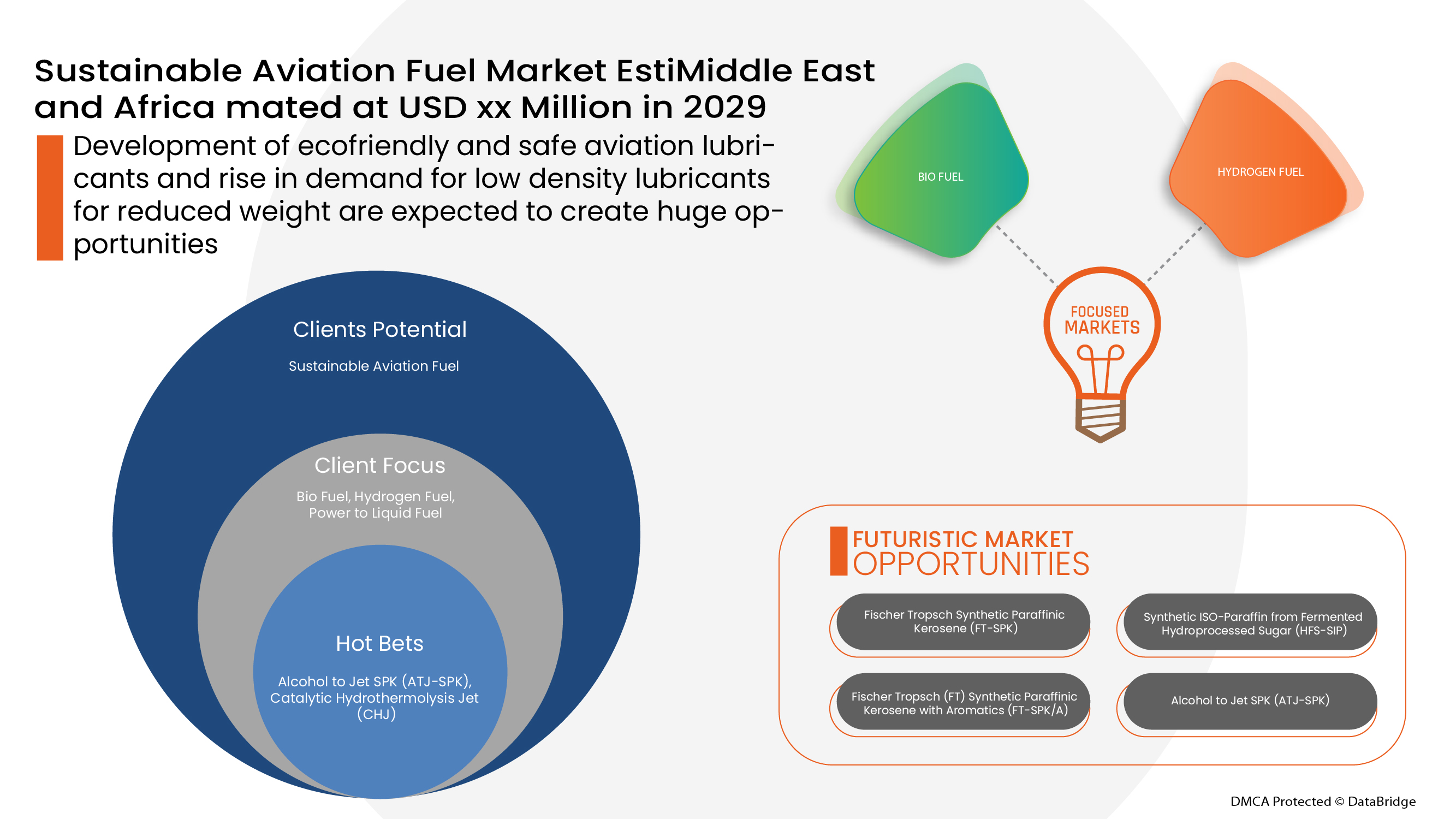

Middle East and Africa Sustainable Aviation Fuel Market, By Fuel Type (Bio Fuel, Hydrogen Fuel, and Power to Liquid Fuel), Manufacturing Technology (Hydroprocessed Fatty Acid Esters And Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic ISO-Paraffin From Fermented Hydroprocessed Sugar (HFS-SIP), Fischer Tropsch (FT) Synthetic Paraffinic Kerosene With Aromatics (FT-SPK/A), Alcohol To Jet SPK (ATJ-SPK) and Catalytic Hydrothermolysis Jet (CHJ)), Blending Capacity (Below 30 %, 30 % to 50 % and Above 50%), Blending Platform (Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicle) Industry Trends and Forecast to 2029.

