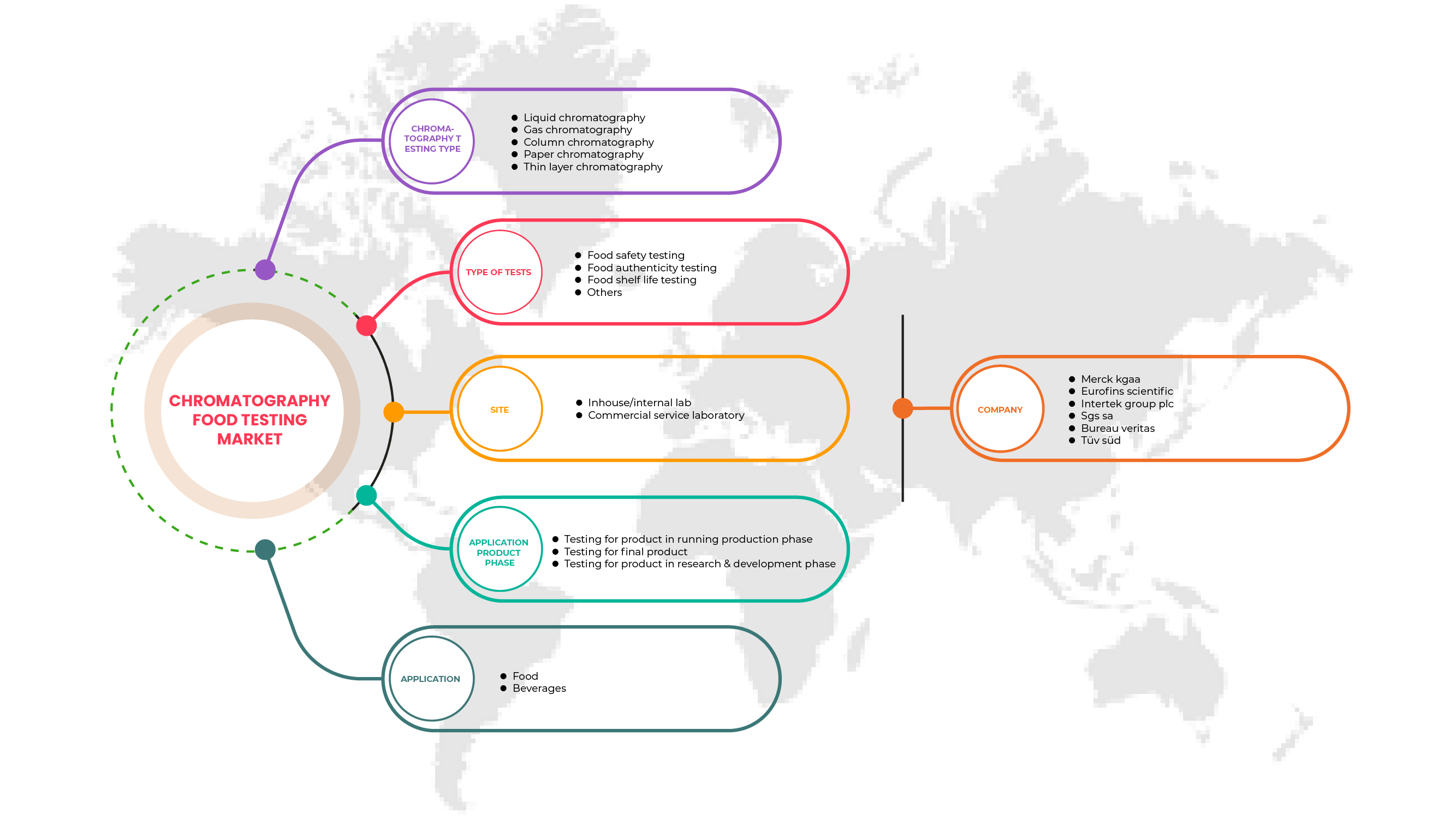

북미 크로마토그래피 식품 테스트 시장, 크로마토그래피 테스트 유형(액체 크로마토그래피, 가스 크로마토그래피, 컬럼 크로마토그래피, 종이 크로마토그래피 및 박층 크로마토그래피), 테스트 유형(식품 안전 테스트, 식품 진위성 테스트, 식품 유통기한 테스트 및 기타), 사이트(사내/내부 실험실 및 상업 서비스 실험실), 응용 제품 단계(생산 단계의 제품 테스트, 최종 제품 테스트 및 연구 개발 단계의 제품 테스트), 응용(식품 및 음료) 산업 동향 및 2029년까지의 예측.

북미 크로마토그래피 식품 테스트 시장 분석 및 통찰력

크로마토그래피 식품 검사는 식품의 품질을 결정하는 것부터 첨가물, 살충제, 병원균 및 인간의 건강에 영향을 미칠 수 있는 기타 유해 오염 물질을 감지하는 것까지 식품 사슬의 다양한 단계에서 사용될 수 있습니다. COVID-19와 같은 팬데믹이 지역 전체에 걸쳐 증가하면서 크로마토그래피 식품 검사를 포함한 식품 검사의 성장이 촉진되었습니다.

