Middle East and Africa Submarine Cable System Market, By Product (Wet Plant Products and Dry Plant Products), Voltage (Medium Voltage and High Voltage, Extra High Voltage), Offering (Installation And Commissioning, Repair And Maintenance And Upgrades), Fiber Class (Unrepeatered and Repeatered), Cables Type (Loose Tube Cables, Ribbon Cables and Others), Armor Type (Light Weight Armor, Single Armor, Double Armor and Rock Armor), Depth (0 to 500M, 500M to 1000M, 1000M to 5000M and Others), Application (Power Cables and Communication Cables) - Industry Trends and Forecast to 2029.

Middle East and Africa Submarine Cable System Market Analysis and Size

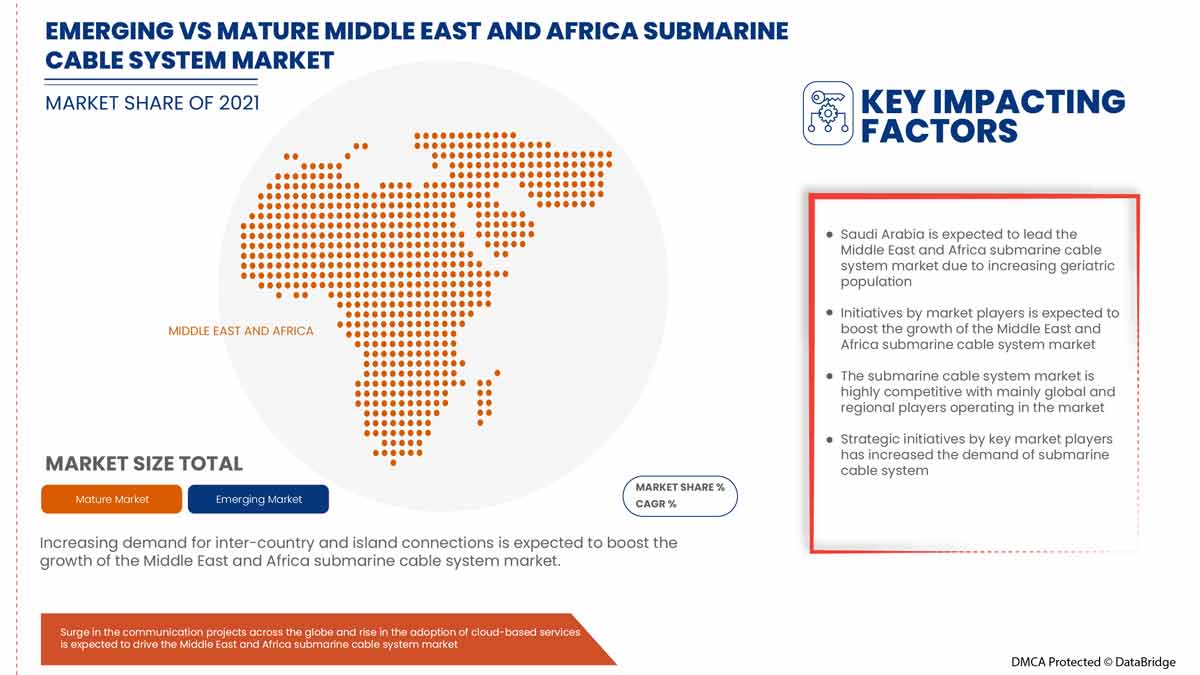

A submarine cable is laid on the sea bed between land-based stations to carry telecommunication signals across stretches of sea and ocean. The rising telecom subscriptions and high investments in offshore wind farms have directly influenced the submarine cable market growth. Also, the growing investments of content and cloud service providers are flourishing the growth of the submarine cable market. Also, the increasing internet traffic in emerging regions positively impacts the market's growth. Furthermore, the growing demand for bandwidth is also acting as an active growth driver for the growth of the submarine cable market. Moreover, the increasing number of offshore wind farms and rising demand for inter-country and island power connections are creating a huge demand for submarine cable and lifting the growth of the submarine cable market.

