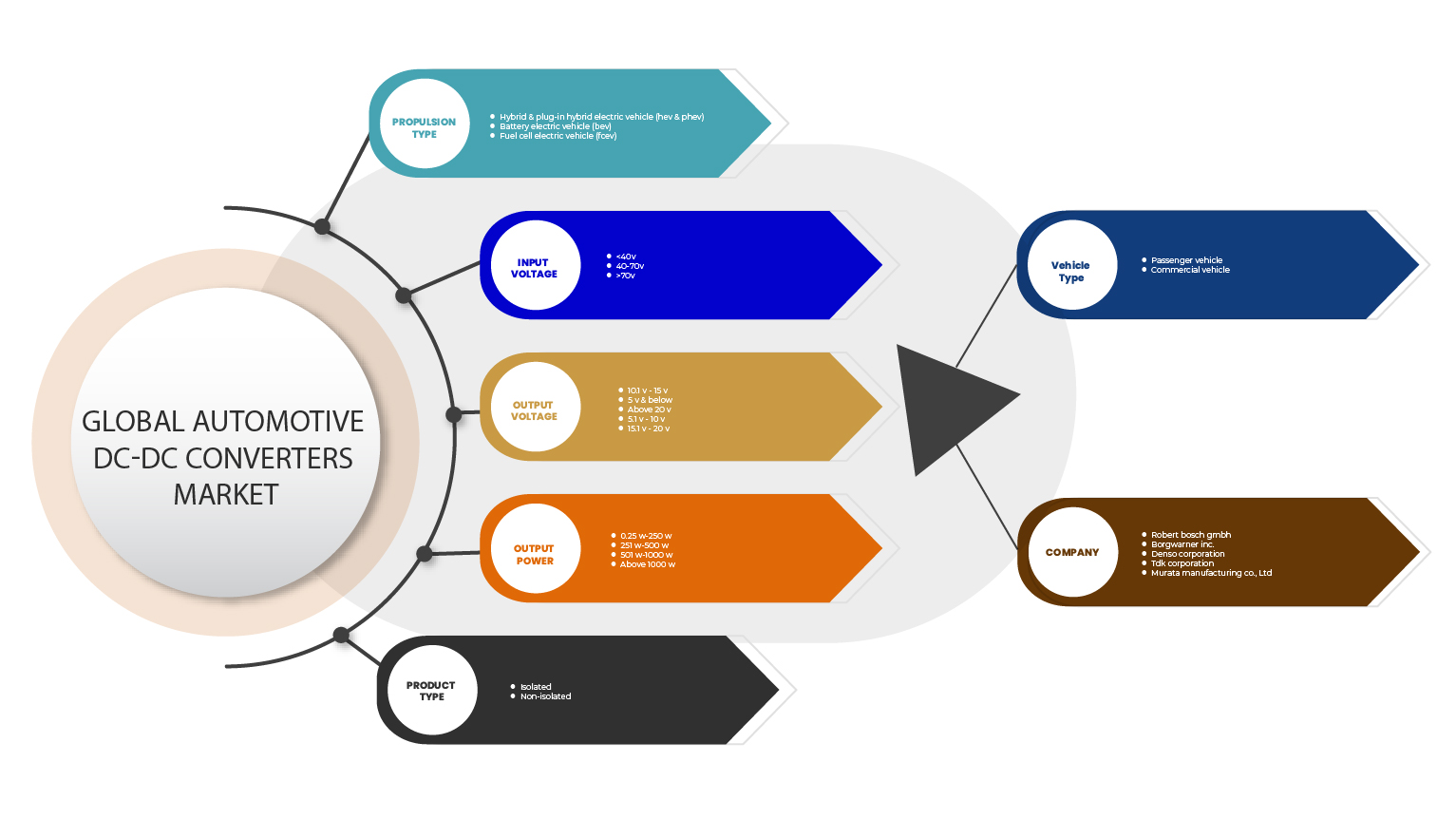

북미 자동차용 DC-DC 컨버터 시장, 제품 유형(절연형, 비절연형), 입력 전압(40V 미만, 40V - 70V, 70V 초과), 출력 전압(10.1V - 15V, 5V 이하, 5.1V - 10V, 15.1V - 20V, 20V 초과), 출력 전력(0.25W - 250W, 251W - 500W, 501W - 1000W, 1000W 초과), 추진 유형(하이브리드 및 플러그인 하이브리드 전기 자동차(HEV 및 PHEV), 배터리 전기 자동차(BEV), 연료 전지 전기 자동차(FCEV)), 차량 유형(승용차, 상용차) - 업계 동향 및 2029년까지의 예측.