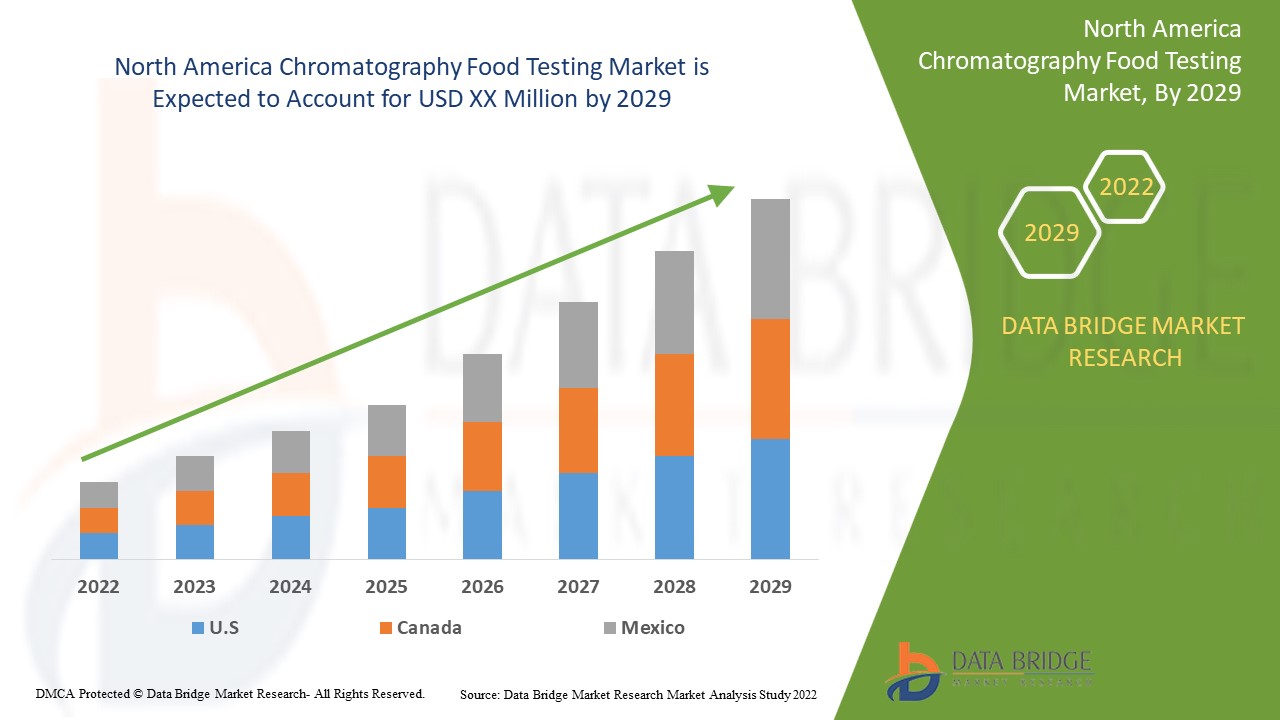

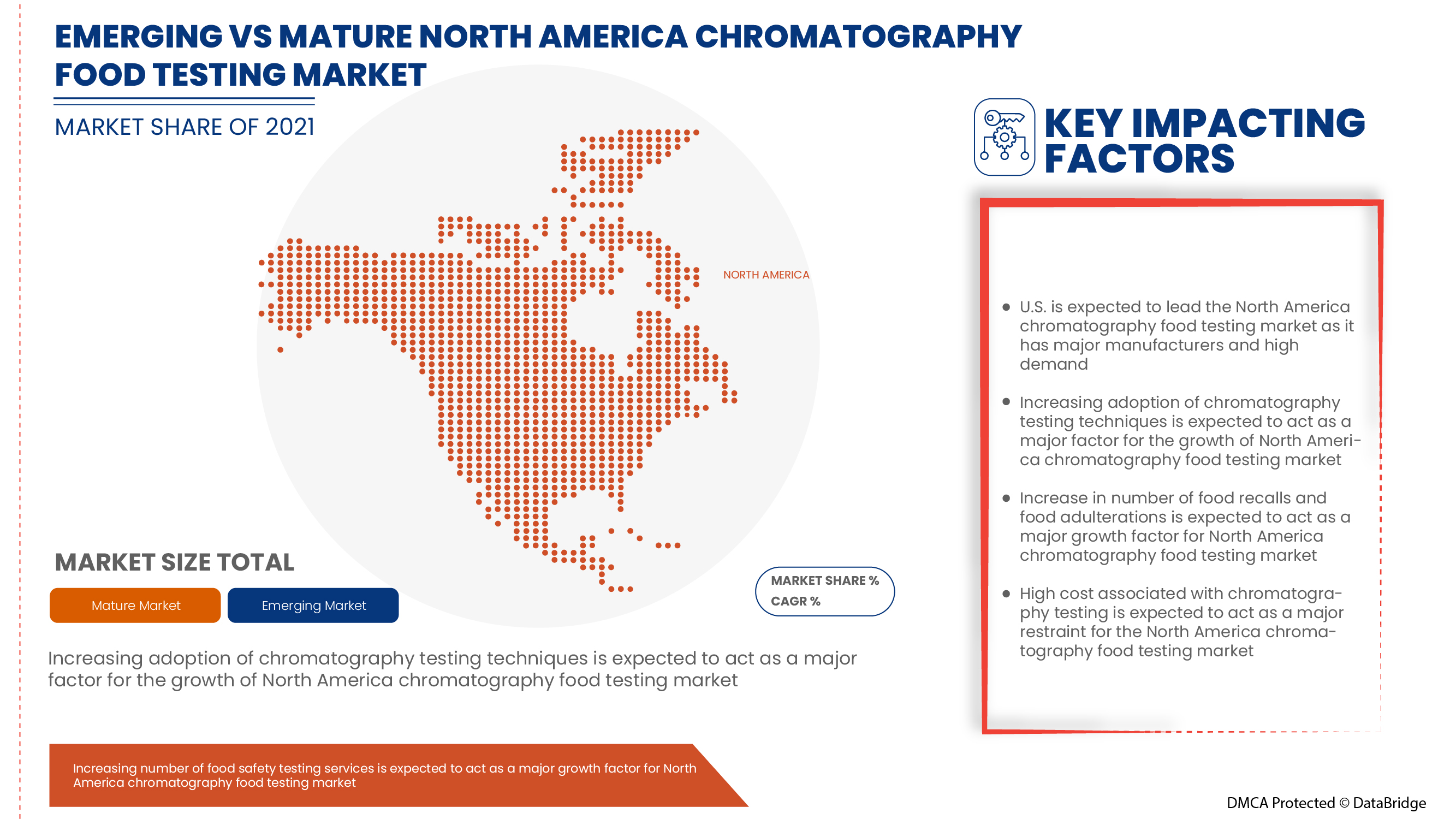

식품 매개 질병의 증가, 테스트 산업의 기술 발전, 식품 규제 및 표준의 엄격성, 식품 안전 테스트 서비스에 대한 투자 증가는 시장을 주도하는 몇 가지 요인입니다. 그러나 크로마토그래피 장비의 높은 비용과 대체 식품 테스트 기술의 존재는 시장 성장을 방해할 수 있습니다. Data Bridge Market Research는 북미 크로마토그래피 식품 테스트 시장이 2022년에서 2029년까지의 예측 기간 동안 6.6%의 CAGR로 성장할 것이라고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

