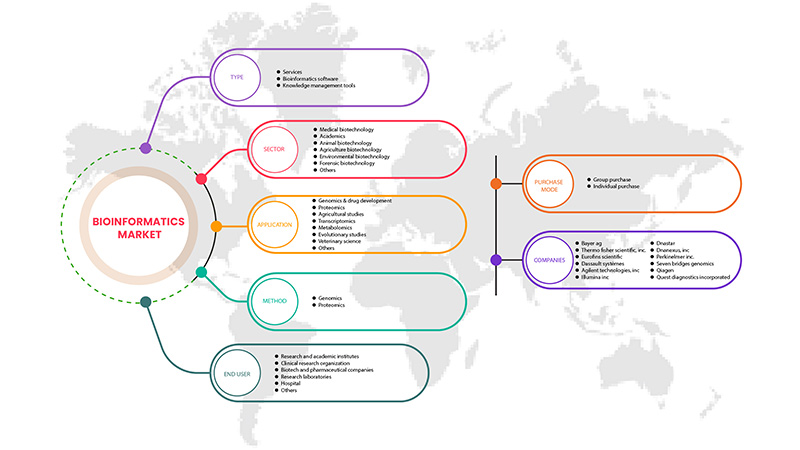

북미 생물정보학 시장, 유형별(지식 관리 도구, 생물정보학 소프트웨어 및 서비스), 부문별(의료 생명공학, 학계, 동물 생명공학, 농업 생명공학, 환경 생명공학, 법의학 생명공학 및 기타), 응용 분야별(유전체학 및 약물 개발, 단백체학, 진화 연구, 농업 연구, 수의학, 대사 체학 , 전사체학 및 기타), 구매 모드(단체 구매 및 개별 구매), 방법별(유전체학 및 단백체학), 최종 사용자(연구 및 학술 기관, 임상 연구 기관, 생명공학 및 제약 회사, 연구소, 병원 및 기타) - 산업 동향 및 2029년까지의 예측.

북미 생물정보학 시장 분석 및 통찰력

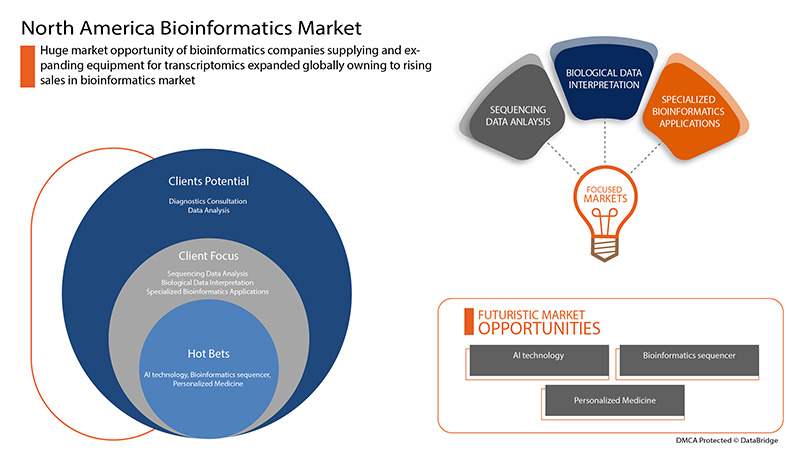

생물정보학 시장 성장을 주도하는 요인은 염기당 유전자 시퀀싱 비용 감소, 생물정보학에 대한 수요 증가, 주요 시장 참여자가 제공하는 광범위한 제품 포트폴리오, 개인화된 의료에서 생물정보학 사용, 생물정보학에 대한 공공-민간 부문 자금 지원 증가입니다. 그러나 시장 성장을 억제할 것으로 예상되는 요인은 계측 비용 상승, 임상 생물정보학 분석의 어려움, 생물정보학의 사이버 보안입니다.