북미 자동차 DC-DC 컨버터 시장 분석 및 규모

전력 반도체와 집적 회로의 도입으로 기술을 사용하여 경제적으로 실행 가능해졌습니다. 1976년까지 트랜지스터 자동차 라디오 수신기는 고전압을 필요로 하지 않았지만 일부 라디오 운영자는 트랜지스터화된 전원 공급 장치가 사용 가능했음에도 불구하고 고전압을 필요로 하는 모바일 트랜시버에 진동기 공급 장치와 다이나모터를 계속 사용했습니다. 그 이후로 전력 밀도 증가에 대한 시장 수요는 직류(DC) 소스를 한 전압 레벨에서 다른 전압 레벨로 변환하는 많은 DC-DC 컨버터의 개발을 주도했습니다. DC-DC 컨버터의 채택은 IoT 의 채택 증가, 향상된 전력 밀도에 대한 수요 증가, 스마트 그리드, 에너지 저장 시스템 및 전기 자동차 의 채택 증가 로 지난 3년 동안 증가했습니다 . 첨단 기술의 도입 및 구현으로 DC-DC 컨버터 수요가 촉진될 것으로 예상됩니다. 결과적으로 DC-DC 컨버터 시장은 예측 기간 동안 더 높은 성장률을 보일 것으로 예상됩니다.