Middle East and Africa Sustainable Aviation Fuel Market Analysis and Size

The aviation industry is keen on bringing down carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. Alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, the adoption of sustainable aviation fuels such as E-fuels, synthetic fuels, green jet fuels, bio jet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation.

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. Factors such as a rise in a number of airline passengers, growing disposable income, increase in air transportation, and increase in consumption of synthetic lubricants supplement the growth of the Middle East and Africa sustainable aviation fuel market. However, the lack of infrastructure act as a restraining factor for the market.

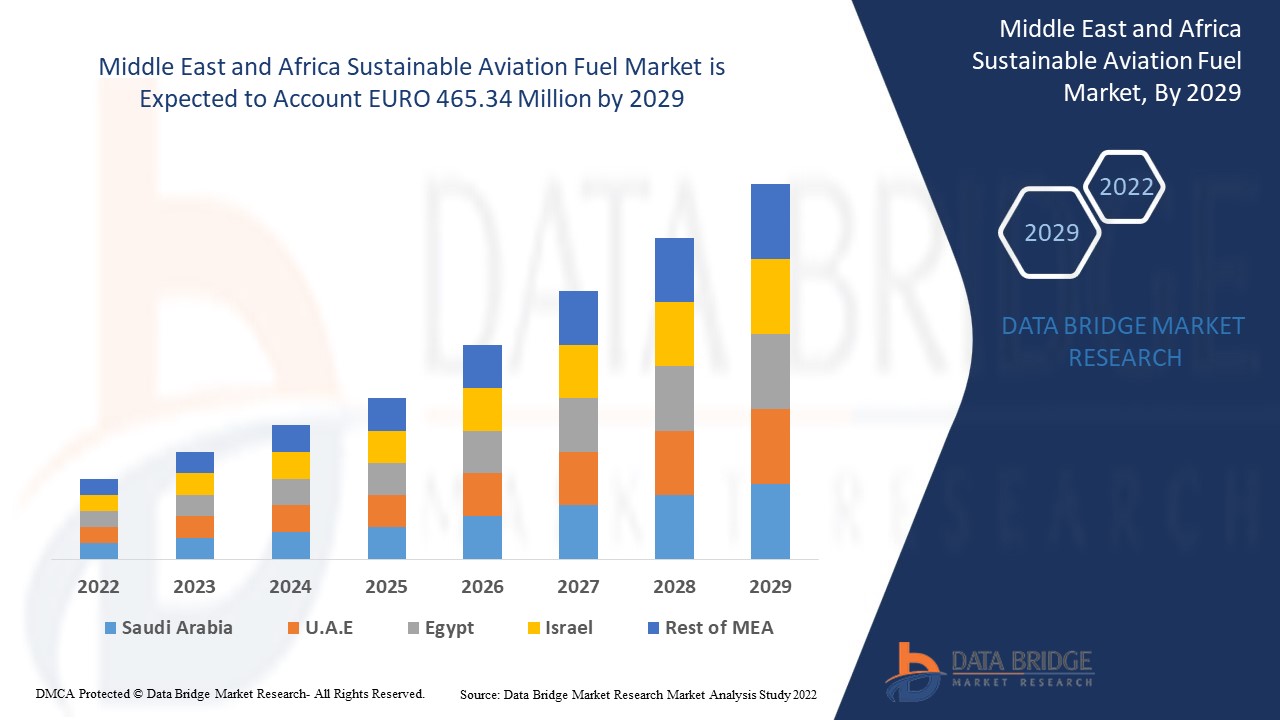

Data Bridge Market Research analyses that the sustainable aviation fuel market is expected to reach the value of EURO 465.34 million by 2029, at a CAGR of 40.7% during the forecast period. “Bio Fuel" accounts for the largest technology segment in the sustainable aviation fuel market due to increase in air transportation consumption of synthetic lubricants. The sustainable aviation fuel market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in EURO Million, Volumes in Units, Pricing in EURO |

|

Segments Covered |

연료 유형별(바이오 연료, 수소 연료 및 전력에서 액체 연료로), 제조 기술별(수소 처리된 지방산 에스테르 및 지방산 - 합성 파라핀 등유(Hefa-Spk), 피셔 트롭쉬 합성 파라핀 등유(FT-SPK), 발효 수소 처리된 당으로부터 합성 이소 파라핀(Hfs-Sip), 방향족이 포함된 피셔 트롭쉬(FT) 합성 파라핀 등유(FT-SPK/A), 알코올에서 제트 Spk(ATJ-SPK) 및 촉매적 가수열분해 제트(CHJ)), 혼합 용량별(30% 미만, 30%에서 50%, 50% 이상), 혼합 플랫폼별(상업용 항공, 군용 항공, 비즈니스 및 일반 항공, 무인 항공기) |

