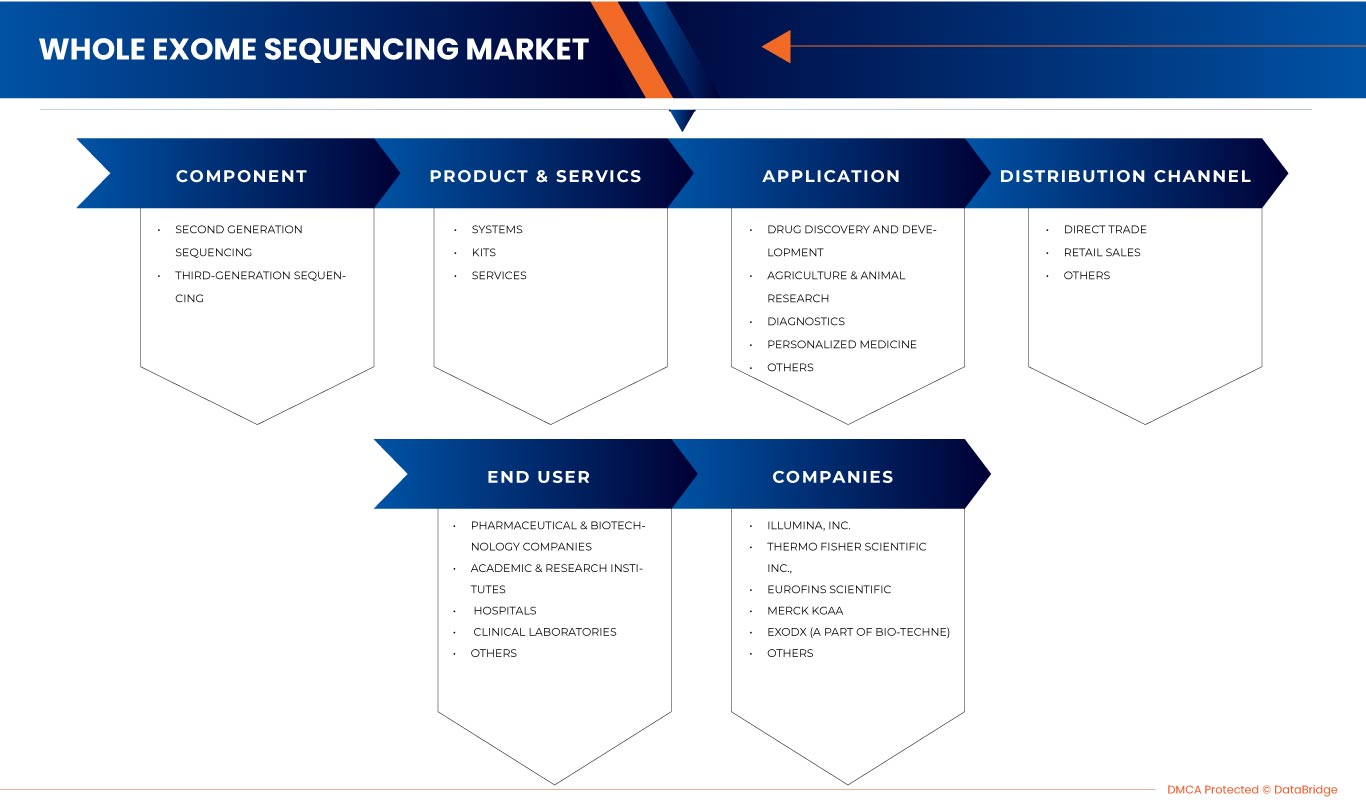

중동 및 아프리카 전체 엑솜 시퀀싱 시장, 구성 요소(2세대 시퀀싱 및 3세대 시퀀싱), 제품 및 서비스(시스템, 키트 및 서비스), 응용 분야(신약 발견 및 개발, 농업 및 동물 연구, 진단, 개인 맞춤 의료 및 기타), 최종 사용자(제약 및 생명 공학 회사, 학계 및 연구 기관, 병원 및 진료소, 임상 실험실 및 기타), 유통 채널(직거래, 소매 판매 및 기타), 산업 동향 및 2029년까지의 예측.