However, regulatory, environmental, and intricate authorization procedures leading to delays as well as the complex repairing procedure for deep water power cable links are acting as the major restrictions for the growth of submarine cable in the above-mentioned forecasted period, whereas the growing buzz around space-based internet communications constellations can challenge the submarine cable market growth.

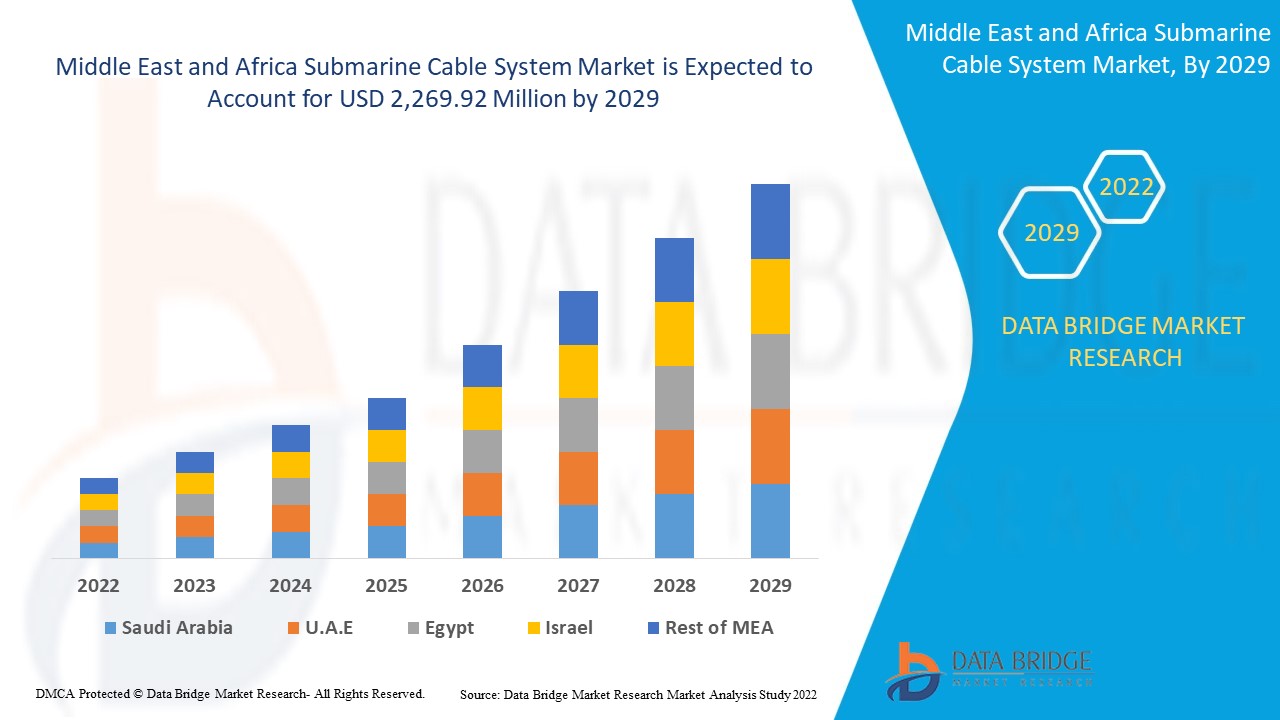

Data Bridge Market Research analyses that the Middle East and Africa submarine cable system market is expected to reach USD 2,269.92 million by 2029, at a CAGR of 6.1% during the forecast period. "Dry Plants products" accounts for the most prominent technology segment. This type of technology is in demand as it offers maximum work efficiency by avoiding the installation of cables in critical areas. The submarine cable system market report also comprehensively covers pricing, patent, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Segments Covered |