반면, 시장 참여자의 전략적 이니셔티브, 제품 개발, 생물정보학 기술의 발전 및 의료비 지출 증가는 생물정보학 시장 성장의 기회로 작용할 수 있습니다. 그러나 숙련된 전문성의 필요성, 임상 실험실에서 생물정보학 기술을 구현하는 데 따른 과제 및 규제 승인은 생물정보학 시장에 과제를 안겨줄 수 있습니다. 전 세계 생물정보학 시장과 관련된 최근의 발전이 있습니다.

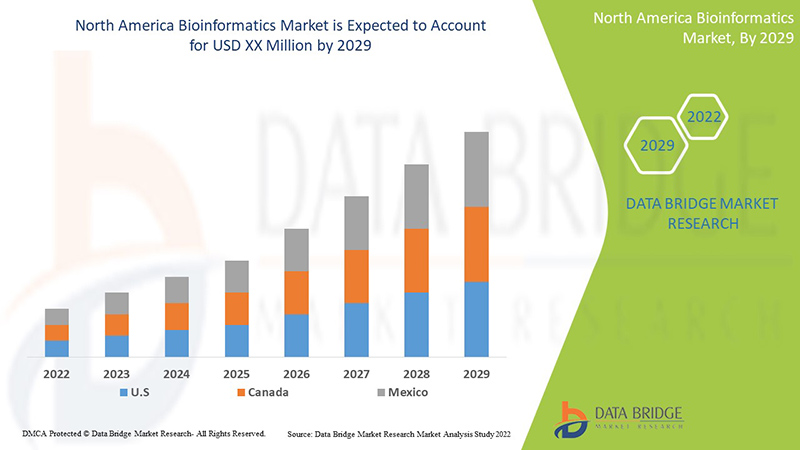

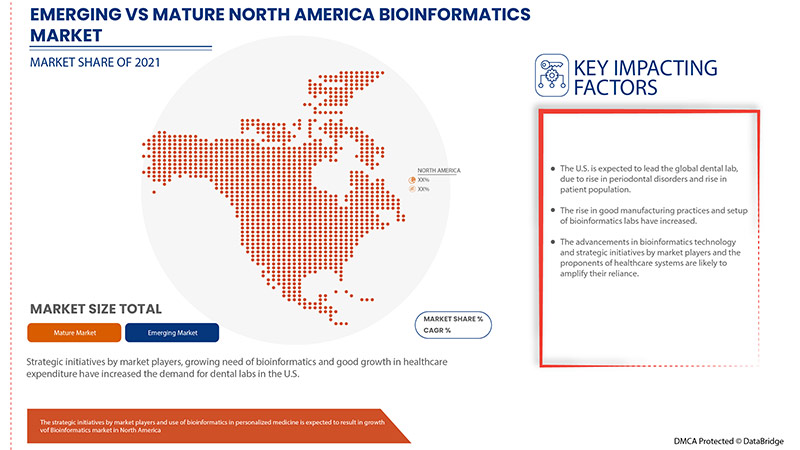

약물 개발 및 설계에서 생물정보학을 사용하는 데 대한 수요가 증가함에 따라 북미 시장 성장이 촉진될 것으로 예상됩니다. Data Bridge Market Research는 북미 생물정보학 시장이 2022년에서 2029년까지의 예측 기간 동안 21.8%의 CAGR로 성장할 것으로 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

유형별(지식 관리 도구, 생물정보학 소프트웨어 및 서비스), 부문별(의료 생명공학, 학계, 동물 생명공학, 농업 생명공학, 환경 생명공학, 법의학 생명공학 및 기타), 응용 분야별(유전체학 및 약물 개발, 프로테오믹스, 진화 연구, 농업 연구, 수의학, 대사체학, 전사체학 및 기타), 구매 방식(단체 구매 및 개별 구매), 방법별(유전체학 및 프로테오믹스) 최종 사용자(연구 및 학술 기관, 임상 연구 기관, 바이오텍 및 제약 회사, 연구 실험실, 병원 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. 등 |

시장 정의

생물정보학은 컴퓨터 프로그래밍, 빅데이터, 분자생물학을 결합한 것으로, 과학자들이 생물학적 데이터의 패턴을 이해하고 식별할 수 있도록 해줍니다. 특히 게놈과 DNA 시퀀싱을 연구하는 데 유용합니다. 과학자들이 방대한 양의 데이터를 정리할 수 있기 때문입니다.