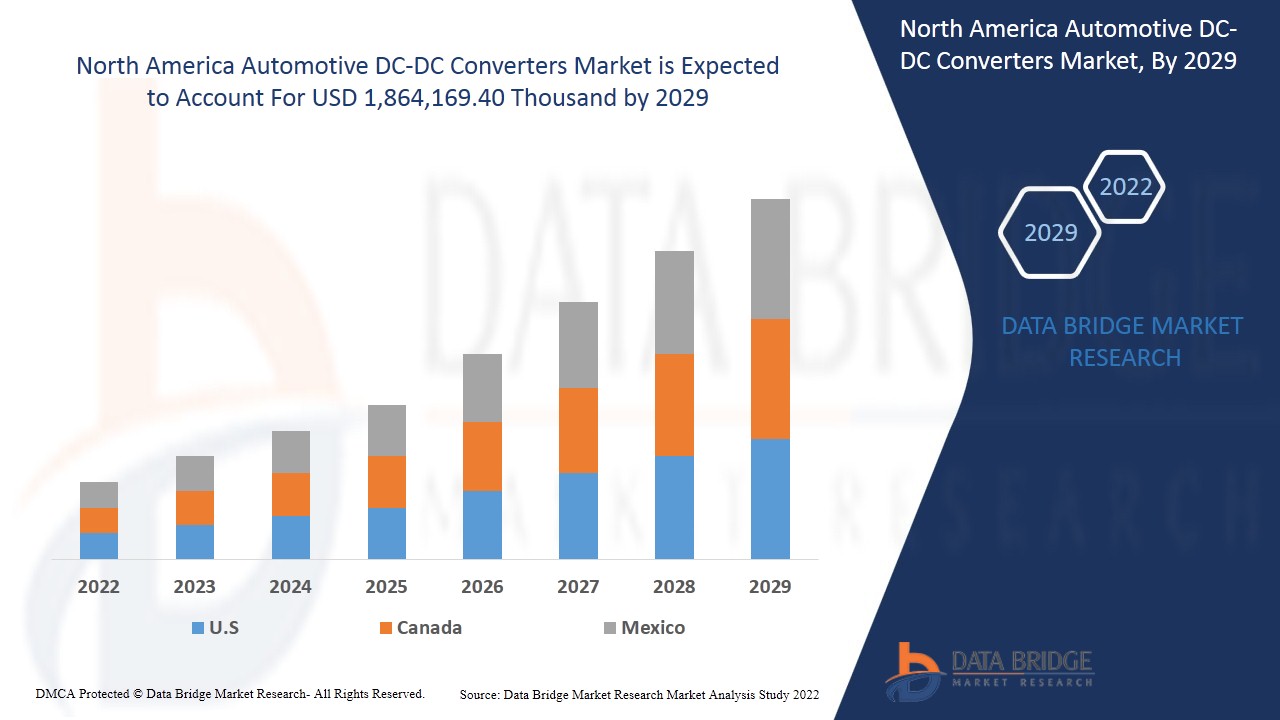

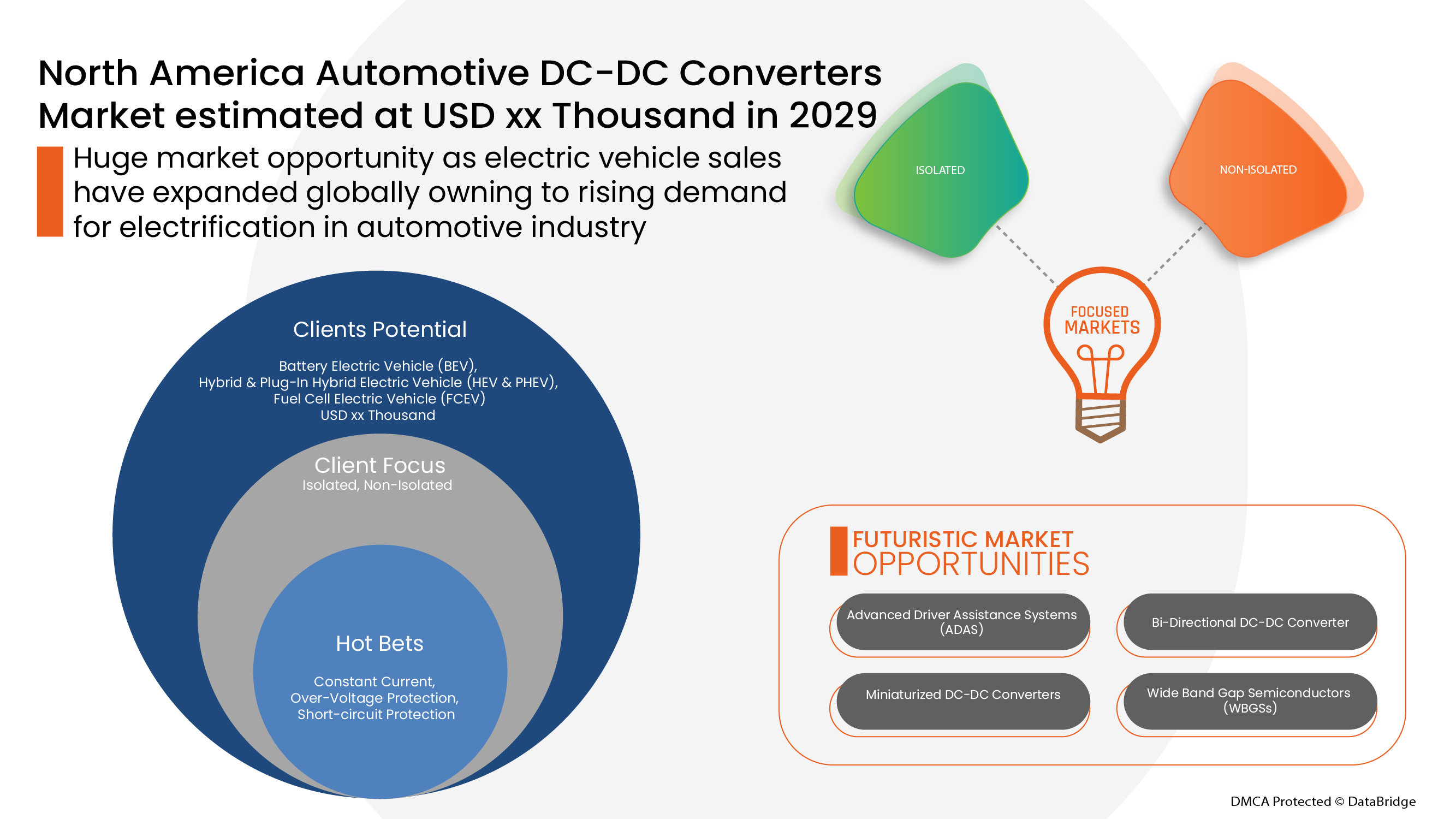

Data Bridge Market Research는 북미 자동차 DC-DC 컨버터 시장이 2029년까지 1,864,169.40만 달러 규모에 도달할 것으로 예상하고, 2022-2029년 예측 연도에 28.7%의 CAGR로 성장할 것으로 분석했습니다. 자동차 DC-DC 컨버터 시장 보고서는 또한 가격 분석, 특허 분석 및 기술 발전에 대한 심층적인 내용을 다룹니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

매출은 천 달러, 가격은 달러로 표시됨 |

|

다루는 세그먼트 |

제품 유형별(절연형, 비절연형), 입력 전압(40V 미만, 40V - 70V, 70V 초과), 출력 전압(10.1V - 15V, 5V 이하, 5.1V - 10V, 15.1V - 20V, 20V 초과), 출력 전력(0.25W - 250W, 251W - 500W, 501W - 1000W, 1000W 초과), 추진 유형(하이브리드 및 플러그인 하이브리드 전기 자동차(HEV 및 PHEV), 배터리 전기 자동차(BEV), 연료 전지 전기 자동차(FCEV)), 차량 유형(승용차, 상용차) |

|

적용 국가 |

북미의 미국, 캐나다, 멕시코 |

|

시장 참여자 포함 |

MORNSUN Guangzhou Science & Technology Co.,Ltd, Robert Bosch GmbH, Continental AG, Sinpro Electronics Co., Ltd, Texas Instruments Incorporated, Infineon Technologies AG, DENSO CORPORATION, Vicor Corporation, RECOM Power GmbH, TDK Corporation, Vitesco Technologies, Deutronic Elektronik GmbH, Murata Manufacturing