 무역 경로와 관련된 혼잡 및 일부 국가 간의 무역 제한과 같은 요인이 시장 성장을 제한하고 있습니다. 팬데믹 상황에서 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 화물 운송 관리에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급적이고 정확한 솔루션을 제공할 것입니다. 또한 국제 무역을 촉진하기 위한 정부 이니셔티브가 시장 성장으로 이어졌습니다.

최근 개발

- 2021년 3월, SAP SE는 Sedna Systems와의 파트너십을 발표했습니다. 이 파트너십에 따라 두 회사는 SAP TMS를 Sedna Systems의 팀 협업 및 이메일 관리 솔루션과 통합하여 고객이 운송 관리 관련 데이터를 완전히 제어할 수 있도록 도울 수 있습니다. 이를 통해 회사는 시장에서 입지를 굳건히 할 수 있을 것입니다.

- 2022년 2월, Oracle은 Oracle Fusion Cloud Supply Chain & Manufacturing(SCM) 내에 새로운 물류 관리 기능 도입을 발표했습니다. 이 회사는 Oracle Fusion Cloud Transportation Management를 업데이트하여 조직이 비용과 위험을 줄이고, 고객 경험을 개선하고, 비즈니스 중단에 더 잘 적응할 수 있도록 도울 수 있습니다. 따라서 이를 통해 이 회사는 시장에서 더 많은 고객을 유치할 수 있을 것입니다.

북미 화물 운송 관리 시장 범위

화물 운송 관리 시장은 운송 모드, 제공, 배포 모드, 조직 규모 및 산업을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

교통수단별

- 도로

- 철도

- 선박

- 항공로

글로벌 화물 운송 관리 시장은 운송 방식을 기준으로 도로, 철도, 해상, 항공으로 구분됩니다.

제공함으로써

- 솔루션

- 서비스

글로벌 화물 운송 관리 시장은 제공되는 솔루션을 기준으로 솔루션과 서비스로 세분화되었습니다.

배포 모드별

- 클라우드 또는 호스팅

- 온 프레미스

배포 모드를 기준으로 글로벌 화물 운송 관리 시장은 클라우드 또는 호스팅과 온프레미스로 구분됩니다.

조직 규모별

- 대기업

- 중소기업

글로벌 화물 운송 관리 시장은 조직 규모를 기준으로 대기업과 중소기업으로 구분됩니다.

산업별

- 조작

- 소매 및 전자 상거래

- 운송

- FMCG(빠르게 움직이는 소비재)

- 헬스케어

- 음식 & 음료

- 석유 및 가스

- 에너지 및 유틸리티

- 전자제품

- 자동차

- IT & 텔레콤

- 기타

산업을 기준으로 볼 때, 글로벌 화물 운송 관리 시장은 제조업, 소매 및 전자 상거래, 운송, FMCG(일용소비재), 의료, 식품 및 음료, 석유 및 가스, 에너지 및 공공 서비스, 전자, 자동차, IT 및 통신 등으로 세분화됩니다.

화물 운송 관리 시장 지역 분석/통찰력

화물 운송 관리 시장을 분석하고, 위에 언급된 대로 국가, 운송 모드, 제공 서비스, 배포 모드, 조직 규모 및 산업별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

화물 운송 관리 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 북미 화물 운송 관리 시장을 지배합니다. 미국은 북미 화물 운송 관리 시장에서 가장 빠르게 성장할 가능성이 높습니다. 미국은 전 세계적으로 다양한 상품의 높은 수입 및 수출로 주요 물류 운영의 최전선에 있습니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 화물 운송 관리 시장 점유율 분석

화물 운송 관리 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우위가 있습니다. 위에 제공된 데이터 포인트는 화물 운송 관리 시장과 관련된 회사의 초점에만 관련이 있습니다.