시장 분석 및 통찰력

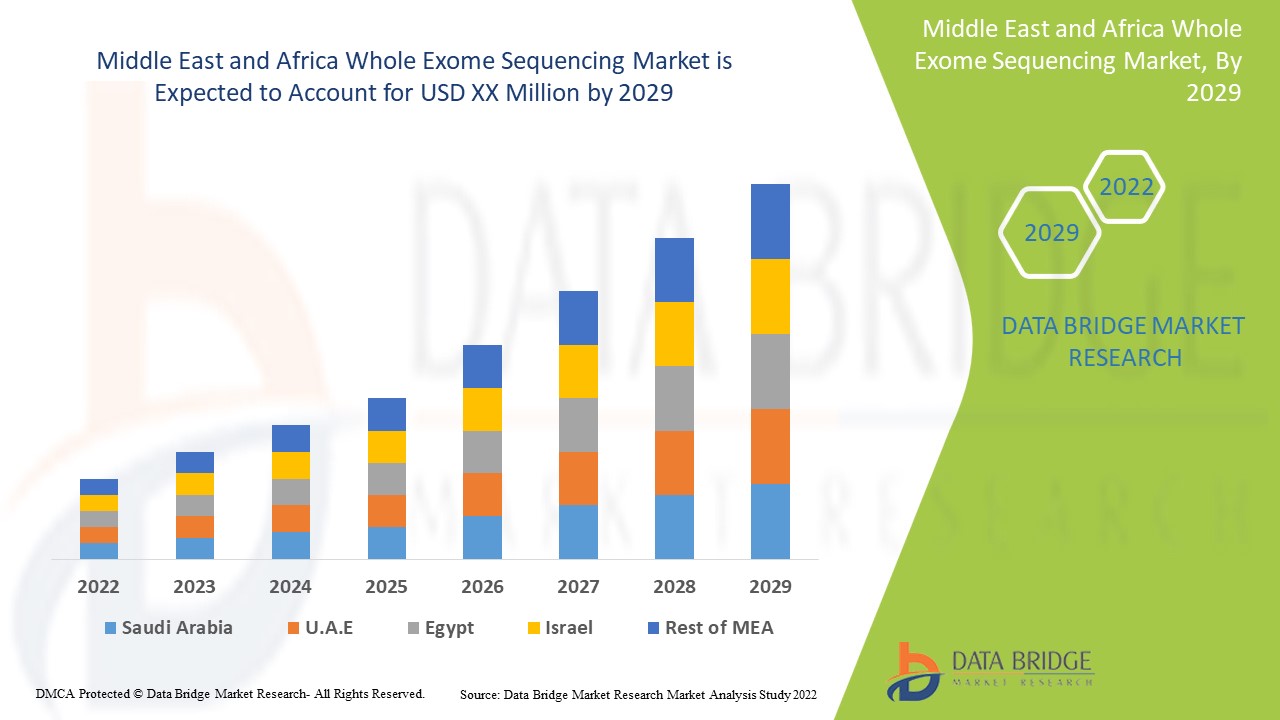

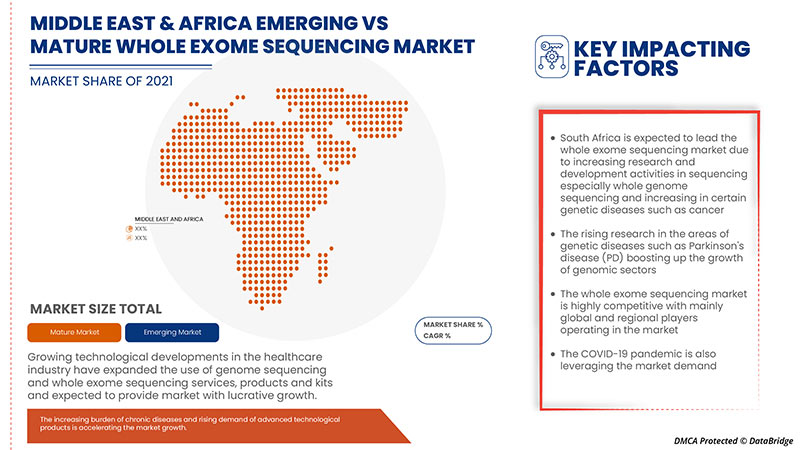

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 2022년에서 2029년의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년에서 2029년의 예측 기간 동안 8.2%의 CAGR로 성장하고 있다고 분석합니다. 