유전학에서 독성학, 진균학, 방사선생물학에 이르기까지 전문화할 수 있는 생물학 분야가 수십 개 있습니다. 그리고 그 중에서도 생물정보학은 생물학적 정보를 식별, 평가, 저장, 검색할 수 있는 흥미로운 분야 중 하나입니다. 학제간 연구 분야로서 컴퓨터 과학, 통계학, 생물학의 다양한 응용 프로그램을 통합하여 DNA 시퀀싱, 단백질 분석, 진화 유전학 등과 같은 생물학적 데이터를 이해하기 위한 소프트웨어 애플리케이션을 개발합니다.

다가올 미래에는 약물 발견에 관한 생물정보학과 관련된 중요한 결정은 생물학을 이해할 뿐만 아니라 생물정보학 도구와 이를 통해 제공되는 지식을 활용하여 가설을 개발하고 양질의 표적을 식별할 수 있는 개인에 의해 내려질 것입니다.

북미 생물정보학 시장 역학

운전자

- 염기당 유전자 시퀀싱 비용 감소

구강 건강은 잇몸, 치아 및 구강-안면 시스템의 건강을 유지하는 데 가장 중요한 측면 중 하나로, 말하고, 씹고, 웃을 수 있게 해줍니다. 세계보건기구의 2020년 3월 25일 보고서에 따르면 전 세계적으로 약 23억 명이 영구치 충치로 고통받고 있으며, 그 중 약 5억 3천만 명의 어린이가 유치 충치로 고통받고 있습니다. 북미에서는 모든 연령대에서 치주 질환이 유병률이 높습니다. 따라서 치주 치과 질환이 증가함에 따라 구강 내 스캐너의 가용성과 사용이 시장 성장을 촉진할 것으로 예상됩니다.

- 생물정보학에 대한 증가하는 수요

유전체학 중심 약리학이 다양한 만성 질환, 특히 암의 치료에 더 큰 역할을 계속함에 따라 차세대 시퀀싱(NGS)은 개별 종양과 특정 수용체의 분자적 기초에 대한 더 깊고 정확한 통찰력을 제공하는 강력한 도구로 진화하고 있습니다. 프로그래밍을 배우는 생물학자, 컴퓨터 프로그래머, 수학자 또는 생물학의 기초를 배우는 데이터베이스 관리자를 포함하는 생물학 연구에 정보학이 필수적입니다.

기회

- 최근 몇 년 동안의 제품 개발

생물정보학 시장 임상 응용 분야의 성장 곡선은 기존 응용 프로그램이 추진력을 얻고 새로운 응용 프로그램이 발판을 마련함에 따라 상승 추세를 따르고 있습니다. 지난 몇 년 동안의 제품 개발은 시장 규모가 성장하는 데 도움이 되었습니다. 이는 또한 이러한 제품을 시장에 출시하는 데 대한 규제 기관의 지원을 보여줍니다.

예를 들어-

- 2021년 6월, Agilent Technologies, Inc.는 Refuses, CCDS 및 GENCODE의 단백질 코딩 영역에 대한 특정 내용과 현재 적용 범위를 제공하는 Sure Select Human All Exon V8이라는 새로운 엑솜 디자인을 출시했습니다. 또한, 포착하기 어려운 엑손과 경쟁 엑솜에서 무시되는 TERT 프로모터가 포함됩니다.