Co., Ltd, STMicroelectronics, Semiconductor Components Industries, LLC, TOYOTA INDUSTRIES CORPORATION, Inmotion, SHINDENGEN ELECTRIC MANUFACTURING CO., LTD, BorgWarner Inc., & Skyworks Solutions Inc. 등이 있습니다. |

시장 정의

자동차용 DC-DC 컨버터는 차량에 통합하기 위한 블록 설계에 포함된 인덕터, 마이크로컨트롤러 유닛(MCU), 자기 코어 구성 요소로 구성됩니다. DC-DC 컨버터는 자동차의 점화 시스템에 부착되어 엔진의 재시동 및 종료를 효과적으로 제어하여 배출가스를 줄입니다. DC-DC 컨버터는 설정된 전압 범위 내에서 작동하여 수많은 온보드 전자 장비에 전원을 공급합니다. 자동차에 통합된 인포테인먼트 시스템은 파워트레인에서 공급되는 약 12V의 안정적인 전기 공급이 필요하기 때문입니다.

DC-DC 컨버터는 주로 절연 및 전압 변환에서 중요한 역할을 합니다. 고급 운전자 지원 시스템(ADAS)과 차량 내 인포테인먼트의 확산으로 인해 차량은 다중 레벨이 필요한 바퀴 달린 복잡한 전자 시스템으로 바뀌었고, 무소음 DC-DC 컨버터는 어느 정도 시장 성장을 촉진하고 있습니다.

자동차 DC-DC 컨버터 시장 동향

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

- 지역 전체의 전기 자동차 판매 증가

자동차 산업은 고급 전기 자동차에 대한 수요 증가로 인해 수년에 걸쳐 엄청난 성장을 보이고 있습니다. 전기 자동차 판매를 주도하는 요인 중 일부는 차량 배출에 대한 엄격한 정부 규제, 고성능 및 저배출에 대한 수요 증가를 포함합니다. IEA(국제 에너지 기구)에 따르면 소비자는 2020년에 전기 자동차 구매에 1,200억 달러를 지출했으며, 이는 2019년 대비 50% 증가한 수치이며, 이는 전기 자동차 판매가 41% 증가한 수치입니다. 이로 인해 EV의 DC-DC 컨버터에 대한 수요가 증가했습니다.