의료비 지출과 자금 조달의 증가는 예측 기간 동안 시장 수요를 촉진한 주요 원동력입니다.

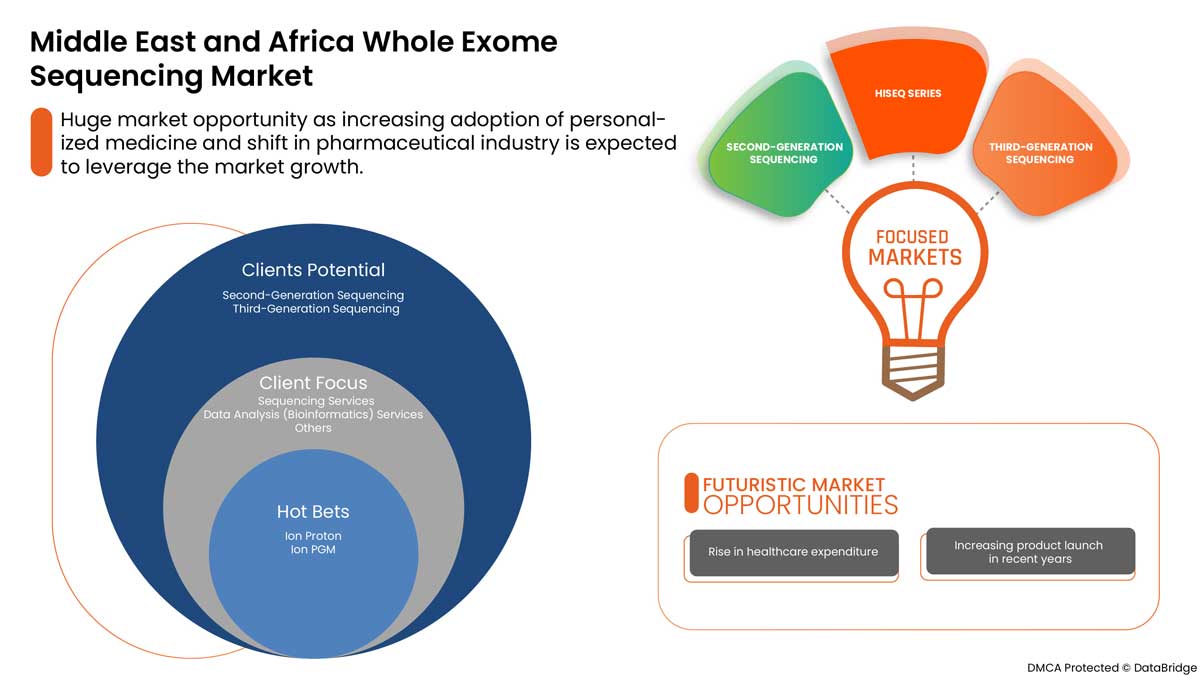

그러나 전체 엑솜 시퀀싱 치료와 관련된 부작용은 전체 엑솜 시퀀싱 시장의 미래 성장을 방해할 수 있습니다. 주요 시장 참여자의 파트너십 및 인수와 같은 전략적 제휴 채택은 전체 엑솜 시퀀싱 시장 성장의 기회로 작용합니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 |

