Middle East And Africa Refractive Surgery Devices Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

38.44 Million

USD

60.59 Million

2021

2029

USD

38.44 Million

USD

60.59 Million

2021

2029

| 2022 –2029 | |

| USD 38.44 Million | |

| USD 60.59 Million | |

|

|

|

중동 및 아프리카 굴절 수술 장비 시장 , 제품 유형별(레이저, 파킥 안구 내 렌즈(IOL), 수차계/파면 수차 측정기, 수술 도구 및 액세서리, 굴절 수술 키트, 동공 직경 측정기, 에피케라톰, 마이크로케라톰, 열각막형성술, 변연 이완 절개 키트 및 기타), 수술 유형(LASIK(레이저 원위 각막 절삭술, 굴절 각막 절제술(PRK), 파킥 안구 내 렌즈(IOL), 난시 각막 절개술(AK), 자동 층상 각막 이식술(ALK), 각막 내 링(INTACS), 레이저 열 각막 이식술(LTK), 전도성 각막 이식술(CK), 방사형 각막 절개술(RK) 및 기타), 응용 분야(근시(근시), 원시(원시), 난시 노안 및 최종 사용자(병원, 전문 클리닉, 외래 수술 센터 및 기타), 유통 채널(직접 입찰, 제3자 유통업체 및 기타) 산업 동향 및 2029년까지의 예측.

시장 정의 및 통찰력

굴절 수술 장치는 근시( myopia ), 원시(hyperopia), 노안 또는 난시와 같은 굴절 이상을 개선하거나 교정하는 데 사용됩니다 . 이러한 장치에는 엑시머 레이저, YAG 레이저 , 마이크로케라톰 및 펨토초 레이저가 포함됩니다. 굴절 수술은 안경이나 콘택트 렌즈에 대한 의존도를 크게 줄입니다. 다양한 굴절 장치가 시중에 시력 결함을 치료하는 데 사용됩니다.

굴절 이상은 각막 이나 안구 의 부적절한 모양으로 인해 발생합니다 . 굴절 수술 절차에는 고급 레이저, LASIK 치료, 광굴절 각막 절제술 및 파킥 인공 수정체 및 토릭 인공 수정체와 같은 다양한 렌즈와 같은 다양한 굴절 수술 장치를 사용하여 안구나 각막을 재형성하는 것이 포함됩니다.

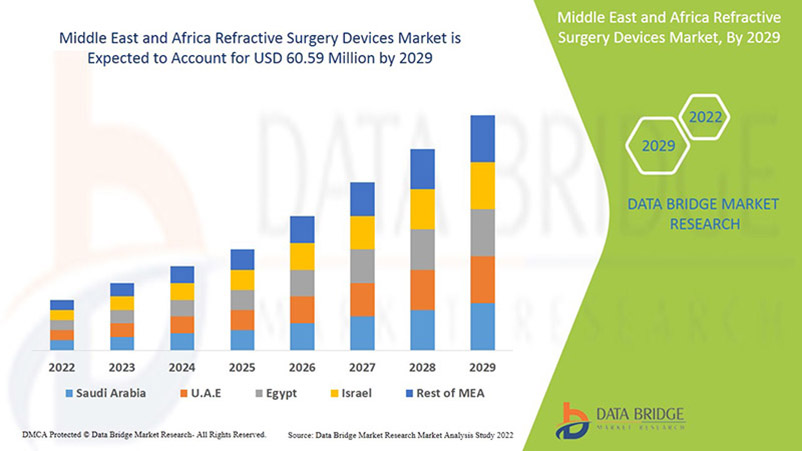

굴절 수술 기기 시장은 2022년부터 2029년까지의 예측 기간 동안 시장 성장을 이룰 것으로 예상됩니다. Data Bridge Market Research는 시장이 2022년부터 2029년까지의 예측 기간 동안 6.1%의 CAGR로 성장하고 있으며 2021년 3,844만 달러에서 2029년까지 6,059만 달러에 도달할 것으로 예상된다고 분석했습니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2022년부터 2029년까지 |