- 서비스로서의 이동성(MaaS) 모델의 인기 상승

서비스로서의 모빌리티(MaaS) 개념은 전기 자동차 부문에서 인기를 얻고 있습니다. 점점 더 많은 제조업체, 서비스 제공업체, 회사, 정책 입안자 및 대중이 편의성을 위해 전기 모빌리티에 주목하고 있습니다.

MaaS(Mobility-as-a-Service)는 오염 수준 증가, 급속한 도시화, 차량 유지 관리 비용, 전 세계 대도시의 주차 공간 부족 및 제한 등 다양한 요인으로 인해 개인 소유의 교통 수단에서 서비스로서 제공되는 MaaS로의 전환을 설명합니다.

- 상용차에 DC-DC 컨버터를 통합하기 위한 R&D 노력

전기 자동차에 대한 엄격한 배출 기준의 글로벌 채택은 자동차 OEM(Original Equipment Manufacturers)이 연료 효율을 높이기 위해 차량 제공에 첨단 기술을 통합하도록 동기를 부여하고 있습니다. 이는 중형 및 대형 상용차(M&HCV)용 전기 구동계 개발로 이어졌습니다. 전기 구동계는 더 높은 효율과 더 나은 차량 성능을 보장하기 위해 DC-DC 컨버터를 통합해야 합니다. 게다가 상용차 판매 증가로 인해 부품 제조업체는 제품 제공을 업그레이드하게 되었습니다.

- 전기 자동차의 전자 부품 비용 상승

전기 자동차는 운송과 환경에 가장 적합하며, 대기 오염에 대한 압력을 제어하는 데 도움이 됩니다. 그러나 전기 자동차의 초기 비용은 가솔린 엔진 차량에 비해 더 높습니다. 이는 환경에 해를 끼치지 않는 기술적으로 업그레이드된 구성 요소가 포함되어 있기 때문입니다. 그러나 전기 자동차의 운영 비용은 가솔린 엔진 차량보다 저렴합니다.

- DC-DC 컨버터의 설계 복잡성

일반적으로 차량 전기화는 전기로 구동되는 파워트레인과 온보드 및 오프보드 충전 시스템과 같은 보조 시스템에 초점을 맞춥니다. 또한, 전기적 내용과 복잡성이 증가하고 설계 주기가 짧아짐에 따라 최적의 설계팀이 설계 방법을 지속적으로 개선해야 합니다.

자동차 DC-DC 컨버터 시장에 대한 COVID-19 이후의 영향

COVID-19는 자동차 DC-DC 컨버터 시장에 큰 영향을 미쳤습니다. 거의 모든 국가가 필수품을 생산하는 곳을 제외한 모든 생산 시설을 폐쇄하기로 했습니다. 정부는 COVID-19의 확산을 막기 위해 비필수품의 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황에서 거래하는 유일한 사업은 프로세스를 열고 실행할 수 있는 필수 서비스입니다.

자동차 DC-DC 컨버터 시장의 성장은 모든 지역과 국가에서 자동차 산업의 전기화 채택이 증가하는 데 기인합니다. 자동차 산업은 팬데믹 동안 주요 문제에 직면했지만, 전기 자동차 판매는 팬데믹 이후 시나리오에서 더 높은 수준으로 뛰어올랐습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체는 DC-DC 컨버터에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 첨단 기술을 제공할 것입니다. 또한 전기 자동차 사용을 위한 정부 이니셔티브로 인해 시장이 성장했습니다.

최근 개발

- 2022년 2월, RECOM Power GmbH는 저전력에서 킬로와트까지의 완전 맞춤형, 반 맞춤형, 수정 표준 AC/DC 및 DC/DC 컨버터의 새로운 제품군을 출시했습니다.

- 2022년 1월, Continental AG는 높은 컴퓨팅 파워와 차량 내 대형 디스플레이 랜드스케이프로 새로운 BMW iX의 사용자 경험을 향상시켰습니다. 이를 통해 회사는 미래의 통합형과 중앙 집중형 차량 아키텍처 간의 격차를 메우는 데 더욱 도움이 되었습니다.

북미 자동차 DC-DC 컨버터 시장 범위

자동차 DC-DC 컨버터 시장은 제품 유형, 입력 전압, 출력 전압, 출력 전력, 추진 유형 및 차량 유형을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

제품 유형

- 외딴

- 비격리

제품 유형을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 분리형과 비분리형으로 구분됩니다.