최근 몇 년 동안의 제품 개발은 이러한 기술의 잠재력을 보여주었고, 이 시장에서 활동하는 회사들은 시장에 더욱 진보된 제품을 출시하려고 노력하고 있으며, 이는 예측 기간 동안 시장 성장을 위한 수익성 있는 기회를 창출할 것으로 기대됩니다.

- 시장 참여자의 전략적 이니셔티브

바이오인포매틱스에 대한 수요는 연구 개발 수준이 증가하고 바이오인포매틱스 서비스 시장이 성장하고 혁신적인 약물에 대한 욕구가 증가함에 따라 시장에서 증가하고 있습니다. 따라서 주요 시장 참여자들은 새로운 제품을 개발하고 다른 시장 참여자들과 협력하여 사업 운영과 수익성을 개선함으로써 새로운 전략을 구현했습니다.

예를 들어-

- 2020년 1월 Charles River는 FiOS Genomics와 전략적 제휴를 맺고 마이크로어레이, 차세대 시퀀싱(NGS), 프로테오믹스, 대사체학 및 후성유전학과 같은 약물 개발과 관련된 고차원 다변량 데이터 세트의 수집 및 분석에 도움이 되는 생물정보학, 통계학 및 생물학 분야의 지식을 습득했습니다.

인수, 컨퍼런스, 집중된 세그먼트 제품 출시를 포함한 시장 참여자들의 이러한 전략적 이니셔티브는 회사의 제품 포트폴리오를 성장시키고 개선하는 데 도움이 되며 궁극적으로 더 많은 수익 창출로 이어집니다. 따라서 시장 참여자들의 이러한 전략적 이니셔티브는 시장 성장을 촉진할 것으로 예상되는 기회로 예상할 수 있습니다.

제약/도전

- 임상 생물정보학 분석의 어려움

빅데이터 분석의 거의 활용되지 않은 잠재력은 인간 질병의 생물학에 대한 오랜 의문에 답하고자 하는 많은 차세대 데이터 세트의 생산으로 인해 악화된 피드 버즈입니다. 이러한 접근 방식이 새로운 생물학적 통찰력을 밝히는 강력한 수단이 될 가능성이 있지만, 현재 몇 가지 중요한 과제가 빅데이터의 힘을 활용하려는 노력을 방해하고 있습니다. 일반적인 과제로는 분석 소프트웨어 도구의 효과적인 평가, 하이브리드 병렬 컴퓨팅(HPC) 병렬화 및 가속 기술을 사용하여 전체 프로세스를 가속화하는 것, 자동화 전략의 발전, 데이터 저장 대안, 마지막으로 여러 실험 조건에서 결과를 완전히 활용하기 위한 새로운 방법의 개발이 있습니다.

- 임상 연구실에서 생물정보학 기술을 구현하는 데 있어서의 과제

생물정보학 기술은 엄청나게 복잡한 생물학적 데이터 분석을 수행할 수 있습니다. 이 용량은 동시에 생물학적 데이터의 구성 및 분석을 위한 계산 도구를 용이하게 하여 진단 스크리닝을 개선하는 데 도움이 됩니다. 임상 실험실에서 이러한 강력한 기술을 적용하는 것은 데이터의 범위, 양 및 의료 기술적 결과 때문에 과제를 제기합니다.

임상 연구실에서 차세대 시퀀싱을 구현하는 데 있어 다양한 과제는 다음과 같습니다.

- 문제가 생길 수 있는 첫 번째 영역 중 하나는 종종 가장 간과되는 "샘플 품질"입니다. 플랫폼은 종종 엄선된 샘플(예: Genome in a Bottle Consortium의 참조 자료)을 사용하여 테스트되고 비교되지만, 실제 샘플은 종종 훨씬 더 큰 과제를 제시하고 따라서 수요 증가에 대한 과제로 작용합니다.

- 높은 처리 시간은 또한 이 시장에서 작동하는 기기에 대한 주요 과제이기도 합니다.

