North America Collagen Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

790.67 Million

USD

1,204.26 Million

2021

2029

USD

790.67 Million

USD

1,204.26 Million

2021

2029

| 2022 –2029 | |

| USD 790.67 Million | |

| USD 1,204.26 Million | |

|

|

|

북미 콜라겐 시장 제품 유형별(젤라틴, 가수분해 콜라겐, 천연 콜라겐, 콜라겐 펩타이드, 기타), 유형(I형, II형, III형, IV형), 형태(분말, 액체), 출처(소, 가금류, 돼지, 해양, 기타), 제품 범주(GMO, 비GMO), 기능(텍스처, 안정제, 유화제, 발견, 기타), 응용 분야(식품, 음료, 건강기능식품 및 식이 보충제 , 화장품 및 개인 관리, 동물 사료, 실험실 테스트, 기타) - 2029년까지의 산업 동향 및 예측

시장 분석 및 규모

식품 산업에서 콜라겐의 사용 증가, 단백질 소비와 영양 화장품에 대한 관심 증가, 의료 분야에서의 응용 증가, 생체재료를 기반으로 한 콜라겐 사용 증가는 북미 콜라겐 시장 성장을 견인하는 주요 요인입니다. 또한 1인당 소득 증가와 확장되는 식품 가공 산업은 콜라겐 제조업체에 상당한 성장 기회를 제공합니다.

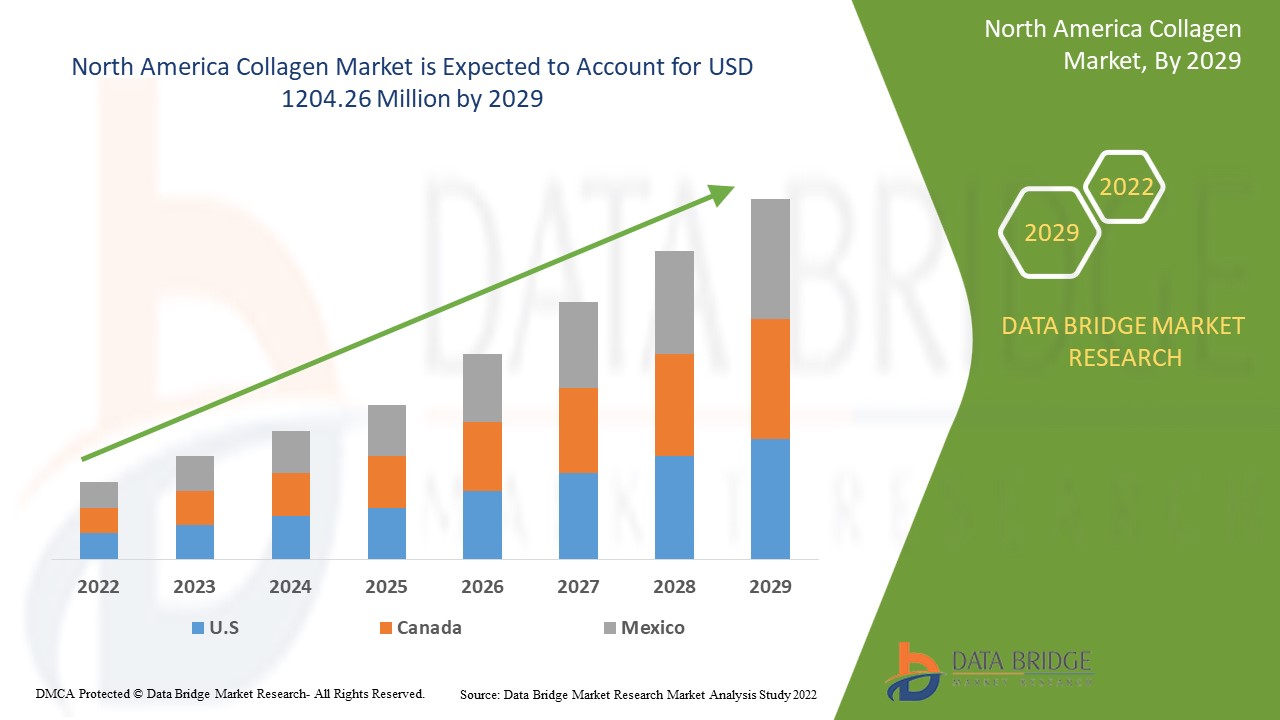

Data Bridge Market Research는 콜라겐 시장이 2021년에 7억 9,067만 달러 규모였으며 2022-2029년 예측 기간 동안 5.4%의 CAGR로 2029년까지 12억 426만 달러 규모에 도달할 것으로 분석했습니다. Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 세그먼트, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, 특허 분석 및 소비자 행동이 포함되어 있습니다.