By Product (Wet Plant Products and Dry Plant Products), Voltage (Medium Voltage and High Voltage, Extra High Voltage), Offering (Installation And Commissioning, Repair And Maintenance And Upgrades), Fiber Class (Unrepeatered and Repeatered), Cables Type (Loose Tube Cables, Ribbon Cables and Others), Armor Type (Light Weight Armor, Single Armor, Double Armor and Rock Armor), Depth (0 to 500M, 500M to 1000M, 1000M to 5000M and Others), Application (Power Cables and Communication Cables) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel & Rest of Middle East and Africa |

|

Market Players Covered |

HENGTONG GROUP CO., LTD, TE Connectivity, Saudi Ericsson, APAR, NEC Corporation, NXT A/S, Norddeutsche Seekabelwerke GmbH (A Subsidiary of Prysmian Group), JDR Cable Systems Ltd, ZTT, Hexatronic Group, Alcatel Submarine Networks, Corning Incorporated, The Okonite Company, AFL (a subsidiary of Fujikura Ltd.), LEONI, NEXANS, Ocean Specialists, Inc. (a subsidiary of Continental Shelf Associates, Inc.), TFKable, Sumitomo Electric Industries, Ltd., Tratos, Hellenic Cables S.A. and HESFIBEL SUBSEA CABLES among others. |

Market Definition

A submarine cable system refers to the cable frameworks connected to a land-based station that helps to transmit the signals over the ocean and marine water bodies. The connectivity combination over long distances combines communication and electricity transmission through the cable systems laid under water.

The demand and the deployment of the submarine cable system are completely dependent on the Middle East and Africa increase in telecom and internet subscriptions. They are expected to expand the submarine systems in unexplored areas. Moreover, sea freight and GPS play a major role in developing submarine cables across all countries and regions in the modern world. This needs the application of proper and unique government regulations to develop a standard procedure and connectivity. Hence it includes several set of rules and regulations which helps to boost the market.

Submarine Cable System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers/Opportunities

- Rise in the trend of offshore wind power generation

Submarine cables have been around since the mid-1800s. But, for a large portion of their set of experiences, such cables were utilized fundamentally to send power from conventional sources, for example, coal plants, either between nations or out to islands or oil stages. The submarine cable industry faced a decline during the 19th century. That changed during the 2000s, as rising energy costs and worries about environmental change animated interest in growing offshore wind and more effective transnational power grids.

Wind power generation is a clean energy source that does not require fuel and power generation offshore has strong winds, attracting offshore wind power generation development projects across the globe.

- Rise in the adoption of cloud-based services

The development over the air using various new satellite groups of stars being sent off and the rising fondness for getting to content through portable organizations over remote wireless transmissions. These remote transmissions are connected through data center infrastructures. They are interconnected through cables laid in a submarine to develop connections among different data centers in different countries and regions. This implies a need for submarine cables that helps to connect data centers and directly improve cloud-based connectivity for all types of organizations. Thus, the adoption of cloud-based services and solutions is expected to be a major driver of the growth of the submarine cable system market.

- Deployment of various technologies in submarine cable systems

Power feeding to submarine cable systems is a long-established practice, from coaxial submarine systems to present-day optical amplifier systems. The main principles of electrical powering to the submarine cable systems, as discussed in this chapter, are power feeding equipment (PFE) installed in the terminal stations, return path through earth and sea, and the PFE feeding a constant current to stabilize the repeater characteristics and transmission performance.

Restraint/Challenges

- High initial investments act as an entry barrier for SMEs

The connection through subsea cable is lengthy and thus the cost is directly dependent on the length of the cable systems used which directly Thus, it has been observed that usually, the major players in the market involves in the submarine cable service business as it involves huge investments which the SMEs cannot offer. This will restrict more players from entering the market and promote dominance, which is expected to restrict market growth.

- Complex repairing procedures

Cable ships are loaded with enough cable for repairs, maybe 5-10 km, which can be loaded in a few hours. Cable has to be added to make the repair, since there is not enough slack to bring the cable up and cut a piece out. After the cable is retrieved and on board, in a repair room that looks like a laboratory, engineers repair the cable.

