북미 연령 관련 황반변성(AMD) 질환 시장, 유형별(건성 AMD 및 습성 AMD ), 최종 사용자(병원, 전문 클리닉, 외래 수술 센터, 가정 의료 및 기타), 유통 채널(직접 입찰 및 소매 판매) 산업 동향 및 2029년까지의 예측

시장 분석 및 통찰력

북미 연령 관련 황반변성(AMD) 질환 시장은 노령 인구 증가, 연령 관련 황반변성(AMD) 질환 유병률 증가, 파이프라인 제품 수요 증가, 연구 개발 투자 증가로 시장 성장과 같은 요인에 의해 주도되고 있습니다. 현재 선진국과 신흥국에서 의료비 지출이 증가하여 제조업체가 새롭고 혁신적인 제품을 개발할 수 있는 경쟁 우위를 확보할 것으로 예상됩니다.

연령 관련 황반변성 유병률은 인구 고령화와 기대 수명 증가로 인해 선진국에서 증가할 것으로 예상됩니다. 환자의 약 60%가 출생 직후에 발생하는 심각한 시각 장애를 앓고 있는 것으로 추정됩니다. 이 질환은 환자의 눈의 중앙 시야가 흐릿해지는 결과를 초래합니다. 연령 관련 황반변성(AMD) 질환 치료 및 진단에 대한 수요는 선진국에서 더욱 증가했습니다. 그러나 치료 및 시술과 관련된 높은 비용과 제품 승인에 대한 엄격한 정부 규정은 연령 관련 황반변성(AMD) 질환 시장의 성장을 방해할 것으로 예상됩니다.