매출은 천 달러, 볼륨은 단위, 가격은 달러로 표시됨 |

|

다루는 세그먼트 |

크로마토그래피 시험 유형(액체 크로마토그래피, 가스 크로마토그래피, 컬럼 크로마토그래피, 종이 크로마토그래피, 박층 크로마토그래피), 시험 유형( 식품 안전 시험 , 식품 진위성 시험, 식품 유통기한 시험, 기타), 사이트(사내/내부 실험실, 상업 서비스 실험실), 응용 제품 단계(실행 중인 생산 단계의 제품 시험, 최종 제품 시험, 연구 개발 단계의 제품 시험), 응용(식품 및 음료) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, QIMA, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Food Safety Net Services, ADPEN Laboratories, Inc., Element Materials Technology, NSF, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., Shimadzu Corporation 등이 있습니다. |

시장 정의

식품매개 질병은 첨가물, 살충제, 병원성 박테리아, 바이러스, 기생충 등으로 부패하거나 오염된 음식을 섭취하여 감염되는 것으로 인해 발생합니다. 식품매개 질병은 부적절한 식품 취급, 인식 부족 등 다양한 요인을 통해 퍼질 수 있습니다. 이러한 질병 유발 요인은 식품을 섭취하기 전에 테스트해야 합니다. 크로마토그래피는 식품의 품질을 결정하는 것부터 첨가물, 살충제 및 기타 유해 오염 물질을 감지하는 것까지 식품 사슬의 다양한 단계에서 사용할 수 있습니다.

북미 크로마토그래피 식품 테스트 시장 역학

운전자

- 식품매개 질병 증가

식품매개 질병은 오염된 음식이나 음료를 섭취함으로써 발생합니다. 알려진 식품매개 질병은 250개가 넘습니다. 대부분의 감염은 박테리아, 바이러스, 기생충에 의해 발생하고 일부는 화학 물질과 독소에 의해 발생합니다. 대장균은 인간의 장에 사는 주요 박테리아 종입니다.

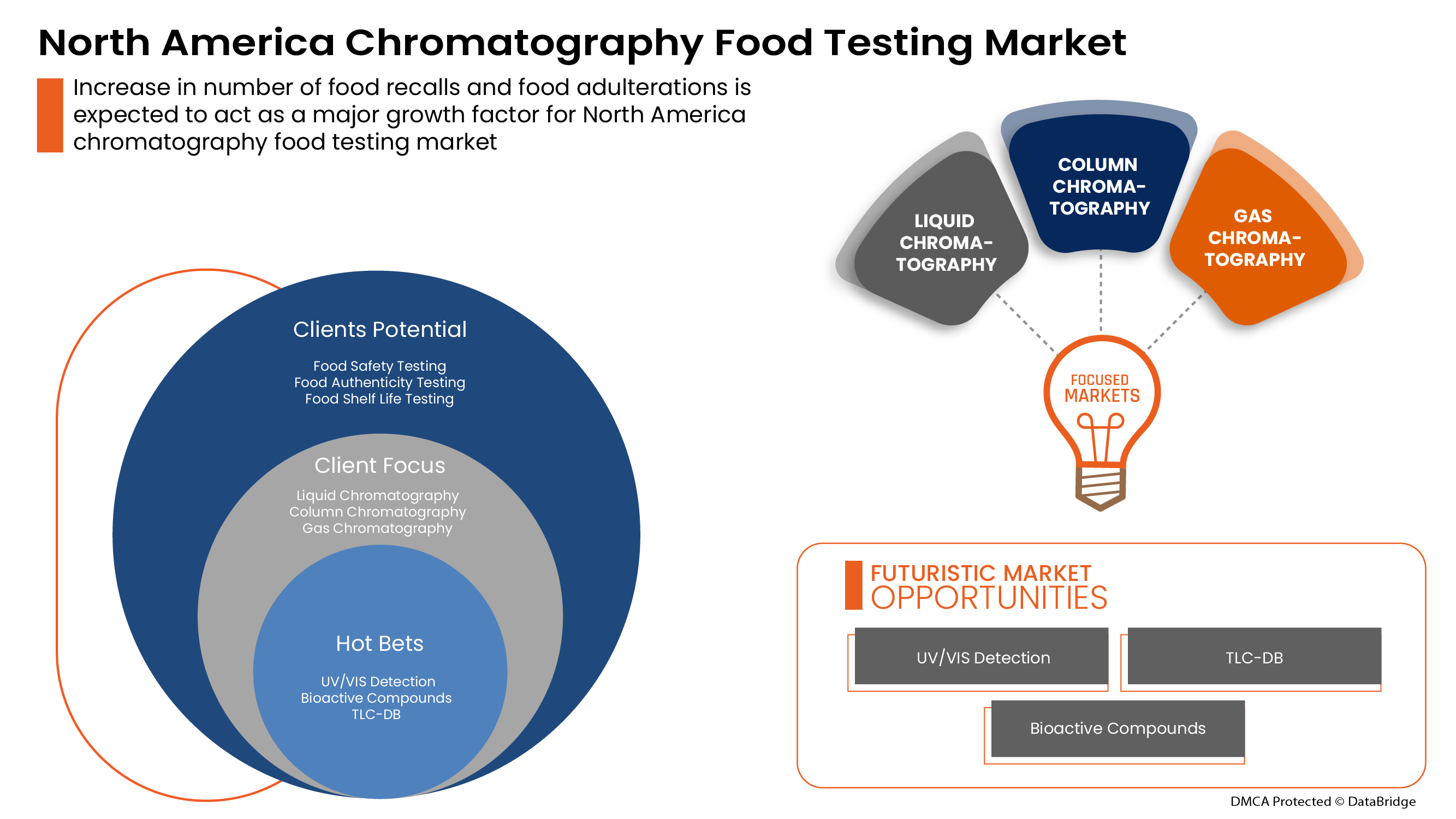

- 크로마토그래피 테스트 기술의 채택 증가

크로마토그래피는 혼합물의 성분을 분리, 식별 및 정제하여 정성 및 정량 분석을 가능하게 하는 중요한 생물물리학 기술입니다. 오늘날 크로마토그래피를 통해 식품 산업은 특정 식품의 영양소에 대한 정확한 정보를 제공할 수 있으며, 그 외 많은 정보도 제공할 수 있습니다.

