북미 골판지 포장 시장, 원자재(라이너보드 및 매체), 스타일(슬롯 상자, 망원경, 폴더, 트레이, 시트, 팬폴드, 다이 컷 블리스 및 다이 컷 인테리어), 등급(미표백 테스트라이너, 화이트탑 테스트라이너, 미표백 크라프트라이너, 화이트탑 크라프트라이너, 폐기물 기반 플루팅 및 반화학 플루팅), 최종 용도(가공 식품, 의료, 음료, 화학 제품, 섬유, 개인 관리, 전기 제품, 자동차 부품, 유리 제품 및 도자기 , 목재 및 목재 제품, 가정 관리, 과일 및 채소, 종이 제품, 담배, 기타), 국가(미국, 캐나다 및 멕시코) 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력 : 북미 골판지 포장 시장

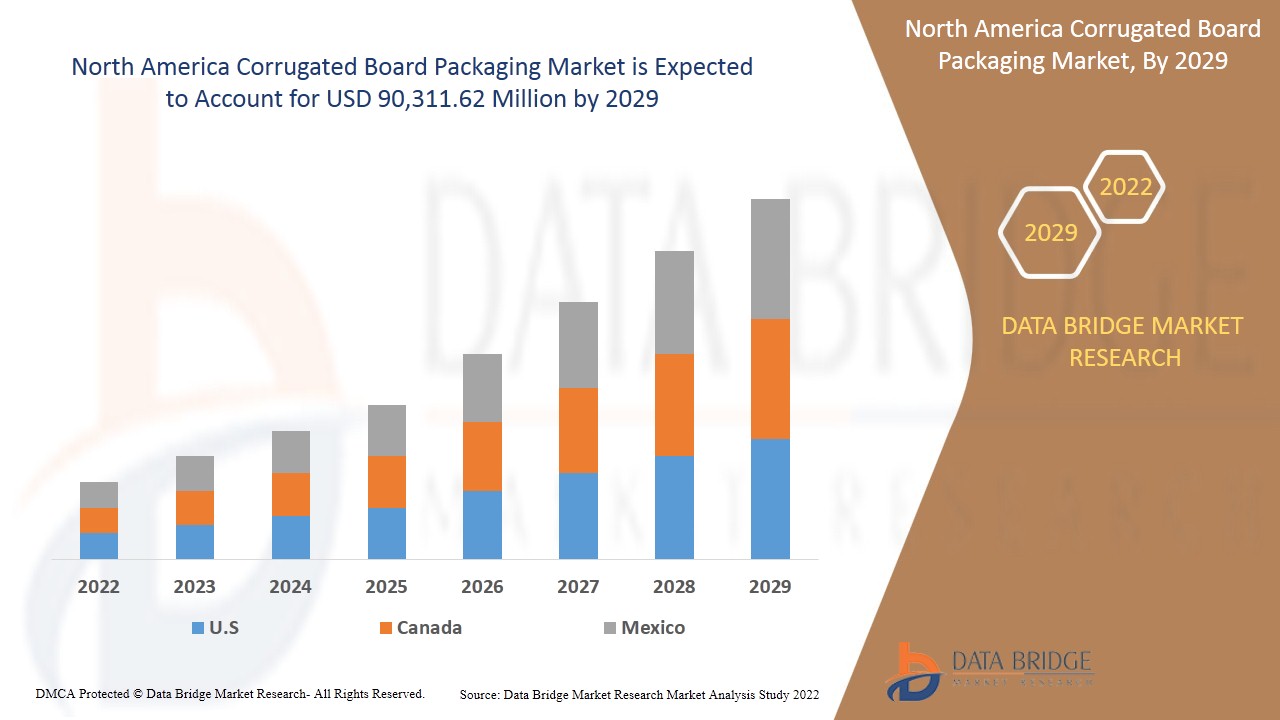

북미 골판지 포장 시장은 2022년에서 2029년의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년에서 2029년의 예측 기간 동안 5.6%의 CAGR로 성장하고 있으며 2029년까지 90,311.62백만 달러에 도달할 것으로 예상한다고 분석했습니다. 식품 및 음료 포장 산업에서 소형 및 중형 골판지 포장이 증가하고 포장 산업에서 재활용 골판지 제품에 대한 선호도가 높아지고 있습니다. 건설 및 전자 산업에서 골판지 포장 제품에 대한 증가하는 수요를 충족하기 위해 일부 회사는 인수, 합작 투자 및 다양한 지역에서 제품 출시를 통해 생산 용량을 확장하고 있습니다.