|

양적 단위 |

수익은 백만 달러, 가격은 미화로 표시됨 |

|

다루는 세그먼트 |

구성 요소별(2세대 시퀀싱 및 3세대 시퀀싱 ), 제품 및 서비스(시스템, 키트 및 서비스), 응용 프로그램(약물 발견 및 개발, 농업 및 동물 연구, 진단, 개인화 의학 및 기타), 최종 사용자(제약 및 생명 공학 회사, 학계 및 연구 기관, 병원 및 진료소, 임상 실험실 및 기타), 유통 채널(직거래, 소매 판매 및 기타) |

|

적용 국가 |

사우디 아라비아, 남아프리카, UAE, 이스라엘, 이집트, 기타 중동 및 아프리카 |

|

시장 참여자 포함 |

Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx(Bio-Techne의 일부), FOUNDATION MEDICINE, INC.(F. Hoffmann-La Roche Ltd의 자회사), GeneFirst Limited, CeGaT GmbH, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta US Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics(PerkinElmer Inc.의 자회사), GeneDx, LLC, Psomagen, Integrated DNA Technologies, Inc. 등이 있습니다. |

전체 엑솜 시퀀싱 시장 정의

전체 엑솜은 게놈의 모든 단백질 코딩 유전자 영역을 시퀀싱하기 위한 게놈 기술입니다. 전체 엑솜 시퀀싱은 여러 가지 의학적 상태에 대한 통합 진단을 찾고 있는 환자에게 제공됩니다. 주로 개인의 게놈의 엑손(또는 단백질 코딩) 영역과 관련 시퀀스의 뉴클레오티드 시퀀스를 결정하는 데 사용되는 실험실 프로세스로, 전체 DNA 시퀀스의 약 1%를 나타내며 WES라고도 합니다. 전체 엑솜 시퀀싱은 게놈의 단백질 코딩 영역을 시퀀싱하는 널리 사용되는 전체 엑솜 시퀀싱 방법입니다. 인간 엑솜은 게놈의 2% 미만을 차지하지만 알려진 질병 관련 변이의 약 85%를 포함하고 있어 이 방법은 전체 게놈 시퀀싱에 비해 비용 효율적인 대안입니다.

엑솜 농축을 이용한 엑솜 시퀀싱은 인구 유전학, 유전 질환 및 암 연구를 포함한 광범위한 응용 분야에서 코딩 변이를 효율적으로 검출할 수 있습니다. 글로벌 전체 엑솜 시퀀싱 시장의 성장은 시퀀싱에 소요되는 시간과 비용이 감소한 데 기인합니다. 새로운 기술과 암 치료법의 개발로 임상 종양학에서 전체 엑솜 시퀀싱 시장은 앞으로 몇 년 동안 엄청난 잠재력을 가지고 있습니다.

중동 및 아프리카 전체 엑솜 시퀀싱 시장 역학

운전자

- 차세대 시퀀싱(NGS) 도입 증가

유전체학에 초점을 맞춘 약리학이 특히 암을 비롯한 다양한 만성 질환의 치료에 점점 더 큰 역할을 함에 따라 차세대 시퀀싱(NGS)은 개별 종양과 특정 수용체의 분자적 기초에 대한 더 깊고 정확한 통찰력을 제공하는 강력한 도구로 발전하고 있습니다.

NGS는 종양학 분야에 상당한 영향을 미칠 수 있는 기존 방법에 비해 정확도, 민감도 및 속도 면에서 이점을 제공합니다. NGS는 단일 검사에서 여러 유전자를 평가할 수 있으므로 원인 돌연변이를 식별하기 위해 여러 검사를 주문할 필요가 없습니다.

- 타겟 시퀀싱 방법의 사용 증가

유전체학에 초점을 맞춘 약리학이 특히 암을 비롯한 다양한 만성 질환의 치료에 점점 더 큰 역할을 함에 따라 차세대 시퀀싱(NGS)은 개별 종양과 특정 수용체의 분자적 기초에 대한 더 깊고 정확한 통찰력을 제공하는 강력한 도구로 발전하고 있습니다.