보고 범위 및 시장 세분화

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2014-2019로 사용자 정의 가능) |

|

양적 단위 |

매출은 백만 달러, 볼륨은 단위, 가격은 달러로 표시 |

|

다루는 세그먼트 |

제품 유형(젤라틴, 가수분해 콜라겐, 천연 콜라겐, 콜라겐 펩타이드, 기타), 유형(I형, II형, III형, IV형), 형태(분말, 액상), 출처(소, 가금류, 돼지, 해양, 기타), 제품 범주(GMO, 비GMO), 기능(텍스처, 안정제, 유화제, 발견, 기타), 응용 분야(식품, 음료, 건강기능식품 및 식이 보충제, 화장품 및 개인 관리, 동물 사료 , 실험실 테스트, 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Rousselot(네덜란드), GELITA AG(독일), Weishardt(프랑스), Tessenderlo Group NV(벨기에), Nitta Gelatin Inc.(일본), LAPI GELATINE Spa(이탈리아), ITALGELATINE SpA(이탈리아), Ewald-Gelatine GmbH(독일), REINERT GRUPPE Ingredients GmbH(독일), TrobasGelatine BV(네덜란드), GELNEX(브라질), JuncàGelatines SL(스페인), HolistaCollTech Ltd.(호주), Collagen Solutions Plc(영국), Advanced BioMatrix, Inc.(미국) |

|

기회 |

|

시장 정의

콜라겐은 세포외 기질과 신체 전반의 여러 조직에서 발견되는 불용성 섬유 구조 단백질입니다. 아미노산, 글리신, 하이드록시프롤린, 아르기닌에서 합성됩니다. 뇌 건강을 증진하고, 뼈 손실을 예방하고, 관절 통증을 완화하고, 근육량을 늘리고, 머리카락과 손톱 성장을 개선하고, 피부의 강도와 탄력을 개선합니다.

콜라겐 시장 동향

운전자

- 식품 및 음료 산업에서 콜라겐이 제공하는 수많은 이점

콜라겐은 제과 제품에 사용되어 씹힘성, 거품 안정성 및 질감을 개선합니다. 유제품의 질감 및 안정화제로 사용됩니다. 또한 영양 바 성분의 결합제로 작용하여 영양 바의 부드러움과 유연성을 개선합니다. 콜라겐이 제공하는 수많은 기능의 결과로 식품 산업에서의 사용이 증가했습니다. 또한 영양실조와 특정 흡수 및 소화 장애를 치료하는 데 사용됩니다. 가치 판매 측면에서 이러한 요인이 콜라겐 시장의 성장을 주도할 것으로 예상됩니다.

- 개인 관리 산업에서 콜라겐의 적용 확대

인간 피부의 콜라겐 섬유는 시간이 지남에 따라 퇴화되어 두께와 강도를 잃고 피부 노화를 초래합니다. 콜라겐은 뼈 재생, 연골 재생, 혈관 및 심장 재건, 피부 교체 및 부드러운 피부 증강을 위한 영양 보충제로 화장품 크림에 사용됩니다. 콜라겐은 많은 비누, 샴푸, 얼굴 크림, 바디 로션 및 기타 화장품에서 발견되는 성분입니다. 가수분해 콜라겐은 피부 및 헤어 케어 제품의 핵심 구성 요소입니다. 개인 관리 산업에서 가수분해 콜라겐은 샴푸 및 샤워 젤의 계면 활성제 및 활성 세척제와 결합됩니다.

기회

변화하는 라이프스타일, 식습관, 서구식 식습관의 도입, 식품의 기능성 성분에 대한 수요 증가, 공정 개선을 필요로 하는 산업 활동의 증가는 신흥 경제권에서 콜라겐 시장이 성장하는 데 기여했습니다. 신흥 경제권은 시장 성장에 탁월한 기회를 제공합니다. 북미 소비 증가로 인해 다양한 국가의 시장 이해 관계자들은 콜라겐 생산을 늘리기 위해 끊임없이 노력해 왔습니다. 식품 및 음료 부문의 제조 회사는 수익성 있는 수익 기회를 창출하기 위해 전략적 접근 방식을 사용하고 있습니다.

제약

동물성 식품 및 음료 소비에 대한 문화적 금지는 시장 성장에 제약으로 작용할 수 있습니다. 더욱이 개발도상국의 부족한 가공 기술은 시장 성장에 더욱 큰 도전이 될 것입니다.