- 식품 리콜 및 식품 오염 증가

식품 리콜은 소비자에게 안전 위험을 초래할 수 있는 특정 식품을 판매, 유통 및 소비에서 제외하기 위해 취하는 조치입니다. 식품 리콜은 제조업체, 도매업체, 소매업체, 정부 기관 및 소비자와 같은 다양한 출처의 보고 또는 불만으로 인해 시작될 수 있습니다.

기회

-

테스트 산업의 기술 발전

최근 시장 성장을 주도하고 있는 크로마토그래피 식품 테스트의 기술 동향은 인공지능(AI) , 디지털화, 연결 기술, 데이터 및 머신 러닝으로 구동되는 스마트 자동화 기술입니다. 팬데믹 이전에는 스마트하고 자동화된 기술의 이점에 대한 관심이 높았습니다.

제약/도전

- 크로마토그래피 테스트와 관련된 높은 비용 및 대체 식품 테스트 기술의 존재

그러나 현재 종이 크로마토그래피, 박층 크로마토그래피, 가스 크로마토그래피, 멤브레인 크로마토그래피, 염료 리간드 크로마토그래피와 같은 다양한 유형의 크로마토그래피 테스트가 있습니다. 이러한 크로마토그래피 테스트는 식품, 생물제약, 건강기능식품 및 생물가공 산업 등에서 널리 사용됩니다. 크로마토그래피 테스트는 다양한 산업에서 테스트 후 정확한 결과를 얻기 위해 사용되지만 크로마토그래피 테스트는 비용이 많이 들고 테스트에 많은 시간이 걸립니다. 식품 산업에서 사용되는 크로마토그래피 테스트를 방해할 수 있는 또 다른 요소는 관련 비용입니다.

COVID-19가 북미 크로마토그래피 식품 테스트 시장에 미치는 영향

COVID-19는 식품 검사 서비스가 붐을 일으키면서 시장에 긍정적인 영향을 미쳤습니다. COVID-19로 인해 크로마토그래피 식품 검사 시스템과 서비스에 대한 소비자들의 수요가 커지면서 오염과 병원균을 감지해야 할 필요성이 식품 산업이 따라야 할 의무가 되었습니다. 이로 인해 크로마토그래피 식품 검사를 포함한 다양한 유형의 식품 검사 서비스가 성장했습니다.

최근 개발

- 2022년 6월, PerkinElmer, Inc.는 차세대 자동 가스크로마토그래피 플랫폼 솔루션을 출시했습니다. 이 솔루션의 주요 특징은 자동 가스크로마토그래피(GC), 헤드스페이스 샘플러, GC/질량 분석(GC/MS) 솔루션이었습니다.

북미 크로마토그래피 식품 테스트 시장 범위

북미 크로마토그래피 식품 테스트 시장은 크로마토그래피 테스트 유형, 테스트 유형, 사이트, 응용 제품 단계 및 응용 프로그램을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

크로마토그래피 테스트 유형

- 액체크로마토그래피

- 가스크로마토그래피

- 컬럼 크로마토그래피

- 종이 크로마토그래피

- 박층크로마토그래피

크로마토그래피 테스트 유형을 기준으로 북미 크로마토그래피 식품 테스트 시장은 액체 크로마토그래피, 가스 크로마토그래피, 컬럼 크로마토그래피, 종이 크로마토그래피, 박층 크로마토그래피로 구분됩니다.

테스트 유형

- 식품 안전 테스트

- 식품 진위성 테스트

- 식품 유통기한 테스트

- 기타

테스트 유형을 기준으로 북미 크로마토그래피 식품 테스트 시장은 식품 안전 테스트, 식품 진위성 테스트, 식품 유통기한 테스트 및 기타로 구분됩니다.

대지

- 사내/내부 연구실

- 상업 서비스 연구소

북미 크로마토그래피 식품 검사 시장은 현장을 기준으로 사내 연구실과 상업 서비스 연구실로 구분됩니다.

응용 프로그램 제품 단계

- 생산 단계 실행 중 제품 테스트

- 최종 제품 테스트

- 연구 및 개발 단계에서 제품 테스트

북미 크로마토그래피 식품 테스트 시장은 응용 제품 단계를 기준으로 생산 단계의 제품 테스트, 최종 제품 테스트, 연구 개발 단계의 제품 테스트로 세분화됩니다.

애플리케이션

- 음식

- 음료수

북미 크로마토그래피 식품 검사 시장은 응용 분야를 기준으로 식품 및 음료로 구분됩니다.

북미 크로마토그래피 식품 테스트 시장 지역 분석/통찰력

북미 크로마토그래피 식품 검사 시장을 분석하고, 위에 언급된 대로 국가, 크로마토그래피 검사 유형, 검사 유형, 장소, 적용 제품 단계 및 적용 분야별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

2022년에는 미국이 광범위한 팬데믹으로 인해 크로마토그래피 테스트 기술 채택이 늘어나고 식품 안전에 대한 강조와 지역 내 테스트 산업의 기술 발전이 증가함에 따라 북미 크로마토그래피 식품 테스트 시장을 장악할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 크로마토그래피 식품 테스트 시장 점유율 분석

크로마토그래피 식품 테스트 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 솔루션 출시, 제품 폭과 범위, 응용 분야 지배력이 있습니다. 제공된 위의 데이터 포인트는 북미 크로마토그래피 식품 테스트 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 크로마토그래피 식품 검사 시장의 주요 기업으로는 SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS, Intertek Group plc, QIMA, Merck KGaA, Cotecna, Mérieux NutriSciences Corporation, Food Safety Net Services, ADPEN Laboratories, Inc., Element Materials Technology, NSF, Neogen Corporation, Waters Corporation, Thermo Fisher Scientific Inc., Shimadzu Corporation 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 LIQUID CHROMATOGRAPHY TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.2 GROWING FOOD ADULTERATION CASES