골판지 포장 제품은 보관 및 운송 중에 깨지기 쉽고 무겁고 부피가 크거나 가치가 높은 제품을 극도의 보호 기능을 제공하도록 설계되었습니다. 여러 겹의 골판지 포장은 포장 제품에 강도를 제공하고 평균 골판지보다 더 강하게 만듭니다. 골판지에는 크래프트 라이너 , 테스트 라이너, 칩 선형과 같은 다양한 유형의 라이너가 사용되어 강도를 제공합니다. 골판지는 운송 중에 제품의 쿠션 역할도 합니다. 골판지 포장 제품은 100% 재생 가능하고 비용 효율적이며 목재 및 금속 포장을 대체하는 데 사용됩니다. 단상, 단벽, 이중벽, 삼중벽 등 여러 유형의 골판지 포장이 있습니다. 단상 골판지 포장에는 단일 플루트와 선형 보드 1~2장이 포함됩니다. 단일벽 골판지 포장에는 골판지 매체 1장을 접착하여 라이너 보드 2장 사이에 놓습니다. 더블 월보드는 라이너 보드의 세 층 사이에 두 겹의 골판지 매체가 접착된 골판지 포장 유형을 말합니다. 트리플 월보드는 골판지 포장 유형을 말하며, 골판지 매체의 세 층과 라이너 보드의 네 겹으로 구성되어 모든 종류의 골판지 포장 중에서 가장 튼튼하다고 여겨집니다.

산업 전반에 걸쳐 가벼운 골판지 상자에 대한 구매가 증가함에 따라 시장 성장이 촉진될 것으로 예상되지만, 제품 포장에 대한 엄격한 정부 규제로 인해 북미 골판지 포장 시장이 제한될 것으로 예상됩니다. 기업 간의 인수 및 협력 증가로 시장이 성장할 기회가 생길 것으로 예상되지만, 포장의 지속 가능성에 대한 인식 부족으로 인해 시장 성장에 큰 어려움이 발생하고 있습니다.

골판지 포장 시장 보고서는 시장 점유율, 새로운 개발 및 제품 파이프라인 분석, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 의사 결정, 제품 출시, 지리적 확장 및 시장의 기술 혁신 측면에서의 분석 기회에 대한 세부 정보를 제공합니다. 분석 및 골판지 포장 시장 시나리오를 이해하려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 요청하세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

골판지 포장 시장 범위 및 시장 규모

북미 골판지 포장 시장은 등급, 원자재, 스타일 및 최종 용도를 기준으로 하는 네 가지 주요 세그먼트로 구분됩니다. 세그먼트 간의 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

- 원자재를 기준으로 북미 골판지 포장 시장은 라이너보드와 매체로 세분화됩니다. 라이너보드 세그먼트는 천연 자원과 재활용 자원으로 세분화됩니다. 재활용 자원 하위 세그먼트는 OCC, 회수지, 혼합지 및 사무용지로 세분화됩니다. 매체 세그먼트는 천연 자원과 재활용 자원으로 세분화됩니다. 재활용 자원 하위 세그먼트는 OCC, 회수지, 혼합지 및 사무용지로 세분화됩니다. 2022년에는 라이너보드 세그먼트가 쉬운 가공 기술, 향상된 효율성 및 더 쉬운 사용으로 인해 북미 골판지 포장 시장을 지배할 것으로 예상됩니다. 그러나 강도가 제한되어 시장에서 소비가 제한됩니다.

- 스타일 세그먼트를 기준으로 북미 골판지 포장 시장은 슬롯 박스, 텔레스코프, 폴더, 트레이, 다이 컷 블리스, 다이 컷 인테리어, 시트, 팬폴드로 세분화됩니다. 2022년에는 슬롯 박스 세그먼트가 북미 시장의 식품 및 음료 산업에서 적용이 확대됨에 따라 시장을 지배할 것으로 예상됩니다. 시장에서 쉽게 구할 수 있어 북미 시장에서 슬롯 박스 세그먼트가 성장합니다.

- 등급 세그먼트를 기준으로 북미 골판지 포장 시장은 화이트탑 크래프트 라이너, 미표백 크래프트 라이너, 화이트탑 테스트 라이너, 미표백 테스트 라이너, 폐기물 기반 플루팅, 반화학 플루팅으로 세분화됩니다. 2022년에는 미표백 테스트 라이너 세그먼트가 풍부하게 공급되어 북미 시장에서 소비가 극대화되어 시장을 지배할 것으로 예상됩니다. 이 힘의 저항 특성은 북미 시장에서 미표백 테스트 라이너 세그먼트를 주도하는 다양한 영역에서 적용을 극대화합니다.