Post COVID-19 Impact on Submarine Cable System Market

COVID-19 significantly impacted the submarine cable system market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology in the submarine cable system market. The companies will bring advanced and accurate solutions to the market.

Recent Development

- In November 2021, LEONI announced the partnership in the ADOPD project developing ultrafast fiber-optical computational units based on Adaptive Optical Dendrites. This project will help the company to understand the various processes and interactions and result in the development of better product technologies in various segments, especially in cable systems

- In July 2022, NEXANS announced winning a new project by EuroAsia interconnector Limited to develop European electricity interconnection linking the national grids of Israel, Cyprus, and Greece (Crete). This project will help the company provide technology for deep water subsea power cables utilizing NEXANS long term developments for 3,000m ultradeep waters and the installation capabilities that will be recognized in the market.

Middle East and Africa Submarine Cable System Market Scope

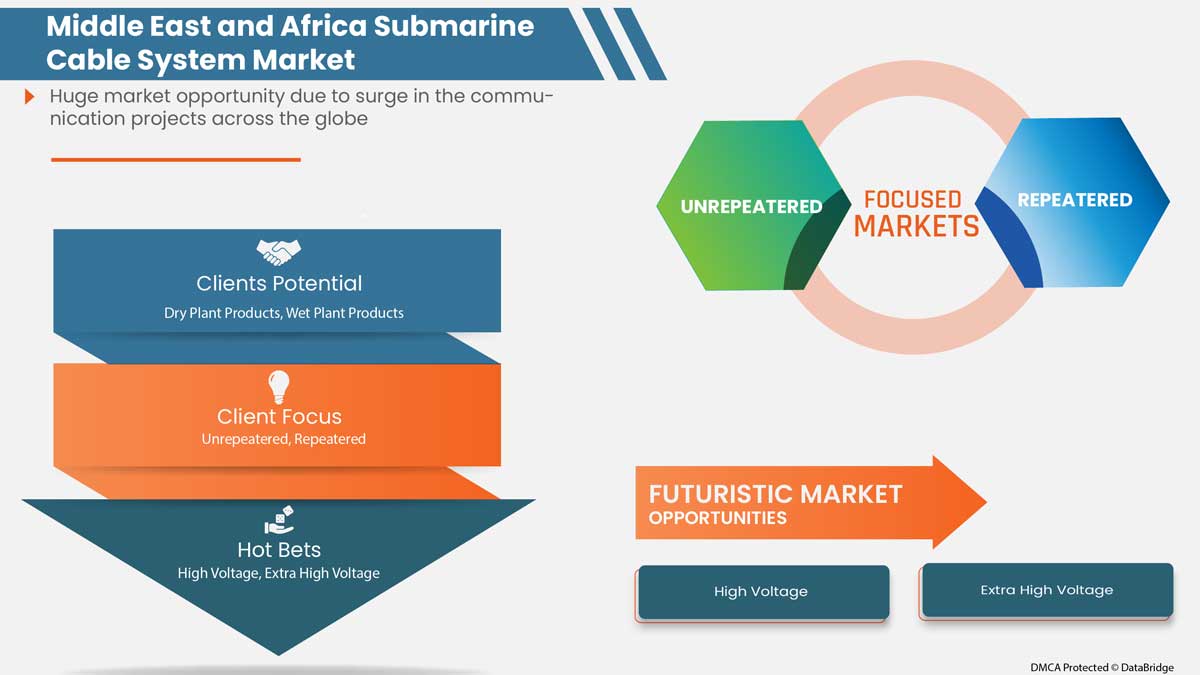

The submarine cable system market is segmented based on product, voltage, offering, fiberglass, cable type, armor type, depth, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product

- Wet plant Products

- Dry Plant Products

On the basis of product, the Middle East and Africa submarine cable system market is segmented into wet plant products and dry plant products.