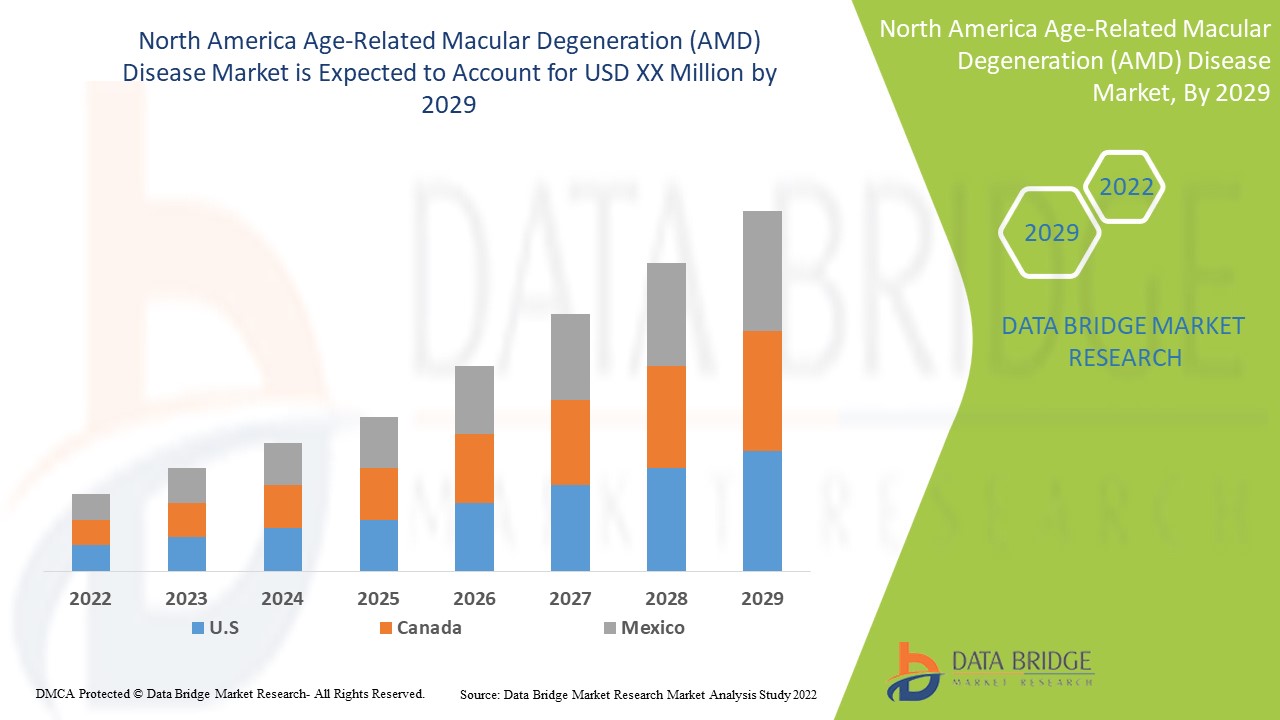

북미 연령 관련 황반변성(AMD) 질환 시장은 긍정적이며 질병의 진행을 줄이는 것을 목표로 합니다. Data Bridge Market Research는 북미 연령 관련 황반변성(AMD) 질환 시장이 2022년에서 2029년까지의 예측 기간 동안 8.0%의 CAGR로 성장할 것이라고 분석합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 해 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

유형별(건성 AMD 및 습성 AMD), 최종 사용자(병원, 전문 클리닉, 외래 수술 센터, 홈 헬스케어 및 기타), 유통 채널(직접 입찰 및 소매 판매) 산업 동향 및 2029년까지의 예측 |

|

적용 국가 |

국가별(미국, 캐나다, 멕시코) 산업 동향 및 2029년까지의 예측 |

|

시장 참여자 포함 |

Novartis AG, Bayer AG, Astellas Pharma Inc., REGENXBIO Inc., Ionis Pharmaceutics, Ocugen Inc, Johnson & Johnson Services, Inc., IVERIC bio, MeiraGTx Limited, Adverum Biotechnologies, Inc., Graybug Vision Inc., Kodiak Sciences Inc., Genentech Inc. 등 |

시장 정의

연령 관련 황반변성(AMD)은 선명하고 직진적인 시야를 제어하는 눈의 황반 부위에 손상을 줄 수 있는 안구 질환입니다. 이로 인해 중앙 시야가 흐릿해집니다. 시력 상실은 비정상적인 혈관 성장으로 인해 발생할 수 있습니다. 때때로 비정상적인 새로운 혈관이 맥락막에서 자라 황반으로 들어갑니다. 맥락막은 망막과 눈의 바깥쪽 단단한 막(강막) 사이에 있는 혈관 층입니다. 이러한 비정상적인 혈관은 체액이나 혈액을 누출하여 망막의 기능을 방해할 수 있습니다. 황반변성은 노화된 사람들에게 흔합니다. 시술 증가의 다른 이유는 노화 원인의 증가와 의료 시설에 대한 요구 사항으로 정의할 수 있으며, 여기에는 의료 요구 사항이 최대인 진단을 위한 환자 친화적 기술에 대한 치료가 포함되며, 이는 의료 시설의 부담을 더욱 줄일 수 있습니다.

연령 관련 황반변성(AMD) 질환의 진단 및 치료는 제품 승인 후 질병을 진단할 수 있는 다양한 기술로 구성됩니다. 질병에 대한 치료법은 최근 승인되어 시장 성장을 뒷받침합니다. 그러나 이러한 치료법은 비용이 많이 들고 모든 환자가 이용할 수 있는 것은 아닙니다.

북미 연령 관련 황반변성(AMD) 질병 시장 역학

운전자

- 노령 인구 증가

세계의 노인 인구는 급속도로 증가하고 있습니다. 나이가 들면서 만성 질환의 유병률이 증가함에 따라 노인 환자 수도 함께 증가합니다. 나이는 근본적인 생물학적 메커니즘에 영향을 미치는 필수 매개변수이기 때문에 모든 질병 진행에 심각한 위험 요소입니다. 따라서 노화는 북미에서 초기 AMD가 발생하는 위험 요소 중 하나입니다. AMD 관련 황반변성(AMD)은 눈의 황반부에 손상을 줄 수 있습니다. 이로 인해 중앙 시력이 흐릿해집니다. 돌이킬 수 없는 실명을 일으킬 수 있으며 노인의 시각 장애의 주요 원인입니다.