화물 운송 관리 시장에서 운영되는 주요 기업 중 일부는 다음과 같습니다. CTSI-GLOBAL, GEODIS, THE DECARTES SYSTEMS GROUP INC, Manhattan Associates, Transplace, Softeon, GlobalTranz, Oracle, SAP SE, Accenture, Blue Yonder Group, Inc., E2open, LLC., Trimble Inc., DSV, Werner Enterprises, Supply Chain Solutions, CH Robinson Worldwide, Inc., TRANSPOREON GmbH, MercuryGate 등

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TRANSPORTATION MODE TIMELINE CURVE

2.1 MARKET INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH BENEFITS OFFERED BY FREIGHT TRANSPORTATION MANAGEMENT

5.1.2 INCREASING NORTH AMERICAIZATION LEADING TO HIGH FREIGHT TRANSPORTATION

5.1.3 INCREASING DEMAND FOR RAIL FREIGHT TRANSPORTS

5.1.4 HIGH USE OF FREIGHT TRANSPORTATION MANAGEMENT IN ROADWAYS

5.1.5 INCREASING GROWTH OF LOGISTICS THROUGH AIRWAYS AND WATERWAYS

5.2 RESTRAINTS

5.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

5.2.2 GOVERNMENT RESTRICTIONS AND REGULATIONS ON TRADE

5.3 OPPORTUNITIES

5.3.1 INTRODUCTION OF NEW ADVANCED TECHNOLOGIES

5.3.2 INCREASING GROWTH IN E-COMMERCE

5.3.3 GROWING INCLINATION TOWARDS DIGITALIZATION

5.3.4 INCREASING USE OF GREEN FREIGHT

5.4 CHALLENGES

5.4.1 RISK ASSOCIATED WITH CYBER-ATTACKS

5.4.2 LACK OF TRAINING AND EDUCATION

5.4.3 LACK OF DIGITAL LITERACY IN VARIOUS REGIONS

6 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE

6.1 OVERVIEW

6.2 ROADWAYS

6.3 RAILWAYS

6.4 MARINE

6.5 AIRWAYS

7 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTIONS

7.2.1 FREIGHT 3PL SOLUTIONS

7.2.1.1 CROSS DOCK OPERATION

7.2.1.2 LOAD OPTIMIZATION PLATFORM

7.2.1.3 FREIGHT ORDER MANAGEMENT

7.2.1.4 BROKERAGE OPERATIONAL MANAGEMENT

7.2.1.5 BUSINESS INTELLIGENCE SOLUTION

7.2.1.6 OTHERS

7.2.2 FREIGHT TRANSPORTATION COST MANAGEMENT SYSTEM

7.2.3 FREIGHT MOBILITY SOLUTION

7.2.3.1 GPS

7.2.3.2 RFID

7.2.4 FREIGHT SECURITY SOLUTIONS

7.2.4.1 CARGO TRACKING

7.2.4.2 INTRUSION DETECTION

7.2.4.3 VIDEO SURVEILLANCE

7.2.5 FREIGHT INFORMATION MANAGEMENT SYSTEM

7.2.6 FLEET TRACKING SOLUTION

7.2.7 FLEET MAINTENANCE SOLUTION

7.2.8 FREIGHT OPERATION MANAGEMENT SOLUTION

7.2.8.1 AUDIT AND PAYMENT SOLUTION

7.2.8.2 SUPPLIER AND VENDOR MANAGEMENT

7.2.8.3 CRM

7.2.8.4 OTHERS

7.2.9 WAREHOUSE MANAGEMENT SYSTEM

7.3 SERVICES

7.3.1 INTEGRATION SERVICES

7.3.2 MANAGED SERVICES

7.3.3 BUSINESS SERVICES

8 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD OR HOSTED

8.2.1 SUBSCRIPTION BASED

8.2.2 TRANSACTION BASED

8.3 ON PREMISE

9 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMES

10 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY

10.1 OVERVIEW

10.2 MANUFACTURING

10.3 RETAIL & E-COMMERCE

10.4 TRANSPORTATION

10.5 FAST MOVING CONSUMER GOODS (FMCG)

10.6 HEALTHCARE

10.7 FOOD & BEVERAGES

10.8 OIL & GAS

10.9 ENERGY & UTILITY

10.1 ELECTRONICS

10.11 AUTOMOTIVE

10.12 IT & TELECOM

10.13 OTHERS

11 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ORACLE

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 APPLICATION PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 C.H. ROBINSON WORLDWIDE, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAP SE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ACCENTURE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 GEODIS