COVID-19가 북미 생물정보학 시장에 미치는 영향

팬데믹 동안 북부 생물정보학 분야는 생물학과 정보 기술을 결합한 분야에 중점을 두고 있습니다. 이 산업의 핵심은 IT 기술을 사용하여 분석하고 변환하는 생물학적 데이터입니다. 생물정보학은 항상 많은 과학 연구 분야에 필수적인 지원을 제공하는 데 큰 잠재력을 가지고 있었습니다. 생물정보학이 제공할 수 있는 도구를 통해 과학자들은 더 큰 데이터 세트를 파악하고 이를 마이닝하여 분석하여 핵심 발견으로 이어질 수 있는 중요한 정보를 발견할 수 있습니다. 최근 몇 년 동안 비교 유전체학, DNA 마이크로어레이, 기능 유전체학을 포함하여 유전학과 게놈이 생물정보학의 주요 초점이었습니다.

최근 개발 사항

- 2022년 3월, Thermo Fisher Scientific Inc는 임상 실험실에서 사용할 수 있는 CE-IVD 마크가 있는 차세대 시퀀싱(NGS) 기기를 출시했습니다. CE-IVD 마크가 있는 차세대 시퀀싱 기기는 단일 기기에서 진단 테스트와 임상 연구를 수행하는 데 사용됩니다. 이 기기를 출시하면서 제품군에 새로운 제품이 추가되었고 NGS 기기가 유통되어 제품 수익이 증가할 것으로 예상됩니다.

북미 생물정보학 시장 범위

북미 생물정보학 시장은 유형, 부문, 응용 프로그램, 구매 모드, 유전체학, 최종 사용자라는 6개 세그먼트를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 지식 관리 도구

- 생물정보학 소프트웨어

- 서비스

북미 생물정보학 시장은 유형을 기준으로 지식 관리 도구, 생물정보학 소프트웨어, 서비스로 구분됩니다.

부문

- 의료 생명공학

- 학업

- 동물 생명공학

- 농업생명공학

- 환경생물공학

- 법의학 생명공학

- 기타

북미 생물정보학 시장은 분야별로 의료 생명공학, 학술 생명공학, 동물 생명공학, 농업 생명공학, 환경 생명공학, 법의학 생명공학 등으로 구분됩니다.

애플리케이션

- 유전체학 및 약물 개발

- 프로테오믹스

- 진화 연구

- 농업 연구

- 수의학

- 대사체학

- 전사체학

- 기타

북미 생물정보학 시장은 응용 분야별로 유전체학 및 약물 개발, 단백체학, 진화 연구, 농업 연구, 수의학, 대사 체학, 전사체학 등으로 구분됩니다.

구매 모드

- 단체구매

- 개별 구매

구매 방식을 기준으로 북미 생물정보학 시장은 단체 구매와 개별 구매로 구분됩니다.

방법

- 유전체학

- 프로테오믹스

방법을 기준으로 북미 생물정보학 시장은 유전체학 및 단백체학으로 구분됩니다.

최종 사용자

- 연구 및 학술 기관

- 임상 연구 기관

- 바이오텍 및 제약 회사

- 연구실

- 병원

- 기타

최종 사용자를 기준으로 북미 생물정보학 시장은 연구 및 학술 기관, 임상 연구 기관, 생명공학 및 제약 회사, 연구 실험실, 병원 등으로 구분됩니다.

