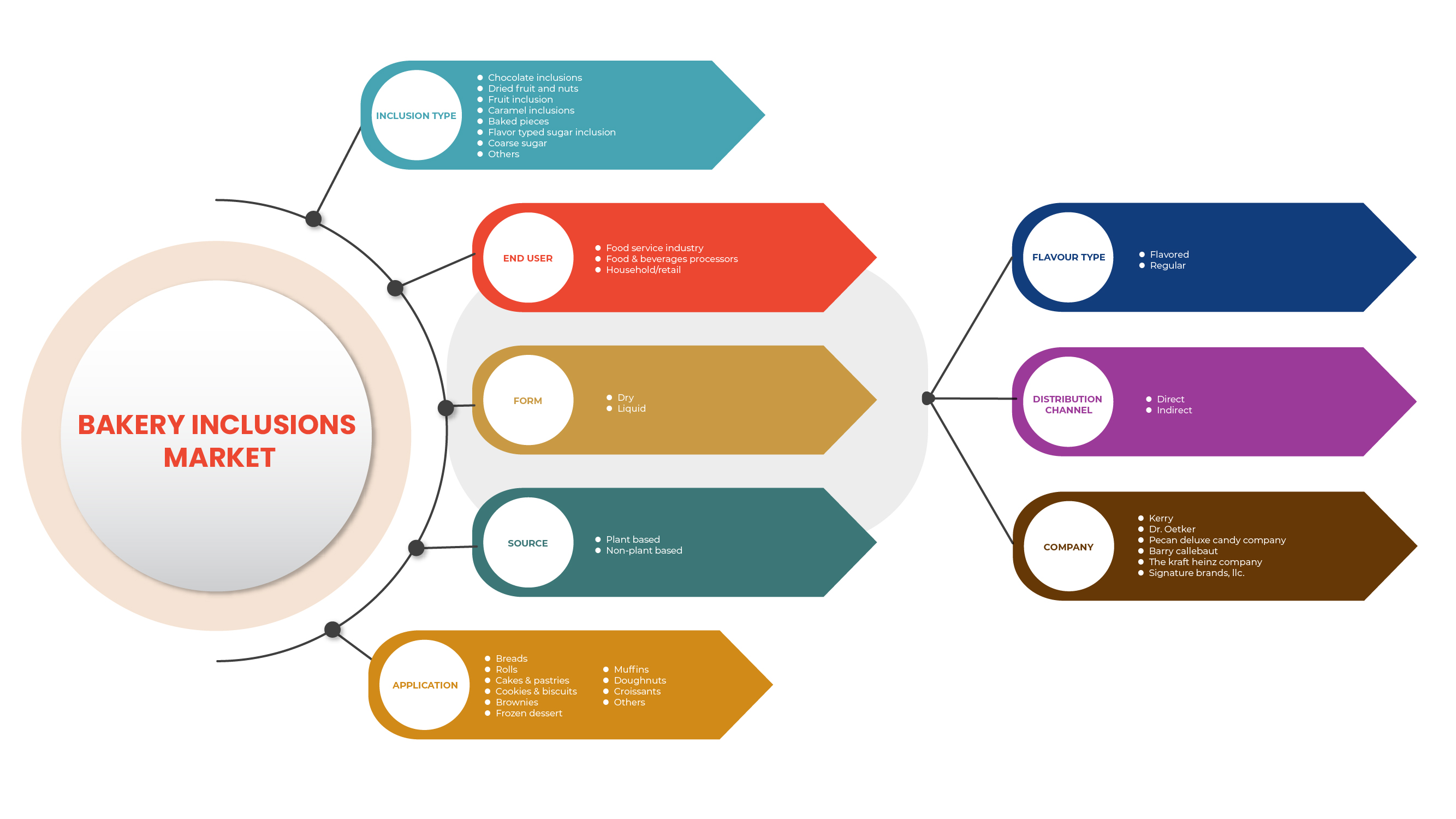

북미 베이커리 인클루전 시장, 인클루전 유형별(초콜릿 인클루전, 캐러멜 인클루전 , 말린 과일 및 견과류, 거친 설탕, 구운 조각, 과일 인클루전 풍미 설탕 인클루전 및 기타), 최종 사용자(식품 및 음료 가공업체, 식품 서비스 산업 및 가정/소매), 형태(건조 및 액상), 출처(식물성 및 비식물성), 응용 분야(빵, 머핀, 도넛, 크루아상, 롤, 케이크 및 페이스트리, 쿠키 및 비스킷 및 기타), 풍미(향미 및 일반), 유통 채널(직접 및 간접) - 2029년까지의 산업 동향 및 예측.