NGS는 종양학 분야에 상당한 영향을 미칠 수 있는 기존 방법에 비해 정확도, 민감도 및 속도 면에서 이점을 제공합니다. NGS는 단일 검사에서 여러 유전자를 평가할 수 있으므로 원인 돌연변이를 식별하기 위해 여러 검사를 주문할 필요가 없습니다.

제지

-

엑손에 대한 덜 포괄적인 적용 범위

모든 엑손이 포괄적으로 포착되지는 않습니다. 중요한 엑손이 인간 게놈의 현재 표준 주석에 포함되지 않을 수 있으며, 현재 WES 기술로 엑솜의 100%를 커버하는 것은 매우 힘듭니다. 결과적으로 이러한 "놓친" 엑손의 질병 유발 변이는 감지되지 않습니다.

WES는 구조적 변화에 대한 민감도가 낮아 감지가 제한적입니다. 그럼에도 불구하고 indel과 duplication을 포함한 일부 CNV는 WES에서 감지할 수 있지만 기술적 한계로 인해 다른 CNV는 놓칠 가능성이 높습니다.

기회

-

주요 시장 참여자의 전략적 이니셔티브

유전적 질환의 발생률 증가와 지역 전체의 노령 인구 증가로 인해 시장에서 전체 엑솜 시퀀싱에 대한 수요가 증가하고 있습니다. 따라서 주요 시장 참여자들은 사업 운영과 수익성을 개선하기 위해 다른 시장 참여자들과 협력하는 전략을 실행했습니다.

도전

- 전체 엑솜 시퀀싱과 관련된 윤리적 및 법적 문제

고처리량 게놈 기술과 차세대 시퀀싱의 급속한 발전으로 인해 의료 게놈 연구가 보다 쉽게 접근 가능하고 저렴해졌으며, 여기에는 질병의 근저에 있는 유전적 요인을 밝히기 위해 환자 및 대조군의 전체 게놈과 엑솜을 시퀀싱하는 것도 포함됩니다. 최근 몇 년 동안 고처리량 게놈 기술과 차세대 시퀀싱(NGS) 방법의 발전으로 인간 게놈 연구의 범위가 바뀌었습니다. 이러한 발전으로 인해 전체 엑솜 시퀀싱(WES) 연구를 일상적으로 수행하는 것이 가능해졌습니다.

연구의 대규모 협력적 특성으로 인해 윤리적 및 법적 문제가 점점 더 우려되고 있으며 아프리카에서 중요한 의미를 갖습니다. 아프리카 인구는 유전적 다양성 수준이 가장 높고, 광범위한 환경 및 문화적 환경에서 살고 있으며, 유전체학 접근법을 사용하여 연구할 수 있는 질병 부담이 높음에도 불구하고 WES에서 법적 문제에 직면하고 있기 때문에 독특한 관심을 받고 있습니다.

COVID-19 이후 Whole Exome Sequencing 시장에 미치는 영향

COVID-19로 인해 예방 조치를 위해 의료 전문가와 일반 대중 모두에서 의료용품에 대한 수요가 크게 증가했습니다. 이러한 품목의 제조업체는 시장에 개인 보호 장비를 안정적으로 공급함으로써 의료용품에 대한 수요 증가를 이용할 기회가 있습니다. COVID-19는 전체 엑솜 시퀀싱 시장에 큰 영향을 미칠 것으로 예상됩니다.

최근 개발

- 2022년 5월, 과학 서비스 분야의 세계적 리더인 Thermo Fisher Scientific과 Qatar Foundation(QF)의 회원인 Qatar Genome Program(QGP)은 카타르에서 예측 유전체학의 유전체 연구와 임상 응용을 가속화하는 목표로 협력하여 전 세계 아랍 인구에 정밀 의학의 이점을 확대하기 위한 한 걸음을 내딛었습니다. 이를 통해 회사는 입지를 확대할 수 있었습니다.