파이프라인 분석

북미 생물정보학 시장 지역 분석/통찰력

북미 생물정보학 시장을 분석하고, 위에 참조된 대로 지역, 유형, 부문, 응용 분야, 구매 모드, 유전체학 및 최종 사용자별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

북미 생물정보학 시장 보고서에서 다루는 국가는 미국, 캐나다, 뉴멕시코입니다. 미국은 치주 질환 발병률 증가, 의료 관광 증가, 생물정보학 기술 혁신 성장, 연구 개발 활동 증가로 인해 시장을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변경 사항을 제공합니다. 신규 판매, 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 브랜드의 존재 및 가용성과 지역 및 국내 브랜드의 대규모 또는 희소한 경쟁으로 인해 직면한 과제가 판매 채널에 미치는 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 생물정보학 시장 점유율 분석

북미 생물정보학 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우위가 있습니다. 위에 제공된 데이터 포인트는 북미 생물정보학 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 생물정보학 시장의 주요 기업으로는 Thermo Fisher Scientific Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, SOPHiA GENETICS., BGI, Eurofins Scientific, Water Corporation, Partek Incorporated, DNASTAR, Dassault Systèmes, Bayer AG, DNANEXUS, INC., PerkinElmer Inc., Seven Bridges Genomics, Quest Diagnostics Incorporated., AstridBio Technologies Inc., BioBam, GenoFAB, Inc. 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA BIOINFORMATICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 TYPE SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATIONS OF THE NORTH AMERICA BIOINFORMATICS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

6.1.2 GROWING NEED FOR BIOINFORMATICS

6.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYERS

6.1.4 USE OF BIOINFORMATICS IN PERSONALIZED MEDICINE

6.1.5 INCREASING PUBLIC-PRIVATE SECTOR FUNDING FOR BIOINFORMATICS

6.2 RESTRAINTS

6.2.1 HIGH COST OF INSTRUMENTATION

6.2.2 DIFFICULTY IN CLINICAL BIOINFORMATICS ANALYSIS

6.2.3 CYBER SECURITY CONCERNS IN BIOINFORMATICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 PRODUCT DEVELOPMENT IN RECENT YEARS

6.3.3 ADVANCEMENT IN BIOINFORMATICS TECHNOLOGY

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM BIOINFORMATICS TECHNOLOGY

6.4.2 CHALLENGES TO IMPLEMENTING BIOINFORMATICS TECHNOLOGY IN THE CLINICAL LABS

7 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 SERVICES

7.2.1 DIAGNOSTICS CONSULTATION

7.2.2 DATA ANALYSIS

7.2.2.1 STRUCTURAL

7.2.2.2 FUNCTIONAL

7.3 BIOINFORMATICS SOFTWARE

7.3.1 INFORMATICS INFRASTRUCTURE AND PIPELINE SETUP

7.3.2 SAMPLE AND EXPERIMENT MANAGEMENT

7.3.3 SEQUENCING DATA ANALYSIS

7.3.3.1 SEQUENCE ANALYSIS PLATFORM

7.3.3.2 SEQUENCE ALIGNMENT PLATFORM

7.3.3.3 SEQUENCE MANIPULATION PLATFORM

7.3.3.4 STRUCTURAL ANALYSIS PLATFORM

7.3.3.5 OTHERS

7.3.4 BIOLOGICAL DATA INTERPRETATION

7.3.5 SPECIALIZED BIOINFORMATICS APPLICATIONS

7.3.5.1 SINGLE CELL GENE EXPRESSION

7.3.5.2 GENE EXPRESSION

7.3.5.3 VARIANT DETECTION

7.3.5.4 CNV ANALYSIS

7.3.5.5 METAGENOMICS

7.3.5.6 METHYLATION

7.3.5.7 CHIP-SEQ

7.3.5.8 NON-CODING RNA EXPRESSION

7.3.5.9 OTHERS

7.3.6 OTHERS

7.4 KNOWLEDGE MANAGEMENT TOOLS

7.4.1 GENERALIZED KNOWLEDGE MANAGEMENT TOOLS

7.4.2 SPECIALIZED KNOWLEDGE MANAGEMENT TOOLS

8 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR

8.1 OVERVIEW

8.2 MEDICAL BIOTECHNOLOGY

8.3 ACADEMICS

8.4 ANIMAL BIOTECHNOLOGY

8.5 AGRICULTURAL BIOTECHNOLOGY

8.6 ENVIRONMENTAL BIOTECHNOLOGY

8.7 FORENSIC BIOTECHNOLOGY

8.8 OTHERS

9 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENOMICS & DRUG DEVELOPMENT