|

적용 국가 |

남아프리카, 사우디아라비아, UAE, 이스라엘, 이집트 및 중동 및 아프리카(MEA)의 나머지 지역, |

|

시장 참여자 포함 |

Neste, Gevo, VELOCYS, Fulcrum BioEnergy, SkyNRG, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Preem AB, Eni, Sasol Ltd, BP plc 등이 있습니다. |

시장 정의

지속 가능한 항공 연료는 항공기에서 사용하도록 설계된 독특한 형태의 연료이며 동시에 항공기의 성능을 향상시킵니다. 지속 가능한 항공 연료는 지속 가능한 원료에서 파생되며 화학적으로 표준 화석 제트 연료와 매우 유사할 수 있습니다. 지속 가능한 항공 연료의 유용성이 증가하면 연료의 수명 주기를 대체하기 때문에 기존 제트 연료에 비해 탄소 배출량이 감소합니다.

항공 기업은 지속 가능한 환경을 확보하고 배출에 대한 엄격한 규제 요건을 충족하기 위해 탄소 발자국을 줄이려는 의지가 있습니다. 또한 레이아웃 수정, 하이브리드 전기 및 전기 구동 항공기, 재생 가능한 제트 연료를 통한 항공 엔진 성능 향상은 항공 산업의 수많은 이해 관계자가 채택하고 있지만 지속 가능한 항공 연료의 채택은 다른 것과 비교할 때 사회적, 경제적 이점과 관련하여 가장 신뢰할 수 있고 실행 가능한 기회 솔루션으로 간주되며 항공의 현대적이고 예상되는 미래 환경 영향을 완화하는 데 광범위하게 기여합니다.

지속 가능한 항공 연료 시장 역학

이 섹션에서는 시장 동인, 이점, 기회, 제약 및 과제를 이해하는 것을 다룹니다. 이 모든 내용은 아래와 같이 자세히 논의됩니다.

- 항공 산업에서 GHG 배출 감소에 대한 필요성 증가

인간이 유발한 온실 가스(GHG) 배출은 온실 효과를 증폭시켜 기후 변화를 일으킵니다. 이산화탄소는 주로 석탄, 석유, 천연 가스와 같은 화석 연료의 연소를 통해 배출됩니다. 중동과 아프리카의 가장 큰 오염원 중 일부는 중국과 러시아입니다. 이러한 오염은 주로 OPEC(석유 수출국 기구)이 소유한 석탄, 석유 및 가스 기업으로 인해 발생합니다. 대기 중 이산화탄소 수치는 인간이 유발한 배출로 인해 산업화 이전 시대보다 약 50% 증가했습니다.

항공기 엔진에서 배출되는 오염 물질은 화석 연료 연소에서 배출되는 오염 물질과 동일합니다. 더 높은 고도에서 항공기 배출물은 오염 물질의 농도가 더 높습니다. 이러한 배출물은 중동 및 아프리카 효과와 지역 대기 질에 미치는 영향 측면에서 심각한 환경 문제를 일으킵니다.

- 항공 수송 증가, 합성 윤활유 소비 증가

항공 여행은 경제 성장과 개발을 달성하는 데 중요한 요소입니다. 국가적, 지역적, 전 세계적 규모에서 항공 여행은 중동 및 아프리카 경제로의 통합을 촉진하고 중요한 연계를 제공합니다. 무역, 관광 및 일자리 가능성의 성장에 기여합니다. 항공 시스템은 진화하고 있으며 계속 진화할 것입니다. 그러나 장기적으로 항공 운송 시스템이 용량, 환경 영향, 소비자 행복, 안전 및 보안 측면에서 변화하는 요구를 충족할 만큼 신속하게 적응하는 것은 어려울 것이며, 서비스 제공자의 경제적 실행 가능성을 유지하는 것도 어려울 것입니다.

코로나19 팬데믹과 정부 지원, 특히 연료 기술 분야의 기술적 발견은 항공 산업의 지속 가능한 항공 연료(SAF)로의 전환을 가속화했습니다. 지속 가능한 항공 연료(SAF)의 사용이 증가하는 반면, 비합성 윤활유는 감소하고 있습니다. 대부분의 항공기가 고급 윤활유를 사용하기 때문에 합성 및 반합성 윤활유가 전환의 혜택을 볼 것으로 예상됩니다. 전 세계 지속 가능한 항공 연료(SAF) 시장은 이 요인에 의해 주도될 것으로 예상됩니다.