이 콜라겐 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 콜라겐 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

COVID-19가 콜라겐 시장에 미치는 영향

COVID-19 팬데믹은 식품 및 음료 산업 전체에 상당한 영향을 미칩니다. 격리 규칙으로 인해 공급이 부족하고 공급망이 중단되어 시장의 국내 업체가 어려움을 겪었습니다. 반면에 여러 가지 건강상의 이점을 제공하는 높은 영양가를 가진 제품에 대한 수요가 증가하고 있습니다. 콜라겐은 일반적으로 노인 인구를 돕기 위한 보충제에서 발견됩니다. 노령 인구의 콜라겐 기반 보충제에 대한 수요는 건강, 면역 및 전반적인 웰빙을 증진시킬 것으로 예상됩니다. 또한 팬데믹으로 인해 소비자의 건강 문제가 커짐에 따라 식품 및 음료 제품 라벨에 더 많은 관심을 기울이고 있습니다. 이를 통해 식품 및 음료 제조업체가 시장 점유율을 높일 수 있는 수많은 기회가 생길 것으로 예상됩니다.

최근 개발 사항

- Darling Ingredients의 EnviroFlight 브랜드는 2021년 4월 노스캐롤라이나주 에이펙스에 새로운 R&D 및 기업 센터를 열었습니다. 이 새로운 R&D 시설을 통해 동물 건강, 동물 영양, 화장품 및 기타 제품 개발에서 검은 병사파리 유충(BSFL)의 대체 용도에 대한 지식 기반을 확장하는 등 특정 연구 분야에 더 집중할 수 있게 되었습니다.

- GELITA USA는 2021년 3월에 아이오와주 수시티 근처 포트 닐 산업 지구에 있는 단지의 남동쪽 끝에 30,000제곱피트 규모의 생산 시설인 새로운 콜라겐 펩타이드 유닛을 열었습니다. 이 확장은 주로 GELITA의 콜라겐 펩타이드가 두 자릿수 시장 성장을 이룬 데 따른 것이며, 특히 건강 및 뷰티 시장에서 가까운 미래에 쇠퇴할 조짐이 보이지 않습니다.

북미 콜라겐 시장 범위

콜라겐 시장은 제품 유형, 유형, 형태, 출처, 제품 범주, 기능 및 응용 프로그램을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

제품 유형

- 젤라틴

- 가수분해 콜라겐

- 네이티브 콜라겐

- 콜라겐펩타이드

- 기타

유형

- 1형

- 2형

- 3형

- 4형

형태

- 가루

- 액체

원천

- 소

- 가축

- 물소

- 야크

- 기타

- 가금류

- 돼지

- 선박

- 기타

제품 카테고리

- 유전자 변형

- 비 GMO

기능

- 조직

- 안정제

- 유화제

- 발견

- 기타

애플리케이션

- 제약품

- 화장품

- 건강기능식품

- 스포츠 보충제

- 식품 제품

- 음료수

- 식이 보충제

- 화장품 및 개인 관리

- 동물사료

- 실험실 테스트

- 기타

콜라겐 시장 지역 분석/통찰력

콜라겐 시장을 분석하고, 위에 언급된 대로 국가, 제품 유형, 유형, 형태, 출처, 제품 범주, 기능 및 응용 분야별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

콜라겐 시장 보고서에서 다루는 국가는 미국, 캐나다, 멕시코입니다.

미국은 다양한 응용 분야에서 식이 보충제로 콜라겐을 수용하는 것이 증가함에 따라 시장을 지배할 것으로 예상됩니다. 또한, 캐나다는 콜라겐을 식품 성분으로 광범위하게 사용하는 국가의 확장된 식품 산업으로 인해 지배적입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 콜라겐 시장 점유율 분석

콜라겐 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 콜라겐 시장과 관련된 회사의 초점에만 관련이 있습니다.

콜라겐 시장에서 활동하는 주요 기업은 다음과 같습니다.

- 루셀로(네덜란드)

- GELITA AG(독일)

- 바이샤르트(프랑스)

- Tessenderlo Group NV(벨기에)

- 니타 젤라틴 주식회사(일본)

- LAPI GELATINE 스파(이탈리아)

- ITALGELATINE SpA(이탈리아)

- Ewald-Gelatine GmbH(독일)

- REINERT GRUPPE Ingredients GmbH (독일)

- TrobasGelatine BV (네덜란드)

- GELNEX(브라질)

- JuncàGelatines SL(스페인)

- HolistaCollTech Ltd. (호주)

- 콜라겐 솔루션 주식회사(영국)

- Advanced BioMatrix, Inc. (미국)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA COLLAGEN MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION METHOD COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 NORTH AMERICA COLLAGEN MARKET: LIST OF SUBSTITUTES