4.3 INDUSTRY TRENDS & FUTURE PERSPECTIVE

4.4 SUPPLY CHAIN ANALYSIS

4.5 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF CHROMATOGRAPHY FOOD TESTING TECHNOLOGIES

4.6 OVERVIEW OF TECHNOLOGICAL ADVANCEMENT IN THE FIELD

4.7 TECHNOLOGICAL TRENDS IN CHROMATOGRAPHY FOOD TESTING

4.8 EMERGING TREND ANALYSIS

4.8.1 ETHYLENE OXIDE AND 2-CHLOROETHANOL ANALYSIS

4.8.2 NEW TECHNOLOGIES WITH HIGH ACCURACY AND PRECISION

5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, REGULATORY FRAMEWORK AND GUIDELINES

5.1 FOOD AND BEVERAGES SAFETY AND QUALITY REGULATIONS

5.2 FOOD SAFETY & STANDARDS PACKAGING & LABELLING REGULATIONS 2011

5.3 ANALYSIS OF LAWSUITS RELATED TO CHROMATOGRAPHY FOOD TESTING

5.4 FOODBORNE ILLNESS OUTBREAKS AND RELEVANT ACTIONS TAKEN BY GOVERNMENT BODIES

5.5 RECENTLY FORMED LAWS FOR CHROMATOGRAPHY FOOD TESTING BY GOVERNMENT BODIES CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS

5.6 CHANGES IN NORTH AMERICA FOOD SAFETY REGULATIONS

5.7 FOOD PRODUCTS RECALLS

5.8 FOOD PRODUCTS WITHDRAWALS

6 REGIONAL SUMMARY

6.1 SUMMARY WRITE-UP (NORTH AMERICA)

6.1.1 OVERVIEW

6.2 SUMMARY WRITE-UP (EUROPE)

6.2.1 OVERVIEW

6.3 SUMMARY WRITE-UP (ASIA-PACIFIC)

6.3.1 OVERVIEW

6.4 SUMMARY WRITE-UP (SOUTH AMERICA)

6.4.1 OVERVIEW

6.5 SUMMARY WRITE-UP (MIDDLE EAST AND AFRICA)

6.5.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN NUMBER OF FOODBORNE ILLNESSES