- 항공사의 지속 가능한 항공 연료 수요 증가

항공 부문은 항공 여행 증가를 줄이고 지속 가능한 항공 연료(SAF) 사용을 빠르게 확대하는 것을 포함한 세계의 기후 목표를 충족하기 위해 "긴급 조치"를 채택하고 있습니다. SAF의 목적은 기존의 지속 가능한 바이오매스 또는 가스에서 탄소를 재활용하여 석유 원유에서 정제된 화석 제트 연료를 대체하는 제트 연료로 만드는 것입니다. SAF의 목적은 기존의 지속 가능한 바이오매스 또는 가스에서 탄소를 재활용하여 석유 원유에서 정제된 화석 제트 연료를 대체하는 제트 연료로 만드는 것입니다. 항공 부문 전체와 IATA 회원 항공사는 적극적인 배출 감소 목표를 달성하기 위해 노력하고 있습니다. SAF(지속 가능한 항공 연료)는 이러한 목표를 달성하는 데 있어 핵심 요소로 강조되었습니다. 산업의 기후 목표를 충족시키기 위해 지속 가능한 항공 연료를 사용하려면 정부의 지원이 필요합니다.

주요 업계 참여자들이 지속 가능한 항공 연료(SAF)의 필요성을 인식함에 따라, 서비스 제공업체들은 다양한 항공사에서 다양한 지속 가능한 항공 연료(SAF) 대안을 채택하기 시작했으며, 이는 지속 가능한 항공 연료(SAF)의 성장을 더욱 크게 촉진할 것으로 예상됩니다.

- 지속 가능한 항공 연료 생산 수요를 충족하기 위한 원료 및 정유소의 가용성 부족

생물 기반 원료로 만든 지속 가능한 항공 연료(SAF)는 항공의 탄소 발자국을 줄이기 위한 계획의 중요한 부분입니다. 기술적으로 SAF를 제트 연료로 대체하고 혼합하는 것은 가능합니다. 사실 항공 산업은 10년 이상 SAF를 사용해 왔습니다. 그러나 공급과 수요 제약으로 인해 소비 수준은 여전히 매우 낮습니다.

오일 작물, 설탕 작물, 조류, 폐유 및 기타 생물학적 및 비생물학적 자원은 합성 연료, e-연료 및 바이오 제트 연료와 같은 대체 항공 연료의 전체 생산 체인에서 필수적인 역할을 하는 원자재입니다. 제조에 필요한 원자재가 부족하여 지속 가능한 항공 연료에 대한 필요성이 중단될 수 있습니다. 제조에 필요한 원자재가 부족하여 지속 가능한 항공 연료에 대한 수요가 중단될 수 있습니다. 또한 이러한 원료의 최적 활용에 중요한 역할을 하는 정유소 제한은 SAF 제조의 전체 프로세스에 추가됩니다. 연료 공급이 부족하면 연료의 혼합 용량에 부담을 주어 효율성이 낮아집니다.

지속 가능성 기준을 충족하는 원료에 대한 도로 가솔린 부문의 경쟁이 심화되면 원료 가용성이 병목 현상이 됩니다. 원료 비용은 SAF 비용의 상당 부분을 차지하며, 가격 변동은 연료 생산자에게 공급 문제를 일으킬 수 있습니다. 따라서 운송업체의 높은 연료 추가 요금은 어느 정도 시장 성장을 더욱 방해하고 있습니다.

- 원유 가격 변동 및 윤활유 오염

중동과 아프리카의 경쟁과 비용 압박이 심화되면서 기업과 공급망은 감지되지 않은 비용 절감 잠재력을 발견해야 합니다. 특히 원유 시장과의 인터페이스는 개선이 유망한 분야입니다. 오늘날의 비즈니스 환경에서 모든 조직은 원유와 윤활유 상품의 가격 변동 위험에 직면해 있습니다. 생산에서 제조업체는 상당한 양의 석유 상품에 의존할 수 있으며, 결과적으로 구성 요소와 하위 조립품을 통해 직간접적으로 조달하는 석유 제품의 가격 변동성에 특히 영향을 받을 수 있습니다. 변동성이 크고 불안정한 중동과 아프리카 시장은 제조 조직에 광범위한 영향을 미칩니다. 에너지 비용 상승에서 원유 제조 비용의 예상치 못한 변동에 이르기까지 예상치 못한 장애물이 공급망을 불안정하게 만들고 제조업체가 흑자를 유지하기 어렵게 만들고 있습니다. 많은 원자재의 공급을 확보하기 어려워짐에 따라 상품 가격 변동성은 일시적인 현상이 아닐 수 있으며, 제조업체는 추가 비용을 흡수하거나 비용을 완화할 새로운 방법을 찾거나 이미 지출을 꺼리는 고객에게 가격 인상을 전가해야 합니다. 가격은 공급 시장의 긴축에 영향을 받기 때문에 이러한 추세는 조만간 바뀔 조짐이 보이지 않습니다. 따라서 원유 및 기타 윤활유의 변동 비용은 중동 및 아프리카 지속 가능한 항공 연료(SAF) 시장에 큰 제약으로 작용합니다.