- 2022년 3월, Illumina, Fulgent Genetics, Invitae, GeneDx, PerkinElmer Genomics를 포함한 몇몇 선도적인 유전체학 기업과 연구소가 CardioGenomic Testing Alliance(CGTA)를 결성했습니다. CGTA는 심장학에서 유전체 검사에 대한 인식과 활용을 높이는 것을 목표로 하는 협력 그룹입니다. CGTA는 의료 제공자와 기타 이해 관계자에게 이러한 검사의 가치에 대해 교육하여 전문 의료 학회의 기존 지침을 준수하고, 의료 관리 및 계단식 검사를 알리고, 임상 결과를 개선하고자 합니다. 이를 통해 회사가 지침을 준수하는 데 도움이 되었습니다.

중동 및 아프리카 전체 엑솜 시퀀싱 시장 세분화

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 구성 요소, 제품 및 서비스, 애플리케이션, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다. 세그먼트 간 성장은 틈새 성장 포켓과 시장에 접근하고 핵심 애플리케이션 영역과 타겟 시장의 차이점을 파악하기 위한 전략을 분석하는 데 도움이 됩니다.

요소

- 2세대 시퀀싱

- 3세대 시퀀싱

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 구성 요소를 기준으로 2세대 시퀀싱과 3세대 시퀀싱으로 구분됩니다.

제품 및 서비스

- 시스템

- 키트

- 서비스

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 제품과 서비스를 기준으로 시스템, 키트, 서비스로 구분됩니다.

애플리케이션

- 진단

- 약물 발견 및 개발

- 개인맞춤의학

- 농업 및 동물 연구

- 기타

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 응용 분야를 기준으로 약물 발견 및 개발, 농업 및 동물 연구, 진단, 개인화 의학 및 기타로 세분화됩니다.

최종 사용자

- 병원 및 진료소

- 제약 및 생명공학 회사

- 학술 및 연구 기관

- 임상실험실

- 기타

최종 사용자를 기준으로 중동 및 아프리카 전체 엑솜 시퀀싱 시장은 제약 및 생명 공학 회사, 학술 및 연구 기관, 병원 및 진료소, 임상 실험실 및 기타로 세분화됩니다.

유통 채널

- 직접 거래

- 소매 판매

- 기타

중동 및 아프리카 전체 엑솜 시퀀싱 시장은 유통 채널을 기준으로 직접 거래, 소매 판매 및 기타로 구분됩니다.

전체 엑솜 시퀀싱 시장 국가 수준 분석

엑솜 시퀀싱 시장 전체를 분석하고, 구성 요소, 제품 및 서비스, 응용 분야, 최종 사용자 및 유통 채널별로 시장 규모 정보를 제공합니다.

전체 엑솜 시퀀싱 시장 보고서에서 다루는 국가는 사우디아라비아, 남아프리카공화국, UAE, 이스라엘, 이집트, 기타 중동 및 아프리카 국가입니다.

남아프리카 공화국은 예측, 치료를 위한 차세대 시퀀싱 방법의 수용 증가로 인해 예측 기간 동안 우위를 점할 것입니다. 남아프리카 공화국은 암과 같은 다양한 만성 질환의 모니터링으로 인해 성장할 것으로 예상됩니다.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Whole exome sequencing market also provides you with detailed market analysis for every country growth in healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, impact of regulatory scenarios, and trending parameters regarding whole exome sequencing market.

Competitive Landscape and Whole Exome Sequencing Market Share Analysis

Whole exome sequencing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Whole exome sequencing market.