황반변성은 노령층에서 더 흔합니다. 질병의 진단은 다양한 단계에서 가능하며, 유전자 검사와 망막 영상은 질병을 감지하는 기술 중 일부입니다. 질병의 진단은 주로 광학 영상 기술과 기타 표준 프로세스를 통해 수행됩니다. 따라서 노령 인구의 증가율은 북미 연령 관련 황반변성(AMD) 질병 시장 성장을 촉진할 것으로 예상됩니다.

- 연령 관련 황반변성(AMD) 질환의 유병률 증가

선진국에서는 연령 관련 황반변성(AMD) 질환 치료 및 진단에 대한 수요가 더욱 증가했습니다. 이러한 국가는 유전 질환의 유병률이 증가하는 것과 함께 연령 관련 황반변성(AMD) 질환 시장에 대한 환불 정책을 가지고 있었습니다.

따라서 이는 연령 관련 황반변성(AMD) 질환의 유병률 증가가 북미 연령 관련 황반변성(AMD) 질환 시장 성장을 견인할 것으로 예상된다는 것을 의미합니다.

기회

- 상승하는 연구개발

연구 개발은 다양한 종류의 환자를 치료하기 위한 치료법을 수정하는 데 필수적입니다. 연령 관련 황반변성(AMD) 치료 및 시술에 대한 수요는 전 세계적으로 증가하고 있으며 북미의 모든 국가를 포함합니다. 이것이 회사들이 환자와 의료 종사자에게 효과적인 치료를 제공하는 데 성공하기 위해 지속적으로 연구 개발에 집중하는 이유입니다.

질병이 진행되고, 시력이 점점 손상되고, 망막 조직이 퇴화하고, 영구적인 손상을 입는 등 효과적인 증강 요인이 포함되어 특정 방식으로 개인에게만 효과가 나타날 수 있습니다.

기업들이 끊임없이 개발 활동에 참여함에 따라 더 많은 혁신적인 제품이 시장에 출시됩니다. 따라서 이는 북미 연령 관련 황반변성(AMD) 질환 성장의 기회로서 연구 개발이 증가할 것으로 예상된다는 것을 의미합니다. 전 세계 정부가 인구에게 최상의 치료를 제공하기 위해 내린 다양한 프로그램과 결정은 수요를 증가시킬 것으로 예상되는 주요 요인이며 북미 연령 관련 황반변성(AMD) 질환 시장에 기회가 될 것입니다.

제지/도전

- 미용 수술의 높은 비용

제품의 비용은 시장에서 중요한 요소입니다. 연령 관련 황반변성(AMD) 질환의 경우 일반적으로 매우 정교하고 정밀해야 하며 다른 사양으로 인해 제품 비용이 증가합니다. 게다가 장기간 치료와 관련된 비용은 평균 소득자가 감당하기 매우 어렵습니다. 중환자 치료 및 집중 치료실 서비스의 활용은 전 세계적으로 증가하고 있으며, 그 비용이 많이 드는 것은 현재 의료 시스템에서 주요 관심사입니다.

퇴행성 질환이 있는 환자는 일반적으로 빈번한 화폐화 및 기타 사용으로 인해 상당한 양의 의료 자원을 소모하는 장기 치료를 받아야 합니다. 이로 인해 장기적인 경제적 비용을 감당할 수 없는 대부분의 환자는 치료 초기 단계에서 퇴원합니다. 그러나 이로 인해 진단 시 새로운 합병증의 가능성과 취약성이 증가하여 추가적인 의료 자원과 치료가 필요합니다. 혁신적이고 진보된 제품의 비용이 높기 때문에 치료 비용도 비례적으로 상승하여 연령 관련 황반변성(AMD) 질환 치료 및 진단과 관련된 높은 비용이 북미 연령 관련 황반변성(AMD) 질환 시장 성장을 제한할 것으로 예상됩니다.