|

기준 연도 |

2021 |

|

역사적 연도 |

2020 (2019-2014까지 사용자 정의 가능) |

|

양적 단위 |

수익 (단위: USD 백만) |

|

다루는 세그먼트 |

제품 유형별(레이저, 파킥 인공 수정체(IOL), 수차계/파면 수차계, 수술 도구 및 액세서리, 굴절 수술 키트, 동공 직경 측정기, 상피각막절제술, 미세각막절제술, 열각막형성술, 변연 이완 절개 키트 및 기타), 수술 유형별(LASIK(레이저 원위각막절제술, 굴절각막절제술(PRK), 파킥 인공 수정체(IOL), 난시각막절제술(AK), 자동 층상각막형성술(ALK), 각막내 링(INTACS), 레이저 열각막형성술(LTK), 전도성 각막형성술(CK), 방사형 각막절제술(RK) 및 기타), 적용 분야별(근시, 원시, 난시 및 노안), 최종 사용자별(병원, 전문 병원, 외래 수술 센터 및 기타), 유통 채널(직접 입찰, 제3자 유통업체 및 기타) |

|

적용 국가 |

남아프리카, 사우디아라비아, UAE, 이집트, 이스라엘, 쿠웨이트, 중동 및 아프리카의 나머지 지역 |

|

시장 참여자 포함 |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc.(Topcon Corporation의 자회사), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon 등 |

굴절 수술 장치 시장의 시장 역학은 다음과 같습니다.

운전자

- 기술의 발전 증가

최근 몇 년 동안 의료 분야의 기술 개발이 엄청나게 증가했습니다. 굴절 수술 기기 기술의 발전은 질병 관리 중에 고통스럽지 않고 복잡하지 않은 치료를 지원합니다. 게다가 다양한 굴절 수술 기기의 혁신과 업그레이드는 질병 진단의 정확하고 빠른 결과를 돕습니다. 굴절 수술 기기의 혁신은 질병 치료 중에 기술 기반 치료 도구의 비용 효율성을 제공합니다.

예를 들어,

- Contoura Vision India에 따르면 Contoura 비전 수술은 안경 제거에 있어서 최신의 진보된 안과 수술입니다. 이는 안과 수술에서 가장 안전한 기술적 진보 중 하나로, 안경의 힘을 교정할 뿐만 아니라 각막 불규칙성에도 효과가 있습니다.

- Eye and Laser Centre Organisation 에 따르면 , 2017년 5월, Visumax Femtosecond Laser 기술은 가장 진보된 굴절 수술 치료 중 하나라는 사실이 밝혀졌습니다. 눈의 시각적 결함을 수행할 수 있습니다.

레이저 가변 스팟 스캐닝의 발전과 같은 다양한 굴절 수술 기기의 기술적 발전이 증가함에 따라 굴절 수술 기기 시장이 주도될 것으로 예상됩니다. 따라서 굴절 수술 기기의 혁신과 기술적 발전이 증가함에 따라 예측 기간 동안 시장 성장이 촉진될 것으로 예상됩니다.

- 의료비 지출 증가

지난 10년 동안, 더 나은 환자 의료 서비스를 위해 의료 지출이 급격하게 증가했습니다. 미국은 가장 큰 의료 시장으로, 지난 몇 년 동안 총 의료 지출이 급격하게 증가했습니다. 지출 증가의 근본적인 목적은 적절하고 저렴하며 고품질의 굴절 수술 장치를 제공하는 것입니다. 건강한 인구를 장려하고 선진국과 개발도상국의 의료 비상 사태를 해결하기 위해 각 정부 기관과 의료 기관은 의료 지출 가속화에 주도권을 잡고 있습니다.

예를 들어,

- Health Affairs Organisation에 따르면, 미국 의료비 지출은 2020년에 9.7% 증가하여 4조 1,000억 달러에 달했으며, 이는 2019년에 비해 훨씬 빠른 속도입니다.