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

On the basis of voltage, the Middle East and Africa submarine cable system market is segmented into medium voltage, high voltage, and extra high voltage.

By Offering

- Maintenance

- Upgrades

- Installation and Commissioning

On the basis of offering, the Middle East and Africa submarine cable system market is segmented into maintenance, upgrades, and installation and commissioning.

By Fiber Glass

- Unrepeatered

- Repeatered

On the basis of fiber glass, the Middle East and Africa submarine cable system market is segmented into unrepeatered and repeatered.

By Cables Type

- Loose Tube Cables

- Ribbon Cables

- Others

On the basis of cables type, the Middle East and Africa submarine cable system market is segmented into loose tube cables, ribbon cables, and others.

By Armor Type

- Light Weight Armor

- Single Armor

- Double Armor

- Rock Armor

On the basis of armor type, the Middle East and Africa submarine cable system market is segmented into light weight armor, single armor, double armor, and rock armor.

By Depth

- 0 To 500 M

- 500 M-1000 M

- 1000 M-5000 M

- Others

On the basis of depth, the Middle East and Africa submarine cable system market is segmented into 0 to 500m, 500m to 1000m, 1000m to 5000m, and others.

By Application

- Power Cables

- Communication cables

On the basis of application, the Middle East and Africa submarine cable system market is segmented into power cables and communication cables.

Submarine Cable System Market Regional Analysis/Insights

The submarine cable system market is analyzed, and market size insights and trends are provided by product, voltage, offering, fiber glass, cables type, armor type, depth, and application, as referenced above.

The countries covered in the submarine cable system market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel and Rest of Middle East and Africa.

Saudi Arabia dominates the Middle East and Africa submarine cable system market. Saudi Arabia develops cloud-based solutions and services designed to improve security and contribute new levels of operational intelligence for governments, enterprises, transport, and communities. This will boost the demand for submarine cable system products in the Middle East and Africa.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Submarine Cable System Market Share Analysis

The submarine cable system market competitive landscape provides details about a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies focusing on the submarine cable system market.

Some of the major players operating in the submarine cable system market are HENGTONG GROUP CO., LTD, TE Connectivity, Saudi Ericsson, APAR, NEC Corporation, NXT A/S, Norddeutsche Seekabelwerke GmbH (A Subsidiary of Prysmian Group), JDR Cable Systems Ltd, ZTT, Hexatronic Group, Alcatel Submarine Networks, Corning Incorporated, The Okonite Company, AFL (a subsidiary of Fujikura Ltd.), LEONI, NEXANS, Ocean Specialists, Inc. (a subsidiary of Continental Shelf Associates, Inc.), TFKable, Sumitomo Electric Industries, Ltd., Tratos, Hellenic Cables S.A. and HESFIBEL SUBSEA CABLES among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN THE COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE

5.1.2 RISE IN THE TREND OF OFFSHORE WIND POWER GENERATION

5.1.3 GROWING DEMAND FOR HIGH BANDWIDTH, LOW-LATENCY, AND HIGH REDUNDANCY OWING TO THE EMERGENCE OF 5G

5.1.4 RISE IN THE ADOPTION OF CLOUD-BASED SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS ACT AS ENTRY BARRIER FOR SMES

5.2.2 HIGH PROBABILITY OF DAMAGE DUE TO VULNERABLE CONDITIONS

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF SUBMARINE CABLE OWING TO THE INCREASING INTERNET TRAFFIC ACROSS THE REGION

5.3.2 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS FOR CABLE SYSTEMS

5.3.3 RISING INVESTMENTS BY OTT PROVIDERS TO CREATE ABUNDANT OPPORTUNITIES FOR SALES OF SUBMARINE CABLES

5.3.4 DEPLOYMENT OF VARIED TECHNOLOGIES IN SUBMARINE CABLE SYSTEMS

5.4 CHALLENGES

5.4.1 ALTERNATIVE MODES OF INTERNET SERVICE PROVISIONING

5.4.2 COMPLEX REPAIRING PROCEDURES

6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.2.1 POWER FEEDING EQUIPMENT (PFE)