시장 분석 및 통찰력

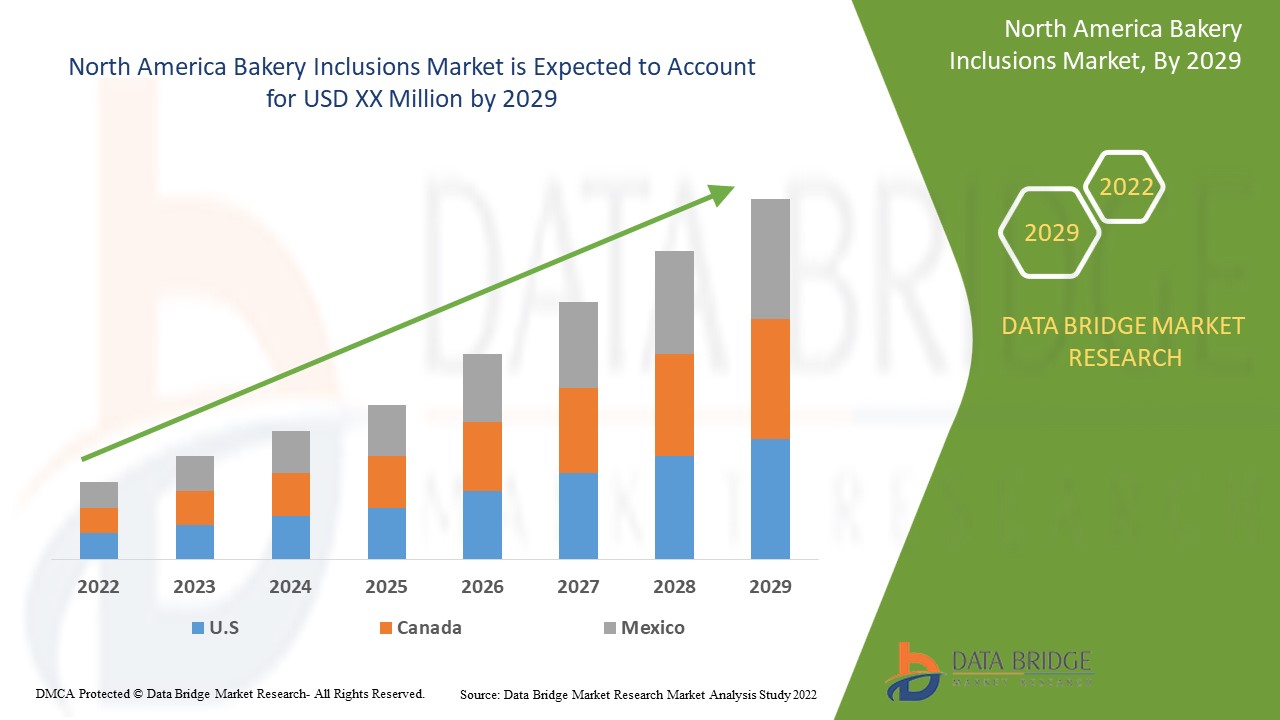

베이커리 인클루전 시장의 주요 성장 요인은 빠르게 변화하는 라이프스타일과 근로 인구의 증가입니다. 베이커리 인클루전 수요를 주도하는 주요 요인은 어떤 종류의 부가가치가 있는 가공 식품에 대한 수요 증가입니다. 게다가 가처분 소득 증가, 급속한 도시화, 편의 간식 및 과자에 대한 수요 증가도 예측 기간 동안 베이커리 인클루전 시장에 대한 전반적인 수요를 높이고 있습니다. 게다가 인클루전이 제공하는 다양한 기능적 특성과 베이커리 및 과자 제품에 대한 수요 증가도 베이커리 인클루전 시장 수요 증가의 가장 중요한 원동력 역할을 합니다. 게다가 식품 및 음료 부문에서 많은 수의 응용 프로그램이 존재함에 따라 베이커리 인클루전 시장 성장도 촉진되고 있습니다. Data Bridge Market Research는 북미 베이커리 인클루전 시장이 2022년부터 2029년까지의 예측 기간 동안 7.5%의 CAGR로 성장할 것으로 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2020-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