- 최종 사용 세그먼트를 기준으로 북미 골판지 포장 시장은 가공 식품, 과일 및 채소, 음료, 개인 관리, 의료, 가정 관리, 화학 제품, 종이 제품, 전기 제품, 유리 및 도자기, 목재 및 목재 제품, 섬유, 담배, 자동차 부품 등으로 세분화됩니다. 2022년에는 개발도상국의 포장 식품에 대한 수요가 증가함에 따라 가공 식품 세그먼트가 시장을 지배할 것으로 예상됩니다. 운반하기 쉬운 특성이 북미 시장의 식품 및 음료 세그먼트를 주도합니다.

골판지 포장 시장 국가 수준 분석

골판지 포장 시장을 분석하고, 위에 언급된 대로 국가, 원자재, 스타일, 등급 및 최종 용도별로 시장 규모 정보를 제공합니다.

골판지 포장 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다. 미국은 환경 친화적인 제품 사용에 대한 소비자들의 인식이 높아짐에 따라 북미 지역을 지배하고 있으며, 이는 예측 기간 동안 미국 골판지 포장 시장 수요를 견인할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 규제 조치 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

업계 전체에서 가벼운 골판지 상자에 대한 구매 경향이 커지면서 시장 성장이 촉진될 것으로 예상됩니다.

골판지 포장 시장은 또한 특정 시장에서 모든 국가 성장에 대한 자세한 시장 분석을 제공합니다. 또한 시장 참여자의 전략과 지리적 입지에 대한 자세한 정보를 제공합니다. 이 데이터는 2020년의 과거 기간에 대해 제공됩니다.

경쟁 환경 및 골판지 포장 시장 점유율 분석

골판지 포장 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 있습니다. 위에 제공된 데이터 포인트는 골판지 포장 시장과 관련된 회사의 초점에만 관련이 있습니다.

골판지 포장 시장의 주요 기업으로는 Packaging Corporation of America, WestRock Company, International Paper, DS Smith, Rengo, Cascades Inc., Mondi, NEFAB GROUP, NIPPON PAPER INDUSTRIES CO., LTD, Wertheimer Box Corp 등이 있습니다.

또한, 북미 지역에서도 많은 계약과 협정이 체결되면서 골판지 포장 시장이 가속화되고 있습니다.

예를 들어,

- 2021년 1월, International Paper는 터키의 골판지 포장 사업을 매각하기로 결정했습니다. 이 계약은 International Paper와 Mondi Group 간의 계약이었습니다. 이 계약은 시장에서 유리한 위치를 차지하기 위해 두 회사 간에 체결되었습니다. 시장은 포장 산업에서 개선을 보게 될 것입니다.

- 2021년 8월, Mondi는 유럽 전역의 온라인 식료품 배달 서비스를 위한 지속 가능한 골판지 포장 솔루션을 출시했습니다. 7개의 새로운 포장 솔루션이 배달을 위한 새로운 포장 솔루션에 대한 수요를 충족합니다. 회사는 COVID 기간 동안 배달 목적으로 새로운 제품을 출시했습니다. 시장은 이러한 배달 목적으로 영양을 공급받을 것입니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 RAW MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVER

5.1.1 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY

5.1.2 CONTINUED INDUSTRIALIZATION ACROSS NORTH AMERICALY FOR UNIQUE CARTONS AND MATERIALS

5.1.3 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING IN THE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGHER COST OF CORRUGATED BOARD FOR PACKAGING

5.2.2 STRINGENT GOVERNMENT REGULATIONS FOR PACKAGING OF PRODUCTS

5.3 OPPORTUNITIES

5.3.1 RISE IN THE ACQUISITIONS & COLLABORATIONS BETWEEN THE COMPANIES

5.3.2 BAN ON PLASTIC PACKAGING PRODUCTS ON THE NORTH AMERICA MARKET

5.3.3 SURGING E-COMMERCE & COURIER SECTOR ACROSS DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARNESS ABOUT SUSTAINABLE PACKAGING