- 영국 정부에 따르면, 2020년에 정부는 최신 기술을 사용하여 NHS(National Health Service) 전반의 진단 치료를 디지털화하고 발전시키기 위해 약 2억 5천만 파운드(약 3억 달러)를 지원했습니다. 이 자금은 NHS 진단 서비스의 기술적 개선을 위해 특별히 할당되어 가능한 한 일찍 건강 상태를 감지하고 치료를 시작할 수 있도록 했습니다.

- 국가 무료 진단 서비스 이니셔티브는 인도 정부가 국가 건강 사명의 일환으로 도입했습니다. 이는 포괄적이고 양질의 의료 서비스를 한 지붕 아래에서 무료로 제공하는 데 중요했습니다. 인도 정부의 이 이니셔티브를 통해 여러 주에서 공공 보건 시설에서 진단 서비스를 이용할 수 있도록 여러 모델을 시도했습니다.

증가하는 의료비 지출은 경제 성장과 의료 부문 성장에도 이롭습니다. 이는 새로운 진단 검사와 새로운 수술 도구의 개발에 상당한 영향을 미칩니다. 따라서 막대한 의료비 지출은 시장 성장에 유리한 요소입니다.

기회

- LASIK 수술의 성과

LASIK 성공률 또는 LASIK 결과는 잘 알려져 있으며, 수천 건의 임상 연구에서 시력과 환자 만족도를 살펴보았습니다. 최근 연구에 따르면 환자의 99%가 20/40 이상의 시력을 얻었고, 90% 이상이 20/20 이상을 얻었습니다. 게다가 LASIK은 전례 없는 96%의 환자 만족도를 보이며, 모든 선택적 시술 중 가장 높습니다.

예를 들어,

- 2016년 백내장 및 굴절 수술 저널에 발표된 연구에 따르면 LASIK 수술의 환자 만족도는 96%인 것으로 나타났습니다.

기사에 따르면, "LASIK: 보상과 위험을 알아보세요", 2018

- 미국 백내장 및 굴절 수술 학회 전 회장인 Eric Donnenfeld 박사는 28년간의 경력 동안 약 85,000건의 수술을 완료했습니다.

- Market Scope에 따르면, FDA가 1999년에 처음 승인한 이후로 약 1천만 명의 미국인이 LASIK 수술을 받았습니다. 매년 약 70만 건의 LASIK 수술이 수행되지만, 이는 2000년의 140만 건의 최고치에서 감소한 수치입니다.

그 이후로 전 세계적으로 성공적인 LASIK 수술의 증가는 제품 개발, 제품 등록 및 제품 출시와 긍정적으로 연관되어 있습니다. 따라서 이는 향후 몇 년 동안 굴절 수술 장치 시장을 주도할 것으로 예상됩니다.

- 시장 참여자들의 전략적 이니셔티브

전 세계적으로 굴절 이상 부담이 증가함에 따라 굴절 수술 기기 시장에 대한 수요가 증가했습니다. 주요 목표는 편리한 적용을 통해 고품질 치료를 위한 혁신적인 제품 및 수술 유형을 개발하여 건강 관리를 개선하는 것입니다. 굴절 수술 기기 시장의 주요 업체는 제품 출시, 인수 등을 포함한 전략적 이니셔티브를 취했으며 굴절 수술 기기 시장에서 더 많은 기회를 선도하고 창출할 것으로 예상됩니다.

예를 들어,

- 2021년 6월, Glaukos Corporation은 호주의 Therapeutic Goods Administration(TGA)으로부터 PRESERFLO MicroShunt에 대한 규제 승인을 받았습니다. PRESERFLO MicroShunt는 IOP가 통제할 수 없는 원발성 개방각 녹내장 환자의 눈에서 안압(IOP)을 낮추는 것을 목표로 하며, 최대 허용 의료 요법이거나/또는 녹내장 진행으로 인해 수술이 필요한 경우입니다.