4.3 NORTH AMERICA COLLAGEN MARKET: MARKETING STRATEGIES

4.3.1 LAUNCHING NEW INNOVATIVE PRODUCTS

4.3.2 PROMOTION OF THEIR PRODUCTS BY EMPHASIZING DIFFERENT APPLICATIONS

4.3.3 A VAST NETWORK OF DISTRIBUTION

4.3.4 LAUNCHING CLEAN, SUSTAINABLE AND ORGANIC PRODUCTS FOR HEALTH-CONSCIOUS CONSUMERS

4.3.5 POPULARITY OF PLANT-BASED MEAT ALTERNATIVE

4.4 NORTH AMERICA COLLAGEN MARKET: PATENT ANALYSIS

4.4.1 DBMR ANALYSIS

4.4.2 COUNTRY-LEVEL ANALYSIS

4.4.3 YEARWISE ANALYSIS

4.4.4 PATENT ANALYSIS BY COMPANY

4.5 NORTH AMERICA COLLAGEN MARKET: PRODUCTION & CONSUMPTION PATTERN

4.6 NORTH AMERICA COLLAGEN MARKET: RAW MATERIAL PRICING ANALYSIS

5 REGULATORY FRAMEWORK

6 IMPACT OF COVID-19 IMPACT ON THE NORTH AMERICA COLLAGEN MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA COLLAGEN MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA COLLAGEN MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USAGE OF COLLAGEN PRODUCTS IN THE COSMETIC INDUSTRY

7.1.2 SUBSTANTIAL DEMAND FOR THE COLLAGEN PRODUCTS AS FOOD STABILIZER

7.1.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.1.4 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY

7.1.5 GROWTH OF FISHING INDUSTRY TO USE FISH AS A RAW MATERIAL FOR GELATIN PRODUCTION

7.2 RESTRAINTS

7.2.1 INCREASING STRINGENT REGULATIONS REGARDING THE USE OF FOOD ADDITIVES

7.2.2 REGULATIONS OVER THE IMPORTS OF RAW MATERIAL FOR THE PRODUCTION OF GELATIN AND COLLAGEN PRODUCTS IN EUROPEAN UNION

7.2.3 RISK OF DISEASE TRANSFER FROM ANIMAL SOURCES

7.2.4 REGULATIONS UPON THE SLAUGHTERING OF FARM AND POULTRY ANIMALS

7.3 OPPORTUNITIES

7.3.1 RISING COLLAGEN APPLICATION AS BIOMATERIALS IN THE LABORATORIES

7.3.2 RECENT TECHNOLOGICAL ADVANCEMENTS, INCLUDING THE FORMATION OF COLLAGEN-BASED PELLET AS GENE DELIVERY CARRIER

7.3.3 RISING COLLAGEN AS INGREDIENTS IN SUPPLEMENTS FOR SPORTS ATHLETES

7.4 CHALLENGES

7.4.1 LACK OF ADVANCED PROCESSING TECHNOLOGIES FOR COLLAGEN EXTRACTION

7.4.2 HIGH PROCESSING COSTS IN THE COLLAGEN INDUSTRY

7.4.3 COMPLICATED GMO CERTIFICATION PROCESS FOR COLLAGEN PRODUCTS LABELLING

8 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 GELATIN

8.3 HYDROLYZED COLLAGEN

8.4 NATIVE COLLAGEN

8.5 COLLAGEN PEPTIDE

8.6 OTHERS

9 NORTH AMERICA COLLAGEN MARKET, BY TYPE

9.1 OVERVIEW

9.2 TYPE I

9.3 TYPE II

9.4 TYPE III

9.5 TYPE IV

10 NORTH AMERICA COLLAGEN MARKET, BY FORM

10.1 OVERVIEW

10.2 POWDER

10.3 LIQUID

11 NORTH AMERICA COLLAGEN MARKET, BY SOURCE

11.1 OVERVIEW

11.2 BOVINE

11.3 POULTRY

11.4 PORCINE

11.5 MARINE

11.6 OTHERS

12 NORTH AMERICA COLLAGEN MARKET, BY PRODUCT CATEGORY

12.1 OVERVIEW

12.2 GMO

12.3 NON-GMO

13 NORTH AMERICA COLLAGEN MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 TEXTURE

13.3 STABILIZER

13.4 EMULSIFIER

13.5 FINDING

13.6 OTHERS

14 NORTH AMERICA COLLAGEN MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 FOOD PRODUCTS

14.3 BEVERAGES

14.4 NUTRACEUTICALS AND DIETARY SUPPLEMENTS

14.5 COSMETICS AND PERSONAL CARE

14.6 ANIMAL FEED

14.7 LABORATORY TESTS

14.8 OTHERS

15 NORTH AMERICA COLLAGEN MARKET, BY REGION

15.1 NORTH AMERICA

16 NORTH AMERICA COLLAGEN MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GELITA AG

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 RECENT DEVELOPMENTS

18.2 ROUSSELOT

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 RECENT DEVELOPMENTS

18.3 DSM

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ASHLAND

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 WEISHARDT

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 RECENT DEVELOPMENTS

18.6 AMICOGEN

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 ITALGELATINE S.P.A.