최근 개발 사항

- 2022년 1월, 제넨텍(Genentech, Inc)은 미국 식품의약국(FDA)이 Vabysmo(faricimab-svoa)를 습성 AMD 및 DME 치료에 승인했다고 발표했습니다. 이를 통해 회사는 예측 기간 동안 제품을 시장에 출시하는 데 도움이 될 것입니다.

- Graybug Vision Inc.는 2022년 4월, 회사가 원발성 개방각 녹내장(POAG)에 대한 GB-401의 임상 전 데이터를 ARVO(Association for Research in Vision and Ophthalmology) 연례 회의에서 포스터 프레젠테이션을 발표했다고 발표했습니다. 이를 통해 시장에서 약물의 안전성과 평가 가능성이 높아질 것입니다.

북미 연령관련 황반변성(AMD) 질환 시장 세분화

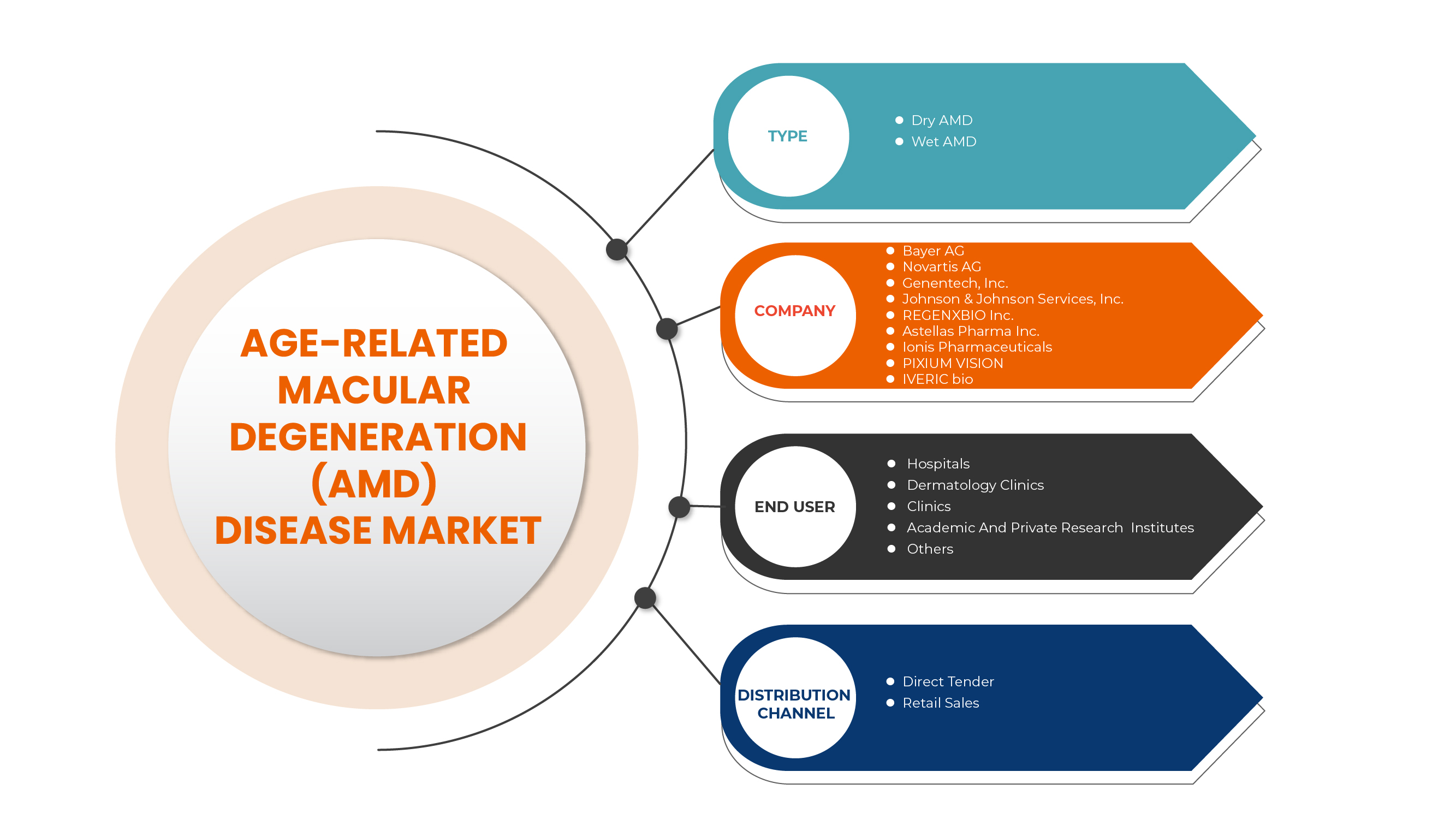

북미 연령 관련 황반변성(AMD) 질환 시장은 유형, 최종 사용자 및 유통 채널을 기준으로 하는 세 가지 주요 세그먼트로 분류됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 응용 분야와 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

유형

- 건성 AMD

- 습성 AMD

북미 연령 관련 황반변성(AMD) 질병 시장은 유형을 기준으로 건성 AMD와 습성 AMD로 구분됩니다.

최종 사용자

- 병원

- 전문 클리닉

- 외래 수술 센터

- 홈 헬스케어

- 기타

북미 연령관련 황반변성(AMD) 질환 시장은 최종 사용자를 기준으로 병원, 전문 클리닉, 외래 수술 센터, 가정 건강 관리 및 기타로 구분됩니다.

유통 채널

- 소매 판매

- 직접 입찰

유통 채널을 기준으로 볼 때, 북미 연령 관련 황반변성(AMD) 질병 시장은 소매 판매와 직접 입찰로 구분됩니다.

연령 관련 황반변성(AMD) 질환 시장 지역 분석/통찰력

연령 관련 황반변성(AMD) 질환 시장을 분석하고, 위에 언급된 대로 유형, 최종 사용자 및 유통 채널별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

연령 관련 황반변성(AMD) 질병 보고서에 포함된 국가는 미국, 캐나다, 멕시코입니다.

미국은 개발 도상국의 기술 발전이 급속히 진행됨에 따라 우위를 점할 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 북미 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 연령 관련 황반변성(AMD) 질환 시장 점유율 분석

북미 연령 관련 황반변성(AMD) 질환 시장 경쟁 구도는 경쟁업체의 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 북미 지역 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 있습니다. 위에 제공된 데이터 포인트는 연령 관련 황반변성(AMD) 질환 시장에 대한 회사의 초점과만 관련이 있습니다.

시장의 주요 기업으로는 Novartis AG, Bayer AG, Astellas Pharma Inc., REGENXBIO Inc., Ionis Pharmaceutics, Ocugen Inc, Johnson & Johnson Services, Inc., IVERIC bio, MeiraGTx Limited, Adverum Biotechnologies, Inc., Graybug Vision Inc., Kodiak Sciences Inc., Genentech Inc. 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 북미 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF AGE-RELATED MACULAR DEGENERATION