9.2.1 SERVICES

9.2.2 SEQUENCING PLATFORMS

9.2.3 KNOWLEDGE MANAGEMENT TOOLS

9.2.4 GENOMICS & DRUG DEVELOPMENT BY TYPE

9.2.4.1 PREVENTIVE MEDICINE

9.2.4.2 MOLECULAR MEDICINE

9.2.4.3 PERSONALIZED MEDICINE

9.2.4.4 CHEMOINFORMATICS AND DRUG DESIGN

9.2.4.5 ANTIBIOTIC RESISTANCE

9.3 PROTEOMICS

9.3.1 SERVICES

9.3.2 SERVICES SEQUENCING PLATFORMS

9.3.3 KNOWLEDGE MANAGEMENT TOOLS

9.4 AGRICULTURAL STUDIES

9.4.1 SERVICES

9.4.2 SERVICES SEQUENCING PLATFORMS

9.4.3 KNOWLEDGE MANAGEMENT TOOLS

9.5 TRANSCRIPTOMICS

9.5.1 SERVICES

9.5.2 SERVICES SEQUENCING PLATFORMS

9.5.3 KNOWLEDGE MANAGEMENT TOOLS

9.6 METABOLOMICS

9.6.1 SERVICES

9.6.2 SERVICES SEQUENCING PLATFORMS

9.6.3 KNOWLEDGE MANAGEMENT TOOLS

9.7 EVOLUTIONARY STUDIES

9.7.1 SERVICES

9.7.2 SERVICES SEQUENCING PLATFORMS

9.7.3 KNOWLEDGE MANAGEMENT TOOLS

9.8 VETERINARY SCIENCE

9.8.1 SERVICES

9.8.2 SERVICES SEQUENCING PLATFORMS

9.8.3 KNOWLEDGE MANAGEMENT TOOLS

9.9 OTHERS

9.9.1 SERVICES

9.9.2 SERVICES SEQUENCING PLATFORMS

9.9.3 KNOWLEDGE MANAGEMENT TOOLS

10 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE

10.1 OVERVIEW

10.2 GROUP PURCHASE

10.3 INDIVIDUAL PURCHASE

11 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD

11.1 OVERVIEW

11.2 GENOMICS

11.2.1 DNA

11.2.2 RNA

11.3 PROTEOMICS

12 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER

12.1 OVERVIEW

12.2 RESEARCH AND ACADEMIC INSTITUTES

12.3 CLINICAL RESEARCH ORGANIZATION

12.4 BIOTECH AND PHARMACEUTICAL COMPANIES

12.5 RESEARCH LABORATORIES

12.6 HOSPITALS

12.7 OTHERS

13 NORTH AMERICA BIOINFORMATICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BAYER AG

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 EUROFINS SCIENTIFIC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 DASSAULT SYSTÈMES

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 AGILENT TECHNOLOGIES, INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ASTRIDBIO TECHNOLOGIES INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BGI (A SUBSIDIARY OF BGI GROUP)

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 DNANEXUS INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DNASTAR

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENOFAB, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 ILLUMINA, INC

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 PARTEK INCORPORATED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 PERKINELMER INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 QIAGEN

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 QUEST DIAGNOSTICS INCORPORATED (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SEVEN BRIDGES GENOMICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 SOPHIA GENETICS

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 STRAND LIFE SCIENCES

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 WATERS CORPORATION

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 BIOINFORMATICSCOST PER SAMPLE