- 2021년 6월: Bausch & Lomb Incorporated는 정보 기술 서비스 산업의 회사인 Lochan과 계약을 체결했습니다. 이 회사들은 Bausch & Lomb Incorporated의 eyeTELLIGENCE 임상 의사 결정 지원 소프트웨어의 차세대를 개발하는 것을 목표로 했습니다. eyeTELLIGENCE의 우세한 클라우드 기반 인프라를 활용하여 이 소프트웨어는 외과의가 백내장, 망막 및 굴절 수술 절차의 모든 요소를 손쉽게 결합하여 전체 진료 효율성을 높일 수 있도록 개발되었습니다.

- 2021년 3월, NIDEK는 Windows용 RT-6100 CB, RT-6100 Intelligent Refractor용 옵션 제어 소프트웨어, TS-610 Tabletop Refraction System을 공개했습니다. 이 소프트웨어는 환자와 운영자의 고유한 요구 사항에 맞춰 조정됩니다. 또한 이 소프트웨어는 사회적 거리두기 요구 사항을 충족하는 굴절을 가능하게 합니다.

굴절 수술 기기 시장에서 주요 기업들이 출시하고 인수한 이러한 많은 전략적 제품은 전 세계 기업들에게 기회를 열어주었습니다. 이러한 전략을 통해 기업들은 시장에서 입지를 강화할 수 있습니다. 따라서 전략적 이니셔티브는 시장 참여자들이 시장에서 매출 성장을 가속화할 수 있는 황금의 기회라고 예측됩니다.

도전/제약

- 시술의 이점에 대한 인식 부족 및 사람들의 신뢰 부족

많은 국가에서 일반 대중은 근시, 난시, 노안 등과 같은 굴절 이상에 대한 굴절 수술이나 다양한 이점을 알지 못합니다. 사람들은 수술이 시장에 큰 도전을 줄 것으로 예상되는 심각한 부작용으로 이어질까봐 두려워합니다.

예를 들어,

- 국립보건원(NIH) 2021 연구에 따르면, 사람들은 합병증에 대한 걱정과 시술에 대한 정보 부족으로 수술을 거부했다고 밝혔습니다. 게다가, 이 연구에 따르면 참가자의 82.5%가 굴절 수술이 시력을 향상시킬 수 있다는 사실을 알지 못했습니다.

- 2019년 개발도상국의 국제 의학 저널에 따르면 다음과 같이 언급되어 있습니다.

- 전체 참여자의 32.2%는 굴절수술이 위험하다고 생각했고, 9.5%는 심각한 합병증을 유발한다고 생각했습니다.

- 또한 인도의 한 연구에 따르면 참가자의 64%가 굴절 수술이 시력을 개선할 수 있다는 사실을 몰랐다고 합니다.

굴절수술의 이점에 대한 인식 부족과 수술 합병증에 대한 사람들의 두려움은 시장 성장에 큰 어려움을 초래할 것으로 예상됩니다.

- 눈 치료를 위한 의료 시설 부족

저소득 및 중소득 국가의 빈곤 인구는 부유한 인구보다 실명과 안과 질환으로 더 많이 고통받습니다. 선진국에서 취한 발전 및 전략적 계획은 저소득 국가에서 동등하게 시작되지 않습니다. 많은 저소득 국가는 일반적으로 초기 1차 안과 치료를 위해 지역 보건 종사자, 의사 보조원 및 백내장 외과 의사에게 의존합니다. 저소득 국가(LIC)의 안과는 열대 기후, 허약한 전기 그리드, 열악한 도로 및 수자원 인프라, 제한된 진단 기능 및 제한된 치료 옵션과 같은 복잡성으로 인해 매우 어렵습니다.

예를 들어,

- 기사 "저소득 국가의 안과를 위한 혁신적인 진단 도구"에 따르면, 2020년 보고서는 고소득 국가의 실명 및 안구 질환 유병률이 1,000명당 0.3명이지만 저소득 국가의 추정치는 1,000명당 1.5명이라고 명시합니다. 이는 저소득 국가에서 안과 치료에 대한 충족되지 않은 필요성을 보여줍니다.