탄소 조각은 일반적으로 펌프 고장을 일으킬 만큼 충분히 단단하거나 크지 않습니다. 그러나 작은 필터나 노즐을 막을 만큼 충분히 클 수 있습니다. 작동 오염의 또 다른 원인은 윤활 시스템에 모래, 자갈, 금속 입자가 있는 것입니다. 이는 중동 및 아프리카 지속 가능한 항공 연료(SAF) 시장에 제약 요인으로 작용합니다.

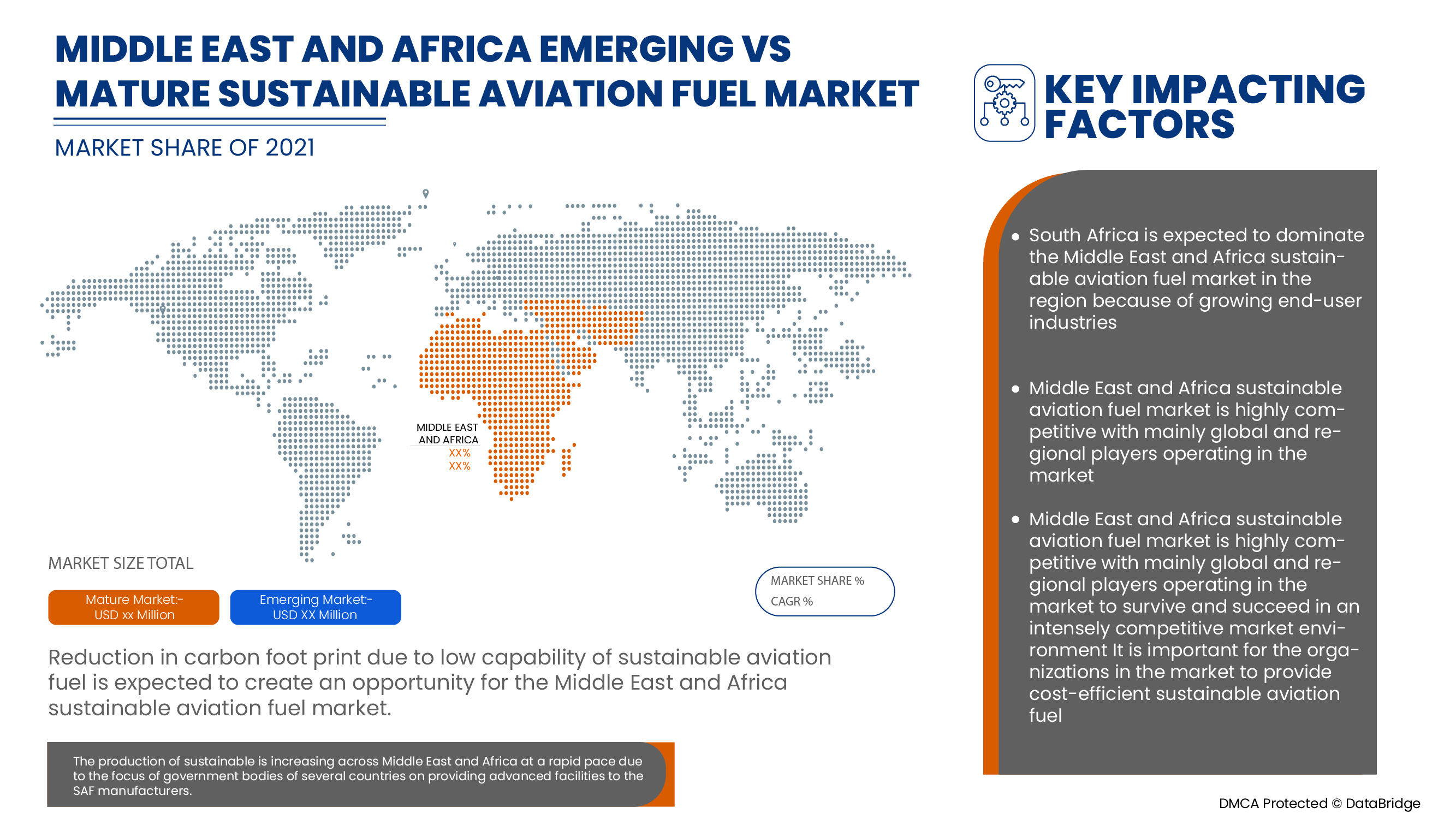

- 지속 가능한 항공 연료의 낮은 능력으로 인한 탄소 발자국 감소

지속 가능한 항공 연료(SAF)는 대체하는 전통적인 제트 연료에 비해 연료 수명 동안 탄소 배출을 줄입니다. 동물이나 식물에서 나오는 식용유와 기타 비야자 폐유는 일반적인 원료이며, 가정과 회사에서 나오는 포장재, 종이, 직물, 음식 쓰레기와 같은 고형 폐기물은 그렇지 않으면 매립지에 버려지거나 소각됩니다. 폐목재와 같은 산림 잔해물과 빠르게 자라는 식물과 조류와 같은 에너지 작물도 가능한 공급원입니다.

지속 가능한 원료 사용, 생산 공정 및 공항 공급망에 따라 SAF는 기존 제트 연료를 대체하는 것과 비교해 연료 수명 동안 탄소 배출량을 최대 80%까지 줄일 수 있습니다.

SAF는 표준 제트 연료와 최대 50%까지 혼합할 수 있으며 기존 제트 연료와 동일한 품질 테스트를 거칩니다. 그런 다음 혼합물은 Jet A 또는 Jet A-1로 재인증됩니다. 표준 제트 연료와 동일한 방식으로 처리할 수 있으므로 SAF를 활용하려는 연료 공급 인프라나 항공기에 대한 변경이 필요하지 않아 중동 및 아프리카 지속 가능한 항공 연료 시장이 성장할 수 있는 기회가 생깁니다.

- 친환경적이고 안전한 항공 윤활유 개발