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 3GTMS

14.6.1 COMPANY SNAPSHOT

14.6.2 PLATFORM PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BLUE YONDER GROUP, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CTSI-NORTH AMERICA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 DSV

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 E2OPEN, LLC

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 NORTH AMERICATRANZ

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MANHATTAN ASSOCIATES

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 MERCURYGATE

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SOFTEON

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SUPPLY CHAIN SOLUTIONS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 THE DESCARTES SYSTEMS GROUP INC

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 TRANSPLACE

14.17.1 COMPANY SNAPSHOT

14.17.2 SOLUTION PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 TRIMBLE INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TRANSPOREON GMBH

14.19.1 COMPANY SNAPSHOT

14.19.2 PLATFORM PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 WERNER ENTERPRISES

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ROADWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA RAILWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA MARINE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA AIRWAYS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 8 NORTH AMERICA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA 3PL IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FREIGHT MOBILITY SOLUTION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA FREIGHT OPERATION MANAGEMENT SOLUTION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 14 NORTH AMERICA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA ON PREMISE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA LARGE ENTERPRISES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 21 NORTH AMERICA SMES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 22 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA MANUFACTURING IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 24 NORTH AMERICA RETAIL & E-COMMERCE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPORTATION IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 26 NORTH AMERICA FAST MOVING CONSUMER GOODS (FMCG) IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 28 NORTH AMERICA FOOD & BEVERAGES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 29 NORTH AMERICA OIL & GAS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 30 NORTH AMERICA ENERGY & UTILITY IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONICS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 32 NORTH AMERICA AUTOMOTIVE IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 33 NORTH AMERICA IT & TELECOM IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 35 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 48 U.S. FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 49 U.S. FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 U.S. SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 U.S. CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 59 U.S. FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 60 CANADA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 61 CANADA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 CANADA SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 CANADA CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 CANADA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 71 CANADA FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 72 MEXICO FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TRANSPORTATION MODE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 MEXICO SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO FREIGHT 3PL SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO FREIGHT MOBILITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO FREIGHT SECURITY SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MEXICO FREIGHT OPERATION MANAGEMENT SOLUTIONS IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO SERVICES IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CLOUD OR HOSTED IN FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO FREIGHT TRANSPORTATION MANAGEMENT MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 10 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: SEGMENTATION

FIGURE 11 HIGH BENEFITS OFFERED BY FREIGHT TRANSPORTATION MANAGEMENT IS EXPECTED TO DRIVE THE NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ROADWAYS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET IN 2022 & 2029

FIGURE 13 EUROPE IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET

FIGURE 15 EXPORTED VALUE OF THE PRODUCT FROM 2015-2019, IN USD MILLION

FIGURE 16 TOTAL INLAND FREIGHT TRANSPORT, TONES-KILOMETERS, MILLION

FIGURE 17 U.S.-NORTH AMERICAN FREIGHT BY MODE: 2018-2019 (USD BILLION)

FIGURE 18 TONNAGE LOADED AND DISCHARGE, 2020 (BILLIONS OF TONS)

FIGURE 19 CONTAINER PORT TRAFFIC

FIGURE 20 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY TRANSPORTATION MODE, 2021

FIGURE 21 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY OFFERING, 2021

FIGURE 22 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 23 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 24 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY INDUSTRY, 2021

FIGURE 25 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: BY TRANSPORTATION MODE (2022-2029)

FIGURE 30 NORTH AMERICA FREIGHT TRANSPORTATION MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.