5.4.2 IMPACT OF HUMID AND MOIST WEATHER ON THE FIRMNESS OF CORRUGATED BOX

6 ANALYSIS ON IMPACT OF COVID 19 ON THE MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST MARKET GROWTH

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE & DEMAND

6.4 IMPACT ON SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 LINERBOARD

7.2.1 RECYCLED RESOURCES

7.2.1.1 OCC

7.2.1.2 RECOVERY PAPER

7.2.1.3 MIXED PAPER

7.2.1.4 OFFICE PAPER

7.2.2 NATURAL RESOURCES

7.3 MEDIUM

7.3.1 RECYCLED RESOURCES

7.3.1.1 OCC

7.3.1.2 RECOVERY PAPER

7.3.1.3 MIXED PAPER

7.3.1.4 OFFICE PAPER

7.3.2 NATURAL RESOURCES

8 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE

8.1 OVERVIEW

8.2 SLOTTED BOX

8.3 TELESCOPES

8.4 FOLDERS

8.5 TRAYS

8.6 SHEETS

8.7 FANFOLD

8.8 DIE CUT BLISS

8.9 DIE CUT INTERIORS

9 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE

9.1 OVERVIEW

9.2 UNBLEACHED TESTILINER

9.3 WHITE-TOP TESTILINER

9.4 UNBLEACHED KRAFTLINER

9.5 WHITE-TOP KRAFTLINER

9.6 WASTE-BASED FLUTING

9.7 SEMI-CHEMICAL FLUTING

10 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE

10.1 OVERVIEW

10.2 PROCESSED FOODS

10.3 HEALTHCARE

10.4 BEVERAGES

10.5 CHEMICALS

10.6 TEXTILES

10.7 PERSONAL CARE

10.8 ELECTRICAL GOODS

10.9 VEHICLE PARTS

10.1 GLASSWARE AND CERAMICS

10.11 WOOD AND TIMBER PRODUCTS

10.12 HOUSEHOLD CARE

10.13 FRUITS AND VEGETABLES

10.14 PAPER PRODUCTS

10.15 TOBACCO

10.16 OTHER

11 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY SHARE ANALYSIS

14.1 WESTROCK COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 INTERNATIONAL PAPER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 PACKAGING CORPORATION OF AMERICA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 DS SMITH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 RENGO CO, LTD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 ARABIAN PACKAGING CO, LLC

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 B SMITH PACKAGING LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 CASCADE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 GEORGIA PACIFIC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 JONSAC AB

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 KLABIN S.A.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 KLINGELE PAPIERWERKE GMBH & CO.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MONDI

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 NEFAB GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NEWAY PACKAGING

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 NIPPON

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 OJI HOLDING CORPORATION

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SMURFIT KAPPA

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SEALED AIR

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENT

14.2 WERTHEIMER BOX CORPORATION

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 BASIC RULES TO CONSIDER FOR SINGLE WALL CORRUGATED FIBERBOARD BOXES:

TABLE 2 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SLOTTED BOX IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TELESCOPE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA FOLDERS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TRAYS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SHEETS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA FANFOLD IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DIE CUT BLISS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DIE CUT INTERIORS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA UNBLEACHED TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA WHITE-TOP TESTILINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA UNBLEACHED KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA WHITE-TOP KRAFTLINER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA WASTE-BASED FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SEMI-CHEMICAL FLUTING IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PROCESSED FOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA BEVERAGES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TEXTILES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PERSONAL CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ELECTRICAL GOODS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA VEHICLE PARTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA GLASSWARE AND CERAMICS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WOOD AND TIMBER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA HOUSEHOLD CARE IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FRUITS AND VEGETABLES IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PAPER PRODUCTS IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA TOBACCO IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER IN CORRUGATED BOARD PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 50 U.S. CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 U.S. LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 56 U.S. CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 57 U.S. CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 CANADA CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 59 CANADA LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 64 CANADA CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 65 CANADA CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO CORRUGATED BOARD PACKAGING MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 67 MEXICO LINERBOARD IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO MEDIUM IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO RECYCLED RESOURCES IN CORRUGATED BOARD PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO CORRUGATED BOARD PACKAGING MARKET, BY STYLE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CORRUGATED BOARD PACKAGING MARKET, BY GRADE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO CORRUGATED BOARD PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: SEGMENTATION

FIGURE 11 GROWING INCLINATION OF PURCHASES TOWARD LIGHT WEIGHT CORRUGATED BOXES ACROSS THE INDUSTRY IS EXPECTED TO DRIVE NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RAW MATERIAL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND ALSO THE FASTEST GROWING REGION IN THE NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVER, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET

FIGURE 15 BELOW FIGURE DEPICTS THE EARNING REVENUE FROM DIFFERENT TYPE OF PACKAGING IN U.S. PACKAGING INDUSTRY IN 2016 (IN %)

FIGURE 16 U.S RETAIL SALES VIA E-COMMERCE IN 2019

FIGURE 17 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL, 2021

FIGURE 18 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY STYLE, 2021

FIGURE 19 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY GRADE, 2021

FIGURE 20 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY END-USE, 2021

FIGURE 21 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 22 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 23 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 26 NORTH AMERICA CORRUGATED BOARD PACKAGING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.