저소득 국가의 또 다른 주요 문제는 눈의 통증과 기타 장애에 대한 사람들의 인식 부족입니다. 많은 연구 조사에서 저소득 국가의 눈 건강 관리에 대한 높은 요구 사항이 보고되고 있으며, 충족되지 않은 요구 사항은 여전히 많은 의료 기관에서 주목을 받고 있습니다.

예를 들어,

- 2014년 영국안과학저널은 정부가 추진한 비전2020 계획이 중·저소득 국가를 타깃으로 한 이니셔티브 부족으로 아직 달성되지 않았다고 보고했다.

따라서 저소득 및 중소득 국가의 눈 치료를 위한 열악한 의료 시설은 굴절 수술 장치 시장 성장에 가장 큰 과제로 간주됩니다.

COVID-19 이후 굴절 수술 장비 시장 에 미치는 영향

COVID-19는 시장에 영향을 미쳤습니다. 팬데믹 동안 봉쇄와 격리로 인해 대중의 이동이 제한되었습니다. 그 결과 수술 날짜와 시간이 지연되었습니다. 따라서 팬데믹은 이 시장에 부정적인 영향을 미쳤습니다.

최근 개발

- 2021년 7월, 존슨앤존슨비전은 차세대 백내장 유화술(phaco) 시스템인 VERITAS Vision System을 출시했습니다. 이 시스템은 외과의 효율성, 환자 안전, 편안함이라는 세 가지 중요한 영역을 돌보기 위해 개발되었습니다. 이를 통해 회사의 제품 포트폴리오가 증가했습니다.

굴절 수술 장치 시장 범위

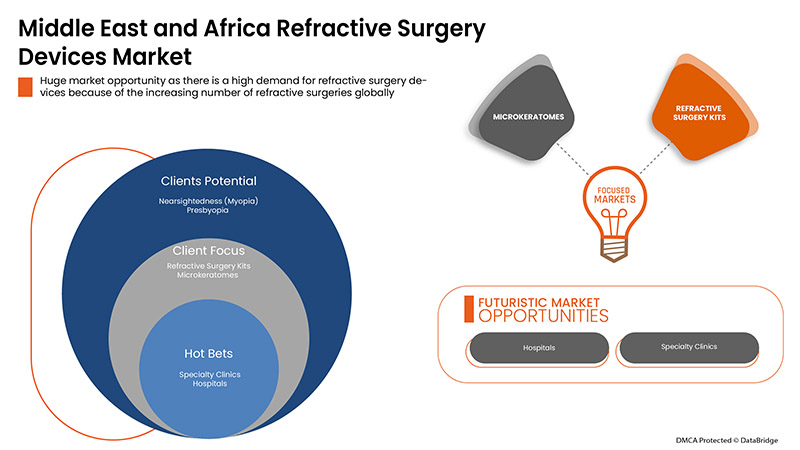

굴절 수술 기기 시장은 제품 유형, 수술 유형, 응용 분야, 최종 사용자 및 유통 채널로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제품 유형

- 원자 램프

- 파킥 인공 수정체(IOL)

- 수차계 / 파면 수차 측정

- 수술 도구 및 액세서리

- 굴절수술 키트

- 동공 직경 측정기

- 에피케라토메스

- 미세각막절삭기

- 열각막성형술

- 림발 이완 절개 키트

- 기타

제품 유형을 기준으로 볼 때, 굴절 수술 기기 시장은 레이저, 파키아 인공 수정체(IOL), 수차계/파면 수차계, 수술 도구 및 부속품, 굴절 수술 키트, 동공 직경 측정기, 상피각막절제술, 미세각막절제술, 열각막형성술, 각막변연 이완 절개 키트 등으로 구분됩니다.