오늘날의 세계에서 항공 산업은 붐을 일으키고 있으며, 이로 인해 모든 분야의 항공기 항공 연료 생산자 간의 경쟁이 심화되고 있습니다. 장기 항공 연료 생산을 위한 대체 환경 친화적인 공급원은 항공 연료 부문에 미래에 영향을 미칠 것으로 예상됩니다. 지속 가능한 항공 연료 시장은 전 세계 항공기에서 고급 연료가 사용되는 추세가 증가함에 따라 수년에 걸쳐 상당히 성장했습니다.

지속 가능한 항공 연료 생산을 위한 바이오매스 작물 재배는 또한 농부들이 이 새로운 산업에 원료를 공급하여 비수기에 더 많은 돈을 벌 수 있게 하며, 동시에 영양소 손실 감소 및 토양 품질 개선과 같은 농업적 이점을 확보할 수 있게 합니다. 이를 통해 중동 및 아프리카 지속 가능한 항공 연료(SAF) 시장이 성장할 수 있는 기회가 생깁니다.

- 지속 가능한 항공 연료의 높은 비용으로 인해 항공사 운영 비용이 증가합니다.

노동비와 연료비는 항공사가 직면한 가장 중요한 두 가지 비용입니다. 단기적으로 노동비는 일반적으로 안정적이지만 연료 가격은 석유 가격에 따라 크게 변동합니다. 연료는 항공사 운영 비용의 상당 부분을 차지하며 총 지출의 20-30%를 차지합니다. 석유 가격 급등은 항공사에 가장 힘든 순간 중 하나였습니다. 항공사는 티켓 가격을 인상하거나 항공편 수를 줄임으로써 점진적으로 상승하는 가격에 대비할 수 있지만, 예상치 못한 가격 인상으로 인해 많은 항공사가 손실을 입습니다.

지속 가능한 항공 연료(SAF) 사용 목표가 올해부터 연료 비용을 증가시켜 항공사의 상황을 더욱 어렵게 만들 것입니다. 국제 항공 운송 협회(IATA)에 따르면 중동 및 아프리카 SAF 생산량은 연간 약 1억 리터에 불과하며, 전체 항공 연료 사용량의 0.1%에 불과합니다. 반면 다양한 항공사는 2030년까지 이 비율을 10%로 늘리겠다고 약속했는데, 이는 진정으로 높은 목표입니다.