7.1.2 AN INCREASE IN THE AMOUNT OF FOOD RECALLS AND FOOD ADULTERATIONS

7.1.3 INCREASING ADOPTION OF CHROMATOGRAPHY TESTING TECHNIQUES

7.2 RESTRAINTS

7.2.1 HIGH COST ASSOCIATED WITH CHROMATOGRAPHY TESTING

7.2.2 PRESENCE OF ALTERNATIVE FOOD TESTING TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN THE TESTING INDUSTRY

7.3.2 GROWING APPLICATIONS OF CHROMATOGRAPHY IN VARIOUS FIELDS

7.3.3 INCREASING NUMBER OF FOOD SAFETY TESTING SERVICE PROVIDERS

7.3.4 RIGIDITY IN FOOD REGULATION AND STANDARDS

7.3.5 INCREASING ACQUISITIONS AND PARTNERSHIPS AMONG MARKET PLAYERS

7.4 CHALLENGES

7.4.1 LACK OF HARMONIZATION IN FOOD SAFETY STANDARDS

7.4.2 LACK OF INFRASTRUCTURE AND SKILLED PROFESSIONALS

8 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE

8.1 OVERVIEW

8.2 LIQUID CHROMATOGRAPHY

8.3 GAS CHROMATOGRAPHY

8.4 COLUMN CHROMATOGRAPHY

8.5 PAPER CHROMATOGRAPHY

8.6 THIN LAYER CHROMATOGRAPHY

9 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS

9.1 OVERVIEW

9.2 FOOD SAFETY TESTING

9.2.1 ALLERGEN TESTING

9.2.1.1 MILK

9.2.1.2 EGG

9.2.1.3 SEAFOOD

9.2.1.4 PEANUT & SOY

9.2.1.5 GLUTEN

9.2.1.6 TREE NUTS

9.2.1.7 OTHERS

9.2.2 PATHOGENS TESTING

9.2.2.1 SALMONELLA SPP

9.2.2.2 E. COLI

9.2.2.3 LISTERIA SPP

9.2.2.4 LISTERIA

9.2.2.5 CAMPYLOBACTER

9.2.2.6 VIBRIO SPP

9.2.2.7 OTHERS

9.2.3 HEAVY METALS TESTING

9.2.3.1 LEAD

9.2.3.2 ARSENIC

9.2.3.3 CADMIUM

9.2.3.4 MERCURY

9.2.3.5 OTHERS

9.2.4 NUTRITIONAL LABELLING

9.2.5 GMO TESTING

9.2.5.1 STACKED

9.2.5.2 HERBICIDE TOLERANCE

9.2.5.3 INSECT RESISTANCE

9.2.6 ORGANIC CONTAMINANTS TESTING

9.2.7 MYCOTOXINS TESTING

9.2.7.1 AFLATOXINS

9.2.7.2 OCHRATOXINS

9.2.7.3 PATULIN

9.2.7.4 FUMONISINS

9.2.7.5 TRICHOTHECENES

9.2.7.6 DEOXYNIVALENOL

9.2.7.7 ZEARALENONE

9.2.8 PESTICIDES TESTING

9.2.8.1 INSECTICIDES

9.2.8.2 HERBICIDES

9.2.8.3 FUNGICIDES

9.2.8.4 OTHERS

9.3 FOOD AUTHENTICITY TESTING

9.3.1 ADULTERATION TESTS

9.3.2 ORGANIC

9.3.3 ALLERGEN TESTING

9.3.4 MEAT SPECIATION

9.3.5 GMO TESTING

9.3.6 HALAL VERIFICATION

9.3.7 KOSHER VERIFICATION

9.3.8 PROTECTED GEOGRAPHICAL INDICATION (PGI)

9.3.9 PROTECTED DENOMINATION OF ORIGIN (PDO)

9.3.10 FALSE LABELLING

9.4 FOOD SHELF LIFE TESTING

9.4.1 ORGANOLEPTIC AND APPEARANCE

9.4.1.1 COLOR

9.4.1.2 TEXTURE

9.4.1.3 PACKAGING

9.4.1.4 AROMA

9.4.1.5 TASTE

9.4.1.6 SEPARATION

9.4.1.7 STRATIFICATION

9.4.2 RANCIDITY

9.4.2.1 PEROXIDE VALUE (PV)

9.4.2.2 P-ANISIDINE (P-AV)

9.4.2.3 FREE FATTY ACIDS (FFA)

9.4.3 INGREDIENT ACTIVITY

9.4.4 NUTRIENT STABILITY

9.4.5 CHEMICAL TESTS

9.4.6 ACIDITY LEVELS

9.4.7 BROWNING

9.4.7.1 ENZYMATIC BROWNING

9.4.7.2 CHEMICAL BROWNING

9.4.8 REAL-TIME SHELF TESTING

9.4.9 ACCELERATED SHELF-LIFE TESTING

9.4.10 ACCELERATED (40C/75%RH)

9.4.11 INTERMEDIATE (30C/65%RH)

9.4.12 AMBIENT (25C/60%RH)

9.4.13 TROPICAL (30C/75%RH)

9.4.14 REFRIGERATED (2C TO 8C)

9.4.15 FROZEN (-15C TO -20C)

9.4.16 OTHERS

9.5 OTHERS

10 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET , BY SITE

10.1 OVERVIEW

10.2 INHOUSE/INTERNAL LAB

10.3 COMMERCIAL SERVICE LABORATORY

11 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE

11.1 OVERVIEW

11.2 TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE

11.3 TESTING FOR FINAL PRODUCT

11.4 TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE

12 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 PROCESSED FOOD

12.2.1.1 PROCESSED FOOD, BY TYPE

12.2.1.1.1 CANNED FRUITS & VEGETABLES

12.2.1.1.2 JAMS, PRESERVES & MARMALADES

12.2.1.1.3 FRUIT & VEGETABLE PUREE

12.2.1.1.4 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.1.5 READY MEALS

12.2.1.1.6 SOUPS

12.2.1.1.7 PICKLES

12.2.1.1.8 OTHERS

12.2.1.2 PROCESSED FOOD, BY CHROMATOGRAPHY TESTING TYPE

12.2.1.2.1 LIQUID CHROMATOGRAPHY

12.2.1.2.2 GAS CHROMATOGRAPHY

12.2.1.2.3 COLUMN CHROMATOGRAPHY

12.2.1.2.4 THIN LAYER CHROMATOGRAPHY

12.2.1.2.5 PAPER CHROMATOGRAPHY

12.2.2 DAIRY PRODUCTS

12.2.2.1 DAIRY PRODUCTS, BY TYPE

12.2.2.1.1 ICE CREAM

12.2.2.1.2 CHEESE

12.2.2.1.3 MILK DESSERT

12.2.2.1.3.1 MILK DESSERT, BY TYPE

12.2.2.1.3.2 Pudding

12.2.2.1.3.3 Custard

12.2.2.1.3.4 Others

12.2.2.1.4 YOGURT

12.2.2.1.5 CHEESE BASED DESERTS

12.2.2.1.5.1 CHEESE BASED DESERTS, BY TYPE

12.2.2.1.5.2 Cheese Cake

12.2.2.1.5.3 Cheese Pudding

12.2.2.1.5.4 Cheese Cake

12.2.2.1.5.5 Others

12.2.2.1.6 OTHERS

12.2.2.2 DAIRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.2.2.1 LIQUID CHROMATOGRAPHY

12.2.2.2.2 GAS CHROMATOGRAPHY

12.2.2.2.3 COLUMN CHROMATOGRAPHY

12.2.2.2.4 THIN LAYER CHROMATOGRAPHY

12.2.2.2.5 PAPER CHROMATOGRAPHY

12.2.3 MEAT & POULTRY PRODUCTS

12.2.3.1 MEAT & POULTRY PRODUCTS, BY TYPE

12.2.3.1.1 CHICKEN & EGGS

12.2.3.1.2 SEAFOOD

12.2.3.1.3 BEEF

12.2.3.1.4 LAMB & GOAT

12.2.3.1.5 PORK

12.2.3.1.6 OTHERS

12.2.3.2 MEAT & POULTRY PRODUCTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.3.2.1 LIQUID CHROMATOGRAPHY

12.2.3.2.2 GAS CHROMATOGRAPHY

12.2.3.2.3 COLUMN CHROMATOGRAPHY

12.2.3.2.4 THIN LAYER CHROMATOGRAPHY

12.2.3.2.5 PAPER CHROMATOGRAPHY

12.2.4 VEGETABLES

12.2.4.1 Vegetables, BY TYPE

12.2.4.1.1 LEAFY GREENS

12.2.4.1.2 CRUCIFEROUS VEGETABLES

12.2.4.1.3 MARROW VEGETABLES

12.2.4.1.4 ROOT VEGETABLES

12.2.4.1.5 ONION

12.2.4.1.6 GARLIC

12.2.4.1.7 OTHERS

12.2.4.2 VEGETABLES, BY CHROMATOGRAPHY TESTING TYPE

12.2.4.2.1 LIQUID CHROMATOGRAPHY

12.2.4.2.2 GAS CHROMATOGRAPHY

12.2.4.2.3 COLUMN CHROMATOGRAPHY

12.2.4.2.4 THIN LAYER CHROMATOGRAPHY

12.2.4.2.5 PAPER CHROMATOGRAPHY

12.2.5 FRUITS

12.2.5.1 Fruits, BY TYPE

12.2.5.1.1 APPLE & PEARS

12.2.5.1.2 CITRUS FRUITS

12.2.5.1.3 TROPICAL FRUITS

12.2.5.1.4 BERRIES

12.2.5.1.5 MELONS

12.2.5.1.6 OTHERS