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ADVANCED BIOMATRIX, INC.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 COBIOSA

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 COLLAGEN SOLUTIONS PLC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 CONNOILS LLC

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 ET-CHEM

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 EWALD-GELATINE GMBH

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 GELNEX

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENTS

18.15 HOLISTA COLLTECH

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 JELLAGEN

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 JUNCÀ GELATINES SL

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 KENNEY & ROSS LIMITED MARINE GELATIN

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 LAPI GELATINE S.P.A.

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 NIPPI COLLAGEN NA INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 NORLAND PRODUCTS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 PB LEINER (A PART OF TESSENDERLO GROUP)

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SMPNUTRA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 TITAN BIOTECH

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 VITAL PROTEINS LLC

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 3503 GELATIN …HS CODE: 3503 (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 4 EXPORT DATA OF 3504 PEPTONES AND THEIR DERIVATIVES; OTHER PROTEIN SUBSTANCES AND THEIR DERIVATIVES, N.E.S.; HIDE…HS CODE: 3504 (USD THOUSAND)

TABLE 5 COLLAGEN RAW MATERIAL PRICE ANALYSIS IN 2020 (PER KGS)

TABLE 6 PERCENTAGE OF COLLAGEN YIELD FROM DIFFERENT SOURCES

TABLE 7 FOUR COMMON TYPES OF COLLAGEN AND THEIR RESPECTIVE LOCATION

그림 목록

FIGURE 1 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA COLLAGEN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA COLLAGEN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA COLLAGEN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA COLLAGEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA COLLAGEN MARKET: THE PRODUCT TYPE LIFELINE CURVE

FIGURE 7 NORTH AMERICA COLLAGEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 NORTH AMERICA COLLAGEN MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA COLLAGEN MARKET: SEGMENTATION

FIGURE 13 ASIA PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA COLLAGEN MARKET, AND EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 GROWTH IN THE USE OF COLLAGEN PROTEINS IN THE MEDICAL AND PHARMACEUTICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA COLLAGEN MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 COLLAGEN DEVICES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA COLLAGEN MARKET IN 2021 & 2028

FIGURE 16 PATENT REGISTERED FOR COLLAGEN BY COUNTRY (2016 - 2021)

FIGURE 17 PATENT REGISTERED YEAR (2016 - 2021)

FIGURE 18 CONCENTRATION OF EACH AMINO ACID IN HYDROLYSED COLLAGEN (IN %)

FIGURE 19 NORTH AMERICA COLLAGEN MARKET BY PRODUCTION (USD MILLION)

FIGURE 20 CONSUMPTION OF COLLAGEN BY REGION (USD MILLION)

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA COLLAGEN MARKET

FIGURE 22 ESTIMATED PRODUCTION OF COSMETICS IN THAILAND (2017-2020) (USD BILLION)

FIGURE 23 PERCENTAGE OF SPORTS NUTRITION NEW PRODUCT LAUNCHES TRACKED WITH COLLAGEN NORTH AMERICALY (2012-2016)

FIGURE 24 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 25 NORTH AMERICA COLLAGEN MARKET: BY TYPE, 2020

FIGURE 26 NORTH AMERICA COLLAGEN MARKET: BY FORM, 2020

FIGURE 27 NORTH AMERICA COLLAGEN MARKET: BY SOURCE, 2020

FIGURE 28 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT CATEGORY, 2020

FIGURE 29 NORTH AMERICA COLLAGEN MARKET: BY FUNCTION, 2020

FIGURE 30 NORTH AMERICA COLLAGEN MARKET: BY APPLICATION, 2020

FIGURE 31 NORTH AMERICA COLLAGEN MARKET: SNAPSHOT, 2020

FIGURE 32 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 33 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 34 NORTH AMERICA COLLAGEN MARKET: BY COUNTRY, 2020

FIGURE 35 NORTH AMERICA COLLAGEN MARKET: BY PRODUCT TYPE, 2020

FIGURE 36 NORTH AMERICA COLLAGEN MARKET: COMPANY SHARE 2020 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.