불행히도, 제조량이 제한적이기 때문에 비용도 마찬가지로 비쌉니다. IATA에 따르면 SAF 비용은 화석 연료의 2~4배로 추산되고, Air France-KLM의 최근 공개에 따르면 비용 차이가 등유의 4~8배에 가까울 수 있다고 합니다.

정부는 국제항공운송협회(IATA) 및 기타 단체로부터 경제적 자극의 형태로 SAF 개발을 장려할 것을 촉구받았습니다. 이는 지속 가능한 항공 연료(SAF) 가격 상승의 길을 열어 중동 및 아프리카 지속 가능한 항공 연료 시장에 도전이 됩니다.

COVID-19 이후 지속 가능한 항공 연료 시장에 미치는 영향

COVID-19는 지속 가능한 항공 연료 시장에 큰 영향을 미쳤습니다. 거의 모든 국가가 필수 상품을 생산하는 곳을 제외한 모든 생산 시설을 폐쇄하기로 했습니다. 정부는 COVID-19의 확산을 막기 위해 비필수 상품의 생산 및 판매 중단, 국제 무역 차단 등 몇 가지 엄격한 조치를 취했습니다. 이 팬데믹 상황에서 거래하는 유일한 사업은 프로세스를 열고 실행할 수 있는 필수 서비스입니다.

지속 가능한 항공 연료 시장의 성장은 항공 산업에서 GHG 배출을 줄여야 할 필요성으로 인해 증가하고 있습니다. 그러나 지속 가능한 항공 연료 생산 수요를 충족시킬 수 있는 원료 및 정유소의 부족과 같은 요인이 지속 가능한 항공 연료 시장 성장을 제한하고 있습니다. 팬데믹 상황에서 생산 시설이 폐쇄되면서 시장에 상당한 영향을 미쳤습니다.

제조업체는 COVID-19 이후 회복하기 위해 다양한 전략적 결정을 내리고 있습니다. 업체들은 지속 가능한 항공 연료에 관련된 기술을 개선하기 위해 여러 연구 개발 활동을 수행하고 있습니다. 이를 통해 회사는 시장에 고급의 정확한 컨트롤러를 제공할 것입니다. 또한 정부 당국이 항공화물에 지속 가능한 항공 연료를 사용하면서 시장이 성장했습니다.

최근 개발

- 2022년 3월, Neste는 DHL Express와 협력하여 역대 최대 규모의 지속 가능한 항공 연료 거래 중 하나를 발표했습니다. 이 계약은 Neste가 지금까지 체결한 지속 가능한 항공 연료(SAF)에 대한 가장 큰 계약이며 항공 산업에서 가장 큰 SAF 계약 중 하나입니다. 이 협력은 전 세계적으로 원활한 연결을 제공하여 Neste의 현재 네트워크를 강화할 것입니다.

- 2022년 3월, BP 벤처스는 드론을 사용하여 메탄 탐지를 지원하는 선구적인 무인 항공기(UAV) 사업인 Flylogix에 300만 파운드의 자본 투자를 했습니다. 이 BP 벤처스는 전 세계적으로 원활한 연결을 제공하여 새로운 에너지 사업과 현재 네트워크를 연결하고 성장시키는 데 중점을 둡니다.

중동 및 아프리카 지속 가능한 항공 연료 시장 범위

지속 가능한 항공 연료 시장은 연료 유형, 제조 기술, 혼합 용량 및 혼합 플랫폼을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

연료 유형

- 바이오연료

- 수소연료

- 전력을 액체 연료로 변환

연료 유형을 기준으로 중동 및 아프리카 지속 가능한 항공 연료 시장은 바이오 연료, 수소 연료 및 액체 연료로 세분화됩니다.

제조 기술

- 수소화 지방산 에스테르 및 지방산 - 합성 파라핀 등유(HEFA-SPK)

- 피셔 트롭쉬 합성 파라핀 등유(FT-SPK)

- 발효 수소화 당으로부터 합성 이소파라핀(HFS-SIP)

- 방향족 화합물이 포함된 피셔 트롭쉬(FT) 합성 파라핀 등유(FT-SPK/A)

- 알코올 투 제트 스팩(ATJ-SPK)

- 촉매 수소열분해 제트(CHJ)

제조 기술을 기준으로, 중동 및 아프리카의 지속 가능한 항공 연료 시장은 수소화 처리된 지방산 에스테르와 지방산, 합성 파라핀 등유(HEFA-SPK), 피셔-트로프슈 합성 파라핀 등유(FT-SPK), 발효 수소화 처리된 당에서 얻은 합성 이소파라핀(HFS-SIP), 방향족 화합물이 포함된 피셔-트로프슈(FT) 합성 파라핀 등유(FT-SPK/A), 알코올 제트 SPK(ATJ-SPK) 및 촉매 수소 열분해 제트(CHJ)로 구분됩니다.