포함 유형별(초콜릿 포함물, 캐러멜 포함물, 말린 과일 및 견과류, 거친 설탕, 구운 조각, 과일 포함물 풍미 설탕 포함물 및 기타), 최종 사용자(식품 및 음료 가공업체, 식품 서비스 산업 및 가정/소매), 형태(건조 및 액체), 출처(식물성 및 비식물성), 응용 분야(빵, 머핀, 도넛, 크루아상, 롤, 케이크 및 페이스트리, 쿠키 및 비스킷 및 기타), 풍미(향 및 일반), 유통 채널(직접 및 간접) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

케리, Dr. Oetker, Pecan Deluxe Candy Company, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Cacau Foods do Brasil., Shantou Hehe Technology Co.,Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, Paulaur Corporation, GÜNTHART & Co.KG, Signature Brands, LLC 등 |

북미 베이커리 인클루전 시장 역학

운전자

- 빵류 소비 증가

베이커리 제품에는 효모 발효 팬 빵, 하스 빵, 플랫브레드, 비스킷, 케이크, 머핀, 쿠키, 번, 퍼프, 밀가루 토르티야가 포함됩니다. 이들은 밀 곡물 가루, 수수 가루와 같은 다양한 밀가루와 다양한 밀가루의 많은 블렌드로 제조되며, 블렌더, 유화제, 풍미 강화제, 방부제 및 원하는 질감, 색상, 맛 및 향을 향상시키기 위한 많은 다른 성분이 포함됩니다. 초콜릿 인클루전, 캐러멜 인클루전, 말린 과일 및 견과류, 거친 설탕, 구운 조각, 과일 인클루전 및 풍미 설탕 인클루전 등과 같은 다양한 인클루전이 베이커리 제품에 사용되고 있습니다. 이러한 인클루전은 베이커리 제품에 맛과 질감을 제공합니다.

- 과일과 견과류를 기반으로 한 베이커리 제품에는 맛과 건강상의 이점이 결합되어 있습니다.

건조 과일 포함물은 비만이 증가하고 있기 때문에 설탕이 적은 제품에 대한 수요가 증가함에 따라 전 세계적으로 선호되는 포함물입니다. 이러한 과일 포함물은 제품에 자연스러운 단맛을 제공합니다. 시중에서 가장 일반적으로 사용되는 과일 포함물은 사과, 살구, 바나나, 체리, 블랙커런트, 리그, 포도, 망고, 파인애플, 복숭아 등입니다.

과일 인클루전은 항산화제, 비타민, 미네랄 및 기타 기능적 건강상의 이점과 같은 건강상의 이점을 제공합니다. 또한, 인클루전에서 천연 설탕 공급원을 활용하고 가공 설탕에서 벗어나는 추세가 진화함에 따라 과일 인클루전 수요가 증가하고 있습니다. 또한 전 세계 건강을 의식하는 소비자들의 관심을 끌고 있습니다.

기회

- 편의식품 수요 증가

오늘날 고객들의 저녁 식사 솔루션에 대한 수요는 빠르게 증가하고 있으며, 고객들 사이에서 식사 소비 행동이 눈에 띄게 변화하고 있습니다. 개인들이 점점 더 집에서 먹을 음식을 준비할 시간과 기술이 부족한 반면, 많은 소비자들은 기성품 시장에 돈을 쓸 의향이 있습니다. 이러한 요인으로 인해 편의 식품 소매 시장에 대한 수요가 증가했습니다.