입력 전압

- 40V 이하

- 40V - 70V

- 70V 이상

입력 전압을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 40V 미만, 40V~70V, 70V 이상으로 구분됩니다.

출력 전압

- 10.1V - 15V

- 5V 이하

- 5.1V - 10V

- 15.1V - 20V

- 20V 이상

출력 전압을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 10.1V - 15V, 5V 이하, 5.1V - 10V, 15.1V - 20V, 20V 이상으로 구분됩니다.

출력 전력

- 0.25W - 250W

- 251W - 500W

- 501W - 1000W

- 1000W 이상

출력 전력을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 0.25W - 250W, 251W - 500W, 501W - 1000W, 1000W 이상으로 구분됩니다.

추진 유형

- 하이브리드 및 플러그인 하이브리드 전기 자동차(HEV 및 PHEV)

- 배터리 전기 자동차(BEV)

- 연료전지 전기자동차(FCEV)

추진 유형을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 하이브리드 및 플러그인 하이브리드 전기 자동차(HEV 및 PHEV), 배터리 전기 자동차(BEV), 연료 전지 전기 자동차(FCEV)로 구분됩니다.

차량 유형

- 승용차

- 상업용 차량

차량 유형을 기준으로 북미 자동차용 DC-DC 컨버터 시장은 승용차, 상용차로 구분됩니다.

자동차 DC-DC 컨버터 시장 지역 분석/통찰력

북미 자동차용 DC-DC 컨버터 시장을 분석하고, 위에 참조된 대로 국가, 제품 유형, 입력 전압, 출력 전압, 출력 전력, 추진 유형 및 차량 유형별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

자동차용 DC-DC 컨버터 시장 보고서에서 다루는 국가는 북미 지역의 미국, 캐나다, 멕시코입니다.