블렌딩 용량

- 30% 이하

- 30% ~ 50%

- 50% 이상

혼합 용량을 기준으로 중동 및 아프리카의 지속 가능한 항공 연료 시장은 30% 미만, 30%~50%, 50% 이상으로 구분되었습니다.

블렌딩 플랫폼

- 상업 항공

- 군 항공

- 비즈니스 및 일반 항공

- 무인 항공기

혼합 플랫폼을 기반으로 중동 및 아프리카 지속 가능한 항공 연료 시장은 상업 항공, 군용 항공, 비즈니스 및 일반 항공, 무인 항공기로 세분화되었습니다.

지속 가능한 항공 연료 시장 지역 분석/통찰력

지속 가능한 항공 연료 시장을 분석하고, 위에 언급된 대로 국가, 연료 유형, 제조 기술, 혼합 용량 및 혼합 플랫폼 산업별로 시장 규모에 대한 통찰력과 추세를 제공합니다.

지속 가능한 항공 연료 시장 보고서에서 다루는 국가는 남아프리카, 사우디 아라비아, UAE, 이스라엘, 이집트 및 중동 및 아프리카의 나머지 지역입니다.

남아프리카 공화국은 중동 및 아프리카의 지속 가능한 항공 연료 시장을 장악하고 있으며, 이는 효율적인 지속 가능한 항공 연료 시장에 대한 수요와 규제가 증가하고 있기 때문입니다. 또한 이 지역에서 지속 가능한 항공 연료를 개발하기 위한 R&D 투자가 증가했습니다. 이 지역의 수요는 정부가 새로운 프로젝트에 점점 더 많이 투자하고 항공 배출을 탈탄소화하기 위한 이니셔티브를 취함에 따라 주도될 것으로 예상됩니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 추세 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 중동 및 아프리카 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 지속 가능한 항공 연료 시장 점유율 분석

지속 가능한 항공 연료 시장 경쟁 구도는 경쟁자별 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 중동 및 아프리카 지역, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 응용 분야 우위가 있습니다. 위에 제공된 데이터 포인트는 지속 가능한 항공 연료 시장과 관련된 회사의 초점에만 관련이 있습니다.

지속 가능한 항공 연료 시장의 주요 기업으로는 Neste, Gevo, VELOCYS, Fulcrum BioEnergy, SkyNRG, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Preem AB, Eni, Sasol Ltd, BP plc 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 ISRAEL

10.1.4 EGYPT

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 MIDDLE EAST & AFRICA BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 MIDDLE EAST & AFRICA HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 MIDDLE EAST & AFRICA POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 MIDDLE EAST & AFRICA HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 MIDDLE EAST & AFRICA FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 MIDDLE EAST & AFRICA SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 MIDDLE EAST & AFRICA FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 MIDDLE EAST & AFRICA ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 MIDDLE EAST & AFRICA CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 MIDDLE EAST & AFRICA BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 MIDDLE EAST & AFRICA 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 MIDDLE EAST & AFRICA ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 MIDDLE EAST & AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 MIDDLE EAST & AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 MIDDLE EAST & AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 MIDDLE EAST & AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 MIDDLE EAST & AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 MIDDLE EAST & AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 27 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 28 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 30 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 33 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 34 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 35 MIDDLE EAST AND AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 40 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 41 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 42 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 43 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 44 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 45 SOUTH AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 46 SOUTH AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 SOUTH AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 50 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 51 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 52 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 53 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 55 SAUDI ARABIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 56 SAUDI ARABIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 SAUDI ARABIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 60 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 61 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 62 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 63 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 64 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 65 ISRAEL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 66 ISRAEL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 ISRAEL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 68 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 69 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 70 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 71 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 72 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 73 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 74 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 75 EGYPT BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 76 EGYPT MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 77 EGYPT UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 78 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 79 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 10 THE INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 11 BIO FUEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 13 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET

FIGURE 15 MIDDLE EAST & AFRICA AIR TRANSPORT PASSENGER DEMAND

FIGURE 16 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY TECHNOLOGY, 2021

FIGURE 17 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY MANUFACTURING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING CAPACITY, 2021

FIGURE 19 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING PLATFORM, 2021

FIGURE 20 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY FUEL TYPE (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.