코로나바이러스 팬데믹은 대부분의 국가가 이동을 제한하고 국경을 봉쇄해야 하기 때문에 고객의 생활 방식을 컴포트 푸드 소비로 바꾸고 있습니다. 이 기간 동안, 특히 팬데믹이 국가를 강타하고 있는 미국에서 미리 조리된 음식에 대한 필요성이 가장 중요합니다.

제약/도전

- 제빵제품의 유통기한은 제한적이다

베이커리 제품에 대한 주요 관심사는 맛, 질감, 향 측면에서 신선도를 유지하는 것입니다. 베이커리 제품은 유통기한이 제한되어 있습니다. 다양한 효소는 적절한 질감, 안정성, 신선도, 부피, 베이커리 제품의 향을 유지하여 베이커리 제품의 신선도를 향상시키기 위해 유전자 변형되었습니다. 이러한 효소는 인체 건강에 해로운 영향을 미치므로 베이커리 제품 시장을 제한할 것으로 예상됩니다.

COVID-19 이후 북미 베이커리 인클루전 시장 에 미치는 영향

COVID-19는 북미 베이커리 인클루전 시장에 어느 정도 영향을 미쳤습니다. 봉쇄로 인해 제조 공정이 중단되었고 최종 사용자의 수요도 감소하여 시장에 영향을 미쳤습니다. COVID 이후 베이커리 인클루전 수요는 소비자의 구매 패턴 변화와 자동차, 항공우주 및 방위, 전자 및 전기, 건축 및 건설 등 다양한 최종 사용자 사이에서 베이커리 인클루전 수요 증가로 점진적으로 전환되면서 증가했습니다.

최근 개발 사항

- 2022년 1월, Pecan Deluxe Candy Company는 2021년 식품 품질 및 안전상 대형 기업상을 수상했습니다. 이 상은 회사가 더 많은 고객 기반을 유치하는 데 도움이 되었습니다.

- 2021년 4월, Pecan Deluxe Candy Company는 Popping Boba를 출시했습니다. 이 제품 출시는 회사가 제품 포트폴리오를 확대하는 데 도움이 되었습니다.

- 2021년 9월, Oetker 박사는 Kuppies를 인수했습니다. 이 인수는 회사가 입지와 포트폴리오를 확대하는 데 도움이 되었습니다.

- 2021년 4월, Pecan Deluxe Candy Company는 Popping Boba를 출시했습니다. 이 제품 출시는 회사가 제품 포트폴리오를 확대하는 데 도움이 되었습니다.

- 2021년 9월, Nimbus Foods Ltd는 Herza와 전략적 파트너십을 맺었습니다. Herza는 식품 제조에 사용되는 기능성 초콜릿과 화합물의 선도적 생산자입니다. 이 파트너십은 회사가 제품 범위를 확대하는 데 도움이 되었습니다.

북미 베이커리 포함 시장 범위

북미 베이커리 인클루전 시장은 인클루전 유형, 풍미, 형태, 최종 사용자, 출처, 응용 프로그램 및 유통 채널로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

포함 유형

- 초콜릿 포함

- 말린 과일과 견과류

- 과일 포함

- 카라멜 포함

- 구운 조각

- 맛 유형별 설탕 포함

- 거친 설탕

- 기타

북미 베이커리 포함물 시장은 포함물 유형을 기준으로 초콜릿 포함물, 캐러멜 포함물, 말린 과일 및 견과류, 거친 설탕, 구운 조각, 과일 포함물, 향미가 첨가된 설탕 포함물 등으로 구분됩니다.

최종 사용자

- 음식 서비스 산업

- 식품 및 음료 가공업체

- 가정/소매

북미 제빵용 첨가물 시장은 최종 사용자를 기준으로 식품 및 음료 가공업체, 식품 서비스 산업, 가정/소매로 구분됩니다.

형태

- 마른

- 액체

북미 제빵용 첨가물 시장은 형태에 따라 건조형과 액상으로 구분됩니다.

원천

- 식물성

- 비식물성

북미 제빵류 포함물 시장은 원료를 기준으로 식물성 및 비식물성 기반으로 구분됩니다.