TABLE 2 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MEDICAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ACADEMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ANIMAL TECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA AGRICULTURAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENVIRONMENTAL BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FORENSIC BIOTECHNOLOGY IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA GROUP PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA INDIVIDUAL PURCHASE IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RESEARCH AND ACADEMIC INSTITUTES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA CLINICAL RESEARCH ORGANIZATION IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BIOTECH AND PHARMACEUTICAL COMPANIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA RESEARCH LABORATORIES IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HOSPITALS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BIOINFORMATICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.S. BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 83 U.S. BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 U.S. GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 U.S. GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 U.S. AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 U.S. METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 U.S. EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 U.S. VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 U.S. OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 U.S. BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 95 U.S GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 96 U.S. BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 CANADA SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 CANADA KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 105 CANADA BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 CANADA GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 CANADA GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 CANADA PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 CANADA AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 CANADA METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 CANADA EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 CANADA VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 CANADA OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 CANADA BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 116 CANADA BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 117 CANADA GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 118 CANADA BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 MEXICO BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO SERVICES IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BIOINFORMATICS SOFTWARE IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SEQUENCING DATA ANALYSIS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SPECIALIZED BIOINFORMATICS APPLICATIONS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO KNOWLEDGE MANAGEMENT TOOLS IN BIOINFORMATICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BIOINFORMATICS MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 MEXICO GENOMICS & DRUG DEVELOPMENT IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 MEXICO GENOMICS & DRUG DEVELOPMENT BY TYPE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PROTEOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 MEXICO AGRICULTURAL STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO TRANSCRIPTOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 MEXICO METABOLOMICS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 MEXICO EVOLUTIONARY STUDIES IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 MEXICO VETERINARY SCIENCE IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 MEXICO OTHERS IN BIOINFORMATICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 137 MEXICO BIOINFORMATICS MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 138 MEXICO BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 139 MEXICO GENOMICS IN BIOINFORMATICS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BIOINFORMATICS MARKET, BY END USER, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA BIOINFORMATICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BIOINFORMATICS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 NORTH AMERICA BIOINFORMATICS MARKET: DATA TRIANGULATION

FIGURE 4 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT

FIGURE 5 NORTH AMERICA BIOINFORMATICS MARKET: BOTTOM-UP APPROACH

FIGURE 6 NORTH AMERICA BIOINFORMATICS MARKET: TOP-DOWN APPROACH

FIGURE 7 NORTH AMERICA BIOINFORMATICS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 NORTH AMERICA BIOINFORMATICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA BIOINFORMATICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BIOINFORMATICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA BIOINFORMATICS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 NORTH AMERICA BIOINFORMATICS MARKET SEGMENTATION

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA DENTAL LABMARKET AND IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 GROWING APPLICATIONS OF BIOINFORMATICS AND LOW COST OF BIOINFORMATICS SEQUENCING ARE EXPECTED TO DRIVE THE MARKET FOR NORTH AMERICA BIOINFORMATICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SERVICES SEGMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BIOINFORMATICS MARKET IN 2019 & 2026

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BIOINFORMATICS MARKET

FIGURE 17 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 18 GROWING NEED FOR BIOINFORMATICS IN VITAL APPLICATIONS

FIGURE 19 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2021

FIGURE 24 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BIOINFORMATICS MARKET: BY SECTOR, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BIOINFORMATICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2021

FIGURE 32 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BIOINFORMATICS MARKET: BY PURCHASE MODE, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2021

FIGURE 36 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA BIOINFORMATICS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 39 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2021

FIGURE 40 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 41 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 42 NORTH AMERICA BIOINFORMATICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 43 NORTH AMERICA BIOINFORMATICS MARKET: SNAPSHOT (2021)

FIGURE 44 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021)

FIGURE 45 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 NORTH AMERICA BIOINFORMATICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA BIOINFORMATICS MARKET: BY TYPE (2022-2029)

FIGURE 48 NORTH AMERICA BIOINFORMATICS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.