6.1.2 INCREASING GERIATRIC POPULATION

6.1.3 INCREASE IN PIPELINE PRODUCTS

6.1.4 INCREASE IN STRATEGIC INITIATIVE BY KEY PLAYERS

6.2 RESTRAINTS

6.2.1 HIGH COST OF TREATMENT AND PROCEDURES

6.2.2 LACK OF ENOUGH QUALIFIED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 INCREASING RESEARCH AND DEVELOPMENT

6.3.2 INCREASE IN AWARENESS AND TREATMENT-SEEKING RATE OF AMD

6.3.3 EMERGING REIMBURSEMENT POLICIES FOR THE TREATMENT

6.3.4 INCREASING PRODUCT APPROVAL FOR AGE-RELATED MACULAR DEGENERATION (AMD)

6.4 CHALLENGES

6.4.1 LIMITED ACCESS TO TREATMENT

6.4.2 STRINGENT GOVERNMENT REGULATIONS FOR PRODUCTS

7 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE

7.1 OVERVIEW

7.2 DRY AMD

7.3 WET AMD

7.3.1 MEDICATIONS

7.3.2 ANTI-VEGF THERAPY

7.3.3 GENE THERAPY

7.3.4 SURGERY

8 NORTH AMERICA AGE- RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER

8.1 OVERVIEW

8.2 HOSPITALS

8.3 SPECIALTY CLINICS

8.4 AMBULATORY SURGICAL CENTERS

8.5 HOME HEALTHCARE

8.6 OTHERS

9 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.2.1 HOSPITAL PHARMACIES

9.2.2 RETAIL PHARMACIES

9.2.3 OTHERS

9.3 DIRECT TENDER

10 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 NOVARTIS AG

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.1.5.1 AGREEMENT

13.2 GENENTECH, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 COMPANY SHARE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BAYER AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 ADVERUM BIOTECHNOLOGIES, INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 ASTELLAS PHARMA INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 GRAYBUG VISION INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 GENSIGHT BIOLOGICS

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.7.4.1 EVENT

13.7.4.2 AWARD

13.8 IONIS PHARMACEUTICALS

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.8.4.1 EVENT

13.9 IVERIC BIO

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 JOHNSON &JOHNSON SERVICES, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.10.4.1 COLLABORATION

13.11 KODIAK SCIENCES INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MEIRAGTX LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.12.3.1 EVENTS

13.12.3.2 AWARD

13.12.3.3 COLLABORATION

13.13 OCUGEN INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.13.3.1 INVESTMENT

13.13.3.2 CLINICAL TRIAL

13.14 PIXIUM VISION

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.14.4.1 AWARD

13.15 REGENXBIO INC.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.15.3.1 EVENT

13.15.3.2 COLLABORATION

13.15.3.3 CERTIFICATION

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 VARIOUS EXAMPLES OF OPHTHALMIC DEVICES ARE SUMMARIZED IN THE BELOW-GIVEN TABLE ACCORDING TO THEIR CLASSIFICATION

TABLE 2 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA DRY AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEDICATIONS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HOSPITALS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SPECIALTY CLINICS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA HOME HEALTHCARE IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL , 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DIRECT TENDER IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA MEDICATIONS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 U.S. AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 U.S. WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 U.S. MEDICATIONS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 28 U.S. AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 U.S. RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 CANADA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 CANADA WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 CANADA MEDICATIONS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 CANADA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 CANADA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 CANADA RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL,, 2020-2029 (USD MILLION)

TABLE 36 MEXICO AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO WET AMD IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MEXICO MEDICATIONS IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MEXICO AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 MEXICO AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 MEXICO RETAIL SALES IN AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND EUROPE IS GROWING AT THE FASTEST PACE IN NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 INCREASE IN THE PREVALENCE OF AGE-RELATED MACULAR DEGENERATION (AMD) AND GROWING GERIATRIC POPULATION ARE DRIVING THE NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRY AMD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET

FIGURE 16 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY TYPE, 2021

FIGURE 17 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY END USER, 2021

FIGURE 21 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 24 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 25 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET : SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET : BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET : BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET : BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET : BY TYPE (2022-2029)

FIGURE 33 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION (AMD) DISEASE MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.