애플리케이션

- 빵

- 롤스

- 케이크 & 페이스트리

- 쿠키 & 비스킷

- 브라우니

- 냉동 디저트

- 머핀

- 도넛

- 크루아상

- 기타

북미 제빵류 포함물 시장은 응용 분야별로 빵, 머핀, 도넛, 크루아상, 롤, 케이크 및 페이스트리, 쿠키 및 비스킷 등으로 구분됩니다.

맛의 종류

- 맛이 나는

- 정기적인

맛을 기준으로 북미 베이커리 제품 시장은 풍미형과 일반형으로 구분됩니다.

유통 채널

- 직접

- 간접적

북미 베이커리 포함품 시장은 유통 채널을 기준으로 직접 및 간접으로 구분됩니다.

북미 베이커리 인클루전 시장 지역 분석/통찰력

북미 베이커리 포함물 시장을 분석하고, 포함물 유형, 맛, 형태, 최종 사용자, 출처, 응용 분야 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

베이커리 포함물 시장 보고서에서 다루는 지역은 미국, 캐나다, 멕시코입니다.

예측 기간 동안 미국은 제빵 제품 사용 증가로 인해 북미 제빵 포함물 시장을 지배할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규정의 변화를 제공합니다. 신규 및 교체 판매, 국가 인구 통계, 질병 역학 및 수출입 관세와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 주요 포인터 중 일부입니다. 또한 글로벌 브랜드의 존재 및 가용성과 국내 및 국내 브랜드와의 치열한 경쟁으로 인해 직면한 과제, 판매 채널의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 북미 베이커리 포함 시장 점유율 분석

북미 베이커리 인클루전 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우세입니다. 위에 제공된 데이터 포인트는 회사가 북미 베이커리 인클루전 시장에 집중하는 것과만 관련이 있습니다.

베이커리 인클루전 시장에서 활동하는 주요 기업으로는 Kerry, Dr. Oetker, Pecan Deluxe Candy Company, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Cacau Foods do Brasil., Shantou Hehe Technology Co.,Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, Paulaur Corporation, GÜNTHART & Co.KG, Signature Brands, LLC 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 북미 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BAKERY INCLUSIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 BRAND LEVEL VS PRIVATE LABEL

4.3 FUTURE TRENDS

4.3.1 TASTE

4.3.2 LOW SUGAR, LOW CALORIE, AND CLEAN LABEL DEMAND

4.4 HOW FLAVORS ARE DELIVERED TO BAKERY PRODUCERS

4.4.1 INTERNAL FLAVORING

4.4.2 FILLINGS AND ICING

4.5 IMPORT & EXPORT ANALYSIS OF NORTH AMERICA BAKERY INCLUSION MARKET

4.5.1 IMPORT-EXPORT ANALYSIS OF CHOCOLATE

4.5.2 IMPORT-EXPORT ANALYSIS OF EDIBLE FRUIT AND NUTS

4.6 MARKETING STRATEGIES

4.7 PATENT ANALYSIS OF NORTH AMERICA BAKERY INCLUSIONS MARKET

4.7.1 DBMR ANALYSIS

4.7.2 COUNTRY-LEVEL ANALYSIS

4.7.3 YEARWISE ANALYSIS

4.8 NORTH AMERICA BAKERY INCLUSION MARKET PRODUCTION AND CONSUMPTION

5 SUPPLY CHAIN OF NORTH AMERICA BAKERY INCLUSIONS MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 PROCESSED INCLUSIONS:

5.4 MARKETING AND DISTRIBUTION

5.5 END USERS

6 NORTH AMERICA BAKERY INCLUSION MARKET: REGULATIONS

6.1 COMMISSION REGULATION (EU)

6.2 EUROPEAN UNION

6.3 REGULATIONS BY USFDA

6.4 GOVERNMENT OF CANADA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMPTION OF BAKERY PRODUCTS

7.1.2 HEALTH BENEFITS COMBINED WITH TASTE IN FRUIT- AND NUT-BASED BAKERY INCLUSIONS

7.1.3 QUALITY CLAIMS AND CERTIFICATIONS FOR INCLUSIONS LEND CREDIBILITY TO END PRODUCTS

7.1.4 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF BAKERY PRODUCTS

7.2.2 DECREASE IN ADOPTION OF BAKERY PRODUCTS DUE TO INCREASED HEALTH CONSCIOUSNESS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN DEMAND FOR CONVENIENT FOOD PRODUCTS