수술 유형

- 라식(레이저 현장 각막절삭술)

- 굴절각막절제술(PRK)

- 파킥 인공 수정체(IOL)

- 난시각막절개술(AK)

- 자동화 층상각막이식술(ALK)

- 각막내 링(INTACS)

- 레이저 열각막이식술(LTK)

- 전도성 각막이식술(CK)

- 방사상 각막절개술(RK)

- 기타

굴절 수술 기기 시장은 수술 유형을 기준으로 LASIK(레이저 원위각막이식술), 광굴절각막절제술(PRK), 파키아 인공수정체(IOL), 난시각막절개술(AK), 자동 층상각막이식술(ALK), 각막내링수술(INTACS), 레이저 열각막이식술(LTK), 전도성 각막이식술(CK), 방사형 각막절개술(RK) 등으로 구분됩니다.

애플리케이션

- 근시(Myopia)

- 원시(Hyperopia)

- 난시

- 노시

굴절 수술 장치 시장은 응용 분야별로 근시, 원시, 난시, 노안으로 구분됩니다.

최종 사용자

- 병원

- 전문 클리닉

- 외래 수술 센터

- 기타

굴절수술 기기 시장은 최종 사용자를 기준으로 병원, 전문 병원, 외래 수술 센터 등으로 구분됩니다.

유통 채널

- 직접 입찰

- 제3자 유통업체

- 기타

굴절수술기기 시장은 유통 채널을 기준으로 직접 입찰, 제3자 유통업체 및 기타로 구분됩니다.

굴절 수술 장치 시장 지역 분석/통찰력

The refractive surgery devices market is analysed and market size insights and trends are provided by country, product type, surgery type, application, end user, and distribution channel as referenced above.

The countries covered in the refractive surgery devices market report are the Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Kuwait, Rest of Middle East and Africa.

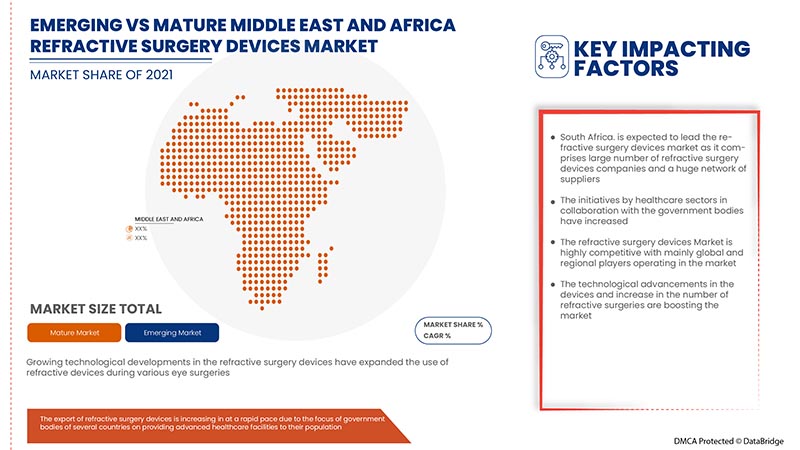

South Africa dominates the refractive surgery devices market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period due to increase in the number of refractive surgeries in the region and technological advancements.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refractive Surgery Devices Market Share Analysis

The refractive surgery devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on refractive surgery devices market.

Some of the major companies dealing in the refractive surgery devices market are Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, among others.

Research Methodology

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 이 외에도 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, vs. 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가 전화를 요청하십시오.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 것을 자랑으로 생각합니다. 보고서는 타겟 브랜드의 가격 추세 분석, 추가 국가 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 타겟 경쟁업체의 시장 분석은 기술 기반 분석에서 시장 포트폴리오 전략까지 분석할 수 있습니다. 필요한 만큼 많은 경쟁업체를 원하는 형식과 데이터 스타일로 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 Excel 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용할 수 있는 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 KUWAIT

12.1.7 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 EGYPT LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 EGYPT REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 EGYPT REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 KUWAIT LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 KUWAIT REFRACTIVE SURGERY DEVICES MARKET, DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 REST OF MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.