12.2.5.2 Fruits, BY CHROMATOGRAPHY TESTING TYPE

12.2.5.2.1 LIQUID CHROMATOGRAPHY

12.2.5.2.2 GAS CHROMATOGRAPHY

12.2.5.2.3 COLUMN CHROMATOGRAPHY

12.2.5.2.4 THIN LAYER CHROMATOGRAPHY

12.2.5.2.5 PAPER CHROMATOGRAPHY

12.2.6 CEREALS & GRAINS

12.2.6.1 CEREALS & GRAINS, BY TYPE

12.2.6.1.1 RICE

12.2.6.1.2 WHEAT

12.2.6.1.3 BARLEY

12.2.6.1.4 MAIZE

12.2.6.1.5 OAT

12.2.6.1.6 SORGHUM

12.2.6.1.7 OTHERS

12.2.6.2 Cereals & Grains, BY CHROMATOGRAPHY TESTING TYPE

12.2.6.2.1 LIQUID CHROMATOGRAPHY

12.2.6.2.2 GAS CHROMATOGRAPHY

12.2.6.2.3 COLUMN CHROMATOGRAPHY

12.2.6.2.4 THIN LAYER CHROMATOGRAPHY

12.2.6.2.5 PAPER CHROMATOGRAPHY

12.2.7 EDIBLE OILS

12.2.7.1 EDIBLE OILS, BY TYPE

12.2.7.1.1 SOYBEAN OIL

12.2.7.1.2 SUNFLOWER OIL

12.2.7.1.3 GROUNDNUT OIL

12.2.7.1.4 COCONUT OIL

12.2.7.1.5 OLIVE OIL

12.2.7.1.6 OTHERS

12.2.7.2 EDIBLE OILS, BY CHROMATOGRAPHY TESTING TYPE

12.2.7.2.1 LIQUID CHROMATOGRAPHY

12.2.7.2.2 GAS CHROMATOGRAPHY

12.2.7.2.3 COLUMN CHROMATOGRAPHY

12.2.7.2.4 THIN LAYER CHROMATOGRAPHY

12.2.7.2.5 PAPER CHROMATOGRAPHY

12.2.8 OILSEEDS & PULSES

12.2.8.1 OILSEEDS & PULSES, BY TYPE

12.2.8.1.1 GRAM

12.2.8.1.2 PEA

12.2.8.1.3 SUNFLOWERS

12.2.8.1.4 LENTILS

12.2.8.1.5 SOYBEANS

12.2.8.1.6 GROUNDNUT

12.2.8.1.7 SESAME

12.2.8.1.8 PALM

12.2.8.1.9 COTTON SEED

12.2.8.1.10 OTHERS

12.2.8.2 OILSEEDS & PULSES, BY CHROMATOGRAPHY TESTING TYPE

12.2.8.2.1 LIQUID CHROMATOGRAPHY

12.2.8.2.2 GAS CHROMATOGRAPHY

12.2.8.2.3 COLUMN CHROMATOGRAPHY

12.2.8.2.4 THIN LAYER CHROMATOGRAPHY

12.2.8.2.5 PAPER CHROMATOGRAPHY

12.2.9 CONFECTIONERY

12.2.9.1 CONFECTIONERY, BY TYPE

12.2.9.1.1 CHOCOLATES

12.2.9.1.2 CANDY BARS

12.2.9.1.3 JELLIES

12.2.9.1.4 MERINGUES

12.2.9.1.5 MARMALADES

12.2.9.1.6 OTHERS

12.2.9.2 CONFECTIONERY, BY CHROMATOGRAPHY TESTING TYPE

12.2.9.2.1 LIQUID CHROMATOGRAPHY

12.2.9.2.2 GAS CHROMATOGRAPHY

12.2.9.2.3 COLUMN CHROMATOGRAPHY

12.2.9.2.4 THIN LAYER CHROMATOGRAPHY

12.2.9.2.5 PAPER CHROMATOGRAPHY

12.2.10 SPICES

12.2.11 NUTS

12.2.11.1 NUTS, BY TYPE

12.2.11.1.1 ALMOND

12.2.11.1.2 WALNUT

12.2.11.1.3 CASHEWNUT

12.2.11.1.4 BRAZIL NUT

12.2.11.1.5 MACADAMIA NUTS

12.2.11.1.6 OTHERS

12.2.11.2 NUTS, BY CHROMATOGRAPHY TESTING TYPE

12.2.11.2.1 LIQUID CHROMATOGRAPHY

12.2.11.2.2 GAS CHROMATOGRAPHY

12.2.11.2.3 COLUMN CHROMATOGRAPHY

12.2.11.2.4 THIN LAYER CHROMATOGRAPHY

12.2.11.2.5 PAPER CHROMATOGRAPHY

12.2.12 HERBAL EXTRACTS AND HERBS

12.2.13 HONEY

12.2.14 BABY FOOD

12.2.15 PLANT-BASED MEAT AND MEAT ALTERNATIVES

12.2.15.1 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY TYPE

12.2.15.1.1 TOFU

12.2.15.1.2 BURGER AND PATTIES

12.2.15.1.3 SAUSAGES

12.2.15.1.4 SEITEN

12.2.15.1.5 STRIPS AND NUGGETS

12.2.15.1.6 MEATBALLS

12.2.15.1.7 TEMPEH

12.2.15.1.8 OTHERS

12.2.15.2 PLANT-BASED MEAT AND MEAT ALTERNATIVES, BY CHROMATOGRAPHY TESTING TYPE

12.2.15.2.1 LIQUID CHROMATOGRAPHY

12.2.15.2.2 GAS CHROMATOGRAPHY

12.2.15.2.3 COLUMN CHROMATOGRAPHY

12.2.15.2.4 THIN LAYER CHROMATOGRAPHY

12.2.15.2.5 PAPER CHROMATOGRAPHY

12.2.16 OTHERS

12.3 BEVERAGES

12.3.1 BEVERAGES, BY TYPE

12.3.1.1 NON-ALCOHOLIC

12.3.1.1.1 CARBONATED DRINKS

12.3.1.1.2 JUICES

12.3.1.1.3 SPORT DRINKS

12.3.1.1.4 COFFEE

12.3.1.1.5 NUTRITIONAL DRINKS

12.3.1.1.6 PLANT-BASED MILK

12.3.1.1.6.1 SOY MILK

12.3.1.1.6.2 ALMOND MILK

12.3.1.1.6.3 OAT MILK

12.3.1.1.6.4 CASHEW MILK

12.3.1.1.6.5 RICE

12.3.1.1.6.6 OTHERS

12.3.1.1.7 SMOOTHIES

12.3.1.1.8 TEA

12.3.1.1.9 MINERAL WATER

12.3.1.1.10 OTHERS

12.3.1.2 ALCOHOLIC

12.3.1.2.1 BEER

12.3.1.2.2 WINE

12.3.1.2.3 VODKA

12.3.1.2.4 WHISKEY

12.3.1.2.5 BRANDY

12.3.1.2.6 GIN

12.3.1.2.7 TEQUILA

12.3.1.2.8 OTHERS

12.3.2 BEVERAGES, BY CHROMATOGRAPHY TESTING TYPE

12.3.2.1 LIQUID CHROMATOGRAPHY

12.3.2.2 GAS CHROMATOGRAPHY

12.3.2.3 COLUMN CHROMATOGRAPHY

12.3.2.4 THIN LAYER CHROMATOGRAPHY

12.3.2.5 PAPER CHROMATOGRAPHY

13 NORTH AMERICA CHROMATOGRAPHY FOOD TESTINGMARKET, BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CHROMATOGRAPHY FOOD TETING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MERCK KGAA

16.1.1 COMPANY SNAPSHOT

16.1.2 RECENT FINANCIAL

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 EUROFINS SCIENTIFIC

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIAL

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 INTERTEK GROUP PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 RECENT FINANCIAL

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 INDUSTRIES AND SERVICE PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 SGS SA

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 SERVICE PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 BUREAU VERITAS

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICES PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ADPEN LABORATORIES, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ALS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 SERVICE PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUREQUALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BVAQ

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 COTECNA

16.10.1 COMPANY SNAPSHOT

16.10.2 SERVICES PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 ELEMENT MATERIALS TECHNOLOGY (FORMERLY AVOMEEN)

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FOOD SAFETY NET SERVICES

16.12.1 COMPANY SNAPSHOT

16.12.2 SERVICE PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 IFP INSTITUT FÜR PRODUKTQUALITÄT GMBH

16.13.1 COMPANY SNAPSHOT

16.13.2 SOLUTION PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MÉRIEUX NUTRISCIENCES CORPORATION

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NEOGEN CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 NSF.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PACIFIC LABS