7.3.2 GROW IN DEMAND FOR VEGAN AND PLANT-BASED BAKERY PRODUCTS

7.3.3 TECHNOLOGY INTERVENTION IN INCLUSIONS PROPELLING UTILIZATION IN DIFFERENT APPLICATIONS

7.4 CHALLENGES

7.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7.4.2 STRINGENT GOVERNMENT REGULATIONS

8 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE

8.1 OVERVIEW

8.2 CHOCOLATE INCLUSIONS

8.2.1 CHOCOLATE CHUNKS

8.2.1.1 DARK

8.2.1.2 MILK

8.2.1.3 WHITE

8.2.2 CHOCOLATE FLAKES

8.2.2.1 DARK

8.2.2.2 MILK

8.2.2.3 WHITE

8.2.3 CHOCOLATE SYRUPS

8.2.3.1 DARK

8.2.3.2 MILK

8.2.3.3 WHITE

8.2.4 OTHERS

8.2.4.1 DARK

8.2.4.2 MILK

8.2.4.3 WHITE

8.3 DRIED FRUITS AND NUTS

8.3.1 ALMOND

8.3.2 WALNUTS

8.3.3 HAZELNUTS

8.3.4 CASHEW

8.3.5 CHESTNUTS

8.3.6 BRAZIL NUTS

8.3.7 MACADAMIA NUTS

8.3.8 HICKORY NUTS

8.3.9 RESINS

8.3.10 OTHERS

8.4 FRUIT INCLUSION

8.4.1 BERRIES

8.4.1.1 STRAWBERRY

8.4.1.2 BLACKBERRY

8.4.1.3 CRANBERRY

8.4.1.4 BLUEBERRY

8.4.1.5 RASPBERRY

8.4.1.6 OTHERS

8.4.2 CHERRY

8.4.3 APPLE

8.4.4 BANANA

8.4.5 CITRUS FRUITS

8.4.5.1 LEMON

8.4.5.2 LIME

8.4.5.3 ORANGE

8.4.5.4 GRAPE FRUIT

8.4.5.5 OTHERS

8.4.6 BLACKCURRANT

8.4.7 MANGO

8.4.8 APRICOT

8.4.9 PINEAPPLE

8.4.10 PEACH

8.4.11 GRAPE

8.4.12 RIG

8.4.13 OTHERS

8.5 CARAMEL INCLUSIONS

8.5.1 NUTS SABLAGE

8.5.2 CARAMEL CRISPY BITES

8.5.3 CARAMEL CRUNCHES

8.6 BAKED PIECES

8.7 FLAVOR TYPED SUGAR INCLUSION

8.8 COARSE SUGAR

8.9 OTHERS

9 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE INDUSTRY

9.2.1 RESTAURANTS

9.2.2 HOTELS

9.2.3 CAFES

9.2.4 SHAKES AND SMOOTHIES PARLORS

9.2.5 OTHERS

9.3 FOOD & BEVERAGES PROCESSORS

9.4 HOUSEHOLD/RETAIL

10 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 FLAKES & CRUNCHES

10.2.2 CHIPS & NIBS

10.2.3 POWDER

10.2.4 CUBES/PIECES

10.2.5 GRANULES

10.3 LIQUID

10.3.1 CONCENTRATES

10.3.2 PUREE

11 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 PLANT BASED

11.3 NON-PLANT BASED

12 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BREADS

12.3 ROLLS

12.4 CAKES & PASTRIES

12.5 COOKIES & BISCUITS

12.6 BROWNIES

12.7 FROZEN DESSERT

12.8 MUFFINS

12.9 DOUGHNUTS

12.1 CROISSANTS

12.11 OTHERS

13 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 CARAMEL

13.2.2 BUTTERSCOTCH

13.2.3 STRAWBERRY

13.2.4 VANILLA

13.2.5 BLUEBERRY

13.2.6 MOCHA

13.2.7 BANANA

13.2.8 CHERRY

13.2.9 PEPPERMINT

13.2.10 OTHERS

13.3 REGULAR

14 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.2.1 STORE-BASED RETAILING