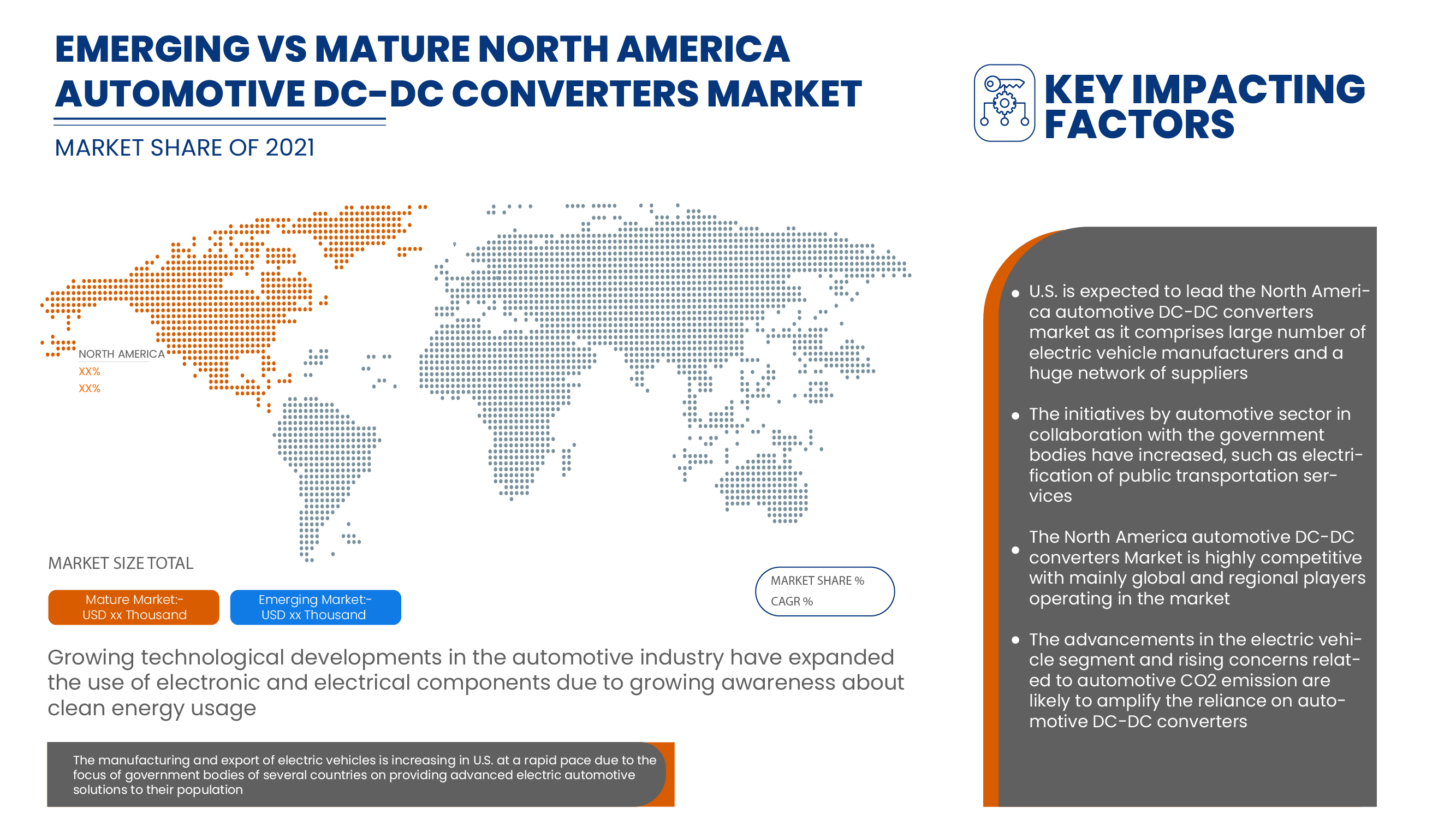

미국은 북미 자동차용 DC-DC 컨버터 시장을 장악하고 있는데, 주된 이유는 자동차 산업의 전기화가 증가하면서 DC-DC 컨버터를 비롯한 전기 및 전자 부품에 대한 수요가 크게 증가하고 있기 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 자동차 DC-DC 컨버터 시장 점유율 분석

북미 자동차 DC-DC 컨버터 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우위가 있습니다. 제공된 위의 데이터 포인트는 북미 자동차 DC-DC 컨버터 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 자동차용 DC-DC 컨버터 시장의 주요 기업으로는 Robert Bosch GmbH, BorgWarner Inc., DENSO Corporation, TDK Corporation, Murata Manufacturing Co., Ltd., TOYOTA INDUSTRIES CORPORATION, Vitesco Technologies Group AG, Infineon Technologies AG, STMicroelectronics, Skyworks Solutions, Inc., MORNSUN Guangzhou Science & Technology Co. Ltd., SHINDENGEN ELECTRIC MANUFACTURING CO., LTD., Vicor Corporation, Texas Instruments Incorporated, Continental AG, Semiconductor Components Industries, LLC, Inmotion Technologies AB, Deutronic Elektronik GmbH, Sinpro Electronics Co., Ltd., RECOM Power GmbH 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MARKET CHALLENGE MATRIX

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 MARKET PRODUCT TYPE COVERAGE GRID

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN SALES OF ELECTRIC VEHICLES WORLDWIDE