The major companies which are dealing in the s Whole exome sequencing market are Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx (a part of Bio-Techne), FOUNDATION MEDICINE, INC. (A subsidiary of F. Hoffmann-La Roche Ltd), GeneFirst Limited, CeGaT GmbH, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta U.S. Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics (A Subsidiary of PerkinElmer Inc.), GeneDx, LLC, Psomagen, Integrated DNA Technologies, Inc., among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF TARGETED SEQUENCING METHODS

6.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

6.1.3 INCREASING DIAGNOSTICS APPLICATIONS OF WHOLE EXOME SEQUENCING

6.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

6.2 RESTRAINTS

6.2.1 LESS COMPREHENSIVE COVERAGE OF EXONS

6.2.2 CYBER SECURITY CONCERNS IN GENOMICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 INCREASING PRODUCT LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 ETHICAL AND LEGAL ISSUES RELATED TO WHOLE EXOME SEQUENCING

7 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SECOND-GENERATION SEQUENCING

7.2.1 SEQUENCING BY SYNTHESIS (SBS)

7.2.2 SEQUENCING BY HYBRIDIZATION (SBH) AND SEQUENCING BY LIGATION (SBL)

7.3 THIRD-GENERATION SEQUENCING

8 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE

8.1 OVERVIEW

8.2 SYSTEMS

8.2.1 HISEQ SERIES

8.2.1.1 HISEQ 2500

8.2.1.2 HISEQ 1500

8.2.2 MISEQ SERIES

8.2.3 ION TORRENT PLATFORMS

8.2.3.1 ION PROTON

8.2.3.2 ION PGM

8.2.4 OTHERS

8.3 KITS

8.3.1 DNA FRAGMENTATION, END REPAIR, A-TAILING, AND SIZE SELECTION KITS

8.3.2 LIBRARY PREPARATION KITS

8.3.3 TARGET ENRICHMENT KITS

8.3.4 OTHERS

8.4 SERVICES

8.4.1 SEQUENCING SERVICES

8.4.2 DATA ANALYSIS (BIOINFORMATICS) SERVICES

8.4.3 OTHERS

9 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISCOVERY AND DEVELOPMENT

9.3 AGRICULTURE & ANIMAL RESEARCH

9.4 DIAGNOSTICS

9.5 PERSONALIZED MEDICINE

9.6 OTHERS

10 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

10.3 ACADEMIC & RESEARCH INSTITUTES

10.4 HOSPITALS AND CLINICS

10.5 CLINICAL LABORATORIES

10.6 OTHERS

11 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TRADE

11.3 RETAIL SALES

11.4 OTHERS

12 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 COMPANY PROFILE

14.1 PERKINELMER GENOMICS (A SUBSIDIARY OF PERKINELMER INC.)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COM PANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COM PANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 EXODX (A PART OF BIO-TECHNE)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COM PANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COM PANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 FOUNDATION MEDICINE, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COM PANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AZENTA US, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BECKMAN COULTER, INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BIONEER CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 CD GENOMICS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CEGAT GMBH

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUROFINS SCIENTIFIC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 GENEDX, LLC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GENEFIRST LIMITED.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 ILLUMINA, INC

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGRATED DNA TECHNOLOGIES, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 MERIDIAN BIOSCIENCE, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 PSOMAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 QIAGEN

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SOPHIA GENETICS

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TWIST BIOSCIENCE

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA THIRD-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DRUG DISCOVERY AND DEVELOPMENT IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA AGRICULTURE & ANIMAL RESEARCH IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DIAGNOSTICS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PERSONALIZED MEDICINE IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ACADEMIC & RESEARCH INSTITUTES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HOSPITALS AND CLINICS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CLINICAL LABORATORIES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA DIRECT TRADE IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RETAIL SALES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 U.A.E WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 U.A.E SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 66 U.A.E WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.A.E WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 U.A.E WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 EGYPT WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 EGYPT SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 EGYPT WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 EGYPT WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 EGYPT WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 REST OF MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASE IN USE OF WES TECHNOLOGY FOR NEW SCIENTIFIC APPLICATIONS AND INCREASING THE PREFERENCE OF WES OVER WHOLE-GENOME SEQUENCING IS ITS LOW-COST SEQUENCING CAPABILITY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET

FIGURE 15 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2021

FIGURE 16 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2021

FIGURE 20 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2021

FIGURE 24 LOBAL WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.