16.17.1 COMPANY SNAPSHOT

16.17.2 SERVICES PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 QIMA

16.18.1 COMPANY SNAPSHOT

16.18.2 SOLUTION PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 R J HILL LABORATORIES LIMITED

16.19.1 COMPANY SNAPSHOT

16.19.2 SOLUTION PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 SHIMADZU CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 SPECTRO ANALYTICAL LABS PVT. LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SYMBIO LABORATORIES

16.22.1 COMPANY SNAPSHOT

16.22.2 SOLUTION PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 THERMO FISHER SCIENTIFIC INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TÜV SÜD

16.24.1 COMPANY SNAPSHOT

16.24.2 SERVICE PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 WATERS CORPORATION

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 PRODUCT PORTFOLIO

16.25.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 COMPARATIVE ANALYSIS

TABLE 2 FREQUENCY OF SIGNS AND SYMPTOMS AMONG CASES OF FOODBORNE ILLNESS.

TABLE 3 CHOLERA ATTACK RATE BY AGE GROUP, MANKHOWKWE CAMP, MALAWI, MARCH–MAY 1988, SHOWS THE HIGHEST DISEASE RATES AMONG PERSONS AGED 15 YEARS AND ABOVE.

TABLE 4 THE PRICE IS ASSOCIATED WITH THE SPACE PARTS OF HPLC AND GC INSTRUMENTS

TABLE 5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA LIQUID CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA GAS CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA COLUMN CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA PAPER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA THIN LAYER CHROMATOGRAPHY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE OF TESTS, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA FOOD SAFETY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA ALLERGEN TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA PATHOGENS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA HEAVY METALS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA GMO TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA MYCOTOXINS TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA PESTICIDES TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA COMMUNICATIONS SATELLITES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA FOOD AUTHENTICITY TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA ORGANOLEPTIC AND APPEARANCE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA RANCIDITY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA BROWNING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY METHOD, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA FOOD SHELF LIFE TESTING IN CHROMATOGRAPHY FOOD TESTING MARKET, BY PACKAGED FOOD CONDITION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY SITE, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA INHOUSE/INTERNAL LAB IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA COMMERCIAL SERVICE LABORATORY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION PRODUCT PHASE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA TESTING FOR PRODUCT IN RUNNING PRODUCTION PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA TESTING FOR FINAL PRODUCT IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA TESTING FOR PRODUCT IN RESEARCH & DEVELOPMENT PHASE IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA PROCESSED FOOD IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA MILK DESSERT IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CHEESE BASED DESERTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA DAIRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEAT & POULTRY PRODUCTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA VEGETABLES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA FRUITS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA CEREALS & GRAINS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA EDIBLE OILS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA OILSEEDS & PULSES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA CONFECTIONERY IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA NUTS IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN CHROMATOGRAPHY FOOD TESTING MARKET, CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA NON-ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA PLANT-BASED MILK IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA ALCOHOLIC IN CHROMATOGRAPHY FOOD TESTING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA BEVERAGES IN CHROMATOGRAPHY FOOD TESTING MARKET, BY CHROMATOGRAPHY TESTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SEGMENTATION

FIGURE 11 RISING NUMBER OF FOODBORNE ILLNESSES IS EXPECTED TO DRIVE NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LIQUID CHROMATOGRAPHY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN OF CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET

FIGURE 15 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET : BY CHROMATOGRAPHY TESTING TYPE, 2021

FIGURE 16 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY TYPE OF TESTS, 2021

FIGURE 17 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET : BY SITE, 2021

FIGURE 18 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION PRODUCT PHASE, 2021

FIGURE 19 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY APPLICATION,2021

FIGURE 20 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA CHROMATOGRAPHY FOOD TESTING MARKET: BY CHROMATOGRAPHY TESTING TYPE (2022-2029)

FIGURE 25 NORTH AMERICA CHROMATOGRAPHY FOOD TETING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.