5.1.2 RISE IN POPULARITY OF MOBILITY AS A SERVICE (MAAS) MODEL

5.1.3 GROWING ADOPTION OF ENERGY-EFFICIENT VEHICLES TO PROMOTE LOW CO2 EMISSION

5.1.4 RISE IN EXPANSION OF ADVANCED DRIVING ASSISTANCE SYSTEMS (ADAS)

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATORY COMPLIANCE AND SAFETY STANDARDS FOR AUTOMOBILE INDUSTRIES

5.2.2 HIGHER COST OF ELECTRONIC COMPONENTS IN ELECTRIC VEHICLE

5.3 OPPORTUNITIES

5.3.1 RISE IN ACQUISITION AND PARTNERSHIP FOR VARIOUS PRODUCT DEVELOPMENT AMONG ORGANIZATIONS

5.3.2 R&D EFFORTS TO INTEGRATE DC-DC CONVERTERS INTO COMMERCIAL VEHICLES

5.3.3 HIGHER FLUCTUATION IN FUEL PRICES IS INSISTING CONSUMERS TO OPT FOR ELECTRIC VEHICLE

5.3.4 DEVELOPMENT OF MINIATURIZED LIGHT WEIGHT DC-DC CONVERTERS

5.4 CHALLENGES

5.4.1 DESIGN COMPLICATIONS IN DC-DC CONVERTERS

5.4.2 AVAILABILITY OF LOW QUALITY OF DC-DC CONVERTERS ON GREY MARKET

6 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 ISOLATED

6.3 NON-ISOLATED

7 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE

7.1 OVERVIEW

7.2 40 V-70 V

7.3 BELOW 40 V

7.4 ABOVE 70 V

8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE

8.1 OVERVIEW

8.2 10.1 V - 15 V

8.3 5 V & BELOW

8.4 ABOVE 20 V

8.5 5.1 V-10 V

8.6 15.1 V-20 V

9 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER

9.1 OVERVIEW

9.2 0.25 W-250 W

9.3 251 W-500 W

9.4 501 W-1000 W

9.5 ABOVE 1000 W

10 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE

10.1 OVERVIEW

10.2 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

10.3 BATTERY ELECTRIC VEHICLE (BEV)

10.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

11 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PASSENGER VEHICLE

11.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.3 COMMERCIAL VEHICLE

11.3.1 BY TYPE

11.3.1.1 LIGHT COMMERCIAL VEHICLE

11.3.1.2 MEDIUM & HEAVY COMMERCIAL VEHICLE

11.3.2 BY PROPULSION TYPE

11.3.2.1 HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV)

11.3.2.2 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

12 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ROBERT BOSCH GMBH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVLOPMENT

15.2 BORGWARNER INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVLOPMENTS

15.3 DENSO CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 TDK CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 MURATA MANUFACTURING CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 CONTINENTAL AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DEUTRONIC ELEKTRONIK GMBH

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 INFINEON TECHNOLOGIES AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 INMOTION

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RECOM POWER GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 SINPRO ELECTRONICS CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SKYWORKS SOLUTIONS INC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVLOPMENTS

15.16 STMICROELECTRONICS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 TEXAS INSTRUMENTS INCORPORATED

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TOYOTA INDUSTRIES CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 VICOR CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 VITESCO TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 2 NORTH AMERICA ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA NON-ISOLATED IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA 40 V-70 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA BELOW 40 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA ABOVE 70 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA 10.1 V - 15 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA 5 V & BELOW IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA ABOVE 20 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA 5.1 V - 10 V IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA 15.1 V - 20 V IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA 0.25 W-250 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA 251 W-500 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 501 W-1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ABOVE 1000 W IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA HYBRID & PLUG-IN HYBRID ELECTRIC VEHICLE (HEV & PHEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA BATTERY ELECTRIC VEHICLE (BEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FUEL CELL ELECTRIC VEHICLE (FCEV) IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTERS MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 41 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 42 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 43 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 U.S. AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 U.S. PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 50 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 51 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 52 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 CANADA AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 CANADA PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 CANADA COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY INPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 59 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT VOLTAGE, 2020-2029 (USD THOUSAND)

TABLE 60 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY OUTPUT POWER, 2020-2029 (USD THOUSAND)

TABLE 61 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 62 MEXICO AUTOMOTIVE DC-DC CONVERTER MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 MEXICO PASSENGER VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 MEXICO COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MEXICO COMMERCIAL VEHICLE IN AUTOMOTIVE DC-DC CONVERTER MARKET, BY PROPULSION TYPE, 2020-2029 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: PRODUCT TYPE COVERAGE GRID

FIGURE 7 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: SEGMENTATION

FIGURE 11 INCREASE IN SALES OF ELECTRIC VEHICLES ACROSS THE REGION IS EXPECTED TO DRIVE THE NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE IN THE NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET IN THE FORECAST PERIOD OF 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES OF NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET

FIGURE 15 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 16 CHANGES IN VEHICLE DATA IN-LINE WITH THE MOBILITY SERVICES

FIGURE 17 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY INPUT VOLTAGE, 2021

FIGURE 19 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT VOLTAGE, 2021

FIGURE 20 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY OUTPUT POWER, 2021

FIGURE 21 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY PROPULSION TYPE, 2021

FIGURE 22 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTER MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 NORTH AMERICA AUTOMOTIVE DC-DC CONVERTERS MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.