14.2.1.1 SUPERMARKETS/HYPERMARKETS

14.2.1.2 SPECIALTY STORES

14.2.1.3 CONVENIENCE STORES

14.2.1.4 WHOLESALERS

14.2.1.5 GROCERY STORES

14.2.1.6 OTHERS

14.2.2 NON-STORE RETAILING

14.2.2.1 ONLINE

14.2.2.2 VENDING

14.3 DIRECT

15 NORTH AMERICA BAKERY INCLUSIONS MARKET

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 DR. OETKER

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.1.4 SWOT ANALYSIS

18.2 KERRY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.2.5 SWOT ANALYSIS

18.3 BARRY CALLEBAUT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUS ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.3.5 SWOT ANALYSIS

18.4 THE KRAFT HEINZ COMPANY

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.4.5 SWOT ANALYSIS

18.5 PECAN DELUXE CANDY COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.5.4 SWOT ANALYSIS

18.6 AMERICAN SPRINKLE COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BRITANNIA SUPERFINE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 CACAU FOODS DO BRASIL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CAPE FOODS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 GIRRBACH SÜßWARENDEKOR GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GÜNTHART & CO. KG

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HANNS G. WERNER GMBH + CO. KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 NIMBUS FOODS LTD

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 PAULAUR CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 SHANTOU HEHE TECHNOLOGY CO.,LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SIGNATURE BRANDS, LLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 4 EXPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 5 CANADA'S BAKERY PRODUCTS, MARKET SIZE BY RETAIL VALUE SALES

TABLE 6 PRODUCTION AND CONSUMPTION OF BREAD 2020

TABLE 7 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA BERRIES INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.S. BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.S. CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.S. DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.S. FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.S. BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 U.S. FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 U.S. BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 U.S. DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 U.S. LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 U.S. BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 73 U.S. BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 77 U.S. INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 U.S. STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 U.S. NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 CANADA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 CANADA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 CANADA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 CANADA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 CANADA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 97 CANADA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 CANADA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 100 CANADA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 CANADA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 CANADA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 CANADA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 MEXICO BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 MEXICO BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 MEXICO FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 MEXICO BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 MEXICO DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 MEXICO LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 120 MEXICO BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 MEXICO BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 MEXICO INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 MEXICO STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 MEXICO NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BAKERY INCLUSIONS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BAKERY INCLUSIONS MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA BAKERY INCLUSIONS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BAKERY INCLUSIONS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BAKERY INCLUSIONS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BAKERY INCLUSIONS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BAKERY INCLUSIONS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND OF BAKERY PRODUCTS AND INCREASE IN DEMAND OF READY TO EAT PRODUCTS ARE LEADING THE GROWTH OF THE NORTH AMERICA BAKERY INCLUSIONS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCLUSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BAKERY INCLUSIONS MARKETIN 2022 & 2029

FIGURE 12 PATENT REGISTERED FOR BAKERY INCLUSIONS, BY COUNTRY

FIGURE 13 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 14 SUPPLY CHAIN OF NORTH AMERICA BAKERY INCLUSIONS MARKET

FIGURE 15 VALUE CHAIN OF NORTH AMERICA BAKERY INCLUSIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA BAKERY INCLUSIONS MARKET

FIGURE 17 AVERAGE ANNUAL EXPENDITURE BY BAKERY PRODUCTS (2017-2020)

FIGURE 18 WORLDWIDE GDP PER CAPITA INCOME (2015-2020)

FIGURE 19 U.S. BAKERY PRODUCTS SALES SHARED IN 2021

FIGURE 20 GLOBAL NUMBER OF PEOPLE SIGNING TO 'VEGANUARY' CAMPAIGN, (2014-2019)

FIGURE 21 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE, 2021

FIGURE 22 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY END USER, 2021

FIGURE 23 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY FORM, 2021

FIGURE 24 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY SOURCE, 2021

FIGURE 25 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY APPLICATION, 2021

FIGURE 26 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY FLAVOR TYPE, 2021

FIGURE 27 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 NORTH AMERICA BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 33 NORTH AMERICA BAKERY INCLUSIONS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.