6.2.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

6.2.3 SUBMARINE LINE MONITOR (SLM)

6.2.4 OTHERS

6.3 WET PLANT PRODUCTS

6.3.1 CABLES

6.3.2 REPEATER

6.3.3 BRANCHING UNIT (BU)

6.3.4 OTHERS

7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATERED

9.3 REPEATERED

10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHT WEIGHT ARMOR

11.5 ROCK ARMOR

12 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 5000M-1000M

12.4 0M-500M

12.5 0THERS

13 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 COMMUNICATION CABLES

13.2.1 DRY PLANT PRODUCTS

13.2.1.1 POWER FEEDING EQUIPMENT (PFE)

13.2.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.2.1.3 SUBMARINE LINE MONITOR (SLM)

13.2.1.4 OTHERS

13.2.2 WET PLANT PRODUCTS

13.2.2.1 CABLES

13.2.2.2 REPEATER

13.2.2.3 BRANCHING UNIT (BU)

13.2.2.4 OTHERS

13.3 POWER CABLES

13.3.1 DRY PLANT PRODUCTS

13.3.1.1 POWER FEEDING EQUIPMENT (PFE)

13.3.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.3.1.3 SUBMARINE LINE MONITOR (SLM)

13.3.1.4 OTHERS

13.3.2 WET PLANT PRODUCTS

13.3.2.1 CABLES

13.3.2.2 REPEATER

13.3.2.3 BRANCHING UNIT (BU)

13.3.2.4 OTHERS

14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 U.A.E.

14.1.3 EGYPT

14.1.4 SOUTH AFRICA

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ZTT

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HENGTONG GROUP CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT CATEGORIES

17.2.4 RECENT DEVELOPMENT

17.3 NKT A/S

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 CORNING INCORPORATED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NEXANS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 HELLENIC CABLES S.A.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALCATEL SUBMARINE NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AFL (A SUBSIDIAIRY OF FUJIKURA LTD.)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APAR

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HESFIBEL SUBSEA CABLES

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HEXATRONIC GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 JDR CABLE SYSTEMS LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 LEONI

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NEC CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NORDDEUTSCHE SEEKABELWERKE GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 OCEAN SPECIALISTS, INC. (A SUBSIDIARY OF CONTINENTAL SHELF ASSOCIATES, INC.)

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SAUDI ERICSSON

17.17.1 COMPANY SNAPSHOT

17.17.2 SOLUTION PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SUMITOMO ELECTRIC INDUSTRIES, LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 TE CONNECTIVITY

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 SOLUTION PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TFKABLE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 THE OKONITE COMPANY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 TRATOS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA EXTRA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEDIUM VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA INSTALLATION AND COMMISSIONING IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REPAIR AND MAINTENANCE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA UPGRADES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA UNREPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LOOSE TUBE CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA RIBBON CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA SINGLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DOUBLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LIGHT WEIGHT ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ROCK ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA 1000M-5000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA 500M-1000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA 0M-500M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA COMMUNICATION CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA POWER CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E. WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 EGYPT DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 95 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 98 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 EGYPT COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 EGYPT DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SOUTH AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 ISRAEL WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ISRAEL POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 ISRAEL DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 ISRAEL WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 SURGE IN COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 DRY PLANT PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

FIGURE 14 FDI PROJECTS FOR COMMUNICATIONS AND MEDIA (2019-2020)

FIGURE 15 OFFSHORE WIND ELECTRICITY GENERATION

FIGURE 16 NET ANNUAL WIND CAPACITY EXPANSIONS, 2018-2020

FIGURE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2021

FIGURE 18 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2021

FIGURE 19 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2021

FIGURE 20 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2021

FIGURE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2021

FIGURE 24 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 25 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.